- Q4 2024 revenues of $979.6 million, up 14.6% year-over-year

(yoy); Bruker organic revenue up 3.9%, and constant-exchange rate

(CER) revenue up 15.8%; Bruker Scientific Instrument (BSI) segment

organic revenue up 4.5%

- Q4 2024 non-GAAP operating margin of 18.1%, as operational

excellence and integration initiatives fully offset strategic

M&A and FX operating margin headwinds

- Q4 2024 GAAP diluted EPS $0.09; non-GAAP diluted EPS $0.76,

up 8.6% yoy

- FY 2024 revenues of $3.37 billion, up 13.6% yoy; Bruker

organic revenue up 4.0%, and CER revenue up 14.0%; BSI segment

organic revenue up 4.2%

- FY 2024 GAAP diluted EPS $0.76; non-GAAP diluted EPS $2.41,

down 6.6% yoy, due to impact of strategic acquisitions that closed

in H1-24

- Bruker initiates FY 2025 guidance (with percentages

year-over-year):

- Revenue $3.47 to $3.54 billion; up 3% to 5%, with CER growth

of 5% to 7%

- Non-GAAP EPS of $2.67 to $2.72; up 11% to 13%, with CER

increase of 14% to 16%

Bruker Corporation (Nasdaq: BRKR) today announced financial

results for its fourth quarter and for the full year ended December

31, 2024.

Frank H. Laukien, Bruker’s President and CEO, commented: “The

year 2024 was transformational for Bruker. We completed several

strategic acquisitions to access very large addressable markets

with strong secular tailwinds. In the process, we added key spatial

biology, molecular diagnostics and lab automation platforms to our

portfolio. For the fourth year in a row, Bruker has delivered well

above-market organic and double-digit CER revenue growth. With

approximately 70% cumulative revenue growth in the last four years,

we have now achieved significant scale.”

He continued: “Operational excellence and good progress with the

integration of our strategic acquisitions have delivered

significant organic operating margin improvements in the fourth

quarter, fully offsetting the initial margin headwinds from our

FY24 strategic M&A. We are confident in our ability to drive

solid revenue growth, strong margin expansion and double-digit EPS

growth in 2025, and beyond.”

Fourth Quarter 2024 Financial Results

Bruker’s revenues for the fourth quarter of 2024 were $979.6

million, an increase of 14.6% compared to $854.5 million in the

fourth quarter of 2023. In the fourth quarter of 2024, revenues

increased 3.9% organically year- over-year with constant-exchange

rate (CER) revenue growth of 15.8%. Revenue growth from

acquisitions was 11.9%, while foreign currency translation had an

unfavorable impact of 1.2%.

Fourth quarter 2024 Bruker Scientific Instruments (BSI) revenues

of $911.3 million increased 16.3% year-over- year, with organic

revenue growth of 4.5%. Fourth quarter 2024 Bruker Energy &

Supercon Technologies (BEST) revenues of $72.1 million decreased

4.1% year-over-year, with organic revenue, net of intercompany

eliminations, decreasing by 2.8%.

Fourth quarter 2024 GAAP operating income was $72.1 million,

compared to $103.5 million in the fourth quarter of 2023. Non-GAAP

operating income was $177.5 million in the fourth quarter of 2024,

an increase of 14.9% compared to $154.5 million in the fourth

quarter of 2023. Bruker’s fourth quarter 2024 non-GAAP operating

margin was 18.1%, achieving the same level as in the fourth quarter

of 2023, with 300 bps of organic operating margin improvements

fully offsetting M&A and FX margin headwinds.

Fourth quarter 2024 GAAP diluted earnings per share (EPS) were

$0.09, compared to $1.41 in the fourth quarter of 2023. Fourth

quarter 2024 non-GAAP diluted EPS were $0.76, an increase of 8.6%

compared to $0.70 in the fourth quarter of 2023.

Fiscal Year 2024 Financial Results

FY 2024 Bruker’s revenues were $3.37 billion, an increase of

13.6% from $2.96 billion in 2023. FY 2024 revenues increased 4.0%

organically year-over-year, with CER revenue growth of 14.0%.

Revenue growth from acquisitions was 10.0%, while foreign currency

translation had an unfavorable impact of 0.4%.

FY 2024 BSI revenues of $3.1 billion increased 14.7% compared to

$2.7 billion in 2023, including organic growth of 4.2%. FY 2024

BEST revenues of $283.0 million increased 0.8%, compared to $280.7

million in 2023. Organic revenue growth for BEST, net of

intercompany eliminations, was 1.9%.

In the first half of FY 2024, Bruker closed several strategic

acquisitions with an initial net dilutive impact to operating

margin and EPS. FY 2024 GAAP operating income was $253.1 million,

compared to $436.9 million in 2023. Non-GAAP operating income in FY

2024 was $518.0 million, down 5.2% compared to $546.3 million in

2023. Bruker’s non-GAAP operating margin in FY 2024 was 15.4%, a

decrease of 300 bps compared to 18.4% in 2023.

FY 2024 GAAP diluted EPS was $0.76, compared to $2.90 in FY

2023. FY 2024 non-GAAP diluted EPS was $2.41, down 6.6% compared to

$2.58 in FY 2023.

A reconciliation of non-GAAP to GAAP financial measures is

provided in the tables accompanying this press release.

Fiscal Year 2025 Financial Outlook

Bruker expects FY 2025 revenues of $3.47 to $3.54 billion,

compared to FY 2024 revenues of $3.37 billion, with 3% to 5%

year-over-year reported revenue growth, including:

- CER revenue growth of 5% to 7%

- Organic revenue growth of 3% to 4%

- M&A revenue growth contribution of 2% to 3%

- Foreign currency translation headwind of approximately 2%

Bruker expects FY 2025 non-GAAP EPS of $2.67 to $2.72, compared

to FY 2024 non-GAAP EPS of $2.41, an increase of 11% to 13%

year-over-year, with CER non-GAAP EPS growth of 14% to 16%.

Bruker’s FY 2025 revenue and non-GAAP EPS guidance is based on

foreign currency exchange rates as of December 31, 2024.

For the Company’s outlook for 2025 organic revenue growth,

M&A revenue growth, constant exchange rate revenue growth, and

constant exchange rate non-GAAP EPS growth, and non-GAAP EPS, we

are not able to provide without unreasonable effort the most

directly comparable GAAP financial measures, or reconciliations to

such GAAP financial measures on a forward-looking basis. Please see

“Use of Non-GAAP Financial Measures” below for a description of

items excluded from our expected non-GAAP EPS.

Quarterly Earnings Call

Bruker will host a conference call and webcast to discuss its

financial results, business outlook, and related corporate and

financial matters today, February 13, 2025, at 8:30 am Eastern

Standard Time. To listen to the webcast, investors can go to

https://ir.bruker.com and click on the “Q4 2024 Earnings Webcast”

hyperlink. A slide presentation will be referenced during the

webcast and will be posted to our Investor Relations website

shortly before the webcast begins. Investors can also listen to the

earnings webcast via telephone by dialing 1-888-437-2685 (U.S. toll

free) or +1-412-317-6702 (international) and referencing “Bruker’s

Fourth Quarter 2024 Earnings Conference Call”.

Bruker is enabling investors to pre-register for the earnings

conference call so that they can expedite their entry into the call

and avoid the need to wait for a live operator. In order to

pre-register for the call, investors can visit

https://dpregister.com/sreg/10196649/fe70e3a396 and enter their

contact information. Investors will then be issued a personalized

phone number and PIN to dial into the live conference call.

Individuals can pre-register any time prior to the start of the

conference call.

A telephone replay of the conference call will be available by

dialing 1-877-344-7529 (U.S. toll free) or +1-412-317-0088

(international) and entering replay access code: 5344184. The

replay will be available beginning one hour after the end of the

conference call through March 13, 2025.

About Bruker Corporation – Leader of the Post-Genomic Era

(Nasdaq: BRKR)

Bruker is enabling scientists and engineers to make breakthrough

post-genomic discoveries and develop new applications that improve

the quality of human life. Bruker’s high performance scientific

instruments and high value analytical and diagnostic solutions

enable scientists to explore life and materials at molecular,

cellular, and microscopic levels. In close cooperation with our

customers, Bruker is enabling innovation, improved productivity,

and customer success in post-genomic life science molecular and

cell biology research, in applied and biopharma applications, in

microscopy and nanoanalysis, as well as in industrial and cleantech

research, and next-gen semiconductor metrology in support of AI.

Bruker offers differentiated, high value life science and

diagnostics systems and solutions in preclinical imaging, clinical

phenomics research, proteomics and multiomics, spatial and

single-cell biology, functional structural and condensate biology,

as well as in clinical microbiology and molecular diagnostics. For

more information, please visit www.bruker.com.

Use of Non-GAAP Financial Measures

To supplement our consolidated financial statements, which are

prepared and presented in accordance with U.S. generally accepted

accounting principles (GAAP), we use the following non-GAAP

financial measures: non- GAAP gross profit; non-GAAP gross profit

margin; non-GAAP operating income; non-GAAP operating income

margin; non-GAAP SG&A expense; non-GAAP interest and other

income (expense), net; non-GAAP profit before income taxes;

non-GAAP income tax rate; non-GAAP net income and non-GAAP diluted

earnings per share. These non-GAAP measures exclude costs related

to restructuring actions, acquisition and related integration

expenses, amortization of acquired intangible assets, and other

non-operational costs.

We also may refer to constant-exchange rate (CER) currency

revenue growth, constant-exchange rate (CER) non-GAAP EPS growth,

and free cash flow or use which are also non-GAAP financial

measures. We define the term CER currency revenue as GAAP revenue

excluding the effect of changes in foreign currency translation

rates. We define the term CER EPS as non-GAAP EPS excluding the

effect of changes in foreign currency translation rates. We define

free cash flow as net cash provided by operating activities less

additions to property, plant, and equipment. We believe free cash

flow is a useful measure to evaluate our business because it

indicates the amount of cash generated after additions to property,

plant, and equipment that is available for, among other things,

acquisitions, investments in our business, repayment of debt and

return of capital to shareholders.

The presentation of these non-GAAP financial measures is not

intended to be a substitute for, or superior to, the financial

information prepared and presented in accordance with GAAP and may

be different from non-GAAP financial measures used by other

companies, and therefore, may not be comparable among companies. We

believe these non-GAAP financial measures provide meaningful

supplemental information regarding our performance. However, we

urge investors to review the reconciliation of these financial

measures to the comparable GAAP financial measures included in the

accompanying tables, and not to rely on any single financial

measure to evaluate our business. Specifically, management believes

that the non-GAAP measures mentioned above provide relevant and

useful information which is widely used by analysts, investors and

competitors in our industry, as well as by our management, in

assessing both consolidated and business unit performance.

We use these non-GAAP financial measures to evaluate our

period-over-period operating performance because our management

believes this provides a more comparable measure of our continuing

business by adjusting for certain items that are not reflective of

the underlying performance of our business. These measures may also

be useful to investors in evaluating the underlying operating

performance of our business and forecasting future results. We

regularly use these non-GAAP financial measures internally to

understand, manage, and evaluate our business results and make

operating decisions. We also measure our employees and compensate

them, in part, based on certain non-GAAP measures and use this

information for our planning and forecasting activities.

Additional information relating to the non-GAAP financial

measures used in this press release and reconciliations to the most

directly comparable GAAP financial measures are provided in the

tables accompanying this press release following our GAAP financial

statements.

With respect to our outlook for 2025 non-GAAP organic revenue,

non-GAAP M&A revenue, non-GAAP constant exchange rate (CER)

revenue and non-GAAP EPS, we are not providing the most directly

comparable GAAP financial measures or corresponding reconciliations

to such GAAP financial measures on a forward-looking basis, because

we are unable to predict with reasonable certainty certain items

that may affect such measures calculated and presented in

accordance with GAAP without unreasonable effort. Our expected

non-GAAP organic revenue and EPS ranges exclude primarily the

future impact of restructuring actions, unusual gains and losses,

acquisition-related expenses and purchase accounting fair value

adjustments. These reconciling items are uncertain, depend on

various factors outside our management’s control and could

significantly impact, either individually or in the aggregate, our

future period revenues and EPS presented in accordance with

GAAP.

Forward-Looking Statements

Any statements contained in this press release which do not

describe historical facts may constitute forward- looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended, including statements regarding our fiscal year

2025 and beyond financial outlook, our outlook for reported revenue

growth, organic revenue growth, M&A revenue growth

contributions, CER currency revenue growth, margin improvements,

foreign currency translation revenue impact, EPS, non-GAAP EPS, and

CER non-GAAP EPS growth; management’s expectations for the impact

of foreign currency and acquisitions; and for future financial and

operational performance and business outlook; future economic

conditions; and statements found under the “Use of Non-GAAP

Financial Measures” section of this release. Any forward-looking

statements contained herein are based on current expectations, but

are subject to risks and uncertainties that could cause actual

results to differ materially from those indicated, including, but

not limited to, the length and severity of any recession and the

impact on global economic conditions, the impact of supply chain

challenges, including inflationary pressures, the impact of

geopolitical tensions and any sanctions, including any reduction in

natural gas exports from Russia resulting from its ongoing conflict

with Ukraine and resulting market disruptions, such as higher

prices for and reduced availability of key metals used in our

products, the conflict in Israel, Palestine and surrounding areas

and the possible expansion of such conflicts and potential

geopolitical consequences, the ongoing tensions between the United

States and China, tariff and trade policy changes, and the

increasing potential of conflict involving countries in Asia that

are critical to our supply chain operations, such as Taiwan and

China, continued volatility in the capital markets, the impact of

increased interest rates, the integration and assumption of

liabilities of businesses we have acquired or may acquire in the

future, including our recent acquisitions of PhenomeX, ELITech,

Chemspeed, and NanoString, our restructuring and cost-control

initiatives, changing technologies, product development and market

acceptance of our products, the cost and pricing of our products,

manufacturing and outsourcing, competition, dependence on

collaborative partners, key suppliers and third party distributors,

capital spending and government funding policies, changes in

governmental regulations, intellectual property rights, litigation,

exposure to foreign currency fluctuations, the impact of foreign

currency exchange rates, our ability to service our debt

obligations and fund our anticipated cash needs, the effect of a

concentrated ownership of our common stock, loss of key personnel,

payment of future dividends and other risk factors discussed from

time to time in our filings with the Securities and Exchange

Commission, or SEC. These and other factors are identified and

described in more detail in our filings with the SEC, including,

without limitation, our annual report on Form 10-K for the year

ended December 31, 2023, as may be updated by our quarterly reports

on Form 10-Q. We expressly disclaim any intent or obligation to

update these forward-looking statements other than as required by

law.

Bruker Corporation

PRELIMINARY CONDENSED CONSOLIDATED

BALANCE SHEETS (unaudited)

(in millions)

December 31,

2024

December 31,

2023

ASSETS

Current assets:

Cash and cash equivalents

$

183.4

$

488.3

Accounts receivable, net

560.4

492.0

Inventories

1,069.2

968.3

Other current assets

245.3

215.6

Total current assets

2,058.3

2,164.2

Property, plant and equipment, net

669.3

599.7

Goodwill, intangibles, net and other

long-term assets

3,082.8

1,486.0

Total assets

$

5,810.4

$

4,249.9

LIABILITIES, REDEEMABLE NONCONTROLLING

INTERESTS AND SHAREHOLDERS’ EQUITY

Current liabilities:

Current portion of long-term debt

$

32.5

$

121.2

Accounts payable

234.1

202.7

Deferred revenue and customer advances

441.6

400.0

Other current liabilities

576.4

478.2

Total current liabilities

1,284.6

1,202.1

Long-term debt

2,061.8

1,160.3

Other long-term liabilities

648.8

474.2

Redeemable noncontrolling interests

18.1

18.7

Total shareholders' equity

1,797.1

1,394.6

Total liabilities, redeemable

noncontrolling interests and shareholders' equity

$

5,810.4

$

4,249.9

Bruker Corporation

PRELIMINARY CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (unaudited)

(in millions, except per share

data)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

Revenue

$

979.6

$

854.5

$

3,366.4

$

2,964.5

Cost of revenue

486.3

424.2

1,716.9

1,451.2

Gross profit

493.3

430.3

1,649.5

1,513.3

Operating expenses:

Selling, general and administrative

247.3

211.3

893.8

729.4

Research and development

104.4

83.4

376.5

294.8

Other charges, net

69.5

32.1

126.1

52.2

Total operating expenses

421.2

326.8

1,396.4

1,076.4

Operating income

72.1

103.5

253.1

436.9

Bargain purchase gain (loss) and

associated measurement period adjustments

(8.0

)

144.1

(8.0

)

144.1

Other Interest and other income

(expense)

(8.0

)

(6.7

)

(38.2

)

(36.8

)

Interest and other income (expense),

net

(16.0

)

137.4

(46.2

)

107.3

Income before income taxes, equity in

income (losses) of unconsolidated investees, net of tax, and

noncontrolling interests in consolidated subsidiaries (a)

56.1

240.9

206.9

544.2

Income tax provision

40.7

37.1

91.4

117.7

Equity in income (losses) of

unconsolidated investees, net of tax

(1.5

)

0.8

(1.7

)

2.0

Consolidated net income

13.9

204.6

113.8

428.5

Net income (loss) attributable to

noncontrolling interests in consolidated subsidiaries

0.2

(0.9

)

0.7

1.3

Net income attributable to Bruker

Corporation

$

13.7

$

205.5

$

113.1

$

427.2

Net income per common share attributable

to Bruker Corporation shareholders:

Basic

$

0.09

$

1.41

$

0.76

$

2.92

Diluted

$

0.09

$

1.41

$

0.76

$

2.90

Weighted average common shares

outstanding:

Basic

151.6

145.5

149.0

146.4

Diluted

152.0

146.0

149.5

147.2

a) On subsequent pages this is referred to

as “Profit before income tax”.

Bruker Corporation

PRELIMINARY CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (unaudited)

(in millions)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

Cash flows from operating activities:

Consolidated net income

$

13.9

$

204.6

$

113.8

$

428.5

Adjustments to reconcile consolidated net

income to cash flows from operating activities:

Depreciation and amortization

52.9

37.3

183.8

114.9

Deferred income taxes

(27.4

)

(37.2

)

(71.6

)

(24.4

)

Bargain purchase gain (loss) and

associated measurement period adjustments

8.0

(144.1

)

8.0

(144.1

)

Other non-cash expenses, net

43.8

23.6

87.7

63.0

Changes in operating assets and

liabilities, net of acquisitions and divestitures:

98.7

121.3

(70.5

)

(87.8

)

Net cash provided by operating

activities

189.9

205.5

251.2

350.1

Cash flows from investing activities:

Purchases of property, plant and

equipment

(38.8

)

(31.5

)

(117.4

)

(106.9

)

Cash paid for acquisitions, net of cash

acquired

(20.9

)

(4.3

)

(1,597.6

)

(226.6

)

Other investing activities, net

(0.8

)

(1.0

)

(42.2

)

7.5

Net cash used in investing activities

(60.5

)

(36.8

)

(1,757.2

)

(326.0

)

Cash flows from financing activities:

Repayments of revolving lines of

credit

(224.1

)

—

(1,212.7

)

—

Proceeds from revolving lines of

credit

177.0

—

1,250.3

—

Repayment of long-term debt

(7.6

)

(5.2

)

(135.4

)

(23.5

)

Proceeds from long-term debt

1.1

(1.2

)

973.6

2.0

Proceeds from Public Offering of common

stock, net of issuance costs

—

—

403.0

—

Payment of dividends to common

shareholders

(7.5

)

(7.3

)

(30.1

)

(29.4

)

Repurchase of common stock

—

(50.4

)

—

(152.3

)

Other financing activities, net

(13.8

)

4.2

(18.9

)

9.8

Net cash provided by (used in) financing

activities

(74.9

)

(59.9

)

1,229.8

(193.4

)

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

(19.5

)

15.9

(28.7

)

12.2

Net increase (decrease) in cash, cash

equivalents and restricted cash

35.0

124.7

(304.9

)

(157.1

)

Cash, cash equivalents and restricted cash

at beginning of period

151.7

366.9

491.6

648.7

Cash, cash equivalents and restricted cash

at end of period

$

186.7

$

491.6

$

186.7

$

491.6

Bruker Corporation

SUMMARY OF GAAP AND NON-GAAP FINANCIAL

MEASURES

(unaudited and in millions, except per

share data)

The following tables consist of a summary

of the Company's GAAP and Non-GAAP Financial Measures:

GAAP Financial Measures

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

Gross Profit

$

493.3

$

430.3

$

1,649.5

$

1,513.3

Gross Profit Margin

50.4

%

50.4

%

49.0

%

51.0

%

SG&A Expenses

$

247.3

$

211.3

$

893.8

$

729.4

Interest and other income (expense),

net

$

(16.0

)

$

137.4

$

(46.2

)

$

107.3

Operating Income

$

72.1

$

103.5

$

253.1

$

436.9

Operating Income Margin

7.4

%

12.1

%

7.5

%

14.7

%

Profit before income tax

$

56.1

$

240.9

$

206.9

$

544.2

Income Tax rate

72.5

%

15.4

%

44.2

%

21.6

%

Net Income attributable to Bruker

Corporation

$

13.7

$

205.5

$

113.1

$

427.2

Diluted net income per common share

attributable to Bruker Corporation shareholders

$

0.09

$

1.41

$

0.76

$

2.90

Net cash provided by operating

activities

$

189.9

$

205.5

$

251.2

$

350.1

Revenue

$

979.6

$

854.5

$

3,366.4

$

2,964.5

Revenue Growth Rate

14.6

%

20.6

%

13.6

%

17.1

%

Non-GAAP Financial Measures

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

Non-GAAP Gross Profit

$

514.2

$

442.8

$

1,736.9

$

1,547.6

Non-GAAP Gross Profit Margin

52.5

%

51.8

%

51.6

%

52.2

%

Non-GAAP SG&A Expenses

$

233.7

$

205.2

$

844.2

$

706.9

Non-GAAP Interest and other income

(expense), net

$

(7.9

)

$

(6.7

)

$

(13.9

)

$

(22.7

)

Non-GAAP Operating Income

$

177.5

$

154.5

$

518.0

$

546.3

Non-GAAP Operating Income Margin

18.1

%

18.1

%

15.4

%

18.4

%

Non-GAAP Profit before income tax

$

169.6

$

147.8

$

504.1

$

523.6

Non-GAAP Income Tax rate

32.5

%

31.3

%

28.6

%

27.2

%

Non-GAAP Net Income attributable to Bruker

Corporation

$

115.4

$

102.4

$

360.5

$

379.7

Non-GAAP Diluted earnings per share

$

0.76

$

0.70

$

2.41

$

2.58

Non-GAAP Free Cash Flow

$

151.1

$

174.0

$

133.8

$

243.2

Non-GAAP Constant-exchange rate (CER)

currency revenue

$

989.5

$

839.9

$

3,379.5

$

2,953.3

Non-GAAP Constant-exchange rate (CER)

currency revenue growth rate

15.8

%

18.6

%

14.0

%

16.7

%

The GAAP to Non-GAAP reconciliations of the above financial

measures are detailed in the following pages.

Bruker Corporation

RECONCILIATIONS OF GAAP TO NON-GAAP

FINANCIAL MEASURES

(unaudited and in millions, except per

share data)

Gross Profit and Gross Profit Margin

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

GAAP gross profit and margin

$

493.3

50.4

%

$

430.3

50.4

%

$

1,649.5

49.0

%

$

1,513.3

51.0

%

Non-GAAP adjustments:

Restructuring costs

1.8

0.2

%

2.1

0.2

%

11.6

0.3

%

3.5

0.1

%

Acquisition-related costs

3.5

0.4

%

2.0

0.2

%

22.0

0.7

%

2.5

0.1

%

Purchased intangibles amortization

14.1

1.4

%

7.4

0.8

%

47.8

1.4

%

24.3

0.9

%

Other costs

1.5

0.1

%

1.0

0.1

%

6.0

0.2

%

4.0

0.1

%

Total Non-GAAP adjustments

20.9

2.1

%

12.5

1.3

%

87.4

2.6

%

34.3

1.2

%

Non-GAAP gross profit and

margin

$

514.2

52.5

%

$

442.8

51.7

%

$

1,736.9

51.6

%

$

1,547.6

52.2

%

Selling, General and Administrative

(“SG&A”) Expenses

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

GAAP SG&A expenses

$

247.3

$

211.3

$

893.8

$

729.4

Non-GAAP adjustments:

Purchased intangibles amortization

(13.6

)

(6.1

)

(49.6

)

(22.5

)

Non-GAAP SG&A expenses

$

233.7

$

205.2

$

844.2

$

706.9

Interest and Other Income (Expense),

net

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

GAAP interest and other income

(expense), net

$

(16.0

)

$

137.4

$

(46.2

)

$

107.3

Non-GAAP adjustments:

Bargain purchase gain (loss) and

associated measurement period adjustments

8.0

(144.1

)

8.0

(144.1

)

Investments related adjustments

0.1

—

24.3

14.1

Non-GAAP interest and other income

(expense), net

$

(7.9

)

$

(6.7

)

$

(13.9

)

$

(22.7

)

Operating Income and Operating Income

Margin

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

Operating income and margin

$

72.1

7.4

%

$

103.5

12.1

%

$

253.1

7.5

%

$

436.9

14.7

%

Non-GAAP adjustments:

Restructuring costs

7.1

0.7

%

16.6

1.9

%

24.7

0.7

%

22.3

0.8

%

Acquisition-related costs

29.6

3.0

%

11.4

1.3

%

76.0

2.3

%

19.3

0.7

%

Purchased intangibles amortization

29.1

3.0

%

13.7

1.6

%

99.2

2.9

%

47.1

1.6

%

Acquisition-related litigation charges

35.7

3.6

%

—

—

46.0

1.4

%

Other costs

3.9

0.4

%

9.3

1.2

%

19.0

0.6

%

20.7

0.6

%

Total Non-GAAP adjustments

105.4

10.7

%

51.0

6.0

%

264.9

7.9

%

109.4

3.7

%

Non-GAAP operating income and

margin

$

177.5

18.1

%

$

154.5

18.1

%

$

518.0

15.4

%

$

546.3

18.4

%

Bruker Corporation

RECONCILIATIONS OF GAAP TO NON-GAAP

FINANCIAL MEASURES - Continued

(unaudited and in millions, except per

share data)

Profit before Income Taxes

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

GAAP profit before income tax

$

56.1

$

240.9

$

206.9

$

544.2

Non-GAAP adjustments:

Restructuring costs

7.1

16.6

24.7

22.3

Acquisition-related costs

29.6

11.4

76.0

19.3

Purchased intangibles amortization

29.1

13.7

99.2

47.1

Bargain purchase gain (loss) and

associated measurement period adjustments

8.0

(144.1

)

8.0

(144.1

)

Investments related adjustments

0.1

—

24.3

14.1

Acquisition-related litigation charges

35.7

—

46.0

—

Other costs

3.9

9.3

19.0

20.7

Total Non-GAAP adjustments

113.5

(93.1

)

297.2

(20.6

)

Non-GAAP profit before income

tax

$

169.6

$

147.8

$

504.1

$

523.6

Income Tax Rate

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

GAAP income tax rate

72.5

%

15.4

%

44.2

%

21.6

%

Non-GAAP adjustments:

Tax impact of non-GAAP adjustments

-42.3

%

19.3

%

-15.4

%

6.5

%

Other discrete items

2.3

%

-3.4

%

-0.2

%

-0.9

%

Total Non-GAAP adjustments

-40.0

%

15.9

%

-15.6

%

5.6

%

Non-GAAP income tax rate

32.5

%

31.3

%

28.6

%

27.2

%

Net Income Attributable to Bruker

Corporation

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

GAAP Net Income attributable to Bruker

Corporation

$

13.7

$

205.5

$

113.1

$

427.2

Non-GAAP adjustments:

Restructuring costs

7.1

16.6

24.7

22.3

Acquisition-related costs

29.6

11.4

76.0

19.3

Purchased intangibles amortization

29.1

13.7

99.2

47.1

Bargain purchase gain (loss) and

associated measurement period adjustments

8.0

(144.1

)

8.0

(144.1

)

Investments related adjustments

0.1

—

24.3

14.1

Acquisition-related litigation charges

35.7

—

46.0

—

Other costs

3.9

9.3

19.0

20.7

Tax effect of above Non-GAAP

adjustments

(14.4

)

(9.2

)

(52.6

)

(24.9

)

Equity in income (losses) of

unconsolidated investees, net of tax

1.5

(0.8

)

1.7

(2.0

)

Noncontrolling interests related to

non-GAAP adjustments

1.1

—

1.1

—

Total Non-GAAP adjustments

101.7

(103.1

)

247.4

(47.5

)

Non-GAAP Net Income attributable to

Bruker Corporation

$

115.4

$

102.4

$

360.5

$

379.7

Weighted Average Shares Outstanding

(Diluted)

152.0

146.0

149.5

147.2

Non-GAAP Diluted Earnings Per

Share

$

0.76

$

0.70

$

2.41

$

2.58

Bruker Corporation

RECONCILIATIONS OF GAAP TO NON-GAAP

FINANCIAL MEASURES - Continued

(unaudited and in millions, except per

share data)

Earnings Per Share (Diluted)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

Diluted net income per common share

attributable to Bruker Corporation shareholders

$

0.09

$

1.41

$

0.76

$

2.90

Non-GAAP adjustments:

Restructuring Costs

0.05

0.11

0.17

0.15

Acquisition-related costs

0.19

0.08

0.51

0.13

Purchased intangibles amortization

0.19

0.09

0.66

0.32

Acquisition-related litigation charges

0.23

—

0.31

—

Other costs

0.03

0.06

0.13

0.14

Bargain purchase gain (loss) and

associated measurement period adjustments

0.05

(0.99

)

0.05

(0.98

)

Investments related adjustments

—

—

0.16

0.10

Tax effect of above Non-GAAP

adjustments

(0.09

)

(0.05

)

(0.36

)

(0.17

)

Equity in income (losses) of

unconsolidated investees, net of tax

0.01

(0.01

)

0.01

(0.01

)

Noncontrolling interests related to

non-GAAP adjustments

0.01

—

0.01

—

Total Non-GAAP adjustments

0.67

(0.71

)

1.65

(0.32

)

Non-GAAP earnings per share

(diluted)

$

0.76

$

0.70

$

2.41

$

2.58

Free Cash Flow

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

Net cash provided by operating

activities

$

189.9

$

205.5

$

251.2

$

350.1

Non-GAAP adjustments:

Purchases of property, plant and

equipment

(38.8

)

(31.5

)

(117.4

)

(106.9

)

Non-GAAP free cash flow (use)

$

151.1

$

174.0

$

133.8

$

243.2

Constant-exchange rate (CER) currency

revenue growth

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

GAAP revenue

$

979.6

$

854.5

$

3,366.4

$

2,964.5

Effect of changes in foreign currency

translation rates

9.9

(14.6

)

13.1

(11.2

)

Non-GAAP CER currency revenue

$

989.5

$

839.9

$

3,379.5

$

2,953.3

GAAP Revenue growth rate

14.6

%

20.6

%

13.6

%

17.1

%

Non-GAAP CER currency revenue growth

rate

15.8

%

18.6

%

14.0

%

16.7

%

Bruker Corporation

REVENUE

(unaudited and in millions)

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

Revenue by Segment:

Bruker BioSpin

$

272.4

$

257.9

$

905.7

$

798.5

Bruker CALID

320.6

257.2

1,093.5

960.4

Bruker Nano

318.3

268.5

1,098.3

941.9

BSI Revenue Total

911.3

783.6

3,097.5

2,700.8

BEST

72.1

75.2

283.0

280.7

Eliminations

(3.8

)

(4.3

)

(14.1

)

(17.0

)

Total revenue

$

979.6

$

854.5

$

3,366.4

$

2,964.5

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

Revenue by End Customer

Geography:

United States

$

261.0

$

212.2

$

938.5

$

777.7

Europe

373.1

284.1

1,183.7

981.2

Asia Pacific

278.0

296.2

989.7

989.0

Other

67.5

62.0

254.5

216.6

Total revenue

$

979.6

$

854.5

$

3,366.4

$

2,964.5

Bruker Corporation

Summary of Reported Revenue Growth

Components

(unaudited and in millions)

Total Bruker Corporation

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

Total Bruker

Total Bruker

GAAP revenue as of prior comparable

period

$

854.5

$

708.4

$

2,964.5

$

2,530.7

Acquisitions and divestitures revenue

(1)

101.8

19.0

296.7

56.2

Organic revenue (2)

33.2

112.5

118.3

366.4

Effect of changes in foreign currency

translation rates

(9.9

)

14.6

(13.1

)

11.2

GAAP revenue

$

979.6

$

854.5

$

3,366.4

$

2,964.5

Revenue growth

14.6

%

20.6

%

13.6

%

17.1

%

Organic revenue growth

3.9

%

15.9

%

4.0

%

14.5

%

Bruker Scientific Instruments

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

Bruker Scientific Instruments

(3)

Bruker Scientific Instruments

(3)

GAAP revenue as of prior comparable

period

$

783.6

$

651.8

$

2,700.8

$

2,305.9

Acquisitions and divestitures revenue

(1)

101.8

19.0

296.7

56.2

Organic revenue (2)

35.2

101.0

113.2

333.4

Effect of changes in foreign currency

translation rates

(9.3

)

11.8

(13.2

)

5.3

GAAP revenue

$

911.3

$

783.6

$

3,097.5

$

2,700.8

Revenue growth

16.3

%

20.2

%

14.7

%

17.1

%

Organic revenue growth

4.5

%

15.5

%

4.2

%

14.5

%

BEST, net of Intercompany Eliminations

Three Months Ended

December 31,

Twelve Months Ended

December 31,

2024

2023

2024

2023

BEST, net of Intercompany

Eliminations

BEST, net of Intercompany

Eliminations

GAAP revenue as of prior comparable

period

$

70.9

$

56.6

$

263.7

$

224.8

Organic revenue (2)

(2.0

)

11.5

5.1

33.0

Effect of changes in foreign currency

translation rates

(0.6

)

2.8

0.1

5.9

GAAP revenue

$

68.3

$

70.9

$

268.9

$

263.7

Revenue growth

-3.7

%

25.3

%

2.0

%

17.3

%

Organic revenue growth

-2.8

%

20.3

%

1.9

%

14.7

%

(1) We define the term acquisitions and divestitures revenue as

GAAP revenue from M&A activities excluding the effect of

changes in foreign currency translation rates.

(2) We define the term organic revenue as GAAP revenue excluding

the effect of changes in foreign currency translation rates and the

effect of acquisitions and divestitures.

(3) Bruker Scientific Instruments (BSI) revenue reflects the sum

of the BSI BioSpin, CALID and Nano Segments as presented in our

Annual Report on Form 10-K for the year ended December 31,

2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250213826255/en/

Joe Kostka Director, Investor Relations Bruker Corporation T: +1

(978) 313-5800 E: Investor.Relations@bruker.com

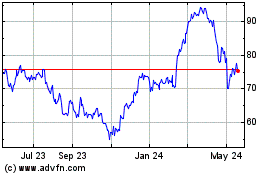

Bruker (NASDAQ:BRKR)

Historical Stock Chart

From Mar 2025 to Apr 2025

Bruker (NASDAQ:BRKR)

Historical Stock Chart

From Apr 2024 to Apr 2025