FTAI Aviation Ltd. (NASDAQ: FTAI) (“FTAI” or the “Company”) today

announced its Strategic Capital Initiative (“SCI”) has obtained a

commitment for $2.5 billion of asset-level debt financing led by

global investment firm ATLAS SP Partners (“ATLAS SP”), the

structured products business majority owned by Apollo funds, and

Deutsche Bank AG, New York Branch. FTAI believes this debt

financing will provide the SCI the ability to deploy $4.0+ billion

of total capital into on-lease 737NG and A320ceo aircraft while

allowing FTAI to maintain an asset-light business model. All

engines owned by the SCI will be powered exclusively via engine and

module exchanges with FTAI’s Maintenance, Repair and Exchange

(“MRE”) business.

“We are thrilled that our Strategic Capital Initiative has

secured this financing commitment,” said Joseph P. Adams, CEO and

Chairman of FTAI. “We believe this will allow the SCI to be one of

the largest investors focused on mid-life, on-lease aircraft and we

are grateful for the support of SCI capital partners and lenders,

whose confidence in our business affirms and amplifies our strong

momentum.”

Mr. Adams continued, “This is an exciting time for FTAI as our

MRE offering continues to penetrate the market and transform the

way asset owners think about engine maintenance. With a $22 billion

total addressable market and only 5% market share today*, we

believe we are in the early innings of growth for our Aerospace

Products business. We are also grateful for our growing customer

base, and we look forward to driving cost and time savings for more

asset owners with our differentiated Maintenance, Repair and

Exchange services.”

John Zito, Co-President of Apollo Asset Management said, “We are

excited for ATLAS SP to support FTAI’s Strategic Capital Initiative

in its inaugural asset-level debt financing. We believe this

financing provides ATLAS SP clients with compelling, risk-adjusted

returns, and demonstrates our continued leadership in leading

inaugural issuances and financings for our clients. We are pleased

to be partnering with the FTAI Strategic Capital Initiative team

and their differentiated platform.

Carey Lathrop, CEO of ATLAS SP continued, “We are honored to

have served as structuring agent and lead arranger and to have been

able to commit $2 billion directly in support of FTAI’s Strategic

Capital Initiative. With global travel at record highs, the

tailwinds for the aircraft finance industry are robust, and we look

forward to building our relationship with FTAI through future

bespoke financings. FTAI’s newly launched Strategic Capital

Initiative combined with its innovative approach to aircraft engine

maintenance services will lead to numerous ways to partner in the

future.”

The financing commitment is subject to certain customary

conditions.

* $22 billion total addressable market based on total

maintenance dollars spent industrywide in 2024 on CFM56-5B/7B and

V2500 engines, and FTAI’s 5% of market share is based on total

revenue from Aerospace Products in 2024.

Advisors

In connection with the launch of FTAI’s Strategic Capital

Initiative, Kirkland & Ellis LLP, McGuireWoods LLP and Gibson,

Dunn & Crutcher LLP are serving as legal counsel and Lincoln

International LLC is serving as financial advisor. Clifford Chance

LLP is serving as counsel to the 2025 Partnership lenders.

ATLAS SP Partners served as the sole structuring agent and lead

arranger on the financing, and Deutsche Bank served as an

arranger.

Fourth Quarter and Full Year 2024 Earnings

As previously disclosed, the Company plans to announce its

financial results for the fourth quarter and full year 2024 after

the closing of Nasdaq on Wednesday, February 26, 2025. Management

will host a conference call on Thursday, February 27,

2025 at 8:00 A.M. Eastern Time. The conference call may

be accessed by registering via the following link

https://register.vevent.com/register/BId401ec69ff8f491fb21444c5bbd87f54/.

Once registered, participants will receive a dial-in and unique pin

to access the call. A simultaneous webcast of the conference call

will be available to the public on a listen-only basis

at https://www.ftaiaviation.com/. The information contained

on, or accessible through, any websites included in this press

release is not incorporated by reference into, and should not be

considered a part of, this press release.

ABOUT FTAI AVIATION

FTAI owns and maintains commercial jet engines with a focus on

CFM56 and V2500 engines. FTAI’s propriety portfolio of products,

including the Module Factory and a joint venture to manufacture

engine PMA, enables it to provide cost savings and flexibility to

our airline, lessor, and maintenance, repair, and operations

customer base. Additionally, FTAI owns and leases jet aircraft

which often facilitates the acquisition of engines at attractive

prices. FTAI invests in aviation assets and aerospace products that

generate strong and stable cash flows with the potential for

earnings growth and asset appreciation.

FORWARD-LOOKING STATEMENTS

This communication contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995, including but not limited to, whether the SCI will be able to

close on such committed financing, the SCI’s ability to deploy

$4.0+ billion of total capital into on-lease 737NG and A320ceo

aircraft, whether FTAI’s Aerospace Products business will continue

to grow, the Company’s ability to drive cost and time savings for

more asset owners, and the SCI’s ability to partner with ATLAS SP

in the future. Forward-looking statements are not statements of

historical fact but instead are based on the Company’s present

beliefs and assumptions and on information currently available to

the Company. You can identify these forward-looking statements by

the use of forward-looking words such as “outlook,” “believes,”

“expects,” “potential,” “continues,” “may,” “will,” “should,”

“could,” “seeks,” “approximately,” “predicts,” “intends,” “plans,”

“estimates,” “anticipates,” “target,” “projects,” “contemplates” or

the negative version of those words or other comparable words. Any

forward-looking statements contained in this communication are

based upon the Company’s historical performance and on its current

plans, estimates and expectations in light of information currently

available to the Company. The inclusion of this forward-looking

information should not be regarded as a representation by the

Company that the future plans, estimates or expectations

contemplated by the Company will be achieved. Such forward-looking

statements are subject to various risks and uncertainties and

assumptions relating to the Company’s operations, financial

results, financial condition, business, prospects, growth strategy

and liquidity. Accordingly, there are or will be important factors

that could cause the Company’s actual results to differ materially

from those indicated in these statements, including, but not

limited to, the risk factors set forth in Item 1A. “Risk Factors”

of the Company’s Annual Report on Form 10-K for the year

ended December 31, 2023 and the Company’s Quarterly

Reports on Form 10-Q for the quarterly periods ended March 31,

2024, June 30, 2024, and September 30, 2024, as updated

by annual, quarterly and other reports the Company files with

the Securities and Exchange Commission.

Contacts

Alan AndreiniInvestor RelationsFTAI Aviation Ltd.(646)

734-9414aandreini@ftaiaviation.com

Media

Tim Lynch / Aaron Palash / Kelly SullivanJoele Frank, Wilkinson

Brimmer Katcher(212) 355-4449

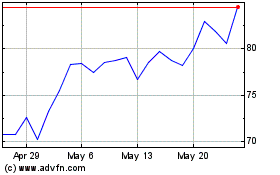

FTAI Aviation (NASDAQ:FTAI)

Historical Stock Chart

From Jan 2025 to Feb 2025

FTAI Aviation (NASDAQ:FTAI)

Historical Stock Chart

From Feb 2024 to Feb 2025