Barclays (LSE:BARC) reported strong results for 2024, with solid growth across its retail banking, credit card and mortgage operations.

The bank’s pre-tax profit increased by 25% to £3.58 billion, up from £2.87 billion the previous year. This improvement was driven primarily by higher net interest income and a one-time gain from the acquisition of Tesco (LSE:TSCO) Bank.

The company’s total income rose 9% to £8.27 billion, compared to £7.59 billion in 2023. However, when excluding the £556 million gain associated with the Tesco acquisition, the increase was a more moderate 2%, which reflects stable but competitive conditions in the UK banking sector.

Net interest income grew by 3% to £6.63 billion, aided by an increase in mortgage lending and structural hedge momentum, although this was partially offset by deposit dynamics and mortgage margin compression.

Consumer banking remained central to the company’s growth. Personal Banking income surged 13% to £5.33 billion, largely fuelled by the Tesco acquisition. Without this impact, revenue remained steady at £4.78 billion, as higher mortgage lending and new customer growth balanced out competitive pressure on margins.

Income from Barclaycard Consumer UK declined by 3% to £937 million, reflecting lower interest earnings on credit card balances despite steady customer spending.

UK mortgage balances holding steady at £163.1 billion, slightly down from £163.5 billion in 2023. Mortgage gross lending increased by 5% to £23.9 billion, suggesting continued demand despite interest rate fluctuations.

Customer behaviour trends also pointed to an increasing shift toward digital banking, with the number of digitally active customers rising to 13.4 million from 12.7 million. At the same time, Barclays continued to scale back its physical presence, reducing its number of branches from 306 to 221.

Barclays managed to cut total operating expenses by 2%, reducing them to £4.33 billion from £4.41 billion.

The cost-to-income ratio improved significantly, dropping from 58% to 52%, reflecting better efficiency across operations. Credit impairment charges rose to £365 million from £304 million, largely due to higher provisions in personal banking and credit cards, though the overall loan loss rate remained low at 16 basis points.

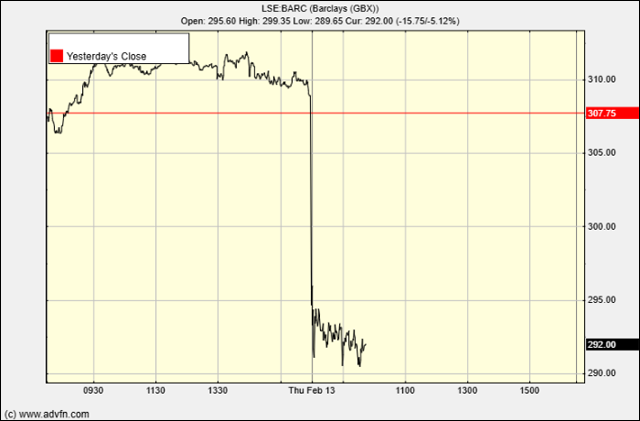

Despite these positive results, the Barclays share price fell 5.8%. Richard Hunter, head of markets at Interactive Investor, said: “A stable, dependable and progressive set of numbers such as these would normally fire the share price ahead, but given Barclays’ recent run the height of expectation has turned into a temporary headwind.”

Hot Features

Hot Features