Tractor Supply Company (NASDAQ: TSCO), the largest rural

lifestyle retailer in the United States (the “Company”), today

reported financial results for its fourth quarter and fiscal year

2024 ended December 28, 2024. Comparison period per share amounts

have been retroactively adjusted to reflect the Company’s 5-for-1

stock split, effective December 20, 2024.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250130994126/en/

- Fourth Quarter Net Sales Increased 3.1% with Comparable Store

Sales Increase of 0.6% with Strong Comparable Average Transaction

Growth of 2.3%

- Fiscal Year 2024 Net Sales Increased 2.2% with Comparable Store

Sales Increase of 0.2%

- Fourth Quarter Diluted Earnings per Share (“EPS”) of $0.44 and

Fiscal Year 2024 Diluted EPS of $2.04

- Returned More than $1 Billion to Shareholders through Share

Repurchases and Dividends

- Company Provides Fiscal Year 2025 Guidance with Net Sales

Growth in the Mid-Single Digits and Diluted EPS Outlook of $2.10 to

$2.22

“In 2024, our business performed well in a challenging retail

environment, and we made significant progress on our Life Out Here

strategy. We achieved numerous milestones during the year,

including having about half of our stores in the Project Fusion

layout and opening our 10th and largest distribution center. The

fundamentals of our business remain strong with ongoing market

share gains, record Neighbor’s Club members, digital sales in

excess of one billion dollars and high-return new store openings. I

extend my sincere gratitude to the more than 50,000 Team Members

for their steadfast dedication to upholding our Mission and Values

and supporting their communities,” said Hal Lawton, President and

Chief Executive Officer of Tractor Supply.

“We enter the back half of the decade with momentum and

opportunity. Our existing initiatives are creating value and have

continued runway for growth. Our recently announced Life Out Here

2030 strategy represents significant opportunities to continue to

gain market share in a growing total addressable market. Our

acquisition of Allivet, a leading online pet pharmacy, is a great

example of unlocking new opportunities for growth. We expect our

2025 comparable store sales to improve throughout the year as the

macro headwinds impacting our business abate. We remain excited

about our bright future and are committed to delivering sustained

long-term value creation for our shareholders," said Lawton.

Fourth Quarter 2024

Results

Net sales for the fourth quarter of 2024 increased 3.1% to $3.77

billion from $3.66 billion in the fourth quarter of 2023. The

increase in net sales was driven by new store openings and growth

in comparable store sales. Comparable store sales increased 0.6%,

as compared to the fourth quarter of 2023, driven by a comparable

average transaction count increase of 2.3%, partially offset by a

comparable average ticket decrease of 1.7%. All merchandise

categories performed within a relatively tight band. The growth of

consumable, usable and edible products was in line with the chain

average as positive unit growth was offset by average unit price

pressure.

Gross profit increased 2.8% to $1.33 billion from $1.29 billion

in the prior year’s fourth quarter, and gross margin decreased 9

basis points to 35.2% from 35.3% in the prior year’s fourth

quarter. The Company was lapping its most difficult gross margin

comparison with 129 basis-points of expansion in the prior

year.

Selling, general and administrative (“SG&A”) expenses,

including depreciation and amortization, increased 5.5% to $1.01

billion from $958.8 million in the prior year’s fourth quarter. As

a percentage of net sales, SG&A expenses increased 60 basis

points to 26.8% from 26.2% in the fourth quarter of 2023. The

increase in SG&A as a percent of net sales was primarily

attributable to planned growth investments including higher

depreciation and the onboarding of a new distribution center and

modest deleverage of the Company’s fixed costs given the level of

comparable store sales growth. These factors were partially offset

by a disciplined focus on productivity, ongoing cost control and

modest benefits from the Company’s ongoing sale-leaseback

strategy.

Operating income was $318.3 million in the fourth quarter of

2024 compared to $334.2 million in the fourth quarter of 2023.

The effective income tax rate was 21.5% compared to 23.1% in the

fourth quarter of 2023.

Net income decreased 4.6% to $236.4 million from $247.9 million.

Diluted EPS decreased 3.3% to $0.44 compared to $0.46 in the fourth

quarter of 2023.

The Company repurchased approximately 2.7 million shares of its

common stock for $154.4 million and paid quarterly cash dividends

totaling $117.3 million, returning a total of $271.7 million of

capital to shareholders in the fourth quarter of 2024.

The Company opened 26 new Tractor Supply stores and four

Petsense by Tractor Supply stores in the fourth quarter of

2024.

Fiscal Year 2024 Results

Net sales for fiscal 2024 increased 2.2% to $14.88 billion from

$14.56 billion in fiscal 2023. Comparable store sales increased

0.2% compared to fiscal 2023.

Gross profit increased 3.2% to $5.40 billion from $5.23 billion

in fiscal 2023, and gross margin increased 34 basis points to 36.3%

from 35.9% in fiscal 2023.

SG&A expenses, including depreciation and amortization,

increased 4.8% to $3.93 billion from $3.75 billion in fiscal 2023.

As a percent of net sales, SG&A expenses increased 63 basis

points to 26.4% from 25.8% in fiscal 2023.

Operating income decreased 0.8% to $1.47 billion compared to

$1.48 billion in fiscal 2023.

The effective income tax rate was 22.1% compared to 22.7% in

fiscal 2023.

Net income decreased 0.5% to $1.10 billion from $1.11 billion,

and diluted EPS increased 1.1% to $2.04 from $2.02 in fiscal

2023.

In fiscal 2024, the Company repurchased approximately 10.6

million shares of its common stock for $560.8 million. The Company

also paid quarterly cash dividends totaling $472.5 million during

fiscal 2024, returning $1.03 billion of capital to

shareholders.

During fiscal 2024, the Company opened 80 new Tractor Supply

stores and 11 new Petsense by Tractor Supply stores and closed

three Petsense by Tractor Supply stores.

Fiscal Year 2025 Financial

Outlook

The Company is providing its financial guidance for fiscal 2025.

This outlook is based on what the Company can reasonably predict at

this time.

For fiscal 2025, the Company expects the following:

Net Sales

+5% to +7%

Comparable Store Sales

+1% to +3%

Operating Margin Rate

9.6% to 10.0%

Net Income

$1.12 billion to $1.18

billion

Earnings per Diluted Share

$2.10 to $2.22

Capital Expenditures, Net of Sale

Leaseback Proceeds

$650 million to $725 million

Share Repurchases

$525 million to $600 million

The Company’s operating margin outlook reflects 15 to 20 basis

points of investments for its Life Out Here 2030 strategic

initiatives. Capital plans for 2025 include opening a total of

approximately 90 Tractor Supply stores, continuing Project Fusion

remodels and garden center transformations, building its 11th

distribution center and opening a total of 10 new Petsense by

Tractor Supply stores. The fiscal year 2025 guidance includes

benefits from the Company’s acquisition of Allivet and ongoing

sale-leaseback transactions which the Company anticipates will be

in line with the prior year’s transactions.

Conference Call

Information

Tractor Supply Company will hold a conference call today,

Thursday, January 30, 2025 at 10 a.m. ET. The call will be webcast

live at IR.TractorSupply.com. An investor presentation will be

available on the investor relations section of the Company’s

website at least 15 minutes prior to the conference call.

Please allow extra time prior to the call to visit the site and

download the streaming media software required to listen to the

webcast.

A replay of the webcast will also be available at

IR.TractorSupply.com shortly after the conference call

concludes.

About Tractor Supply

Company

For more than 85 years, Tractor Supply Company (NASDAQ: TSCO)

has been passionate about serving the needs of recreational

farmers, ranchers, homeowners, gardeners, pet enthusiasts and all

those who enjoy living Life Out Here. Tractor Supply is the largest

rural lifestyle retailer in the U.S., ranking 293 on the Fortune

500. The Company’s more than 50,000 Team Members are known for

delivering legendary service and helping customers pursue their

passions, whether that means being closer to the land, taking care

of animals or living a hands-on, DIY lifestyle. In store and

online, Tractor Supply provides what customers need – anytime,

anywhere, any way they choose at the low prices they deserve.

As part of the Company’s commitment to caring for animals of all

kinds, Tractor Supply is proud to include Petsense by Tractor

Supply, a pet specialty retailer, and Allivet, a leading online pet

pharmacy, in its family of brands. Together, Tractor Supply is able

to provide comprehensive solutions for pet care, livestock wellness

and rural living, ensuring customers and their animals thrive. From

its stores to the customer’s doorstep, Tractor Supply is here to

serve and support Life Out Here.

As of December 28, 2024, the Company operated 2,296 Tractor

Supply stores in 49 states and 206 Petsense by Tractor Supply

stores in 23 states. For more information, visit

www.tractorsupply.com and www.Petsense.com.

Forward-Looking

Statements

This press release contains certain forward-looking statements,

including statements regarding market share gains, value creation,

customer trends, new stores and distribution centers, property

development plans, return of capital, and financial guidance for

2025, including net sales, comparable store sales, operating margin

rates, net income, earnings per diluted share, capital expenditures

and plans, share repurchase, and sale-leaseback transactions. All

forward-looking statements are subject to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995,

are subject to the finalization of the Company’s quarterly

financial and accounting procedures, and may be affected by certain

risks and uncertainties, any one, or a combination, of which could

materially affect the results of the Company’s operations.

Forward-looking statements are usually identified by or are

associated with such words as “will,” “would,” “intend,” “expect,”

“continue,” “believe,” “anticipate,” “optimistic,” “forecasted” and

similar terminology. Actual results could vary materially from the

expectations reflected in these statements. As with any business,

all phases of our operations are subject to facts outside of our

control. These factors include, without limitation, those factors

discussed in the “Risk Factors” section of the Company’s Annual

Reports or Form 10-K and other filings with the Securities and

Exchange Commission, including our Quarterly Report on Form 10-Q

for the quarter ended September 28, 2024. Forward-looking

statements made by or on behalf of the Company are based on

knowledge of its business and the environment in which it operates,

but because of the factors listed above, actual results could

differ materially from those reflected by any forward-looking

statements. Consequently, all of the forward-looking statements

made are qualified by these cautionary statements and those

contained in the Company’s Annual Report on Form 10-K, quarterly

reports on Form 10-Q, and other filings with the Securities and

Exchange Commission. There can be no assurance that the results or

developments anticipated by the Company will be realized or, even

if substantially realized, that they will have the expected

consequences to or effects on the Company or its business and

operations. Readers are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date

hereof. The Company does not undertake any obligation to release

publicly any revisions to these forward-looking statements to

reflect events or circumstances after the date hereof or to reflect

the occurrence of unanticipated events, except as required by

law.

(Financial tables to follow)

Consolidated Statements of Income

(Unaudited)

(in thousands, except per

share and percentage data)

Three Months Ended

Year Ended

December 28,

2024

December 30,

2023

December 28,

2024

December 30,

2023

% of

% of

% of

% of

Net

Net

Net

Net

Sales

Sales

Sales

Sales

Net sales

$

3,773,531

100.00

%

$

3,659,841

100.00

%

$

14,883,231

100.00

%

$

14,555,741

100.00

%

Cost of merchandise sold

2,443,901

64.76

2,366,778

64.67

9,486,674

63.74

9,327,522

64.08

Gross profit

1,329,630

35.24

1,293,063

35.33

5,396,557

36.26

5,228,219

35.92

Selling, general and administrative

expenses

891,226

23.62

855,554

23.38

3,481,863

23.39

3,356,258

23.06

Depreciation and amortization

120,055

3.18

103,274

2.82

447,162

3.00

393,049

2.70

Operating income

318,349

8.44

334,235

9.13

1,467,532

9.86

1,478,912

10.16

Interest expense, net

17,203

0.46

11,948

0.33

54,592

0.37

46,510

0.32

Income before income taxes

301,146

7.98

322,287

8.80

1,412,940

9.49

1,432,402

9.84

Income tax expense

64,739

1.72

74,384

2.03

311,700

2.09

325,176

2.23

Net income

$

236,407

6.26

%

$

247,903

6.77

%

$

1,101,240

7.40

%

$

1,107,226

7.61

%

Net income per share:

Basic (a)

$

0.44

$

0.46

$

2.05

$

2.03

Diluted (a)

$

0.44

$

0.46

$

2.04

$

2.02

Weighted average shares

outstanding:

Basic (a)

533,588

540,696

536,949

545,480

Diluted (a)

536,376

544,096

539,652

548,729

Dividends declared per common share

outstanding (a)

$

0.22

$

0.21

$

0.88

$

0.82

Note: Percent of net sales amounts may not

sum to totals due to rounding.

(a) All share and per share information

has been adjusted to reflect the five-for-one stock split effective

December 20, 2024.

Consolidated Statements of Comprehensive

Income

(Unaudited)

(in thousands)

Three Months Ended

Year Ended

December 28,

2024

December 30,

2023

December 28,

2024

December 30,

2023

Net income

$

236,407

$

247,903

$

1,101,240

$

1,107,226

Other comprehensive (loss) / income:

Change in fair value of interest rate

swaps, net of taxes

(1,333

)

(2,499

)

(5,576

)

(4,482

)

Total other comprehensive (loss) /

income

(1,333

)

(2,499

)

(5,576

)

(4,482

)

Total comprehensive income

$

235,074

$

245,404

$

1,095,664

$

1,102,744

Consolidated Balance Sheets

(Unaudited)

(in thousands)

December 28,

2024

December 30,

2023

ASSETS

Current assets:

Cash and cash equivalents

$

251,491

$

397,071

Inventories

2,840,177

2,645,854

Prepaid expenses and other current

assets

196,614

218,553

Income taxes receivable

21,635

2,461

Total current assets

3,309,917

3,263,939

Property and equipment, net

2,727,436

2,437,184

Operating lease right-of-use assets

3,415,444

3,141,971

Goodwill and other intangible assets

269,520

269,520

Other assets

83,168

75,537

Total assets

$

9,805,485

$

9,188,151

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

1,236,177

$

1,179,803

Accrued employee compensation

100,853

91,478

Other accrued expenses

581,971

533,029

Current portion of finance lease

liabilities

3,300

3,311

Current portion of operating lease

liabilities

396,892

369,461

Total current liabilities

2,319,193

2,177,082

Long-term debt

1,831,969

1,728,964

Finance lease liabilities, less current

portion

27,983

31,388

Operating lease liabilities, less current

portion

3,164,273

2,902,858

Deferred income taxes

44,320

60,032

Other long-term liabilities

147,413

138,065

Total liabilities

7,535,151

7,038,389

Stockholders’ equity:

Common stock (a)

7,116

7,093

Additional paid-in capital (a)

1,376,532

1,312,772

Treasury stock

(6,025,238

)

(5,458,855

)

Accumulated other comprehensive income

1,217

6,793

Retained earnings

6,910,707

6,281,959

Total stockholders’ equity

2,270,334

2,149,762

Total liabilities and stockholders’

equity

$

9,805,485

$

9,188,151

(a) Common stock and Additional paid-in

capital balances have been adjusted to reflect the five-for-one

stock split effective December 20, 2024.

Consolidated Statements of Cash Flows

(Unaudited)

(in thousands)

Year Ended

December 28,

2024

December 30,

2023

Cash flows from operating

activities:

Net income

$

1,101,240

$

1,107,226

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

447,162

393,049

Gain on disposition of property and

equipment

(62,500

)

(48,013

)

Share-based compensation expense

48,367

57,015

Deferred income taxes

(22,602

)

6,172

Change in assets and liabilities:

Inventories

(194,323

)

40,872

Prepaid expenses and other current

assets

11,484

22,380

Accounts payable

56,374

(218,829

)

Accrued employee compensation

9,375

(31,498

)

Other accrued expenses

20,917

(13,082

)

Income taxes

(19,174

)

(11,931

)

Other

24,515

30,672

Net cash provided by operating

activities

1,420,835

1,334,033

Cash flows from investing

activities:

Capital expenditures

(784,047

)

(753,883

)

Proceeds from sale of property and

equipment

140,129

86,504

Proceeds from sale of business assets

—

14,310

Net cash used in investing activities

(643,918

)

(653,069

)

Cash flows from financing

activities:

Borrowings under debt facilities

785,000

1,767,000

Repayments under debt facilities

(685,000

)

(1,195,000

)

Debt discounts and issuance costs

—

(9,729

)

Principal payments under finance lease

liabilities

(4,787

)

(4,808

)

Repurchase of shares to satisfy tax

obligations

(23,941

)

(24,245

)

Repurchase of common stock

(560,634

)

(594,390

)

Net proceeds from issuance of common

stock

39,357

24,397

Cash dividends paid to stockholders

(472,492

)

(449,620

)

Net cash used in financing activities

(922,497

)

(486,395

)

Net (decrease)/increase in cash and

cash equivalents

(145,580

)

194,569

Cash and cash equivalents at beginning of

period

397,071

202,502

Cash and cash equivalents at end of

period

$

251,491

$

397,071

Supplemental disclosures of cash flow

information:

Cash paid during the period for:

Interest, net of amounts capitalized

$

65,865

$

56,315

Income taxes cash paid

351,464

325,222

Supplemental disclosures of non-cash

activities:

Non-cash accruals for property and

equipment

$

82,324

$

60,055

Increase in operating lease liabilities

resulting from new or modified right-of-use assets

659,008

628,991

Increase in finance lease liabilities

resulting from new or modified right-of-use assets

—

450

Selected

Financial and Operating Information

(Unaudited)

Three Months Ended

Year Ended

December 28,

2024

December 30,

2023

December 28,

2024

December 30,

2023

Sales Information:

Comparable store sales increase

(decrease)

0.6

%

(4.2

)%

0.2

%

—

%

New store sales (% of total sales)

2.0

%

4.2

%

2.0

%

4.5

%

Average transaction value

$

59.39

$

60.48

$

60.20

$

60.67

Comparable store average transaction value

(decrease)/increase (a)

(1.7

)%

(1.5

)%

(0.6

)%

0.4

%

Comparable store average transaction count

increase

2.3

%

(2.7

)%

0.8

%

(0.4

)%

Total selling square footage (000’s)

39,105

38,476

39,105

38,476

Exclusive brands (% of total sales)

29.3

%

29.6

%

28.6

%

28.6

%

Imports (% of total sales)

14.8

%

14.8

%

11.9

%

12.2

%

Store Count Information:

Tractor

Supply

Beginning of period

2,270

2,198

2,216

2,147

New stores opened

26

19

80

70

Stores closed

—

(1

)

—

(1

)

End of period

2,296

2,216

2,296

2,216

Petsense by Tractor

Supply

Beginning of period

205

195

198

186

New stores opened

4

3

11

13

Stores closed

(3

)

—

(3

)

(1

)

End of period

206

198

206

198

Consolidated end of period

2,502

2,414

2,502

2,414

Pre-opening costs (000’s)

$

2,865

$

2,493

$

9,718

$

13,178

Balance Sheet Information:

Average inventory per store (000’s)

(b)

$

1,063.7

$

1,026.0

$

1,063.7

$

1,026.0

Inventory turns (annualized)

3.34

3.51

3.30

3.49

Share repurchase program:

Cost (000’s) (c)

$

155,909

$

111,553

$

566,383

$

602,947

Average purchase price per share (d)

$

56.42

$

40.76

$

53.03

$

43.71

(a) Comparable store average

transaction value changes include the impact of transaction value

changes achieved on the current period change in transaction

count.

(b) Assumes average inventory

cost, excluding inventory in transit.

(c) Effective January 1, 2023,

the Company’s share repurchases are subject to a 1% excise tax as a

result of the Inflation Reduction Act of 2022. Excise taxes

incurred on share repurchases represent direct costs of the

repurchase and are recorded as a part of the cost basis of the

shares within treasury stock.

(d) Average purchase price per

share amounts adjusted to reflect the 5-for-1 forward stock split

effective December 20, 2024.

Note: Comparable store metrics

percentages may not sum to total due to rounding.

Three Months Ended

Year Ended

December 28, 2024

December 30, 2023

December 28, 2024

December 30, 2023

Capital Expenditures

(millions):

Existing stores

$

74.2

$

83.8

$

284.0

$

330.0

New stores, relocated stores and stores

not yet opened

62.4

58.3

241.2

130.6

Information technology

57.7

48.2

153.5

134.6

Distribution center capacity and

improvements

50.6

35.8

95.8

156.2

Corporate and other

1.1

1.1

9.5

2.5

Total

$

246.0

$

227.2

$

784.0

$

753.9

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250130994126/en/

Investors Mary Winn Pilkington (615) 440-4212 Joseph Underwood

(615) 440-4658 investorrelations@tractorsupply.com Media Tricia

Whittemore (615) 440-4410

corporatecommunications@tractorsupply.com

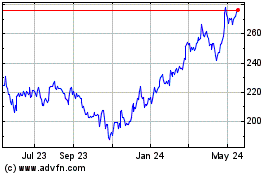

Tractor Supply (NASDAQ:TSCO)

Historical Stock Chart

From Jan 2025 to Feb 2025

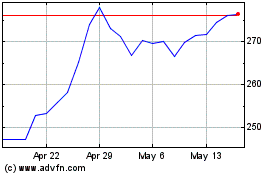

Tractor Supply (NASDAQ:TSCO)

Historical Stock Chart

From Feb 2024 to Feb 2025