Reabold Resources PLC Transaction in Own Shares (3113Z)

11 January 2024 - 6:00PM

UK Regulatory

TIDMRBD

RNS Number : 3113Z

Reabold Resources PLC

11 January 2024

11 January 2024

Reabold Resources plc

("Reabold" or the "Company")

Transaction in Own Shares

Reabold Resources plc, the oil & gas investing company with

a diversified portfolio of exploration, appraisal and development

projects, announces that , in accordance with the terms of its

share buyback programme announced on 13 December 2023, it has

purchased the following number of ordinary shares of 0.1 pence each

in the capital of the Company ("Ordinary Shares") through Stifel

Nicolaus Europe Limited ("Stifel") . The repurchased shares will be

held in the Company's Treasury.

Date of purchase: 10 January 2024

Aggregate number of Ordinary Shares purchased: 8,509,792

Lowest price paid per Ordinary Share (pence per share): 0.0840 pence

Highest price paid per Ordinary Share (pence per share): 0.0865 pence

Volume weighted average price paid per Ordinary Share (pence per share): 0.0850 pence

Following the share buyback, the Company will have

10,194,413,490 Ordinary Shares in issue, and 280,271,717 Ordinary

Shares held in Treasury.

The figure of 10,194,413,490 may be used by shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the Company under the FCA's Disclosure Guidance and

Transparency Rules.

In accordance with Article 5(1)(b) of Regulation (EU) No

596/2014 (the Market Abuse Regulation) as in force in the UK by

virtue of the European Union (Withdrawal) Act 2018, the table below

contains detailed information of the individual trades made by

Stifel as part of the buyback programme.

Schedule of purchases:

Ordinary Shares purchased: Reabold Resources plc (ISIN:

GB00B95L0551)

Date of purchases: 10 January 2024

Investment firm: Stifel Nicolaus Europe Limited

Individual transactions:

Transaction date and Number of shares Transaction price Trading venue

time purchased (pence per share)

10 January 2024, 11:22

AM 1,000,000 0.0860 LSE

----------------- ------------------- --------------

10 January 2024, 01:58

PM 1,876,543 0.0855 LSE

----------------- ------------------- --------------

10 January 2024, 02:00

PM 1,600,000 0.0865 LSE

----------------- ------------------- --------------

10 January 2024, 04:35

PM 4,033,249 0.0840 LSE

----------------- ------------------- --------------

For further information, contact:

Reabold Resources plc c/o Camarco

Sachin Oza +44 (0) 20 3757

Stephen Williams 4980

Strand Hanson Limited - Nominated &

Financial Adviser +44 (0) 20 7409

James Spinney 3494

James Dance

Rob Patrick

Stifel Nicolaus Europe Limited - Joint

Broker +44 (0) 20 7710

Callum Stewart 7600

Simon Mensley

Ashton Clanfield

Cavendish - Joint Broker +44 (0) 20 7220

Barney Hayward 0500

Camarco

Billy Clegg

Rebecca Waterworth +44 (0) 20 3757

Sam Morris 4980

Notes to Editors

Reabold Resources plc has a diversified portfolio of

exploration, appraisal and development oil & gas projects.

Reabold's strategy is to invest in low-risk, near-term projects

which it considers to have significant valuation uplift potential,

with a clear monetisation plan, where receipt of such proceeds will

be returned to shareholders and re-invested into further growth

projects. This strategy is illustrated by the recent sale of the

undeveloped Victory gas field to Shell, the proceeds of which are

being returned to shareholders and re-invested.

The information contained within this announcement is considered

to be inside information prior to its release, as defined in

Article 7 of the Market Abuse Regulation No. 596/2014 which is part

of UK law by virtue of the European Union (Withdrawal) Act 2018, as

amended.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

POSQKKBKFBKDNDD

(END) Dow Jones Newswires

January 11, 2024 02:00 ET (07:00 GMT)

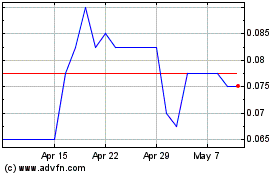

Reabold Resources (LSE:RBD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Reabold Resources (LSE:RBD)

Historical Stock Chart

From Dec 2023 to Dec 2024