Full Year 2024 Net Revenue of $1.7 billion

and Full Year Organic Revenue growth of 5.0%

Introduces 2025 guidance

Krispy Kreme, Inc. (NASDAQ: DNUT) (“Krispy Kreme”, “KKI”, or the

“Company”) today reported financial results for the fourth quarter

and full year ended December 29, 2024.

Fourth Quarter Highlights (vs Q4

2023)

- Net revenue of $404.0 million

- Organic revenue(1) grew 1.8%, to $400.6 million, and was

impacted adversely by an estimated 280 basis points from lost

revenue linked to the 2024 Cybersecurity Incident

- GAAP net loss of $22.2 million

- Adjusted EBITDA(1) of $45.9 million, impacted adversely by an

estimated $10 million impact from the 2024 Cybersecurity

Incident

- GAAP operating cash flow of $27.0 million

Full Year Highlights (vs FY

2023)

- Net revenue of $1,665.4 million

- Organic revenue(1) grew 5.0%, to $1,658.1 million, and was

impacted adversely by an estimated 70 basis points from lost

revenue linked to the 2024 Cybersecurity Incident

- GAAP net income of $3.8 million

- Adjusted EBITDA(1) of $193.5 million, impacted adversely by an

estimated $10 million impact from the 2024 Cybersecurity

Incident

- GAAP operating cash flow of $45.8 million

- Global Points of Access increased 3,410, or 24.1% to

17,557

“We delivered an 18th consecutive quarter of year-over-year

organic sales growth. Excluding the estimated cybersecurity

incident impact, results were largely in line with our

expectations,” said Josh Charlesworth, Krispy Kreme CEO.

“Last quarter, we announced we were aligning our talent and

capital to our business priorities, and we have taken significant

action. We have restructured our management teams to maximize

profitable U.S. expansion and capital-light international growth.

We expect to soon award contracts to outsource U.S. logistics.

Finally, we have begun a process to evaluate refranchising certain

international markets. I believe these changes will drive capital

efficient growth, as we continue our transformation into a bigger

and better Krispy Kreme.”

Financial Highlights

Quarters Ended

Fiscal Years Ended

$ in millions, except per share data

December 29,

2024

December 31,

2023

Change

December 29,

2024

December 31,

2023

Change

GAAP:

Net revenue

$

404.0

$

450.9

(10.4

)%

$

1,665.4

$

1,686.1

(1.2

)%

Operating (loss)/income

$

(11.5

)

$

(5.3

)

nm

$

(8.7

)

$

13.1

nm

Operating (loss)/income margin

(2.8

)%

(1.2

)%

-160 bps

(0.5

)%

0.8

%

-130 bps

Net (loss)/income

$

(22.2

)

$

1.9

nm

$

3.8

$

(36.6

)

nm

Net (loss)/income attributable to

KKI

$

(22.4

)

$

2.6

nm

$

3.1

$

(37.9

)

nm

Diluted (loss)/income per share

$

(0.13

)

$

0.02

$

(0.15

)

$

0.02

$

(0.23

)

$

0.25

Non-GAAP (1):

Organic revenue

$

400.6

$

393.5

1.8

%

$

1,658.1

$

1,578.8

5.0

%

Adjusted net income, diluted

$

1.2

$

15.1

nm

$

19.2

$

46.2

nm

Adjusted EBITDA

$

45.9

$

64.1

(28.4

)%

$

193.5

$

211.6

(8.6

)%

Adjusted EBITDA margin

11.4

%

14.2

%

-280 bps

11.6

%

12.6

%

-100 bps

Adjusted EPS

$

0.01

$

0.09

$

(0.08

)

$

0.11

$

0.27

$

(0.16

)

(1)

Non-GAAP figures – please refer

to “Non-GAAP Measures” and “Reconciliation of Non-GAAP Financial

Measures.”

Key Operating Metrics

Fiscal Years Ended

$ in millions

December 29,

2024

December 31,

2023

Change

Global Points of Access

17,557

14,147

24.1

%

Sales per Hub (U.S.) trailing four

quarters

$

4.9

$

4.9

—

%

Sales per Hub (International) trailing

four quarters

$

10.1

$

9.9

2.0

%

Digital Sales as a Percent of Retail

Sales

14.4

%

19.3

%

-490 bps

Fourth Quarter 2024 Consolidated

Results (vs Q4 2023)

Krispy Kreme’s fourth quarter results reflect the strength of

the omni-channel model, delivering net revenue of $404.0 million, a

decline of 10.4%, compared to $450.9 million in the same quarter

last year primarily due to the sale of a majority ownership stake

of Insomnia Cookies in the third quarter of 2024 ($101 million

impact) and the 2024 Cybersecurity Incident (estimated $11 million

impact). Organic revenue grew 1.8%, driven by the Company’s first

quarter of Delivered Fresh Daily (“DFD”) sales in excess of $100

million worldwide. Organic revenue was impacted adversely by an

estimated 280 basis points from lost revenue linked to the 2024

Cybersecurity Incident.

GAAP net loss was $22.2 million, compared to income in the prior

year of $1.9 million. GAAP Diluted Loss per Share was $(0.13), a

decline of $(0.15) from the same quarter last year.

Global Points of Access grew 24.1%, linked to the Company’s

accelerating U.S. expansion now reaching more than 1,900 McDonald’s

restaurants with daily deliveries of Krispy Kreme doughnuts,

alongside growth internationally.

Adjusted EBITDA in the quarter declined 28.4% to $45.9 million,

linked to an estimated $10 million dollar impact from the 2024

Cybersecurity Incident, with Adjusted EBITDA margins contracting

280 basis points to 11.4%. Adjusted EBITDA Margin reflects an

estimated 210 basis point negative impact from the 2024

Cybersecurity Incident.

Adjusted Net Income, diluted declined to $1.2 million in the

quarter from $15.1 million in the same quarter last year. Adjusted

EPS declined $0.08 to $0.01 from $0.09 in the same quarter last

year, due to increased interest expense and depreciation and

amortization and an estimated impact of $0.04 due to the 2024

Cybersecurity Incident.

Full Year 2024 Consolidated Results (vs

FY 2023)

Krispy Kreme’s full year results reflect the sale of a majority

ownership stake of Insomnia Cookies, as net revenue declined 1.2%

to $1.67 billion in 2024, compared to $1.69 billion in the prior

year. GAAP net income was $3.8 million, compared to a loss of $36.6

million. GAAP Diluted EPS was $0.02 compared to a loss of

$0.23.

Total company organic revenue grew 5.0%, and was impacted

adversely by an estimated 70 basis points from lost revenue due to

the 2024 Cybersecurity Incident. Organic revenue growth was driven

by Global Points of Access growth, strong marketing activations,

and pricing actions.

Adjusted EBITDA declined 8.6% to $193.5 million, primarily

linked to the sale of a majority ownership stake of Insomnia

Cookies and an estimated $10 million impact from the 2024

Cybersecurity Incident. Adjusted Net Income, diluted declined to

$19.2 million from $46.2 million in the prior year. Adjusted EPS

declined $0.16 to $0.11 from $0.27 in the prior year, due to

increased depreciation and amortization, as we invested in our

global expansion as well as higher tax rates with a greater portion

of earnings generated in higher tax rate jurisdictions.

Diluted weighted average common shares outstanding for the full

year 2024 were 171.5 million, compared to 170.5 million for the

full year 2023.

Fourth Quarter 2024 Segment Results (vs

Q4 2023)

U.S.: In the U.S. segment, net revenue declined $50.9

million, or 17.2%, largely attributable to the sale of Insomnia

Cookies ($57.4 million impact), a decline in retail sales, and the

2024 Cybersecurity Incident; partially offset by growth in the DFD

business. Organic revenue declined by 1.2%, with an estimated

headwind of 460 basis points attributable to the 2024 Cybersecurity

Incident. Sales per Hub in the U.S. remained consistent at $4.9

million and DFD average sales per door per week decreased, as

expected, and were $631, driven by changing customer mix.

U.S. Adjusted EBITDA decreased 44.0% to $23.6 million with

Adjusted EBITDA margin contraction of 460 basis points to 9.6%, of

which an estimated 350 basis points were attributable the 2024

Cybersecurity Incident.

International: In the International segment, net revenue

grew $7.4 million, or 5.7%. International organic revenue grew

7.8%, driven by points of access growth of 648, or 14%, and

continued premiumization efforts.

International Adjusted EBITDA declined 7.7% to $25.7 million

with adjusted EBITDA margin declining approximately 270 basis

points, as strength in Australia was offset by lower volume in the

U.K. leading to deleveraging.

Market Development: In the Market Development segment,

net revenue declined $3.4 million, or 14.2%, driven by the impact

of franchise acquisitions. Organic revenue decline in the segment

was 0.7%.

Market Development Adjusted EBITDA grew 6.8% to $11.9 million.

Adjusted EBITDA margins expanded to 57.8%, driven by favorable

sales mix and selling, general and administrative expense

improvement.

Balance Sheet and Capital

Expenditures

During the fourth quarter 2024, the Company invested $33.9

million in capital expenditures, driven primarily by investments in

the Hub and Spoke model for the U.S. expansion of the DFD network.

For the full year 2024, capital expenditures as a percentage of

revenue were 7.25%.

In the full year 2024, the Company reduced its supply chain

financing liabilities by $44.3 million, including a $23.2 million

impact from the Insomnia Cookies divestiture. The company generated

Operating Cash Flow of $45.8 million in the year.

2024 Cybersecurity

Incident

As previously disclosed, unauthorized activity on a portion of

our information technology systems resulted in the Company

experiencing certain operational disruptions, including with online

ordering in parts of the U.S. (the “2024 Cybersecurity Incident”).

Online ordering, retail shops, and core business functions are now

fully operational. The incident materially affected the Company’s

business operations and is reasonably likely to materially impact

the Company’s results of operations and financial condition. In the

fourth quarter of 2024, we incurred approximately $3 million of

remediation expenses related to the 2024 Cybersecurity Incident. In

addition, we estimate that we lost revenue within our U.S. segment

in an amount of $11 million related to the incident with a

corresponding estimated $10 million impact on Adjusted EBITDA

(includes margin on the aforementioned lost revenues, as well as

operational inefficiencies). We expect to continue to incur costs

in full year 2025 related to the incident, including operational

inefficiencies early in the first quarter and costs related to fees

for our cybersecurity experts and other advisors. The Company holds

cybersecurity insurance that is expected to offset a portion of the

losses and costs from the incident.

2025 Financial Outlook

Krispy Kreme issues the following guidance for the full year

2025 (vs FY2024)

- Net Revenue of $1,550 to $1,650 million

- Organic Revenue growth(1) of +5% to +7%

- Adjusted EBITDA(1) of $180 to $200 million

- Adjusted EPS(1) of $0.04 to $0.08

- Income Tax rate between 32% and 36%

- Capital Expenditures of 6% to 7% of net revenue

- Interest Expense, net of $65 million to $75 million

The company expects leverage to trend towards 4.0x by year end

2025.

Notes:

(1)

Non-GAAP figures. The Company

does not reconcile forward-looking non-GAAP measures. See “Non-GAAP

Measures.”

Definitions

The following definitions apply to terms used throughout this

press release:

- Global Points of Access: Reflects all locations at which

fresh doughnuts can be purchased. We define global points of access

to include all Hot Light Theater Shops, Fresh Shops, Carts and Food

Trucks, DFD Doors (which includes Delivered Fresh Daily (“DFD”)

branded cabinets and merchandising units within high traffic

grocery and convenience stores, quick service or fast casual

restaurants (“QSR”), club memberships, and drug stores) and Cookie

Bakeries (through the date of the Insomnia cookies divestiture),

and other points at which fresh doughnuts can be purchased at both

Company-owned and franchise locations as of the end of the

respective reporting period. We monitor Global Points of Access as

a metric that informs the growth of our omni-channel presence over

time and believe this metric is useful to investors to understand

our footprint in each of our segments and by asset type.

- Hubs: Reflects locations where fresh doughnuts are

produced and processed for sale at any point of access. We define

Hubs to include self-sustaining Hot Light Theater Shops and

Doughnut Factories, at both Company-owned and franchise locations

as of the end of the respective reporting period.

- Hubs with Spokes: Reflects Hubs currently producing

product for other Fresh Shops, Carts and Food Trucks, or DFD Doors,

and excludes Hubs not currently producing product for other shops,

Carts and Food Trucks, or DFD Doors.

- Sales Per Hub: Sales per Hub equals Fresh Revenues from

Hubs with Spokes, divided by the average number of Hubs with Spokes

at the end of the five most recent quarters.

- Fresh Revenues from Hubs with Spokes: Fresh Revenues is

a measure focused on the Krispy Kreme doughnut business and

includes product sales generated from our Hot Light Theater Shops,

Fresh Shops, Carts and Food Trucks, DFD Doors, and digital channels

and excludes sales from Cookie Bakeries and Branded Sweet Treats

(through the date of the Insomnia cookies divestiture and Branded

Sweet Treats exit, respectively). Fresh Revenues from Hubs with

Spokes equals the Fresh Revenues derived from Hubs with

Spokes.

- Free Cash Flow: Defined as cash provided by operating

activities less purchases of property and equipment.

Conference Call

Krispy Kreme will host a public conference call and webcast at

8:30 AM Eastern Time today to discuss its results for the fourth

quarter of 2024. To register for the conference call, please use

this link. After registering, confirmation will be sent

through email, including dial-in details and unique conference call

codes for entry. To listen to the live webcast and Q&A, visit

the Krispy Kreme investor relations website at

investors.krispykreme.com. A replay of the webcast will be

available on the website within 24 hours after the call. Krispy

Kreme’s earnings press release and related materials will also be

available on the investor relations section of the Company’s

website.

Investor Relations

ir@krispykreme.com

Financial Media Edelman

Smithfield for Krispy Kreme, Inc. Ashley Firlan & Ashna Vasa

KrispyKremeIR@edelman.com

About Krispy Kreme

Headquartered in Charlotte, N.C., Krispy Kreme is one of the

most beloved and well-known sweet treat brands in the world. Our

iconic Original Glazed® doughnut is universally recognized for its

hot-off-the-line, melt-in-your-mouth experience. Krispy Kreme

operates in 40 countries through its unique network of fresh

doughnut shops, partnerships with leading retailers, and a rapidly

growing digital business with more than 17,500 fresh points of

access. Our purpose of touching and enhancing lives through the joy

that is Krispy Kreme guides how we operate every day and is

reflected in the love we have for our people, our communities, and

the planet. Connect with Krispy Kreme Doughnuts at

www.KrispyKreme.com and follow us on social: X, Instagram and

Facebook.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Forward-looking statements can be identified by the use of

forward-looking terminology, including terms such as “plan,”

“believe,” “may,” “continue,” “guidance,” “could,” “will,”

“should,” “would,” “anticipate,” “estimate,” “expect,” “intend,”

“outlook,” “objective,” “seek,” “strive,” “working towards” or, in

each case, the negatives of these words, comparable terminology, or

similar references to future periods; however, statements may be

forward-looking whether or not these terms or their negatives are

used. Forward-looking statements are not a representation by us

that the future plans, estimates, or expectations contemplated by

us will be achieved. Our actual results could differ materially

from the forward-looking statements included in this press release.

We consider the assumptions and estimates on which our

forward-looking statements are based to be reasonable, but they are

subject to various risks and uncertainties relating to our

operations, financial results, financial conditions, business,

prospects, future plans and strategies, projections, liquidity, the

economy, and other future conditions. Therefore, you should not

place undue reliance on any of these forward-looking statements.

Important factors could cause our actual results to differ

materially from those contained in forward-looking statements,

including, without limitation: food safety issues, including risks

of food-borne illnesses, tampering, contamination, and

cross-contamination; impacts from the 2024 Cybersecurity Incident

or any other material failure, inadequacy, or interruption of our

information technology systems, including breaches or failures of

such systems or other cybersecurity or data security-related

incidents; any harm to our reputation or brand image; changes in

consumer preferences or demographic trends; the impact of inflation

or changes in foreign exchange rates; our ability to execute on our

omni-channel business strategy; regulatory investigations,

enforcement actions or material litigation; and other risks and

uncertainties described under the heading “Risk Factors” in our

Annual Report on Form 10-K filed with the Securities and Exchange

Commission (“SEC”) and in other filings we make from time to time

with the SEC. These forward-looking statements are made only as of

the date of this document, and we undertake no obligation to

publicly update or revise any forward-looking statement whether as

a result of new information, future events, or otherwise, except as

may be required by law.

Non-GAAP Measures

This press release includes certain financial information that

is not presented in conformity with accounting principles generally

accepted in the U.S. (“GAAP”). These non-GAAP financial measures

including organic revenue growth/(decline), Adjusted EBITDA,

Adjusted EBITDA margin, Adjusted EBIT, Adjusted Net Income,

Diluted, Adjusted EPS, Free Cash Flow, Net Debt, Fresh Revenue from

Hubs with Spokes and Sales per Hub. These non-GAAP financial

measures are not standardized, and it may not be possible to

compare these financial measures with other companies’ non-GAAP

financial measures having the same or similar names, limiting their

usefulness as comparative measures. Other companies may calculate

similarly titled financial measures differently than we do or may

not calculate them at all. Additionally, these non-GAAP financial

measures are not measurements of financial performance under GAAP

or a substitute for results reported under GAAP. In order to

facilitate a clear understanding of our consolidated historical

operating results, we urge you to review our non-GAAP financial

measures in conjunction with our historical consolidated financial

statements and notes thereto filed with the SEC and not to rely on

any single financial measure.

The Company does not provide reconciliations of forward-looking

non-GAAP financial measures to the most directly comparable GAAP

financial measure because it is unable to predict with reasonable

certainty or without unreasonable effort non-recurring items, such

as those reflected in our reconciliation of historic numbers. The

variability of these items is unpredictable and may have a

significant impact.

See “Reconciliation of Non-GAAP Financial Measures” below for a

reconciliation of the non-GAAP financial measures to the most

directly comparable GAAP financial measure.

Krispy Kreme, Inc.

Consolidated Statements of

Operations

(in thousands, except per

share amounts)

Fiscal Years Ended

December 29,

2024 (52 weeks)

December 31,

2023 (52 weeks)

January 1,

2023 (52 weeks)

(unaudited)

Net revenues

Product sales

$

1,627,778

$

1,651,166

$

1,497,882

Royalties and other revenues

37,619

34,938

32,016

Total net revenues

1,665,397

1,686,104

1,529,898

Product and distribution costs

409,177

443,243

406,227

Operating expenses

809,916

776,589

704,287

Selling, general and administrative

expense

274,303

266,863

223,198

Marketing expenses

47,695

45,872

42,566

Pre-opening costs

3,411

4,120

4,227

Other (income)/expenses, net

(3,967

)

10,378

10,157

Depreciation and amortization expense

133,597

125,894

110,261

Operating (loss)/income

(8,735

)

13,145

28,975

Interest expense, net

60,066

50,341

34,102

Gain on divestiture of Insomnia

Cookies

(90,455

)

—

—

Other non-operating expense, net

1,885

3,798

3,036

Income/(loss) before income

taxes

19,769

(40,994

)

(8,163

)

Income tax expense/(benefit)

15,954

(4,347

)

612

Net income/(loss)

3,815

(36,647

)

(8,775

)

Net income attributable to noncontrolling

interest

720

1,278

6,847

Net income/(loss) attributable to

Krispy Kreme, Inc.

$

3,095

$

(37,925

)

$

(15,622

)

Net income/(loss) per share:

Common stock - Basic

$

0.02

$

(0.23

)

$

(0.10

)

Common stock - Diluted

$

0.02

$

(0.23

)

$

(0.10

)

Weighted average shares

outstanding:

Basic

169,341

168,289

167,471

Diluted

171,500

168,289

167,471

Quarter Ended

December 29,

2024 (13 weeks)

December 31,

2023 (13 weeks)

(unaudited)

Net revenues

Product sales

$

394,193

$

441,399

Royalties and other revenues

9,830

9,506

Total net revenues

404,023

450,905

Product and distribution costs

98,476

112,951

Operating expenses

200,190

200,636

Selling, general and administrative

expense

67,153

74,508

Marketing expenses

12,484

13,771

Pre-opening costs

720

1,193

Other expenses, net

2,463

16,429

Depreciation and amortization expense

34,035

36,752

Operating loss

(11,498

)

(5,335

)

Interest expense, net

15,598

13,483

Gain on divestiture of Insomnia

Cookies

(3,327

)

—

Other non-operating expense, net

770

767

Loss before income taxes

(24,539

)

(19,585

)

Income tax benefit

(2,376

)

(21,468

)

Net (loss)/income

(22,163

)

1,883

Net income/(loss) attributable to

noncontrolling interest

280

(727

)

Net (loss)/income attributable to

Krispy Kreme, Inc.

$

(22,443

)

$

2,610

Net (loss)/income per share:

Common stock - Basic

$

(0.13

)

$

0.02

Common stock - Diluted

$

(0.13

)

$

0.02

Weighted average shares

outstanding:

Basic

169,989

168,609

Diluted

169,989

170,678

Krispy Kreme, Inc.

Consolidated Balance

Sheets

(in thousands, except per

share data)

As of

December 29, 2024

December 31, 2023

(unaudited)

ASSETS

Current assets:

Cash and cash equivalents

$

28,962

$

38,185

Restricted cash

353

429

Accounts receivable, net

67,722

59,362

Inventories

28,133

34,716

Taxes receivable

16,155

15,526

Prepaid expense and other current

assets

31,615

25,363

Total current assets

172,940

173,581

Property and equipment, net

511,139

538,220

Goodwill

1,047,581

1,101,939

Other intangible assets, net

819,934

946,349

Operating lease right of use asset,

net

409,869

456,964

Investments in unconsolidated entities

91,070

2,806

Other assets

19,497

20,733

Total assets

$

3,072,030

$

3,240,592

LIABILITIES AND SHAREHOLDERS’

EQUITY

Current liabilities:

Current portion of long-term debt

$

56,356

$

54,631

Current operating lease liabilities

46,620

50,365

Accounts payable

123,316

156,488

Accrued liabilities

124,212

134,005

Structured payables

135,668

130,104

Total current liabilities

486,172

525,593

Long-term debt, less current portion

844,547

836,615

Noncurrent operating lease liabilities

405,366

454,583

Deferred income taxes, net

130,745

123,925

Other long-term obligations and deferred

credits

40,768

36,093

Total liabilities

1,907,598

1,976,809

Commitments and contingencies

Shareholders’ equity:

Common stock, $0.01 par value; 300,000

shares authorized as of both December 29, 2024 and December 31,

2023; 170,060 and 168,628 shares issued and outstanding as of

December 29, 2024 and December 31, 2023, respectively

1,701

1,686

Additional paid-in capital

1,466,508

1,443,591

Shareholder note receivable

(1,906

)

(3,850

)

Accumulated other comprehensive

(loss)/income, net of income tax

(32,128

)

7,246

Retained deficit

(299,638

)

(278,990

)

Total shareholders’ equity attributable

to Krispy Kreme, Inc.

1,134,537

1,169,683

Noncontrolling interest

29,895

94,100

Total shareholders’ equity

1,164,432

1,263,783

Total liabilities and shareholders’

equity

$

3,072,030

$

3,240,592

Krispy Kreme, Inc.

Consolidated Statements of

Cash Flows

(in thousands)

Fiscal Years Ended

December 29,

2024 (52 weeks)

December 31,

2023 (52 weeks)

January 1,

2023 (52 weeks)

(unaudited)

CASH FLOWS PROVIDED BY OPERATING

ACTIVITIES:

Net income/(loss)

$

3,815

$

(36,647

)

$

(8,775

)

Adjustments to reconcile net income/(loss)

to net cash provided by operating activities:

Depreciation and amortization expense

133,597

125,894

110,261

Deferred and other income taxes

3,067

(18,486

)

(14,237

)

Loss on extinguishment of debt

—

472

—

Impairment and lease termination

charges

4,464

24,909

18,297

Loss on disposal of property and

equipment

1,250

110

393

Gain on divestiture of Insomnia

Cookies

(90,455

)

—

—

Gain on remeasurement of equity method

investment

(5,579

)

—

—

Gain on sale-leaseback

(1,569

)

(9,646

)

(6,549

)

Share-based compensation

35,149

24,196

18,170

Change in accounts and notes receivable

allowances

646

654

570

Inventory write-off

2,783

11,248

868

Settlement of interest rate swap

derivatives

—

7,657

8,476

Amortization related to settlement of

interest rate swap derivatives

(5,910

)

(10,289

)

—

Other

(619

)

2,155

2,232

Change in operating assets and

liabilities, excluding business acquisitions and divestitures, and

foreign currency translation adjustments:

Accounts, notes, and taxes receivable

(13,895

)

(3,523

)

(9,485

)

Inventories

(2,011

)

780

(12,515

)

Other current and noncurrent assets

(873

)

(2,395

)

(1,691

)

Operating lease assets and liabilities

(1,227

)

5,111

(793

)

Accounts payable and accrued

liabilities

(20,156

)

(74,471

)

32,015

Other long-term obligations and deferred

credits

3,355

(2,185

)

2,581

Net cash provided by operating

activities

45,832

45,544

139,818

CASH FLOWS PROVIDED BY/(USED FOR)

INVESTING ACTIVITIES:

Purchase of property and equipment

(120,792

)

(121,427

)

(111,717

)

Proceeds from disposals of assets

183

218

1,077

Proceeds from sale-leaseback

6,308

10,025

8,401

Acquisition of shops and franchise rights

from franchisees, net of cash acquired

(31,938

)

—

(17,330

)

Purchase of equity method investment

(3,506

)

(1,424

)

(989

)

Net proceeds from divestiture of Insomnia

Cookies

124,126

—

—

Principal payment received from loan to

Insomnia Cookies

45,000

—

—

Principal payments received from loans to

franchisees

985

20

59

Disbursement for loan receivable

(1,086

)

—

(975

)

Net cash provided by/(used for)

investing activities

19,280

(112,588

)

(121,474

)

CASH FLOWS (USED FOR)/PROVIDED BY

FINANCING ACTIVITIES:

Proceeds from the issuance of debt

676,250

1,175,698

149,000

Repayment of long-term debt and lease

obligations

(712,778

)

(1,084,390

)

(101,181

)

Payment of financing costs

—

(5,175

)

—

Proceeds from structured payables

376,189

241,148

282,023

Payments on structured payables

(345,327

)

(214,574

)

(294,457

)

Payment of contingent consideration

related to a business combination

—

(925

)

(900

)

Capital contribution from shareholders,

net of loans issued

919

764

(288

)

Payments of issuance costs in connection

with initial public offering

—

—

(12,458

)

Proceeds from sale of noncontrolling

interest in subsidiary

1,562

292

593

Distribution to shareholders

(23,692

)

(23,558

)

(23,430

)

Payments for repurchase and retirement of

common stock

(5,489

)

(1,880

)

(4,019

)

Distribution to noncontrolling

interest

(41,583

)

(15,538

)

(11,721

)

Net cash (used for)/provided by

financing activities

(73,949

)

71,862

(16,838

)

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

(462

)

(1,934

)

(4,968

)

Net (decrease)/increase in cash, cash

equivalents and restricted cash

(9,299

)

2,884

(3,462

)

Cash, cash equivalents and restricted cash

at beginning of the fiscal year

38,614

35,730

39,192

Cash, cash equivalents and restricted

cash at end of the fiscal year

$

29,315

$

38,614

$

35,730

Net cash provided by operating

activities

$

45,832

$

45,544

$

139,818

Less: Purchase of property and

equipment

(120,792

)

(121,427

)

(111,717

)

Free cash flow

$

(74,960

)

$

(75,883

)

$

28,101

Krispy Kreme, Inc. Reconciliation of

Non-GAAP Financial Measures (unaudited and in thousands,

except per share amounts)

We define “Adjusted EBITDA” as earnings before interest expense,

net, income tax expense, and depreciation and amortization, with

further adjustments for share-based compensation, certain strategic

initiatives, acquisition and integration expenses, and certain

other non-recurring, infrequent or non-core income and expense

items. Adjusted EBITDA is a principal metric that management uses

to monitor and evaluate operating performance and provides a

consistent benchmark for comparison across reporting periods.

“Adjusted EBITDA margin” reflects Adjusted EBITDA as a percentage

of net revenues.

We define “Adjusted EBIT” as earnings before interest expense,

net and income tax expense, with further adjustments for

share-based compensation, certain strategic initiatives,

acquisition and integration expenses, and certain other

non-recurring, infrequent or non-core income and expense items.

Adjusted EBIT is a principal metric that management uses to monitor

and evaluate operating performance and provides a consistent

benchmark for comparison across reporting periods.

We define “Adjusted Net Income, Diluted” as net income/(loss)

attributable to common shareholders, adjusted for interest expense,

share-based compensation, certain strategic initiatives,

acquisition and integration expenses, amortization of

acquisition-related intangibles, the tax impact of adjustments, and

certain other non-recurring, infrequent or non-core income and

expense items. “Adjusted EPS” is Adjusted Net Income, Diluted

converted to a per share amount.

Adjusted EBITDA, Adjusted EBITDA margin, Adjusted EBIT, Adjusted

Net Income, Diluted, and Adjusted EPS have certain limitations,

including adjustments for income and expense items that are

required by GAAP. In evaluating these non-GAAP measures, you should

be aware that in the future we will incur expenses that are the

same as or similar to some of the adjustments in this presentation,

such as share-based compensation. Our presentation of these

non-GAAP measures should not be construed to imply that our future

results will be unaffected by any such adjustments. Management

compensates for these limitations by relying on our GAAP results in

addition to using these non-GAAP measures supplementally.

Quarter Ended

Fiscal Years Ended

(in thousands)

December 29,

2024

December 31,

2023

December 29,

2024

December 31,

2023

Net (loss)/income

$

(22,163

)

$

1,883

$

3,815

$

(36,647

)

Interest expense, net

15,598

13,483

60,066

50,341

Income tax (benefit)/expense

(2,376

)

(21,468

)

15,954

(4,347

)

Share-based compensation

10,546

6,375

35,149

24,196

Employer payroll taxes related to

share-based compensation

59

85

358

395

Gain on divestiture of Insomnia

Cookies

(3,327

)

—

(90,455

)

—

Other non-operating expense, net (1)

770

767

1,885

3,798

Strategic initiatives (2)

(441

)

5,216

19,993

29,057

Acquisition and integration expenses

(3)

245

32

3,282

511

New market penetration expenses (4)

213

367

1,407

1,380

Shop closure expenses, net (5)

4,073

16,979

4,861

17,335

Restructuring and severance expenses

(6)

6,792

2,251

7,561

5,050

Gain on remeasurement of equity method

investment (7)

—

—

(5,579

)

—

Gain on sale-leaseback

(1,569

)

—

(1,569

)

(9,646

)

Other (8)

3,460

1,419

3,203

4,307

Amortization of acquisition related

intangibles (9)

7,700

7,346

30,297

29,373

Adjusted EBIT

$

19,580

$

34,735

$

90,228

$

115,103

Depreciation expense and amortization of

right of use assets

26,335

29,406

103,300

96,521

Adjusted EBITDA

$

45,915

$

64,141

$

193,528

$

211,624

Quarter Ended

Fiscal Years Ended

(in thousands)

December 29,

2024

December 31,

2023

December 29,

2024

December 31,

2023

Segment Adjusted EBITDA:

U.S.

$

23,561

$

42,101

$

112,767

$

130,979

International

25,746

27,887

90,716

96,532

Market Development

11,858

11,104

47,904

42,966

Corporate

(15,250

)

(16,951

)

(57,859

)

(58,853

)

Total Adjusted EBITDA

$

45,915

$

64,141

$

193,528

$

211,624

Quarter Ended

Fiscal Years Ended

(in thousands, except per share

amounts)

December 29,

2024

December 31,

2023

December 29,

2024

December 31,

2023

Net (loss)/income

$

(22,163

)

$

1,883

$

3,815

$

(36,647

)

Share-based compensation

10,546

6,375

35,149

24,196

Employer payroll taxes related to

share-based compensation

59

85

358

395

Gain on divestiture of Insomnia

Cookies

(3,327

)

—

(90,455

)

—

Other non-operating expense, net (1)

770

767

1,885

3,798

Strategic initiatives (2)

(441

)

5,216

19,993

29,057

Acquisition and integration expenses

(3)

245

32

3,282

511

New market penetration expenses (4)

213

367

1,407

1,380

Shop closure expenses, net (5)

4,073

16,979

4,861

17,335

Restructuring and severance expenses

(6)

6,792

2,251

7,561

5,050

Gain on remeasurement of equity method

investment (7)

—

—

(5,579

)

—

Gain on sale-leaseback

(1,569

)

—

(1,569

)

(9,646

)

Other (8)

3,460

1,419

3,203

4,307

Amortization of acquisition related

intangibles (9)

7,700

7,346

30,297

29,373

Loss on extinguishment of 2019 Facility

(10)

—

—

—

472

Tax impact of adjustments (11)

(4,075

)

(29,303

)

9,690

(20,729

)

Tax specific adjustments (12)

(778

)

979

(3,988

)

(1,364

)

Net (income)/loss attributable to

noncontrolling interest

(280

)

727

(720

)

(1,278

)

Adjusted net income attributable to

common shareholders - Basic

$

1,225

$

15,123

$

19,190

$

46,210

Additional income attributed to

noncontrolling interest due to subsidiary potential common

shares

(8

)

(13

)

(20

)

(28

)

Adjusted net income attributable to

common shareholders - Diluted

$

1,217

$

15,110

$

19,170

$

46,182

Basic weighted average common shares

outstanding

169,989

168,609

169,341

168,289

Dilutive effect of outstanding common

stock options, RSUs, and PSUs

1,861

2,069

2,159

2,204

Diluted weighted average common shares

outstanding

171,850

170,678

171,500

170,493

Adjusted net income per share

attributable to common shareholders:

Basic

$

0.01

$

0.09

$

0.11

$

0.27

Diluted

$

0.01

$

0.09

$

0.11

$

0.27

(1)

Primarily foreign translation

gains and losses in each period. Fiscal 2024 also consists of

equity method income from Insomnia Cookies following the

divestiture.

(2)

Fiscal 2024 consists primarily of

costs associated with the divestiture of the Insomnia Cookies

business, preparing for the McDonald’s U.S. expansion, and global

transformation. Fiscal 2023 consists primarily of costs associated

with global transformation and U.S. initiatives such as the

decision to exit the Branded Sweet Treats business, including

property, plant and equipment impairments, inventory write-offs,

employee severance, and other related costs. Fiscal 2022 consists

mainly of equipment disposals, equipment relocation and

installation, consulting and advisory fees, and other costs

associated with the shift of Branded Sweet Treats manufacturing

capability from Burlington, Iowa to Winston-Salem, North

Carolina.

(3)

Consists of acquisition and

integration-related costs in connection with the Company’s business

and franchise acquisitions, including legal, due diligence, and

advisory fees incurred in connection with acquisition and

integration-related activities for the applicable period.

(4)

Consists of start-up costs

associated with entry into new countries in which the Company has

not previously operated, including Brazil and Spain.

(5)

Includes lease termination costs,

impairment charges, and loss on disposal of property, plant and

equipment.

(6)

Fiscal 2024 consists primarily of

costs associated with the restructuring of the U.S. and U.K.

executive teams. Fiscal 2023 and 2022 consist primarily of costs

associated with restructuring of the global executive team.

(7)

Consists of a gain related to the

remeasurement of the equity method investments in KremeWorks USA,

LLC and KremeWorks Canada, L.P. to fair value immediately prior to

the acquisition of the shops.

(8)

Fiscal 2024 consists primarily of

$3.1 million in costs related to remediation of the 2024

Cybersecurity Incident, including fees for cybersecurity experts

and other advisors. Fiscal 2023 and fiscal 2022 consist primarily

of legal and other regulatory expenses incurred outside the

ordinary course of business.

(9)

Consists of amortization related

to acquired intangible assets as reflected within depreciation and

amortization in the Consolidated Statements of Operations.

(10)

Includes interest expenses

related to unamortized debt issuance costs from our prior credit

agreement (the “2019 Facility”) associated with extinguished

lenders as a result of the March 2023 debt refinancing.

(11)

Tax impact of adjustments

calculated by applying the applicable statutory rates. The

Company’s adjusted effective tax rate is 34.0%, 27.2%, and 24.1%

for each of the fiscal years 2024, 2023, and 2022, respectively.

Fiscal 2024 and fiscal 2023 also include the impact of disallowed

executive compensation expense. Fiscal 2022 includes the impact of

disallowed executive compensation expense and a discrete tax

benefit related to a legal accrual.

(12)

Fiscal 2024 consists of the

recognition of previously unrecognized tax benefits unrelated to

ongoing operations, a discrete tax benefit unrelated to ongoing

operations, the release of valuation allowances associated with the

divestiture of Insomnia Cookies, and the effect of various tax law

changes on existing temporary differences. Fiscal 2023 consists of

the recognition of a previously unrecognized tax benefit unrelated

to ongoing operations, the effect of tax law changes on existing

temporary differences, and a discrete tax benefit unrelated to

ongoing operations. Fiscal 2022 consists of the recognition of

previously unrecognized tax benefits unrelated to ongoing

operations, as well as benefits attributable to multiple tax years

due to lapse of the statute of limitations. Fiscal 2022 also

includes the effect of discrete adjustments to the Company’s

deferred tax liabilities that are unrelated to the Company’s

ongoing operations.

Krispy Kreme, Inc.

Segment Reporting

(unaudited and in thousands,

except percentages or otherwise stated)

Quarter Ended

December 29,

2024

December 31,

2023

January 1,

2023

Net revenues:

U.S.

$

245,121

$

296,006

$

270,836

International

138,386

130,978

113,015

Market Development

20,516

23,921

20,748

Total net revenues

$

404,023

$

450,905

$

404,599

Organic revenue growth measures our revenue growth trends

excluding the impact of acquisitions, divestitures, and foreign

currency, and we believe it is useful for investors to understand

the expansion of our global footprint through internal efforts. We

define “organic revenue growth” as the growth in revenues,

excluding (i) acquired shops owned by us for less than 12 months

following their acquisition, (ii) the impact of foreign currency

exchange rate changes, (iii) the impact of shop closures related to

restructuring programs such as the shop portfolio optimization

program initiated for Krispy Kreme U.S. during fiscal 2022, (iv)

the impact of the Branded Sweat Treats business exit, (v) the

impact of the divestiture of Insomnia Cookies, and (vi) revenues

generated during the 53rd week for those fiscal years that have a

53rd week based on our fiscal calendar.

Q4 2024 Organic Revenue - QTD

(in thousands, except

percentages)

U.S.

International

Market

Development

Total Company

Total net revenues in fourth quarter of

fiscal 2024

$

245,121

$

138,386

$

20,516

$

404,023

Total net revenues in fourth quarter of

fiscal 2023

296,006

130,978

23,921

450,905

Total Net Revenues

(Decline)/Growth

(50,885

)

7,408

(3,405

)

(46,882

)

Total Net Revenues (Decline)/Growth

%

-17.2

%

5.7

%

-14.2

%

-10.4

%

Less: Impact of Insomnia Cookies

divestiture

(57,434

)

—

—

(57,434

)

Adjusted net revenues in fourth quarter of

fiscal 2023

238,572

130,978

23,921

393,471

Adjusted net revenue

growth/(decline)

6,549

7,408

(3,405

)

10,552

Impact of acquisitions

(9,428

)

(1,757

)

3,244

(7,941

)

Impact of foreign currency translation

—

4,545

—

4,545

Organic Revenue

(Decline)/Growth

$

(2,879

)

$

10,196

$

(161

)

$

7,156

Organic Revenue (Decline)/Growth

%

-1.2

%

7.8

%

-0.7

%

1.8

%

Q4 2023 Organic Revenue - QTD

(in thousands, except

percentages)

U.S.

International

Market

Development

Total Company

Total net revenues in fourth quarter of

fiscal 2023

$

296,006

$

130,978

$

23,921

$

450,905

Total net revenues in fourth quarter of

fiscal 2022

270,836

113,015

20,748

404,599

Total Net Revenues Growth

25,170

17,963

3,173

46,306

Total Net Revenues Growth %

9.3

%

15.9

%

15.3

%

11.4

%

Less: Impact of shop optimization program

closures

(1,754

)

—

—

(1,754

)

Less: Impact of Branded Sweet Treats

exit

(8,841

)

—

—

(8,841

)

Adjusted net revenues in fourth quarter of

fiscal 2022

260,241

—

113,015

20,748

394,004

Adjusted net revenue growth

35,765

17,963

3,173

56,901

Impact of foreign currency translation

—

(4,921

)

—

(4,921

)

Organic Revenue Growth

$

35,765

$

13,042

$

3,173

$

51,980

Organic Revenue Growth %

13.7

%

11.5

%

15.3

%

13.2

%

Fiscal Years Ended

December 29,

2024

December 31,

2023

January 1,

2023

Net revenues:

U.S.

$

1,058,736

$

1,104,944

$

1,010,250

International

519,102

489,631

435,651

Market Development

87,559

91,529

83,997

Total net revenues

$

1,665,397

$

1,686,104

$

1,529,898

Full Year 2024 Organic Revenue -

YTD

(in thousands, except

percentages)

U.S.

International

Market

Development

Total Company

Total net revenues in fiscal 2024

$

1,058,736

$

519,102

$

87,559

$

1,665,397

Total net revenues in fiscal 2023

1,104,944

489,631

91,529

1,686,104

Total Net Revenues

(Decline)/Growth

(46,208

)

29,471

(3,970

)

(20,707

)

Total Net Revenues (Decline)/Growth

%

-4.2

%

6.0

%

-4.3

%

-1.2

%

Less: Impact of shop optimization program

closures

(463

)

—

—

(463

)

Less: Impact of Insomnia Cookies

divestiture

(100,965

)

—

—

(100,965

)

Less: Impact of Branded Sweet Treats

exit

(5,853

)

—

—

(5,853

)

Adjusted net revenues in fiscal 2023

997,663

489,631

91,529

1,578,823

Adjusted net revenue

growth/(decline)

61,073

29,471

(3,970

)

86,574

Impact of acquisitions

(15,656

)

(2,865

)

5,371

(13,150

)

Impact of foreign currency translation

—

5,883

—

5,883

Organic Revenue Growth

$

45,417

$

32,489

$

1,401

$

79,307

Organic Revenue Growth %

4.6

%

6.6

%

1.5

%

5.0

%

Full Year 2023 Organic Revenue -

YTD

(in thousands, except

percentages)

U.S.

International

Market

Development

Total Company

Total net revenues in fiscal 2023

$

1,104,944

$

489,631

$

91,529

$

1,686,104

Total net revenues in fiscal 2022

1,010,250

435,651

83,997

1,529,898

Total Net Revenues Growth

94,694

53,980

7,532

156,206

Total Net Revenues Growth %

9.4

%

12.4

%

9.0

%

10.2

%

Less: Impact of shop optimization program

closures

(11,367

)

—

—

(11,367

)

Less: Impact of Branded Sweet Treats

exit

(24,577

)

—

—

(24,577

)

Adjusted net revenues in fiscal 2022

974,306

435,651

83,997

1,493,954

Adjusted net revenue growth

130,638

53,980

7,532

192,150

Impact of acquisitions

(7,678

)

—

2,227

(5,451

)

Impact of foreign currency translation

—

(5,039

)

—

(5,039

)

Organic Revenue Growth

$

122,960

$

48,941

$

9,759

$

181,660

Organic Revenue Growth %

12.6

%

11.2

%

11.6

%

12.2

%

Fresh Revenues from Hubs with Spokes and Sales per Hub are

defined above.

Fiscal Years Ended

Sales per Hub

(in thousands, unless otherwise

stated)

December 29,

2024 (52 weeks)

December 31,

2023 (52 weeks)

January 1,

2023 (52 weeks)

U.S.:

Revenues

$

1,058,736

$

1,104,944

$

1,010,250

Non-Fresh Revenues (1)

(3,161

)

(9,416

)

(38,380

)

Fresh Revenues from Insomnia Cookies and

Hubs without Spokes (2)

(307,665

)

(399,061

)

(404,430

)

Fresh Revenues from Hubs with

Spokes

747,910

696,467

567,440

Sales per Hub (millions)

4.9

4.9

4.5

International:

Fresh Revenues from Hubs with Spokes

(3)

$

519,102

$

489,631

$

435,651

Sales per Hub (millions) (4)

10.1

9.9

9.6

(1)

Includes the exited Branded Sweet

Treats business revenues as well as licensing royalties from

customers for use of the Krispy Kreme brand.

(2)

Includes Insomnia Cookies

revenues (through the date of the divestiture) and Fresh Revenues

generated by Hubs without Spokes.

(3)

Total International net revenues

is equal to Fresh Revenues from Hubs with Spokes for that business

segment.

(4)

International sales per Hub

comparative data has been restated in constant currency based on

current exchange rates.

Krispy Kreme, Inc.

Global Points of

Access

Global Points of

Access

Fiscal Years Ended

December 29, 2024

December 31, 2023

January 1, 2023

(unaudited)

U.S.:

Hot Light Theater Shops

237

229

234

Fresh Shops

70

70

62

Cookie Bakeries (1)

—

267

231

DFD Doors (2)

9,644

6,808

5,729

Total

9,951

7,374

6,256

International:

Hot Light Theater Shops

49

44

46

Fresh Shops

519

483

448

Carts, Food Trucks, and Other (3)

17

16

14

DFD Doors

4,583

3,977

3,210

Total

5,168

4,520

3,718

Market Development:

Hot Light Theater Shops

108

116

106

Fresh Shops

1,095

968

813

Carts, Food Trucks, and Other (3)

30

30

27

DFD Doors

1,205

1,139

917

Total

2,438

2,253

1,863

Total Global Points of Access (as

defined)

17,557

14,147

11,837

Total Hot Light Theater Shops

394

389

386

Total Fresh Shops

1,684

1,521

1,323

Total Cookie Bakeries (1)

—

267

231

Total Shops

2,078

2,177

1,940

Total Carts, Food Trucks, and

Other

47

46

41

Total DFD Doors

15,432

11,924

9,856

Total Global Points of Access (as

defined)

17,557

14,147

11,837

(1)

Reflects the divestiture of

Insomnia Cookies during fiscal 2024.

(2)

Includes more than 1,900

McDonald’s QSR shops as of December 29, 2024.

(3)

Carts and Food Trucks are

non-producing, mobile (typically on wheels) facilities without

walls or a door where product is received from a Hot Light Theater

Shop or Doughnut Factory. Other includes a vending machine. Points

of Access in this category are primarily found in international

locations in airports and train stations.

Krispy Kreme, Inc.

Global Hubs

Hubs

Fiscal Years Ended

December 29, 2024

December 31, 2023

January 1, 2023

(unaudited)

U.S.:

Hot Light Theater Shops (1)

232

220

228

Doughnut Factories

6

4

4

Total

238

224

232

Hubs with Spokes

158

149

133

Hubs without Spokes

80

75

99

International:

Hot Light Theater Shops (1)

40

36

34

Doughnut Factories

14

14

14

Total

54

50

48

Hubs with Spokes

54

50

48

Market Development:

Hot Light Theater Shops (1)

106

112

104

Doughnut Factories

27

23

24

Total

133

135

128

Total Hubs

425

409

408

(1)

Includes only Hot Light Theater

Shops and excludes Mini Theaters. A Mini Theater is a Spoke

location that produces some doughnuts for itself and also receives

doughnuts from another producing location.

Krispy Kreme, Inc.

Net Debt and Leverage

(in thousands, except leverage

ratio)

As of

December 29, 2024

December 31, 2023

(unaudited)

Current portion of long-term debt

$

56,356

$

54,631

Long-term debt, less current portion

844,547

836,615

Total long-term debt, including debt

issuance costs

900,903

891,246

Add back: Debt issuance costs

3,322

4,371

Total long-term debt, excluding debt

issuance costs

904,225

895,617

Less: Cash and cash equivalents

(28,962

)

(38,185

)

Net debt

$

875,263

$

857,432

Adjusted EBITDA - trailing four

quarters

193,528

211,624

Net leverage ratio

4.5 x

4.1 x

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250224225524/en/

Investor Relations

ir@krispykreme.com

Financial Media Edelman

Smithfield for Krispy Kreme, Inc. Ashley Firlan & Ashna Vasa

KrispyKremeIR@edelman.com

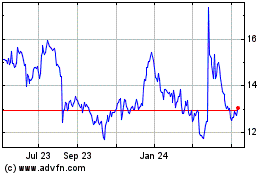

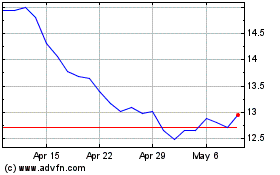

Krispy Kreme (NASDAQ:DNUT)

Historical Stock Chart

From Feb 2025 to Mar 2025

Krispy Kreme (NASDAQ:DNUT)

Historical Stock Chart

From Mar 2024 to Mar 2025