Chainlink Whales Waking Up – Data Shows Signs Of Accumulation

14 November 2024 - 11:30AM

NEWSBTC

Chainlink (LINK) has seen a whirlwind of price activity, surging

50% before experiencing a sharp 15% retracement within 10 days.

This volatility showcases the potential and unpredictability

surrounding LINK’s recent price action, drawing attention from

analysts and investors alike. According to crypto analyst Ali

Martinez, there’s a notable trend unfolding beneath the surface:

Chainlink whales have been steadily accumulating LINK over the past

two months. This accumulation by large holders suggests a growing

conviction in LINK’s long-term value, reinforcing a bullish outlook

for the asset. Related Reading: Bitcoin Weekly RSI Entering Power

Zone – Last Time BTC Soared 80% Martinez’s data underscores this

trend, highlighting that whales are continuing to add LINK to their

portfolios despite the recent ups and downs in price. This activity

suggests a solid foundation of support at current levels, as whales

often act as market stabilizers. The coming weeks are

expected to be pivotal for LINK, as further accumulation by large

holders could fuel another upward move. Investors are now watching

closely as Chainlink’s price action could signal a broader shift in

sentiment within the DeFi and Oracle sectors. Whether LINK will

continue to build on this bullish momentum or enter a period of

consolidation remains to be seen. Chainlink Waking Up Smart Money

Chainlink has recently posted an impressive surge, aligning with

the broader market’s rally as bullish sentiment resurfaces across

the crypto space. Key data from crypto analyst Ali Martinez

indicates a strong accumulation pattern among Chainlink whales, who

have amassed over 15 million LINK in the past two months—an

investment valued at around $165 million. This substantial

accumulation suggests high confidence among large holders, who

appear committed to backing LINK despite its inherent price

volatility. While many altcoins have benefited from a wave of

retail-driven speculation, Chainlink’s recent surge seems to be

fueled by more than short-term market excitement. The active

participation of whales, typically seen as more strategic

investors, indicates a solid support base at current levels.

Martinez’s analysis highlights that the trend of accumulation by

whales has been steady, even amid price fluctuations, which often

signals confidence in longer-term potential. Related Reading:

Dogecoin Could Target $2.4 If Price Aligns With Macro Pattern –

Details However, the next few weeks will be telling. Analysts and

investors closely monitor whether this accumulation trend will

continue or if it was a temporary push to capitalize on favorable

market conditions. Sustained buying by whales would likely

bolster LINK’s price further, reinforcing that Chainlink’s network

and utility as a decentralized oracle provider hold significant

value in the evolving blockchain ecosystem. Conversely, if

accumulation slows, LINK could see a period of consolidation as the

market recalibrates. Key Levels To Watch Chainlink is trading

at $13.3 after reaching a local high of $15.3, marking a

significant move that has renewed investors’ optimism. In this

recent rally, LINK broke above the 200-day moving average (MA) at

$12.8, a critical level often seen as a key indicator of long-term

market sentiment. To confirm this bullish momentum, LINK

needs to hold this 200-day MA as a support level; if successful, it

would reinforce the bullish price structure and signal the

potential for further gains. Holding above $12.8 would set a strong

foundation for LINK’s price action, suggesting that buyers have

established control and are willing to defend current levels.

Related Reading: Cardano Skyrockets Over 40% – Funding Rate

Suggests Further Upside If this support holds, LINK could

make a sustained push above its recent local high at $15.3.

Analysts anticipate that a confirmed breakout would open the door

for LINK to test higher resistance levels, with the potential for a

strong continuation in the coming weeks. However, if LINK

fails to hold the 200-day MA, the price may retest lower support

areas, potentially disrupting the bullish momentum. For now, all

eyes remain on $12.8 as LINK attempts to solidify its recent gains

and prepare for a possible run higher. Featured image from Dall-E,

chart from TradingView

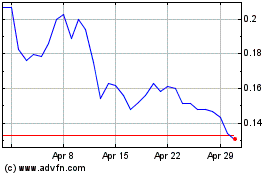

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024