TIDMFLK

RNS Number : 7560J

Fletcher King PLC

15 December 2022

FLETCHER KING PLC

Interim Results for the 6 months ended 31 October 2022

Financial Highlights

Turnover: GBP1,338,000 (2021: GBP1,426,000)

Earnings before tax: GBP32,000 (2021: GBP11,000)

Basic EPS: 0.23p per share (2021: 0.12p per share)

Dividend proposed: nil (2021: nil)

Operational Highlights

-- Earnings before tax improved slightly on the comparative

period last year, with lower operational overheads compensating for

a reduction in revenue.

-- Transactional activity has stalled in the current market

conditions and this is likely to continue for a while.

-- Successful in winning some new property management

instructions which will add recurring fee income to the existing

portfolio of asset management and fund management clients.

-- Fee income from bank valuations has also continued to grow.

-- The move to new offices has been well received and provides a

welcome reduction in property overheads.

Commenting on the results David Fletcher, Chairman of Fletcher

King said:

"With inflation driving up interest rates, and the current

political and economic uncertainty, the property market is going

through a period of transition and it is unclear how long this

might last. Transactional activity is likely to remain subdued for

a while as this period of price adjustment plays out. The market

turbulence will however create opportunities and we remain vigilant

to prospects for growth and development".

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation and the Directors of the Company

are responsible for the release of this announcement.

ENQUIRIES:

Fletcher King Plc

David Fletcher / Peter Bailey

Tel: 020 7493 8400

Cairn Financial Advisers LLP (Nomad)

James Caithie / Liam Murray

Tel: 020 7213 0880

The interim results are available on the Company's website:

www.fletcherking.co.uk

CHAIRMAN'S STATEMENT

Results

Turnover for the period was GBP1,338,000 (2021: GBP1,426,000)

with a profit before tax of GBP32,000 (2021: GBP11,000).

Dividend

In view of the continued uncertainty and the low level of profit

the Board is not declaring an interim dividend (2021: no

dividend).

The Commercial Property Market

Both capital and occupational markets are now suffering, mainly

as a result of the current economic and political uncertainties,

and capital values in particular have begun to decline.

The capital markets have seen a significant reduction in demand

and there is currently very little activity. A number of large

transactions have fallen through and interest in new propositions

is lukewarm. This situation is likely to continue for some time,

with significant falls in capital values likely in the second half.

Nevertheless there is still considerable foreign capital waiting to

invest, particularly in Central London, and once a degree of

confidence returns to both the economy and our political

leadership, we believe that we are likely to see a significant

change.

Conversely, in the letting markets, despite the fact that rental

values are now experiencing some pressure, lettings are generally

reasonably active and even in the retail sector we have achieved

some satisfactory lettings in a number of our managed portfolios.

These are in locations throughout the country, although principally

in prime locations.

Demand for Grade A offices in the City and West End remains very

strong, record rents are still being achieved and we are also

seeing some substantial companies looking to bring their offices

into the centre from the suburbs.

For the first time in many years, the industrial sector is

experiencing reduced demand and capital values have come under

pressure. In our view this is likely to see it becoming the worst

performing sector in the second half.

Business Overview

Bearing in mind the difficult market conditions, it is pleasing

that we are able to report a profit for the period. It would have

been higher if demand in the capital markets had not suffered.

Property Asset Management and Fund Management continue to

perform well and attract new business and we hope to add new

instructions in the coming months.

Our volume of bank valuations continues to grow, despite the

increased cost of borrowing. We have added new clients during the

year and this is likely to continue.

Income from Rating Appeals remains difficult but we hope some of

the long outstanding appeals will be settled in the second

half.

The Investment Department had a very disappointing first half

and we anticipate similar under performance in the months to

come.

Our move to new offices has been very successful and the reduced

property overhead is welcomed in these difficult times.

Outlook

It is impossible to predict the future with so much uncertainty

in the world.

We are growing our secure income flow in Property Asset

Management and Fund Management, and continue to perform well on

rent collection.

The volume of valuations seems set to continue but rating is

likely to be slow.

The investment department will continue to be under pressure but

we do have some excellent instructions, although the timing of them

is impossible to predict in the current economic climate.

The good news is that our balance sheet is strong and our

clients remain very loyal for which we thank them. We have an

excellent and hard-working team who are committed to improving

performance.

DAVID FLETCHER

CHAIRMAN

15 December 2022

Fletcher King Plc

Consolidated Interim Statement of Comprehensive Income

for the 6 months ended 31 October 2022

6 months 6 months

ended ended Year ended

31 October 31 October 30 April

2022 2021

(Unaudited) (Unaudited) 2022 (Audited)

GBP000 GBP000 GBP000

------------------------------------- -------------- -------------- ---------------

Revenue 1,338 1,426 2,967

Employee benefits expense (744) (642) (1,630)

Depreciation and amortisation

expense (99) (140) (346)

Gain recognised on remeasurement

of lease liability - - 125

Other operating expenses (496) (643) (1,014)

Share based payment expense (9) - (10)

(1,348) (1,425) (2,875)

Other operating income 26 13 39

Investment income 24 - 18

Finance income 2 - -

Finance expense (10) (3) (15)

-------------- -------------- ---------------

Profit before taxation 32 11 134

Taxation (8) - 18

-------------- -------------- ---------------

Profit for the period 24 11 152

-------------- -------------- ---------------

Other comprehensive income

Fair value gain on financial

assets through other comprehensive

income - - -

Total comprehensive income

for the period 24 11 152

-------------- -------------- ---------------

Earnings per share (note 4)

- Basic 0.23p 0.12p 1.62p

- Diluted 0.21p 0.12p 1.48p

Dividends per share

Interim dividend proposed - - -

Dividends paid 0.50p - -

Fletcher King Plc

Consolidated Interim Statement of Financial Position

as at 31 October 2022

31 October 31 October 30 April

2022 2021 2022

(Unaudited) (Unaudited) (Audited)

GBP000 GBP000 GBP000

-------------------------------- -------------- -------------- -----------

Assets

Non-current assets

Software 69 - 76

Property, plant and equipment 237 8 266

Right-of-use asset 436 136 494

Financial assets 529 529 529

Deferred tax asset 24 - 32

1,295 673 1,397

Current Assets

Trade and other receivables 1,346 837 1,329

Corporation tax debtor - 111 97

Cash and cash equivalents 2,418 3,096 3,365

3,764 4,044 4,791

Total assets 5,059 4,717 6,188

Liabilities

Current liabilities

Trade and other payables 567 647 1,124

Provisions - 100 25

Current taxation liabilities - - -

Lease liabilities 154 580 610

Total current liabilities 721 1,327 1,759

Non current liabilities

Lease liabilities 329 - 402

Shareholders' equity

Share capital 1,025 921 1,025

Share premium 522 140 522

Investment revaluation reserve (101) (101) (101)

Share option reserve 19 - 10

Reserves 2,544 2,430 2,571

Total shareholders' equity 4,009 3,390 4,027

Total equity and liabilities 5,059 4,717 6,188

Fletcher King Plc

Consolidated Interim Statement of Changes in Equity

for the 6 months ended 31 October 2022

Investment Share

Share Share revaluation Option Retained TOTAL

capital premium reserve Reserve earnings EQUITY

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------------------------- ------------- ------------- ------------ -------- --------- -------

Balance at 1

May 2022 1,025 522 (101) 10 2,571 4,027

Profit for the

period - - - - 24 24

Equity dividends

paid - - - - (51) (51)

Share based payment

expense - - - 9 - 9

---------------------------- ------------- ------------- ------------ -------- --------- -------

Balance at 31

October 2022 (Unaudited) 1,025 522 (101) 19 2,544 4,009

============================ ============= ============= ============ ======== ========= =======

Balance at 1

May 2021 921 140 (101) - 2,419 3,379

Profit for the

period - - - - 11 11

Equity dividends - -

paid - - - -

--------------------------- ------------- ------------- ------------ -------- --------- -------

Balance at 31

October 2021 (Unaudited) 921 140 (101) - 2,430 3,390

============================ ============= ============= ============ ======== ========= =======

Balance at 1

May 2021 921 140 (101) - 2,419 3,379

Profit for the

year - - - - 152 152

Share issue 104 443 - - - 547

Cost of share

issue - (61) - - - (61)

Share based payment

expense - - - 10 - 10

Balance at 30

April 2022 (Audited) 1,025 522 (101) 10 2,571 4,027

============================ ============= ============= ============ ======== ========= =======

Fletcher King Plc

Consolidated Interim Statement of Cash Flows

for the 6 months ended 31 October 2022

6 months 6 months

ended ended Year ended

31 October 31 October 30 April

2022

2022 (Unaudited) 2021 (Unaudited) (Audited)

GBP000 GBP000 GBP000

------------------------------------ ------------------ ------------------ -----------

Cash flows from operating

activities

Profit before taxation from

continuing operations 32 11 134

Adjustments for:

Movement in provision (25) - (75)

Depreciation and amortisation

expense 99 140 346

Remeasurement of lease liability - - (125)

Investment income (24) - (18)

Finance income (2) - -

Finance expense 10 3 15

Share based payment expense 9 - 10

Cash flows from operating

activities

before movement in working

capital 99 154 287

(Increase)/decrease in trade

and other receivables (17) 311 (181)

(Decrease)/increase in trade

and other payables (557) (261) 216

------------------ ------------------ -----------

Cash (absorbed by) / generated

from operations (475) 204 322

Taxation received 97 - -

------------------ ------------------ -----------

Net cash flows (used in)/generated

from operating activities (378) 204 322

----------------------------------------- ------------------ ------------------ -----------

Cash flows from investing

activities

Purchase of fixed assets (5) - (352)

Investment income 24 - 18

Finance income 2 - -

Net cash flows from investing

activities 21 - (334)

----------------------------------------- ------------------ ------------------ -----------

Cash flows from financing

activities

Lease payments (539) - (1)

Proceeds of share placing - - 547

Placing costs - - (61)

Dividends paid to shareholders (51) - -

------------------ ------------------ -----------

Net cash flows from financing

activities (590) - 485

----------------------------------------- ------------------ ------------------ -----------

Net (decrease)/increase in

cash and cash equivalents (947) 204 473

Cash and cash equivalents

at start of period 3,365 2,892 2,892

------------------ ------------------ -----------

Cash and cash equivalents

at end of period 2,418 3,096 3,365

Fletcher King Plc

Explanatory Notes

1. General information

The Company is a public limited company incorporated and

domiciled in England and Wales. The address of its registered

office is 19-20 Great Pulteney Street, London W1F 9NF.

These interim financial statements were approved by the Board of

Directors on 14 December 2022.

2. Basis of preparation

The interim financial information in this report has been

prepared using accounting policies consistent with IFRS as endorsed

by the UK. IFRS is subject to amendment and interpretation by the

International Accounting Standards Board (IASB) and the

International Financial Reporting Standards Interpretations

Committee (IFRIC) and there is an ongoing process of review and

endorsement by the UK Endorsement Board. The financial information

has been prepared on the basis of IFRS that the Directors expect to

apply for the year ended 30 April 2023.

The accounting policies applied by the Group in this interim

report are the same as those applied by the Group in the

consolidated financial statements for the year ended 30 April 2022.

There are no new standards, interpretations and amendments,

effective for the first time from 1 May 2022, that have had a

material effect on the financial statements of the Group.

3. Non Statutory Accounts

The financial information for the period ended 31 October 2022

set out in this interim report does not constitute the Group's

statutory accounts for that period. Whilst the financial figures

included in this interim report have been computed in accordance

with IFRS, this interim report does not contain sufficient

information to constitute an interim financial report as that term

is defined in IAS34. The statutory accounts for the year ended 30

April 2022 have been delivered to the Registrar of Companies. The

auditors reported on those accounts; their report was unqualified,

did not contain a statement under either Section 498(2) or Section

498(3) of the Companies Act 2006 and did not include references to

any matters to which the auditor drew attention by way of

emphasis.

The financial information for the 6 months ended 31 October 2022

and 31 October 2021 is unaudited.

Fletcher King Plc

Explanatory Notes

4. Earnings per share

6 months 6 months Year ended

to 31 October to 31 October 30 April

2022 2021 2022

Number Number Number

Weighted average number of shares

for basic earnings per share 10,252,209 9,209,779 9,375,425

Share options 920,000 - 920,000

--------------- --------------- ------------

Weighted average number of shares

for diluted earnings per share 11,172,209 9,209,779 10,295,425

=============== =============== ============

GBP000 GBP000 GBP000

--------------- --------------- ------------

Earnings for basic and diluted earnings

per share: 24 11 152

=============== =============== ============

Basic earnings per share 0.23p 0.12p 1.62p

Diluted earnings per share 0.21p 0.12p 1.48p

=============== =============== ============

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFAFWLEESEDE

(END) Dow Jones Newswires

December 15, 2022 02:00 ET (07:00 GMT)

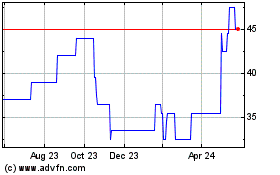

Fletcher King (AQSE:FLK.GB)

Historical Stock Chart

From Feb 2025 to Mar 2025

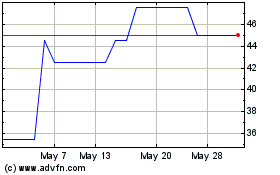

Fletcher King (AQSE:FLK.GB)

Historical Stock Chart

From Mar 2024 to Mar 2025