Patria Reports Second Quarter 2024 Earnings Results

01 August 2024 - 8:00PM

Patria (Nasdaq:PAX) reported today its unaudited results for

the second quarter ended June 30, 2024. The full detailed

presentation of Patria's second quarter 2024 results can be

accessed on the Shareholders section of Patria’s website at

https://ir.patria.com/.

Alex Saigh, Patria’s CEO, said: “The 2nd quarter of 2024 was a

very busy quarter as we continued to make solid progress towards

our near and long-term goals. Fee Related Earnings reached $40

million dollars, representing a 17% increase from 2Q23. We

delivered close to $34 million dollars of Distributable

Earnings, or 22 cents per share. We continued to grow and diversify

our platform as we organically raised $2.2 billion dollars over the

first half of 2024 and approximately $5 billion over the last

twelve months, in addition to multiple inorganic initiatives. As

previously announced, during the quarter we closed on the

acquisition of abrdn’s private equity solutions business, and since

the end of the quarter we completed the transition of the Credit

Suisse real estate business in Brazil, closed on the acquisition of

Nexus Capital which further strengthened our real estate platform

in Colombia, and just today concluded our acquisition of the 50% of

VBI we did not already own. Of note, we are excited to announce an

important update to our capital management strategy and our

intention to repurchase up to 1.8 million shares over the next

twelve months as we look to maximize returns to shareholders.

Overall, I am even more confident that we will reach our 2024

target for Fee Related Earnings of at least $170 million dollars,

on the way to generating $200 to $225 million of FRE in 2025.”

Financial Highlights (reported in $ USD)

IFRS results included $0.8 million of net income attributable to

Patria in Q2 2024. Patria generated Fee Related Earnings of $39.5

million in Q2 2024, up 17% from $33.8 million in Q2 2023, with an

FRE margin of 56%. Distributable Earnings were $33.8 million for Q2

2024, or $0.22 per share.

Dividends

Patria has declared a quarterly dividend of $0.15 per share to

record holders of common stock at the close of business on August

19th, 2024 in accordance with our new capital management strategy.

This dividend will be paid on September 9th, 2024.

Conference Call

Patria will host its second quarter 2024 earnings conference

call via public webcast on August 1st, 2024, at 9:00 a.m. ET. To

register and join, please use the following

link:https://edge.media-server.com/mmc/p/7j8v48dx/

For those unable to listen to the live broadcast, there will be

a webcast replay on the Shareholders section of Patria’s website at

https://ir.patria.com/ shortly after the call’s completion.

About Patria

Patria is a global alternative asset manager and industry leader

in Latin America, with over 35 years of history, combined assets

under management of $40.3 billion, and a global presence with

offices in 13 cities across 4 continents. Patria aims to provide

consistent returns in attractive long-term investment opportunities

as the gateway for alternative investments in Latin America.

Through a diversified platform spanning Private Equity,

Infrastructure, Credit, Real Estate, Public Equities and Global

Private Markets Solutions strategies, Patria provides a

comprehensive range of products to serve its global client base.

Further information is available at www.patria.com.

Forward-Looking Statements

This press release may contain forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. You can identify these forward-looking statements by the

use of words such as “outlook,” “indicator,” “believes,” “expects,”

“potential,” “continues,” “may,” “will,” “could,” “should,”

“seeks,” “approximately,” “predicts,” “intends,” “plans,”

“estimates,” “anticipates” or the negative version of these words

or other comparable words, among others. Forward-looking statements

appear in a number of places in this press release and include, but

are not limited to, statements regarding our intent, belief or

current expectations. Forward-looking statements are based on our

management’s beliefs and assumptions and on information currently

available to our management. Forward-looking statements speak only

as of the date they are made, and we do not undertake any

obligation to update them in light of new information or future

developments or to release publicly any revisions to these

statements in order to reflect later events or circumstances or to

reflect the occurrence of unanticipated events. Such

forward-looking statements are subject to various risks and

uncertainties. Accordingly, there are or will be important factors

that could cause actual outcomes or results to differ materially

from those indicated in these statements. Further information on

these and other factors that could affect our financial results is

included in filings we have made and will make with the U.S.

Securities and Exchange Commission from time to time, including but

not limited to those described under the section entitled “Risk

Factors” in our most recent annual report on Form 20-F, as such

factors may be updated from time to time in our periodic filings

with the United States Securities and Exchange Commission (“SEC”),

which are accessible on the SEC’s website at www.sec.gov. These

factors should not be construed as exhaustive and should be read in

conjunction with the other cautionary statements that are included

in our periodic filings.

Contact

Rob Leet +1 917 769 1611rob.lee.consult@patria.com

Andre Medinat +1 917 769 1611andre.medina@patria.com

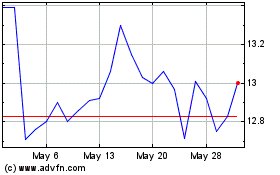

Patria Investments (NASDAQ:PAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

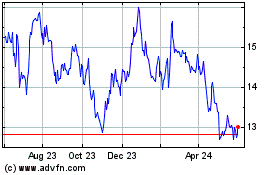

Patria Investments (NASDAQ:PAX)

Historical Stock Chart

From Dec 2023 to Dec 2024