Array Technologies Shares Fall With Plans for Convertible Notes Offering

01 December 2021 - 3:30AM

Dow Jones News

By Robb M. Stewart

Array Technologies Inc.'s shares were under pressure Tuesday

after the solar-tracker technology company proposed a $325 million

convertible bond offering to help fund the planned acquisition of

Soluciones Tecnicas Integrales Norland S.L.

In morning trading, the stock was 11% lower at $20.33, for a

drop of more than 50% since the end of last year.

Array late Monday said it planned to offer convertible senior

notes due 2028 in a private placement and to grant the initial

purchasers of the notes an option to buy in a 13-day period up to

an additional $48.75 million of notes.

If the initial investors take up the option, the company said it

would enter into additional capped call transactions with the

option counterparties. If its deal with STI falls through, Array

said it will use the proceeds from the offering to pay the cost of

capped call transactions and for general corporate purposes.

With the expected pricing of the notes, Array said it expects to

enter into privately negotiated capped call transactions with one

or more of the initial purchasers and other financial institutions,

which it anticipates will reduce potential dilution to its stock

with the conversion of any notes and/or offset any cash payments

the company is required to make in excess of the principal amount

of converted notes.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

November 30, 2021 11:15 ET (16:15 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

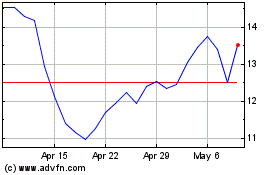

Array Technologies (NASDAQ:ARRY)

Historical Stock Chart

From Apr 2024 to May 2024

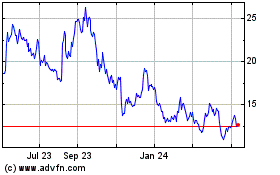

Array Technologies (NASDAQ:ARRY)

Historical Stock Chart

From May 2023 to May 2024