The current global context continues to become grimmer. On one side, we have a trade agreement that is apparently still far from completion and that is despite Donald Trump’s daily attempts to assure the public that “China trade deal is coming along very well”. Whereas on the other side, a growing number of countries show signs of instability both in terms of macroeconomic data and political/social situation: in the latter case we are not talking only about Iran, Iraq, Hong Kong, Istanbul, Pakistan, Indonesia, and Saudi Arabia anymore, as Lebanon, Bolivia and Colombia have also enrolled into protest movements. In terms of data, according to the Tenth District Manufacturing Survey from the Federal Reserve Bank of Kansas City, manufacturing activity in the central part of the U.S. contracted again in November: -3 (est. -2; prev. -3).

First thing first, due to an American Thanksgiving Holiday next week the stock market will be closed on Thursday, November 28th. Besides that, all the data suggests that market correction is about to start, thus we can expect short-term pullbacks. Investors are getting tired of all the uncertainty around the trade war: it is on again, it is off again. Now it looks like the China deal is back on, but at the same time, both chambers of Congress passed a pro-Hong Kong rights bill. Now, everything depends on President Donald Trump’s decision, who is hesitating to say if he will sign it or not. In this context, it is worth mentioning one of his last tweets: “We have to stand with Hong Kong but I’m also standing with President Xi”. Meanwhile, China already demanded Trump to veto the pro-Hong Kong bill. Nevertheless, there is no doubt that eventually, we are going to see some sort of trade deal but it can be not quite what everybody expected.

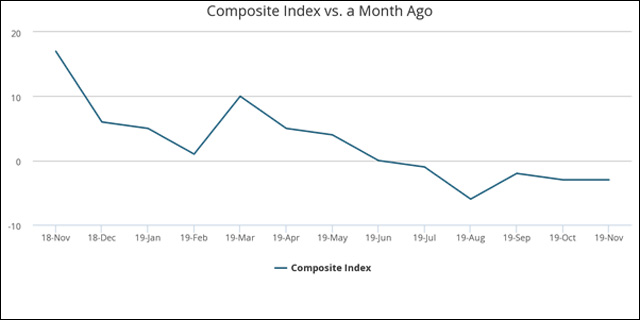

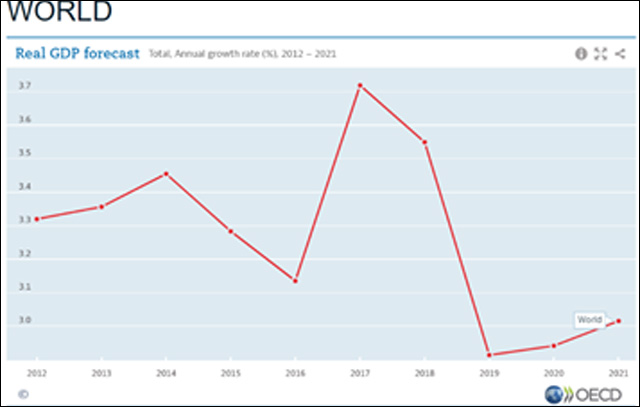

The second thing to look towards is election outcome uncertainty that is beginning to worry markets. Remember, markets do not like uncertainty. As a result, it would not be a surprise to see the acceleration of monetary and fiscal stimulus worldwide next year. Meanwhile, according to FOMC minutes, the US Federal Reserve is taking a pause in the interest rate reduction cycle, unless economic conditions change significantly. Meaning that the Fed may consider ways to reduce rates one more time when new signs of a slowdown in the US economy appear or problems begin in the currency markets. At the same time, the global outlook remains unstable:

Nevertheless, there are still some possibilities to make money on the stock market. For example, despite clear uncertainty around the U.S. and China agreement, banks, health care stocks and companies that rely on consumer spending showed good growth last week.

In the case of the US Dollar index, lately it has been pinned to the 98 level, but no breakout is expected so far. A daily close below 97 may establish the pattern of lower lows and lower highs that would be very bearish. On the other hand, a daily close above 98,5 would be a signal of a healthy recovery.

The crude oil market has also surprised us this week with a big break towards multi-month highs. For the past few days, there has been a lot of movement back and forth. Now, the picture looks bullish, but, as happened last week, everything may change at the last minute. A lot of that may have been driven by the Saudi Aramco IPO and that is despite the fact that It will not be offered in Western markets. Another reason for the crude oil price rise could be the Crude Oil Inventory report.

According to the Energy Information Administration, supplies rose by 1.4 million barrels, which was a bit smaller than the 1.6 million-barrel rise expected by markets. In addition, we find it important to mention that about 3,200 workers at Canadian National Railway Co. went on strike at midnight Tuesday, threatening to suspend shipments of oil, potash, and grain across the country. According to Toronto-Dominion Bank, the strike could cost Canada’s economy US$1.66 billion (C$2.2 billion) if it lasts until November 30, and US$2.33 billion (C$3.1 billion) if it extends to December 5.

Finally yet importantly, talking about gold it doesn’t look that we are going back to the 1500 level, as apparently more selling is coming. Last week it has closed below 1465 (September low), putting us right in the middle of the price channel, with the bottom at about 1420 dollars that can be considered as the downside target.

Hot Features

Hot Features