MicroStrategy Makes Record $4.6 Billion Bitcoin Purchase, Largest Yet

19 November 2024 - 3:10AM

NEWSBTC

Business intelligence firm MicroStrategy has ramped up its Bitcoin

(BTC) investment following President-elect Donald Trump’s victory

in the presidential election. This pivotal moment on November 5 has

provided a catalyst for the broader crypto market, further

encouraging investment in digital assets. Bitcoin Holdings To Over

$29 Billion Led by Bitcoin advocate Michael Saylor, MicroStrategy

disclosed on Monday that it has acquired approximately 51,780

Bitcoin for around $4.6 billion. This acquisition marks the largest

purchase by the company since it began its Bitcoin buying strategy

more than four years ago. According to a filing with the US

Securities and Exchange Commission, the tokens were purchased

between November 11 and November 17. With this latest acquisition,

MicroStrategy’s total Bitcoin holdings now exceed $29 billion or

331,200 BTC. Related Reading: Dogecoin Breaking Out Of Falling

Wedge Pattern – Analyst Reveals Target Saylor’s journey into

Bitcoin began in 2020 as a strategy to hedge against inflation.

Initially funded through cash reserves, the company has since

pivoted to using proceeds from stock issuances and convertible debt

sales to enhance its purchasing power in the cryptocurrency

market. Michael Saylor has also reaffirmed his commitment to

this strategy. He aims to raise $42 billion over the next three

years to further strengthen the company’s BTC portfolio and

transform Microstrategy into a leading crypto bank. BTC Yield

Rises To 20.4% Amid Market Optimism Recent data from South

Korea-based crypto analytics firm CryptoQuant highlights the impact

of MicroStrategy’s latest purchase on its Bitcoin statistics: BTC

Holdings: Increased from 279,420 BTC to 331,200 BTC MSTR Realized

Price: Rose from $42,692 to $49,874 MSTR Market Value to Realized

Value (MVRV): Adjusted from 2.12 to 1.80 Percentage of BTC Owned by

MicroStrategy: Increased from 1.412% to 1.674% This latest

transaction follows closely on the heels of another significant

acquisition on November 11, during which Saylor noted that the

company’s treasury operations had yielded an 7.3% in Bitcoin,

translating to a net benefit of approximately 18,410 BTC for

shareholders. However, with Monday’s announcement and the notable

uptrend in the Bitcoin price over the past two weeks, Saylor

revealed that these metrics have risen to a BTC yield of 20.4% and

a net benefit to shareholders of 51,470 BTC. Related Reading:

Bitcoin Miners Sold Over 3,000 BTC In The Past 48 Hours –

Consolidation Phase Ahead? The correlation between MicroStrategy’s

stock (MSTR) and Bitcoin’s price has also been particularly

noteworthy in recent weeks. Following Bitcoin’s record high of

$93,300 on November 13, MicroStrategy’s stock also reached an

all-time high of $383. Yet, as the leading digital asset of

the market retraced to around $90,650—a 9% increase over the past

week—MSTR’s share price also declined to approximately $359 over

the past weekend, underscoring the strong relationship between the

cryptocurrency and the firm’s stock performance. Featured image

from DALL-E, chart from TradingView.com

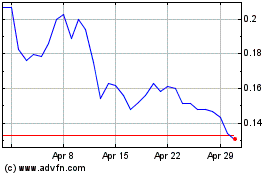

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024