RGP Pulse Survey Highlights Impact of Lower Interest Rates on Corporate Investment

25 October 2024 - 12:00AM

Business Wire

Poll of U.S. financial decision makers shows

how digital transformation and AI are impacting workforce

strategies and investment priorities

RGP® (Nasdaq: RGP), a global professional services firm, today

released new research around how ongoing labor market challenges,

growing digital transformation spend and the Fed’s September

interest rate cut are impacting workforce strategy decisions for

U.S. companies.

More than half of financial decision makers (51%) polled after

the Fed’s September meeting expect their organization to increase

some investments before the end of 2024, while four in five (81%)

expect to increase investments by the first half of 2025.

Respondents cited business process optimization and automation as

the top area of increased investment if a lower interest rate

environment were to unlock new capital in 2025, followed by digital

transformation and AI.

“Many organizations entered the first quarter of the year with

the expectation that they’d be operating in a lower interest rate

environment and our research shows that last month’s rate cut is

having a rather immediate impact on corporate investment,” said

Kate Duchene, Chief Executive Officer of RGP. “Skills gaps have

widened or remained the same for two in five organizations that we

surveyed. We’re seeing that talent shortages and growing investment

in change and transformation projects are driving organizations to

rethink and increase their investment in workforce strategy in

2025.”

Shifting Workforce Strategies

Nine out of 10 financial decision makers (88%) said their

organization is currently planning to increase overall investment

in workforce strategy development in 2025. While 39% of

organizations are focused on increasing resources to reskill and

upskill existing employees, 24% are planning to increase investment

in outside talent to fill skill gaps. One in five (22%) respondents

reported plans to increase investment in internal headcount.

Half of financial decision makers (49%) said that a growing

urgency to better leverage AI and automation could have the biggest

impact on their investment in workforce development in the next 12

months. Most respondents (65%) believe that AI will account for

less than 10% of job elimination within their organization in the

next two years, while half (47%) expect AI to account for 11-30% of

job creation in the same period.

Digital Transformation and AI Investment Remains

Significant

RGP’s latest research illustrates the extent of digital

transformation spending, which is expected to grow to a $9.15

trillion market by 2033.1 Nearly three in four respondents (71%)

said their organization is spending $5 million or more on digital

transformation projects in 2024, while 42% reported that their

organization is spending more than $10 million this year.

Financial decision makers cited IT operations and security as

the top priority within their organization’s AI investment over the

next 12 months, followed by product development and innovation, and

HR and talent management.

Growing Importance of ERP

The enterprise resource planning (ERP) software market is

projected to grow to $238.79 billion by 2032, as cloud migration

remains a top priority for organizations readying their data

management for AI adoption.2 More than half of respondents (53%)

said their organization either completed a cloud migration within

the last 12 months or is currently going through a cloud migration.

However, 13% of financial decision makers reported that their

organization has not yet gone through a cloud migration.

Organizations are also placing greater emphasis on ERP within

their M&A plans. Among organizations that are considering

M&A over the next 12 months, 85% said ERP and data are

important or critical factors in their search criteria.

The findings are based on a poll of 204 U.S. full-time

professionals conducted between September 19 and October 2, 2024.

The poll consisted of respondents at the director level or above

who influence finance decision-making at organizations with $500

million or more in annual revenue.

ABOUT RGP

RGP is a global professional services firm that powers the

operational needs and change initiatives of its client base

utilizing a combination of three distinct brands:

- On-Demand by RGP™: Our on-demand talent solutions, providing

businesses with a go-to source for bringing in experts when they

need them;

- Veracity by RGP™: Our consulting arm, driving transformation

across people, processes & technology; and

- Countsy by RGP™: Our outsourced services for accounting, human

resources and equity, helping startups, scaleups and spinouts focus

on their growth.

Regardless of engagement model, we Dare to Work Differently® by

leveraging human connection and collaboration to deliver practical

solutions and impactful results. We offer a more effective way to

work that favors flexibility and agility as businesses confront

change and transformation pressures amid skilled labor

shortages.

Based in Irvine, CA with offices worldwide, we annually engage

with over 1,700 clients around the world from 43 physical practice

offices, multiple virtual offices and approximately 3,300

professionals. RGP is proud to have served 88% of the Fortune 100

as of August 2024 and has been recognized by U.S. News & World

Report (2024-2025 Best Companies to Work for) and Forbes (America’s

Best Management Consulting Firms 2024, America’s Best Midsize

Employers 2024, World's Best Management Consulting Firms 2024).

The Company is listed on the Nasdaq Global Select Market, the

exchange’s highest tier by listing standards. To learn more about

RGP, visit: https://rgp.com. (RGP-F)

1 Precedence Research: Digital Transformation Market Size, Share

and Trends 2024 to 2034

https://www.precedenceresearch.com/digital-transformation-market 2

Fortune Business Insights: Enterprise Resource Planning (ERP)

Software Market Source:

https://www.fortunebusinessinsights.com/enterprise-resource-planning-erp-software-market-102498

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241024467630/en/

Investor Contact: Jennifer Ryu, Chief Financial Officer

(US+) 1-714-430-6500 jennifer.ryu@rgp.com

Media Contact: Pat Burek Financial Profiles (US+)

1-310-622-8244 pburek@finprofiles.com

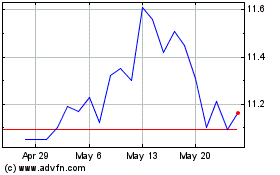

Resources Connection (NASDAQ:RGP)

Historical Stock Chart

From Nov 2024 to Dec 2024

Resources Connection (NASDAQ:RGP)

Historical Stock Chart

From Dec 2023 to Dec 2024