The Trade Desk also announced an additional

share repurchase authorization, bringing the total amount of

authorized future repurchases to $1 billion of its Class A common

stock.

The Trade Desk, Inc. (“The Trade Desk,” the “Company” or “we”)

(NASDAQ: TTD), a provider of a global technology platform for

buyers of advertising, today announced financial results for its

fourth quarter and fiscal year ended December 31, 2024.

“The Trade Desk once again outpaced nearly every segment of

digital advertising in 2024, delivering $2.4 billion of revenue –

marking accelerated growth of 26% year over year – and a record $12

billion of spend on our platform. At the same time, we achieved

significant profitability and cash flow. While we are proud of

these accomplishments, we are disappointed that we fell short of

our own expectations in the fourth quarter,” said Jeff Green,

founder and CEO of The Trade Desk. “In December, we undertook a

reorganization to accelerate opportunities across CTV, retail

media, identity, supply chain optimization, and audio while forging

ahead with innovations like Kokai and the Ventura Operating System.

As more of the world’s leading advertisers shift to premium

scalable channels in contrast to the limitations of user-generated

content, the opportunity ahead is immense. In 2025 and beyond, we

are uniquely positioned to help our clients take full advantage of

data-driven advertising on the premium internet, helping them drive

growth and brand loyalty for their businesses.”

Fourth Quarter and Full Year 2024

Financial Highlights:

The following table summarizes the Company’s unaudited

consolidated financial results for the three and twelve months

ended December 31, 2024 and 2023 ($ in millions, except per share

amounts):

Three Months Ended

December 31,

Year Ended

December 31,

2024

2023

2024

2023

GAAP Results

Revenue

$

741

$

606

$

2,445

$

1,946

Increase in revenue year over year

22

%

23

%

26

%

23

%

Net income

$

182

$

97

$

393

$

179

Net income margin

25

%

16

%

16

%

9

%

GAAP diluted earnings per share

$

0.36

$

0.19

$

0.78

$

0.36

Non-GAAP Results

Adjusted EBITDA

$

350

$

284

$

1,011

$

772

Adjusted EBITDA margin

47

%

47

%

41

%

40

%

Non-GAAP net income

$

297

$

207

$

832

$

628

Non-GAAP diluted earnings per share

$

0.59

$

0.41

$

1.66

$

1.26

Fourth Quarter and 2024 Recent Business

Highlights

- Continued Share Gains: 2024 gross spend of $12

billion.

- Strong Customer Retention: Customer retention remained

over 95% during the year, as it has for the past eleven consecutive

years.

- Continued Collaboration and Support for Unified ID 2.0:

The Trade Desk is building support for Unified ID 2.0 (UID2), an

industry-wide approach to identity that preserves the value of

relevant advertising while putting user control and privacy at the

forefront. UID2 is an upgrade and alternative to third-party

cookies. Recent partnerships and pledges of integration and support

include:

- iHeartMedia announced its adoption of UID2 to empower its

advertising partners with tools for effective targeting, precise

measurement, and accurate attribution.

- Leading supply-side platforms, including FreeWheel, Index

Exchange, Magnite, and PubMatic have integrated European Unified ID

(EUID) to enhance addressability across the open internet.

- “Ventura”, a Revolutionary Streaming TV Operating System

(OS): Ventura represents a major advance in streaming TV

operating systems as it solves key issues with prevailing market

systems today, including frustrating user experiences, inefficient

advertising supply chains and content conflicts-of-interest. The

Trade Desk plans to partner with TV original equipment

manufacturers (OEMs) and other distribution partners to deploy the

Ventura OS.

- Agreement to Acquire Sincera: Sincera is a leading

digital advertising data company that provides objective,

actionable insights to the advertising ecosystem. Integration of

Sincera’s tools with The Trade Desk platform will help advertisers

gain a clearer perspective on what they are buying so they may

better value those impressions. With this acquisition, The Trade

Desk’s platform will also show publishers which data signals are

most highly valued by advertisers. As previously announced, the

acquisition is subject to customary closing conditions and is

expected to close in the first quarter of 2025.

- Industry Recognition (2024):

- Institutional Investor Awards - Most Honored Company, Best CEO,

Best Company Board, Best IR Program, Best IR Professional, Best IR

Team, Best Analyst Day

- U.S. News & World Report - Best Company To Work For

- Business Insider Rising Stars of Adtech

- AdExchanger Top Women in Media & Ad Tech

- MM+M 40 under 40

- Retail TouchPoints 40 under 40

Financial Guidance:

First Quarter 2025 outlook summary:

- Revenue at least $575 million

- Adjusted EBITDA of approximately $145 million

The Company has not provided an outlook for GAAP net income or

reconciliation of Adjusted EBITDA guidance to net income, the

closest corresponding U.S. GAAP measure, because net income outlook

is not available without unreasonable efforts on a forward-looking

basis due to the variability and complexity with respect to the

charges included in the calculation of this non-GAAP measure; in

particular, the measures and effects of our stock-based

compensation expense that are directly impacted by unpredictable

fluctuations in our share price. The Company expects the

variability of the above charges could have a significant and

potentially unpredictable impact on our future U.S. GAAP financial

results.

Use of Non-GAAP Financial

Information

Included within this press release are the non-GAAP financial

measures of Adjusted EBITDA, Adjusted EBITDA margin, Non-GAAP net

income and Non-GAAP diluted earnings per share (“EPS”) that

supplement the Consolidated Statements of Operations of the

“Company” prepared under generally accepted accounting principles

(“GAAP”). Adjusted EBITDA is net income before depreciation and

amortization expense; stock-based compensation expense; interest

income, net; and provision for income taxes. Adjusted EBITDA margin

is Adjusted EBITDA divided by revenue, and Adjusted EBITDA margin’s

closest corresponding U.S. GAAP measure is net income margin, which

is GAAP net income divided by revenue. Non-GAAP net income excludes

charges and the related income tax effects for stock-based

compensation. Tax rates on the tax-deductible portions of the

stock-based compensation expense approximating 25% to 30% have been

used in the computation of non-GAAP net income and non-GAAP diluted

EPS. Reconciliations of GAAP to non-GAAP amounts for the periods

presented herein are provided in schedules accompanying this

release and should be considered together with the Consolidated

Statements of Operations. These non-GAAP measures are not meant as

a substitute for GAAP, but are included solely for informational

and comparative purposes. The Company’s management believes that

this information can assist investors in evaluating the Company's

operational trends, financial performance, and cash-generating

capacity. Management believes these non-GAAP measures allow

investors to evaluate the Company’s financial performance using

some of the same measures as management. However, the non-GAAP

financial measures should not be regarded as a replacement for or

superior to corresponding, similarly captioned, GAAP measures and

may be different from non-GAAP financial measures used by other

companies.

Fourth Quarter and Fiscal Year 2024

Financial Results Webcast and Conference Call

Details

- When: February 12, 2025 at 2:00 P.M. Pacific Time (5:00

P.M. Eastern Time).

- Webcast: A live webcast of the call can be accessed from

the Investor Relations section of The Trade Desk’s website at

http://investors.thetradedesk.com/. Following the call, a replay

will be available on the Company’s website.

- Dial-in: To access the call via telephone in North

America, please dial 888-506-0062. For callers outside the United

States, please dial 1-973-528-0011. Participants should reference

the conference call ID code “277752” after dialing in.

- Audio replay: An audio replay of the call will be

available beginning about two hours after the call. To listen to

the replay in the United States, please dial 877-481-4010 (replay

code: 51930). Outside the United States, please dial 1-919-882-2331

(replay code: 51930). The audio replay will be available via

telephone until February 19, 2025.

The Trade Desk, Inc. uses its Investor Relations website

(http://investors.thetradedesk.com/), its X feed (@TheTradeDesk),

LinkedIn page (https://www.linkedin.com/company/the-trade-desk/),

Facebook page (https://www.facebook.com/TheTradeDesk/) and Jeff

Green’s LinkedIn profile (https://www.linkedin.com/in/jefftgreen/)

as a means of disclosing information about the Company and for

complying with its disclosure obligations under Regulation FD. The

information that is posted through these channels may be deemed

material. Accordingly, investors should monitor these channels in

addition to The Trade Desk’s press releases, SEC filings, public

conference calls and webcasts.

Share Repurchase Program

The Company used approximately $57 million of cash to repurchase

its Class A common stock in the fourth quarter of 2024. The Company

used approximately $235 million of cash to repurchase its Class A

common stock in the year ended December 31, 2024, at an average

repurchase price of $93.97. As of December 31, 2024, the Company

had approximately $464 million available and authorized for

repurchases. In January 2025, the Company repurchased approximately

$28 million of its Class A common stock.

The Company also announced that its board of directors approved

an additional $564 million under its share repurchase program

pursuant to which the Company may purchase its outstanding Class A

Common Stock, bringing the total amount for future repurchases to

$1 billion. This program does not obligate the Company to acquire

any particular amount of Class A Common Stock, and may be modified,

suspended or terminated at any time at the discretion of the

Company’s board of directors.

About The Trade Desk

The Trade Desk™ is a technology company that empowers buyers of

advertising. Through its self-service, cloud-based platform, ad

buyers can create, manage, and optimize digital advertising

campaigns across ad formats and devices. Integrations with major

data, inventory, and publisher partners ensure maximum reach and

decisioning capabilities, and enterprise APIs enable custom

development on top of the platform. Headquartered in Ventura, CA,

The Trade Desk has offices across North America, Europe and Asia

Pacific. To learn more, visit thetradedesk.com or follow us on

Facebook, X, LinkedIn and YouTube.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. These statements relate to expectations concerning matters

that (a) are not historical facts, (b) predict or forecast future

events or results, or (c) embody assumptions that may prove to have

been inaccurate, including statements relating to industry and

market trends, the Company’s growth and financial targets, such as

revenue and Adjusted EBITDA and the amount, timing and sources of

funding for the Company’s share repurchase program. When words such

as “believe,” “expect,” “anticipate,” “will,” “outlook” or similar

expressions are used, the Company is making forward-looking

statements. Although the Company believes that the expectations

reflected in such forward-looking statements are reasonable, it

cannot give readers any assurance that such expectations will prove

correct. These forward-looking statements involve risks,

uncertainties and assumptions, including those related to the

Company’s relatively limited operating history, which makes it

difficult to evaluate the Company’s business and prospects, the

market for programmatic advertising developing slower or

differently than the Company’s expectations, the demands and

expectations of clients and the ability to attract and retain

clients. The actual results may differ materially from those

anticipated in the forward-looking statements as a result of

numerous factors, many of which are beyond the control of the

Company. These are disclosed in the Company’s reports filed from

time to time with the Securities and Exchange Commission, including

its most recent Form 10-K and any subsequent filings on Forms 10-Q

or 8-K, available at www.sec.gov. Readers are urged not to place

undue reliance on these forward-looking statements, which speak

only as of the date of this press release. The Company does not

intend to update any forward-looking statement contained in this

press release to reflect events or circumstances arising after the

date hereof.

THE TRADE DESK, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Amounts in thousands, except

per share amounts)

(Unaudited)

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

Revenue

$

741,012

$

605,797

$

2,444,831

$

1,946,120

Operating expenses (1):

Platform operations

135,267

100,695

472,012

365,598

Sales and marketing

150,629

126,793

546,517

447,970

Technology and development

127,893

102,004

463,319

411,794

General and administrative

131,914

131,867

535,816

520,278

Total operating expenses

545,703

461,359

2,017,664

1,745,640

Income from operations

195,309

144,438

427,167

200,480

Total other income, net

(26,290

)

(16,238

)

(80,135

)

(67,515

)

Income before income taxes

221,599

160,676

507,302

267,995

Provision for income taxes

39,370

63,353

114,226

89,055

Net income

$

182,229

$

97,323

$

393,076

$

178,940

Earnings per share:

Basic

$

0.37

$

0.20

$

0.80

$

0.37

Diluted

$

0.36

$

0.19

$

0.78

$

0.36

Weighted-average shares outstanding:

Basic

493,958

489,454

490,879

489,261

Diluted

506,843

499,682

501,924

500,182

___________________________ (1) Includes

stock-based compensation expense as follows:

THE TRADE DESK, INC.

STOCK-BASED COMPENSATION

EXPENSE

(Amounts in thousands)

(Unaudited)

Three Months Ended

December 31,

Year Ended December

31,

2024

2023

2024

2023

Platform operations

$

8,866

$

6,406

$

29,310

$

21,048

Sales and marketing

28,481

21,885

99,135

75,924

Technology and development

40,952

29,540

138,393

120,823

General and administrative (1)

50,930

63,604

227,861

273,826

Total

$

129,229

$

121,435

$

494,699

$

491,621

___________________________ (1) Includes

stock-based compensation expense related to a long-term CEO

performance grant of $27 million and $42 million for the three

months ended December 31, 2024 and 2023, respectively, as well as

$128 million and $198 million for the twelve months ended December

31, 2024 and 2023, respectively.

THE TRADE DESK, INC.

CONSOLIDATED BALANCE

SHEETS

(Amounts in thousands)

(Unaudited)

As of December 31,

2024

As of December 31,

2023

ASSETS

Current assets:

Cash and cash equivalents

$

1,369,463

$

895,129

Short-term investments, net

552,026

485,159

Accounts receivable, net

3,330,343

2,870,313

Prepaid expenses and other current

assets

84,626

63,353

Total current assets

5,336,458

4,313,954

Property and equipment, net

209,332

161,422

Operating lease assets

263,761

197,732

Deferred income taxes

230,214

154,849

Other assets, non-current

72,186

60,730

Total assets

$

6,111,951

$

4,888,687

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

2,631,213

$

2,317,318

Accrued expenses and other current

liabilities

177,760

137,996

Operating lease liabilities

64,492

55,524

Total current liabilities

2,873,465

2,510,838

Operating lease liabilities,

non-current

247,723

180,369

Other liabilities, non-current

41,618

33,261

Total liabilities

3,162,806

2,724,468

Stockholders' equity:

Preferred stock

—

—

Common stock

—

—

Additional paid-in capital

2,594,896

1,967,265

Retained earnings

354,249

196,954

Total stockholders' equity

2,949,145

2,164,219

Total liabilities and stockholders'

equity

$

6,111,951

$

4,888,687

THE TRADE DESK, INC.

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(Amounts in thousands)

(Unaudited)

Year Ended December

31,

2024

2023

OPERATING ACTIVITIES:

Net income

$

393,076

$

178,940

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

87,490

80,418

Stock-based compensation

494,699

491,621

Deferred income taxes

(76,903

)

(61,597

)

Noncash lease expense

57,403

48,955

Provision for expected credit losses on

accounts receivable

853

2,960

Other

(7,881

)

(20,379

)

Changes in operating assets and

liabilities:

Accounts receivable

(474,227

)

(554,012

)

Prepaid expenses and other current and

non-current assets

(38,783

)

(26,815

)

Accounts payable

298,919

475,463

Accrued expenses and other current and

non-current liabilities

46,564

35,681

Operating lease liabilities

(41,754

)

(52,913

)

Net cash provided by operating

activities

739,456

598,322

INVESTING ACTIVITIES:

Purchases of investments

(679,539

)

(608,379

)

Maturities of investments

629,088

555,806

Purchases of property and equipment

(98,238

)

(46,790

)

Capitalized software development costs

(8,824

)

(8,230

)

Net cash used in investing activities

(157,513

)

(107,593

)

FINANCING ACTIVITIES:

Repurchases of Class A common stock

(234,784

)

(646,597

)

Proceeds from exercise of stock

options

216,281

60,525

Proceeds from employee stock purchase

plan

49,989

38,482

Taxes paid related to net settlement of

restricted stock awards

(139,095

)

(78,516

)

Net cash used in financing activities

(107,609

)

(626,106

)

Increase (decrease) in cash and cash

equivalents

474,334

(135,377

)

Cash and cash equivalents—Beginning of

year

895,129

1,030,506

Cash and cash equivalents—End of year

$

1,369,463

$

895,129

Non-GAAP Financial Metrics

(Amounts in thousands, except per share

amounts)

(Unaudited)

The following tables show the Company’s

non-GAAP financial metrics reconciled to the comparable GAAP

financial metrics included in this release.

Three Months Ended

December 31,

Year Ended

December 31,

2024

2023

2024

2023

Net income

$

182,229

$

97,323

$

393,076

$

178,940

Add back (deduct):

Depreciation and amortization expense

24,112

20,529

87,490

80,418

Stock-based compensation expense

129,229

121,435

494,699

491,621

Interest income, net

(24,956

)

(18,952

)

(78,842

)

(68,508

)

Provision for income taxes

39,370

63,353

114,226

89,055

Adjusted EBITDA

$

349,984

$

283,688

$

1,010,649

$

771,526

Three Months Ended

December 31,

Year Ended

December 31,

2024

2023

2024

2023

GAAP net income

$

182,229

$

97,323

$

393,076

$

178,940

Add back (deduct):

Stock-based compensation expense

129,229

121,435

494,699

491,621

Adjustment for income taxes

(14,733

)

(11,896

)

(55,472

)

(42,462

)

Non-GAAP net income

$

296,725

$

206,862

$

832,303

$

628,099

GAAP diluted earnings per share

$

0.36

$

0.19

$

0.78

$

0.36

GAAP weighted-average shares

outstanding—diluted

506,843

499,682

501,924

500,182

Non-GAAP diluted earnings per share

$

0.59

$

0.41

$

1.66

$

1.26

Non-GAAP weighted-average shares used in

computing Non-GAAP earnings per share, diluted

506,843

499,682

501,924

500,182

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250212539982/en/

Investors Jake Graves Senior Manager, Investor Relations

The Trade Desk ir@thetradedesk.com

Media Melinda Zurich VP, Communications The Trade Desk

melinda.zurich@thetradedesk.com

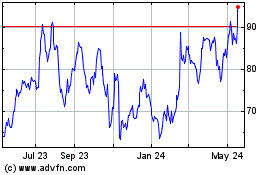

The Trade Desk (NASDAQ:TTD)

Historical Stock Chart

From Jan 2025 to Feb 2025

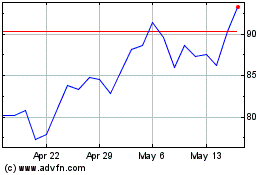

The Trade Desk (NASDAQ:TTD)

Historical Stock Chart

From Feb 2024 to Feb 2025