Randstad to Buy Monster Worldwide for $429 Million--Update

09 August 2016 - 11:35PM

Dow Jones News

By Ian Walker and Jana Simmons

Randstad Holding NV said Tuesday it agreed to buy Monster

Worldwide Inc. for $429 million--snapping up a pioneer of the

online job-posting industry and bolstering the Dutch recruitment

giant's position in the U.S.

Monster, based in Weston, Mass., pushed into the then-nascent

business of digital recruiting in 1994, and now offers staffing

services in more than 40 countries. But in recent years, it, too,

has become more of a traditional player.

It has struggled to keep up with an onslaught of competitors,

including niche, online job boards. Recruiters have also gravitated

to networking sites like LinkedIn Corp., which connects companies,

recruiters and employees, who may or may not be looking for jobs

right away.

Upon completion of the deal, Monster will delist from the New

York Stock Exchange, and operate as a separate entity under

Randstad. It will retain the Monster brand. The deal is subject to

regulatory approval and other conditions.

Randstad said it agreed to pay $3.40 a share for Monster, a 23%

premium to its closing stock price on Monday. The Dutch company

said it would finance the deal through existing credit facilities

and expects to complete it in the fourth quarter of this year. The

transaction will immediately add to Randstad per-share earnings,

the company said.

After the deal, Monster "will be better positioned to fulfill

our core mission, and our employees will benefit from becoming part

of a larger, more diversified company," said Monster Chief

Executive Tim Yates.

Randstad ranks itself as the second-largest, human-resources

services provider in the world, behind Switzerland's Adecco Group

AG. It offers a range of placement and job-search services,

including a network of walk-in job placement branches.

It is a smaller player in the U.S., however, where it competes

with ManpowerGroup. Randstad generated revenue of EUR19.2 billion

($21.3 billion) in 2015, but only EUR4.7 billion of that came from

North America.

It has recently used deal making to push into the U.S. In

September, it agreed to pay $100 million for U.S. startup

RiseSmart, which provides job placement analytics.

It has been on an acquisition tear of late elsewhere. Earlier

this year, it bought Obiettivo Lavoro, an Italian recruiting agency

for EUR102.5 million and Japan's Careo Group, a temporary-staffing

provider, for an undisclosed sum. It is also in the process of

completing a EUR420 million purchase of French rival Ausy SA.

On Tuesday, it said it would now reduce the pace of M&A and

focus on integrating recent acquisitions. It expects to limit

acquisition spend in the medium term to around EUR100 million.

Write to Ian Walker at ian.walker@wsj.com and Jana Simmons at

Jana.Simmons@wsj.com

(END) Dow Jones Newswires

August 09, 2016 09:20 ET (13:20 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

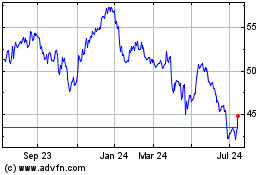

Randstad NV (EU:RAND)

Historical Stock Chart

From Feb 2025 to Mar 2025

Randstad NV (EU:RAND)

Historical Stock Chart

From Mar 2024 to Mar 2025