Gran Tierra Energy Inc.

(“Gran Tierra” or

the “Company”) (NYSE American:GTE)(TSX:GTE)(LSE:GTE) today

announced its 2025 capital budget, production guidance and

operational update. All dollar amounts are in United States

dollars and all production volumes are on a working interest before

royalties basis and are expressed in barrels of oil equivalent

(

“boe”) per day (

“BOEPD”), unless

otherwise stated.

Message to Shareholders

Gary Guidry, President and Chief Executive

Officer of Gran Tierra, commented: “Following up on a strong 2024,

which included a very successful exploration campaign and a new

country entry into Canada, we are looking forward to our 2025

development and exploration program. Our 2025 budget, which is

expected to be fully funded by Cash Flow1, takes a balanced,

returns-focused approach to capital allocation while focusing on

portfolio longevity. At the midpoint of the Base Case, our

production guidance of 50,000 BOEPD represents an increase of 44%

from the 34,710 BOEPD 2024 total company production achieved in

2024.

We plan to focus on profitably growing reserves

and production across our Colombian, Ecuadorian and Canadian

assets, pursue high impact exploration throughout our portfolio,

and invest in facility and infrastructure projects to maximize the

long-term value of our assets. This year’s budget would fulfil our

exploration commitments in Ecuador which were a result of obtaining

the lands back in 2019. Since 2021 we have drilled 10 exploration

wells, had 9 discoveries and shot 238 kilometers of 3D seismic in

Ecuador. This year, we expect to drill four exploration wells in

Ecuador and two to three wells to further appraise our exciting

discoveries. We have also planned a very active capital program in

the Suroriente block including drilling 5-7 wells, investing in a

gas-to-power project, and significant facility investment to

increase fluid handling due to increased production and water

injection. We forecast spending approximately $60-$80 million in

Suroriente, which would fulfil a material component of our $123

million commitment associated with obtaining the 20-year extension.

In addition, we plan on drilling a further two to four high impact

exploration wells in Colombia. The exploration program and

Suroriente capital program represent approximately $135 million of

this year’s capital program. After the fulfilment of commitments in

2025, we expect 2026 and beyond to be focused on exploiting our

extensive asset base, including anticipated development of our

recent discoveries, drilling on our extensive Canadian landholdings

and optimizing our assets under waterflood.

We believe Gran Tierra is strongly positioned

with a low base decline, a robust portfolio of conventional and

unconventional oil and gas assets, and a high-impact exploration

program. As we continue to profitably advance our operational and

financial goals, we remain deeply committed to the well-being of

our employees and the communities where we operate, recognizing

their essential role in our success.”

Key Highlights:

2025 Guidance:

- Gran Tierra is

forecasting the following ranges for the Company’s 2025

budget:

|

2025 Budget |

Low Case |

Base Case |

High Case |

|

Brent Oil Price ($/bbl) |

65.00 |

75.00 |

85.00 |

|

WTI Oil Price ($/bbl) |

61.00 |

71.00 |

81.00 |

|

AECO Natural Gas Price ($CAD/thousand cubic feet) |

2.00 |

2.50 |

3.50 |

|

Production (BOEPD) |

47,000-53,000 |

47,000-53,000 |

47,000-53,000 |

|

Operating Netback3 ($ million) |

330-370 |

430-470 |

510-550 |

|

EBITDA4 ($ million) |

300-340 |

380-420 |

460-500 |

|

Cash Flow1 ($ million) |

200-240 |

260-300 |

300-340 |

|

Capital Expenditures ($ million) |

200-240 |

240-280 |

240-280 |

|

Free Cash Flow2 ($ million) |

- |

20 |

60 |

|

Number of Development Wells (gross) |

8-12 |

10-14 |

10-14 |

|

Number of Exploration Wells (gross) |

6 |

6-8 |

6-8 |

|

Budgeted Costs |

Costs per BOE ($/boe) |

|

Lifting |

12.00-14.00 |

|

Workovers |

1.50-2.50 |

|

Transportation |

1.00-2.00 |

|

General and Administration |

2.00-3.00 |

|

Interest |

4.00-4.50 |

|

Current Tax |

2.00-3.00 |

* Budgeted royalties as a percentage of total revenue

were approximately 19% in the base case

- 2025

Base Capital Program: Building on a successful capital

campaign in 2024, Gran Tierra plans to continue to execute on its

strategy of delivering value by seeking to add new reserves,

investing in facility and infrastructure projects to maximize

recovery and minimize cost, and providing future growth through

exploration. Gran Tierra forecasts spending approximately 55% of

its capital program in Colombia, 30% in Ecuador, and 15% in Canada,

respectively.

|

Category |

Capital ($ million) |

Key Activities |

|

Colombia Development |

105-120 |

Suroriente (47% W.I.): Drill 5-7 gross development

wells;facility expansion, gas-to-power generation upgrades

andsocial investment in the areaAcordionero (100%

W.I.): Investment facility expansionactivities,

gas-to-power generation upgrades and injectorconversions |

|

Ecuador Development |

35-45 |

Chanangue/Charapa (100% W.I.): Drill 2-3 appraisal

wells |

|

Canada Development |

35-45 |

Simonette (50% W.I.): Drill 5 gross development

wellsNisku (100% W.I.): Drill 1 development

well |

|

Exploration |

65-70 |

Ecuador: Drill 4 exploration

wellsColombia: Drill 2 to 4 exploration wells |

| |

-

Development: Gran Tierra expects to drill a total

of 10 to 14 net development wells in its 2025 capital program,

including:

-

Suroriente: The Company plans to drill 5-7 gross

development wells in the Cohembi oil field located in the Southern

Putumayo Basin of Colombia. In addition to development drilling,

Gran Tierra is also planning facility expansion, gas-to-power

generation upgrades, and continued social investment in the area.

With the planned investments in 2025, production and reserves are

expected to significantly increase in 2026 and beyond.

-

Acordionero: The Company plans to focus on the

optimization of the field through continued waterflood expansion

activities, including facility expansions, workovers (ESP upsizes

and injector conversions) and gas-to-power generation upgrades.

These expenditures are expected to reduce unit costs while

maintaining production by offsetting natural declines and

increasing overall recovery. The Company is planning an active

development drilling program in 2026.

-

Chanangue: The Company plans to continue its

appraisal program on the highly prospective Arawana/Zabaleta

productive trend in Ecuador by drilling 2-3 appraisal wells.

-

Simonette: Gran Tierra plans to drill 2.5 net

wells at Simonette targeting two-layer co-development of the Lower

and Middle Montney offering improved capital efficiency and lower

proportionate infrastructure spending.

- Exploration: Approximately 20-30% of the

Company’s 2025 capital program is expected to be allocated to high

impact exploration activities and the drilling of 6 to 8

exploration wells in Colombia and Ecuador in the Base and High

Case. Gran Tierra’s 2025 exploration drilling is planned to follow

up on the encouraging results from the Company’s 2024 exploration

program while meeting all its Ecuador exploration commitments. The

Company continues to focus its exploration program on short-cycle

time, near-field prospects in proven basins with access to

transportation infrastructure.

- Fully

Funded Capital Program Generating Free Cash

Flow2: Gran Tierra’s

mid-point Base Case 2025 capital budget of $260 million is expected

to be fully funded from the Base Case 2025 mid-point Cash Flow1

forecast of $280 million, based on an assumed average $75.00/bbl

Brent oil price, $71.00/bbl WTI oil price, and CAD$2.50/thousand

cubic feet AECO natural gas price. Gran Tierra remains focused on

generating Free Cash Flow2, ongoing net debt5 reduction and

shareholder returns via share buybacks.

- Share

Buybacks: During 2025, Gran Tierra plans to allocate up to

approximately 50% of its Free Cash Flow after exploration to share

buybacks in the Base Case. During 2024, the Company repurchased

approximately 6.7% of its outstanding shares.

Gran Tierra’s Commitment to Go “Beyond

Compliance” with Safe and Sustainable Operations

- 2024 was the

Company’s safest year in company history, with a total of 27.8

million person-hours without a Lost Time Injury (LTI), and a Total

Recordable Case Frequency (TRCF) of 0.03, which places Gran Tierra

within the top quartile in safety performance in the Americas.

Operations Update

- 2024 Production

- Gran Tierra

achieved total company average production in 2024 of approximately

34,710 BOEPD, an increase of 6% from 2023 and 13% from 2022.

- Ecuador

- Chanangue Block:

Gran Tierra has completed its first horizontal well drilled in

Ecuador, the Zabaleta Oeste well. The well drilled through 700 feet

of pay in the Basal Tena formation and has yielded promising

results, confirming the area’s potential for horizontal

development. The well continues to clean-up and we anticipate the

clean-up will take longer than what is expected for a vertical

well. Encouragingly, the well encountered good porosity sands,

validating our geologic and reservoir models and confirming the

extent of the Basal Tena sands within the Chanangue Block.

- Iguana

Block: Following the drilling of the Zabaleta Oeste well,

the rig is currently being mobilized over to the Iguana Block to

drill the first exploration well of 2025.

- Canada

- Simonette: The

development plan with our new Joint Venture partner, Logan Energy,

has commenced with the first two wells being drilled. Both wells

are planned to be stimulated by the end of the first quarter or the

beginning of the second quarter of 2025.

- Central: Gran

Tierra has drilled a well in the Nisku play with a horizontal

lateral length of over 3,000 meters; testing is planned to commence

in February 2025.

- Clearwater: Gran

Tierra has drilled 5 new wells in the Clearwater at East Dawson and

Walrus. The Clearwater program has confirmed the quality of our

acreage in the Clearwater play. These wells are expected to come

onstream in late January 2025.

- Colombia

- Suroriente Block:

A rig is currently being mobilized to the Cohembi North pad, with

first production expected by the end of the first quarter of

2025.

1 “Cash Flow” refers to line item “net cash

provided by operating activities” under generally accepted

accounting principles in the United States of America (“GAAP”).2

“Free Cash Flow” is a non-GAAP measure and does not have a

standardized meaning under GAAP. Free Cash Flow is defined as “net

cash provided by operating activities” less capital expenditures.

Refer to "Non-GAAP Measures" in this press release. Forecast 2025

free cash flow of $80 million “before exploration” is equal to the

Base Case midpoint cash flow of $280 million less the Base Case

midpoint total capital of $260 million, with Base Case midpoint

exploration-only capital of approximately $70 million added back.

Forecast 2025 Free Cash Flow of $20 million “after exploration” is

equal to the Base Case midpoint cash flow of $280 million less the

Base Case midpoint total capital of $260 million. Free Cash Flows

in the table above are the midpoints of the ranges of cash flows

less the midpoints of the ranges of total capital expenditures for

each oil price scenario.3 “Operating netback” is a non-GAAP

measures and does not have standardized meaning under GAAP. Refer

to “Non-GAAP Measures” in this press release.4 Earnings before

interest, taxes and depletion, depreciation and accretion

(“EBITDA”) is a non-GAAP measure and does not have

a standardized meaning under GAAP. Refer to "Non-GAAP Measures" in

this press release.5 Net debt is defined as GAAP total debt before

deferred financing fees less cash.

Contact Information

For investor and media inquiries please contact:

Gary GuidryPresident & Chief Executive Officer

Ryan EllsonExecutive Vice President & Chief Financial

Officer

+1-403-265-3221

info@grantierra.com

About Gran Tierra Energy

Inc.

Gran Tierra Energy Inc., together with its

subsidiaries, is an independent international energy company

currently focused on oil and natural gas exploration and production

in Canada, Colombia and Ecuador. The Company is currently

developing its existing portfolio of assets in Canada, Colombia and

Ecuador and will continue to pursue additional new growth

opportunities that would further strengthen the Company’s

portfolio. The Company’s common stock trades on the NYSE American,

the Toronto Stock Exchange and the London Stock Exchange under the

ticker symbol GTE. Additional information concerning Gran Tierra is

available at www.grantierra.com. Except to the extent expressly

stated otherwise, information on the Company’s website or

accessible from our website or any other website is not

incorporated by reference into and should not be considered part of

this press release. Investor inquiries may be directed to

info@grantierra.com or (403) 265-3221.

Gran Tierra’s filings with the U.S. Securities

and Exchange Commission (the “SEC”) are available on the SEC

website at http://www.sec.gov. The Company’s Canadian securities

regulatory filings are available on SEDAR+ at

http://www.sedarplus.ca and UK regulatory filings are available on

the National Storage Mechanism website at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism.

Forward-Looking Statements and

Advisories

This press release contains opinions, forecasts,

projections, and other statements about future events or results

that constitute forward-looking statements within the meaning of

the United States Private Securities Litigation Reform Act of 1995,

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended, and

financial outlook and forward looking information within the

meaning of applicable Canadian securities laws (collectively,

“forward-looking statements, which can be identified by such terms

as “expect”, “plan”, “can,” “will,” “should,” “guidance,”

“forecast,” “signal,” “measures taken to” and “believes”,

derivations thereof and similar terms identify forward-looking

statements. Such forward-looking statements include, but are not

limited to, the Company’s capital budget amount and uses; the

Company’s strategies related to exploration, drilling and operation

activities; expectations regarding reservoir prospects and

production amounts; future well results (including initial oil and

natural gas production rates and productive capacity based on past

performance); expected future net cash provided by operating

activities (described in this press release as “cash flow”), free

cash flow, operating netback, EBITDA and certain associated

metrics; anticipated capital expenditures, including the location

and impact of capital expenditures; operating and general and

administrative costs; production guidance for 2025; and the

Company’s expectations as to debt repayment, share repurchases and

its positioning for 2025 and beyond. The forward-looking statements

contained in this press release reflect several material factors

and expectations and assumptions of Gran Tierra including, without

limitation, that Gran Tierra will continue to conduct its

operations in a manner consistent with its current expectations,

the ability of Gran Tierra to successfully integrate the assets and

operations of i3 Energy or realize the anticipated benefits and

operating synergies expected from the acquisition of i3 Energy, the

accuracy of testing and production results and seismic data,

pricing and cost estimates (including with respect to commodity

pricing and exchange rates), and the general continuance of current

or, where applicable, assumed operational, regulatory and industry

conditions in Canada, Colombia and Ecuador and areas of potential

expansion, and the ability of Gran Tierra to execute its business

and operational plans in the manner currently planned. Gran Tierra

believes the material factors, expectations and assumptions

reflected in the forward-looking statements are reasonable at this

time, but no assurance can be given that these factors,

expectations and assumptions will prove to be correct.

Among the important factors that could cause

actual results to differ materially from those indicated by the

forward-looking statements in this press release are: certain of

Gran Tierra’s operations are located in South America and

unexpected problems can arise due to guerilla activity, strikes,

local blockades or protests; technical difficulties and operational

difficulties may arise which impact the production, transport or

sale of Gran Tierra’s products; other disruptions to local

operations; global and regional changes in the demand, supply,

prices, differentials or other market conditions affecting oil and

gas, including inflation and changes resulting from a global health

crisis, geopolitical events, including the ongoing conflicts in

Ukraine and the Gaza region, or from the imposition or lifting of

crude oil production quotas or other actions that might be imposed

by OPEC and other producing countries and resulting company or

third-party actions in response to such changes; changes in

commodity prices, including volatility or a prolonged decline in

these prices relative to historical or future expected levels; the

risk that current global economic and credit conditions may impact

oil and natural gas prices and oil and natural gas consumption more

than Gran Tierra currently predicts, which could cause Gran Tierra

to further modify its strategy and capital spending program; prices

and markets for oil and natural gas are unpredictable and volatile;

the effect of hedges; the accuracy of productive capacity of any

particular field; geographic, political and weather conditions can

impact the production, transport or sale of Gran Tierra’s products;

the ability of Gran Tierra to execute its business plan, which may

include acquisitions, and realize expected benefits from current or

future initiatives; the risk that unexpected delays and

difficulties in developing currently owned properties may occur;

the ability to replace reserves and production and develop and

manage reserves on an economically viable basis; the accuracy of

testing and production results and seismic data, pricing and cost

estimates (including with respect to commodity pricing and exchange

rates); the risk profile of planned exploration activities; the

effects of drilling down-dip; the effects of waterflood and

multi-stage fracture stimulation operations; the extent and effect

of delivery disruptions, equipment performance and costs; actions

by third parties; the timely receipt of regulatory or other

required approvals for Gran Tierra’s operating activities; the

failure of exploratory drilling to result in commercial wells;

unexpected delays due to the limited availability of drilling

equipment and personnel; volatility or declines in the trading

price of Gran Tierra’s common stock or bonds; the risk that Gran

Tierra does not receive the anticipated benefits of government

programs, including government tax refunds; Gran Tierra’s ability

to comply with financial covenants in its credit agreement and

indentures and make borrowings under its credit agreement; and the

risk factors detailed from time to time in Gran Tierra's periodic

reports filed with the SEC, including, without limitation, under

the caption "Risk Factors" in Gran Tierra's Annual Report on Form

10-K for the year ended December 31, 2023 filed on February 20,

2024 and its other filings with the SEC. These filings are

available on the SEC’s website at http://www.sec.gov and on SEDAR

at www.sedar.com. Guidance is uncertain, particularly when

given over extended periods of time, and results may be materially

different. Although the current capital spending program and long

term strategy of Gran Tierra is based upon the current expectations

of the management of Gran Tierra, should any one of a number of

issues arise, Gran Tierra may find it necessary to alter its

business strategy and/or capital spending program and there can be

no assurance as at the date of this press release as to how those

funds may be reallocated or strategy changed and how that would

impact Gran Tierra's results of operations and financing position.

All forward-looking statements are made as of the date of this

press release and the fact that this press release remains

available does not constitute a representation by Gran Tierra that

Gran Tierra believes these forward-looking statements continue to

be true as of any subsequent date. Actual results may vary

materially from the expected results expressed in forward-looking

statements. Gran Tierra disclaims any intention or obligation to

update or revise any forward-looking statements, whether as a

result of new information, future events or otherwise, except as

expressly required by applicable law. Gran Tierra's forward-looking

statements are expressly qualified in their entirety by this

cautionary statement.

The estimates of future production, EBITDA, net

cash provided by operating activities (described in this press

release as “Cash Flow”), Free Cash Flow and operating netback may

be considered to be future-oriented financial information or a

financial outlook for the purposes of applicable Canadian

securities laws. Financial outlook and future-oriented financial

information contained in this press release about prospective

financial performance, financial position or cash flows are

provided to give the reader a better understanding of the potential

future performance of the Company in certain areas and are based on

assumptions about future events, including economic conditions and

proposed courses of action, based on management’s assessment of the

relevant information currently available, and to become available

in the future. In particular, this press release contains projected

operational and financial information for 2025. These projections

contain forward-looking statements and are based on a number of

material assumptions and factors set out above. Actual results may

differ significantly from the projections presented herein. The

actual results of Gran Tierra’s operations for any period could

vary from the amounts set forth in these projections, and such

variations may be material. See above for a discussion of the risks

that could cause actual results to vary. The future-oriented

financial information and financial outlooks contained in this

press release have been approved by management as of the date of

this press release. Readers are cautioned that any such financial

outlook and future-oriented financial information contained herein

should not be used for purposes other than those for which it is

disclosed herein. The Company and its management believe that the

prospective financial information has been prepared on a reasonable

basis, reflecting management’s best estimates and judgments, and

represent, to the best of management’s knowledge and opinion, the

Company’s expected course of action. However, because this

information is highly subjective, it should not be relied on as

necessarily indicative of future results.

Presentation of Oil and Gas

Information

This press release contains certain oil and gas

metrics, including operating netback, which do not have

standardized meanings or standard methods of calculation and

therefore such measures may not be comparable to similar measures

used by other companies and should not be used to make comparisons.

Such metrics are calculated as described in this press release and

have been included herein to provide readers with additional

measures to evaluate the Company’s performance; however, such

measures are not reliable indicators of the future performance of

the Company and future performance may not compare to the

performance in previous periods.

References to a formation where evidence of

hydrocarbons has been encountered is not necessarily an indicator

that hydrocarbons will be recoverable in commercial quantities or

in any estimated volume. Gran Tierra's reported production is a mix

of light crude oil and medium, heavy crude oil, tight oil,

conventional natural gas, shale gas and natural gas liquids for

which there is no precise breakdown since the Company’s sales

volumes typically represent blends of more than one product type.

Well test results should be considered as preliminary and not

necessarily indicative of long-term performance or of ultimate

recovery. Well log interpretations indicating oil and gas

accumulations are not necessarily indicative of future production

or ultimate recovery. If it is indicated that a pressure transient

analysis or well-test interpretation has not been carried out, any

data disclosed in that respect should be considered preliminary

until such analysis has been completed. References to thickness of

“oil pay” or of a formation where evidence of hydrocarbons has been

encountered is not necessarily an indicator that hydrocarbons will

be recoverable in commercial quantities or in any estimated

volume.

Boe’s have been converted on the basis of six

thousand cubic feet (“Mcf”) natural gas to 1 bbl of oil. Boe’s may

be misleading, particularly if used in isolation. A boe conversion

ratio of 6 Mcf: 1 bbl is based on an energy equivalency conversion

method primarily applicable at the burner tip and does not

represent a value equivalency at the wellhead. In addition, given

that the value ratio based on the current price of oil as compared

with natural gas is significantly different from the energy

equivalent of six to one, utilizing a boe conversion ratio of 6

Mcf: 1 bbl would be misleading as an indication of value.

Non-GAAP Measures

This press release includes forward-looking

non-GAAP financial measures as further described herein. These

non-GAAP measures do not have a standardized meaning under GAAP.

Investors are cautioned that these measures should not be construed

as an alternative to net income or loss or other measures of

financial performance as determined in accordance with GAAP. Gran

Tierra’s method of calculating these measures may differ from other

companies and, accordingly, it may not be comparable to similar

measures used by other companies. These non-GAAP financial measures

are presented along with the corresponding GAAP measure so as to

not imply that more emphasis should be placed on the non-GAAP

measure.

Gran Tierra is unable to provide forward-looking

net income, net cash provided by operating activities, and oil and

gas sales, the GAAP measures most directly comparable to the

non-GAAP measures EBITDA, free cash flow and operating netback,

respectively, due to the impracticality of quantifying certain

components required by GAAP as a result of the inherent volatility

in the value of certain financial instruments held by the Company

and the inability to quantify the effectiveness of commodity price

derivatives used to manage the variability in cash flows associated

with the forecasted sale of its oil and natural gas production and

changes in commodity prices.

Operating netback as presented is defined as

projected 2025 oil and gas sales less projected 2025 operating and

transportation expenses. The most directly comparable GAAP measures

are oil and gas sales and oil and gas sales price, respectively.

Management believes that operating netback is useful supplemental

measures for management and investors to analyze financial

performance and provides an indication of the results generated by

our principal business activities prior to the consideration of

other income and expenses. Gran Tierra is unable to provide a

quantitative reconciliation of either forward-looking operating

netback to its most directly comparable forward-looking GAAP

measure because management cannot reliably predict certain of the

necessary components of such forward-looking GAAP measures.

EBITDA as presented is defined as projected 2025

net income adjusted for DD&A expenses, interest expense and

income tax expense or recovery. The most directly comparable GAAP

measure is net income. Management uses this financial measure to

analyze performance and income or loss generated by our principal

business activities prior to the consideration of how non-cash

items affect that income, and believes that this financial measure

is also useful supplemental information for investors to analyze

performance and our financial results. Gran Tierra is unable to

provide a quantitative reconciliation of forward-looking EBITDA to

its most directly comparable forward-looking GAAP measure because

management cannot reliably predict certain of the necessary

components of such forward-looking GAAP measure.

Free cash flow as presented is defined as GAAP

projected “net cash provided by operating activities” less

projected 2025 capital spending. The most directly comparable GAAP

measure is net cash provided by operating activities. Management

believes that free cash flow is a useful supplemental measure for

management and investors to in order to evaluate the financial

sustainability of the Company’s business. Gran Tierra is unable to

provide a quantitative reconciliation of forward-looking free cash

flow to its most directly comparable forward-looking GAAP measure

because management cannot reliably predict certain of the necessary

components of such forward-looking GAAP measure.

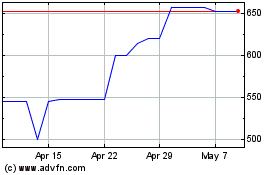

Gran Tierra Energy (LSE:GTE)

Historical Stock Chart

From Dec 2024 to Jan 2025

Gran Tierra Energy (LSE:GTE)

Historical Stock Chart

From Jan 2024 to Jan 2025