Form 424B3 - Prospectus [Rule 424(b)(3)]

22 August 2024 - 11:56AM

Edgar (US Regulatory)

| PROSPECTUS SUPPLEMENT |

Filed pursuant to Rule 424(b)(3) |

| (to prospectus dated November 29, 2023) |

Registration No. 333-275787 |

PATRIA INVESTMENTS

LIMITED

(incorporated in the Cayman Islands)

245,355 Class A Common Shares

This prospectus supplement relates to the offer

and sale, from time to time, of up to 245,355 Patria Investments Limited (“Patria”) Class A common shares, par value $0.0001

(“Class A common shares”), by the selling stockholder named herein (the “Selling Stockholder”) that will receive

Class A common shares as compensation under the Nexus Transaction (as defined below). We are not offering any Class A common shares under

this prospectus supplement and will not receive any proceeds from the sale of Class A common shares offered by the Selling Stockholder.

The Selling Stockholder acquired the Class A common shares in connection with our acquisition of certain equity interests in Nexus Capital

Partners S.A.S. a simplified stock corporation (sociedad por acciones simplificada) organized and existing under the laws of the

Republic of Colombia (“Nexus”) one of the top independent alternative real estate asset managers in Colombia (the “Nexus

Transaction”). Pursuant to the Nexus Transaction Agreement, we agreed to issue Class A common shares to the Selling Stockholder

as consideration for the acquisition. We are registering the offer and sale of the shares that we issued as consideration to satisfy registration

rights we granted to the Selling Stockholder.

The Selling Stockholder may use this prospectus

supplement to resell, from time to time, such shares, so long as it satisfies certain conditions set forth in the applicable agreements

between us and the applicable Selling Stockholder.

While Patria will not receive any of the proceeds

from any issuance of Class A common shares to the Selling Stockholder or from any sale of such shares by the Selling Stockholder, Patria

has agreed to pay certain expenses relating to the registration of such shares. See “Selling Stockholder” and “Plan

of Distribution.” The Selling Stockholder may, from time to time, offer and sell the shares held by it directly or indirectly through

agents or broker-dealers on terms to be determined at the time of sale. See “Plan of Distribution.”

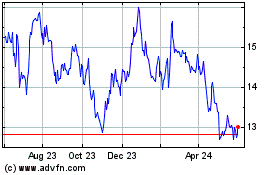

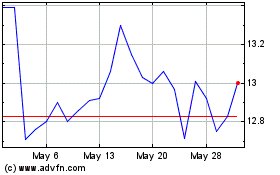

Patria’s Class A common shares are traded

on the Nasdaq Global Select Market, or “NASDAQ,” under the ticker symbol “PAX.” On August 21, 2024, the last reported

sales price of the Class A common shares on the NASDAQ was $11.79 per share.

Investing in Patria’s Class A common

shares involves risks. You should carefully read and consider the risks described in “Risk Factors” on page S-2 of this prospectus

supplement and as incorporated by reference herein before investing in Patria’s Class A common shares.

Neither the Securities and Exchange Commission

(the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is August

22, 2024.

table

of contents

Page

Prospectus Supplement

| About This Prospectus Supplement |

S-1 |

| Risk Factors |

S-2 |

| Use of Proceeds |

S-3 |

| Selling Stockholder |

S-4 |

| Plan of Distribution |

S-6 |

Prospectus

| About This Prospectus |

1 |

| Where You Can Find More Information |

2 |

| Incorporation of Documents by Reference |

3 |

| Forward-Looking Statements |

4 |

| Risk Factors |

6 |

| Patria Investments Limited |

7 |

| Use of Proceeds |

9 |

| Description of Share Capital |

10 |

| Service of Process and Enforcement of Civil Liabilities |

22 |

| Taxation |

23 |

| Selling Shareholders |

24 |

| Plan of Distribution |

25 |

| Legal Matters |

27 |

| Experts |

28 |

About This Prospectus

Supplement

This document contains two parts. The first part

consists of this prospectus supplement, which describes the specific terms of the offering of Class A common shares. The second part,

the accompanying prospectus which is dated November 29, 2023, provides more general information, some of which may not apply to the offering

of Class A common shares. If the description of the offering varies between this prospectus supplement and the accompanying prospectus,

you should rely on the information in this prospectus supplement.

Before purchasing any Class A common shares, you

should carefully read both this prospectus supplement and the accompanying prospectus, together with the additional information described

under the heading “Where You Can Find More Information” in the accompanying prospectus.

On July 16, 2024, Patria’s economic group

entered into a transaction agreement (the “Nexus Transaction Agreement”) to acquire certain equity interests in Nexus Capital

Partners S.A.S. a simplified stock corporation (sociedad por acciones simplificada) organized and existing under the laws of the

Republic of Colombia one of the top independent alternative real estate asset managers in Colombia. Pursuant to the Nexus Transaction

Agreement, we granted certain registration rights to certain shareholders of Nexus. The payment of the relevant purchase price / and of

the investment amount for such acquisition was by means of the delivery of Class A common shares issued by Patria to the Selling Stockholder,

and the transaction was subject to certain conditions precedent (all conditions precedent have been duly implemented).

Risk Factors

Investing in Patria’s Class A common shares

involves risk. Before you invest in the Class A common shares, you should carefully consider all of the risk factors incorporated by reference

in this prospectus supplement, including the risk factors set forth in our Annual Report on Form 20-F for the year ended December 31,

2023, and any subsequent Current Reports on Form 6-K. You should also carefully consider all of the other information included or incorporated

by reference in this prospectus supplement. The occurrence of any of these risks could materially and adversely affect our business, financial

condition, liquidity, cash flows, results of operations, prospects, and our ability to make or sustain distributions to our stockholders,

which could result in a partial or complete loss of your investment in the Class A common shares. Some statements in this prospectus supplement

constitute forward-looking statements. See “Cautionary Statement Regarding Forward-Looking Statements” in the accompanying

prospectus.

Use of Proceeds

Patria will not receive any of the proceeds from

any issuance of Class A common shares to the Selling Stockholder or from any sale of such shares by the Selling Stockholder.

The Selling Stockholder will pay any underwriting

fees, discounts or commissions attributable to the sale of the shares registered under this prospectus supplement, or any fees and expenses

of any broker-dealer or other financial intermediary engaged by any Selling Stockholder. Patria will bear all other costs, fees and expenses

incurred in connection with the registration of the shares covered by this prospectus supplement. See “Selling Shareholders”

and “Plan of Distribution.”

Selling STOCKHOLDERS

Patria issued Class A common shares as consideration

pursuant to the Nexus Transaction Agreement. In such circumstances, the Selling Stockholder may use this prospectus supplement to resell,

from time to time, the Class A common shares received pursuant to the Nexus Transaction Agreement.

Information about the Selling Stockholder is set

forth herein, and information about additional Selling Stockholders (if any) will be set forth in a further prospectus supplement or in

filings that Patria makes with the SEC under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), incorporated

by reference in this prospectus supplement. The Selling Stockholder, including its transferees, pledgees or donees or its successors,

may, from time to time, offer and sell pursuant to this prospectus supplement any or all of the Class A common shares that Patria issued

to the Selling Stockholder pursuant to the Nexus Transaction Agreement.

Based upon information provided by the Selling

Stockholder, except to the extent provided in the footnotes below, neither the Selling Stockholder nor any of its affiliates, officers,

directors or principal equity holders, has held any positions or office (or has had any material relationship) with Patria within the

three years prior to the date they furnished such information.

Unless otherwise indicated in the footnotes below,

Patria believes that the entity named in the table below has sole voting and investment power with respect to the Class A common shares

listed as beneficially owned by it.

The Selling Stockholder may offer and sell all,

some or none of the Class A common shares that Patria may issue pursuant to the Nexus Transaction Agreement. Because the Selling Stockholder

may offer all or some portion of such Class A common shares, Patria cannot estimate the number of Class A common shares that will be held

by the Selling Stockholder upon the termination of any of these sales. In addition, the Selling Stockholder may have sold, transferred

or otherwise disposed of all or a portion of its Class A common shares since the date on which it provided the information regarding its

Class A common shares in transactions exempt from the registration requirements of the Securities Act. This information is based on information

provided by or on behalf of the Selling Stockholder. The number of Class A common shares owned by the Selling Stockholder (or any of its

future transferees) assumes that it does not beneficially own any Class A common shares other than the Class A common shares that Patria

may issue to it pursuant to the Nexus Transaction Agreement.

Percentage ownership information in the following

tables is based on 59,766,997 Class A common shares outstanding and 92,945,430 Class B common shares outstanding as of August 21, 2024.

Class A common shares

The following table sets forth information with

respect to the number of Class A common shares that would become beneficially owned by the Selling Stockholder that may be offered pursuant

to this prospectus supplement.

Name | |

Class A

common shares

Beneficially Owned Prior to Issuance | |

Maximum Number of Class A common shares Issuable pursuant to the Nexus Transaction Agreement(1) | |

Class A common shares Beneficially Owned Following the Issuance | |

Number of Class A common shares Offered | |

Class A common shares Beneficially Owned after Resale(3) |

| | |

| |

| |

Shares | |

Percent(2) | |

| |

Shares | |

Percent(2) |

| V2 Capital S.A.S(4). | |

| — | | |

| 245,355 | | |

| 245,355 | | |

| *% | | |

| 245,355 | | |

| — | | |

| —% | |

| * | Represents beneficial ownership of less than one percent (1%) of our outstanding Class A common shares. |

| (1) | The maximum aggregate number of Class A common shares issuable as consideration pursuant to the Nexus Transaction Agreement that may

be sold under this prospectus supplement is 245,355. |

| (2) | Calculated using 59,766,997 Class A common shares outstanding and 92,945,430 Class B common shares outstanding as of August 21, 2024.

In calculating this percentage for a particular holder, Patria treated as outstanding the maximum number of Class A common shares held

and/or received by that particular holder and excluded all Class A common shares held by any other holder. |

| (3) | Assumes that all Class A common shares issued as consideration pursuant to the Nexus Transaction Agreement have been sold by the Selling

Stockholder. |

| (4) | V2 Capital S.A.S. is a simplified stock corporation (sociedad por acciones simplificada) organized

and existing under the laws of the Republic of Colombia. V2 Capital S.A.S. is indirectly wholly owned and controlled by Fuad Aurelio Velasco

Juri. As a result, Mr. Velasco may be deemed to beneficially own the securities held by V2 Capital S.A.S. Mr. Velasco disclaims any such

beneficial ownership except to the extent of his pecuniary interest therein.

|

Plan of Distribution

This prospectus supplement relates to the offer

and sale from time to time of Class A common shares by the Selling Stockholder. The Class A common shares received by the Selling Stockholder

as consideration pursuant to the Nexus Transaction Agreement are “restricted securities” within the meaning of Rule 144(a)(3)

under the Securities Act and contain a legend setting out such restriction and will be segregated until such time as they are sold under

the registration statement of which this prospectus supplement forms a part. Patria is registering the resale of Class A common shares

for sale to provide the holders thereof with freely tradable securities, but such shares will not become freely tradable until sold pursuant

to the registration statement of which this prospectus supplement forms a part. There can be no assurance that the Selling Stockholder

will sell any or all of the Class A common shares registered pursuant to the registration statement of which this prospectus supplement

forms a part.

The Selling Stockholder may, from time to time,

sell any or all of the Class A common shares beneficially owned by it and offered hereby directly or indirectly through one or more broker-dealers

or agents. The Selling Stockholder will be responsible for any agent’s commissions. The Class A common shares may be sold in one

or more transactions at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the time of

sale or at negotiated prices. The Selling Stockholder may use any one or more of the following methods when selling Class A common shares:

| · | on the NASDAQ or any other national securities exchange or quotation service on which the securities may be listed or quoted at the

time of sale; |

| · | in the over-the-counter market; |

| · | in transactions otherwise than on these exchanges or systems or in the over-the-counter market; |

| · | through the writing of options, swaps or derivatives whether such options are listed on an options exchange or otherwise; |

| · | through ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| · | through block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of

the block as principal to facilitate the transaction; |

| · | through purchases by a broker-dealer as principal and resale by such broker-dealer for its account; |

| · | through an exchange or market distribution in accordance with the rules of the applicable exchange or market; |

| · | in privately negotiated transactions; |

| · | through the settlement of short sales; |

| · | through broker-dealers that may agree with the Selling Stockholder to sell a specified number of such shares at a stipulated price

per share; |

| · | through a combination of any such methods of sale; and |

| · | any other method permitted pursuant to applicable law. |

The Selling Stockholder may also sell the Class

A common shares under Rule 144 under the Securities Act, if available, rather than under this prospectus supplement.

In addition, the Selling Stockholder may enter

into hedging transactions with broker-dealers who may engage in short sales of shares in the course of hedging the positions they assume

with the Selling Stockholder. The Selling Stockholder may also sell shares short and deliver the shares to close out such short position.

Broker-dealers engaged by the Selling Stockholder

may arrange for other broker-dealers to participate in sales. If the Selling Stockholder effects such transactions through underwriters,

broker-dealers or agents, such underwriters, broker-dealers or agents may receive commissions in the form of discounts, concessions or

commissions from the Selling Stockholder or commissions from purchasers of the Class A common shares for whom they may act as agent or

to whom they may sell as principal, or both (which discounts, concessions or commissions as to particular underwriters, broker-dealers

or agents may be less than or in excess of those customary in the types of transactions involved).

The Selling Stockholder and any broker-dealers

or agents that are involved in selling the shares may be deemed to be “underwriters” within the meaning of the Securities

Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale

of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act.

The Selling Stockholder will be subject to the

Exchange Act and the rules promulgated thereunder, including Regulation M, which may limit the timing of purchases and sales of Class

A common shares by the Selling Stockholder and its affiliates.

Pursuant to the applicable registration rights,

Patria has agreed to bear all other costs, fees and expenses incurred in connection with the registration of the Class A common shares

covered by this prospectus supplement. However, Patria does not have any obligation to pay any underwriting fees, discounts or commissions

attributable to the sale of such Class A common shares, or any fees and expenses of any broker-dealer or other financial intermediary

engaged by any Selling Stockholder.

PROSPECTUS

Patria Investments Limited

(Incorporated

in the Cayman Islands)

Class A Common Shares

We may from time to time

in one or more offerings offer and sell our Class A common shares. In addition, from time to time, the selling shareholders to be named

in an applicable prospectus supplement, or the selling shareholders, may offer and sell the equity securities held by them. The selling

shareholders may sell the equity securities through public or private transactions at prevailing market prices or at privately negotiated

prices. We will not receive any proceeds from the sale of the equity securities by the selling shareholders.

The securities may be offered

and sold in the same offering or in separate offerings; to or through underwriters, dealers, and agents; or directly to purchasers. The

names of any underwriters, dealers, or agents involved in the sale of the securities, their compensation and any options to purchase additional

securities granted to them will be described in the applicable prospectus supplement. For a more complete description of the plan of distribution

of the securities, see the section entitled “Plan of Distribution” beginning on page 24 of this prospectus.

This prospectus describes

some of the general terms that may apply to the securities. We and the selling shareholders, as applicable, will provide specific terms

of any offering in a supplement to this prospectus. Any prospectus supplement may also add, update, or change information contained in

this prospectus. To the extent the applicable prospectus supplement is inconsistent, information in this prospectus is superseded by the

information in the applicable prospectus supplement. You should carefully read this prospectus and the applicable prospectus supplement

as well as the documents incorporated or deemed to be incorporated by reference in this prospectus before you purchase any of the securities.

Our Class A common shares

are currently listed on the Nasdaq Global Select Market, or Nasdaq, under the symbol “PAX”.

Investments in the

securities involve risks. See “Risk Factors” on page 6 of this prospectus. You should carefully consider the risks and

uncertainties discussed under the heading “Risk Factors” included in the applicable prospectus supplement or under

similar headings in other documents which are incorporated by reference in this prospectus and the applicable prospectus supplement

before you invest in our securities.

Neither the Securities

and Exchange Commission, or the SEC, nor any state securities commission has approved or disapproved these securities or determined if

this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is November 29,

2023.

TABLE OF CONTENTS

You should rely only on

the information contained or incorporated by reference in this prospectus and in any accompanying prospectus supplement. No one has been

authorized to provide you with different information.

The securities are not

being offered in any jurisdiction where the offer or sale is not permitted.

You should not assume

that the information contained in or incorporated by reference in this prospectus or any prospectus supplement is accurate as of any date

other than the date on the front cover of the applicable document.

Unless otherwise indicated

or the context otherwise requires, all references in this prospectus or any prospectus supplement to “Patria” or the “Company,”

“we,” “our,” “ours,” “us” or similar terms refer to Patria Investments Limited, together

with its consolidated subsidiaries.

The term “Brazil”

refers to the Federative Republic of Brazil and the phrase “Brazilian government” refers to the federal government of Brazil.

“Central Bank” refers to Banco Central do Brasil. References in the prospectus to “real,” “reais”

or “R$” refer to the Brazilian real, the official currency of Brazil and references to “U.S. dollar,” “U.S.

dollars” or “US$” refer to U.S. dollars, the official currency of the United States.

About This Prospectus

This prospectus is part of

an automatic shelf registration statement that we filed with the SEC, as a “well-known seasoned issuer” as defined in Rule

405 under the Securities Act of 1933, as amended, or the Securities Act. By using an automatic shelf registration statement, we may, at

any time and from time to time, offer and sell the securities described in this prospectus in one or more offerings. We may also add,

update or change information contained in this prospectus by means of a prospectus supplement or by incorporating by reference information

that we file or furnish to the SEC. As allowed by the SEC rules, this prospectus and any accompanying prospectus supplement do not contain

all of the information included in the registration statement. For further information, we refer you to the registration statement, including

its exhibits and the documents incorporated by reference in the registration statement. Statements contained in this prospectus or an

applicable prospectus supplement about the provisions or contents of any agreement or other document are not necessarily complete. If

the SEC’s rules and regulations require that an agreement or document be filed as an exhibit to the registration statement, please

see that agreement or document for a complete description of these matters.

You should carefully read

this document and the applicable prospectus supplement. You should also read the documents we have referred you to under “Where

You Can Find More Information” below for information on the Company, the risks we face and our financial statements. The registration

statement and exhibits can be read at the SEC’s website or at the SEC as described under “Where You Can Find More Information.”

We have not authorized any

other person to provide you with different information. If anyone provides you with different or inconsistent information, you should

not rely on it. We are not making an offer to sell the securities in any jurisdiction where the offer or sale is not permitted. You should

assume that the information appearing in this prospectus, in the applicable prospectus supplement, or any documents incorporated by reference

is accurate only as of the date on the front cover of the applicable document. Our business, financial condition, results of operations

and prospects may have changed since then.

Where You Can Find

More Information

Patria has filed with the

SEC a registration statement (including amendments and exhibits to the registration statement) on Form F-3 under the Securities Act. This

prospectus, which is part of the registration statement, does not contain all of the information set forth in the registration statement

and the exhibits and schedules to the registration statement. For further information, we refer you to the registration statement and

the exhibits and schedules filed as part of the registration statement. If a document has been filed as an exhibit to the registration

statement, we refer you to the copy of the document that has been filed. Each statement in this prospectus relating to a document filed

as an exhibit is qualified in all respects by the filed exhibit. Each statement regarding a contract, agreement or other document is qualified

in its entirety by reference to the actual document.

We are subject to the informational

requirements of the Exchange Act that are applicable to foreign private issuers. Accordingly, we are required to file reports and other

information with the SEC, including annual reports on Form 20-F and reports on Form 6-K. You may inspect and copy the reports and other

information to be filed with the SEC at the public reference facilities maintained by the SEC at 100 F Street, N.E., Washington D.C. 20549.

In addition, the SEC maintains an Internet website at http://www.sec.gov, from which you can electronically

access the registration statement and its materials. The information contained on, or accessible through, such website is not incorporated

by reference into this prospectus and should not be considered a part of this prospectus or any prospectus supplement.

As a foreign private issuer,

we are exempt under the Exchange Act from, among other things, the rules prescribing the furnishing and content of proxy statements and

our executive officers, directors and principal shareholders are exempt from reporting and short swing profit recovery provisions contained

in Section 16 of the Exchange Act. In addition we are not required under the Exchange Act to file periodic reports and financial statements

with the SEC as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act.

You may request a copy of

our SEC filings, at no cost, by contacting us at our principal executive office is located at 18 Forum Lane, 3rd floor, Camana Bay, PO

Box 757, KY1-9006 Grand Cayman, Cayman Islands. Our investor relations office can be reached at patriashareholderrelations@patria.com.

Incorporation of

Documents by Reference

The SEC allows us to “incorporate

by reference” the information we file with it into this prospectus. This means that we can disclose important information to you

by referring you to another document filed separately with the SEC. The information incorporated by reference is considered to be a part

of this prospectus, except for any information superseded by information that is included directly in this document or incorporated by

reference subsequent to the date of this document. You should read the information incorporated by reference because it is an important

part of this prospectus.

We incorporate by reference

into this prospectus our annual report on Form 20-F for the fiscal year ended December 31, 2022, filed with the SEC on April 28, 2023,

and any amendments thereto, if any (the “2022 Form 20-F”).

In addition, we incorporate

by reference into this prospectus the following current reports on Form 6-K:

| 1. | our current report on Form 6-K furnished to the SEC on November 27, 2023, containing our unaudited

condensed consolidated financial information for the nine and three-month periods ended September 30, 2023 and 2022 and the notes

thereto (the “2Q2023 Form 6-K”); and |

| 2. | our current report on Form 6-K furnished to the SEC on November 7, 2023, relating to our earnings results

press release and presentation for the nine and three-month periods ended September 30, 2023 and 2022. |

All subsequent reports that

we file on Form 20-F under the Exchange Act after the date of this prospectus and prior to the termination of the offering of the Class

A common shares offered by this prospectus shall also be deemed to be incorporated by reference into this prospectus and to be a part

hereof from the date of filing such documents. We may also incorporate by reference any Form 6-K that we submit to the SEC after the date

of this prospectus and prior to the termination of this offering by identifying in such Form 6-K that it is being incorporated by reference

into this prospectus. Unless expressly incorporated by reference, nothing in this prospectus shall be deemed to incorporate by reference

information furnished to, but not filed with, the SEC.

Any statement contained in

any document incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus to the extent

that a statement contained in this prospectus or any prospectus supplement modifies or supersedes such statement. Any statement so modified

or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

All of the documents that

are incorporated by reference are available at the website maintained by the SEC at http://www.sec.gov.

The information contained on, or accessible through, such website is not incorporated by reference into this prospectus and should not

be considered a part of this prospectus or any prospectus supplement. In addition, we will provide at no cost to each person, including

any beneficial owner, to whom this prospectus has been delivered, upon the written or oral request of any such person to us, a copy of

any or all of the documents referred to above that have been or may be incorporated into this prospectus by reference, including exhibits

to such documents. Requests for such copies should be directed to: Patria Investments Limited, 18 Forum Lane, 3rd floor, Camana Bay, PO

Box 757, KY1-9006 Grand Cayman, Cayman Islands, email: patriashareholderrelations@patria.com.

Forward-Looking

Statements

This prospectus, the registration

statement of which it forms a part, each prospectus supplement and the documents incorporated by reference into these documents contain

estimates and forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. In addition, from

time to time we or our representatives have made or may make forward-looking statements orally or in writing. Furthermore, such forward-looking

statements may be included in various filings that we make with the SEC or press releases or oral statements made by or with the approval

of one of our authorized executive officers. These forward-looking statements are subject to certain known and unknown risks and uncertainties,

as well as assumptions that could cause actual results to differ materially from those reflected in these forward-looking statements.

These estimates and forward-looking

statements are based mainly on our current expectations and estimates of future events and trends that affect or may affect our business,

financial condition, results of operations, cash flow, liquidity, prospects and the trading price of our Class A common shares. Although

we believe that these estimates and forward-looking statements are based upon reasonable assumptions, they are subject to many significant

risks, uncertainties and assumptions and are made in light of information currently available to us.

These statements appear throughout

this prospectus and include statements regarding our intent, belief or current expectations in connection with:

| · | general economic, financial, political, demographic and business conditions in Latin America, as well

as any other macroeconomic factors in the countries we may serve in the future and their impact on our business; |

|

· | general economic, financial, political, demographic and business conditions in Europe, specially during

the conflict between Russia and Ukraine, and elsewhere where military action occurs, which may result in, among other things, global security

issues that may adversely affect international business and economic conditions, and economic sanctions which may impact the global economy; |

| · | fluctuations in exchange rates, interest and inflation in Latin America and any other countries we may

serve in the future; |

|

· | our ability to find suitable assets for investment; |

| · | our ability to manage operations at our current size or manage growth effectively; |

|

· | our ability to successfully expand in Latin America and other new markets; |

| · | the fact that we will rely on our operating subsidiaries to provide us with distributions to fund our

operating activities, which could be limited by law, regulation or otherwise; |

|

· | our ability to arrange financing and maintain sufficient levels of cash flow to implement our expansion

plan; |

| · | our ability to adapt to technological changes in the financial services sector; |

|

· | the availability of qualified personnel and the ability to retain such personnel; |

| · | our capitalization and our funds’ and portfolio companies’ level of indebtedness; |

|

· | the interests of our controlling shareholders; |

| · | changes in the laws and regulations applicable to the private investment market in Brazil, Chile and in

the other countries we operate; |

|

· | risk associated with our international operations; |

| · | our ability to compete and conduct our business in the future; |

|

· | changes in our businesses; |

| · | government interventions, resulting in changes in the economy, taxes, rates or regulatory environment; |

|

· | our ability to effectively market and maintain a positive brand image; |

| · | the availability and effective operation of management information systems and other technology; |

|

· | our ability to comply with applicable cybersecurity, privacy and data protection laws and regulations; |

| · | changes in client demands and preferences and technological advances, and our ability to innovate to respond

to such changes; |

|

· | our ability to attract and maintain the services of our senior management and key employees; |

| · | changes in labor, distribution and other operating costs; |

|

· | our compliance with, and changes to, government laws, regulations and tax matters that currently apply

to us; |

| · | other factors that may affect our financial condition, liquidity and results of operations; and |

|

· | other risk factors discussed under “Risk Factors” included in documents we file from time

to time with the SEC that are incorporated by reference herein, including in our most recent annual report on Form 20-F, which is incorporated

by reference herein. |

The words “believe,”

“understand,” “may,” “will,” “aim,” “estimate,” “continue,” “anticipate,”

“seek,” “intend,” “expect,” “should,” “could,” “forecast” and

similar words are intended to identify forward-looking statements. You should not place undue reliance on such statements, which speak

only as of the date they were made. Neither we nor any selling shareholders undertake any obligation to update publicly or to revise any

forward-looking statements after we distribute this prospectus because of new information, future events or other factors. Our independent

public auditors have neither examined nor compiled the forward-looking statements and, accordingly, do not provide any assurance with

respect to such statements. In light of the risks and uncertainties described above, the future events and circumstances discussed in

this prospectus might not occur and are not guarantees of future performance. Because of these uncertainties, you should not make any

investment decision based upon these estimates and forward-looking statements. You are advised to consult any additional disclosures we

have made or will make in our reports to the SEC on Forms 20-F and on Forms 6-K that are designated as being incorporated by reference

into this prospectus. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are

expressly qualified in their entirety by the cautionary statements contained in this prospectus.

Risk Factors

Any investment in the Class

A common shares involves a high degree of risk. Before purchasing any securities, you should carefully consider and evaluate all of the

information included and incorporated by reference in this prospectus or any applicable prospectus supplement, including the risk factors

incorporated by reference from our most recent annual report on Form 20-F, as updated by other reports and documents we file with the

SEC after the date of this prospectus that are incorporated by reference herein or in the applicable prospectus supplement. See “Incorporation

of Documents by Reference” and “Where You Can Find More Information.” Additional risk factors that you should carefully

consider may be included in a prospectus supplement or other offering materials relating to an offering of our Class A common shares.

We encourage you to read

these risk factors in their entirety. In addition to these risks, other risks and uncertainties not presently known to us or that we currently

deem immaterial may also adversely affect our business operations and financial condition. Such risks could cause actual results to differ

materially from anticipated results. This could cause the trading price of the securities to decline, perhaps significantly, and investors

may lose part or all of their investment. You should not purchase the securities described in this prospectus unless you understand and

know you can bear all of the investment risks involved.

In general, investing in

the securities of issuers with operations in emerging market countries such as Brazil, Chile and other Latin American countries involves

risks that are different from the risks associated with investing in the securities of U.S. companies and companies located in other countries

with more developed capital markets.

Patria Investments

Limited

We are a leading global alternative

investment firm focused on Latin America, with combined assets under management, or “AUM,” of US$27.2 billion and US$23.8

billion as of December 31, 2022 and 2021, respectively. With offices in ten cities across four continents, we serve over 500 limited partners,

or “LPs.” Our current product offering encompasses six product lines – private equity, infrastructure, credit, public

equities, real estate, and advisory and distribution. As of December 31, 2022 and 2021, we had 80 and 60 active funds, respectively.

We seek to provide global

and Latin American investors with attractive investment products that allow for portfolio diversification and consistent returns, aiming

to be their partner of choice when investing in alternatives in Latin America. We have two flagship strategies: (1) private equity, launched

in 1994 (US$10.9 billion and US$9.0 billion in AUM as of December 31, 2022 and 2021, respectively, and currently in the market for its

seventh vintage fund); and (2) infrastructure, launched in 2006 (US$5.8 and US$5.1 billion in AUM as of December 31, 2022 and 2021, respectively,

and currently in the market for its fifth vintage fund). These flagship strategies utilize drawdown fund structures, which we define as

illiquid, closed-end funds in which upfront capital commitments are allocated to investments, and funded through capital calls from limited

partners over the contractual life of the fund, which typically ranges from 10 to 14 years. Over multiple fund vintages, these strategies

have generated solid returns allowing their sustained growth. The consolidated equal-weighted net internal rate of return, or “IRR,”

in U.S. dollars for all our flagship private equity and infrastructure products since inception was 28.6% and 28.7% as of December 31,

2022 and 2021, respectively (30.1% and 30.5% in Brazilian reais, respectively). We have overseen the deployment of more than US$25 billion

through capital raised by our drawdown products, capital raised in IPOs and follow-ons, debt raised by underlying companies and capital

expenditures sourced from operational cash flow of underlying companies, with more than 100 investments and over 290 underlying acquisitions

as of December 31, 2022.

Our credit and public equities

strategies gained traction with our combination with Moneda Asset Management concluded in December 2021. As of December 31, 2022 and 2021,

the total AUM for our credit platform was US$4.7 billion and US$5.0 billion, respectively. As of the same dates, the total AUM for our

public equities products was US$2.1 billion and US$2.2 billion, respectively.

In addition to these products,

we believe we have a compelling opportunity to develop our additional two asset classes. Our real estate strategy is currently focused

on real estate investment trusts, or “REITs,” to leverage on the ongoing financial deepening in Latin America, which we believe

gained momentum with the agreement to acquire VBI Real Estate See “—Agreement to Acquire VBI Real Estate to Anchor Brazil

Real Estate Platform.” Our advisory and distribution platform, launched as a result of our combination with Moneda, had an aggregate

AUM of US$2.3 billion and US$2.2 billion as of December 31, 2022 and 2021, respectively. We expect it to play an important role on our

aspiration of becoming the conduit of capital for alternative investments coming both to and from Latin America.

Our successful track record

derived from our strategy and our strong capabilities has attracted a committed and diversified base of investors, with over 500 Limited

Partners, or “LPs,” across four continents, including some of the world’s largest and most important sovereign wealth

funds, public and private pension funds, insurance companies, funds of funds, financial institutions, endowments, foundations, and family

offices. We believe our historical returns in U.S. dollars are particularly notable in view of the levels of currency volatility and our

historically limited use of leverage, which, we also believe, made us better investors focused on value creation, strategy execution and

operational excellence, with more limited reliance upon financial engineering.

Consistent with our entrepreneurial

culture and our aim to provide attractive investment opportunities to our growing and progressively more sophisticated client base, we

have applied our core competencies to develop other products around our strategy. From our initial flagship private equity funds, we developed

other investment options, such as our infrastructure funds, co-investments funds (focused on successful companies from our flagship funds)

and Constructivist Equity Funds (applying our private equity approach to listed companies). Our IPO allows us to go further and expand

our product offerings inorganically – exemplified by our sizable credit, public equities and advisory and distribution platforms

originated or expanded by our combination with Moneda Asset Management, the launch of our growth equity strategy with the agreement to

partner up with Kamaroopin, the growth of our Real Estate platform with the agreement to acquire VBI, and the expansion into Venture Capital

by acquiring Igah Ventures.

As of December 31, 2022,

we had 385 professionals, of which 90 were partners and directors, 27 of these working together for more than 19 years, operating in ten

offices around the globe, including investment offices in, Montevideo (Uruguay), São Paulo (Brazil), Bogotá (Colombia),

and Santiago (Chile), as well as client-coverage offices in New York (United States), Sausalito

(United States), London (United Kingdom), Dubai (UAE), and Hong Kong (China) to cover our LP base, in addition to our corporate business

and management office in George Town (Cayman Islands).

Patria was incorporated in

Bermuda on July 6, 2007 as a limited liability exempted company and changed the jurisdiction of its incorporation to the Cayman Islands

on October 12, 2020, registering by way of continuation as a Cayman Islands exempted company with limited liability duly registered

with the Cayman Islands Registrar of Companies. Our principal executive office is located at 18 Forum Lane, 3rd floor, Camana Bay, PO

Box 757, KY1-9006 Grand Cayman, Cayman Islands. Our investor relations office can be reached at patriashareholderrelations@patria.com

and our website address is www.patria.com. The information contained on, or accessible through,

such website is not incorporated by reference into this prospectus and should not be considered a part of this prospectus or any prospectus

supplement.

Use of Proceeds

We intend to use the proceeds

from the sale of the Class A common shares offered by us as set forth in the applicable prospectus supplement.

In the case of a secondary

offering of Class A common shares, we will not receive any of the proceeds of the sale by any selling shareholders of the Class A common

shares covered by this prospectus.

Description of

Share Capital

General

Patria was incorporated in

Bermuda on July 6, 2007 as a limited liability exempted company and changed the jurisdiction of its incorporation to the Cayman Islands

on October 12, 2020, registering by way of continuation as a Cayman Islands exempted company with limited liability duly registered

with the Cayman Islands Registrar of Companies. Our corporate purposes are unrestricted and we have the authority to carry out any object

not prohibited by any law as provided by Section 7(4) of the Companies Act.

Our affairs are governed

principally by: (1) our Memorandum and Articles of Association; (2) the Companies Act; and (3) the common law of the Cayman

Islands. As provided in our Articles of Association, subject to Cayman Islands law, we have full capacity to carry on or undertake any

business or activity, do any act or enter into any transaction, and, for such purposes, full rights, powers and privileges. Our registered

office is at c/o Maples Corporate Services Limited, P.O. Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands.

The following discussion summarizes the material terms of the Class

A common shares of Patria which may be offered by this prospectus. This discussion does not purport to be complete and is qualified in

its entirety by reference to theMemorandum and Articles of Association included as Exhibit 3.1 to the Amendment No. 2 to our registration

statement on Form F-1 (File noNo. 333-251823), filed with the SEC on January 14, 2021.

Our shareholders adopted

the Memorandum and Articles of Association included as Exhibit 3.1 to the Amendment No. 2 to our registration statement on Form F-1 (File

No. 333-251823), filed with the SEC on January 14, 2021.

Our Memorandum and Articles

of Association authorize the issuance of up to US$100,000, consisting of 1,000,000,000 shares of par value US$0.0001. Of those authorized

shares, (1) 500,000,000 are designated as Class A common shares, (2) 250,000,000 are designated as Class B common shares, and (3)

250,000,000 are as yet undesignated and may be issued as common shares or shares with preferred rights. As of the date hereof, 54,247,500

Class A common shares and 92,945,430 Class B common shares of our authorized share capital were issued, fully paid and outstanding.

Our Class A common shares are listed on the Nasdaq

under the symbol “PAX.”

Initial settlement of our

Class A common shares took place on the closing date of our initial public offering through The Depository Trust Company, or “DTC,”

in accordance with its customary settlement procedures for equity securities. Each person owning Class A common shares held through

DTC must rely on the procedures thereof and on institutions that have accounts therewith to exercise any rights of a holder of the Class A

common shares. Persons wishing to obtain certificates for their Class A common shares must make arrangements with DTC.

The following is a summary

of the material provisions of our authorized share capital and our Articles of Association.

The Memorandum and Articles

of Association authorize two classes of common shares: Class A common shares, which are entitled to one vote per share, and Class B

common shares, which are entitled to 10 votes per share and to maintain a proportional ownership interest in the event that additional

Class A common shares are issued. Any holder of Class B common shares may convert his or her shares at any time into Class A

common shares on a share-for-share basis. The rights of the two classes of common shares are otherwise identical, except as described

below. The implementation of this dual class structure was required by Patria Holdings, one of our existing shareholders, as a condition

of undertaking an initial public offering of our common shares. See “—Anti-Takeover Provisions in Our Articles of Association—Two

Classes of Common Shares.”

At the date hereof, Patria’s

total authorized share capital was US$100,000, divided into 1,000,000,000 shares par value US$0.0001 each, of which:

| • | 500,000,000 shares are designated as Class A common shares; and |

| • | 250,000,000 shares are designated as Class B common shares. |

The remaining 250,000,000

authorized but unissued shares are presently undesignated and may be issued by our board of directors as common shares of any class or

as shares with preferred, deferred or other special rights or restrictions in accordance with the Memorandum and Articles of Association.

We currently have a total

issued share capital of US$14,720, divided into 147,192,930 common shares. Those common shares are divided into 54,247,500 Class A

common shares and 92,945,430 Class B common shares.

Treasury Stock

As of the date hereof, Patria

has no shares in treasury.

Issuance of Shares

Except as expressly provided

in Patria’s Articles of Association, the board of directors has general and unconditional authority to allot, grant options over,

offer or otherwise deal with or dispose of any unissued shares in the Company’s capital without the approval of our shareholders

(whether forming part of the original or any increase in issued share capital), either at a premium or at par, with or without preferred,

deferred or other special rights or restrictions, whether relating to dividend, voting, return of capital or otherwise and to such persons,

on such terms and conditions, and at such times as the directors may decide, but so that no share shall be issued at a discount, except

in

accordance with the provisions

of the Companies Act. In accordance with its Articles of Association, Patria shall not issue bearer shares.

Patria’s Articles of

Association provide that at any time there are Class A common shares in issue, additional Class B common shares may only be

issued pursuant to (1) a share split, subdivision of shares or similar transaction or where a dividend or other distribution is paid

by the issue of shares or rights to acquire shares or following capitalization of profits, (2) a merger, consolidation, or other

business combination involving the issuance of Class B common shares as full or partial consideration, or (3) an issuance of

Class A common shares, whereby holders of the Class B common shares are entitled to purchase a number of Class B common

shares that would allow them to maintain their proportional ownership interests in Patria (following an offer by Patria to each holder

of Class B common shares to issue to such holder, upon the same economic terms and at the same price, such number of Class B

common shares as would ensure such holder may maintain a proportional ownership interest in Patria pursuant to Patria’s Articles

of Association). In light of: (a) the above provisions; (b) the fact that future transfers by holders of Class B common

shares will generally result in those shares converting to Class A common shares, subject to limited exceptions as provided in the

Articles of Association; and (c) the ten-to-one voting ratio between our Class B common shares and Class A common shares

means that holders of our Class B common shares will in many situations continue to maintain control of all matters requiring shareholder

approval. This concentration of ownership and voting power will limit or preclude your ability to influence corporate matters for the

foreseeable future. For more information see “—Preemptive or Similar Rights.”

Patria’s Articles of

Association also provide that the issuance of non-voting common shares requires the affirmative vote of a majority of the then-outstanding

Class A common shares.

Fiscal Year

Patria’s fiscal year

begins on January 1 of each year and ends on December 31 of the same year.

Voting Rights

The holders of the Class A

common shares and Class B common shares have identical rights, except that (1) the holder of Class B common shares is entitled

to 10 votes per share, whereas holders of Class A common shares are entitled to one vote per share, (2) Class B common shares

have certain conversion rights and (3) the holder of Class B common shares is entitled to maintain a proportional ownership interest

in the event that additional Class A common shares are issued. For more information see “—Preemptive or Similar Rights”

and “—Conversion.” The holders of Class A common shares and Class B common shares vote together as a single

class on all matters (including the election of directors) submitted to a vote of shareholders, except as provided below and as otherwise

required by law.

Patria’s Articles of

Association provide as follows regarding the respective rights of holders of Class A common shares and Class B common shares:

| • | class consents from the holders of Class A common shares or Class B common shares, as applicable,

shall be required for any variation to the rights attached to their respective class of shares, however, the directors may treat any two

or more classes of shares as forming one class if they consider that all such classes would be affected in the same way by the proposal; |

| • | the rights conferred on holders of Class A common shares shall not be deemed to be varied by the

creation or issue of further Class B common shares and vice versa; and |

| • | the rights attaching to the Class A common shares and the Class B common shares shall not be

deemed to be varied by the creation or issue of shares with preferred or other rights, including, without limitation, shares with enhanced

or weighted voting rights. |

As set forth in the Articles

of Association, the holders of Class A common shares and Class B common shares, respectively, do not have the right to vote

separately if the number of authorized shares of such class is increased or decreased. Rather, the number of authorized Class A common

shares and Class B common shares may be increased or decreased (but not below the number of shares of such class then outstanding)

by the affirmative vote of the holders of a majority of the voting power of the issued and outstanding Class A common shares and

Class B common shares, voting together in a general meeting.

Preemptive or Similar Rights

The Class A common shares

and Class B common shares are not entitled to preemptive rights upon transfer and are not subject to conversion (except as described

below under “—Conversion”), redemption or sinking fund provisions.

The Class B common shares

are entitled to maintain a proportional ownership interest in the event that additional Class A common shares are issued. As such,

except for certain exceptions, if Patria issues Class A common shares, it must first make an offer to each holder of Class B

common shares to issue to such holder on the same economic terms such number of Class B common shares as would ensure such holder

may maintain a proportional ownership interest in Patria. This right to maintain a proportional ownership interest may be waived by a

majority of the holders of Class B common shares.

Conversion

The outstanding Class B

common shares are convertible at any time as follows: (1) at the option of the holder, a Class B common share may be converted

at any time into one Class A common share or (2) upon the election of the holders of a majority of the then-outstanding Class B

common shares, all outstanding Class B common shares may be converted into a like number of Class A common shares. In addition,

each Class B common share will convert automatically into one Class A common share upon any transfer, whether or not for value,

except for certain transfers described in the Articles of Association, including transfers to affiliates, transfers to and between trusts

solely for the benefit of the shareholder or its affiliates, and partnerships, corporations and other entities exclusively owned by the

shareholder or its affiliates. Furthermore, each Class B common share will convert automatically into one Class A common share

and no Class B common shares will be issued thereafter if, at any time, the total number of the issued and outstanding Class B

common shares is less than 10% of the total number of shares outstanding.

No class of Patria’s

common shares may be subdivided or combined unless the other class of common shares is concurrently subdivided or combined in the same

proportion and in the same manner.

Equal Status

Except as expressly provided

in Patria’s Articles of Association, Class A common shares and Class B common shares have the same rights and privileges

and rank equally, share ratably and are identical in all respects as to all matters. In the event of any merger, consolidation, scheme,

arrangement or other business combination requiring the approval of our shareholders entitled to vote thereon (whether or not Patria is

the surviving entity), the holders of Class A common shares shall have the right to receive, or the right to elect to receive, the

same form of consideration as the holders of Class B common shares, and the holders of Class A common shares shall have the

right to receive, or the right to elect to receive, at least the same amount of consideration on a per share basis as the holders of Class B

common shares. In the event of any (1) tender or exchange offer to acquire any Class A common shares or Class B common

shares by any third party pursuant to an agreement to which Patria is a party, or (2) any tender or exchange offer by Patria to acquire

any Class A common shares or Class B common shares, the holders of Class A common shares shall have the right to receive,

or the right to elect to receive, the same form of consideration as the holders of Class B common shares, and the holders of Class A

common shares shall have the right to receive, or the right to elect to receive, at least the same amount of consideration on a per share

basis as the holders of Class B common shares.

Record Dates

For the purpose of determining

shareholders entitled to notice of, or to vote at, any general meeting of shareholders or any adjournment thereof, or shareholders entitled

to receive dividend or other distribution payments, or in order to make a determination of shareholders for any other purpose, Patria’s

board of directors may set a record date which shall not exceed forty (40) clear days prior to the date where the determination will

be made.

General Meetings of Shareholders

As a condition of admission

to a shareholders’ meeting, a shareholder must be duly registered as a shareholder of Patria at the applicable record date for that

meeting and, in order to vote, all calls or installments then payable by such shareholder to Patria in respect of the shares that such

shareholder holds must have been paid.

Subject to any special rights

or restrictions as to voting then attached to any shares, at any general meeting, every shareholder who is present in person or by proxy

(or, in the case of a shareholder being a corporation, by its duly authorized representative not being himself or herself a shareholder

entitled to vote) shall have one vote per Class A common share and 10 votes per Class B common share.

As a Cayman Islands exempted

company, Patria is not obliged by the Companies Act to call annual general meetings; however, the Articles of Association provide that

in each year the Company will hold an annual general meeting of shareholders, at a time determined by the board of directors. For the

annual general meeting of shareholders the agenda will include, among other things, the presentation of the annual accounts and the report

of the directors. In addition, the agenda for an annual general meeting of shareholders will only include such items as have been included

therein by the board of directors.

Also, Patria may, but is

not required to (unless required by the laws of the Cayman Islands), hold other extraordinary general meetings during the year. General

meetings of shareholders are generally expected to take place in São Paulo, Brazil, but may be held elsewhere if the directors

so decide.

The Companies Act provides

shareholders a limited right to request a general meeting, and does not provide shareholders with any right to put any proposal before

a general meeting in default of a company’s Articles of Association. However, these rights may be provided in a company’s

Articles of Association. Patria’s Articles of Association provide that upon the requisition of one or more shareholders representing

not less than one-third of the voting rights entitled to vote at general meetings, the board will convene an extraordinary general meeting

and put the resolutions so requisitioned to a vote at such meeting. The Articles of Association provide no other right to put any proposals

before annual general meetings or extraordinary general meetings.

Subject to regulatory requirements,

the annual general meeting and any extraordinary general meetings must be called by not less than ten (10) clear days’ notice

prior to the relevant shareholders meeting and convened by a notice discussed below. Alternatively, upon the prior consent of all holders

entitled to receive notice, with regard to the annual general meeting, and the holders of 95% in par value of the shares entitled to attend

and vote at an extraordinary general meeting, that meeting may be convened by a shorter notice and in a manner deemed appropriate by those

holders.

Patria will give notice of

each general meeting of shareholders by publication on its website and in any other manner that it may be required to follow in order

to comply with Cayman Islands law, Nasdaq and SEC requirements. The holders of registered shares may be given notice of a shareholders’

meeting by means of letters sent to the addresses of those shareholders as registered in our shareholders’ register, or, subject

to certain statutory requirements, by electronic means.

Holders whose shares are

registered in the name of DTC or its nominee, which we expect will be the case for all holders of Class A common shares, will not

be shareholders or members of the Company and must rely on the procedures of DTC regarding notice of shareholders’ meetings and

the exercise of rights of a holder of the Class A common shares.

A quorum for a general meeting

consists of any one or more persons holding or representing by proxy not less than one-third of the aggregate voting power of all shares

in issue and entitled to vote upon the business to be transacted.

A resolution put to a vote

at a general meeting shall be decided on a poll. An ordinary resolution to be passed by the shareholders at a general meeting requires

the affirmative vote of a simple majority of the votes cast by, or on behalf of, the shareholders entitled to vote, present in person

or by proxy and voting at the meeting. A special resolution requires the affirmative vote on a poll of no less than two-thirds of the

votes cast by the shareholders entitled to vote who are present in person or by proxy at a general meeting. Both ordinary resolutions

and special resolutions may also be passed by a unanimous written resolution signed by all the shareholders of our company, as permitted

by the Companies Act and our Articles of Association.

Pursuant to Patria’s

Articles of Association, general meetings of shareholders are to be chaired by the chairman of our board of directors or in his absence

the vice-chairman of the board of directors. If the chairman or vice-chairman of our board of directors is absent, the directors present

at the meeting shall appoint one of them to be chairman of the general meeting. If neither the chairman nor another director is present

at the general meeting within 15 minutes after

the time appointed for holding

the meeting, the shareholders present in person or by proxy and entitled to vote may elect any one of the shareholders to be chairman.

The order of business at each meeting shall be determined by the chairman of the meeting, and he or she shall have the right and authority

to prescribe such rules, regulations and procedures and to do all such acts and things as are necessary or desirable for the proper conduct

of the meeting, including, without limitation, the establishment of procedures for the maintenance of order and safety, limitations on

the time allotted to questions or comments on the affairs of the Company, restrictions on entry to such meeting after the time prescribed

for the commencement thereof, and the opening and closing of the polls.

Liquidation Rights

If Patria is voluntarily

wound up, the liquidator, after taking into account and giving effect to the rights of preferred and secured creditors and to any agreement

between Patria and any creditors that the claims of such creditors shall be subordinated or otherwise deferred to the claims of any other

creditors and to any contractual rights of set-off or netting of claims between Patria and any person or persons (including without limitation

any bilateral or any multilateral set-off or netting arrangements between the Company and any person or persons), and subject to any agreement

between Patria and any person or persons to waive or limit the same, shall apply Patria’s property in satisfaction of its liabilities

pari passu and subject thereto shall distribute the property amongst the shareholders according to their rights and interests in

Patria.

Changes to Capital

Pursuant to the Articles

of Association, Patria may from time to time by ordinary resolution:

| • | increase its share capital by such sum, to be divided into shares of such amount, as the resolution shall

prescribe; |

| • | consolidate and divide all or any of its share capital into shares of a larger amount than its existing

shares; |

| • | convert all or any of its paid-up shares into stock and reconvert that stock into paid-up shares of any

denomination; |

| • | subdivide its existing shares or any of them into shares of a smaller amount, provided that in the subdivision

the proportion between the amount paid and the amount, if any, unpaid on each reduced share shall be the same as it was in the case of

the share from which the reduced share is derived; or |

| • | cancel any shares which, at the date of the passing of the resolution, have not been issued or agreed

to be issued to any person and diminish the amount of its share capital by the amount of the shares so canceled. |

Patria’s shareholders

may by special resolution, subject to confirmation by the Grand Court of the Cayman Islands on an application by the Company for an order

confirming such reduction, reduce its share capital or any capital redemption reserve in any manner permitted by law.

In addition, subject to the

provisions of the Companies Act and our Articles of Association, Patria may:

| • | issue shares on terms that they are to be redeemed or are liable to be redeemed; |

| • | purchase its own shares (including any redeemable shares); and |

| • | make a payment in respect of the redemption or purchase of its own shares in any manner authorized by

the Companies Act, including out of its own capital. |

Transfer of Shares

Subject to any applicable

restrictions set forth in the Articles of Association, any shareholder of Patria may transfer all or any of his or her common shares by

an instrument of transfer in the usual or common form or in the form prescribed by the Nasdaq or any other form approved by Patria’s

board of directors.

The Class A common shares

sold in our initial public offering are traded on the Nasdaq in book-entry form and may be transferred in accordance with Patria’s

Articles of Association and Nasdaq’s rules and regulations.

However, Patria’s board

of directors may, in its absolute discretion, decline to register any transfer of any common share which is either not fully paid up to

a person of whom it does not approve or is issued under any share incentive scheme for employees which contains a transfer restriction

that is still applicable to such common share. The board of directors may also decline to register any transfer of any common share unless:

| • | a fee of such maximum sum as the Nasdaq may determine to be payable or such lesser sum as the board of

directors may from time to time require is paid to Patria in respect thereof; |

| • | the instrument of transfer is lodged with Patria, accompanied by the certificate (if any) for the common

shares to which it relates and such other evidence as our board of directors may reasonably require to show the right of the transferor

to make the transfer; |

| • | the instrument of transfer is in respect of only one class of shares; |

| • | the instrument of transfer is properly stamped, if required; |

| • | the common shares transferred are free of any lien in favor of Patria; and |

| • | in the case of a transfer to joint holders, the transfer is not to more than four joint holders. |

If the directors refuse to

register a transfer, they are required, within two months after the date on which the instrument of transfer was lodged, to send to the

transferee notice of such refusal.

Share Repurchase

The Companies Act and the

Articles of Association permit Patria to purchase its own shares, subject to certain restrictions. The board of directors may only exercise

this power on behalf of Patria, subject to the Companies Act, the Articles of Association and to any applicable requirements imposed from

time to time by the SEC, Nasdaq, or by any recognized stock exchange on which our securities are listed.

Dividends and Capitalization of Profits

Our intention is to pay to

holders of Class A common shares dividends representing approximately 85% of our Distributable Earnings, subject to adjustment by

amounts determined by our board of directors to be necessary or appropriate. The dividend amount could also be adjusted upwards or downwards.

For more information on Distributable Earnings, see “Item 5. Operating and Financial Review and Prospects—A. Operating Results—Non-GAAP

Financial Measures and Reconciliations—Distributable Earnings (DE)” in our 2022 Form 20-F. For more information on our dividend

policy, see “Item 8. Financial Information—A. Consolidated Statements and Other Financial Information” in our 2022 Form

20-F.

Subject to the Companies

Act, Patria’s shareholders may, by resolution passed by a simple majority of the voting rights entitled to vote at a general meeting,

declare dividends (including interim dividends) to be paid to shareholders, but no dividend shall be declared in excess of the amount

recommended by the board of directors. The board of directors may also declare dividends. Dividends may be declared and paid out of funds

lawfully available to Patria. Except as otherwise provided by the rights attached to shares and the Articles of Association of Patria,

all dividends shall be paid in proportion to the number of Class A common shares or Class B common shares a shareholder holds

at the date the dividend is declared (or such other date as may be set as a record date); but, (1) if any share is issued on terms

providing that it shall rank for dividend as from a particular date, that share shall rank for dividend accordingly, and (2) where

we have shares in issue which are not fully paid up (as to par value), we may pay dividends in proportion to the amounts paid up on each

share.

The holders of Class A

common shares and Class B common shares shall be entitled to share equally in any dividends that may be declared in respect of Patria’s

common shares from time to time. In the event that a dividend is paid in the form of Class A common shares or Class B common

shares, or rights to acquire Class A common shares or Class B common shares, (1) the holders of Class A common shares

shall receive Class A common shares, or rights to acquire Class A common shares, as the case may be; and (2) the holder

of Class B common shares shall receive Class B common shares, or rights to acquire Class B common shares, as the case may

be.

Appointment, Disqualification and Removal of

Directors

Patria is managed by its

board of directors. The Articles of Association provide that, unless otherwise determined by a special resolution of shareholders, the

board of directors will be composed of four to 11 directors, with the number being determined by a majority of the directors then in office.

There are no provisions relating to retirement of directors upon reaching any age limit. The Articles of Association also provide that,

while Patria’s shares are admitted to trading on Nasdaq, the board of directors must always comply with the residency and citizenship

requirements of the U.S. securities laws applicable to foreign private issuers.

The Articles of Association

provide that directors shall be elected by an ordinary resolution of our shareholders, which requires the affirmative vote of a simple

majority of the votes cast on the resolution by the shareholders entitled to vote who are present, in person or by proxy, at the meeting.

Each director shall be appointed and elected for such term as the resolution appointing him or her may determine or until his or her death,

resignation or removal.

On October 1, 2010,

we entered into a shareholders’ agreement, or the “Shareholders’ Agreement,” with Patria Holdings Limited and

Blackstone PAT Holdings IV, L.L.C. The Shareholders’ Agreement contains certain customary provisions, including the rights of Patria

Holdings Limited and Blackstone PAT Holdings IV, L.L.C. to designate a certain number of the members of our board of directors. The Shareholders’

Agreement (including the board designation rights and Patria’s rights with respect to use of the Blackstone name) was terminated

in connection with the completion of our initial public offering, except for certain provisions that survive in accordance with the terms

of the Shareholders’ Agreement, including drag-along and tag-along rights.

Our directors are Olimpio