UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED

PURSUANT

TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED

PURSUANT TO RULE 13d-2(a)

Under the Securities Exchange Act of 1934

(Amendment No. 11)*

Abcam plc

(Name of Issuer)

Ordinary Shares

(Title of Class of Securities)

000380204

(CUSIP Number)

Jonathan Milner

Honey Hill House, 20 Honey Hill

Cambridge CB3 0BG

With copies to:

|

Richard M. Brand

Cadwalader, Wickersham & Taft LLP

200 Liberty Street

New York, NY 10281

212-504-6000 |

Michael Newell

Cadwalader, Wickersham & Taft LLP

100 Bishopsgate

London EC2N 4AG

44 (0) 20 7170 8540 |

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

September 14, 2023

(Date of Event Which Requires Filing of This

Statement)

If the filing person

has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this

schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box. x

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7

for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of

this cover page shall not be deemed to be “filed” for the purpose of section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

| 1 |

|

NAME OF REPORTING PERSON

Dr. Jonathan Milner |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨ (b) x

|

| 3 |

|

SEC USE ONLY

|

| 4 |

|

SOURCE OF FUNDS

PF (See Item 3) |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e) ¨

|

| 6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United Kingdom

|

|

Number of

shares

beneficially

owned by

each

reporting

person

with

|

|

7 |

|

SOLE VOTING POWER

11,713,9001 |

| |

8 |

|

SHARED VOTING POWER

2,410,8022 |

| |

9 |

|

SOLE DISPOSITIVE POWER

11,713,9001 |

| |

10 |

|

SHARED DISPOSITIVE POWER

2,410,8022 |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

14,124,7021, 2 |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨

|

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

6.14%* |

| 14 |

|

TYPE OF REPORTING PERSON

IN |

| |

|

|

|

|

|

|

* All percentage calculations set forth herein are based upon the aggregate

of 229,723,147 Ordinary Shares outstanding as of June 14, 2023, as reported in Exhibit 99.2 of the Issuer’s Report of Foreign Private

Issuer on Form 6-K filed with the SEC on June 16, 2023.

1 Includes 11,700,200 Ordinary Shares directly held by the

Reporting Person and 13,700 shares directly held by the Reporting Person through American Depository Shares representing, each, one Ordinary

Share (“ADS”).

2 Includes 399,382 ADSs held by the Reporting Person’s

spouse, 1,977,967 ADSs held by three limited companies over which the Reporting Person exercises investment discretion and 33,453 ADSs

held by a charitable trust to which the Reporting Person is a trustee and signatory. The Reporting Person disclaims beneficial ownership

over the shares beneficially owned by his spouse, except to the extent of his pecuniary interest therein.

This Amendment No. 11 to Schedule

13D (this “Amendment No. 11”) amends and supplements the Schedule 13D filed on May 1, 2023, as amended and supplemented on

May 18, 2023, May 30, 2023, June 5, 2023, June 6, 2023, June 12, 2023, June 20, 2023, June 21, 2023, June 23, 2023, June 27, 2023 and

August 16, 2023 (the “Original 13D,” and as amended and supplemented by this Amendment No. 11, the “Schedule 13D”)

by the Reporting Person, relating to the Ordinary Shares of the Issuer. Except as specifically provided herein, this Amendment No. 11

does not modify any of the information previously reported in the Schedule 13D. Capitalized terms not defined in this Amendment No. 11

shall have the meaning ascribed to them in the Original 13D.

The purpose of this Amendment No. 11 is to update

the disclosure in Items 4, 5 and 7 of the Schedule 13D as hereinafter set forth.

| ITEM 1. |

SECURITY AND ISSUER |

This statement on Schedule

13D relates to the Ordinary Shares of the Issuer. The principal executive offices of the Issuer are located at Discovery Drive, Cambridge

Biomedical Campus, Cambridge, CB2 0AX, United Kingdom.

| ITEM 2. |

IDENTITY AND BACKGROUND |

(a), (f) This statement is being filed by

Dr. Jonathan Milner, a citizen of the United Kingdom.

(b) The address of the Reporting Person is

Honey Hill House, 20 Honey Hill, Cambridge, CB3 0BG.

(c) The Reporting Person’s

principal occupation is as an investor and executive in life sciences companies.

(d), (e) During the last

five years, the Reporting Person (i) has not been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors)

and (ii) was not a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such

proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities

subject to, federal or state securities laws or finding any violations with respect to such laws.

| ITEM 4. |

PURPOSE OF TRANSACTION |

Item 4 is hereby amended to add the following:

On September 14, 2023, the Reporting Person published

a press release regarding the Issuer, as set forth more fully in Exhibit 99.17 hereto.

| ITEM 5. |

PURPOSE OF TRANSACTION |

Item 5 of the Schedule 13D is hereby amended and

restated as follows:

(a) The Reporting Person is the holder of 11,700,200

Ordinary Shares and 13,700 ADSs. In addition, the Reporting Person may be deemed to share beneficial ownership over (a) 1,977,967 ADSs beneficially

owned by three limited companies over which the Reporting Person exercises investment discretion, (b) 399,382 ADSs beneficially owned

by the Reporting Person’s spouse and (c) 33,453 ADSs held by a charitable trust to which the Reporting Person is a trustee and signatory.

The Reporting Person disclaims beneficial ownership over the shares beneficially owned by his spouse, except to the extent of his pecuniary

interest therein. The shares described in this Item 5 represent approximately 6.14% of the outstanding Ordinary Shares.

(b)

| |

(i) |

Sole power to vote or to direct the vote: 11,713,900 |

| |

(ii) |

Shared power to vote or direct the vote: 2,410,802 |

| |

(iii) |

Sole power to dispose or to direct the disposition of: 11,713,900 |

| |

(iv) |

Shared power to dispose or to direct the disposition of: 2,410,802 |

(c) See Schedule III, which is incorporated herein

by reference, describes the transactions by the Reporting Person in the Common Stock during the past sixty days.

(d) N/A

(e) N/A

| ITEM 7. |

MATERIAL TO BE FILED AS EXHIBITS |

Item 7 is hereby amended to add the following

exhibit:

Exhibit 99.17 Press Release by Jonathan Milner, dated September 14, 2023.

SIGNATURES

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: September 14, 2023

| By: | /s/ Jonathan Milner |

| | | Name: Jonathan Milner |

| | | |

Schedule III

TRADING DATA

The following table sets forth all transactions in the Ordinary Shares

of the Issuer effected by the Reporting Person in the past 60 days. Except as otherwise noted below, all such transactions were purchases

or sales of Ordinary Shares effected in the open market and the table excludes commissions paid in per share prices.

| Reporting Person |

|

Trade Date |

|

Buy/Sell |

|

|

No. of

Shares/

Quantity |

|

|

Unit Cost/

Proceeds |

|

|

Security |

|

| Avocet 66 Ltd. |

|

7/26/2023 |

|

|

Sell |

|

|

|

5,000 |

|

|

$ |

23.3206 |

|

|

|

ADS |

|

| Jonathan Milner |

|

9/11/2023 |

|

|

Buy |

|

|

|

4,500 |

|

|

$ |

22.8599 |

|

|

|

ADS |

|

| Jonathan Milner |

|

9/12/2023 |

|

|

Buy |

|

|

|

4,500 |

|

|

$ |

22.7899 |

|

|

|

ADS |

|

| Jonathan Milner |

|

9/13/2023 |

|

|

Buy |

|

|

|

4,500 |

|

|

$ |

22.8389 |

|

|

|

ADS |

|

Exhibit 19.17

Dr. Jonathan

Milner opposes Danaher's acquisition of Abcam and calls

for EGM to replace

Board

CAMBRIDGE, England, 14 September 2023 –

Dr. Jonathan Milner, the founder and one of the largest investors in Abcam plc (“Abcam” or the “Company”) (NYSE:

ABCM) with ownership of 6.14%, today announces his decision to vote against the proposed acquisition of Abcam by Danaher Corporation (NYSE:

DHR) or its affiliates (“Danaher”). In addition to this, he will formally request the Abcam Board of Directors to convene

a General Meeting (“EGM”) with the purpose of replacing the Company’s Board, including the current CEO, CFO and Chairman.

Jonathan Milner's decision to oppose the acquisition

is informed by extensive feedback received from many shareholders and analysts, who share his belief that the $24 per share offer announced

on 28 August 2023 by the Company substantially undervalues Abcam. When considering the potential of the Company as an independent entity

with an effective Board and Executive Leadership, the proposed acquisition price falls significantly short of its inherent worth.

Having served Abcam as CEO from 1999 to 2014

and later as Deputy Chairman from 2015 to 2020, Jonathan Milner brings a depth of insight into the Company and his tenure has consistently

demonstrated a commitment to shareholder value. Building on this legacy, earlier this year, he rolled out a six-month plan, aimed

at elevating Abcam's market position by improving operating and EBITDA margins, boosting free cash flow, and resuming dividend payments.

Jonathan Milner has assembled a shadow Board for Abcam. The highly-qualified and independent Board nominees he has put together are a

testament to his vision, combining significant sector expertise with top-tier governance practices.

Looking forward, Jonathan Milner's plan includes

maintaining Abcam's NASDAQ listing while adding back a Main Market Listing on the London Stock Exchange, achieving a dual listing to better

cater to UK institutions, especially in light of recent regulatory advantages, whilst prioritising still the maintenance of the all-important

Nasdaq listing in US. This dual approach is projected to augment shareholder value across short, medium, and long-term horizons.

Details on the proposed new EGM date will be shared

imminently.

Ends

Contacts

Jonathan Milner

https://abcamfocus.com/

Investor contact

Alliance Advisors

Alliance Advisors LLC

T: +44 7733 265 198 / focusabcam@allianceadvisors.com

Michael Roper

International PR advisers

ICR Consilium (Europe)

T: +44 (0)20 3709 5700 / E: Focusabcam@consilium-comms.com

Mary-Jane Elliott / Matthew Neal / Davide Salvi

ICR (US)

T: +1 646 677 1811 / E: FocusAbcam@icrinc.com

Dan McDermott

IMPORTANT ADDITIONAL INFORMATION

THIS DOCUMENT HAS BEEN ISSUED BY DR. JONATHAN

MILNER ("DR. MILNER").

DR. MILNER WILL PUBLISH A PROXY STATEMENT AND

ACCOMPANYING BLUE PROXY CARD IN DUE COURSE TO BE USED TO SOLICIT VOTES IN SUPPORT OF THE PROPOSALS THAT WILL BE PRESENTED FOR SHAREHOLDER

VOTE AT THE PROPOSED EXTRAORDINARY ANNUAL MEETING OF STOCKHOLDERS OF ABCAM PLC (THE "COMPANY").

DR. MILNER STRONGLY ADVISES ALL SHAREHOLDERS

OF THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ONLINE ON THE WEBSITE OF THE U.S. SECURITIES AND EXCHANGE

COMMISSION AT WWW.SEC.GOV AND ON A WEBSITE HOSTED BY DR. MILNER TO PROVIDE INFORMATION TO SHAREHOLDERS ABOUT THE

EXTRAORDINARY GENERAL MEETING AT WWW.ABCAMFOCUS.COM. HOLDERS OF COMPANY SECURITIES ALSO SHOULD RECEIVE COPIES OF THE PROXY

STATEMENT AND PROXY CARD BY MAIL, AND COPIES WILL BE PROVIDED AT NO CHARGE UPON REQUEST MADE TO DR. MILNER’S PROXY SOLICITOR,

ALLIANCE ADVISORS, BY EMAIL TO FOCUSABCAM@ALLIANCEADVISORS.COM OR BY PHONE TO 877-777-8211 FROM NORTH AMERICA OR TO 0800-102- 6998

FROM ELSEWHERE.

THIS DOCUMENT IS FOR DISCUSSION AND INFORMATIONAL

PURPOSES ONLY. THE VIEWS EXPRESSED HEREIN REPRESENT THE OPINIONS OF DR. MILNER AS OF THE DATE HEREOF. DR. MILNER RESERVES THE RIGHT TO

CHANGE ANY OF HIS OPINIONS EXPRESSED HEREIN AT ANY TIME AND FOR ANY REASON AND EXPRESSLY DISCLAIMS ANY OBLIGATION TO CORRECT, UPDATE OR

REVISE THE INFORMATION CONTAINED HEREIN OR TO OTHERWISE PROVIDE ANY ADDITIONAL MATERIALS. SUBJECT TO THE FOREGOING, AND AS SET FORTH BELOW,

DR. MILNER INTENDS TO MAKE AVAILABLE AT AN APPROPRIATE TIME ADDITIONAL INFORMATION ABOUT THE EXTRAORDINARY GENERAL MEETING INCLUDING HOW

TO VOTE AT SUCH MEETING.

DR. MILNER HAS INVESTMENTS IN THE COMPANY WHICH

WILL BE DISCLOSED IN THE PROXY STATEMENT AND OTHER PROXY MATERIALS, AND CONSEQUENTLY HAS A FINANCIAL INTEREST IN THE PROFITABILITY OF

HIS POSITIONS IN THE COMPANY. ACCORDINGLY THIS DOCUMENT SHOULD NOT BE REGARDED AS IMPARTIAL. NOTHING IN THIS DOCUMENT SHOULD BE TAKEN

AS ANY INDICATION OF DR. MILNER 'S CURRENT OR FUTURE TRADING OR VOTING INTENTIONS AND/OR ACTIVITIES WHICH MAY CHANGE AT ANY TIME.

CERTAIN INFORMATION IN THIS DOCUMENT IS BASED

ON PUBLICLY AVAILABLE INFORMATION WITH RESPECT TO THE COMPANY, INCLUDING PUBLIC FILINGS AND DISCLOSURES MADE BY THE COMPANY AND OTHER

SOURCES, AS WELL AS DR. MILNER'S ANALYSIS OF SUCH PUBLICLY AVAILABLE INFORMATION. DR. MILNER HAS RELIED UPON AND ASSUMED, WITHOUT INDEPENDENT

VERIFICATION, THE ACCURACY AND COMPLETENESS OF SUCH INFORMATION, AND NO REPRESENTATION OR WARRANTY IS MADE THAT ANY SUCH DATA OR INFORMATION

IS COMPLETE OR ACCURATE. DR. MILNER RECOGNISES THAT THERE MAY BE CONFIDENTIAL OR OTHERWISE NON-PUBLIC INFORMATION WITH RESPECT TO THE

COMPANY THAT COULD ALTER THE OPINIONS OF DR. MILNER WERE SUCH INFORMATION KNOWN.

NO REPRESENTATION, WARRANTY OR UNDERTAKING, EXPRESS

OR IMPLIED, IS GIVEN AND NO RESPONSIBILITY OR LIABILITY OR DUTY OF CARE IS OR WILL BE ACCEPTED BY DR. MILNER CONCERNING: (I) THIS DOCUMENT

AND ITS CONTENTS, INCLUDING WHETHER THE INFORMATION AND OPINIONS CONTAINED HEREIN ARE ACCURATE, FAIR, COMPLETE OR CURRENT; (II) THE PROVISION

OF ANY FURTHER INFORMATION, WHETHER BY WAY OF UPDATE TO THE INFORMATION AND OPINIONS CONTAINED IN THIS DOCUMENT OR OTHERWISE TO THE RECIPIENT

AFTER THE DATE OF THIS DOCUMENT; OR (III) THAT DR. MILNER'S INVESTMENT PROCESSES OR INVESTMENT OBJECTIVES WILL OR ARE LIKELY TO BE ACHIEVED

OR SUCCESSFUL OR THAT DR. MILNER'S INVESTMENTS WILL MAKE ANY PROFIT OR WILL NOT SUSTAIN LOSSES. PAST PERFORMANCE IS NOT INDICATIVE OF

FUTURE RESULTS. TO THE FULLEST EXTENT PERMITTED BY LAW, DR. MILNER WILL NOT BE RESPONSIBLE FOR ANY LOSSES, WHETHER DIRECT, INDIRECT OR

CONSEQUENTIAL, INCLUDING LOSS OF PROFITS, DAMAGES, COSTS, CLAIMS OR EXPENSES RELATING TO OR ARISING FROM THE RECIPIENT'S OR ANY PERSON'S

RELIANCE ON THIS DOCUMENT.

EXCEPT FOR THE HISTORICAL INFORMATION CONTAINED

HEREIN, THE INFORMATION AND OPINIONS INCLUDED IN THIS DOCUMENT CONSTITUTE FORWARD-LOOKING STATEMENTS, INCLUDING ESTIMATES AND PROJECTIONS

PREPARED WITH RESPECT TO, AMONG OTHER THINGS, THE COMPANY'S ANTICIPATED OPERATING PERFORMANCE, THE VALUE OF THE COMPANY'S SECURITIES,

DEBT OR ANY RELATED FINANCIAL INSTRUMENTS THAT ARE BASED UPON OR RELATE TO THE VALUE OF SECURITIES OF THE COMPANY (COLLECTIVELY, "COMPANY

SECURITIES"), GENERAL ECONOMIC AND MARKET CONDITIONS AND OTHER FUTURE EVENTS. YOU SHOULD BE AWARE THAT ALL FORWARD-LOOKING STATEMENTS,

ESTIMATES AND PROJECTIONS ARE INHERENTLY UNCERTAIN AND SUBJECT TO SIGNIFICANT ECONOMIC, COMPETITIVE, AND OTHER UNCERTAINTIES AND CONTINGENCIES

AND HAVE BEEN INCLUDED SOLELY FOR ILLUSTRATIVE PURPOSES. ACTUAL RESULTS MAY DIFFER MATERIALLY FROM THE INFORMATION CONTAINED HEREIN DUE

TO REASONS THAT MAY OR MAY NOT BE FORESEEABLE. THERE CAN BE NO ASSURANCE THAT THE COMPANY SECURITIES WILL TRADE AT THE PRICES THAT MAY

BE IMPLIED HEREIN, AND THERE CAN BE NO ASSURANCE THAT ANY ESTIMATE, PROJECTION OR ASSUMPTION HEREIN IS, OR WILL BE PROVEN, CORRECT.

THIS DOCUMENT DOES NOT CONSTITUTE (A) AN OFFER

OR INVITATION TO BUY OR SELL, OR A SOLICITATION OF AN OFFER TO BUY OR SELL, ANY SECURITY OR OTHER FINANCIAL INSTRUMENT AND NO LEGAL RELATIONS

SHALL BE CREATED BY ITS ISSUE, (B) A "FINANCIAL PROMOTION" FOR THE PURPOSES OF THE FINANCIAL SERVICES AND MARKETS ACT 2000,

(C) "INVESTMENT ADVICE" AS DEFINED BY THE FCA HANDBOOK, (D) "INVESTMENT RESEARCH" AS DEFINED BY THE FCA HANDBOOK,

OR (E) AN "INVESTMENT RECOMMENDATION" AS DEFINED BY REGULATION (EU) 596/2014 AND BY REGULATION (EU) NO. 596/2014 AS IT FORMS

PART OF U.K. DOMESTIC LAW BY VIRTUE OF SECTION 3 OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018 ("EUWA 2018") INCLUDING AS AMENDED

BY REGULATIONS ISSUED UNDER SECTION 8 OF EUWA 2018. THIS DOCUMENT IS NOT (AND MAY NOT BE CONSTRUED TO BE) LEGAL, TAX, INVESTMENT, FINANCIAL

OR OTHER ADVICE. EACH RECIPIENT SHOULD CONSULT THEIR OWN LEGAL COUNSEL AND TAX AND FINANCIAL ADVISERS AS TO LEGAL AND OTHER MATTERS CONCERNING

THE INFORMATION CONTAINED HEREIN. THIS DOCUMENT DOES NOT PURPORT TO BE ALL-INCLUSIVE OR TO CONTAIN ALL OF THE INFORMATION THAT MAY BE

RELEVANT TO AN EVALUATION OF THE COMPANY, COMPANY SECURITIES OR THE MATTERS DESCRIBED HEREIN.

NO AGREEMENT, COMMITMENT, UNDERSTANDING OR OTHER

LEGAL RELATIONSHIP EXISTS OR MAY BE DEEMED TO EXIST BETWEEN OR AMONG DR. MILNER AND ANY OTHER PERSON BY VIRTUE OF FURNISHING THIS DOCUMENT.

DR. MILNER IS NOT ACTING FOR OR ON BEHALF OF, AND IS NOT PROVIDING ANY ADVICE OR SERVICE TO, ANY RECIPIENT OF THIS DOCUMENT. DR. MILNER

IS NOT RESPONSIBLE TO ANY PERSON FOR PROVIDING ADVICE IN RELATION TO THE SUBJECT MATTER OF THIS DOCUMENT. BEFORE DETERMINING ON ANY COURSE

OF ACTION, ANY RECIPIENT SHOULD CONSIDER ANY ASSOCIATED RISKS AND CONSEQUENCES AND CONSULT WITH ITS OWN INDEPENDENT ADVISORS AS IT DEEMS

NECESSARY.

DR. MILNER HAS NOT SOUGHT OR OBTAINED CONSENT

FROM ANY THIRD PARTY TO USE ANY STATEMENTS OR INFORMATION CONTAINED HEREIN. ANY SUCH STATEMENTS OR INFORMATION SHOULD NOT BE VIEWED AS

INDICATING THE SUPPORT OF SUCH THIRD PARTY FOR THE VIEWS EXPRESSED HEREIN. ALL TRADEMARKS AND TRADE NAMES USED HEREIN ARE THE EXCLUSIVE

PROPERTY OF THEIR RESPECTIVE OWNERS.

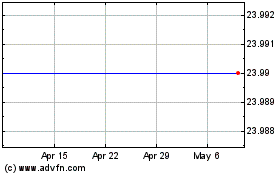

Abcam (NASDAQ:ABCM)

Historical Stock Chart

From Apr 2024 to May 2024

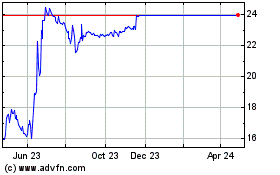

Abcam (NASDAQ:ABCM)

Historical Stock Chart

From May 2023 to May 2024