The market continues its correction with the mega-cap stocks, S&P 500, Nasdaq Composite, and the Dow Jones Industrial Average losing a bit of momentum. Сongress still can’t reach an agreement on a new stimulus package. President Trump approved the proposed deal to keep TikTok operating in the US, meanwhile, the Fed left its rates unchanged.

Part of the volatility could be also contributed to the quarterly options expiration that took place on September 18. The price of options contracts decrease the closer the option gets to the expiration date, thus more shares a market maker must hedge via either buying or selling the underlying security.

S&P Global Ratings, on the other hand, revised Spain’s outlook to negative from stable, saying the country’s policy response to growing economic and fiscal challenges is “at risk from political fragmentation and reform fatigue.”

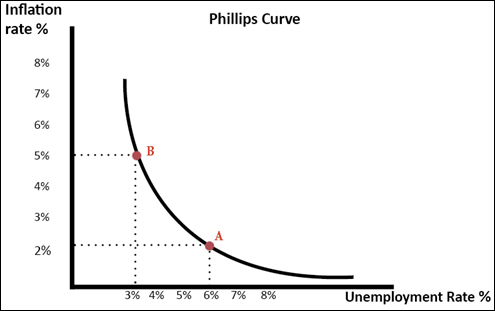

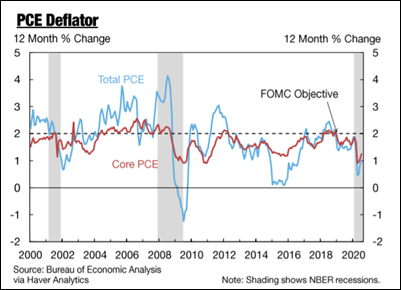

Last week, all eyes were on the central bank meetings. In the US, besides leaving its rates unchanged the Fed said they don’t plan to move until inflation rises above 2%. Still, the bank raised its GDP forecast for 2020 from -6,5% to -3,7%. In 2021, on the other hand, the forecast has been lowered from 5% to 4%. In addition, the Fed will stop relying on Keynesian “Phillips Curve” forecasting models, which in turn rely on the theory that inflation is caused by tight labor markets. Instead, the Fed will refrain from tightening monetary policy until there are clear indications that inflation is rising.

We also got the September 2020 Snapshot of the U.S. Economy:

- Consumer spending continued to recover in July.

- Real business equipment spending plunged in 2020Q2.

- Housing activity continued to rebound in July.

- Payroll employment continued to expand in August. The unemployment rate fell, mainly due to a further decline in temporary layoffs.

- Core PCE inflation remained well below the FOMC’s longer-run objective.

- S. equity indices increased over the last month, amid rising volatility. The nominal 10-year Treasury yield rose modestly but remained low.

- The level of real GDP in 2020Q2 was about 10,0% below the estimate of real potential GDP from the Congressional Budget Office.

- Despite a rebound in June and July, capacity utilization rates continued to be at very low levels.

The Bank of Japan also left its rates unchanged but gave a more optimistic forecast on the economy than in July. Even though deflationary pressures remain and the bank is ready to act whenever the situation requires it. It is also worth mentioning that Yoshihide Suga became the country’s 99th prime minister on Wednesday, putting an end to the administration led by his predecessor Shinzo Abe — the longest in modern Japanese history — and marking the beginning of a new era. The new prime minister said he would stick with the current expansionary monetary policy.

In England, the central bank kept its monetary policy unchanged and kept the key rate at its current record low of 0.1%, but added it is preparing for a no-deal exit. Currently, the outlook for the country, from an economic perspective, remains uncertain. In terms of inflation, it is expected to remain below 1% until early 2021, well below the central bank’s official target of 2%.

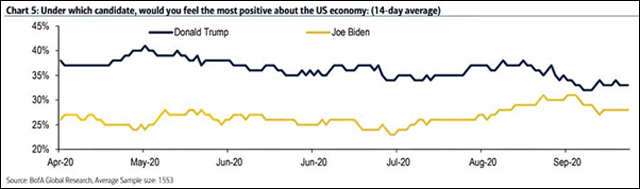

Talking about the US presidential election, former vice-president Joe Biden, the Democratic party’s nominee, is polling ahead of incumbent Republican President Donald Trump in key battleground states.

What begins to worry is that economic reports from most of the major economies show the recovery has slowed, as people tend to stay home in the context of growing virus cases. The latest Retail sales, housing starts, and unemployment claims data were weaker than expected. It could be also contributed to the lack of a fiscal deal from Congress.

Chart of the week

Macroeconomic Data & Events

This week traders will keep an eye on the impact of the second wave of COVID-19 on companies’ supply chains. In particular, we will know September flash manufacturing and services purchasing managers’ indexes in the Eurozone, UK, and US. Besides that, the Riksbank and Norges Bank meetings will take place.

September 21: China loan prime rate (Sep), Spain trade balance (Jul), US Chicago Fed national activity index (Aug), and Brazil business confidence (Sep).

September 22: Euro area consumer confidence (Flash, Sep), the US existing home sales (Aug), Richmond Fed manufacturing index (Sep).

September 23: PMI for US, Eurozone, UK, Germany, and France (Sep), Germany consumer confidence (Oct) Spain GDP (Final, Q2), US house price index (Jul), BoJ meeting minutes (14-15 Jul), ECB non-monetary policy meeting.

September 24: France business confidence (Sep), Germany Ifo business climate (Sep), US initial jobless claims, Kansas Fed manufacturing index (Sep) South Korea and UK consumer confidence (Sep) ECB general council meeting.

September 25: France consumer confidence (Sep), Italy consumer, and business confidence (Sep) and US durable goods orders (Aug).

Hot Features

Hot Features