0001069183FALSE00010691832025-03-052025-03-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________________

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

March 5, 2025

Date of Report (Date of earliest event reported)

________________________________________________________

Axon Enterprise, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-16391 | 86-0741227 |

(State or other jurisdiction of

incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

17800 N. 85th St.

Scottsdale, Arizona 85255

(Address of principal executive offices, including zip code)

(480) 991-0797

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.00001 Par Value | AXON | The NASDAQ Stock Market LLC |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter). Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 8.01 Other Events

Notes Offering

On March 5, 2025, Axon Enterprise, Inc. (the “Company”) announced that it intends to offer, subject to market and other conditions, $1,500.0 million aggregate principal amount of its senior notes, comprising senior notes due 2030 (the “2030 Notes”) and senior notes due 2033 (the “2033 Notes” and, together with the 2030 Notes, the “Notes”). A copy of the press release announcing the offering is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The offering of the Notes will be made in a private offering that is exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), in the United States only to persons reasonably believed to be qualified institutional buyers in reliance on Rule 144A under the Securities Act and to non-U.S. persons outside the United States in reliance on Regulation S under the Securities Act. The Notes have not been and will not be registered under the Securities Act or any state securities laws, and may not be offered or sold in the United States absent registration under the Securities Act or an applicable exemption from the registration requirements of the Securities Act and applicable state laws.

This announcement shall not constitute an offer to sell or a solicitation of an offer to buy any security, including the Notes, and shall not constitute an offer to sell or a solicitation of an offer to buy, or a sale of, the Notes or any other security in any jurisdiction in which such offer, solicitation, or sale is unlawful.

Credit Agreement Amendment

In connection with the offering, the Company expects to enter into an amendment (the “Amendment”) to its credit agreement, dated December 15, 2022, by and between the Company, as borrower, and JPMorgan Chase Bank, N.A., as administrative agent, J.P. Morgan Securities L.L.C., as sole bookrunner and sole left lead arranger, and the other lenders party thereto from time to time (as amended, supplemented or otherwise modified, the “Credit Agreement”), which Amendment would become effective substantially concurrently with the consummation of the offering. The Amendment is expected to increase the existing revolving credit facility (the “Revolving Facility”) under the Credit Agreement by $100.0 million to $300.0 million, with the ability to increase the Revolving Facility by an additional $100.0 million, increase the availability for the issuance of letters of credit by $20.0 million to $50.0 million, extend the maturity date of the Credit Agreement from December 15, 2027 to five years from the closing of the Amendment (or, in each case, the date that is six months prior to the stated maturity date of the 0.50% Senior Convertible Notes due 2027 (the “Convertible Notes”) unless the Convertible Notes have been redeemed, repurchased, converted or defeased in full), permit the offering and provide for other updates to the covenants and terms of the Credit Agreement.

Item 9.01 Financial Statements and Exhibits

(d)Exhibits

| | | | | | | | |

Exhibit Number | | Exhibit Description |

| 99.1 | | |

| | |

| 104 | | The cover page from this Current Report on Form 8-K, formatted as Inline XBRL |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Dated: March 5, 2025 | Axon Enterprise, Inc. | |

| | | |

| By: | /s/ BRITTANY BAGLEY | |

| | Brittany Bagley

Chief Operating Officer and Chief Financial Officer | |

AXON ANNOUNCES PROPOSED OFFERING OF $1,500.0 MILLION OF SENIOR NOTES

SCOTTSDALE, Ariz., March 5, 2025 – Axon Enterprise, Inc. (Nasdaq: AXON) (“Axon”) announced today that it intends to offer, subject to market and other conditions, $1,500.0 million aggregate principal amount of senior notes, comprising senior notes due 2030 (the “2030 Notes”) and senior notes due 2033 (the “2033 Notes” and, together with the 2030 Notes, the “Notes”) in a private offering that is exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”). Axon intends to use the net proceeds of this offering for general corporate purposes, which may include, among other things, potentially repurchasing or redeeming Axon’s 0.50% Convertible Senior Notes due 2027 (the “Existing Convertible Notes”), and providing capital to support Axon’s growth and to acquire or invest in product lines, products, services or technologies.

The Notes of each series will be general senior unsecured obligations of Axon. As of the issue date, none of Axon’s subsidiaries will guarantee the Notes. Following the issue date, each of Axon’s existing and future domestic securities that guarantees Axon’s existing revolving credit facility and certain other indebtedness, if any, subject to certain exceptions, will guarantee the Notes of each series.

The Notes will be offered and sold only to persons reasonably believed to be qualified institutional buyers in reliance on Rule 144A under the Securities Act and to non-U.S. persons outside the United States in reliance on Regulation S under the Securities Act. The Notes have not been and will not be registered under the Securities Act or any state securities laws, and may not be offered or sold in the United States absent registration under the Securities Act or an applicable exemption from the registration requirements of the Securities Act and applicable state laws.

This press release is for informational purposes only and is neither an offer to sell nor a solicitation of an offer to buy the Notes or any other security, and shall not constitute an offer to sell or a solicitation of an offer to buy, or a sale of, the Notes or any other security in any jurisdiction in which such offer, solicitation, or sale is unlawful. This press release does not constitute an offer to purchase or a redemption notice in respect of the Existing Convertible Notes.

ABOUT AXON

Axon is a technology leader in global public safety. Our moonshot goal is to cut gun-related deaths between police and the public by 50% before 2033. Axon is building the public safety operating system of the future by integrating a suite of hardware devices and cloud software solutions that lead modern policing. Axon's suite includes TASER energy devices, body cameras, in-car cameras, cloud-hosted digital evidence management solutions, productivity software and real-time operations capabilities. Axon's growing global customer base includes first responders across international, federal, state and local law enforcement, fire, corrections and emergency medical services, as well as the justice sector, enterprises and consumers.

Media Contact:

Alex Engel

Vice President, Communications

Press@Axon.com

Non-Axon trademarks are property of their respective owners.

The Delta Logo and Axon are trademarks of Axon Enterprise, Inc., some of which are registered in the US and other countries. For more information visit www.axon.com/legal. All rights reserved.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

Forward-looking statements in this press release include, but are not limited to, statements regarding the completion, timing and size of the proposed offering, the intended use of proceeds and the anticipated terms of the Notes being offered, as well as statements about Axon’s future plans and goals, proposed products and services and related development efforts and activities; expectations about the market for Axon’s current and future products and services, including statements related to Axon’s user base and customer profiles. Axon may not consummate the proposed offering described in this press release and, if the proposed offering is consummated, cannot provide any assurances regarding the final terms of the offer or the Notes or its ability to effectively apply the net proceeds as described above. Words such as “may,” “will,” “should,” “could,” “would,” “predict,” “potential,” “continue,”

“expect,” “anticipate,” “future,” “intend,” “plan,” “believe,” “estimate,” and similar expressions, as well as statements in future tense, identify forward-looking statements. However, not all forward-looking statements contain these words

Axon cannot guarantee that any forward-looking statement will be realized, although it believes it has been prudent in Axon’s plans and assumptions. Achievement of future results is subject to risks, uncertainties and potentially inaccurate assumptions. The following important factors could cause actual results to differ materially from those in the forward-looking statements: Axon’s exposure to cancellations of government contracts due to non-appropriation clauses, exercise of a cancellation clause or non-exercise of contractually optional periods; the ability of law enforcement agencies to obtain funding, including based on tax revenues; Axon’s ability to design, introduce and sell new products, services or features; Axon’s ability to defend against litigation and protect Axon’s intellectual property, and the resulting costs of this activity; Axon’s ability to win bids through the open bidding process for governmental agencies; Axon’s ability to manage its supply chain and avoid production delays, shortages and impacts to expected gross margins; the impacts of inflation, macroeconomic conditions and global events; the impact of catastrophic events or public health emergencies; the impact of stock-based compensation expense, impairment expense and income tax expense on Axon’s financial results; customer purchase behavior, including adoption of Axon’s software as a service delivery model; negative media publicity or sentiment regarding Axon’s products; the impact of various factors on gross margins; defects in, or misuse of, Axon’s products; changes in the costs of product components and labor; loss of customer data, a breach of security or an extended outage, including by Axon’s third-party cloud-based storage providers; exposure to international operational risks; delayed cash collections and possible credit losses due to Axon’s subscription model; changes in government regulations in the United States and in foreign markets, especially related to the classification of Axon’s products by the United States Bureau of Alcohol, Tobacco, Firearms and Explosives; Axon’s ability to integrate acquired businesses; the impact of declines in the fair values or impairment of Axon’s investments, including Axon’s strategic investments; Axon’s ability to attract and retain key personnel; litigation or inquiries and related time and costs; Axon’s ability to remediate the material weakness in Axon’s internal controls; and counter-party risks relating to cash balances held in excess of federally insured limits. Many events beyond Axon’s control may determine whether results it anticipates will be achieved. Should known or unknown risks or uncertainties materialize, or should underlying assumptions prove inaccurate, actual results could differ materially from past results and those anticipated, estimated or projected. You should bear this in mind as you consider forward-looking statements. The Annual Report on Form 10-K that Axon filed with the Securities and Exchange Commission ("SEC") for the year ended December 31, 2024, lists various important factors that could cause actual results to differ materially from expected and historical results. These factors are intended as cautionary statements for investors within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended. Readers can find them under the heading “Risk Factors” in Axon’s Annual Report on Form 10-K for the year ended December 31, 2024, and investors should refer to them. You should understand that it is not possible to predict or identify all such factors. You should understand that it is not possible to predict or identify all such factors. Consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties.

Except as required by law, Axon undertakes no obligation to publicly update forward-looking statements, whether as a result of new information, future events or otherwise. You are advised, however, to consult any further disclosures Axon makes on related subjects in Axon’s Form 8-K, 10‑Q and 10‑K reports to the SEC.

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

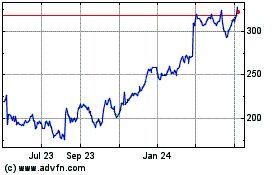

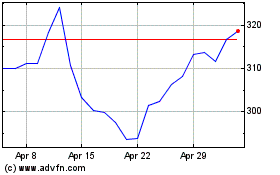

Axon Enterprise (NASDAQ:AXON)

Historical Stock Chart

From Feb 2025 to Mar 2025

Axon Enterprise (NASDAQ:AXON)

Historical Stock Chart

From Mar 2024 to Mar 2025