Patria Reports Third Quarter 2024 Earnings Results

05 November 2024 - 10:00PM

Patria (Nasdaq:PAX) reported today its unaudited results for the

third quarter ended September 30, 2024. The full detailed

presentation of Patria's third quarter 2024 results can be accessed

on the Shareholders section of Patria’s website at

https://ir.patria.com/.

Alex Saigh, Patria’s CEO, said: “The third quarter of 2024 was

another exciting quarter for Patria as Fee Earning AUM reached $34

billion representing year-over-year and sequential growth of 58%

and 9% percent, respectively. We also delivered $34.9 million of

distributable earnings or $0.23 per share and remain confident in

reaching our 2024 FRE target of $170 million as well as our 2025

target of $200 million to $225 million. The highlight of the

quarter was our robust organic fundraising of over $2 billion, led

by our credit business and our GPMS platform, and we’ve raised more

than $4.2 billion year to date through the end of 3Q, putting us on

track to meet or exceed our $5 billion fundraising target for 2024.

Over the last 12 months and as of 3Q, we raised over $5.6 billion,

all organically. Our fundraising success, which is being driven by

investment platforms that did not exist at the time of our IPO just

under four years ago, highlights how the increased diversification

of our platform and the investments we are making in distribution

and new product development are translating into stronger and more

diverse growth for the firm, leaving us very excited about what

lies ahead. As we embark on our next chapter of growth, we look

forward to sharing more details with you at our next investor day

on December 9th in New York.”

Financial Highlights (reported in $ USD)

IFRS results included $1.5 million of net income attributable to

Patria in Q3 2024. Patria generated Fee Related Earnings of $40.6

million in Q3 2024, up 13% from $36.0 million in Q3 2023, with an

FRE margin of 53%. Distributable Earnings were $34.9 million for Q3

2024, or $0.23 per share.

Dividends

Patria has declared a quarterly dividend of $0.15 per share to

record holders of common stock at the close of business on November

18th, 2024, in accordance with our new capital management strategy.

This dividend will be paid on December 9th, 2024.

Conference Call

Patria will host its third quarter 2024 earnings conference call

via public webcast on November 5th, 2024, at 9:00 a.m. ET. To

register and join, please use the following link:

https://edge.media-server.com/mmc/p/emuekpt7/

For those unable to listen to the live broadcast, there will be

a webcast replay on the Shareholders section of Patria’s website at

https://ir.patria.com/ shortly after the call’s completion.

About Patria

Patria is a global alternative asset manager and industry leader

in Latin America. Founded over 35 years ago, Patria has total

assets under management of $44.7 billion, and offices in 13 cities

on 4 continents. Patria aims to generate attractive long-term

investment returns and, through a diversified platform with

strategies that include Private Equity, Infrastructure, Credit,

Real Estate, Public Equities and Global Private Markets Solutions,

serve as the gateway to alternative investments for both local

investors in Latin America, as well as global investors. Further

information is available at www.patria.com.

Forward-Looking Statements

This press release may contain forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. You can identify these forward-looking statements by the

use of words such as “outlook,” “indicator,” “believes,” “expects,”

“potential,” “continues,” “may,” “will,” “could,” “should,”

“seeks,” “approximately,” “predicts,” “intends,” “plans,”

“estimates,” “anticipates” or the negative version of these words

or other comparable words, among others. Forward-looking statements

appear in a number of places in this press release and include, but

are not limited to, statements regarding our intent, belief or

current expectations. Forward-looking statements are based on our

management’s beliefs and assumptions and on information currently

available to our management. Forward-looking statements speak only

as of the date they are made, and we do not undertake any

obligation to update them in light of new information or future

developments or to release publicly any revisions to these

statements in order to reflect later events or circumstances or to

reflect the occurrence of unanticipated events. Such

forward-looking statements are subject to various risks and

uncertainties. Accordingly, there are or will be important factors

that could cause actual outcomes or results to differ materially

from those indicated in these statements. Further information on

these and other factors that could affect our financial results is

included in filings we have made and will make with the U.S.

Securities and Exchange Commission from time to time, including but

not limited to those described under the section entitled “Risk

Factors” in our most recent annual report on Form 20-F, as such

factors may be updated from time to time in our periodic filings

with the United States Securities and Exchange Commission (“SEC”),

which are accessible on the SEC’s website at www.sec.gov. These

factors should not be construed as exhaustive and should be read in

conjunction with the other cautionary statements that are included

in our periodic filings.

Contact

Patria Shareholder RelationsE.

PatriaShareholderRelations@patria.com T. +1 917 769 1611

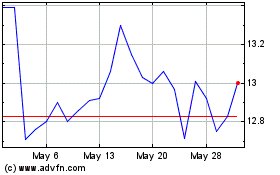

Patria Investments (NASDAQ:PAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

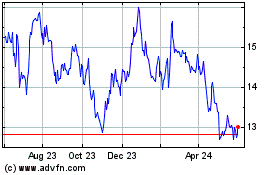

Patria Investments (NASDAQ:PAX)

Historical Stock Chart

From Dec 2023 to Dec 2024