As filed with the Securities and Exchange Commission

on February 19, 2025

Registration

No. 333-_______

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

TRILOGY METALS

Inc.

(Exact name of registrant as specified in its

charter)

| British Columbia |

98-1006991 |

| (State or other jurisdiction of |

(I.R.S. Employer |

| incorporation or organization) |

Identification Number) |

| |

|

|

Suite 901, 510 Burrard Street

Vancouver, British Columbia

Canada, V6C 3A8

(604) 638-8088 |

| (Address, including zip code, and telephone number, including area code of registrant’s principal executive offices) |

Registered Agent Services, Inc.

Corporate Center One

5301 Southwest Parkway, Suite 400

Austin, TX 78735

(888) 705-7274

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

|

Kimberley R. Anderson

Dorsey & Whitney LLP

701 5th Avenue, Suite 6100

Seattle, Washington 98104

(206) 903-8800 |

|

Trisha Robertson

Blake, Cassels & Graydon LLP

1133 Melville Street, Suite 3500

Vancouver, B.C., Canada V6E 4E5

(604) 631-3300 |

From time to time after the effective date of this Registration Statement

(Approximate date of commencement of proposed sale to the public)

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box. ¨

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the

following box. x

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check

the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ¨

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register

additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following

box. ¨

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging

growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting

company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated

filer ¨ | |

Accelerated filer ¨ | |

Non-accelerated

filer x |

| Smaller reporting company x | |

Emerging growth company ¨ | |

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ¨

The registrant hereby amends

this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further

amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a)

of the Securities Act, or until the registration statement shall become effective on such date as the Securities and Exchange Commission,

acting pursuant to said Section 8(a), may determine.

The information in this prospectus

is not complete and may be changed. We may not sell these securities or accept an offer to buy these securities until the registration

statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and

it is not soliciting offers to buy these securities in any state where such offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED FEBRUARY 19, 2025

$50,000,000

Common Shares

Warrants

Share Purchase Contracts

Subscription Receipts

Units

We may offer and issue from time to time common

shares (the “Common Shares”), warrants to purchase Common Shares (the “Warrants”), Share Purchase

Contracts (as defined herein), Subscription Receipts (as defined herein) and units comprised of some or all of the other securities described

above (“Units”) (all of the foregoing, collectively, the “Securities”) or any combination thereof

up to an aggregate initial offering price of $50,000,000 in one or more transactions under this shelf prospectus (which we refer to as

the “Prospectus”). Securities may be offered separately or together, at times, in amounts, at prices and on terms to

be determined based on market conditions at the time of sale and set forth in an accompanying shelf prospectus supplement (a “Prospectus

Supplement”).

This Prospectus provides you with a general description

of the Securities that we may offer. Each time we offer Securities, we will provide you with a Prospectus Supplement that describes specific

information about the particular Securities being offered and may add, update or change information contained or incorporated by reference

in this Prospectus. You should read both this Prospectus and the Prospectus Supplement, together with the additional information which

is incorporated by reference into this Prospectus and the Prospectus Supplement.

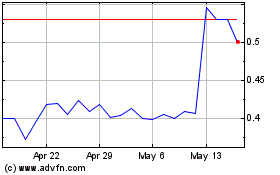

Our outstanding Common Shares are listed and posted

for trading on the Toronto Stock Exchange (“TSX”) and the NYSE American LLC (“NYSE American”), under

the symbol “TMQ”. On February 18, 2025, being the last complete trading day prior to the date hereof, the last reported sale

price of our Common Shares on the TSX was C$1.89 per Common Share and on the NYSE American was US$1.32 per Common Share. Unless

otherwise specified in the applicable Prospectus Supplement, Securities other than the Common Shares will not be listed on any securities

exchange. There is currently no market through which the Securities, other than the Common Shares, may be sold and you may not be able

to resell such Securities purchased under this Prospectus and any applicable Prospectus Supplement. This may affect the pricing of such

Securities in the secondary market, the transparency and availability of trading prices, the liquidity of the Securities, and the extent

of issuer regulation. See “Risk Factors”.

Investing

in our Securities involves a high degree of risk. You should carefully read the “Risk Factors” section

contained elsewhere in this Prospectus and carefully consider the discussion of risks and uncertainties under the heading “Risk

Factors” contained in any applicable Prospectus Supplement and in the documents that are incorporated by reference herein and

therein.

Prospective investors should be aware that

the acquisition of the Securities described herein may have tax consequences. You should read the tax discussion contained in the applicable

Prospectus Supplement and consult your tax advisor with respect to your own particular circumstances. See “Certain Canadian and

U.S. Federal Income Tax Considerations” in this Prospectus.

The date of this Prospectus is , 2025.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This Prospectus is a part of a registration statement

that we have filed with the SEC utilizing a “shelf” registration process. Under this shelf registration process,

we may sell any combination of the Securities described in this Prospectus in one or more offerings up to an aggregate initial offering

price of $50,000,000. The specific terms of the Securities with respect to a particular offering will be set out in the applicable Prospectus

Supplement and may include, where applicable: (i) in the case of Common Shares, the number of Common Shares offered, the issue price,

and any other terms specific to the Common Shares being offered; (ii) in the case of Warrants, the designation, terms, number of Common

Shares issuable upon exercise of the Warrants, any procedures that will result in the adjustment of these numbers, the exercise price,

dates and periods of exercise, the currency in which the Warrants are issued and any other specific terms; (iii) in the case of Share

Purchase Contracts, the designation, number and terms of the Common Shares to be purchased under the Share Purchase Contract, any procedures

that will result in the adjustment of these numbers, the purchase price and purchase date or dates of the Common Shares, any requirements

of the purchaser to secure its obligations under the Share Purchase Contract and any other specific terms; (iv) in the case of Subscription

Receipts, the number of Subscription Receipts offered, the issue price, the currency, the terms, conditions and procedures for the conversion

or exercise of such Subscription Receipts into or for Common Shares or other securities or pursuant to which the holders thereof will

become entitled to receive Common Shares or such other securities, and any other terms specific to the Subscription Receipts being offered;

and (v) in the case of Units, the number of Units offered, the terms of the Units, the offering price, the number of Common Shares, Warrants

or other Securities included in each Unit and any other specific terms. Where required by statute, regulation or policy, and where Securities

are offered in currencies other than Canadian dollars, appropriate disclosure of foreign exchange rates applicable to such Securities

will be included in the Prospectus Supplement describing such Securities.

We may offer and sell Securities to or through

underwriting syndicates or dealers, through agents or directly to purchasers. The Prospectus Supplement for each offering of Securities

will describe in detail the plan of distribution for that offering.

In connection with any offering of the Securities

(unless otherwise specified in a Prospectus Supplement), the underwriters or agents may over-allot or effect transactions which stabilize

or maintain the market price of the Securities offered at a higher level than that which might exist in the open market. Such transactions,

if commenced, may be interrupted or discontinued at any time. See “Plan of Distribution”.

Please carefully read both this Prospectus and

any Prospectus Supplement together with the documents incorporated herein by reference under “Documents Incorporated by Reference”

and the additional information described below under “Where You Can Find Additional Information”.

This Prospectus and the documents incorporated

by reference in this Prospectus contain forward-looking statements and forward-looking information within the meaning of the U.S. Private

Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. See “Cautionary Statement Regarding Forward-Looking

Statements”.

Prospective investors should be aware that

the acquisition of the Securities described herein may have tax consequences. You should read the tax discussion contained in the applicable

Prospectus Supplement and consult your tax advisor with respect to your own particular circumstances.

You should rely only on the information contained

or incorporated by reference in this Prospectus and any Prospectus Supplement. We have not authorized anyone to provide you

with different information. The distribution or possession of this Prospectus in or from certain jurisdictions may be restricted

by law. This Prospectus is not an offer to sell these Securities and is not soliciting an offer to buy these Securities in

any jurisdiction where the offer or sale is not permitted or where the person making the offer or sale is not qualified to do so or to

any person to whom it is not permitted to make such offer or sale. The information contained in this Prospectus is accurate

only as of the date of this Prospectus and any information incorporated by reference is accurate as of the date of the applicable document

incorporated by reference, regardless of the time of delivery of this Prospectus or of any sale of the Securities. Our business,

financial condition, results of operations and prospects may have changed since that date.

In this Prospectus and in any Prospectus Supplement,

unless the context otherwise requires, references to “Trilogy”, the “Company”, “we”, “us”

and “our” refer to Trilogy Metals Inc., either alone or together with our subsidiaries as the context requires.

The complete mailing address and telephone number

of our principal executive officers is Suite 901, 510 Burrard Street, Vancouver, British Columbia, Canada, V6C 3A8; (604) 638-8088.

Unless stated otherwise or as the context otherwise

requires, all references to dollar amounts in this Prospectus and any Prospectus Supplement are references to United States dollars. References

to “$” or “US$” are to United States dollars and references to “Cdn$” or “C$” are to Canadian

dollars. See “Exchange Rate Information”. Our financial statements that are incorporated by reference into this Prospectus

and any Prospectus Supplement have been prepared in accordance with accounting principles generally accepted in the United States.

risk factors

Investing in the Securities is speculative

and involves a high degree of risk due to the nature of our business and the present stage of exploration of our mineral properties. The

following risk factors, as well as risks currently unknown to us, could materially adversely affect our future business, operations and

financial condition and could cause them to differ materially from the estimates described in forward-looking information relating to

Trilogy, or our business, property or financial results, each of which could cause purchasers of Securities to lose all or part of their

investments. The risks set out below are not the only risks we face; risks and uncertainties not currently known to us or that we currently

deem to be immaterial may also materially and adversely affect our business, financial condition, results of operations and prospectus.

Before deciding to invest in any Securities, investors should consider carefully the risks included herein and incorporated by reference

in this Prospectus (including subsequently filed documents incorporated by reference) and those described in any Prospectus Supplement.

Risks

Related to Our Securities

Need for future financing.

The future development of the Company’s

business will require additional financings or refinancings. There are no assurances that such financing or refinancing will be available,

or if available, available on terms acceptable to the Company. If sufficient capital is not available, the Company may be required to

delay the expansion of its business and operations, which could have a material adverse effect on the Company’s business, financial

condition, prospects or results of operations.

Future sales, issuances or exercises

of equity securities could decrease the value of Common Shares, dilute investors’ voting power and reduce our earnings per share.

Our articles of incorporation allow us to issue

an unlimited number of Common Shares for such consideration and on such terms and conditions as shall be established by the board of directors

of the Company (the “Board”), in many cases, without the approval of the shareholders.

The Company has incentive stock options to purchase

Common Shares (“Options”) issued, representing a right to receive Common Shares upon their exercise. In addition, the

Company has restricted share units (“RSUs”) and deferred share units (“DSUs”) issued, representing

a right to receive Common Shares on vesting and satisfaction of the settlement conditions. The exercise of the Options or the settlement

of the RSUs and DSUs and the subsequent resale of such Common Shares in the public market could adversely affect the prevailing market

price and the Company’s ability to raise equity capital in the future at a time and price which deems it appropriate. The Company

may also enter into commitments in the future which would require the issuance of additional Common Shares or may grant Warrants, and

the Company is expected to grant additional Options, RSUs and DSUs. Any share issuances from the Company’s treasury will result

in immediate dilution to existing shareholders’ percentage interest in the Company.

We may also sell additional equity securities

(including through the sale of securities convertible into Common Shares) and may issue additional equity securities to finance our operations,

exploration, development, acquisitions or other projects. We cannot predict the size of future sales and issuances of equity securities

or the effect, if any, that future sales and issuances of equity securities will have on the market price of the Common Shares. Sales

or issuances of a substantial number of equity securities, or the perception that such sales could occur, may adversely affect prevailing

market prices for the Common Shares. With any additional sale or issuance of equity securities, investors will suffer dilution of their

voting power and may experience dilution in our earnings per share.

Sales by existing shareholders

can reduce share prices.

Sales of a substantial number of Common Shares

in the public market could occur at any time. These sales, or the market perception that the holders of a large number of Common Shares

intend to sell Common Shares, could reduce the market price of the Common Shares. If this occurs and continues, it could impair the Company’s

ability to raise additional capital through the sale of Securities.

Our Common Shares are subject

to various factors that have historically made share prices volatile.

The market price of our Common Shares may be subject

to large fluctuations, which may result in losses to investors. In recent years, the securities markets in Canada have experienced a high

level of price and volume volatility, and the market price of many companies, particularly those considered exploration or development

stage companies, have experienced wide fluctuations in price which have not necessarily been related to the operating performance, underlying

asset values or prospects of such companies. The market price of the Common Shares may increase or decrease in response to a number of

events and factors, including but not limited to: our operating performance and the performance of competitors and other similar companies;

volatility in metal prices; the arrival or departure of key personnel; the number of Common Shares to be publicly traded after an offering

pursuant to any Prospectus Supplement; the public’s reaction to our press releases, material change reports, other public announcements

and our filings with the various securities regulatory authorities; changes in earnings estimates or recommendations by research analysts

who track the Common Shares or the shares of other companies in the resource sector; changes in general economic and/or political conditions;

acquisitions, strategic alliances or joint ventures involving us or our competitors; and the factors listed under the heading “Cautionary

Statement Regarding Forward-Looking Statements”.

The market price of the Common Shares may be affected

by many other variables which are not directly related to our success and are, therefore, not within our control, including other developments

that affect the market for all resource sector securities, the breadth of the public market for the Common Shares and the attractiveness

of alternative investments.

Securities class-action litigation often has been

brought against companies following periods of volatility in the market price of their securities. Trilogy may in the future be the target

of similar litigation. Securities litigation could result in substantial costs and damages and divert management’s attention and

resources.

Loss of entire investment.

There is no guarantee that an investment in the

Securities will earn any positive return in the short term or long term. An investment in the Securities is highly speculative and involves

a high degree of risk and should be undertaken only by investors whose financial resources are sufficient to enable them to assume such

risks and who have no need for immediate liquidity in their investment. An investment in the Securities is appropriate only for investors

who have the capacity to absorb a loss of their entire investment.

We will have broad discretion

over the use of proceeds.

While detailed information regarding the use of

proceeds from the sale of our Securities will be described in the applicable Prospectus Supplement, we will have broad discretion over

the use of the net proceeds from an offering of our Securities. Because of the number and variability of factors that will determine our

use of such proceeds, the Company’s ultimate use might vary substantially from its planned use. You may not agree with how we allocate

or spend the proceeds from an offering of our Securities. We may pursue acquisitions, collaborations or other opportunities that do not

result in an increase in the market value of our Securities, including the market value of our Common Shares, and that may increase our

losses.

We do not intend to pay any

cash dividends in the foreseeable future.

We have not declared or paid any dividends on

our Common Shares. Our current business plan requires that for the foreseeable future, any future earnings be reinvested to finance the

growth and development of our business. We do not intend to pay cash dividends on the Common Shares in the foreseeable future. We will

not declare or pay any dividends until such time as our cash flow exceeds our capital requirements and will depend upon, among other things,

conditions then existing including earnings, financial condition, restrictions in financing arrangements, business opportunities and conditions

and other factors, or our Board determines that our shareholders could make better use of the cash.

Negative operating cash flow.

Trilogy had negative operating cash flow for recent

past financial reporting periods. The Company anticipates that it will continue to have negative operating cash flow until such time,

if at all, the Upper Kobuk Mineral Projects go into production. To the extent that Trilogy has negative operating cash flow in future

periods, Trilogy may need to allocate a portion of its cash reserves to fund such negative cash flow. Trilogy may also be required to

raise additional funds through the issuance of equity securities. There can be no assurance that additional capital or other types of

financing will be available when needed or that these financings will be on terms favourable to Trilogy.

There is no assurance of a sufficient liquid

trading market for Common Shares in the future.

Shareholders may be unable to sell significant

quantities of Common Shares into the public trading markets without a significant reduction in the price of their Common Shares, or at

all. There can be no assurance that there will be sufficient liquidity of Common Shares on the trading market, and that Trilogy will continue

to meet the listing requirements of the exchange on which Common Shares are listed.

There is no market for certain of our offered

Securities.

There is no market through which Warrants, Share

Purchase Contracts, Subscription Receipts or Units may be sold. Unless otherwise specified in the applicable Prospectus Supplement, the

Company does not intend to apply for listing of the Warrants, Share Purchase Contracts, Subscription Receipts, or Units on any securities

exchanges. There can be no assurance that an active trading market will develop for the aforementioned securities, or if developed, that

such a market will be sustained at the price level at which it was offered. The liquidity of the trading market in those securities, and

the market price quoted of those securities, may be adversely affected, by among other things:

| · | changes in the overall market for those securities; |

| · | changes in our financial performance or prospects; |

| · | changes or perceived changes in our creditworthiness; |

| · | the prospects for companies in the industry generally; |

| · | the number of holders of those securities; |

| · | the interest of securities dealers in making a market for those securities; and |

| · | prevailing interest rates. |

There can be no assurance that fluctuations in

the trading price will not materially adversely impact our ability to raise equity funding without significant dilution to our existing

shareholders, or at all.

Risks Related to the Company

We may be a “passive foreign investment

company” in future periods, which may have adverse U.S. federal income tax consequences for U.S. shareholders.

U.S. investors in our Common Shares should be

aware that we believe we were not a passive foreign investment company (“PFIC”) for the years ending November 30, 2020

and 2021, but we believe we were a PFIC for the years ending November 30, 2018, 2019, 2022, 2023 and 2024 and may be a PFIC in future

tax years. If we are a PFIC for any year during a U.S. taxpayer’s holding period, then such holder generally will be required to

treat any gain realized upon a disposition of Common Shares and any so-called “excess distribution” received on its Common

Shares as ordinary income, and to pay an interest charge on a portion of such gain or distributions, unless the shareholder makes a timely

and effective “QEF election” or a “mark-to-market election”. In certain circumstances, the sum of the tax and

the interest charge may exceed the total amount of proceeds realized on the disposition, or the amount of excess distribution received,

by the U.S. shareholder. A U.S. taxpayer who makes a QEF election generally must report on a current basis its share of our net capital

gain and ordinary earnings for any year in which we are a PFIC, whether or not we distribute any amounts to our shareholders. A U.S. taxpayer

who makes the mark-to-market election generally must include as ordinary income each year the excess of the fair market value of the Common

Shares over the U.S. taxpayer’s tax basis therein. Information regarding material U.S. federal income tax consequences to persons

investing in the Securities offered by this Prospectus will be set forth in an applicable Prospectus Supplement. Prospective purchasers

should consult its own tax advisor regarding the PFIC rules and the U.S. federal income tax consequences of the acquisition, ownership,

and disposition of our Securities.

Other risks.

Prospective

purchasers should carefully consider the risks in the documents incorporated by reference into this Prospectus (including subsequently

filed documents incorporated by reference), including in the Form 10-K under “Risk Factors”. If any of such or other

risks occurs, the Company’s business, prospects, financial condition, financial performance and cash flows could be materially adversely

impacted. In that case, the applicable Securities could decline in value and purchasers could lose all or part of their investment. There

is no assurance that any risk management steps taken by the Company will avoid future loss due to the occurrence of such risks or other

unforeseen risks.

CAUTIONARY NOTE

TO United States INVESTORS

Unless

otherwise indicated, all resource estimates, and any future reserve estimates, included or incorporated by reference in this Prospectus

and any Prospectus Supplement have been, and will be, prepared in accordance with (i) National Instrument 43-101 – Standards

of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum

Definition Standards for Mineral Resources and Mineral Reserves (“CIM Definition Standards”), and (ii) Subpart 229.1300

of Regulation S-K – Disclosure by Registrants Engaged in Mining Operations (“S-K 1300”). NI 43-101 is a rule

developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific

and technical information concerning mineral projects. S-K 1300 contains the rules established by the Securities and Exchange Commission

(the “SEC”) concerning mining disclosure by U.S. reporting companies. While the S-K 1300 rules are similar to NI 43-101

rules in Canada, they are not identical and therefore the Company has prepared technical reports under both NI 43-101 and S-K 1300. The

information contained or incorporated herein, contains pertinent information required under both NI 43-101 and S-K 1300.

Cautionary Statement

Regarding Forward-Looking Statements

The

information discussed in this Prospectus and the documents incorporated by reference into this Prospectus includes “forward-looking

information” and “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act

of 1995 and applicable Canadian securities laws. These forward-looking statements may include statements regarding perceived merit of

properties, exploration results and budgets, mineral reserves and resource estimates, work programs, capital expenditures, operating

costs, cash flow estimates, production estimates and similar statements relating to the economic viability of a project, timelines, strategic

plans, statements relating anticipated activity with respect to the Ambler Mining District Industrial Access Project or Ambler Access

Project (“AAP”), the Company’s plans and expectations relating to the Arctic and Bornite projects (the “Upper

Kobuk Mineral Projects”), completion of transactions, market prices for precious and base metals, or other statements that

are not statements of fact. These statements relate to analyses and other information that are based on forecasts of future results,

estimates of amounts not yet determinable and assumptions of management.

Statements concerning mineral

resource and reserve estimates may also be deemed to constitute “forward-looking statements” to the extent that they involve

estimates of the mineralization that will be encountered if the property is developed and, in the case of mineral reserves, such statements

reflect the conclusion based on certain assumptions that the mineral deposit can be economically and legally exploited. Any statements

that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or

future events or performance (often, but not always, identified by words or phrases such as “expects”, “is expected”,

“anticipates”, “believes”, “plans”, “projects”, “estimates”, “assumes”,

“intends”, “strategy”, “goals”, “objectives”, “potential”, “possible”

or variations thereof or stating that certain actions, events, conditions or results “may”, “could”, “would”,

“should”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms

and similar expressions) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject

to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those

reflected in the forward-looking statements, including, without limitation:

| · | risks related to inability to define proven and probable reserves; |

| · | risks related to our ability to finance the development of our mineral properties through external financing,

strategic alliances, the sale of property interests or otherwise; |

| · | uncertainty as to whether there will ever be production at the Company’s mineral exploration and

development properties; |

| · | risks related to our ability to commence production and generate material revenues or obtain adequate

financing for our planned exploration and development activities; |

| · | risks related to lack of infrastructure including but not limited to the risk whether or not the AAP will receive the requisite permits and, if it does, whether the Alaska Industrial Development and Export Authority will

build the AAP; |

| · | risks related to inclement weather which may delay or hinder exploration activities at our mineral properties; |

| · | risks related to our dependence on a third party for the development of our projects; |

| · | none of the Company’s mineral properties are in production or are under development; |

| · | commodity price fluctuations; |

| · | uncertainty related to title to our mineral properties; |

| · | our history of losses and expectation of future losses; |

| · | risks related to increases in demand for equipment, skilled labor and services needed for exploration

and development of mineral properties and related cost increases; |

| · | uncertainties relating to the assumptions underlying our resource estimates, such as metal pricing, metallurgy,

mineability, marketability and operating and capital costs; |

| · | uncertainty related to inferred, indicated and measured mineral resources; |

| · | mining and development risks, including risks related to infrastructure, accidents, equipment breakdowns,

labor disputes or other unanticipated difficulties with or interruptions in development, construction or production; |

| · | uncertainty related to successfully acquiring commercially mineable mineral rights; |

| · | risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity

of our mineral deposits; |

| · | risks related to governmental regulation and permits, including environmental regulation, including the

risk that more stringent requirements or standards may be adopted or applied due to circumstances unrelated to the Company and outside

of our control; |

| · | the risk that permits and governmental approvals necessary to develop and operate mines at our mineral

properties will not be available on a timely basis or at all; |

| · | risks related to the need for reclamation activities on our properties and uncertainty of cost estimates

related thereto; |

| · | risks related to the acquisition and integration of operations or projects; |

| · | risks related to industry competition in the acquisition of exploration properties and the recruitment

and retention of qualified personnel; |

| · | our need to attract and retain qualified management and technical personnel; |

| · | risks related to conflicts of interests of some of our directors and officers; |

| · | risks related to potential future litigation; |

| · | risks related to market events and general economic conditions; |

| · | risks related to the voting power of our major shareholders and the impact that a sale by such shareholders

may have on our share price; |

| · | risks related to global climate change; |

| · | risks related to adverse publicity from non-governmental organizations; |

| · | uncertainty as to our ability to maintain the adequacy of internal control over financial reporting as

per the requirements of Section 404 of the Sarbanes-Oxley Act; |

| · | increased regulatory compliance costs, associated with rules and regulations promulgated by the SEC,

Canadian Securities Administrators, the NYSE American, the TSX, and the Financial Accounting Standards Boards, and more specifically,

our efforts to comply with the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank”); |

| · | the need for future financing; |

| · | risks related to future sales, issuances or exercises of equity securities decreasing the value of

Common Shares, diluting investors’ voting power and reducing future earnings per share; |

| · | risks related to the sales by existing shareholders; |

| · | uncertainty as to the volatility in the price of the Common

Shares; |

| · | loss of the entire investment; |

| · | risks related to the Company’s use of proceeds from the

sale of its Securities; |

| · | the Company’s expectation of not paying cash dividends; |

| · | risks associated with negative operating cash flow; |

| · | the uncertainty of maintaining a liquid trading market for the

Common Shares; |

| · | the absence of a public market for certain of the Securities; |

| · | adverse federal income tax consequences for U.S. shareholders should the Company be a “passive

foreign investment company”; and |

| · | those risks identified in the Form 10-K (as defined herein)

for the year-ended November 30, 2024 under the heading “Risks Factors”. |

This list is not exhaustive

of the factors that may affect any of our forward-looking statements. Forward-looking statements are statements about the future and are

inherently uncertain, and our actual achievements or other future events or conditions may differ materially from those reflected in the

forward-looking statements due to a variety of risks, uncertainties and other factors, including, without limitation, those referred to

in this Prospectus under the heading “Risk Factors” and in the documents incorporated by reference in this Prospectus. All

forward-looking statements contained in this Prospectus or in the documents incorporated by reference herein are qualified by these cautionary

statements.

Our forward-looking statements

are based on the beliefs, expectations and opinions of management on the date the statements are made. In connection with the forward-looking

statements contained in this Prospectus and the documents incorporated, or deemed to be incorporated, by reference, we have made certain

assumptions about our business, including about:

| · | our ability to achieve production at the Upper Kobuk Mineral

Projects; |

| · | the accuracy of our mineral resource and reserve estimates; |

| · | the results, costs and timing of future exploration drilling

and engineering; |

| · | timing and receipt of approvals, consents and permits under

applicable legislation; |

| · | the adequacy of our financial resources; |

| · | the receipt of third party contractual, regulatory and governmental

approvals for the exploration, development, construction and production of our properties; |

| · | the Company’s history and continued good relationships

with South32 (as defined herein), workers, unions, local communities and other stakeholders; |

| · | the Company’s ability to comply with environmental, health

and safety laws and other regulatory requirements; |

| | | |

| | · | our expected ability to develop adequate infrastructure and that the cost of doing so will be reasonable; |

| · | there being no significant disruptions affecting operations,

whether relating to labor, supply, power, damage to equipment or other matters; |

| · | mine plans and estimated development schedules remaining consistent

with the plans outlined in the technical reports for each project; |

| · | expected trends and specific assumptions regarding metal prices

and currency exchange rates; and |

| · | prices for and availability of fuel, electricity, parts and

equipment and other key supplies remaining consistent with current levels. |

We have also assumed that no

significant events will occur outside of our normal course of business. Although we have attempted to identify important factors that

could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other

factors that cause actions, events or results not to be as anticipated, estimated or intended. We believe that the assumptions inherent

in the forward-looking statements are reasonable as of the date of this Prospectus. However, forward-looking statements are not guarantees

of future performance and, accordingly, undue reliance should not be put on such statements due to the inherent uncertainty therein.

We do not assume any obligation

to update forward-looking statements if circumstances or management’s beliefs, expectations or opinions should change, except as

required by law. For the reasons set forth above, investors should not place undue reliance on forward-looking statements.

Exchange Rate

Information

The following table sets forth (i) the rate of

exchange for the U.S. dollar, expressed in Canadian dollars, in effect at the end of the periods indicated; (ii) the average exchange

rates for the U.S. dollar, expressed in Canadian dollars, in effect during such periods; and (iii) the high and low exchange rates for

the U.S. dollar, expressed in Canadian dollars, during such periods, each based on the Bank of Canada rate in effect on each trading day

for the relevant period, for conversion of U.S. dollars into Canadian dollars:

| |

|

|

Fiscal Year Ended

November 30 |

|

| |

|

|

2024 |

|

|

2023 |

|

|

2022 |

|

| High for period |

|

|

|

1.4082 |

|

|

|

1.3875 |

|

|

|

1.3856 |

|

| Low for period |

|

|

|

1.3205 |

|

|

|

1.3128 |

|

|

|

1.2451 |

|

| Average for period |

|

|

|

1.3635 |

|

|

|

1.3509 |

|

|

|

1.2947 |

|

| Rate at end of period |

|

|

|

1.4056 |

|

|

|

1.3582 |

|

|

|

1.3508 |

|

On February 18, 2025, the exchange rate for the

U.S. dollar, as expressed in Canadian dollars based on the Bank of Canada average daily rate, was C$1.00 = US$0.7046 (US$1.00 = C$1.4193).

The Company

The

following description of the Company is, in some instances, derived from selected information about us contained in the

documents incorporated by reference into this Prospectus. This description does not contain all of the information about us and our properties

and business that you should consider before investing in any Securities. You should carefully read the entire Prospectus and the applicable

Prospectus Supplement, including the section titled “Risk Factors” that immediately follows this description of the Company,

as well as the documents incorporated by reference into this Prospectus and the applicable Prospectus Supplement, before making an investment

decision.

Corporate Structure

Name, address and incorporation

Trilogy Metals Inc. was incorporated on April

27, 2011 under the name NovaCopper Inc. pursuant to the terms of the Business Corporations Act (British Columbia) (“BCBCA”).

NovaCopper Inc. changed its name to Trilogy Metals Inc. on September 1, 2016 to better reflect its diversified metals resource base. Our

registered office is located at Suite 3500, The Stack, 1133 Melville Street, Vancouver, British Columbia, and our head office is located

at Suite 901, 510 Burrard Street, Vancouver, British Columbia.

Intercorporate relationships

The following chart depicts our corporate structure

together with the jurisdiction of incorporation of our subsidiaries. All ownership is 100% unless otherwise stated.

On

February 11, 2020, the Company’s Upper Kobuk Mineral Projects were transferred to Ambler Metals LLC (“Ambler Metals”),

a limited liability company incorporated under the laws of Delaware and owned equally by Trilogy and South32 Limited (“South32”).

All mineral resources and mineral reserve estimates with respect to the Upper Kobuk Mineral Projects that are disclosed in the Form 10-K

are reported on a 100% basis unless otherwise noted.

Description of the Business

Our principal business is the exploration and

development of the Upper Kobuk Mineral Projects located in the Ambler Mining District in Northwest Alaska, United States The Upper Kobuk

Mineral Projects are held by Ambler Metals and are comprised of the (i) Arctic project, which contains a high-grade polymetallic volcanogenic

massive sulfide deposit; and the (ii) Bornite project, which contains a carbonate-hosted copper - cobalt deposit. Our goals include expanding

mineral resources and advancing the Upper Kobuk Mineral Projects through technical, engineering and feasibility studies so that production

decisions can be made on those projects. Our interest in Ambler Metals is held by a wholly-owned subsidiary, NovaCopper US Inc. (dba Trilogy

Metals US), registered to do business in the State of Alaska. We also conduct early-stage exploration through a wholly owned subsidiary,

995 Exploration Inc.

Recent Developments

Since the date of the Form 10-K, there have been

no recent developments.

Use of Proceeds

Specific information about the use of proceeds

from the specific issuance of any Securities will be set forth in the applicable Prospectus Supplement.

We had negative operating cash flow for the financial

year ended November 30, 2024. We anticipate that we will continue to have negative cash flow until such time, if ever, that commercial

production is achieved at the Upper Kobuk Mineral Projects. To the extent that we have negative operating cash flows in future periods

we may need to allocate a portion of our existing working capital to fund such negative cash flow. See “Risk Factors”.

Dividend Policy

We have not declared or paid any dividends on

our Common Shares since the date of our incorporation. We intend to retain our earnings, if any, to finance the growth and development

of our business and do not expect to pay dividends or to make any other distributions in the near future. Our Board will review this policy

from time to time having regard to our financing requirements, financial condition and other factors considered to be relevant.

Consolidated

Capitalization

There have been no material changes in our capital

structure since February 13, 2025, the date of our financial statements for the most recently completed financial period.

prior sales

Information in respect of our Common Shares that

were issued within the previous twelve-month period, including Common Shares that we issued upon the exercise of Options, RSUs and DSUs

granted under our equity incentive plans, and in respect of such equity securities exercisable or convertible into Common Shares that

we granted under such equity incentive plans, will be provided as required in any applicable Prospectus Supplement.

trading price

and volume

The Common Shares are listed and posted for trading

on the TSX and the NYSE American under the symbol “TMQ”. Trading price and volume of the Company’s securities will be

provided as required for our Common Shares in each Prospectus Supplement to this Prospectus.

Description

of Share Capital

Our

authorized share capital consists of an unlimited number of Common Shares without par value. As at the

date of this Prospectus, we had 163,941,185 Common Shares outstanding.

Common Shares

All of the Common Shares rank equally as to voting

rights, participation in a distribution of our assets on a liquidation, dissolution or winding-up of the Company and the entitlement to

dividends. The holders of the Common Shares are entitled to receive notice of all meetings of shareholders and to attend and vote the

shares at the meetings. Each Common Share carries with it the right to one vote.

In the event of the liquidation, dissolution or

winding-up of the Company or other distribution of its assets, the holders of the Common Shares will be entitled to receive, on a pro

rata basis, all of the assets remaining after we have paid out our liabilities. There are no pre-emptive rights or conversion rights and

no provisions for redemption or purchase for cancellation, surrender or sinking or purchase fund. Distributions in the form of dividends,

if any, will be set by the Board. See “Dividend Policy”.

Provisions as to the modification, amendment or

variation of the rights attached to the Common Shares are contained in our articles and the BCBCA. Generally speaking, substantive changes

to the share capital require the approval of the shareholders by special resolution (at least two-thirds of the votes cast).

DESCRIPTION

OF WARRANTS

This section describes the general terms that

will apply to any Warrants.

Warrants may be offered separately or together

with other Securities, as the case may be. Each series of Warrants will be issued under a separate Warrant indenture to be entered into

between us and one or more banks or trust companies acting as Warrant agent. The applicable Prospectus Supplement will include details

of the Warrant agreements covering the Warrants being offered. The Warrant agent will act solely as the agent of the Company and will

not assume a relationship of agency with any holders of Warrant certificates or beneficial owners of Warrants. The following sets forth

certain general terms and provisions of the Warrants offered under this Prospectus.

Warrants

The particular terms of each issue of Warrants

will be described in the related Prospectus Supplement. This description will include, where applicable:

| · | the designation and aggregate number of Warrants; |

| · | the price at which the Warrants will be offered; |

| · | the currency or currencies in which the Warrants will be offered; |

| · | the designation and terms of the Common Shares purchasable upon exercise of the Warrants; |

| · | the date on which the right to exercise the Warrants will commence and the date on which the right will

expire; |

| · | the number of Common Shares that may be purchased upon exercise of each Warrant and the price at which

and the currency or currencies in which the Common Shares may be purchased upon exercise of each Warrant; |

| · | the designation and terms of any securities with which the Warrants will be offered, if any, and the number

of the Warrants that will be offered with each Security; |

| · | the date or dates, if any, on or after which the Warrants and the related securities will be transferable

separately; |

| · | whether the Warrants will be subject to redemption or call and, if so, the terms of such redemption or

call provisions; |

| · | material United States and Canadian tax consequences of owning the Warrants; and |

| · | any other material terms or conditions of the Warrants. |

Prior to the exercise of their Warrants, holders

of Warrants will not have any of the rights of holders of the securities subject to the Warrants.

DESCRIPTION

OF SHARE PURCHASE CONTRACTS

We may issue Share Purchase Contracts, including

contracts obligating holders to purchase from us, and for us to sell to the holders, a specified number of Common Shares, at a future

date or dates, or similar contracts issued on a “prepaid” basis (in each case, “Share Purchase Contracts”).

The price per Common Share and the number of Common Shares may be fixed at the time the Share Purchase Contracts are issued or may be

determined by reference to a specific formula set forth in the Share Purchase Contracts. The Share Purchase Contracts will require either

the share purchase price be paid at the time the Share Purchase Contracts are issued or that payment be made at a specified future date.

The Share Purchase Contracts may require holders to secure their obligations thereunder in a specified manner. Any Share Purchase Contracts

we issue will be physically settled by delivery of our Common Shares.

The applicable Prospectus Supplement will describe

the terms of the Share Purchase Contracts. The description in the Prospectus Supplement will not necessarily be complete, and reference

will be made to the Share Purchase Contracts, and, if applicable, collateral, depositary or custodial arrangements, relating to the Share

Purchase Contracts. Material United States and Canadian federal income tax considerations applicable to the holders of the Share Purchase

Contracts will also be discussed in the applicable Prospectus Supplement.

DESCRIPTION

OF SUBSCRIPTION RECEIPTS

We may issue Subscription Receipts, which will

entitle holders thereof to receive, upon satisfaction of Release Conditions (as defined herein) and for no additional consideration, Common

Shares, Warrants or any combination of Securities as is specified in the applicable Prospectus Supplement. Subscription Receipts will

be issued pursuant to one or more Subscription Receipt agreements (each, a “Subscription Receipt Agreement”), each

to be entered into between the Company and an escrow agent (the “Escrow Agent”) that will be named in the applicable

Prospectus Supplement. Each Escrow Agent will be a financial institution organized under the laws of Canada or a province thereof and

authorized to carry on business as a trustee. If underwriters or agents are used in the sale of any Subscription Receipts, one or more

of such underwriters or agents may also be a party to the subscription agreement governing the Subscription Receipts sold to or through

such underwriter or agent.

The following description sets forth certain general

terms and provisions of Subscription Receipts that may be issued hereunder and is not intended to be complete. The statements made in

this Prospectus relating to any Subscription Receipt Agreement and Subscription Receipts to be issued thereunder are summaries of certain

anticipated provisions thereof and are subject to, and are qualified in their entirety by reference to, all provisions of the applicable

Subscription Receipt Agreement. Prospective investors should refer to the Subscription Receipt Agreement relating to the specific Subscription

Receipts being offered for the complete terms of the Subscription Receipts. We will file a copy of any Subscription Receipt Agreement

relating to an offering of Subscription Receipts with the securities regulatory authorities in Canada and the United States after we have

entered into it.

The applicable Prospectus Supplement and the Subscription

Receipt Agreement for any Subscription Receipts that we may offer will describe the specific terms of the Subscription Receipts offered.

This description may include, but may not be limited to, any of the following, if applicable:

| · | the designation and aggregate number of Subscription Receipts being offered; |

| · | the price at which the Subscription Receipts will be offered; |

| · | the designation, number and terms of the Common Shares, Warrants or a combination of Securities to be

received by the holders of Subscription Receipts upon satisfaction of the Release Conditions, and any procedures that will result in the

adjustment of those numbers; |

| · | the conditions (the “Release Conditions”) that must be met in order for holders of

Subscription Receipts to receive, for no additional consideration, the Common Shares, Warrants or a combination of Securities; |

| · | the procedures for the issuance and delivery of the Common Shares, Warrants or a combination of Securities

to holders of Subscription Receipts upon satisfaction of the Release Conditions; |

| · | whether any payments will be made to holders of Subscription Receipts upon delivery of the Common Shares,

Warrants or a combination of Securities upon satisfaction of the Release Conditions; |

| · | the identity of the Escrow Agent; |

| · | the terms and conditions under which the Escrow Agent will hold all or a portion of the gross proceeds

from the sale of Subscription Receipts, together with interest and income earned thereon (collectively, the “Escrowed Funds”),

pending satisfaction of the Release Conditions; |

| · | the terms and conditions pursuant to which the Escrow Agent will hold Common Shares, Warrants or a combination

of Securities pending satisfaction of the Release Conditions; |

| · | the terms and conditions under which the Escrow Agent will release all or a portion of the Escrowed Funds

to the Company upon satisfaction of the Release Conditions; |

| · | if the Subscription Receipts are sold to or through underwriters or agents, the terms and conditions under

which the Escrow Agent will release a portion of the Escrowed Funds to such underwriters or agents in payment of all or a portion of their

fees or commissions in connection with the sale of the Subscription Receipts; |

| · | procedures for the refund by the Escrow Agent to holders of Subscription Receipts of all or a portion

of the subscription price of their Subscription Receipts, plus any pro rata entitlement to interest earned or income generated on such

amount, if the Release Conditions are not satisfied; |

| · | any contractual right of rescission to be granted to initial purchasers of Subscription Receipts in the

event that this Prospectus, the Prospectus Supplement under which Subscription Receipts are issued or any amendment hereto or thereto

contains a misrepresentation; |

| · | any entitlement of the Company to purchase the Subscription Receipts in the open market by private agreement

or otherwise; |

| · | whether the Company will issue the Subscription Receipts as one or more global securities (“Global

Securities”) and, if so, the identity of the depository for the Global Securities; |

| · | whether the Company will issue the Subscription Receipts as bearer securities, as registered securities

or both; |

| · | provisions as to modification, amendment or variation of the Subscription Receipt Agreement or any rights

or terms of the Subscription Receipts, including upon any subdivision, consolidation, reclassification or other material change of the

Common Shares, Warrants or other Securities, any other reorganization, amalgamation, merger or sale of all or substantially all of the

Company’s assets or any distribution of property or rights to all or substantially all of the holders of Common Shares; |

| · | whether the Company will apply to list the Subscription Receipts on any exchange; |

| · | material U.S. and Canadian federal income tax consequences of owning the Subscription Receipts; and |

| · | any other material terms or conditions of the Subscription Receipts. |

DESCRIPTION

OF UNITS

We may issue Units, which may consist of one or

more Common Shares, Warrants or any combination of Securities as is specified in the applicable Prospectus Supplement. In addition, the

applicable Prospectus Supplement relating to an offering of Units will describe all material terms of any Units offered, including, as

applicable:

| · | the designation and aggregate number of Units being offered; |

| · | the price at which the Units will be offered; |

| · | the designation, number and terms of the Securities comprising the Units and any agreement governing the

Units; |

| · | the date or dates, if any, on or after which the Securities comprising the Units will be transferable

separately; |

| · | whether the Company will apply to list the Units on a securities exchange or automated interdealer quotation

system; |

| · | material U.S. and Canadian federal income tax consequences of owning the Units, including how the purchase

price paid for the Units will be allocated among the securities comprising the Units; and |

| · | any other material terms or conditions of the Units. |

PLAN OF DISTRIBUTION

We may sell the Securities to or through underwriters

or dealers, and may also sell Securities to one or more other purchasers directly or through agents, including sales pursuant to ordinary

brokerage transactions and transactions in which a broker-dealer solicits purchasers or may issue Securities in whole or in partial payment

of the purchase price of assets acquired by us or our subsidiaries. Each Prospectus Supplement will set forth the terms of the offering

or issue, including the name or names of any underwriters or agents, the purchase price or prices of the Securities and the proceeds to

us from the sale of the Securities.

The Securities may be sold, from time to time

in one or more transactions at a fixed price or prices which may be changed or at market prices prevailing at the time of sale, at prices

related to such prevailing market prices or at negotiated prices, including sales in transactions that are deemed to be an “at-the-market

distribution” as defined in National Instrument 44-102 – Shelf Distributions (an “ATM Distribution”) and

in accordance with Rule 415(a)(4) under the United States Securities Act of 1933 (the “Securities Act”),

including sales made directly on the TSX, NYSE American or other existing trading markets for the Securities. The prices at which the

Securities may be offered may vary as between purchasers and during the period of distribution. If, in connection with the offering of

Securities at a fixed price or prices, the underwriters have made a bona fide effort to sell all of the Securities at the initial offering

price fixed in the applicable Prospectus Supplement, the public offering price may be decreased and thereafter further changed, from time

to time, to an amount not greater than the initial public offering price fixed in such Prospectus Supplement, in which case the compensation

realized by the underwriters will be decreased by the amount that the aggregate price paid by purchasers for the Securities is less than

the gross proceeds paid by the underwriters to the Company.

Only underwriters named in the Prospectus Supplement

are deemed to be underwriters in connection with our securities offered by that Prospectus Supplement.

Underwriters, dealers and agents who participate

in the distribution of the Securities may be entitled to, under agreements to be entered into with us, indemnification by us against certain

liabilities, including liabilities under the Securities Act, and Canadian securities legislation, or to contribution with respect to payments

which such underwriters, dealers or agents may be required to make in respect thereof. Such underwriters, dealers and agents may be customers

of, engage in transactions with, or perform services for, us in the ordinary course of business.

No underwriter or dealer involved in an ATM Distribution,

no affiliate of such underwriter or dealer and no person acting jointly or in concert with such underwriter or dealer has over-allotted,

or will over allot, the Company’s Securities in connection with an ATM Distribution of the Company’s Securities or effect

any other transactions that are intended to stabilize the market price of the Company’s Securities during an ATM Distribution.

In connection with any offering of Securities,

other than in an ATM Distribution, the underwriters may over-allot or effect transactions which stabilize or maintain the market price

of the Securities offered at a level above that which might otherwise prevail in the open market. Such transactions, if commenced, may

be discontinued at any time.

Underwriters, dealers and agents that participate

in the distribution of the Securities offered by this Prospectus may be deemed underwriters under the Securities Act, and any discounts

or commissions they receive from us and any profit on their resale of the securities may be treated as underwriting discounts and commissions

under the Securities Act.

CERTAIN CANADIAN

and U.S. Federal Income Tax Considerations

Information regarding material Canadian and U.S.

federal income tax consequences to persons investing in the Securities offered by this Prospectus will be set forth in an applicable Prospectus

Supplement. You are urged to consult your own tax advisors prior to any acquisition of our Securities.

Legal Matters

Certain legal matters in connection with the Securities

offered hereby will be passed upon on behalf of the Company by Blake, Cassels & Graydon LLP with respect to Canadian legal matters,

and by Dorsey & Whitney LLP with respect to U.S. legal matters.

AUDITORS, Transfer

Agent and Registrar

PricewaterhouseCoopers LLP (“PWC”),

Chartered Professional Accountants, located at Suite 1400, 250 Howe Street, Vancouver, British Columbia, Canada V6C 3S7, are the independent

registered public accounting firm of the Company. PwC have confirmed that they are independent with respect to the Company within the

meaning of the relevant rules and related interpretations prescribed by the relevant professional bodies in Canada, including the Chartered

Professional Accountants of British Columbia Code of Professional Conduct, and any applicable legislation or regulations. PwC has also

confirmed they are independent within the rules of the Public Company Accounting Oversight Board. The consolidated financial statements

of Trilogy for the year ended November 30, 2024 have been audited by PricewaterhouseCoopers LLP, independent registered public accounting

firm, as set forth in their report thereon, included therein, and incorporated herein by reference. Such consolidated financial statements

are incorporated herein by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

PwC, Chartered Professional Accountants, located

at Suite 1400, 250 Howe Street, Vancouver, British Columbia, Canada V6C 3S7, are the independent registered public accounting firm

of Ambler Metals. PwC have confirmed that they are independent with respect to Ambler Metals within the meaning of the relevant rules and

related interpretations prescribed by the relevant professional bodies in Canada, including the Chartered Professional Accountants of

British Columbia Code of Professional Conduct, and any applicable legislation or regulations. PwC has also confirmed they are independent

within the rules of the Public Company Accounting Oversight Board. The consolidated financial statements of Ambler Metals for the

year ended November 30, 2024 have been audited by PwC, independent registered public accounting firm, as set forth in their report

thereon, included therein, and incorporated herein by reference. Such consolidated financial statements are incorporated herein by reference

in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

Our registrar and transfer agent for our Common

Shares is Computershare Investor Services Inc., located at 510 Burrard Street, Vancouver, British Columbia Canada V6C 3B9. The co-transfer

agent and registrar for the Common Shares in the United States is Computershare Trust Company, N.A., at its office at 150 Royall St.,

Canton, MA 02021.

Interest of

Experts

Certain

of the scientific and technical information relating to our mineral projects in this Prospectus and the documents incorporated by reference

herein has been derived from technical reports prepared by the experts listed below and has been included in reliance on such person’s

expertise. Copies of the technical reports can be accessed under the Company’s profile on SEC’s Electronic Data Gathering

and Retrieval system (“EDGAR”) at www.sec.gov/edgar with respect to the S-K 1300 technical report summaries.

The following are the names of persons or companies

(a) that are named as having prepared or certified a report, valuation, statement or opinion included in or included by reference in this

Prospectus; and (b) whose profession or business gives authority to the statement, report or valuation made by the person or Trilogy:

| · | Ausenco Engineering Canada ULC, Wood Canada Limited, SRK Consulting (Canada) Inc. and Brown and Caldwell,

each of which prepared or certified certain portions of the technical report summary titled “Arctic Project S-K 1300 Technical

Report Summary, Ambler Mining District, Alaska” dated November 30, 2022 |

| · | Wood Canada Limited, SRK Consulting (Canada) Inc., Ausenco Engineering Canada ULC. and International Metallurgical

& Environmental and Core Geoscience LLC, each of which prepared or certified certain portions of the technical report summary titled

“S-K 1300 Technical Report Summary on the Initial Assessment of the Bornite Project, Northwest Alaska, USA” dated November

30, 2024; and |

| · | Richard Gosse, P.Geo., VP Exploration of the Company, a “Qualified Person” under S-K 1300

has reviewed and approved the scientific and technical disclosure contained in the annual report on Form 10-K (as defined herein). |

The aforementioned companies, and their directors,

officers, employees and partners, as applicable, as a group, beneficially own, directly or indirectly, less than one percent of our outstanding

securities.

As at the date of this Prospectus, other than

Richard Gosse, none of the aforementioned persons were employed on a contingency basis, or had, or are to receive, in connection with

any offering under this Prospectus, a substantial interest, direct or indirect, in the Company, nor are any such persons connected with

the Company as promoters, managing or principal underwriters, voting trustees, directors, officers, or, except as disclosed herein, employees.

Documents Incorporated

by Reference

Information

has been incorporated by reference in this Prospectus from documents filed with securities commissions or similar authorities in Canada.

Copies of the documents incorporated herein by reference may be obtained on request without charge from the Corporate Secretary of the

Company at Suite 901, 510 Burrard Street, Vancouver, British Columbia, Canada, V6C 3A8, telephone: 604-638-8088. These documents are

also available electronically under the Company’s profile on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov/edgar.

We incorporate by reference the documents listed

below and future filings we make with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as

amended (the “Exchange Act”) (excluding, unless otherwise provided therein or herein, (i) information furnished pursuant to

Item 2.02, Item 7.01 and certain exhibits furnished pursuant to Item 9.01 of our Current Reports on Form 8-K, which are deemed to be furnished

and not filed and therefore not incorporated by reference herein, unless specifically stated otherwise in such filings, after the date

of filing of this registration statement on Form S-3 to which this Prospectus relates). Any statement contained in a document incorporated

by reference in this Prospectus shall be modified or superseded for purposes of this Prospectus to the extent that a statement contained

in this Prospectus, any related free writing prospectus or in any other subsequently filed document which is incorporated by reference

modifies or supersedes such statement.

| (d) | all other documents filed by us with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange

Act, after November 30, 2024 but before the end of the offering of the Securities made by this Prospectus. |

Any statement contained in a document incorporated

by reference in this Prospectus shall be deemed to be modified or superseded for purposes of this Prospectus to the extent that a statement

contained in this Prospectus or in any other subsequently filed document that also is or is deemed to be incorporated by reference in

this Prospectus modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified

or superseded, to constitute a part of this Prospectus. We will provide to each person, including any beneficial owner, to whom a Prospectus

is delivered, a copy of any or all of the information that has been incorporated by reference in the Prospectus but not delivered with

the Prospectus. Copies of the documents incorporated by reference in this Prospectus may be obtained on written or oral request without

charge from the Secretary of the Company at Suite 901, 510 Burrard Street, Vancouver, British Columbia, Canada, V6C 3A8, telephone: (604)

638-8088. Our website is www.trilogymetals.com. Information contained in or accessible through our website does not constitute a part

of this Prospectus.

A Prospectus Supplement containing the specific

terms of an offering of Securities, and other information relating to the Securities, will be delivered to prospective purchasers of such

Securities together with this Prospectus and the applicable Prospectus Supplement and will be deemed to be incorporated into this Prospectus

as of the date of such Prospectus Supplement only for the purpose of the offering of the Securities covered by that Prospectus Supplement.

Upon

a new annual information form, the related annual financial statements and management’s discussion and analysis being filed by the

Company with, and, where required, accepted by, the applicable securities commissions or similar regulatory authorities during the currency

of this Prospectus, the previous annual information form, the previous annual financial statements, the previous management’s

discussion and analysis and all interim financial statements, supplemental information, material change reports and information circulars

filed prior to the commencement of the Company’s financial year in which the new annual information form is filed will be deemed

no longer to be incorporated by reference into this Prospectus for purposes of future offers and sales of our Securities under this Prospectus.

Upon interim consolidated financial statements and the accompanying management’s discussion and analysis and material change report

being filed by us with the applicable securities regulatory authorities during the duration of this Prospectus, all interim consolidated

financial statements and the accompanying management’s discussion and analysis filed prior to the new interim consolidated financial

statements shall be deemed no longer to be incorporated into this Prospectus for purposes of further offers and sales of Securities hereunder.

References to our website in any documents that

are incorporated by reference into this Prospectus do not incorporate by reference the information on such website into this Prospectus,

and we disclaim any such incorporation by reference.

WHERE YOU CAN

FIND additional information

We are subject to the information requirements

of the Securities Exchange Act of 1934 and, accordingly, we file reports with and furnish other information to the SEC. We have filed

with the SEC a registration statement on Form S-3 under the Securities Act of 1933 with respect to the securities offered by this prospectus.

This prospectus does not contain all of the information contained in the registration statement that we filed. For further information

regarding us and the securities covered by this prospectus, you may desire to review the full registration statement, including its exhibits.

The registration statement, including its exhibits, as well as the documents that we file with the SEC, may be inspected and copied at

the public reference facilities maintained by the SEC at 100 F Street, N.E., Room 1580, Washington, D.C. 20549. You may obtain information