TIDMKOD

RNS Number : 6950X

Kodal Minerals PLC

22 December 2023

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR"). With the

publication of this announcement via a Regulatory Information

Service, this inside information is now considered to be in the

public domain.

Kodal Minerals Plc / Index: AIM / Epic: KOD / Sector: Mining

22 December 2023

Kodal Minerals plc ('Kodal', 'Kodal Minerals' or the

'Company')

Interim Results for the six months to 30 September 2023

Kodal Minerals Plc, the mineral exploration and development

company focused on lithium and gold assets in West Africa ,

announces its unaudited interim results for the six months ended 30

September 2023.

Highlights

Operational

-- Funding transaction completed in November 2023 with Hainan

Mining Company ("Hainan" or "Hainan Mining") to provide

o $100m investment in to the Bougouni Lithium Project in Mali

("Bougouni" or the "Project") to fully finance the development of

the mine, with Hainan acquiring a 51% stake in the Project;

o $17.75m subscription for shares in Kodal Minerals, giving

Hainan a 14.7% holding in the Company.

-- New Mineral Resource estimate for Bougouni announced in

November 2023 of 31.9 million tonnes (Mt) at 1.06% Lithium Oxide

(Li2O), an increase of over 40% from the previous Mineral Resource

estimate.

-- Engineering and development work at Bougouni continued

including work on construction of a new access road for the

mine

-- Relationships with the local community in Bougouni remain

strong with ongoing discussions to prioritise an extensive

community development programme

Financial

-- For the 6 months to 30 September 2023, the Company made a

loss of GBP509,000 (6 months to 30 September 2022: GBP491,000).

-- Total investments in lithium and gold assets increased to

GBP17.0 million from GBP14.5 million as at 31 March 2023

-- Cash balances at 30 September 2023 were GBP1.7 million (30

September 2022: GBP0.6 million) and following the closing of the

Funding Transaction now stand at GBP11.2 million.

Overview:

The Company has continued to focus on the fast-track development

of the Bougouni Lithium mine and to that end the Company announced

in January 2023 a major funding transaction for US$117.75 million

(the "Funding Transaction"), paving the way for the opportunity for

Kodal to be the first London-quoted lithium producer. The Funding

Transaction was completed on 15 November 2023 with all funds

received.

The Funding Transaction was agreed with Hainan Mining Co.

Limited ("Hainan" or "Hainan Mining") and its wholly owned

UK-incorporated subsidiary Xinmao Investment Co. Limited ("Xinmao"

and together the "Hainan Group"), and provides full funding for the

development and commencement of production at the Bougouni Lithium

Project in Mali ("Bougouni" or the "Project"), as well as

supporting ongoing exploration and development programmes designed

to continue the expansion of the Project.

The Funding Transaction consists of a US$17.75 million equity

subscription by the Hainan Group into Kodal, with these new

ordinary shares admitted to trading on AIM. As a result, the Hainan

Group now holds 14.72% of the issued share capital of the Company.

The Funding Transaction also includes a US$100 million investment

into Kodal's UK subsidiary company, Kodal Mining UK Limited

("KMUK"), by the Hainan Group, primarily to provide the financing

to construct the Bougouni lithium production operation. Following

the transaction, KMUK is 49% owned by Kodal and 51% by the Hainan

Group.

Bougouni Lithium Project - Mineral Resource Update

In November 2023 Kodal announced a new JORC Mineral Resource

estimate (MRE) for the Bougouni Lithium Project of 31.9 million

tonnes (Mt) at 1.06% Lithium Oxide (Li(2) O), an increase of over

40% from the previous Mineral Resource completed in 2019. The

significant increase relates to the Ngoualana and Boumou deposits

following the drilling programmes completed in early 2023.

The updated Mineral Resource estimate has been prepared as part

of the development plans for Bougouni. As previously announced, the

Company plans for a two-stage development strategy: Stage 1

involves processing ore from the Ngoualana deposit through a dense

media separation ("DMS") process plant; and Stage 2 processing ore

from the Boumou and Sogola-Baoulé deposits through a flotation

plant.

Highlights of the Mineral Resource estimate include:

-- The 40% increase in Bougouni's spodumene resource adds 10.6Mt

to bring the overall MRE to 31.9Mt at 1.06% Li(2) O following 3,230

metres of RC/diamond drilling during 2023.

-- New JORC Mineral Resource estimates have been prepared for

the Boumou and Ngoualana prospects:

o Boumou: 13.1Mt at 1.04% Li(2) O, an increase of 236% from the 2019 estimate

(Boumou Resource reported using a 0.75% Li(2) O lower cut-off,

no top cut-off)

o Ngoualana: 6.7Mt at 1.00% Li(2) O, an increase of 9% from the 2019 estimate

(Ngoualana MRE reported using 0.5% Li(2) O lower cut-off, no top

cut applied)

The MRE update also improves Kodal management's confidence in

the previously defined resource at the Ngoualana prospect ahead of

the proposed DMS mining development.

-- Sogola-Baoulé prospect has a resource of 12.2Mt at 1.1% Li(2)

O, which is unchanged from the 2019 resource estimate, and the next

phase of drilling will include additional metres with potential to

expand Sogola-Baoulé.

-- Boumou prospect remains open along strike and drilling is

planned to target an additional 750m strike length.

-- Ngoualana resource is undergoing open pit optimisation and

the mine design is being updated to capture the increased

resources, and to support the final planning of the Ngoualana

prospect's DMS development.

The next drilling campaign will commence imminently, focussing

on further resource definition, infill and exploration drilling at

Boumou and Sogola-Baoul é prospects, as well as those not included

in the MRE to date, including Kola and Bougouni South, all located

within the current Bougouni mining licence.

Bougouni Lithium Project - Engineering Development

Bougouni Lithium project is an advanced lithium project which

has a mining permit for an initial twelve-year period, renewable in

ten-year blocks until all resources are mined, covering 97 km(2) of

highly prospective lithium deposits, which to date has a JORC

Mineral Resource Estimate of 31.9Mt of Li(2) O at 1.06%.

The Stage 1 development, for the DMS plant, is progressing well,

with the access road upgrade and construction nearing completion

and clearance of site for the proposed processing plant development

commencing.

The Engineering design of the DMS modular units is complete and

engineering representatives from Hainan and Kodal recently visited

the Johannesburg offices of our engineering consultant DRA Global

to review the proposed units.

Engineering works are continuing with the commencement of the

procurement of long lead items and in Mali, our development team is

building our internal capacity for the construction phase and

future operations of the Bougouni Lithium project.

Environmental and Social Governance

Kodal was granted an Environmental Permit over the Project in

November 2019. Supplemental studies have been ongoing in 2023,

including dust and noise monitoring, surface water and

hydrogeological assessments, and waste rock geochemistry

analysis.

The Company has finalised the upgrade of local access roads

following the end of the rainy season (October 2023), utilising

Malian contractors. This upgrade of existing roads in the project

area has improved conditions for the local community as they

approach the harvest season as well as benefiting the Company in

upgrading access to the Ngoualana deposit for the site development

activities.

The Company is continuing to work with the local community to

prioritise a community development programme, which involves direct

consultation with the local communities, in order to document a

programme that will jointly establish priority community

development projects and identify how the Company can provide

support for these initiatives.

Bernard Aylward, CEO of Kodal Minerals, said: "This year has

been transformational for Kodal as we move towards the development

and commencement of production from the Bougouni Lithium mine with

our new partner, the Hainan Group. During this year we have

completed the major Funding package that ensures the development of

the Bougouni Lithium mine as well as supplies additional funding

for further exploration and development. We have increased our JORC

compliant Mineral Resource estimate by over 40% and have identified

advance targets to continue that resource growth and have fast

tracked our project development with continued detailed engineering

and commencement of site works."

"Kodal ends the year 2023 in a strong financial position with a

cash balance exceeding GBP11,236,000 that will allow us to continue

to explore our 100% owned projects in Mali and C ô te d'Ivoire as

well as review opportunities that offer further growth and

expansion opportunities for the Company. Kodal has demonstrated an

expertise in the acquisition, exploration and development of

Lithium and Battery Mineral Projects and the Company will continue

to explore these opportunities that will utilise our successful

team."

"The Bougouni Lithium project remains a focus for the Company as

we work with our development partner to complete construction and

commence production during 2024. Kodal will continue the

exploration and mineral resource development of the Bougouni

Lithium project with an extensive drilling programme commencing at

the Boumou prospect and continuing to test additional high priority

pegmatite targets to support the future development of a Flotation

Processing plant to significantly expand the production of

spodumene concentrate from the project."

Chairman's Statement

I am very pleased to report on the status of our Company

following a remarkable 2023 year. The Company enters the 2024

calendar year in a very strong financial position, having secured

full funding for the development of our flagship Bougouni Lithium

project through the partnership with the Hainan Group.

The development of the Bougouni Lithium project will ensure

Kodal plays a role in the future energy transition away from fossil

fuels as our lithium spodumene concentrate product provides the key

base material for battery production. This year has seen the

lithium price retreat from the recent highs noted in 2022 that

marked, at that time, a 10-fold increase in price over a two year

timeframe. The current price for lithium spodumene concentrate is

in line with the Company's prices used in its feasibility studies

and underlines the robustness of our project.

Kodal continues to review the lithium sector and notes that the

decarbonisation and the energy transition are expected to fuel

sustained commodity demand growth and notes that a report published

by the International Energy Agency has estimated that global

battery and minerals supply chains need to expand ten-fold to meet

projected critical minerals needs by 2030.

The demand for lithium is supported by the increasing primary

markets for lithium that include electric vehicle ("EV") batteries,

other batteries, ceramics and glass. EV batteries are the fastest

growing segment and the key driver of demand growth. The take-up of

electric vehicles is predicted to continue to strongly grow over

the next decade as Government policies, population demand and

increased vehicle choice drive the market.

In addition to the Bougouni Project, Kodal is now also

well-funded to undertake further work on its range of 100% owned

exploration projects in Mali and C ô te d'Ivoire. The Company has

advanced gold exploration projects with potential for near term

resource definition and we are working on a strategy to maximise

the value of these assets.

In the 6-month period ended 30 September 2023, the Group has

recorded a loss of GBP509,000 compared to losses of GBP491,000 for

the 6 months to 30 September 2022 and GBP1,461,000 for the year to

31 March 2023.

Cash balances as at 30 September 2023 were GBP1,706,000 compared

to GBP2,628,000 at 30 September 2022 and GBP545,000 at 31 March

2023. Cash as at 21 December 2023 was GBP11,236,000.

We have a very exciting period ahead of us as we move into the

construction and production phase at the Bougouni Lithium project

in partnership with the Hainan Group. We look forward to reporting

on our progress during 2024.

Robert Wooldridge

Non-Executive Chairman

Contact details:

For further information, please visit www.kodalminerals.com or

contact the following:

Kodal Minerals plc

Bernard Aylward, CEO Tel: +61 418 943

345

Allenby Capital Limited, Nominated Adviser

Jeremy Porter / Vivek Bhardwaj Tel: 020 3328

5656

---------------------------

SP Angel Corporate Finance LLP, Financial Adviser

& Broker Tel: 020 3470

John Mackay / Laura Harrison 0470

---------------------------

Canaccord Genuity Limited, Joint Broker

James Asensio/Gordon Hamilton Tel: 0207 523

4680

---------------------------

Buchanan, Financial PR Tel: 020 7466

Bobby Morse/Oonagh Reidy 5000

kodal@buchanancomms.co.uk

---------------------------

KODAL MINERALS PLC

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 30 SEPTEMBER 2023

Unaudited Unaudited Audited

6 months 6 months Year ended

to to 31 March

30 September 30 September 2023

2023 2022

GBP GBP GBP

Continuing operations

Revenue - - -

Other operating income 6 158,138 - -

Administrative expenses (511,978) (368,850) (944,473)

Share based payments (154,899) (122,006) (516,581)

-------------- -------------- ------------

OPERATING LOSS (508,739) (490,856) (1,461,054)

Finance costs - - -

-------------- -------------- ------------

LOSS BEFORE TAX (508,739) (490,856) (1,461,054)

Taxation - - -

LOSS FOR THE PERIOD/YEAR (508,739) (490,856) (1,461,054)

OTHER COMPREHENSIVE INCOME

Items that may be subsequently

reclassified to profit and loss

Currency translation (loss)/gain (54,725) 259,162 331,259

TOTAL COMPREHENSIVE INCOME

FOR THE PERIOD/YEAR (563,464) (231,694) (1,129,795)

============== ============== ============

Loss per share

Basic and diluted - loss per

share on total earnings - pence

per share 3 (0.0030) (0.0029) (0.0087)

KODAL MINERALS PLC

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 SEPTEMBER 2023

Unaudited Unaudited Audited

as at as at as at

30 September 30 September 31 March

2023 2022 2023

Note GBP GBP GBP

NON-CURRENT ASSETS

Intangible assets 6 17,000,095 12,788,905 14,521,888

Property, plant and equipment 7 76,992 1,356 91,771

17,077,087 12,790,261 14,613,659

-------------- -------------- -------------

CURRENT ASSETS

Other receivables 17,793 18,700 11,175

Cash and cash equivalents 1,705,534 2,628,334 544,988

-------------- -------------- -------------

1,723,327 2,647,034 556,163

Non-current assets classified

as held for sale 267,991 - 513,109

CURRENT LIABILITIES

Trade and other payables (4,348,457) (598,543) (800,007)

-------------- -------------- -------------

NET CURRENT (LIABILITIES)

/ ASSETS (2,357,139) 2,048,491 269,265

-------------- -------------- -------------

NET ASSETS 14,719,948 14,838,752 14,882,924

EQUITY

Attributable to owners of

the parent:

Share capital 10 5,319,525 5,282,416 5,315,619

Share premium account 10 18,808,801 18,456,035 18,765,206

Share based payment reserve 1,849,685 1,272,684 1,537,779

Translation reserve (42,093) (59,466) 12,632

Retained deficit (11,215,970) (10,112,917) (10,748,312)

-------------- -------------- -------------

TOTAL EQUITY 14,719,948 14, 838,752 14,882,924

============== ============== =============

KODAL MINERALS PLC

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 30 SEPTEMBER 2023

Share based Translation

Share Share premium payments reserve Retained Total

capital account reserve deficit equity

GBP GBP GBP GBP GBP

At 31 March 2022

(audited) 4,947,595 15,933,071 1,150,678 (318,627) (9,622,062) 12,090,655

Comprehensive

income

Loss for the period - - - - (490,855) (490,855)

Currency

translation gain - - - 259,161 - 259,161

---------- -------------- -------------- -------------- ------------- -----------

Total comprehensive

income

for the period - - - 259,161 (490,855) (231,694)

Transactions with

owners

Proceeds from

shares issued 334,821 2,522,964 - - - 2,857,785

Share based payment - - 122,006 - - 122,006

---------- -------------- -------------- -------------- ------------- -----------

At 30 September

2022 (unaudited) 5,282,416 18,456,035 1,272,684 (59,466) (10,112,917) 14,838,752

---------- -------------- -------------- -------------- ------------- -----------

Comprehensive

income

Loss for the period - - - - (970,199) (970,199)

Currency

translation gain - - - 72,098 - 72,098

---------- -------------- -------------- -------------- ------------- -----------

Total comprehensive

income

for the period - - - 72,098 (970,199) (898,101)

Transactions with

owners

Proceeds from

exercise of

share options 33,203 309,171 - - - 342,374

Lapse of share

options - - (334,804) - 334,804 -

Share based payment - - 599,899 - - 599,899

---------- -------------- -------------- -------------- ------------- -----------

At 31 March 2023

(audited) 5,315,619 18,765,206 1,537,779 12,632 (10,748,312) 14,882,924

Comprehensive

income

Loss for the period - - - - (508,739) (508,739)

Currency

translation (loss) - - - (54,725) - (54,725)

---------- -------------- -------------- -------------- ------------- -----------

Total comprehensive

income

for the period - - - (54,725) (508,739) (563,464)

Transactions with

owners

Proceeds from

exercise of

share options 3,906 43,595 - - - 47,501

Lapse of share

options - - (41,081) - 41,081 -

Share based payment - - 352,987 - - 352,987

---------- -------------- -------------- -------------- ------------- -----------

At 30 September

2023 (unaudited) 5,319,525 18,808,801 1,849,685 (42,500) (11,215,970) 14,719,948

---------- -------------- -------------- -------------- ------------- -----------

KODAL MINERALS PLC

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF CASH FLOWS

FOR THE SIX MONTHSED 30 SEPTEMBER 2023

Unaudited Unaudited Audited

6 months 6 months Year ended

to to 31 March

30 September 30 September 2023

2023 2022

GBP GBP GBP

Cash flows from operating activities

Loss before tax (508,739) (490,856) (1,461,054)

Adjustments for non-cash items:

Profit on sale of exploration and

evaluation assets (158,138)

Share based payments 154,899 122,006 516,581

Operating cash flow before movements

in working capital (511,978) (368,850) (944,473)

Movement in working capital

(Increase)/decrease in receivables (6,618) (12,931) (5,406)

Increase/(decrease) in payables 802,706 192,202 393,666

-------------- -------------- ------------

Net movements in working capital 796,088 179,271 388,260

Net cash inflow / (outflow) from

operating activities 284,110 (189,579) (556,213)

Cash flows from investing activities

Purchase of tangible assets - - (103,633)

Purchase of exploration and evaluation

assets (2,473,559) (1,045,662) (3,006,324)

Disposal of exploration and evaluation 400,000 -

assets -

-------------- -------------- ------------

Net cash outflow from investing

activities (2,073,559) (1,045,662) (3,109,957)

Cash flow from financing activities

Prepayment on share subscription 2,745,744 - -

Net proceeds from share issues - 2,857,785 2,857,785

Net proceeds from exercise of share

options 47,501 - 342,374

Net cash inflow from financing

activities 2,793,245 2,857,785 3,200,159

-------------- -------------- ------------

Increase/(decrease) in cash and

cash equivalents 1,003,796 1,622,544 (466,011)

Cash and cash equivalents at beginning

of the period 544,988 1,045,515 1,045,515

Exchange gain / (loss) on cash 156,750 (39,725) (34,516)

-------------- -------------- ------------

Cash and cash equivalents at end

of the period 1,705,534 2,628,334 544,988

============== ============== ============

KODAL MINERALS PLC

NOTES TO THE CONSOLIDATED INTERIM FINANCIAL STATEMENTS

FOR THE SIX MONTHSED 30 SEPTEMBER 2023

General information

Kodal Minerals plc is a public limited company incorporated and

domiciled in England & Wales. The Company's shares are publicly

traded on the AIM market of the London stock exchange. Kodal

Minerals Plc and its subsidiaries are involved in the exploration

and evaluation of mineral resources in West Africa.

Basis of preparation

These unaudited condensed consolidated interim financial

statements for the six months ended 30 September 2023 were approved

by the board and authorised for issue on 21 December 2023.

The basis of preparation and accounting policies set out in the

Annual Report and Accounts for the year ended 31 March 2023 have

been applied in the preparation of these condensed consolidated

interim financial statements. These interim financial statements

have been prepared in accordance with the historical cost

convention and in accordance with International Accounting

Standards in conformity with the requirements of the Companies Act

2006 that are expected to be applicable to the consolidated

financial statements for the year ending 31 March 2024 and on the

basis of the accounting policies expected to be used in those

financial statements.

The figures for the six months ended 30 September 2023 and 30

September 2022 are unaudited and do not constitute full accounts.

The comparative figures for the year ended 31 March 2023 are taken

from the 2023 audited accounts, which are available on the Group's

website, and have been delivered to the Registrar of Companies, and

do not constitute full accounts.

The Group has not earned revenue during the period to 30

September 2023 as it is still in the exploration and development

phases of its business. The operations of the Group are currently

being financed from funds which the Company has raised from the

issue of new shares.

The directors have prepared cash flow forecasts for the next 12

months. The forecast includes the proceeds from the shares issued

as part of the Funding Transaction with Hainan, the costs of

targeted exploration of some of the company's gold assets, and the

ongoing overheads of the Group. The forecast shows that the Group

has sufficient cash resources available to allow it to continue as

a going concern and meet its liabilities as they fall due for a

period of at least 12 months from the date of the approval of these

interim results. Accordingly, the interims have been prepared on a

going concern basis.

KODAL MINERALS PLC

NOTES TO THE CONDENSED CONSOLIDATED INTERIM FINANCIAL

STATEMENTS

FOR THE SIX MONTHSED 30 SEPTEMBER 2023

1. SEGMENTAL REPORTING

The operations and assets of the Group are focused in the United

Kingdom and West Africa and comprise one class of business: the

exploration and evaluation of mineral resources. The parent Company

acts as a holding company. At 30 September 2023, the Group had not

commenced commercial production from its exploration sites and

therefore had no revenue for the period.

Six months to 30 September West African West African UK

2023 (Unaudited) Gold Lithium Total

GBP GBP GBP GBP

Other operating income - 158,138 - 158,138

Administration expenses (1,815) (19,832) (490,331) (511,978)

Share based payments - - (154,899) (154,899)

------------- ------------- ------------ ------------

Loss for the period (1,815) 138,306 (645,230) (508,739)

------------- ------------- ------------ ------------

At 30 September 2023

Intangible assets -

exploration and evaluation

expenditure 3,515,208 13,484,887 - 17,000,095

Property plant and equipment 846 76,146 - 76,992

Trade and other receivables - - 17,793 17,793

Cash and cash equivalents 18,929 6,205 1,680,400 1,705,534

Assets held for resale - 267,991 - 267,991

Trade and other payables - (1,402,138) (2,946,289) (4,348,457)

Net assets 3,534,983 12,433,091 (1,250,096) 14,719,948

------------- ------------- ------------ ------------

Six months to 30 September West African West African UK

2022 (Unaudited) Gold Lithium Total

GBP GBP GBP GBP

Administration expenses (293) (9,986) (358,570) (368,849)

Share based payments - - (122,006) (122,006)

------------- ------------- ---------- -----------

Loss for the period (293) (9,986) (480,576) (490,855)

------------- ------------- ---------- -----------

At 30 September 2022

Intangible assets -

exploration and evaluation

expenditure 3,068,268 9,720,637 - 12,788,905

Property plant and equipment 338 1,018 - 1,356

Trade and other receivables 17,088 806 806 18,700

Cash and cash equivalents 23,049 311 2,604,974 2,628,334

Trade and other payables (4,645) (481,624) (112,274) (598,543)

Net assets 3,104,098 9,241,148 2,493,506 14,838,752

------------- ------------- ---------- -----------

West West African

Year to 31 March African Lithium

2023 (Audited) Gold UK Total

GBP GBP GBP GBP

Administration expenses 4,288 27,795 912,390 944,473

Share based payments - - 516,581 516,581

Loss for the year 4,288 27,795 1,428,971 1,461,054

---------- ------------- ---------- -----------

At 31 March 2023

(Audited)

Intangible assets

- exploration and

evaluation expenditure 3,305,948 11,215,940 - 14,521,888

Tangible assets 1,042 90,729 - 91,771

Trade and other receivables - - 11,175 11,175

Cash and cash equivalents 90,426 28,858 425,704 544,988

Assets held for resale - 513,109 - 513,109

Trade and other payables - (670,675) (129,332) (800,007)

Net assets 3,397,416 11,177,961 307,547 14,882,924

---------- ------------- ---------- -----------

2. OPERATING LOSS

The operating loss before tax is stated after charging:

Unaudited Unaudited Audited

6 months 6 months Year ended

to to 31 March

30 September 30 September 2023

2023 2022

GBP GBP GBP

Audit services - - 53,000

Share based payment 154,899 122,006 516,581

Directors' salaries and

fees 97,883 80,530 182,247

Employer's National Insurance - - 10,598

3. LOSS PER SHARE

Basic loss per share is calculated by dividing the loss for the

period attributable to ordinary equity holders of the parent by the

weighted average number of ordinary shares outstanding during the

period.

The following reflects the loss and share data used in the basic

EPS computations:

Loss Weighted average Basic loss

number of shares per share

(pence)

GBP

Six months to 30 September

2023 508,739 17,019,270,573 0.0030

Six months to 30 September

2022 490,855 16,715,347,911 0.0029

Year ended 31 March 2023 1,461,054 16,812,417,355 0.0087

Diluted loss per share is calculated by dividing the loss

attributable to ordinary equity holders of the parent by the

weighted average number of ordinary shares outstanding during the

period plus the weighted average number of ordinary shares that

would be issued on conversion of all the dilutive potential

ordinary shares into ordinary shares. Options in issue are not

considered diluting to the earnings per share as the Group is

currently loss making. Diluted loss per share is therefore the same as the basic loss per share.

4. SHARE BASED PAYMENTS

The share-based payment reserve is used to recognise the value

of equity-settled share-based payments provided to employees,

including key management personnel, as part of their

remuneration.

Unaudited Unaudited Audited

6 months 6 months Year ended

to to 31 March

30 September 30 September 2023

2023 2022

Share options outstanding

Opening balance 582,500,000 250,000,000 250,000,000

Lapsed in the period - (72,500,000) (77,500,000)

Issued in the period - 640,000,000 470,000,000

Exercised in the period (12,500,000) - (60,000,000)

--------------

Closing balance 570,000,000 817,500,000 582,500,000

============== ============== ==============

Unaudited Unaudited Audited

6 months 6 months Year ended

to to 31 March

30 September 30 September 2023

2023 2022

Performance share rights

outstanding

Opening balance 240,000,000 175,000,000 175,000,000

Issued in the period - 75,000,000 75,000,000

Exercised in the period - - (10,000,000)

--------------

Closing balance 240,000,000 250,000,000 240,000,000

============== ============== ==============

Unaudited Unaudited Audited

6 months 6 months Year ended

to to 31 March

30 September 30 September 2023

2023 2022

Share warrants outstanding

Opening balance 326,250,000 205,000,000 205,000,000

Lapsed in the period - (12,500,000) (12,500,000)

Issued in the period - - 170,000,000)

Exercised in the period - - (38,250,000)

--------------

Closing balance 326,250,000 192,500,000 326,250,000

============== ============== ==============

5. TAXATION

There is no taxation charge for the period to 30 September 2023

(6 months to 30 September 2022: GBPnil, year to 31 March 2023:

GBPnil) as the group continues to incur losses.

No deferred tax asset has been recognised in respect of losses

as the timing of their utilisation is uncertain at this stage.

6. INTANGIBLE ASSETS

Exploration and

evaluation

GBP

COST

At 31 March 2022 11,442,403

Additions in the period 1,047,742

Effects of foreign exchange 298,760

----------------

At 30 September 2022 12,788,905

Additions in the period 2,179,214

Classified as held for sale (513,109)

Effects of foreign exchange 66,878

----------------

At 31 March 2023 14,521,888

Additions in the period 2,684,613

Effects of foreign exchange (206,406)

----------------

At 30 September 2023 17,000,095

----------------

AMORTISATION

At 31 March 2022 and 30 September

2022 and 31 March 2023 and

30 September 2023 -

----------------

NET BOOK VALUES

At 30 September 2023 (Unaudited) 17,000,095

================

At 30 September 2022 (Unaudited) 12,788,905

================

At 31 March 2023 (Audited) 14,521,888

================

Assets held for

resale

GBP

COST

At 31 March 2023 513,109

Disposals in the period (241,862)

Effects of foreign exchange (3,256)

----------------

At 30 September 2023 267,991

On 18 April 2023, the Company announced the sale of the Bougouni

West project. This was held as an asset for resale at 31 March 2023

and 30 September 2023. During the period, sale of one of the

Bougouni West licences completed, resulting in other operating

income for the Group of GBP158,138.

7. PROPERTY, PLANT AND EQUIPMENT

Plant and machinery

GBP

COST

At 31 March 2022 27,633

Additions in the period -

Effects of foreign exchange (127)

--------------------

At 30 September 2022 27,761

Additions in the period 103,633

Effects of foreign exchange 264

--------------------

At 31 March 2023 131,403

Additions in the period -

Effects of foreign exchange (1,813)

At 30 September 2023 129,590

--------------------

DEPRECIATION

At 31 March 2022 24,324

Charge for the period 2,081

At 30 September 2022 26,405

Charge for the period 13,227

--------------------

At 31 March 2023 39,632

Charge in the period 12,966

At 30 September 2023 52,598

--------------------

NET BOOK VALUES

At 30 September 2023 (Unaudited) 76,992

====================

At 30 September 2022 (Unaudited) 1,356

====================

At 31 March 2023 (Audited) 91,771

====================

8. SUBSIDIARY ENTITIES

The consolidated financial statements include the following

subsidiary companies:

Country Equity Nature of

Company Subsidiary of holding Business

of incorporation

Kodal Norway Kodal Minerals United Kingdom 100% Dormant company

(UK) Limited Plc

International Kodal Minerals Bermuda 100% Holding company

Goldfields (Bermuda) Plc

Limited

International International Mali 100% Mining exploration

Goldfields Mali Goldfields (Bermuda)

SARL Limited

International International C te d'Ivoire 100% Mining exploration

Goldfields C Goldfields (Bermuda)

te d'Ivoire SARL Limited

Jigsaw Resources International Bermuda 100% Holding company

CIV Limited Goldfields (Bermuda)

Limited

Corvette CIV Jigsaw Resources C te d'Ivoire 100% Mining exploration

SARL CIV Limited

Future Minerals International Mali 100% Mining exploration

Limited Goldfields (Bermuda)

Limited

Kodal Mining Kodal Minerals United Kingdom 100% Holding company

UK Limited Plc

9. ORDINARY SHARES

Allotted, issued and fully paid:

Nominal Number of Share Share Premium

Value Ordinary Shares Capital GBP

Note GBP

At 30 September

2022 16,903,730,956 5,282,416 18,456,035

March 2023 a 106,250,000 33,203 309,171

At 31 March 2023 17,009,980,956 5,315,619 18,765,206

May 2023 b 12,500,000 3,906 43,595

At 30 September

2023 17,022,480,956 5,319,525 18,808,801

----------------- ---------- --------------

Share issue costs have been allocated against the Share Premium

account.

Notes:

a) On 20 March 2023, a total of 106,250,000 shares were issued

pursuant to the exercise of options, warrants and Performance Share

Rights from certain directors, senior management and consultants of

the Company. The shares were issued at between 0.14 and 0.38 pence

per share.

b) On 12 May 2023, a total of 12,500,000 shares were issued

pursuant to the exercise of options. The shares were issued at 0.38

pence per share.

10. RELATED PARTY TRANSACTIONS

Transactions with related parties

Robert Wooldridge, a Director, is a member of SP Angel Corporate

Finance LLP ("SP Angel") which acts as financial advisor and broker

to the Company. During the six months to 30 September 2023, SP

Angel received fees of GBP15,000 (6 months to 30 September 2022:

GBP157,005, year to 31 March 2023: GBP173,605). The balance due to

SP Angel at 30 September 2023 was GBPnil (30 September 2022:

GBPnil, 31 March 2023: GBPnil).

Matlock Geological Services Pty Ltd ("Matlock"), a company

wholly owned by Bernard Aylward, a Director, provided consultancy

services to the Group during the six months to 30 September 2023

and received fees of GBP112,500 (6 months to 30 September 2022:

GBP61,754, year to 31 March 2023: GBP139,514). The balance due to

Matlock at 30 September 2023 was GBP88,690 (30 September 2022:

GBP13,270, 31 March 2023: GBPnil).

Geosmart Consulting Pty Ltd ("Geosmart"), a company wholly owned

by Qingtao Zeng, a former Director, provided consultancy services

to the Group during the six months to 30 September 2023 and

received fees of GBPnil (6 months to 30 September 2022: GBP18,948,

year to 31 March 2023: GBP24,627). The balance due to Geosmart at

30 September 2023 was GBPnil (30 September 2022: GBPnil, 31 March

2023: GBPnil).

Zivvo Pty Ltd ("Zivvo"), a company wholly owned by Steven

Zaninovich, a Director, provided consultancy services to the Group

during the six months to 30 September 2023 and received fees of

GBP105,000 (period to 30 September 2022: GBP37,370, year to 31

March 2023: GBP140,000). The balance due to Zivvo at 30 September

2023 was GBPnil (30 September 2022: GBP37,370, 31 March 2023:

GBPnil).

11. CONTROL

No one party is identified as controlling the Group.

12. EVENTS AFTER THE REPORTING PERIOD

On 27 October 2023, the Company announced that it, Kodal Mining

UK Limited, Hainan Mining Co. Limited, and Hainan's wholly owned

UK-incorporated subsidiary Xinmao Investment Co, Limited had agreed

terms to complete the funding package announced on 19 January 2023.

The agreement for completion of the transaction follows from the

waiving of certain conditions precedent relating to the

reorganisation of Kodal's Mali lithium assets.

On 14 November 2023, the Company announced that it had received

US$17.75 million (approximately GBP14.5 million) from Xinmao

Investment Co, Limited in consideration for the issue of

2,937,801,971 new ordinary shares at a price of 0.4912 pence per

share. The Subscription proceeds include the US$3.5m previously

advanced by the Hainan Group as announced on 3 August 2023.

On 15 November 2023, the Company announced the completion of the

funding transaction for US$117.75 million originally announced on

19 January 2023. The Funding Transaction consists of the US$17.75

million equity subscription into Kodal, noted above, and also

includes a US$100 million investment into Kodal's UK subsidiary

company, Kodal Mining UK Limited by the Hainan Group, primarily to

provide the financing to construct the Bougouni lithium production

operation.

On 16 November 2023, the Company announced that it had received

notices of exercise for options, warrants and Performance Share

Rights from certain directors, former directors, senior management

and consultants of the Company to subscribe for a total of

280,833,333 new ordinary shares. Total subscription proceeds for

the Company from these exercises was GBP651,833.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFLAFDLLFIV

(END) Dow Jones Newswires

December 22, 2023 02:00 ET (07:00 GMT)

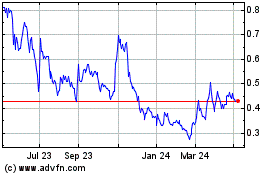

Kodal Minerals (LSE:KOD)

Historical Stock Chart

From Oct 2024 to Nov 2024

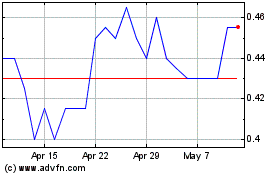

Kodal Minerals (LSE:KOD)

Historical Stock Chart

From Nov 2023 to Nov 2024