Sprout Social, Inc. (“Sprout Social”, the “Company”) (Nasdaq: SPT),

an industry-leading provider of cloud-based social media management

software, today announced financial results for its fourth quarter

ended December 31, 2024.

“The Sprout team delivered a solid fourth quarter,

driving 14% revenue growth and 26% growth in cRPO, laying the

foundation for future growth in 2025 and beyond. As we work to

define the future of social media management, we remain focused on

execution—winning the enterprise, driving customer health,

expanding our partnership ecosystem, and driving deeper engagement

in our customer base,” said Ryan Barretto, CEO.

Fourth Quarter 2024 Financial

Highlights

Revenue

- Revenue was $107.1 million, up 14% compared to the fourth

quarter of 2023.

- Total remaining performance obligations (RPO) of $351.5 million

as of December 31, 2024, up 28% year-over-year.

- Current remaining performance obligations (cRPO) of $249.4

million as of December 31, 2024, up 26% year-over-year.

Operating Income (Loss)

- GAAP operating loss was ($13.7) million, compared to ($18.2)

million in the fourth quarter of 2023.

- Non-GAAP operating income was $11.4 million, compared to $1.7

million in the fourth quarter of 2023.

Net Loss

- GAAP net loss was ($14.4) million, compared to ($20.1) million

in the fourth quarter of 2023.

- Non-GAAP net income was $10.7 million, compared to $1.0 million

in the fourth quarter of 2023.

- GAAP net loss per share was ($0.25) based on 57.5 million

weighted-average shares of common stock outstanding, compared to

($0.36) based on 56.1 million weighted-average shares of common

stock outstanding in the fourth quarter of 2023.

- Non-GAAP net income per share was $0.19 based on 57.5 million

weighted-average shares of common stock outstanding, compared to

$0.02 based on 56.1 million weighted-average shares of common stock

outstanding in the fourth quarter of 2023.

Cash

- Cash and equivalents and marketable securities totaled $90.2

million as of December 31, 2024, compared to $91.5 million as of

September 30, 2024.

- Net cash provided by (used in) operating activities was $4.1

million, compared to ($2.6) million in the fourth quarter of

2023.

- Non-GAAP free cash flow was $6.6 million, compared to ($0.3)

million in the fourth quarter of 2023.

See “Use of Non-GAAP Financial Measures” below for

definitions of Non-GAAP operating income (loss), Non-GAAP net

income (loss), Non-GAAP net income (loss) per share and non-GAAP

free cash flow and the financial tables that accompany this release

for reconciliations of our non-GAAP measures to their closest

comparable GAAP measures. See “Key Business Metrics” below for how

Sprout Social defines RPO, cRPO, the number of customers

contributing over $10,000 in ARR, the number of customers

contributing over $50,000 in ARR, dollar-based net retention rate

and dollar-based net retention rate excluding

small-and-medium-sized business customers.

Customer Metrics

- Grew number of customers contributing over $10,000 in ARR to

9,327 customers as of December 31, 2024, up 7% compared to December

31, 2023.

- Grew number of customers contributing over $50,000 in ARR to

1,718 customers as of December 31, 2024, up 23% compared to

December 31, 2023.

- Dollar-based net retention rate was 104% in 2024, compared to

107% in 2023.

- Dollar-based net retention rate excluding

small-and-medium-sized business (SMB) customers was 108% in 2024,

compared to 111% in 2023.

Recent Customer Highlights

- During the fourth quarter, we had the opportunity to grow with

new and existing customers like: Under Armour, ESPN, Rocket

Mortgage, Klaviyo, Carhartt, Campbell, and Cushman &

Wakefield.

Recent Business Highlights

Sprout Social recently:

- Released a new Total Economic Impact™ study conducted by

Forrester Consulting that found Sprout Social enabled customers to

achieve a 268% return on investment (link)

- Recognized by G2’s Best Software Awards as a top company across

seven categories (link)

- Announced rebranded influencer marketing platform to prepare

brands for the next generation of social (link)

- Launched the 2025 Sprout Social Index™ highlighting the latest

trends in social culture and brand implications for the future

(link)

- Unveiled updates to its suite of AI solutions that enable

marketers to unlock new potential and boost competitiveness

(link)

- Named a leader in worldwide social media marketing software for

large enterprises by IDC Marketscape (link) and earned a 2025

Buyer’s Choice Award from TrustRadius (link)

- Recognized by Built In as a Best Place to Work for the sixth

consecutive year (link)

First Quarter and 2025 Financial

Outlook

For the first quarter of 2025, the Company

currently expects:

- Total revenue between $107.2 million and $108.0 million.

- Non-GAAP operating income between $8.5 million and $9.5

million.

- Non-GAAP net income per share between $0.14 and $0.16 based on

approximately 58.5 million weighted-average shares of common stock

outstanding.

For the full year 2025, the Company currently

expects:

- Total revenue between $448.1 million and $453.1 million.

- Non-GAAP operating income between $38.2 million and $43.2

million.

- Non-GAAP net income per share between $0.65 and $0.74 based on

approximately 59.3 million weighted-average shares of common stock

outstanding.

The Company’s first quarter and 2025 financial

outlook is based on a number of assumptions that are subject to

change and many of which are outside the Company’s control. If

actual results vary from these assumptions, the Company’s

expectations may change. There can be no assurance that the Company

will achieve these results.

The Company does not provide guidance for

operating loss, the most directly comparable GAAP measure to

non-GAAP operating income, or net loss per share, the most directly

comparable GAAP measure to non-GAAP net income per share, and

similarly cannot provide a reconciliation between its forecasted

non-GAAP operating income and non-GAAP net income per share and

these comparable GAAP measures without unreasonable effort due to

the unavailability of reliable estimates for certain items. These

items are not within the Company’s control and may vary greatly

between periods and could significantly impact future financial

results.

Conference Call Information

The financial results and business highlights will

be discussed on a conference call and webcast scheduled at 4:00

p.m. Central Time (5:00 p.m. Eastern Time) today, February 25,

2025. Online registration for this event conference call can be

found at https://registrations.events/direct/Q4I1913111787. The

live webcast of the conference call can be accessed from Sprout

Social’s investor relations website at

http://investors.sproutsocial.com.

Following completion of the events, a webcast

replay will also be available at

http://investors.sproutsocial.com for 12 months.

About Sprout Social Sprout Social

is a global leader in social media management and analytics

software. Sprout’s unified platform puts powerful social data into

the hands of approximately 30,000 brands so they can make strategic

decisions that drive business growth and innovation. With a full

suite of social media management solutions, Sprout offers

comprehensive publishing and engagement functionality, customer

care, connected workflows and AI-powered business intelligence.

Sprout’s award-winning software operates across all major social

media networks and digital platforms. For more information about

Sprout Social (NASDAQ: SPT), visit sproutsocial.com.

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. In some cases, you can identify

forward-looking statements by terms such as “anticipate,”

“believe,” “can,” “continue,” “could,” “estimate,” “expect,”

“explore,””future,” “intend,” “long-term model,” “may,” “medium to

longer term goals,” “might” “outlook,” “plan,” “potential,”

“predict,” “project,” “should,” “strategy,” “target,” “will,”

“would,” or the negative of these terms, and similar expressions

intended to identify forward-looking statements. However, not all

forward-looking statements contain these identifying words. These

statements may relate to our market size and growth strategy, our

estimated and projected costs, margins, revenue, expenditures and

customer and financial growth rates, our Q1 2025 and full year 2025

financial outlook, our plans and objectives for future operations,

growth, initiatives or strategies. By their nature, these

statements are subject to numerous uncertainties and risks,

including factors beyond our control, that could cause actual

results, performance or achievement to differ materially and

adversely from those anticipated or implied in the forward-looking

statements. These assumptions, uncertainties and risks include

that, among others: we may not be able to sustain our revenue and

customer growth rate in the future, including due to risks

associated with our strategic focus on enterprise customers; price

increases have and may continue to negatively impact demand for our

products, customer acquisition and retention and reduce the total

number of customers or customer additions; our business would be

harmed by any significant interruptions, delays or outages in

services from our platform, our API providers, or certain social

media platforms; if we are unable to attract potential customers

through unpaid channels, convert this traffic to free trials or

convert free trials to paid subscriptions, our business and results

of operations may be adversely affected; we may be unable to

successfully enter new markets, manage our international expansion

and comply with any applicable international laws and regulations;

we may be unable to integrate acquired businesses or technologies

successfully or achieve the expected benefits of such acquisitions

and investments; unstable market and economic conditions, such as

recession risks, effects of inflation, labor shortages, supply

chain issues, high interest rates, and the impacts of current and

potential future bank failures and impacts of ongoing overseas

conflicts, have and could continue to adversely impact our business

and that of our existing and prospective customers, which may

result in reduced demand for our products; we may not be able to

generate sufficient cash to service our indebtedness; covenants in

our credit agreement may restrict our operations, and if we do not

effectively manage our business to comply with these covenants, our

financial condition could be adversely impacted; any

cybersecurity-related attack, significant data breach or disruption

of the information technology systems or networks on which we rely

could negatively affect our business; changing regulations relating

to privacy, information security and data protection could increase

our costs, affect or limit how we collect and use personal

information and harm our brand; and risks related to ongoing legal

proceedings. Additional risks and uncertainties that could cause

actual outcomes and results to differ materially from those

contemplated by the forward-looking statements are included under

the caption “Risk Factors” and elsewhere in our filings with the

Securities and Exchange Commission (the “SEC”), including our

Annual Report on Form 10-K for the year ended December 31, 2023

filed with the SEC on February 23, 2024 and our Annual Report on

Form 10-K for the year ended December 31, 2024, to be filed with

the SEC as well as any future reports that we file with the SEC.

Moreover, you should interpret many of the risks identified in

those reports as being heightened as a result of the current

instability in market and economic conditions. Forward-looking

statements speak only as of the date the statements are made and

are based on information available to Sprout Social at the time

those statements are made and/or management's good faith belief as

of that time with respect to future events. Sprout Social assumes

no obligation to update forward-looking statements to reflect

events or circumstances after the date they were made, except as

required by law.

Use of Non-GAAP Financial

Measures

We have provided in this press release certain

financial information that has not been prepared in accordance with

generally accepted accounting principles in the United States

(“GAAP”). Our management uses these non-GAAP financial measures

internally in analyzing our financial results and believes that use

of these non-GAAP financial measures is useful to investors as an

additional tool to evaluate ongoing operating results and trends

and in comparing our financial results with other companies in our

industry, many of which present similar non-GAAP financial

measures. Non-GAAP financial measures are not meant to be

considered in isolation or as a substitute for comparable financial

measures prepared in accordance with GAAP and should be read only

in conjunction with our consolidated financial statements prepared

in accordance with GAAP. A reconciliation of our historical

non-GAAP financial measures to the most directly comparable GAAP

measures has been provided in the financial statement tables

included in this press release, and investors are encouraged to

review these reconciliations.

Non-GAAP gross profit. We define

non-GAAP gross profit as GAAP gross profit, excluding stock-based

compensation expense, amortization expense associated with the

acquired developed technology from our acquisition of Tagger Media,

Inc. (the “Tagger acquisition”) and restructuring charges. We

believe non-GAAP gross profit provides our management and investors

consistency and comparability with our past financial performance

and facilitates period-to-period comparisons of operations, as it

eliminates the effect of stock-based compensation, amortization

expense and restructuring charges which are often unrelated to

overall operating performance. During the fourth quarter of 2024,

we revised our definition of non-GAAP gross profit to exclude

restructuring charges associated with a workforce reorganization,

consisting primarily of severance and other personnel-related

costs.

Non-GAAP gross margin. We define

non-GAAP gross margin as non-GAAP gross profit as a percentage of

revenue.

Non-GAAP operating income (loss).

We define non-GAAP operating income (loss) as GAAP loss from

operations, excluding stock-based compensation expense,

acquisition-related expenses and amortization expense associated

with the acquired intangible assets from the Tagger acquisition,

restructuring charges and non-cash gains from lease modifications.

We believe non-GAAP operating income (loss) provides our management

and investors consistency and comparability with our past financial

performance and facilitates period-to-period comparisons of

operations, as it eliminates the effect of stock-based

compensation, acquisition-related expenses, amortization expense,

restructuring charges and non-cash gains from lease modifications,

which are often unrelated to overall operating performance. During

the fourth quarter of 2024, we revised our definition of non-GAAP

operating income (loss) to exclude restructuring charges associated

with a workforce reorganization, consisting primarily of severance

and other personnel-related costs, and non-cash gain related to an

office lease modification.

Non-GAAP operating margin. We

define non-GAAP operating margin as non-GAAP operating income

(loss) as a percentage of revenue.

Non-GAAP net income (loss). We

define non-GAAP net income (loss) as GAAP net loss, excluding

stock-based compensation expense, acquisition-related expenses,

amortization expense associated with the acquired intangible assets

from the Tagger acquisition, tax expense due to changes in

valuation allowances from business acquisitions, restructuring

charges and non-cash gains from lease modifications. We believe

non-GAAP net income (loss) provides our management and investors

consistency and comparability with our past financial performance

and facilitates period-to-period comparisons of operations, as this

non-GAAP financial measure eliminates the effect of stock-based

compensation, acquisition-related expenses, amortization expense

and tax expense due to changes in valuation allowances from

business acquisitions, restructuring charges and non-cash gains

from lease modifications, which are often unrelated to overall

operating performance. During the fourth quarter of 2024, we

revised our definition of non-GAAP net income (loss) to exclude

restructuring charges associated with a workforce reorganization,

consisting primarily of severance and other personnel-related

costs, and non-cash gain related to an office lease

modification.

Non-GAAP net income (loss) per

share. We define non-GAAP net income (loss) per share as

GAAP net loss per share attributable to common shareholders, basic

and diluted, excluding stock-based compensation expense,

acquisition-related expenses, amortization expense associated with

the acquired intangible assets from the Tagger acquisition, tax

expense due to changes in valuation allowances from business

acquisitions, restructuring charges and non-cash gains from lease

modifications. We believe non-GAAP net income (loss) per share

provides our management and investors consistency and comparability

with our past financial performance and facilitates

period-to-period comparisons of operations, as this non-GAAP

financial measure eliminates the effect of stock-based

compensation, acquisition-related expenses, amortization expense,

tax expense due to changes in valuation allowances from business

acquisitions, restructuring charges and non-cash gains from lease

modifications, which are often unrelated to overall operating

performance. During the fourth quarter of 2024, we revised our

definition of non-GAAP net income (loss) per share to exclude

restructuring charges associated with a workforce reorganization,

consisting primarily of severance and other personnel-related

costs, and non-cash gain related to an office lease

modification.

Non-GAAP free cash flow. We

define non-GAAP free cash flow as net cash provided by (used in)

operating activities less expenditures for property and equipment,

acquisition-related costs, interest and payments related to

restructuring charges. Non-GAAP free cash flow does not reflect our

future contractual obligations or represent the total increase or

decrease in our cash balance for a given period. We believe

non-GAAP free cash flow is a useful indicator of liquidity that

provides information to management and investors about the amount

of cash used in our core operations that, after expenditures for

property and equipment, acquisition-related costs, interest and

payments related to restructuring charges, is not available for

strategic initiatives. During the fourth quarter of 2024, we

revised our definition of non-GAAP free cash flow to exclude

payments related to restructuring charges associated with a

workforce reorganization.

Non-GAAP free cash flow margin.

We define non-GAAP free cash flow margin as non-GAAP free cash flow

as a percentage of revenue.

Non-GAAP sales and marketing expenses,

non-GAAP research and development expenses and non-GAAP general and

administrative expenses. Non-GAAP sales and marketing

expenses, non-GAAP research and development expenses and non-GAAP

general and administrative expenses are defined as sales and

marketing expenses, research and development expenses and general

and administrative expenses, respectively, less stock-based

compensation expense, acquisition-related expenses, restructuring

charges and non-cash gains from lease modifications. We believe

these non-GAAP measures provide our management and investors with

insight into day-to-day operating expenses given that these

measures eliminate the effect of stock-based compensation,

acquisition-related expenses, restructuring charges and non-cash

gains from lease modifications. During the fourth quarter of 2024,

we revised our definition of non-GAAP general and administrative

expenses to exclude restructuring charges associated with a

workforce reorganization, consisting primarily of severance and

other personnel-related costs, and non-cash gain related to an

office lease modification.

Key Business Metrics

Remaining performance obligations

(“RPO”). RPO, or remaining performance obligations,

represents contracted revenue that has not yet been recognized, and

includes deferred revenue and amounts that will be invoiced and

recognized in future periods.

Current remaining performance obligations

(“cRPO”). cRPO, or current RPO, represents contracted

revenue that has not yet been recognized, and includes deferred

revenue and amounts that will be invoiced and recognized in the

next 12 months.

Number of customers contributing more than

$10,000 in ARR. We define number of customers contributing

more than $10,000 in ARR as those on a paid subscription plan that

had more than $10,000 in ARR as of a period end. We view the number

of customers that contribute more than $10,000 in ARR as a measure

of our ability to scale with our customers and attract larger

organizations. We believe this represents potential for future

growth, including expanding within our current customer base.

Number of customers contributing more than

$50,000 in ARR. We define number of customers contributing

more than $50,000 in ARR as those on a paid subscription plan that

had more than $50,000 in ARR as of a period end. We view the number

of customers that contribute more than $50,000 in ARR as a measure

of our ability to scale with large customers and attract

sophisticated organizations. We believe this represents potential

for future growth, including expanding within our current customer

base.

Dollar-based net retention rate.

We calculate dollar-based net retention rate by dividing the ARR

from our customers as of December 31st in the reported year by the

ARR from those same customers as of December 31st in the previous

year. This calculation is net of upsells, contraction, cancellation

or expansion during the period but excludes ARR from new customers.

We use dollar-based net retention to evaluate the long-term value

of our customer relationships, because we believe this metric

reflects our ability to retain and expand subscription revenue

generated from our existing customers.

Dollar-based net retention rate excluding

SMB customers. We calculate dollar-based net retention

rate excluding SMB customers by dividing the ARR from all customers

excluding ARR from customers that we have identified or that

self-identified as having less than 50 employees as of December

31st in the reported year by the ARR from those same customers as

of December 31st of the previous year. This calculation is net of

upsells, contraction, cancellation or expansion during the period

but excludes ARR from new customers. We used dollar-based net

retention excluding SMB customers to evaluate the long-term value

of our larger customer relationships, because we believe this

metric reflects our ability to retain and expand subscription

revenue generated from our existing customers.

While we no longer believe that ARR and number of

customers are key performance indicators of Sprout Social’s

business, these metrics are necessary for an understanding of how

we define number of customers contributing over $10,000 in ARR and

number of customers contributing over $50,000 in ARR. For this

purpose, we define ARR as the annualized revenue run-rate of

subscription agreements from all customers as of the last date of

the specified period and we define a customer as a unique account,

multiple accounts containing a common non-personal email domain, or

multiple accounts governed by a single agreement or entity.

Availability of Information on Sprout

Social’s Website and Social Media Profiles

Investors and others should note that Sprout

Social routinely announces material information to investors and

the marketplace using SEC filings, press releases, public

conference calls, webcasts and the Sprout Social Investors website.

We also intend to use the social media profiles listed below as a

means of disclosing information about us to our customers,

investors and the public. While not all of the information that the

Company posts to the Sprout Social Investors website or to social

media profiles is of a material nature, some information could be

deemed to be material. Accordingly, the Company encourages

investors, the media, and others interested in Sprout Social to

review the information that it shares at the Investors link located

at the bottom of the page on www.sproutsocial.com and to regularly

follow our social media profiles. Users may automatically receive

email alerts and other information about Sprout Social when

enrolling an email address by visiting "Email Alerts" in the

"Shareholder Services" section of Sprout Social's Investor website

at https://investors.sproutsocial.com/.

Social Media Profiles:

www.twitter.com/SproutSocial www.twitter.com/SproutSocialIR www.facebook.com/SproutSocialIncwww.linkedin.com/company/sprout-social-inc-/www.instagram.com/sproutsocial

Contact

Media: Layla Revis Email:

pr@sproutsocial.com Phone: (866) 878-3231

Investors: Alex Kurtz Twitter:

@SproutSocialIR Email: investors@sproutsocial.com Phone: (312)

528-9166

| |

| Sprout

Social, Inc. |

| Consolidated

Statements of Operations (Unaudited) |

| (in

thousands, except share and per share data) |

|

|

|

|

|

| |

Three Months Ended December 31, |

| |

2024 |

|

2023 |

|

Revenue |

|

|

|

|

Subscription |

$ 105,922 |

|

$ 92,224 |

| Professional

services and other |

1,168 |

|

1,360 |

| Total

revenue |

107,090 |

|

93,584 |

| Cost

of revenue(1) |

|

|

|

|

Subscription |

23,094 |

|

20,597 |

| Professional

services and other |

319 |

|

364 |

| Total cost

of revenue |

23,413 |

|

20,961 |

| Gross

profit |

83,677 |

|

72,623 |

|

Operating expenses |

|

|

|

| Research and

development(1) |

27,627 |

|

22,661 |

| Sales and

marketing(1) |

45,889 |

|

47,380 |

| General and

administrative(1) |

23,838 |

|

20,805 |

| Total

operating expenses |

97,354 |

|

90,846 |

| Loss from

operations |

(13,677) |

|

(18,223) |

| Interest

expense |

(656) |

|

(1,544) |

| Interest

income |

878 |

|

1,210 |

| Other

expense, net |

(620) |

|

(118) |

| Loss before

income taxes |

(14,075) |

|

(18,675) |

| Income tax

expense |

342 |

|

1,402 |

| Net

loss |

$ (14,417) |

|

$ (20,077) |

| Net loss per

share attributable to common shareholders, basic and diluted |

$ (0.25) |

|

$ (0.36) |

|

Weighted-average shares outstanding used to compute net loss per

share, basic and diluted |

57,511,942 |

|

56,098,243 |

| |

|

|

|

| (1) Includes

stock-based compensation expense as follows: |

|

|

|

| |

|

| |

Three Months Ended December 31, |

| |

2024 |

|

2023 |

| Cost of

revenue |

$ 1,046 |

|

$ 895 |

| Research and

development |

6,640 |

|

5,529 |

| Sales and

marketing |

7,017 |

|

7,770 |

| General and

administrative |

7,750 |

|

4,465 |

| Total

stock-based compensation expense |

$ 22,453 |

|

$ 18,659 |

| Sprout

Social, Inc. |

| Consolidated

Statements of Operations (Unaudited) |

| (in

thousands, except share and per share data) |

|

|

|

|

|

| |

Twelve Months Ended December 31, |

| |

2024 |

|

2023 |

|

Revenue |

|

|

|

|

Subscription |

$ 402,022 |

|

$ 330,458 |

| Professional

services and other |

3,886 |

|

3,185 |

| Total

revenue |

405,908 |

|

333,643 |

| Cost

of revenue(1) |

|

|

|

|

Subscription |

90,305 |

|

75,076 |

| Professional

services and other |

1,170 |

|

1,192 |

| Total cost

of revenue |

91,475 |

|

76,268 |

| Gross

profit |

314,433 |

|

257,375 |

|

Operating expenses |

|

|

|

| Research and

development(1) |

102,794 |

|

79,550 |

| Sales and

marketing(1) |

184,122 |

|

168,091 |

| General and

administrative(1) |

87,873 |

|

79,011 |

| Total

operating expenses |

374,789 |

|

326,652 |

| Loss from

operations |

(60,356) |

|

(69,277) |

| Interest

expense |

(3,525) |

|

(2,754) |

| Interest

income |

3,973 |

|

7,021 |

| Other

expense, net |

(1,393) |

|

(768) |

| Loss before

income taxes |

(61,301) |

|

(65,778) |

| Income tax

expense |

670 |

|

649 |

| Net

loss |

$ (61,971) |

|

$ (66,427) |

| Net loss per

share attributable to common shareholders, basic and diluted |

$ (1.09) |

|

$ (1.19) |

|

Weighted-average shares outstanding used to compute net loss per

share, basic and diluted |

56,935,910 |

|

55,664,404 |

| |

|

|

|

| (1) Includes

stock-based compensation expense as follows: |

|

|

|

| |

|

| |

Twelve Months Ended December 31, |

| |

2024 |

|

2023 |

| Cost of

revenue |

$ 3,936 |

|

$ 3,224 |

| Research and

development |

25,619 |

|

18,478 |

| Sales and

marketing |

31,544 |

|

30,116 |

| General and

administrative |

23,204 |

|

15,886 |

| Total

stock-based compensation expense |

$ 84,303 |

|

$ 67,704 |

| Sprout

Social, Inc. |

| Consolidated

Balance Sheets (Unaudited) |

| (in

thousands, except share and per share data) |

|

|

|

|

|

| |

|

| |

December 31, 2024 |

|

December 31, 2023 |

|

Assets |

|

|

|

| Current

assets |

|

|

|

|

Cash and cash equivalents |

$ 86,437 |

|

$ 49,760 |

|

Marketable securities |

3,745 |

|

44,645 |

| Accounts

receivable, net of allowances of $2,169 and $2,177 at December 31,

2024 and December 31, 2023, respectively |

84,033 |

|

63,489 |

| Deferred

Commissions |

20,184 |

|

27,725 |

| Prepaid

expenses and other assets |

15,816 |

|

10,324 |

| Total

current assets |

210,215 |

|

195,943 |

| Marketable

securities, noncurrent |

- |

|

3,699 |

| Property and

equipment, net |

10,951 |

|

11,407 |

| Deferred

commissions, net of current portion |

51,653 |

|

26,240 |

| Operating

lease, right-of-use asset |

11,326 |

|

8,729 |

|

Goodwill |

121,315 |

|

121,404 |

| Intangible

assets, net |

21,914 |

|

28,065 |

| Other

assets, net |

967 |

|

1,098 |

| Total

assets |

$ 428,341 |

|

$ 396,585 |

|

Liabilities and Stockholders' Equity |

|

|

|

| Current

liabilities |

|

|

|

| Accounts

payable |

$ 6,984 |

|

$ 6,933 |

| Deferred

revenue |

178,585 |

|

140,536 |

| Operating

lease liability |

3,747 |

|

3,948 |

| Accrued

wages and payroll related benefits |

20,567 |

|

18,362 |

| Accrued

expenses and other |

10,869 |

|

11,260 |

| Total

current liabilities |

220,752 |

|

181,039 |

| Revolving

credit facility |

25,000 |

|

55,000 |

| Deferred

revenue, net of current portion |

1,101 |

|

920 |

| Operating

lease liability, net of current portion |

14,543 |

|

15,083 |

| Other

non-current liabilities |

351 |

|

351 |

| Total

liabilities |

261,747 |

|

252,393 |

| |

|

|

|

|

Stockholders' equity |

|

|

|

| |

|

|

|

| Class A

common stock, par value $0.0001 per share; 1,000,000,000 shares

authorized; 54,219,684 and 51,277,740 shares issued and

outstanding, respectively, at December 31, 2024; 52,133,594 and

49,241,563 shares issued and outstanding, respectively, at December

31, 2023 |

4 |

|

4 |

| Class B

common stock, par value $0.0001 per share; 25,000,000 shares

authorized; 6,687,582 and 6,480,638 shares issued and outstanding,

respectively, at December 31, 2024; 7,201,140 and 6,994,196 shares

issued and outstanding, respectively, at December 31, 2023 |

1 |

|

1 |

| Additional

paid-in capital |

558,391 |

|

471,789 |

| Treasury

stock, at cost |

(37,422) |

|

(35,113) |

| Accumulated

other comprehensive loss |

3 |

|

(77) |

| Accumulated

deficit |

(354,383) |

|

(292,412) |

| Total

stockholders’ equity |

166,594 |

|

144,192 |

| Total

liabilities and stockholders’ equity |

$ 428,341 |

|

$ 396,585 |

| Sprout

Social, Inc. |

| Consolidated

Statements of Cash Flows (Unaudited) |

| (in

thousands) |

|

|

|

|

|

| |

Three Months Ended December 31, |

| |

2024 |

|

2023 |

| Cash

flows from operating activities |

|

|

|

| Net

loss |

$ (14,417) |

|

$ (20,077) |

| Adjustments

to reconcile net loss to net cash provided by operating

activities |

|

|

|

| Depreciation

and amortization of property, equipment and software |

1,064 |

|

835 |

| Amortization

of line of credit issuance costs |

51 |

|

52 |

| Accretion of

discount on marketable securities |

(23) |

|

(470) |

| Amortization

of acquired intangible assets |

1,474 |

|

1,604 |

| Amortization

of deferred commissions |

4,698 |

|

7,518 |

| Amortization

of right-of-use operating lease asset |

467 |

|

425 |

| Stock-based

compensation expense |

22,453 |

|

18,659 |

| Provision

for accounts receivable allowances |

236 |

|

835 |

| Gain on

lease modification |

(1,570) |

|

- |

| Tax expense

due to change in valuation allowance from business acquisition |

- |

|

1,134 |

| Changes in

operating assets and liabilities, excluding impact from business

acquisition |

|

|

|

| Accounts

receivable |

(29,908) |

|

(19,235) |

| Prepaid

expenses and other current assets |

(729) |

|

3,979 |

| Deferred

commissions |

(13,101) |

|

(14,522) |

| Accounts

payable and accrued expenses |

4,650 |

|

(473) |

| Deferred

revenue |

29,475 |

|

18,051 |

| Lease

liabilities |

(678) |

|

(919) |

| Net cash

provided by (used in) operating activities |

4,142 |

|

(2,604) |

| Cash

flows from investing activities |

|

|

|

| Expenditures

for property and equipment |

(888) |

|

(629) |

| Payments for

business acquisition, net of cash acquired |

- |

|

143 |

| Proceeds

from maturity of marketable securities |

4,900 |

|

32,657 |

| Net cash

provided by investing activities |

4,012 |

|

32,171 |

| Cash

flows from financing activities |

|

|

|

| Borrowings

from line of credit |

- |

|

- |

| Repayments

of line of credit |

(5,000) |

|

(20,000) |

| Payments for

line of credit issuance costs |

- |

|

(208) |

| Proceeds

from employee stock purchase plan |

718 |

|

912 |

| Employee

taxes paid related to the net share settlement of stock-based

awards |

(309) |

|

(537) |

| Net cash

used in financing activities |

(4,591) |

|

(19,833) |

| Net increase

in cash, cash equivalents, and restricted cash |

3,563 |

|

9,734 |

|

Cash, cash equivalents, and restricted cash |

|

|

|

| Beginning of

period |

86,855 |

|

43,961 |

| End of

period |

$ 90,418 |

|

$ 53,695 |

| Sprout

Social, Inc. |

| Consolidated

Statements of Cash Flows (Unaudited) |

| (in

thousands) |

| |

|

|

| |

Twelve Months Ended December 31, |

|

|

2024 |

|

2023 |

| Cash

flows from operating activities |

|

|

| Net

loss |

$ (61,971) |

$ (66,427) |

| Adjustments

to reconcile net loss to net cash provided by operating

activities |

|

|

|

Depreciation and amortization of property, equipment and

software |

3,890 |

|

3,137 |

| Amortization

of line of credit issuance costs |

206 |

|

86 |

| Accretion of

discount on marketable securities |

(406) |

|

(3,203) |

| Amortization

of acquired intangible assets |

6,151 |

|

3,541 |

| Amortization

of deferred commissions |

16,347 |

|

26,582 |

| Amortization

of right-of-use operating lease asset |

1,827 |

|

1,553 |

| Stock-based

compensation expense |

84,303 |

|

67,704 |

| Provision

for accounts receivable allowances |

1,709 |

|

2,418 |

| Gain on

lease modification |

(1,570) |

|

- |

| Changes in

operating assets and liabilities, excluding impact from business

acquisition |

|

|

| Accounts

receivable |

(22,253) |

|

(26,982) |

| Prepaid

expenses and other current assets |

(5,452) |

|

444 |

| Deferred

commissions |

(34,219) |

|

(40,540) |

| Accounts

payable and accrued expenses |

3,124 |

|

(226) |

| Deferred

revenue |

38,230 |

|

41,918 |

| Lease

liabilities |

(3,595) |

|

(3,549) |

| Net cash

provided by operating activities |

26,321 |

|

6,456 |

| Cash

flows from investing activities |

|

|

| Expenditures

for property and equipment |

(2,950) |

|

(2,073) |

| Payments for

business acquisition, net of cash acquired |

(1,409) |

|

(145,636) |

| Purchases of

marketable securities |

- |

|

(63,085) |

| Proceeds

from maturity of marketable securities |

45,085 |

|

118,621 |

| Proceeds

from sale of marketable securities |

- |

|

5,538 |

| Net cash

provided by (used in) investing activities |

40,726 |

|

(86,635) |

| Cash

flows from financing activities |

|

|

| Borrowings

from line of credit |

- |

|

75,000 |

| Repayments

of line of credit |

(30,000) |

|

(20,000) |

| Payments for

line of credit issuance costs |

- |

|

(1,031) |

| Proceeds

from exercise of stock options |

29 |

|

29 |

| Proceeds

from employee stock purchase plan |

1,956 |

|

2,339 |

| Employee

taxes paid related to the net share settlement of stock-based

awards |

(2,309) |

|

(2,380) |

| Net cash

(used in) provided by financing activities |

(30,324) |

|

53,957 |

| Net increase

(decrease) in cash, cash equivalents, and restricted cash |

36,723 |

|

(26,222) |

|

Cash, cash equivalents, and restricted cash |

|

|

| Beginning of

period |

53,695 |

|

79,917 |

| End of

period |

$ 90,418 |

|

$ 53,695 |

The following schedule reflects our non-GAAP

financial measures and reconciles our non-GAAP financial measures

to the related GAAP financial measures (in thousands, except per

share data):

|

Reconciliation of Non-GAAP Financial Measures |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Reconciliation of Non-GAAP gross profit |

|

|

|

|

|

|

|

| Gross

profit |

$ 83,677 |

|

$ 72,623 |

|

$ 314,433 |

|

$ 257,375 |

| Stock-based

compensation expense |

1,046 |

|

895 |

|

3,936 |

|

3,224 |

| Amortization

of acquired developed technology |

705 |

|

705 |

|

2,820 |

|

1,175 |

|

Restructuring charges |

62 |

|

- |

|

62 |

|

- |

|

Non-GAAP gross profit |

$ 85,490 |

|

$ 74,223 |

|

$ 321,251 |

|

$ 261,774 |

| |

|

|

|

|

|

|

|

|

Reconciliation of Non-GAAP operating income

(loss) |

|

|

|

|

|

|

| Loss from

operations |

$ (13,677) |

|

$ (18,223) |

|

$ (60,356) |

|

$ (69,277) |

| Stock-based

compensation expense |

22,453 |

|

18,659 |

|

84,303 |

|

67,704 |

|

Acquisition-related expenses |

- |

|

51 |

|

- |

|

4,272 |

| Amortization

of acquired intangible assets |

1,212 |

|

1,213 |

|

4,851 |

|

2,022 |

|

Restructuring charges |

3,020 |

|

- |

|

3,020 |

|

- |

| Gain on

lease modification |

(1,570) |

|

- |

|

(1,570) |

|

- |

|

Non-GAAP operating income |

$ 11,438 |

|

$ 1,700 |

|

$ 30,248 |

|

$ 4,721 |

| |

|

|

|

|

|

|

|

|

Reconciliation of Non-GAAP net income (loss) |

|

|

|

|

|

|

|

| Net

loss |

$ (14,417) |

|

$ (20,077) |

|

$ (61,971) |

|

$ (66,427) |

| Stock-based

compensation expense |

22,453 |

|

18,659 |

|

84,303 |

|

67,704 |

|

Acquisition-related expenses |

- |

|

51 |

|

- |

|

4,272 |

| Amortization

of acquired intangible assets |

1,212 |

|

1,213 |

|

4,851 |

|

2,022 |

|

Restructuring charges |

3,020 |

|

- |

|

3,020 |

|

- |

| Gain on

lease modification |

(1,570) |

|

- |

|

(1,570) |

|

- |

| Tax expense

due to change in valuation allowance from business acquisition |

- |

|

1,134 |

|

- |

|

- |

|

Non-GAAP net income |

$ 10,698 |

|

$ 980 |

|

$ 28,633 |

|

$ 7,571 |

| |

|

|

|

|

|

|

|

|

Reconciliation of Non-GAAP net income (loss) per

share |

|

|

|

|

|

|

| Net loss per

share attributable to common shareholders, basic and diluted |

$ (0.25) |

|

$ (0.36) |

|

$ (1.09) |

|

$ (1.19) |

| Stock-based

compensation expense |

0.39 |

|

0.34 |

|

1.48 |

|

1.22 |

|

Acquisition-related expenses |

- |

|

- |

|

- |

|

0.08 |

| Amortization

of acquired intangible assets |

0.03 |

|

0.02 |

|

0.09 |

|

0.03 |

|

Restructuring charges |

0.05 |

|

- |

|

0.05 |

|

- |

| Gain on

lease modification |

(0.03) |

|

- |

|

(0.03) |

|

- |

| Tax expense

due to change in valuation allowance from business acquisition |

- |

|

0.02 |

|

- |

|

- |

|

Non-GAAP net income per share |

$ 0.19 |

|

$ 0.02 |

|

$ 0.50 |

|

$ 0.14 |

| |

|

|

|

|

|

|

|

|

Reconciliation of Non-GAAP free cash flow |

|

|

|

|

|

|

|

| Net cash

provided by (used in) operating activities |

$ 4,142 |

|

$ (2,604) |

|

$ 26,321 |

|

$ 6,456 |

| Expenditures

for property and equipment |

(888) |

|

(629) |

|

(2,950) |

|

(2,073) |

|

Acquisition-related costs |

- |

|

1,366 |

|

- |

|

4,272 |

| Interest

paid on credit facility |

621 |

|

1,588 |

|

3,635 |

|

1,588 |

| Payments

related to restructuring charges |

2,682 |

|

- |

|

2,682 |

|

- |

|

Non-GAAP free cash flow |

$ 6,557 |

|

$ (279) |

|

$ 29,688 |

|

$ 10,243 |

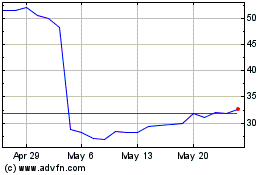

Sprout Social (NASDAQ:SPT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Sprout Social (NASDAQ:SPT)

Historical Stock Chart

From Feb 2024 to Feb 2025