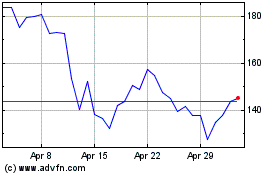

Binance Coin In Turmoil: Nearly 10% Value Erased In Market Shake-Up

05 August 2024 - 6:30AM

NEWSBTC

Binance Coin (BNB) succumbs to bearish pressure alongside other

altcoins in the market. According to the latest market data, the

token is down nearly 10% since last week representing a big slash

in value for investors in the long-term. The huge drop is due to

the current underperforming market after the major cryptocurrencies

slipped with Bitcoin and Ethereum by almost 10% respectively.

Related Reading: Stacks (STX) Drops 23%, But Recent Devs Might Slow

The Trend Despite the recent regulatory turmoil between the

Securities and Exchange Commission and Binance, BNB still shows

some strength as it maintains its top four spot, topping SOL and

XRP. Binance Coin Market Vs Macroeconomics The early half of

August is held in high regard by both crypto finance and

traditional finance investors as major economic indicators are set

to be announced. With the past six indicators flashing red or

neutral, it remains to be seen whether the next few will be bullish

for the broader financial world. But last week, the Federal

Open Market Committee held against lowering interest rates as

inflation was still “somewhat elevated.” However, this opened the

road to September rate cuts as the inflation slows, helping the

market gain gradual ground in the long run. Although the

market remains somewhat optimistic for the September cut, it has

since faded as the broader market slips as investor anxiety remains

high. The S&P 500 and Dow Jones fell by almost 2%

respectively. This further exacerbated the market correction

within the crypto market. As of writing, the crypto market is down

more than 2% in the past 24 hours. BNB was not spared, with the BNB

Chain metrics falling amidst the market downturn. Despite

this, long-term investors in the token continue to remain strong

despite bearish market conditions. According to CoinGlass, BNB

market positions remain majority long with a slight uptick in the

short position takers. However, derivative contracts

featuring BNB took a dip with the open interest dropping by a

significant margin. Although the token follows the broader

market, BNB still remains a strong investment despite the hostile

market conditions. Related Reading: Solana Rebound: SOL To Hit $260

Despite Continuous Dip, Analyst Says Crucial BNB Level Remains But

For How Long? The hostile market environment is slowly dying down

but with the current uncertainties within the macroeconomic side of

things, it remains to be seen whether the BNB bulls can continue to

stem the tide. Keeping aside price, having a majority of long

positions for the token is advantageous for the bulls as it helps

maintain investor confidence in the token. Despite this, the bulls

have a long way ahead. Stabilizing the price around the $514

price range should be their number 1 priority. A bearish

breakthrough on this level will lead to more bleeding, which might

flip investors from long positions to short positions. If

held successfully, BNB bulls have a strong jump-off point to retake

the late-July levels of $558. Featured image from Pexels,

chart from TradingView

Solana (COIN:SOLUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Solana (COIN:SOLUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024