FALSE000165204400016520442025-02-042025-02-040001652044us-gaap:CommonClassAMember2025-02-042025-02-040001652044goog:CapitalClassCMember2025-02-042025-02-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________________________

FORM 8-K

_____________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

February 4, 2025

____________________________________________________________

ALPHABET INC.

(Exact name of registrant as specified in its charter)

_______________________________________________________________ | | | | | | | | |

| Delaware | 001-37580 | 61-1767919 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

1600 Amphitheatre Parkway

Mountain View, CA 94043

(Address of principal executive offices, including zip code)

(650) 253-0000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

______________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, $0.001 par value | GOOGL | Nasdaq Stock Market LLC |

| | (Nasdaq Global Select Market) |

| Class C Capital Stock, $0.001 par value | GOOG | Nasdaq Stock Market LLC |

| | (Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 4, 2025, Alphabet Inc. (“Alphabet” or the “Company”) is issuing a press release and holding a conference call regarding its financial results for the quarter and fiscal year ended December 31, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

This information shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Alphabet is making reference to non-GAAP financial information in both the press release and the conference call. A reconciliation of these non-GAAP financial measures to the comparable GAAP financial measures is contained in the attached press release.

Item 8.01. Other Events.

On February 4, 2025, Alphabet announced a cash dividend of $0.20 per share that will be paid on March 17, 2025, to stockholders of record as of March 10, 2025, on each of the Company’s Class A, Class B, and Class C shares.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibits

| | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (formatted as inline XBRL) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| ALPHABET INC. |

| |

| Date: February 4, 2025 | /s/ ANAT ASHKENAZI |

| Anat Ashkenazi |

| Senior Vice President, Chief Financial Officer |

Alphabet Announces Fourth Quarter and Fiscal Year 2024 Results

MOUNTAIN VIEW, Calif. – February 4, 2025 – Alphabet Inc. (NASDAQ: GOOG, GOOGL) today announced financial results for the quarter and fiscal year ended December 31, 2024.

•Consolidated Alphabet revenues in Q4 2024 increased 12% year over year to $96.5 billion reflecting robust momentum across the business.

•Google Services revenues increased 10% to $84.1 billion, reflecting the strong momentum across Google Search & other and YouTube ads.

•Google Cloud revenues increased 30% to $12.0 billion led by growth in Google Cloud Platform (GCP) across core GCP products, AI Infrastructure, and Generative AI Solutions.

•Total operating income increased 31% and operating margin expanded by 5% percentage points to 32%.

•Net income increased 28% and EPS increased 31% to $2.15.

Sundar Pichai, CEO, said: “Q4 was a strong quarter driven by our leadership in AI and momentum across the business. We are building, testing, and launching products and models faster than ever, and making significant progress in compute and driving efficiencies. In Search, advances like AI Overviews and Circle to Search are increasing user engagement. Our AI-powered Google Cloud portfolio is seeing stronger customer demand, and YouTube continues to be the leader in streaming watchtime and podcasts. Together, Cloud and YouTube exited 2024 at an annual revenue run rate of $110 billion. Our results show the power of our differentiated full-stack approach to AI innovation and the continued strength of our core businesses. We are confident about the opportunities ahead, and to accelerate our progress, we expect to invest approximately $75 billion in capital expenditures in 2025.”

Q4 2024 Financial Highlights

The following table summarizes our consolidated financial results for the quarter and fiscal year ended December 31, 2023 and 2024 (in millions, except for per share information and percentages).

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended December 31, | | Year Ended December 31, |

| 2023 | | 2024 | | 2023 | | 2024 |

| (unaudited) | | | | (unaudited) |

| Revenues | $ | 86,310 | | | $ | 96,469 | | | $ | 307,394 | | | $ | 350,018 | |

| Change in revenues year over year | 13 | % | | 12 | % | | 9 | % | | 14 | % |

Change in constant currency revenues year over year(1) | 13 | % | | 12 | % | | 10 | % | | 15 | % |

| | | | | | | |

| Operating income | $ | 23,697 | | | $ | 30,972 | | | $ | 84,293 | | | $ | 112,390 | |

Operating margin | 27 | % | | 32 | % | | 27 | % | | 32 | % |

| | | | | | | |

Other income (expense), net | $ | 715 | | | $ | 1,271 | | | $ | 1,424 | | | $ | 7,425 | |

| | | | | | | |

| Net income | $ | 20,687 | | | $ | 26,536 | | | $ | 73,795 | | | $ | 100,118 | |

| Diluted EPS | $ | 1.64 | | | $ | 2.15 | | | $ | 5.80 | | | $ | 8.04 | |

(1) Non-GAAP measure. See the section captioned “Reconciliation from GAAP Revenues to Non-GAAP Constant Currency Revenues and GAAP Percentage Change in Revenues to Non-GAAP Percentage Change in Constant Currency Revenues” for more details.

Q4 2024 Supplemental Information (in millions, except for number of employees; unaudited)

Revenues, Traffic Acquisition Costs (TAC), and Number of Employees

| | | | | | | | | | | | | | | |

| Quarter Ended December 31, | | |

| 2023 | | 2024 | | | | |

| Google Search & other | $ | 48,020 | | | $ | 54,034 | | | | | |

| YouTube ads | 9,200 | | | 10,473 | | | | | |

| Google Network | 8,297 | | | 7,954 | | | | | |

| Google advertising | 65,517 | | | 72,461 | | | | | |

| Google subscriptions, platforms, and devices | 10,794 | | | 11,633 | | | | | |

| Google Services total | 76,311 | | | 84,094 | | | | | |

| Google Cloud | 9,192 | | | 11,955 | | | | | |

| Other Bets | 657 | | | 400 | | | | | |

| Hedging gains (losses) | 150 | | | 20 | | | | | |

| Total revenues | $ | 86,310 | | | $ | 96,469 | | | | | |

| | | | | | | |

| Total TAC | $ | 13,986 | | | $ | 14,848 | | | | | |

| | | | | | | |

Number of employees | 182,502 | | | 183,323 | | | |

Segment Operating Results

As announced on October 17, 2024, the Gemini app team that is developing the direct consumer interface to our Gemini models joined Google DeepMind in the quarter ended December 31, 2024. The costs associated with the Gemini app team continue to be reported within our Google Services segment.

| | | | | | | | | | | |

| Quarter Ended December 31, |

| 2023 | | 2024 |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Operating income (loss): | | | |

| Google Services | $ | 26,730 | | | $ | 32,836 | |

| Google Cloud | 864 | | | $ | 2,093 | |

| Other Bets | (863) | | | $ | (1,174) | |

Alphabet-level activities(1) | (3,034) | | | $ | (2,783) | |

| Total income from operations | $ | 23,697 | | | $ | 30,972 | |

(1)In addition to the costs included in Alphabet-level activities, hedging gains (losses) related to revenue were $150 million and $20 million for the three months ended December 31, 2023 and 2024, respectively. For the three months ended December 31, 2023 and 2024, Alphabet-level activities included substantially all of the charges related to employee severance and our office space charges.

Additional Information Relating to the Quarter Ended December 31, 2024 (unaudited)

Dividend Program

Dividend payments to stockholders of Class A, Class B, and Class C shares, were $1.2 billion, $172 million, and $1.1 billion, respectively, totaling $2.4 billion for the three months ended December 31, 2024.

Webcast and Conference Call Information

A live audio webcast of our fourth quarter 2024 earnings release call will be available on YouTube at https://www.youtube.com/watch?v=URIsVKPmhGg. The call begins today at 1:30 PM (PT) / 4:30 PM (ET). This press release, including the reconciliations of certain non-GAAP measures to their nearest comparable GAAP measures, is also available at http://abc.xyz/investor.

We also provide announcements regarding our financial performance, including SEC filings, investor events, press and earnings releases, and blogs, on our investor relations website (http://abc.xyz/investor).

We also share Google news and product updates on Google's Keyword blog at https://www.blog.google/ and News From Google page on X at x.com/NewsFromGoogle, and our executive officers may also use certain social media channels, such as X and LinkedIn, to communicate information about earnings results and company updates, which may be of interest or material to our investors.

Forward-Looking Statements

This press release may contain forward-looking statements that involve risks and uncertainties. Actual results may differ materially from the results predicted, and reported results should not be considered as an indication of future performance. The potential risks and uncertainties that could cause actual results to differ from the results predicted include, among others, those risks and uncertainties included under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the year ended December 31, 2023 and our most recent Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, which are on file with the SEC and are available on our investor relations website at http://abc.xyz/investor and on the SEC website at www.sec.gov. Additional information will also be set forth in our Annual Report on Form 10-K for the year ended December 31, 2024, and may be set forth in other reports and filings we make with the SEC. All information provided in this release and in the attachments is as of February 4, 2025. Undue reliance should not be placed on the forward-looking statements in this press release, which are based on information available to us on the date hereof. We undertake no duty to update this information unless required by law.

About Non-GAAP Financial Measures

To supplement our consolidated financial statements, which are prepared and presented in accordance with GAAP, we use the following non-GAAP financial measures: free cash flow; constant currency revenues; and percentage change in constant currency revenues. The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

We use these non-GAAP financial measures for financial and operational decision-making and as a means to evaluate period-to-period comparisons. We believe that these non-GAAP financial measures provide meaningful supplemental information regarding our performance and liquidity by excluding certain items that may not be indicative of our recurring core business operating results, such as our revenues excluding the effect of foreign exchange rate movements and hedging activities, which are recognized at the consolidated level. We believe that both management and investors benefit from referring to these non-GAAP financial measures in assessing our performance and when planning, forecasting, and analyzing future periods. These non-GAAP financial measures also facilitate management’s internal comparisons to our historical performance and liquidity as well as comparisons to our competitors’ operating results. We believe these non-GAAP financial measures are useful to investors both because (1) they allow for greater transparency with respect to key metrics used by management in its financial and operational decision-making and (2) they are used by our institutional investors and the analyst community to help them analyze the health of our business.

There are a number of limitations related to the use of non-GAAP financial measures. We compensate for these limitations by providing specific information regarding the GAAP amounts excluded from these non-GAAP financial measures and evaluating these non-GAAP financial measures together with their relevant financial measures in accordance with GAAP.

For more information on these non-GAAP financial measures, please see the sections captioned “Reconciliation from GAAP Net Cash Provided by Operating Activities to Non-GAAP Free Cash Flow” and “Reconciliation from GAAP Revenues to Non-GAAP Constant Currency Revenues and GAAP Percentage Change in Revenues to Non-GAAP Percentage Change in Constant Currency Revenues” included at the end of this release.

Contact

| | | | | |

| Investor relations | Media |

| investor-relations@abc.xyz | press@abc.xyz |

Alphabet Inc.

CONSOLIDATED BALANCE SHEETS

(In millions, except par value per share amounts)

| | | | | | | | | | | |

| As of December 31, |

| 2023 | | 2024 |

| | | |

| | | (unaudited) |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 24,048 | | | $ | 23,466 | |

| Marketable securities | 86,868 | | | 72,191 | |

| Total cash, cash equivalents, and marketable securities | 110,916 | | | 95,657 | |

| Accounts receivable, net | 47,964 | | | 52,340 | |

| Other current assets | 12,650 | | | 15,714 | |

| Total current assets | 171,530 | | | 163,711 | |

| Non-marketable securities | 31,008 | | | 37,982 | |

| Deferred income taxes | 12,169 | | | 17,180 | |

| Property and equipment, net | 134,345 | | | 171,036 | |

| Operating lease assets | 14,091 | | | 13,588 | |

| Goodwill | 29,198 | | | 31,885 | |

| Other non-current assets | 10,051 | | | 14,874 | |

| Total assets | $ | 402,392 | | | $ | 450,256 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 7,493 | | | $ | 7,987 | |

| Accrued compensation and benefits | 15,140 | | | 15,069 | |

| Accrued expenses and other current liabilities | 46,168 | | | 51,228 | |

| Accrued revenue share | 8,876 | | | 9,802 | |

| Deferred revenue | 4,137 | | | 5,036 | |

| Total current liabilities | 81,814 | | | 89,122 | |

| Long-term debt | 11,870 | | | 10,883 | |

| Income taxes payable, non-current | 8,474 | | | 8,782 | |

| Operating lease liabilities | 12,460 | | | 11,691 | |

| Other long-term liabilities | 4,395 | | | 4,694 | |

| Total liabilities | 119,013 | | | 125,172 | |

Commitments and contingencies | | | |

| Stockholders’ equity: | | | |

| Preferred stock, $0.001 par value per share, 100 shares authorized; no shares issued and outstanding | 0 | | | 0 | |

Class A, Class B, and Class C stock and additional paid-in capital, $$0.001 par value per share: 300,000 shares authorized (Class A 180,000, Class B 60,000, Class C 60,000); 12,460 (Class A 5,899, Class B 870, Class C 5,691) and 12,211 (Class A 5,835, Class B 861, Class C 5,515) shares issued and outstanding | 76,534 | | | 84,800 | |

| Accumulated other comprehensive income (loss) | (4,402) | | | (4,800) | |

| Retained earnings | 211,247 | | | 245,084 | |

| Total stockholders’ equity | 283,379 | | | 325,084 | |

| Total liabilities and stockholders’ equity | $ | 402,392 | | | $ | 450,256 | |

Alphabet Inc.

CONSOLIDATED STATEMENTS OF INCOME

(In millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended December 31, | | Year Ended December 31, |

| 2023 | | 2024 | | 2023 | | 2024 |

| (unaudited) | | | | (unaudited) |

| Revenues | $ | 86,310 | | | $ | 96,469 | | | $ | 307,394 | | | $ | 350,018 | |

| Costs and expenses: | | | | | | | |

| Cost of revenues | 37,575 | | | 40,613 | | | 133,332 | | | 146,306 | |

| Research and development | 12,113 | | | 13,116 | | | 45,427 | | | 49,326 | |

| Sales and marketing | 7,719 | | | 7,363 | | | 27,917 | | | 27,808 | |

| General and administrative | 5,206 | | | 4,405 | | | 16,425 | | | 14,188 | |

| Total costs and expenses | 62,613 | | | 65,497 | | | 223,101 | | | 237,628 | |

| Income from operations | 23,697 | | | 30,972 | | | 84,293 | | | 112,390 | |

| Other income (expense), net | 715 | | | 1,271 | | | 1,424 | | | 7,425 | |

| Income before income taxes | 24,412 | | | 32,243 | | | 85,717 | | | 119,815 | |

| Provision for income taxes | 3,725 | | | 5,707 | | | 11,922 | | | 19,697 | |

| Net income | $ | 20,687 | | | $ | 26,536 | | | $ | 73,795 | | | $ | 100,118 | |

| | | | | | | |

Basic net income per share | $ | 1.66 | | | $ | 2.17 | | | $ | 5.84 | | | $ | 8.13 | |

Diluted net income per share | $ | 1.64 | | | $ | 2.15 | | | $ | 5.80 | | | $ | 8.04 | |

| Number of shares used in basic earnings per share calculation | 12,488 | | | 12,228 | | | 12,630 | | | 12,319 | |

| Number of shares used in diluted earnings per share calculation | 12,602 | | | 12,348 | | | 12,722 | | | 12,447 | |

Alphabet Inc.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended December 31, | | Year Ended December 31, |

| 2023 | | 2024 | | 2023 | | 2024 |

| (unaudited) | | | | (unaudited) |

| Operating activities | | | | | | | |

| Net income | $ | 20,687 | | | $ | 26,536 | | | $ | 73,795 | | | $ | 100,118 | |

| Adjustments: | | | | | | | |

| Depreciation of property and equipment | 3,316 | | | 4,205 | | | 11,946 | | | 15,311 | |

| Stock-based compensation expense | 5,659 | | | 5,810 | | | 22,460 | | | 22,785 | |

| Deferred income taxes | (1,670) | | | (1,448) | | | (7,763) | | | (5,257) | |

| Loss (gain) on debt and equity securities, net | (471) | | | 67 | | | 823 | | | (2,671) | |

| Other | 1,665 | | | 827 | | | 4,330 | | | 3,419 | |

| Changes in assets and liabilities, net of effects of acquisitions: | | | | | | | |

| Accounts receivable, net | (6,518) | | | (4,570) | | | (7,833) | | | (5,891) | |

Income taxes, net | (9,869) | | | 379 | | | 523 | | | (2,418) | |

| Other assets | 740 | | | 937 | | | (2,143) | | | (1,397) | |

| Accounts payable | 427 | | | 401 | | | 664 | | | 359 | |

Accrued expenses and other liabilities | 4,317 | | | 5,205 | | | 3,937 | | | (1,161) | |

| Accrued revenue share | 797 | | | 581 | | | 482 | | | 1,059 | |

| Deferred revenue | (165) | | | 183 | | | 525 | | | 1,043 | |

| Net cash provided by operating activities | 18,915 | | | 39,113 | | | 101,746 | | | 125,299 | |

| Investing activities | | | | | | | |

| Purchases of property and equipment | (11,019) | | | (14,276) | | | (32,251) | | | (52,535) | |

| Purchases of marketable securities | (28,436) | | | (21,645) | | | (77,858) | | | (86,679) | |

| Maturities and sales of marketable securities | 34,030 | | | 21,649 | | | 86,672 | | | 103,428 | |

| Purchases of non-marketable securities | (851) | | | (1,800) | | | (3,027) | | | (5,034) | |

| Maturities and sales of non-marketable securities | 204 | | | 150 | | | 947 | | | 882 | |

| Acquisitions, net of cash acquired, and purchases of intangible assets | (29) | | | (91) | | | (495) | | | (2,931) | |

| Other investing activities | (66) | | | (167) | | | (1,051) | | | (2,667) | |

| Net cash used in investing activities | (6,167) | | | (16,180) | | | (27,063) | | | (45,536) | |

| Financing activities | | | | | | | |

| Net payments related to stock-based award activities | (2,680) | | | (3,049) | | | (9,837) | | | (12,190) | |

Repurchases of stock (1) | (16,191) | | | (15,551) | | | (61,504) | | | (62,222) | |

| Dividend payments | 0 | | | (2,442) | | | 0 | | | (7,363) | |

| Proceeds from issuance of debt, net of costs | 1,492 | | | 4,895 | | | 10,790 | | | 13,589 | |

| Repayments of debt | (1,929) | | | (3,750) | | | (11,550) | | | (12,701) | |

| Proceeds from sale of interest in consolidated entities, net | 0 | | | 861 | | | 8 | | | 1,154 | |

| Net cash used in financing activities | (19,308) | | | (19,036) | | | (72,093) | | | (79,733) | |

| Effect of exchange rate changes on cash and cash equivalents | (94) | | | (390) | | | (421) | | | (612) | |

| Net increase (decrease) in cash and cash equivalents | (6,654) | | | 3,507 | | | 2,169 | | | (582) | |

| Cash and cash equivalents at beginning of period | 30,702 | | | 19,959 | | | 21,879 | | | 24,048 | |

| Cash and cash equivalents at end of period | $ | 24,048 | | | $ | 23,466 | | | $ | 24,048 | | | $ | 23,466 | |

(1) Includes cash paid for stock repurchases of $15.1 billion and $61.8 billion for the fourth quarter and full year 2024, respectively, as well as excise tax payments of $447 million made during the fourth quarter of 2024.

Segment Results

The following table presents our segment revenues and operating income (loss) (in millions; unaudited):

| | | | | | | | | | | |

| Quarter Ended December 31, |

| 2023 | | 2024 |

| | | |

| Revenues: | | | |

| Google Services | $ | 76,311 | | | $ | 84,094 | |

| Google Cloud | 9,192 | | | 11,955 | |

| Other Bets | 657 | | | 400 | |

| Hedging gains (losses) | 150 | | | 20 | |

| Total revenues | $ | 86,310 | | | $ | 96,469 | |

| Operating income (loss): | | | |

| Google Services | $ | 26,730 | | | $ | 32,836 | |

| Google Cloud | 864 | | | 2,093 | |

| Other Bets | (863) | | | (1,174) | |

Alphabet-level activities | (3,034) | | | (2,783) | |

| Total income from operations | $ | 23,697 | | | $ | 30,972 | |

We report our segment results as Google Services, Google Cloud, and Other Bets:

•Google Services includes products and services such as ads, Android, Chrome, devices, Google Maps, Google Play, Search, and YouTube. Google Services generates revenues primarily from advertising; fees received for consumer subscription-based products such as YouTube TV, YouTube Music and Premium, and NFL Sunday Ticket, as well as Google One; the sale of apps and in-app purchases; and devices.

•Google Cloud includes infrastructure and platform services, applications, and other services for enterprise customers. Google Cloud generates revenues primarily from consumption-based fees and subscriptions received for Google Cloud Platform services, Google Workspace communication and collaboration tools, and other enterprise services.

•Other Bets is a combination of multiple operating segments that are not individually material. Revenues from Other Bets are generated primarily from the sale of healthcare-related services and internet services.

Certain costs are not allocated to our segments because they represent Alphabet-level activities. These costs primarily include certain AI-focused shared R&D activities, including development costs of our general AI models; corporate initiatives such as our philanthropic activities; corporate shared costs such as certain finance, human resource, and legal costs, including certain fines and settlements. Charges associated with employee severance and office space reductions during 2023 and 2024 were also not allocated to our segments. Additionally, hedging gains (losses) related to revenue are not allocated to our segments.

Other Income (Expense), Net

The following table presents our other income (expense), net (in millions; unaudited):

| | | | | | | | | | | |

| Quarter Ended December 31, |

| 2023 | | 2024 |

| Interest income | $ | 1,110 | | | $ | 1,088 | |

| Interest expense | (69) | | | (53) | |

| Foreign currency exchange gain (loss), net | (449) | | | (21) | |

| Gain (loss) on debt securities, net | (115) | | | (431) | |

Gain (loss) on equity securities, net(1) | 586 | | | 364 | |

| Performance fees | (45) | | | (43) | |

| Income (loss) and impairment from equity method investments, net | (256) | | | (87) | |

| Other | (47) | | | 454 | |

| Other income (expense), net | $ | 715 | | | $ | 1,271 | |

(1)Includes all gains and losses, unrealized and realized, on equity securities. For Q4 2024, the net effect of the gain on equity securities of $364 million and the performance fees related to certain investments of $43 million increased the provision for income tax, net income, and diluted net income per share by $67 million, $254 million, and $0.02, respectively. Fluctuations in the value of our investments may be affected by market dynamics and other factors and could significantly contribute to the volatility of OI&E in future periods.

Reconciliation from GAAP Net Cash Provided by Operating Activities to Non-GAAP Free Cash Flow (in millions; unaudited):

We provide non-GAAP free cash flow because it is a liquidity measure that provides useful information to management and investors about the amount of cash generated by the business that can be used for strategic opportunities, including investing in our business and acquisitions, and to strengthen our balance sheet.

| | | | | |

| Quarter Ended December 31, 2024 |

| Net cash provided by operating activities | $ | 39,113 | |

| Less: purchases of property and equipment | (14,276) | |

| Free cash flow | $ | 24,837 | |

Free cash flow: We define free cash flow as net cash provided by operating activities less capital expenditures.

Reconciliation from GAAP Revenues to Non-GAAP Constant Currency Revenues and GAAP Percentage Change in Revenues to Non-GAAP Percentage Change in Constant Currency Revenues (in millions, except percentages; unaudited):

We provide non-GAAP constant currency revenues (“constant currency revenues”) and non-GAAP percentage change in constant currency revenues (“percentage change in constant currency revenues”), because they facilitate the comparison of current results to historic performance by excluding the effect of foreign exchange rate movements (“FX Effect”) as well as hedging activities, which are recognized at the consolidated level, as they are not indicative of our core operating results.

Non-GAAP constant currency revenues is defined as revenues excluding the effect of foreign exchange rate movements and hedging activities and is calculated by translating current period revenues using prior period exchange rates and excluding any hedging effect recognized in the current period. We calculate the percentage change in constant currency revenues by comparing constant currency revenues to the prior year comparable period revenues, excluding any hedging effect recognized in the prior period.

Revenues by Geography

Comparison from the Quarter Ended December 31, 2023 to the Quarter Ended December 31, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Quarter Ended December 31, 2024 |

| | | | | | | | | % Change from Prior Period |

| Quarter Ended December 31, | | Less FX Effect | | Constant Currency Revenues | | As Reported | | Less Hedging Effect | | Less FX Effect | | Constant Currency Revenues |

| 2023 | | 2024 | | | | | | |

| United States | $ | 41,995 | | | $ | 47,375 | | | $ | 0 | | | $ | 47,375 | | | 13 | % | | | | 0 | % | | 13 | % |

| EMEA | 25,010 | | | 28,184 | | | 350 | | | 27,834 | | | 13 | % | | | | 2 | % | | 11 | % |

| APAC | 13,979 | | | 15,156 | | | (50) | | | 15,206 | | | 8 | % | | | | (1) | % | | 9 | % |

| Other Americas | 5,176 | | | 5,734 | | | (565) | | | 6,299 | | | 11 | % | | | | (11) | % | | 22 | % |

Revenues, excluding hedging effect | 86,160 | | | 96,449 | | | (265) | | | 96,714 | | | 12 | % | | | | 0 | % | | 12 | % |

| Hedging gains (losses) | 150 | | | 20 | | | | | | | | | | | | | |

Total revenues(1) | $ | 86,310 | | | $ | 96,469 | | | | | $ | 96,714 | | | 12 | % | | 0 | % | | 0 | % | | 12 | % |

(1)Total constant currency revenues of $96.7 billion for the quarter ended December 31, 2024 increased $10.6 billion compared to $86.2 billion in revenues, excluding hedging effect for the quarter ended December 31, 2023.

Comparison from the Quarter Ended September 30, 2024 to the Quarter Ended December 31, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Quarter Ended December 31, 2024 |

| | | | | | | | | % Change from Prior Period |

| Quarter Ended | | Less FX Effect | | Constant Currency Revenues | | As Reported | | Less Hedging Effect | | Less FX Effect | | Constant Currency Revenues |

| September 30, 2024 | | December 31, 2024 | | | | | | |

| United States | $ | 43,139 | | | $ | 47,375 | | | $ | 0 | | | $ | 47,375 | | | 10 | % | | | | 0 | % | | 10 | % |

| EMEA | 25,472 | | | 28,184 | | | (36) | | | 28,220 | | | 11 | % | | | | 0 | % | | 11 | % |

| APAC | 14,547 | | | 15,156 | | | 26 | | | 15,130 | | | 4 | % | | | | 0 | % | | 4 | % |

| Other Americas | 5,093 | | | 5,734 | | | (81) | | | 5,815 | | | 13 | % | | | | (1) | % | | 14 | % |

| Revenues, excluding hedging effect | 88,251 | | | 96,449 | | | (91) | | | 96,540 | | | 9 | % | | | | 0 | % | | 9 | % |

| Hedging gains (losses) | 17 | | | 20 | | | | | | | | | | | | | |

Total revenues(1) | $ | 88,268 | | | $ | 96,469 | | | | | $ | 96,540 | | | 9 | % | | 0 | % | | 0 | % | | 9 | % |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

(1)Total constant currency revenues of $96.5 billion for the quarter ended December 31, 2024 increased $8.3 billion compared to $88.3 billion in revenues, excluding hedging effect for the quarter ended September 30, 2024.

Comparison from the Year Ended December 31, 2023 to the Year Ended December 31, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Year Ended December 31, 2024 |

| | | | | | | | | % Change from Prior Period |

| Year Ended December 31, | | Less FX Effect | | Constant Currency Revenues | | As Reported | | Less Hedging Effect | | Less FX Effect | | Constant Currency Revenues |

| 2023 | | 2024 | | | | | | |

| United States | $ | 146,286 | | | $ | 170,447 | | | $ | 0 | | | $ | 170,447 | | | 17 | % | | | | 0 | % | | 17 | % |

| EMEA | 91,038 | | | $ | 102,127 | | | 41 | | | 102,086 | | | 12 | % | | | | 0 | % | | 12 | % |

| APAC | 51,514 | | | 56,815 | | | (1,369) | | | 58,184 | | | 10 | % | | | | (3) | % | | 13 | % |

| Other Americas | 18,320 | | | 20,418 | | | (1,608) | | | 22,026 | | | 11 | % | | | | (9) | % | | 20 | % |

Revenues, excluding hedging effect | 307,158 | | | 349,807 | | | (2,936) | | | 352,743 | | | 14 | % | | | | (1) | % | | 15 | % |

| Hedging gains (losses) | 236 | | | 211 | | | | | | | | | | | | | |

Total revenues(1) | $ | 307,394 | | | $ | 350,018 | | | | | $ | 352,743 | | | 14 | % | | 0 | % | | (1) | % | | 15 | % |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

(1)Total constant currency revenues of $352.7 billion for the year ended December 31, 2024 increased $45.6 billion compared to $307.2 billion in revenues, excluding hedging effect for the year ended December 31, 2023.

Total Revenues — Prior Year Comparative Periods

Comparison from the Quarter Ended December 31, 2022 to the Quarter Ended December 31, 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Quarter Ended December 31, 2023 |

| Quarter Ended December 31, | | | | | | % Change from Prior Period |

| | | Less FX Effect | | Constant Currency Revenues | | As Reported | | Less Hedging Effect | | Less FX Effect | | Constant Currency Revenues |

| 2022 | | 2023 | | | | | | |

| Revenues excluding hedging effect | $ | 75,379 | | | $ | 86,160 | | | $ | 940 | | | $ | 85,220 | | | 14 | % | | | | 1 | % | | 13 | % |

| Hedging gains (losses) | $ | 669 | | | $ | 150 | | | | | | | | | | | | | |

| Total revenues | $ | 76,048 | | | $ | 86,310 | | | | | $ | 85,220 | | | 13 | % | | (1) | % | | 1 | % | | 13 | % |

Total Revenues — Prior Year Comparative Periods

Comparison from the Year Ended December 31, 2022 to the Year Ended December 31, 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Year Ended December 31, 2023 |

| | | | | | | | | % Change from Prior Period |

| | Year Ended December 31, | | Less FX Effect | | Constant Currency Revenues | | As Reported | | Less Hedging Effect | | Less FX Effect | | Constant Currency Revenues |

| 2022 | | 2023 | | | | | | |

| Revenues excluding hedging effect | $ | 280,876 | | | $ | 307,158 | | | $ | (1,953) | | | $ | 309,111 | | | 9 | % | | | | (1) | % | | 10 | % |

| Hedging gains (losses) | $ | 1,960 | | | $ | 236 | | | | | | | | | | | | | |

| Total revenues | $ | 282,836 | | | $ | 307,394 | | | | | $ | 309,111 | | | 9 | % | | 0 | % | | (1) | % | | 10 | % |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=goog_CapitalClassCMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

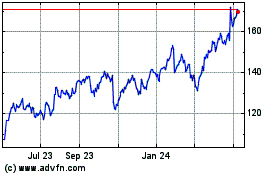

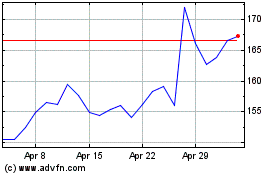

Alphabet (NASDAQ:GOOGL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Alphabet (NASDAQ:GOOGL)

Historical Stock Chart

From Feb 2024 to Feb 2025