UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN

PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2023

Commission File Number: 001-39155

XP Inc.

(Exact name of registrant as specified in its

charter)

20, Genesis Close

Grand Cayman, George Town

Cayman Islands KY-1-1208

+55 (11) 3075-0429

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

XP Inc. |

| |

|

|

| |

|

|

| |

By: |

/s/ Bruno Constantino Alexandre dos Santos |

| |

|

Name: |

Bruno Constantino Alexandre dos Santos |

| |

|

Title: |

Chief Financial Officer |

Date: September 22, 2023

EXHIBIT INDEX

Exhibit 99.1

XP Inc.

(the “Company”)

NOTICE OF ANNUAL GENERAL MEETING OF THE COMPANY

________________________________________________________________________________

NOTICE IS HEREBY GIVEN that an Annual General

Meeting of the Company (the “AGM”) will be held at the offices of the Company located at Av. Chedid Jafet, 75, Torre

Sul, 30th Floor, Vila Olímpia, São Paulo SP 04551-065, Brazil on October 6, 2023 at 10:00 am (BRT).

The AGM will be held at the offices of the Company

in accordance with Cayman Islands law. Shareholders are able to submit a proxy or, if they wish to attend in person, to participate in

the AGM by physically attending the offices of the Company or attending in a virtual form. The details of how to participate virtually

at the AGM are set out in the accompanying proxy card.

The AGM will be held for the purpose of considering

and, if thought fit, passing and approving the following resolutions:

| 1 | To resolve, as an ordinary resolution, the Company’s financial statements and the auditor’s

report for the fiscal year ended December 31, 2022 in the form presented at the AGM, be approved and ratified. |

| 2 | To resolve, as an ordinary resolution, that Frederico Seabra de Carvalho be appointed as an independent

director of the Company to serve in accordance with the memorandum and articles of association of the Company. |

| 3 | To resolve, as an ordinary resolution, that each of Guilherme Dias Fernandes Benchimol, Bruno Constantino

Alexandre dos Santos, Bernardo Amaral Botelho, Fabrício Cunha de Almeida, Martin Emiliano Escobari Lifchitz, Gabriel Klas da Rocha

Leal, Luiz Felipe Amaral Calabró and Cristiana Pereira be re-appointed as directors of the Company to serve in accordance with

the memorandum and articles of association of the Company. |

| 4 | To resolve, as a special resolution, that the Second Amended and Restated Memorandum and Articles of Association

of the Company currently in effect be amended and restated by the deletion in their entirety and the substitution in their place of the

Third Amended and Restated Memorandum and Articles of Association in the form uploaded to the Investor Relations section of the Company's

website on or before the date of the Notice of the AGM. |

The AGM will also serve as an

opportunity for shareholders to discuss Company affairs with management.

The Board of Directors of the

Company (the “Board”) has fixed the close of business Eastern Time on September 8, 2023 as the record date (the “Record

Date”) for determining the shareholders of the Company entitled to receive notice of the AGM or any adjournment thereof. The

holders of record of the Class A common shares and the Class B common shares of the Company as at the close of business on the Record

Date are entitled to receive notice of and attend the AGM and any adjournment thereof.

The Board recommends that shareholders

of the Company vote “FOR” the resolutions at the AGM. Your vote is very important to the Company.

Whether or not you plan to attend

the AGM, please promptly complete, date, sign and return the enclosed proxy card attached to this Notice.

By Order of the Board of Directors

| /s/ Guilherme Benchimol |

|

| Name: |

Guilherme Benchimol |

|

| Title: |

Director |

|

| Dated: |

September 22, 2023 |

|

Registered Office:

c/o Maples Corporate Services Limited

PO Box 309, Ugland House

Grand Cayman

KY1-1104

Cayman Islands

NOTES

IF YOU HAVE EXECUTED A STANDING PROXY, YOUR

STANDING PROXY WILL BE VOTED AS INDICATED IN NOTE 2 BELOW, UNLESS YOU ATTEND THE AGM IN PERSON OR SEND IN A SPECIFIC PROXY.

| 1 | A proxy need not be a shareholder of the Company. A shareholder entitled to attend and vote at the AGM

is entitled to appoint one or more proxies to attend and vote in his/her stead. |

| 2 | Any standing proxy previously deposited by a shareholder with the Company will be voted in favor of the

resolution to be proposed at the AGM unless revoked prior to the AGM or the shareholder attends the AGM in person or executes a specific

proxy. |

| 3 | If two or more persons are jointly registered as holders of a share, the vote of the senior person who

tenders a vote, whether in person or by proxy, shall be accepted to the exclusion of the votes of other joint holders. For this purpose,

seniority shall be determined by the order in which the names stand on the Company’s register of shareholders in respect of the

relevant shares. |

| 4 | Each Class A Common Share shall entitle the holder to one (1) vote on all matters subject to a vote at

general meetings of the Company, and each Class B Common Share shall entitle the holder to ten (10) votes on all matters subject to a

vote at general meetings of the Company. |

| 5 | A shareholder holding more than one share entitled to attend and vote at the AGM need not cast the votes

in respect of such shares in the same way on any resolution and therefore may vote a share or some or all such shares either for or against

a resolution and/or abstain from voting a share or some or all of the shares and, subject to the terms of the instrument appointing any

proxy, a proxy appointed under one or more instruments may vote a share or some or all of the shares in respect of which he is appointed

either for or against a resolution and/or abstain from voting. |

| 6 | No business shall be transacted at the AGM unless a quorum is present. As set out in the Memorandum and

Articles of Association of the Company, one or more shareholders holding not less than 50% in aggregate of the voting power of all shares

in issue and entitled to vote, present in person or by proxy or, if a corporation or other non-natural person, by its duly authorized

representative, constitutes a quorum of the shareholders. No person shall be entitled to vote at the AGM unless he is registered as a

shareholder of the Company on the record date for the AGM nor unless all calls or other sums presently payable by him in respect of such

shares have been paid. |

Schedule

Frederico

Seabra de Carvalho is a member of our board of directors, a position he has held since July 2023. Mr. Carvalho is an Operating

Partner at General Atlantic since September 2012, where he provides strategic support and financial expertise to the firm’s investment

teams and portfolio companies with a focus on Latin America. Before joining General Atlantic, Mr. Carvalho served as Chief Operating Officer

of the Merchant Banking division at BTG Pactual Group from April 2011 to September 2012. Previously, he was a Partner in Deloitte’s

Transaction Services group in São Paulo, leading deal advisory, corporate reorganization, and diligence services for major private

equity investors and strategic clients in Brazil. Mr. Carvalho holds a bachelor’s degree in economics from Universidade de Brasilia,

a bachelor’s degree in law and a master’s degree in tax law and taxation from UDF Centro Universitário and an LL.M.

in taxation from Boston University.

Guilherme

Dias Fernandes Benchimol is the chairman of our board of directors, a position he has held since August 2019. Mr. Benchimol

has over 20 years’ experience in the financial services market. He founded the XP group in 2001 and has been its chief executive

officer since 2001. Mr. Benchimol also served on the board of XP Brazil as the chairman from August 2018 to November 2019. Mr. Benchimol

holds a bachelor’s degree in business economics from Universidade Federal do Rio de Janeiro.

Bruno

Constantino Alexandre dos Santos is a member of our board of directors, a position he has held since November 2019 and our

chief financial officer, a position he has held since November 2019. Mr. Constantino has over 20 years’ experience in the financial

markets. He joined XP CCTVM in 2012 and has been its executive officer since 2019. He is also an executive officer of Banco XP since

2019 and of XP VP since February 2020. Prior to joining us, he was CIO of Graphus Capital from 2010 to 2012 and a partner at BTG Pactual

from 2000 to 2010. He also served as a member of the board of directors of CEMIG from 2002 to 2004, Light from 2006 to 2009 and Valid

from 2010 to 2019.Mr. Constantino holds a certificate from Harvard Business School related to the CFO Leadership Program issued in November,

2021. Mr. Constantino also was also awarded a Chartered Financial Analyst (CFA) charter in 2009. Mr. Constantino holds a bachelor’s

degree in mechanical engineering from Pontifícia Universidade Católica do Rio de Janeiro and an MBA from

IBMEC Group.

Bernardo

Amaral Botelho is a member of our board of directors, a position he has held since November 2019. Mr. Amaral has been

with the XP group since 2007 and was a board member of XP Brazil from August 2018 to November 2019. He is also an executive officer of

XP Brazil, XP CCTVM, Banco XP, XP Gestão, XP Vista, XP Advisory, XP VP, Tecfinance, XP Educação and Leadr. Prior

to joining us, he was a lawyer of Costa Advogados Associados from 2001 to 2007. Mr. Amaral holds a bachelor’s degree in law

from Pontifícia Universidade Católica do Rio de Janeiro and an LLM in business law from IBMEC Group.

Fabrício

Cunha de Almeida is a member of our board of directors, a position he has held since November 2019 and our general counsel,

a position he has held since November 2019. Mr. Almeida has been the general counsel of the XP group since 2013. Prior to joining

us, he was a lawyer at Barbosa, Müssnich & Aragão from 2005 to 2011. Mr. Almeida holds a bachelor’s degree

in law from Universidade Cândido Mendes in Rio de Janeiro and holds a postgraduate degree in corporate law and

capital markets from FGV.

Martin

Emiliano Escobari Lifchitz is a member of our board of directors, a position he has held since November 2019. He has been

with General Atlantic since 2012, and is a member of its Management Committee, is the chair of its Investment Committee, and is the head

of its Latin America business. Mr. Escobari serves on the board of directors of XP Brazil, Empreendimentos Pague Menos SA, Laboratorios

Sanfer, S.A.P.I. de C.V., Grupo Axo, S.A.P.I. de C.V., and has previously served on the boards of Ourofino Saude Animal Participações

S.A., Sura Asset Management, Smiles S.A., Aceco TI Participações S.A., Grupo Linx and Decolar.com, Inc. Mr. Escobari

co-founded submarino.com and was its chief financial officer from 1999 to 2007. He was an associate at the Boston Consulting Group (New

York) from 1994 to 1996, an investment officer at the private equity firm GP Investimentos from 1998 to 1999 and a managing director at

Advent International from 2007 to 2011. Mr. Escobari holds a bachelor’s degree in economics from Harvard College (Harvard University)

and an MBA (George F. Baker Scholar) from Harvard Business School. He serves on the board of Primeira Chance, a scholarship program for

gifted children in Brazil and is active with Endeavor Brazil, where he mentors young entrepreneurs. Mr. Escobari is also a member

of the Brazil office of Harvard’s Rockefeller Center for Latin American Studies and a board member of the Lincoln Center for the

Performing Arts.

Gabriel

Klas da Rocha Leal is a member of our board of directors, a position he has held since November 2019. Mr. Leal

has been with the XP group since 2006, was a board member of XP Brazil from August 2018 to November 2019, and has been an executive officer

of XP CCTVM and Banco XP since 2019 and of XP VP since February 2020. Prior to joining us, he worked at SC Johnson from 2002 to 2006.

Mr. Leal holds a bachelor’s degree in chemical engineering from Pontifícia Universidade Católica do Rio

de Janeiro and an MBA from IBMEC Group.

Luiz

Felipe Amaral Calabró is an independent member of our board of directors and a member of our audit committee, a position

he has held since August 2020. Mr. Calabró is a lawyer with over 20 years’ experience in capital markets; self-regulated

activities in stock, derivatives and commodities exchanges; commercial law; compliance; capital markets and banking regulation; clearing

and depository legal issues; investment funds and asset management regulation; consumer law, banking consumer, contracts, and civil litigation;

and corporation law. After working in various law firms, Mr. Calabró worked at BSM Market Supervision at the B3 from 2007 to 2020,

and is currently a partner at Levy & Salomão Advogados. Mr. Calabró holds graduate, postgraduate and master’s

law degrees from the Pontifical Catholic University (PUC SP) and a PhD in commercial law from the University of São Paulo (USP).

Cristiana

Pereira is an independent member of our board of directors and chairperson of our audit committee, positions she has held since

June 2022. She has been a partner and founder at ACE Governance since March 2018, member of the Board and the Compensation Committee at

Maestro Locadora de Veículos S.A. since June 2020, coordinator of the Audit Committee at CERC S.A. since October 2021, Coordinator

of the Governance Committee and member of the Board at CESAR – Centro de Estudos e Sistemas Avançados do Recife since July

2020, and member of the Board at ARCO ILP S.A. since August 2020. Previously, she was member of Fiscal Council of Bradesco S.A. from March

2020 to May 2022 member of the Board of the HBS Alumni Angels of Brazil, from 2017 to 2020, member of the Consultative Board of the Association

of Public Companies in Brazil – ABRASCA from December 2015 to November 2017, member of the Consultative Board of Association of

Venture Capital and Private Equity – ABVCAP from December 2015 to November 2017. From June 2010 to November 2017, she was Managing

Director of Listings and Issuer Development at B3 S.A. – Brasil, Bolsa, Balcão. Ms. Pereira holds an MBA from Harvard Business

School (2004), a master’s degree from Fundação Getulio Vargas (1997) and a bachelor’s degree in Economics from

State University of Campinas – UNICAMP (1992).

Exhibit 99.2

XP Inc.

c/o Maples Corporate Services Limited

PO Box 309, Ugland House

Grand Cayman

KY1-1104

Cayman Islands

PROXY STATEMENT

General

The board of directors of XP Inc. (the “Company”

or “we”) is soliciting proxies for the annual general meeting of shareholders (the “AGM”) of the

Company to be held on October 6, 2023 at 10:00 a.m. (BRT). The AGM will be held at the offices of the Company located at Av. Chedid Jafet,

75, Torre Sul, 30th Floor, Vila Olímpia, São Paulo SP 04551-065, Brazil in accordance with Cayman Islands law. Shareholders

are able to submit a proxy or, if they wish to attend in person, to participate in the AGM by physically attending the offices of the

Company or attending in a virtual form. The details of how to participate virtually at the AGM are set out in the accompanying proxy card.

On or about September 22, 2023, we first mailed

to our shareholders our proxy materials, including our proxy statement, the notice to shareholders of our AGM and the proxy card, along

with instructions on how to vote using the proxy card provided therewith. This proxy statement can also be accessed, free of charge, on

the Investor Relations section of the Company’s website at https://investors.xpinc.com/en/news-events/shareholder-meetings/ and

on the SEC’s website at https://www.sec.gov.

Record Date, Share Ownership and Quorum

Only the holders of record of Class A common shares

(the “Class A Common Shares”) and Class B common shares (the “Class B Common Shares” and together

with the Class A Common Shares, the “Common Shares”) of the Company as at the close of business on September 8, 2023,

Eastern Time (the “Record Date”) are entitled to receive notice of and attend the AGM and any adjournment thereof.

No person shall be entitled to vote at the AGM unless it is registered as a shareholder of the Company on the record date for the AGM.

As of the close of business on the Record Date,

547,026,933 Common Shares were issued and outstanding, including 435,366,147 Class A Common Shares and 111,660,786 Class B Common Shares.

One or more shareholders holding not less than 50% in aggregate of the voting power of all shares in issue and entitled to vote, present

in person or by proxy or, if a corporation or other non-natural person, by its duly authorized representative, constitutes a quorum of

the shareholders.

Voting and Solicitation

Each Class A Common Share issued and outstanding

as of the close of business on the Record Date is entitled to one vote at the AGM. Each Class B Common Share issued and outstanding as

of the close of business on the Record Date is entitled to ten votes at the AGM. Each ordinary resolution to be put to the vote at the

AGM will be approved by a simple majority of the votes cast, by or on behalf of, the shareholders attending and voting at the AGM and

each special resolution to be put to the vote at the AGM will be approved by at least two-thirds of the votes cast, by or on behalf of,

the shareholders attending and voting at the AGM.

Voting by Holders of Common Shares

Common Shares that are properly voted, for which

proxy cards are properly executed and returned within the deadline set forth below, will be voted at the AGM in accordance with the directions

given. If no specific instructions are given in such proxy cards, the proxy holder will vote in favor of the item(s) set forth in the

proxy card. The proxy holder

will also vote in the discretion of such proxy

holder on any other matters that may properly come before the AGM, or at any adjournment thereof. Where any holder of Common Shares affirmatively

abstains from voting on any particular resolution, the votes attaching to such Common Shares will not be included or counted in the determination

of the number of Common Shares present and voting for the purposes of determining whether such resolution has been passed (but they will

be counted for the purposes of determining the quorum, as described above).

Proxies submitted by registered shareholders

and street shareholders (by returning the proxy card) must be received by us no later than 11:59 p.m., Eastern Time, on October 5, 2023,

to ensure your representation at our AGM.

The manner in which your shares may be voted depends

on how your shares are held. If you own shares of record, meaning that your shares are represented by book entries in your name so that

you appear as a shareholder on the records of American Stock Transfer & Trust Company, LLC (“AST”) (i.e., you are

a registered shareholder), our stock transfer agent, this proxy statement, the notice of AGM and the proxy card will be sent to you by

AST. You may provide voting instructions by returning a proxy card. You also may attend the AGM and vote in person, by either physically

attending the offices of the Company or attending in a virtual form. If you own Common Shares of record and you do not vote by proxy or

in person at the Annual Meeting, your shares will not be voted.

If you own shares in street name (i.e., you are

a street shareholder), meaning that your shares are held by a bank, brokerage firm, or other nominee, you are then considered the “beneficial

owner” of shares held in “street name,” and as a result, this proxy statement, the notice of AGM and the proxy card

will be provided to you by your bank, brokerage firm, or other nominee holding the shares. You may provide voting instructions to them

directly by returning a voting instruction form received from that institution. If you own Common Shares in street name and attend the

AGM, you must obtain a “legal proxy” from the bank, brokerage firm, or other nominee that holds your shares in order to vote

your shares at the meeting and present your voting information card.

Revocability of Proxies

Registered shareholders may revoke their proxy

or change voting instructions before shares are voted at the AGM by submitting a written notice of revocation to our Investor Relations

Department at ir@xpi.com.br, or a duly executed proxy bearing a later date (which must be received by us no later than the date set forth

below) or by attending the AGM and voting in person. A beneficial owner owning Common Shares in street name may revoke or change voting

instructions by contacting the bank, brokerage firm, or other nominee holding the shares or by obtaining a legal proxy from such institution

and voting in person at the AGM. If you are not planning to attend in person our AGM, to ensure your representation at our AGM, revocation

of proxies submitted by registered shareholders and street shareholders (by returning a proxy card) must be received by us no later than

11:59 p.m., Eastern Time, on October 5, 2023.

PROPOSAL 1:

APPROVAL AND RATIFICATION OF THE COMPANY’S

FINANCIAL STATEMENTS AND THE AUDITOR'S REPORT FOR THE FISCAL YEAR ENDED DECEMBER 31, 2022

The Company seeks shareholder approval and ratification

of the Company’s 2022 audited consolidated financial statements (the “Audited Accounts”) in the form presented

at the AGM, which have been prepared in accordance with International Financial Reporting Standards, in respect of the fiscal year ended

December 31, 2022. A copy of the Company’s Audited Accounts is available on the Company’s website at https://investors.xpinc.com/en/news-events/shareholder-meetings/.

The affirmative vote by the holders of a simple

majority of the votes cast, by or on behalf of, the shareholders attending and voting at the AGM is required for this proposal. If proxies

are properly submitted by signing, dating and returning a proxy card, Common Shares represented thereby will be voted in the manner specified

therein. If not otherwise specified, and the proxy card is signed, Common Shares represented by the proxies will be voted in favor of

this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

THE APPROVAL AND RATIFICATION OF THE COMPANY’S FINANCIAL STATEMENTS AND THE AUDITOR'S REPORT FOR THE FISCAL YEAR ENDED DECEMBER

31, 2022.

PROPOSAL 2:

APPROVAL AND RATIFICATION OF THE APPOINTMENT

OF FREDERICO SEABRA DE CARVALHO AS AN INDEPENDENT DIRECTOR

The Company seeks shareholder authorization to appoint Frederico Seabra

de Carvalho as an independent director of the Company to serve in accordance with the Memorandum and Articles of Association of the Company.

The affirmative vote by the holders of a simple

majority of the votes cast, by or on behalf of, the shareholders attending and voting at the AGM is required for this proposal. If proxies

are properly submitted by signing, dating and returning a proxy card, Common Shares represented thereby will be voted in the manner specified

therein. If not otherwise specified, and the proxy card is signed, Common Shares represented by the proxies will be voted in favor of

this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

THE APPROVAL AND RATIFICATION OF THE APPOINTMENT OF frederico seabra de carvalho as an independent

director.

PROPOSAL 3:

APPROVAL AND RATIFICATION OF THE RE-APPOINTMENT

OF EACH OF Guilherme Dias Fernandes Benchimol, Bruno Constantino Alexandre dos Santos, Bernardo

Amaral Botelho, Fabrício Cunha de Almeida, Martin Emiliano Escobari Lifchitz, Gabriel Klas da Rocha Leal, Luiz Felipe Amaral Calabró

and Cristiana Pereira AS DIRECTORS

The Company seeks shareholder authorization to re-appoint each of Guilherme

Dias Fernandes Benchimol, Bruno Constantino Alexandre dos Santos, Bernardo Amaral Botelho, Fabrício Cunha de Almeida, Martin Emiliano

Escobari Lifchitz, Gabriel Klas da Rocha Leal, Luiz Felipe Amaral Calabró and Cristiana Pereira as a director of the Company to

serve in accordance with the Memorandum and Articles of Association of the Company.

The affirmative vote by the holders of a simple

majority of the votes cast, by or on behalf of, the shareholders attending and voting at the AGM is required for this proposal. If proxies

are properly submitted by signing, dating and returning a proxy card, Common Shares represented thereby will be voted in the manner specified

therein. If not otherwise specified, and the proxy card is signed, Common Shares represented by the proxies will be voted in favor of

this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

THE APPROVAL AND RATIFICATION OF THE REAPPOINTMENT OF EACH OF Guilherme Dias Fernandes Benchimol,

Bruno Constantino Alexandre dos Santos, Bernardo Amaral Botelho, Fabrício Cunha de Almeida, Martin Emiliano Escobari Lifchitz,

Gabriel Klas da Rocha Leal, Luiz Felipe Amaral Calabró and Cristiana Pereira AS DIRECTORS.

PROPOSAL 4:

APPROVAL OF THE THIRD AMENDED AND RESTATED

MEMORANDUM AND ARTICLES OF ASSOCIATION

The Company seeks shareholder authorization to

approve the Amended and Restated Memorandum and Articles of Association of the Company currently in effect be amended and restated by

the deletion in their entirety and the

substitution in their place of the Third Amended

and Restated Memorandum and Articles of Association in the form uploaded to the Investor Relations section of the Company's website on

or before the date of the Notice of the AGM. A copy of the Third Amended and Restated Memorandum and Articles of Association is available

on the Company’s website at https://investors.xpinc.com/en/news-events/shareholder-meetings/.

The amendments in the Third Amended and Restated

Memorandum and Articles of Association are primarily being made to remove the references in the Second Amended and Restated Memorandum

and Articles of Association to the Shareholders Agreement dated 29 November 2019 (as amended from time to time) between certain shareholders

of the Company and the Company, as intervening party, which has now been terminated, and to also include other consequential changes as

a result of such termination. In particular, the agreed conversion rights for the conversion of Class B Common Shares to Class A Common

Shares have been hardwired into the Third Amended and Restated Memorandum and Articles of Association and provide that the Class B Common

Shares will convert into Class A Common Shares (i) at the option of the holder of such Class B Common Shares; (ii) prior to any transfer

through a designated stock exchange; and (iii) automatically at such time the total voting power of the holders of Class B Common Shares

represents less than 10% of the voting share rights of the Company. Additional administrative changes have been made in the Third Amended

and Restated Memorandum and Articles of Association to provide flexibility for the Board to appoint any person to act as chairman of any

general meeting, confirm that the Board may appoint additional directors on an interim basis and for the Board to appoint any person to

any committee established by the Board (subject to applicable law and the listing rules of any Designated Stock Exchange).

The affirmative vote by the holders of at least

two-thirds of the votes cast, by or on behalf of, the shareholders attending and voting at the AGM is required for this proposal. If proxies

are properly submitted by signing, dating and returning a proxy card, Common Shares represented thereby will be voted in the manner specified

therein. If not otherwise specified, and the proxy card is signed, Common Shares represented by the proxies will be voted in favor of

this proposal.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

APPROVAL OF THE THIRD AMENDED AND RESTATED MEMORANDUM AND ARTICLES OF ASSOCIATION.

COMPANY INFORMATION

A copy of this proxy statement can be

accessed free of charge, on the Investor Relations section of the Company’s website at https://investors.xpinc.com/en/news-events/shareholder-meetings/.

OTHER MATTERS

We know of no other matters to be submitted to

the AGM. If any other matters properly come before the AGM, it is the intention of the persons named in the enclosed form of proxy to

vote the Common Shares they represent as the board of directors may recommend.

By Order of the Board of Directors,

Dated: September 22, 2023

Exhibit 99.3

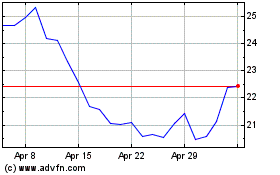

XP (NASDAQ:XP)

Historical Stock Chart

From Nov 2024 to Dec 2024

XP (NASDAQ:XP)

Historical Stock Chart

From Dec 2023 to Dec 2024