false000184439200018443922023-11-132023-11-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 13, 2023 |

MARPAI, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-40904 |

86-1916231 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

615 Channelside Drive, Suite 207 |

|

Tampa, Florida |

|

33602 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 646 303-3483 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Class A Common Stock, par value $0.0001 per share |

|

MRAI |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 2.02 Results of Operations and Financial Condition.

On November 13, 2023, Marpai, Inc. (“Marpai” or the “Company”) issued a press release providing selected financial information for the three and nine months ended September 30, 2023. A copy of the press release is attached as Exhibit 99.1 hereto and is incorporated by reference into this Item 2.02 in its entirety.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

MARPAI, INC. |

|

|

|

|

Date: |

November 13, 2023 |

By: |

/s/ Damien Lamendola |

|

|

|

Name: Damien Lamendola

Title: Chief Executive Officer |

EXH 99.1

FOR IMMEDIATE RELEASE

MARPAI, INC. REPORTS Third QUARTER 2023 RESULTS

•Continued year over year growth related to our acquisition of Maestro Health

•Further identification and implementation of synergies and opportunities continue as a result of the acquisition

•Veteran industry executive leadership announced along with the addition of a seasoned health care leader to strengthen the Board of Directors

•Focus on acceleration of operating efficiencies and customer growth

New York, November 13, 2023 Marpai, Inc. (“Marpai” or the “Company”) (Nasdaq: MRAI), an independent national Third-Party Administrator (TPA) company transforming the $22 billion TPA market supporting self-funded employer health plans, today reported financial results for the third quarter ended September 30, 2023.

The Company’s consolidated results of operations include the results of operations of Marpai and its wholly owned subsidiaries, Marpai Health, Inc. and Marpai Administrators, LLC (formerly Continental Benefits, LLC) for all periods presented, and the results of Maestro Health, LLC (“Maestro Health”) since its acquisition on November 1, 2022.

Third Quarter 2023 Highlights:

•Total revenue for the three months ended September 30, 2023 was $8.7 million, representing an increase of $3.8 million, or nearly 77%, over the same period in 2022. The primary reason for this increase was due to the revenue from the acquisition of Maestro Health.

•The addition of Maestro Health, and organic sales closed by Marpai Administrators, drove a nearly 126% increase in the number of our customers’ employees. As of the end of the third quarter of 2023, the total was approximately 37,000 compared to the same period last year of approximately 16,000.

•The Company had an operating loss of approximately $7.0 million for the three months ended September 30, 2023, compared to an operating loss of approximately $5.8 million during the same period in 2022, as the Company continued to focus on closing the gap to profitability.

•Net loss was nearly $7.3 million for the three months ended September 30, 2023, compared to net loss of approximately $5.8 million for the three months ended September 30, 2022.

•Net loss per share for the three months ended September 30, 2023 was ($0.98) compared to ($1.14) per share from the same period last year.

“I believe that our third quarter results reflect continued momentum towards sustainable profitability,” said Marpai’s new CEO Damien Lamendola. “The pace of improvement achieved and the continued cash burn rate with the volatility of the capital markets drove us to make some rapid changes which we look forward to discussing in our upcoming investors presentation.”

EXH 99.1

Other Highlights:

Withdrawal of Registration Statement on Form S-1

The Company has withdrawn its Form S-1 Registration Statement due to adverse market conditions. The Company is currently evaluating its financing opportunities.

Suspending Financial Guidance

The Company is suspending further financial guidance for full-year 2023 operating results and will not be providing specific financial guidance moving forward.

Webcast and Conference Call Information

Marpai will host an Investor call and webcast on Wednesday, November 29, 2023 at 8:00 a.m. EST to introduce the new Executive Team members and to provide an overview of the Company’s strategic vision and initiatives in place. Please refer to our Investor Relations website at: https://ir.marpaihealth.com for updates and details.

About Marpai, Inc.

Marpai, Inc. (Nasdaq: MRAI) is a leading, national TPA (Third Party Administrator) company bringing value oriented health plan services to employers that directly pay for employee health benefits. Primarily competing in the $22 billion TPA sector serving self-funded employer health plans representing over $1 trillion in annual claims. Marpai works to deliver the healthiest member population for the health plan budget. Operating nationwide, Marpai offers access to leading provider networks including Aetna and Cigna and all TPA services. For more information, visit www.marpaihealth.com, the content of which is not incorporated by reference into this press release.

Forward-Looking Statement Disclaimer

This press release contains forward-looking statements, as that term is defined in the Private Litigation Reform Act of 1995, that involve significant risks and uncertainties. Forward-looking statements can be identified through the use of words such as "anticipates," "expects," "intends," "plans," "believes," "seeks," "estimates," “guidance,” "may," "can," "could", "will", "potential", "should," "goal" and variations of these words or similar expressions. For example, the Company is using forward looking statements when it discusses its belief that the third quarter results reflect continued momentum towards sustainable profitability. Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect Marpai's current expectations and speak only as of the date of this release. Actual results may differ materially from Marpai's current expectations depending upon a number of factors. These factors include, among others, adverse changes in general economic and market conditions, competitive factors including but not limited to pricing pressures and new product introductions, uncertainty of customer acceptance of new product offerings and market changes, risks associated with managing the growth of the business. Except as required by law, Marpai does not undertake any responsibility to revise or update any forward-looking statements whether as a result of new information, future events or otherwise.

EXH 99.1

More detailed information about Marpai and the risk factors that may affect the realization of forward-looking statements is set forth in Marpai's filings with the Securities and Exchange Commission. Investors and security holders are urged to read these documents free of charge on the SEC's web site at http://www.sec.gov.

Media contact:

Laurie Gardner

Lgardner@marpaihealth.com

Investor Relations contact:

Steve Johnson

steve.johnson@marpaihealth.com

###

EXH 99.1

MARPAI, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEET

(in thousands,, except share and per share data)

(UNAUDITED)

|

|

|

|

|

|

|

|

September 30, 2023 |

|

December 31, 2022 |

|

|

(Unaudited) |

|

|

ASSETS: |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

|

$ 3,018 |

|

$ 13,764 |

Restricted cash |

|

11,234 |

|

9,353 |

Accounts receivable, net of allowance for credit losses of $23,458 and $23,458 |

|

977 |

|

1,438 |

Unbilled receivable |

|

595 |

|

350 |

Prepaid expenses and other current assets |

|

961 |

|

1,602 |

Other receivables |

|

32 |

|

31 |

Total current assets |

|

16,817 |

|

26,538 |

|

|

|

|

|

Property and equipment, net |

|

663 |

|

1,506 |

Capitalized software, net |

|

2,743 |

|

4,589 |

Operating lease right-of-use assets |

|

2,520 |

|

3,842 |

Goodwill |

|

6,035 |

|

5,837 |

Intangible assets, net |

|

5,502 |

|

6,323 |

Security deposits |

|

1,309 |

|

1,293 |

Other long-term asset |

|

22 |

|

22 |

Total assets |

|

$ 35,611 |

|

$ 49,950 |

LIABILITIES AND STOCKHOLDERS’ (DEFICIT) EQUITY |

|

|

|

|

Current liabilities: |

|

|

|

|

Accounts payable |

|

$ 3,101 |

|

$ 1,458 |

Accrued expenses |

|

4,660 |

|

5,275 |

Accrued fiduciary obligations |

|

9,878 |

|

9,024 |

Deferred revenue |

|

1,261 |

|

289 |

Current portion of operating lease liabilities |

|

600 |

|

1,311 |

Other short-term liabilities |

|

947 |

|

— |

Due to related party |

|

— |

|

3 |

Total current liabilities |

|

20,447 |

|

17,360 |

|

|

|

|

|

Other long-term liabilities |

|

19,113 |

|

20,203 |

Operating lease liabilities, net of current portion |

|

3,813 |

|

4,772 |

Deferred tax liabilities |

|

1,480 |

|

1,480 |

Total liabilities |

|

44,853 |

|

43,815 |

COMMITMENTS AND CONTINGENCIES |

|

|

|

|

STOCKHOLDERS’ (DEFICIT) EQUITY |

|

|

|

|

Common stock, $0.0001 par value, 227,791,050 shares authorized; 7,810,625 and 5,319,758 issued and outstanding at September 30, 2023 and December 31, 2022, respectively (1) |

|

1 |

|

1 |

Additional paid-in capital |

|

62,476 |

|

54,128 |

Accumulated deficit |

|

(71,719) |

|

(47,993) |

Total stockholders’ (deficit) equity |

|

(9,242) |

|

6,135 |

Total liabilities and stockholders’ (deficit) equity |

|

$ 35,611 |

|

$ 49,950 |

(1) Reflects 1-for-4 reverse stock split that became effective June 29, 2023. See Note 1 to the unaudited condensed consolidated financial statements.

EXH 99.1

MARPAI, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

(in thousands, except share and per share data)

(Unaudited)

|

|

|

|

|

|

|

Three Months Ended |

|

|

September 30, 2023 |

|

September 30, 2022 |

Revenue |

|

$ 8,729 |

|

$ 4,938 |

Costs and expenses |

|

|

|

|

Cost of revenue (exclusive of depreciation and amortization shown separately below) |

|

5,691 |

|

3,626 |

General and administrative |

|

4,986 |

|

2,718 |

Sales and marketing |

|

1,842 |

|

1,054 |

Information technology |

|

1,269 |

|

1,538 |

Research and development |

|

267 |

|

782 |

Depreciation and amortization |

|

927 |

|

842 |

Loss on disposal of assets |

|

7 |

|

— |

Facilities |

|

768 |

|

193 |

Total costs and expenses |

|

15,757 |

|

10,753 |

Operating loss |

|

(7,028) |

|

(5,815) |

Other income (expenses) |

|

|

|

|

Other income |

|

130 |

|

56 |

Interest expense, net |

|

(384) |

|

(3) |

Foreign exchange (loss) gain |

|

(14) |

|

(19) |

Loss before provision for income taxes |

|

(7,296) |

|

(5,781) |

Income tax expense |

|

— |

|

— |

Net loss |

|

$ (7,296) |

|

$ (5,781) |

Net loss per share, basic & fully diluted (1) |

|

$ (0.98) |

|

$ (1.14) |

Weighted average common shares outstanding, basic and

diluted (1) |

|

7,479,401 |

|

5,087,164 |

(1) Reflects 1-for-4 reverse stock split that became effective June 29, 2023. See Note 1 to the unaudited condensed consolidated financial statements.

EXH 99.1

MARPAI, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

(in thousands, except share and per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

Nine Months Ended |

|

|

|

September 30, 2023 |

|

September 30, 2022 |

Revenue |

|

|

$ 28,448 |

|

$ 16,713 |

Costs and expenses |

|

|

|

|

|

Cost of revenue (exclusive of depreciation and amortization shown separately below) |

|

|

18,530 |

|

12,324 |

General and administrative |

|

|

15,938 |

|

7,940 |

Sales and marketing |

|

|

5,494 |

|

4,830 |

Information technology |

|

|

4,775 |

|

3,862 |

Research and development |

|

|

1,291 |

|

2,684 |

Depreciation and amortization |

|

|

2,974 |

|

2,444 |

Loss on disposal of assets |

|

|

350 |

|

60 |

Facilities |

|

|

1,918 |

|

586 |

Total costs and expenses |

|

|

51,270 |

|

34,730 |

Operating loss |

|

|

(22,822) |

|

(18,017) |

Other income (expenses) |

|

|

|

|

|

Other income |

|

|

231 |

|

95 |

Interest expense, net |

|

|

(1,102) |

|

(7) |

Foreign exchange (loss) gain |

|

|

(32) |

|

(5) |

Loss before provision for income taxes |

|

|

(23,725) |

|

(17,934) |

Income tax expense |

|

|

— |

|

— |

Net loss |

|

|

$ (23,725) |

|

$ (17,934) |

Net loss per share, basic & fully diluted (1) |

|

|

$ (3.62) |

|

$ (3.58) |

Weighted average common shares outstanding, basic and

diluted (1) |

|

|

6,552,575 |

|

5,004,779 |

(1) Reflects 1-for-4 reverse stock split that became effective June 29, 2023. See Note 1 to the unaudited condensed consolidated financial statements.

EXH 99.1

MARPAI, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands, except share and per share data)

(Unaudited)

|

|

|

|

|

|

|

Nine Months Ended |

|

|

September 30, 2023 |

|

September 30, 2022 |

Cash flows from operating activities: |

|

|

|

|

Net loss |

|

$ (23,725) |

|

$ (17,934) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

Depreciation and amortization |

|

2,974 |

|

2,444 |

Loss on disposal of assets |

|

350 |

|

60 |

Share-based compensation |

|

1,837 |

|

2,433 |

Shares issued to vendors in exchange for services |

|

79 |

|

31 |

Amortization of right-of-use asset |

|

1,289 |

|

517 |

Gain on termination of lease |

|

33 |

|

— |

Non-cash interest |

|

1,204 |

|

— |

Changes in operating assets and liabilities: |

|

|

|

|

Accounts receivable and unbilled receivable |

|

641 |

|

16 |

Prepaid expense and other assets |

|

216 |

|

377 |

Other receivables |

|

(2) |

|

35 |

Security deposit |

|

(16) |

|

— |

Accounts payable |

|

336 |

|

(433) |

Accrued expenses |

|

(693) |

|

(436) |

Accrued fiduciary obligations |

|

853 |

|

(1,642) |

Operating lease liabilities |

|

(1,670) |

|

(512) |

Due To related party |

|

(3) |

|

— |

Other liabilities |

|

973 |

|

(295) |

Net cash used in operating activities |

|

(15,324) |

|

(15,339) |

Cash flows from investing activities: |

|

|

|

|

Capitalization of software development costs |

|

— |

|

(810) |

Disposal of property and equipment |

|

27 |

|

— |

Purchase of property and equipment |

|

— |

|

(70) |

Net cash provided by (used in) investing activities |

|

27 |

|

(880) |

Cash flows from financing activities: |

|

|

|

|

Proceeds from stock options exercises |

|

0 |

|

— |

Proceeds from issuance of common stock in a public offering, net |

|

6,432 |

|

— |

Net cash provided by financing activities |

|

6,432 |

|

— |

|

|

|

|

|

Net decrease in cash, cash equivalents and restricted cash |

|

(8,865) |

|

(16,219) |

|

|

|

|

|

Cash, cash equivalents and restricted cash at beginning of period |

|

23,117 |

|

25,934 |

Cash, cash equivalents and restricted cash at end of period |

|

$ 14,252 |

|

$ 9,715 |

|

|

|

|

|

EXH 99.1

|

|

|

|

|

Reconciliation of cash, cash equivalents, and restricted cash reported in the condensed consolidated balance sheet |

|

|

|

|

Cash and cash equivalents |

|

$ 3,018 |

|

$ 4,748 |

Restricted cash |

|

11,234 |

|

4,966 |

Total cash, cash equivalents and restricted cash shown in the condensed consolidated statement of cash flows |

|

$ 14,252 |

|

$ 9,714 |

Supplemental disclosure of non-cash activity |

|

|

|

|

Measurement period adjustment to Goodwill |

|

$ 198 |

|

$ — |

v3.23.3

Document And Entity Information

|

Nov. 13, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 13, 2023

|

| Entity Registrant Name |

MARPAI, INC.

|

| Entity Central Index Key |

0001844392

|

| Entity Emerging Growth Company |

true

|

| Securities Act File Number |

001-40904

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

86-1916231

|

| Entity Address, Address Line One |

615 Channelside Drive, Suite 207

|

| Entity Address, City or Town |

Tampa

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33602

|

| City Area Code |

646

|

| Local Phone Number |

303-3483

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

true

|

| Title of 12(b) Security |

Class A Common Stock, par value $0.0001 per share

|

| Trading Symbol |

MRAI

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

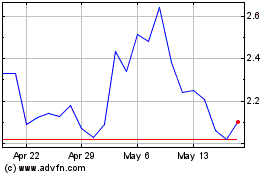

Marpai (NASDAQ:MRAI)

Historical Stock Chart

From Apr 2024 to May 2024

Marpai (NASDAQ:MRAI)

Historical Stock Chart

From May 2023 to May 2024