Bitcoin Expected To Hit $100,000 Before 2025, According To Kalshi Data

14 November 2024 - 12:30PM

NEWSBTC

Bitcoin (BTC) has hit new highs in recent days, with many users of

crypto betting site Kalshi predicting that the largest

cryptocurrency on the market could hit the $100,000 milestone

before the end of 2024. According to recent data from the

event contract market, 60% of users believe Bitcoin will hit this

milestone before January, while 45% are betting it could achieve

this level as early as November. Analyst Predicts Six-Figure

Bitcoin Prices By Year-End Kalshi, which launched in 2021, allows

users to bet on various outcomes, including economic data releases

and election results. The platform gained significant

attention this year due to its legal battle with the Commodity

Futures Trading Commission (CFTC), which ultimately led to US users

being allowed to participate in betting markets for the

presidential election. Since the US presidential election on

November 5, Bitcoin has surged more than 28%. The election outcome

has been viewed as bullish for cryptocurrencies, especially with

President-elect Donald Trump expressing his support for the

industry and hinting at more favorable regulations. Related

Reading: Justin Drake Unveils ‘The Beam Chain’: A Vision For

Ethereum Final Design Analyst Mike Colonnese from H.C. Wainwright

commented on the current market conditions, stating: Strong

positive sentiment is likely to persist through the balance of

2024, and we see Bitcoin prices potentially reaching the six-figure

mark by the end of this year. The analyst further noted that

Bitcoin is now in a phase of “price discovery” after breaking

through its all-time highs early last Wednesday morning, following

the official announcement of Trump’s election victory. This

combination of market enthusiasm and regulatory optimism, he

suggests, could see BTC continue its upward trajectory, attracting

new investors and cementing its place in the financial landscape by

the end of 2024. UBS Warns Of Historical Volatility Although

betting markets and investors have set their sights on BTC

hitting $100,000, Wall Street analysts are warning about the

“speculative” nature of cryptocurrencies. Solita Marcelli,

chief investment officer for the Americas at UBS Global Wealth

Management, emphasized this point in a note to clients on

Tuesday. “We continue to view crypto assets as a speculative

trade rather than a strategic investment in portfolios,” she

stated. Marcelli expressed skepticism regarding the potential for

digital assets to make significant inroads into disruptive

real-world applications, noting their propensity to increase

portfolio volatility. UBS highlighted that since 2014, Bitcoin has

experienced three major drawdowns exceeding 70%, with an average

recovery period of three years. Related Reading: Analyst Warns Of

10% Bitcoin Price Drop Ahead Of CPI Data On a more positive note,

other cryptocurrencies saw gains on Wednesday. Ethereum (ETH),

Solana (SOL), and even Dogecoin (DOGE) experienced upward

movement. Dogecoin surged notably after Trump announced that

Tesla CEO Elon Musk and former Republican presidential candidate

Vivek Ramaswamy would head a newly formed “Department of Government

Efficiency,” cleverly abbreviated to DOGE. However, crypto-related

equities did not follow the bullish trend of Bitcoin. Stocks like

Coinbase (COIN) and Robinhood (HOOD) took a breather after recent

rallies, with Coinbase shares down about 2% on Wednesday, while

Robinhood remained relatively unchanged. After hitting a new

all-time high of $93,000 on Wednesday, BTC has come back down to

the $90,350 level, yet, still up 20% on the week. Featured

image from DALL-E, chart from TradingView.com

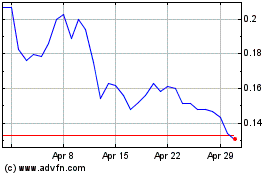

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024