Rainbow Rare Earths Limited Publication of Conference Presentation

20 March 2024 - 10:37PM

RNS Non-Regulatory

RNS Number : 6274H

Rainbow Rare Earths Limited

20 March 2024

20 March 2024

Rainbow Rare Earths

Limited

("Rainbow" or "the Company")

LSE: RBW

Publication of Swiss Mining

Institute Conference Presentation

Rainbow Rare Earths is participating in the

Swiss Mining Institute ("SMI") investor conference this week in

Zurich, Switzerland. A copy of the SMI presentation is

available on the Company's website at:

https://www.rainbowrareearths.com/investors/results-reports-presentations/.

For further

information, please contact:

|

Rainbow Rare

Earths Ltd

|

Company

|

George Bennett

Pete Gardner

|

+27 82 652 8526

|

|

|

IR

|

Cathy Malins

|

+44 7876 796 629

cathym@rainbowrareearths.com

|

|

Berenberg

|

Broker

|

Matthew Armitt

Jennifer Lee

|

+44 (0) 20 3207 7800

|

|

Stifel

|

Broker

|

Ashton Clanfield

Varun Talwar

|

+44 20 7710 7600

|

|

Tavistock

Communications

|

PR/IR

|

Charles Vivian

Tara Vivian-Neal

|

+44 (0) 20 7920 3150

rainbowrareearths@tavistock.co.uk

|

Notes to

Editors:

About

Rainbow:

Rainbow Rare Earths aims to be a forerunner in

the establishment of an independent and ethical supply chain of the

rare earth elements that are driving the green energy transition.

It is doing this successfully via the identification and

development of secondary rare earth deposits that can be brought

into production quicker and at a lower cost than traditional hard

rock mining projects, with a focus on the permanent magnet rare

earth elements neodymium and praseodymium, dysprosium and

terbium.

The Company is focused on the development of

the Phalaborwa Rare Earths Project in South Africa and

the earlier stage Uberaba Project in Brazil. Both projects entail

the recovery of rare earths from phosphogypsum stacks that occur as

the by-product of phosphoric acid production, with the original

source rock for both deposits being a hardrock carbonatite.

Rainbow intends to use a

proprietary separation technique developed by and in conjunction

with its partner K-Technologies, Inc., which

simplifies the process of producing separated rare earth oxides

(versus traditional solvent extraction), leading to cost and

environmental benefits.

The Phalaborwa Preliminary Economic Assessment

has confirmed strong base line economics for the project, which has

a base case NPV10 of US$627 million[1], an average EBITDA operating margin of 75% and a

payback period of < two years. Pilot plant operations commenced

in 2023, with the project expected to reach commercial production

in 2026, just five years after work began on the project by

Rainbow.

More information is available at

www.rainbowrareearths.com.

[1] Net

present value using a 10% forward discount rate

This information is provided by Reach, the non-regulatory

press release distribution service of RNS, part of the London Stock

Exchange. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

NRAFZGZFMGNGDZM

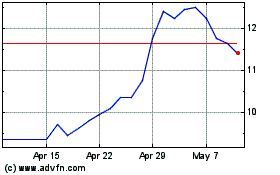

Rainbow Rare Earths (LSE:RBW)

Historical Stock Chart

From Oct 2024 to Nov 2024

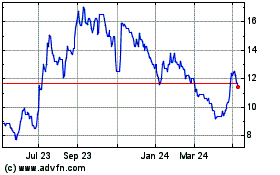

Rainbow Rare Earths (LSE:RBW)

Historical Stock Chart

From Nov 2023 to Nov 2024