Bitcoin (BTC) bounced from $76,606 on March 11,

but the bulls could not sustain the price above $84,500 on March

12.

Nansen principal research analyst Aurelie Barthere told

Cointelegraph that Bitcoin is in a

macro correction in a bull market, with the next crucial level

being “$71,000-$72,000, top of the pre-election trading range.”

Glassnode also projected a similar target in its March 11 market

report. The onchain analytics firm said the recent sell-off had

been triggered by the short-term holders who may have purchased

near the peak in January. Glassnode added that

Bitcoin could

bottom out near $70,000 if selling persists.

Crypto market data daily view. Source:

Coin360

It is not only the crypto markets; even the US stock market has

been under pressure in the past few days. However, a silver lining

for the bulls is that the US Dollar Index (DXY) has corrected from

its multi-year high above 110 to under 104. Bitcoin generally moves

in inverse correlation with the dollar, suggesting that a

bottom may be

around the corner.

Could Bitcoin retest the support at $76,606 or rise above

$85,000? What are the important support and resistance levels to

watch out for in altcoins? Let’s analyze the charts of the top 10

cryptocurrencies to find out.

Bitcoin price analysis

Bitcoin broke below the $78,258 level on March 10 and fell to

$76,606 on March 11, but the bears could not sustain the lower

levels. This suggests solid buying by the bulls.

BTC/USDT daily chart. Source:

Cointelegraph/TradingView

The relief rally is facing selling near the 20-day exponential

moving average ($87,262), but a minor positive in favor of the

bulls is that the relative strength index (RSI) is showing a

positive divergence. Buyers will have to drive the price above the

20-day EMA to suggest that the correction could be ending. The

BTC/USDT pair may then ascend to the 50-day simple moving average

($94,654).

On the downside, the bulls are expected to defend the $73,777

level with all their might because a break below it may sink the

pair to $67,000.

Ether price analysis

Ether (ETH) fell below the $1,993 support on

March 9 and extended the decline, reaching $1,754 on March 11.

ETH/USDT daily chart. Source:

Cointelegraph/TradingView

The bulls are trying to start a recovery, which is expected to

face significant resistance at the breakdown level of $2,111. If

the price turns down sharply from $2,111, it will signal that the

bears have flipped the level into resistance. That heightens the

risk of a break below $1,754. The ETH/USDT pair may then slump to

$1,500.

Conversely, a break above the 20-day EMA ($2,235) suggests that

the markets have rejected the break below $2,111. The pair may then

climb to $2,800, where the bears are expected to step in.

XRP price analysis

XRP (XRP) fell below the $2 support

on March 11, but the bears could not sustain the lower levels, as

seen from the long tail on the candlestick.

XRP/USDT daily chart. Source:

Cointelegraph/TradingView

The bears are trying to stall the recovery at the 20-day EMA

($2.35). If the price continues lower, the possibility of a break

below $2 increases. If that happens, the XRP/USDT pair will

complete a bearish head-and-shoulders pattern. There is minor

support at $1.77, but if the level cracks, the decline could extend

to $1.28.

Contrary to this assumption, if the price breaks above the

20-day EMA, the pair could rise to the 50-day SMA ($2.58) and later

to $3.

BNB price analysis

BNB (BNB) turned up from $507

on March 11, indicating that the bulls are aggressively defending

the $500 to $460 support zone.

BNB/USDT daily chart. Source:

Cointelegraph/TradingView

The relief rally is expected to face selling at the 20-day EMA

($592). If the price turns down sharply from the 20-day EMA, the

bears will try to sink the BNB/USDT pair below $500. The pair may

drop to $460 if they can pull it off.

Instead, if the price rises above the 20-day EMA, it will signal

that the pair may remain inside the $460 to $745 range for a while

longer. The bulls will be back in the driver’s seat on a break and

close above the 50-day SMA ($628).

Solana price analysis

Solana (SOL) turned up from $112 on

March 11, signaling that the bulls are fiercely defending the $110

support.

SOL/USDT daily chart. Source:

Cointelegraph/TradingView

The RSI shows early signs of forming a positive divergence,

indicating that the bearish momentum could weaken. The first sign

of strength will be a break and close above the 20-day EMA

($145).

If the price turns down from the current level or the 20-day

EMA, it suggests that every minor rally is being sold into. That

increases the risk of a break below $110. The SOL/USDT pair could

tumble to $98 and subsequently to $80.

Cardano price analysis

Cardano (ADA) rebounded off the uptrend

line on March 11, suggesting that the bulls are trying to stop the

decline.

ADA/USDT daily chart. Source:

Cointelegraph/TradingView

The bears are unlikely to give up easily and are expected to

sell at the moving averages. If the price turns down from the

moving averages, it will signal selling on rallies. The bears will

then try to strengthen their position by pulling the price below

the uptrend line. If they do that, the ADA/USDT pair could drop to

$0.60 and then to $0.50.

Contrary to this assumption, a break and close above the moving

averages suggests that the bulls are back in the game. The pair may

then rally to $1.02.

Dogecoin price analysis

Dogecoin (DOGE) continued its slide and

reached the $0.14 support on March 11. The bulls are trying to

defend the level but may face selling at higher levels.

DOGE/USDT daily chart. Source:

Cointelegraph/TradingView

If the price turns down from the 20-day EMA ($0.20), it will

suggest that the sentiment remains negative and traders are selling

on rallies. That increases the risk of a break below $0.14. The

DOGE/USDT pair may descend to $0.10 if that happens.

Related:

Here’s what happened in crypto today

On the contrary, a break and close above the 20-day EMA suggests

that the bears are losing their grip. The pair could climb to the

50-day SMA ($0.25), which may pose a solid challenge again.

Pi price analysis

Pi (PI) is taking support at the 61.8% Fibonacci retracement

level of $1.20, indicating buying at lower levels.

PI/USDT daily chart. Source:

Cointelegraph/TradingView

The relief rally is expected to face resistance at the 20-day

EMA ($1.69) and then again at $2. If the price turns down from the

overhead resistance, the PI/USDT pair could range between $2 and

$1.20 for some time.

A break and close above $2 suggests that the correction may be

over. The pair could rally to $2.40. Alternatively, a break and

close below $1.20 could sink the pair to the 78.6% retracement

level of $0.72.

UNUS SED LEO price analysis

UNUS SED LEO (LEO) has been consolidating

just below the $10 level for several days, indicating that the

bulls are holding on to their positions as they anticipate another

leg higher.

LEO/USD daily chart. Source:

Cointelegraph/TradingView

The LEO/USD pair has formed an ascending triangle pattern, which

will complete on a break and close above $10. If that happens, the

pair could resume the uptrend toward the target objective of

$12.04.

This positive view will be invalidated in the near term if the

price turns down and breaks below the uptrend line. That will

negate the bullish setup, starting a drop to $8.84 and later to

$8.30.

Hedera price analysis

Hedera (HBAR) bounced off the

$0.17 support on March 11, indicating that the bulls are

aggressively defending the level.

HBAR/USDT daily chart. Source:

Cointelegraph/TradingView

The recovery is facing selling at the 20-day EMA ($0.22), as

seen from the long wick on the candlestick. If the price continues

lower, the bears will make one more attempt to sink the HBAR/USDT

pair below $0.17. If they succeed, the pair could plunge to

$0.12.

Contrarily, a break above the 20-day EMA suggests that the

selling pressure is reducing. The pair could rise to the downtrend

line, which is an important level to watch out for. If buyers push

the price above the downtrend line, the pair could rally to

$0.29.

This article does not

contain investment advice or recommendations. Every investment and

trading move involves risk, and readers should conduct their own

research when making a decision.

...

Continue reading Price analysis 3/12: BTC, ETH, XRP,

BNB, SOL, ADA, DOGE, PI, LEO, HBAR

The post

Price analysis 3/12: BTC, ETH, XRP, BNB, SOL, ADA,

DOGE, PI, LEO, HBAR appeared first on

CoinTelegraph.

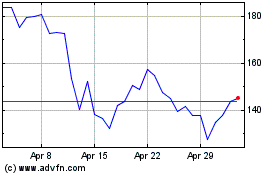

Solana (COIN:SOLUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

Solana (COIN:SOLUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025