NGM Bio Announces Closing of Tender Offer

06 April 2024 - 12:19AM

NGM Biopharmaceuticals, Inc. (“NGM Bio”) (Nasdaq: NGM), a

biotechnology company focused on discovering and developing

transformative therapeutics for patients, today announced that

Atlas Neon Parent, Inc. (“Parent”), an affiliate of The Column

Group, LP (“TCG”), through its wholly-owned subsidiary Atlas Neon

Merger Sub, Inc. (“Merger Sub”), has successfully completed the

previously announced cash tender offer to acquire all outstanding

shares of NGM Bio not held by affiliates of TCG and certain other

stockholders at a price per share of $1.55 in cash (the “Offer

Price”).

The tender offer and related withdrawal rights expired at one

minute after 11:59 p.m. Eastern Time on April 4, 2024 (the

“Expiration Date”). As of the Expiration Date, a total of

22,323,295 shares of NGM Bio common stock were validly tendered,

and not validly withdrawn, representing approximately 27% of the

outstanding shares of NGM Bio common stock as of the Expiration

Date. As of the Expiration Date, the number of shares validly

tendered in accordance with the terms of the tender offer and not

validly withdrawn satisfied the minimum tender condition, and all

other conditions to the tender offer were satisfied or waived.

Immediately after the Expiration Date, Merger Sub irrevocably

accepted for payment all shares validly tendered and not validly

withdrawn and expects to promptly pay for such shares. An

additional 39,516,567 shares, owned by affiliates of TCG and

certain other stockholders, were contributed to Parent pursuant to

rollover agreements in exchange for shares of Parent.

Following the closing of the tender offer, Merger Sub merged

with and into NGM Bio and all shares of NGM Bio common stock that

had not been validly tendered (other than shares held by

stockholders who properly demanded appraisal of such shares or

shares held by affiliates of TCG and certain other stockholders who

agreed to exchange their shares for shares of Parent) were

converted into the right to receive the Offer Price (the “Merger”).

As a result of the Merger, NGM Bio became a privately held and

wholly-owned subsidiary of Parent. Prior to the opening of trading

on The Nasdaq Stock Market LLC (“Nasdaq”) on April 5, 2024, all

shares of NGM Bio common stock ceased trading on Nasdaq, and NGM

Bio intends promptly to cause such shares to be delisted from

Nasdaq and deregistered under the Securities Exchange Act of 1934,

as amended.

Advisors

Guggenheim Securities, LLC acted as exclusive financial advisor

and Hogan Lovells US LLP acted as legal counsel to the special

committee of the board of directors of NGM Bio. Paul, Weiss,

Rifkind, Wharton & Garrison LLP acted as legal counsel to

Parent.

About NGM Biopharmaceuticals, Inc.

NGM Bio is focused on discovering and developing novel,

life-changing medicines for people whose health and lives have been

disrupted by disease. NGM Bio’s biology-centric drug discovery

approach aims to seamlessly integrate interrogation of complex

disease-associated biology and protein engineering expertise to

unlock proprietary insights that are leveraged to generate

promising product candidates and enable their rapid advancement

into proof-of-concept studies. All therapeutic candidates in the

NGM Bio pipeline have been generated by its in-house discovery

engine, always led by biology and motivated by unmet patient need.

Visit us at www.ngmbio.com for more information.

Cautionary Notice Regarding Forward-Looking

Statements

Statements contained in this communication regarding matters

that are not historical facts are “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. Words such as “expects,” “intends,” “focused” and similar

expressions (as well as other words or expressions referencing

future events, conditions or circumstances) are intended to

identify forward-looking statements. Because such statements deal

with future events and are based on NGM Bio’s current expectations,

they are subject to various risks and uncertainties, and actual

results, performance or achievements of NGM Bio could differ

materially from those described in or implied by the statements in

this communication. These forward-looking statements are subject to

risks and uncertainties. Additional risks and uncertainties

affecting NGM Bio and its development programs are set forth in the

section titled “Risk Factors” in NGM Bio’s Annual Report on Form

10-K for the year ended December 31, 2023 filed with the SEC on

March 11, 2024, Quarterly Reports on Form 10-Q, Current Reports on

Form 8-K and other filings and reports that NGM Bio makes from time

to time with the SEC. Except as required by law, NGM Bio assumes no

obligation to update these forward-looking statements, which speak

only as of the date they are made, or to update the reasons if

actual results differ materially from those anticipated in the

forward-looking statements.

For further information, please contact:

NGM Biopharmaceuticals, Inc.

Investor Contact:

ir@ngmbio.com

Media Contact:

media@ngmbio.com

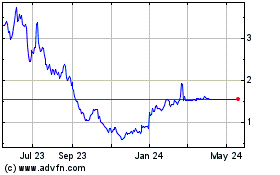

NGM Biopharmaceuticals (NASDAQ:NGM)

Historical Stock Chart

From Feb 2025 to Mar 2025

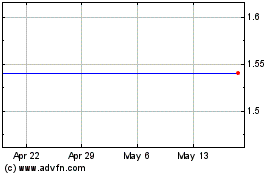

NGM Biopharmaceuticals (NASDAQ:NGM)

Historical Stock Chart

From Mar 2024 to Mar 2025