Update on Debt Funding

Vast Resources plc / Ticker: VAST / Index: AIM /

Sector: Mining

15 January 2024

Vast Resources plc(‘Vast’ or the

‘Company’)

Update on Debt Funding

Vast Resources plc, the AIM-listed mining

company, is pleased to announce an update in relation to the Asset

Backed Debt facility from A&T Investments SARL (“Alpha”) as

announced on 16 May 2022 and the debt owed to Mercuria Energy

Trading SA (“Mercuria”) relating to Tranche A of the Prepayment

Agreement announced on 21 March 2018 (together the

“Creditors”).

As announced on the 6 November 2023, the

totality of the debt owed to Mercuria and Alpha was due to be

repaid on or before 30 November 2023. On 4 December 2023 the

Company announced it was in discussions with the Creditors for a

repayment extension beyond 30 November 2023. The Company has now

concluded legal documentation for an extension to 31 January 2024

with a further period of one month to 29 February 2024 to effect

repayment prior to the creditors having an ability to commence any

enforcement of security so as to allow the Company to finalise

ongoing repayment initiatives as previously announced.

**ENDS**

For further information, visit

www.vastplc.com or please contact:

| Vast

Resources plcAndrew Prelea (CEO) |

www.vastplc.com+44 (0) 20 7846 0974 |

| Beaumont

Cornish – Financial & Nominated AdvisorRoland

CornishJames Biddle |

www.beaumontcornish.com+44 (0) 20 7628 3396 |

| Shore

Capital Stockbrokers Limited – Joint Broker Toby Gibbs /

James Thomas (Corporate Advisory) |

www.shorecapmarkets.co.uk +44 (0) 20 7408 4050 |

| Axis

Capital Markets Limited – Joint Broker Richard

Hutchinson |

www.axcap247.com +44 (0) 20 3206 0320 |

| St Brides

Partners LimitedSusie Geliher |

www.stbridespartners.co.uk+44 (0) 20 7236 1177 |

ABOUT VAST RESOURCES PLC

Vast Resources plc is a United Kingdom AIM

listed mining company with mines and projects in Romania,

Tajikistan, and Zimbabwe.

In Romania, the Company is focused on the rapid

advancement of high-quality projects by recommencing production at

previously producing mines.

The Company's Romanian portfolio includes 100%

interest in Vast Baita Plai SA which owns 100% of the producing

Baita Plai Polymetallic Mine, located in the Apuseni Mountains,

Transylvania, an area which hosts Romania's largest polymetallic

mines. The mine has a JORC compliant Reserve & Resource Report

which underpins the initial mine production life of approximately

3-4 years with an in-situ total mineral resource of 15,695 tonnes

copper equivalent with a further 1.8M-3M tonnes exploration target.

The Company is now working on confirming an enlarged exploration

target of up to 5.8M tonnes.

The Company also owns the Manaila Polymetallic

Mine in Romania, which the Company is looking to bring back into

production following a period of care and maintenance. The Company

has also been granted the Manaila Carlibaba Extended Exploitation

Licence that will allow the Company to re-examine the exploitation

of the mineral resources within the larger Manaila Carlibaba

licence area.

Vast has an interest in a joint venture company

which provides exposure to a near term revenue opportunity from the

Takob Mine processing facility in Tajikistan. The Takob Mine

opportunity, which is 100% financed, will provide Vast with a 12.25

percent royalty over all sales of non-ferrous concentrate and any

other metals produced. Processing of stockpiled ore on site is

expected to commence in mid-2022.

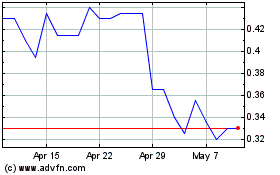

Vast Resources (LSE:VAST)

Historical Stock Chart

From Oct 2024 to Nov 2024

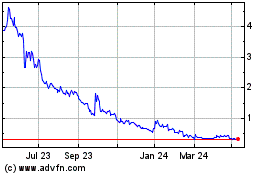

Vast Resources (LSE:VAST)

Historical Stock Chart

From Nov 2023 to Nov 2024