Why is XRP price up today?

13 March 2025 - 1:18AM

Cointelegraph

XRP (XRP) pared some losses

following this week’s market crash,

with 6% daily gains over the last 24 hours to trade at $2.24.

The top-ten altcoin trades 18% above the 24-hour low of $1.89 as

the crypto market sentiment recovers slightly.

XRP/USD daily chart. Source:

Cointelegraph/TradingView

Let’s examine the key drivers behind XRP’s rebound today.

Franklin Templeton’s XRP ETF filing

One of the primary catalysts behind today’s XRP price surge is

Franklin Templeton’s filing of an XRP ETF in the United States.

Key takeaways:

-

On March 11, California-based asset manager Franklin Templeton

filed an S-1

registration form with the US Securities and Exchange Commission

(SEC) to launch a spot XRP

ETF.

-

Franklin Templeton is a major global asset manager with $1.5

trillion in assets under management.

-

It joins a growing list of financial giants like

Bitwise,

Grayscale,

and WisdomTree in

pursuing XRP-based ETFs.

-

This filing signals a strong vote of confidence in XRP’s

potential as a mainstream investment vehicle.

-

The news has fueled speculation of major capital inflows that

could push XRP price into double digits.

“Franklin Templeton has filed the 17th XRP ETF, which alone has

$1.53 trillion USD under their asset management,”

said pseudonymous XRP

analyst Dark Defender in a March 12 post on X.

“Just imagine when all are approved. Double digits for

XRP will be as easy as a pie.”

Meanwhile, the odds of a US spot XRP ETF

being

approved in 2025 are now at 76% on Polymarket.

XRP ETF approval odds on Polymarket. Source:

Polymarket

If approved, it would boost XRP’s credibility and

could draw

billions of dollars in capital inflows, according to JP

Morgan.

Despite the SEC delaying

decisions on other XRP ETF applications, such as those from

Grayscale and Canary Capital, until May 2025, Franklin Templeton’s

entry—given its size and reputation—has boosted market confidence,

contributing to XRP’s price rebound.

MVRV metric suggests XRP price bottom

Beyond external catalysts, onchain data provides a compelling

case for XRP’s price recovery.

Key points:

-

Metrics like the Market Value to Realized Value (MVRV) ratio

indicate that XRP may have bottomed.

-

The MVRV ratio compares XRP’s market cap to the value of coins

at their last transaction, offering insight into whether the asset

is overbought or oversold.

-

Data from Santiment shows XRP’s 30-day MVRV ratio has plunged to

a low of -16%, the lowest since April 2024.

XRP 30-day MVRV. Source: Santiment

-

The chart above shows it inside a zone typically associated with

accumulation, suggesting that selling pressure has subsided.

-

Historically, XRP usually experiences a reversal whenever the

30D MVRV declines below 10%.

XRP price eyes V-shaped recovery to $2.64

XRP’s price action has been nurturing a V-shaped recovery chart

pattern on the four-hour chart since March 6, as shown below.

-

A V-shaped recovery is a bullish pattern formed when an asset

experiences a sharp price increase after a steep decline.

-

XRP appears to be on a similar trajectory and now trades below a

key supply congestion zone between $2.30 and $2.45, where all the

major simple moving averages (SMAs) are currently sitting.

-

The bulls must now push XRP above this area to increase the

chances of the price rising to the neckline at $2.64 to complete

the V-pattern.

-

Completing the V-shaped recovery would result in 20% gains from

the current price.

XRP/USD daily chart. Source:

Cointelegraph/TradingView

This article does not

contain investment advice or recommendations. Every investment and

trading move involves risk, and readers should conduct their own

research when making a decision.

...

Continue reading Why is XRP price up today?

The post

Why is XRP price up today? appeared first on

CoinTelegraph.

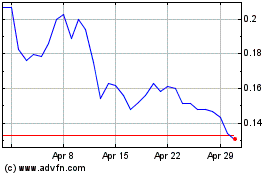

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

Dogecoin (COIN:DOGEUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025