TIDMHEIT

RNS Number : 1979L

Harmony Energy Income Trust PLC

04 September 2023

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED IN IT ARE NOT

FOR RELEASE, PUBLICATION, TRANSMISSION, FORWARDING OR DISTRIBUTION,

DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO OR FROM THE

UNITED STATES OR ANY JURISDICTION WHERE TO DO SO MIGHT CONSTITUTE A

VIOLATION OF LOCAL APPLICABLE SECURITIES LAWS OR REGULATIONS.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF REGULATION (EU) NO 596/2014 WHICH IS PART OF UK LAW

BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018 ("MAR"). UPON

PUBLICATION OF THIS ANNOUNCEMENT, THE INSIDE INFORMATION IS NOW

CONSIDERED TO BE IN THE PUBLIC DOMAIN FOR THE PURPOSES OF MAR.

4 September 2023

Harmony Energy Income Trust plc

(the "Company" or "HEIT")

Sale of Rye Common Project

Harmony Energy Income Trust plc, which invests in battery energy

storage systems ("BESS") in Great Britain, announces that it has

completed the sale of its "shovel-ready" BESS development project,

Rye Common (99 MW) (the "Rye Common Project") to Pulse Clean Energy

Limited (the "Sale") at a premium to its carrying value.

Background

The Rye Common Project was acquired by the Company from Harmony

Energy Limited in December 2022 alongside two other "shovel ready"

BESS projects, Wormald Green and Hawthorn Pit, which are currently

under construction and on track for energisation in Q2 2024 and Q3

2024, respectively.

Given the challenging capital raising environment that has

remained following the Government's 'mini-budget' in September

2022, the Company opted to secure funding for the construction of

the Hawthorn Pit and Wormald Green projects through the successful

increase in its debt facilities with NatWest and Rabobank, as

announced in February 2023.

Alternative funding options for the construction of the Rye

Common Project were considered including potential vendor financing

and other deferred capex structures, however it was ultimately

determined by the Board that a sale of the project should also be

explored.

The Sale

The Sale process attracted multiple bidders at attractive prices

demonstrating the continued high level of interest for BESS

projects with near-term energisation potential. In aggregate, the

proceeds of the Sale coupled with recycled cash previously

allocated to this project represents a 1.5 per cent. premium to the

carrying value of the Rye Common Project as at 30 April 2023 set

out in the Company's interim results.

The Investment Adviser and the Board believe that the successful

Sale at this value:

a) demonstrates the high-quality nature of BESS projects developed

by Harmony Energy Limited. The Company benefits from an exclusive

right of first refusal over a further 505 MW of pipeline BESS

projects controlled by Harmony Energy Limited and in various

stages of development; and

b) validates the Company's carrying values for projects.

Following the Sale, the Company's portfolio comprises 395.4 MW /

790.8 MWh across eight BESS projects, of which three are

operational and five are under construction.

END

For further information, please contact:

Harmony Energy Advisors Limited

Paul Mason

Max Slade

Peter Kavanagh

James Ritchie

info@harmonyenergy.co.uk

Berenberg

Gillian Martin

Ben Wright

Dan Gee-Summons +44 (0)20 3207 7800

Stifel Nicolaus Europe Limited

Mark Young

Edward Gibson-Watt

Rajpal Padam

Madison Kominski +44 (0)20 7710 7600

Camarco

Eddie Livingstone-Learmonth

Andrew Turner +44 (0)20 3757 4980

JTC (UK) Limited

Uloma Adighibe

Harmony.CoSec@jtcgroup.com +44 (0)20 3832 3877

LEI: 254900O3XI3CJNTKR453

About Harmony Energy Advisors Limited (the "Investment

Adviser")

The Investment Adviser is a wholly owned subsidiary of Harmony

Energy Limited.

The management team of the Investment Adviser have been

exclusively focussed on the energy storage sector (across multiple

projects) in Great Britain for over six years, both from the point

of view of asset owner/developer and in a third-party advisory

capacity. The Investment Adviser is an appointed representative of

Laven Advisors LLP, which is authorised and regulated by the

Financial Conduct Authority.

Important Information

This announcement contains inside information for the purposes

of Article 7 of MAR. Upon publication of this announcement, the

inside information is now considered to be in the public domain for

the purposes of MAR. The person responsible for arranging the

release of this announcement on behalf of the Company is Harmony

Energy Advisors Limited .

This announcement does not constitute an offer to sell or the

solicitation of an offer to acquire or subscribe for shares in the

Company in any jurisdiction. This distribution of this announcement

outside the UK may be restricted by law. No action has been taken

by the Company that would permit possession of this announcement in

any jurisdiction outside the UK where action for that purpose is

required. Persons outside the UK who come into possession of this

announcement should inform themselves about the distribution of

this announcement in their particular jurisdiction.

This announcement contains (or may contain) certain

forward-looking statements with respect to certain of the Company's

plans and/or the plans of one or more of its investee companies and

their respective current goals and expectations relating to their

respective future financial condition and performance and which

involve a number of risks and uncertainties. The Company's target

returns are a target only and there is no guarantee that these will

be achieved. This Company cautions readers that no forward-looking

statement is a guarantee of future performance and that actual

results could differ materially from those contained in the

forward-looking statements.

It should also be noted that any future NAV per Share announced

by the Company in due course will, in addition to the matters

described in this announcement, also be affected by valuation

movements in the Company's portfolio and other factors including,

without limitation, purchase prices of battery energy storage

systems and components, project development and construction costs,

income and pricing from contracts with National Grid ESO and other

counterparties, the potential for trading profitability in the

wholesale electricity markets and/or Balancing Mechanism,

performance of the Company's investments, and the availability of

projects which meet the Company's minimum return parameters in

accordance with the Company's investment policy.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCXXLFBXKLEBBK

(END) Dow Jones Newswires

September 04, 2023 02:00 ET (06:00 GMT)

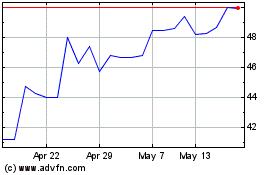

Harmony Energy Income (LSE:HEIT)

Historical Stock Chart

From Apr 2024 to May 2024

Harmony Energy Income (LSE:HEIT)

Historical Stock Chart

From May 2023 to May 2024