XP Inc. Announces Pricing of Senior Notes Offering

29 June 2024 - 11:40AM

Business Wire

XP Inc. (“XP” or “we”) (Nasdaq: XP) , a leading,

technology-driven platform and a trusted provider of low-fee

financial products and services in Brazil, announced that on June

27, 2024 it priced an offering of US$500 million aggregate

principal amount of 6.750% senior unsecured notes due 2029 (the

"notes"). The notes will be guaranteed by XP Investimentos S.A. The

transaction is expected to close on July 2, 2024, subject to the

satisfaction of customary closing conditions. XP intends to use the

net proceeds from the offering of the notes to purchase tendered

3.250% senior unsecured notes due 2026 and for general corporate

purposes.

The notes are being offered and sold to qualified institutional

buyers pursuant to Rule 144A under the Securities Act of 1933, as

amended (the "Securities Act") and to persons outside of the United

States in compliance with Regulation S under the Securities Act.

The offer and sale of the notes has not been and will not be

registered under the Securities Act or the securities laws of any

other jurisdiction, and the notes may not be offered or sold in the

United States except pursuant to an exemption from, or in a

transaction not subject to, the registration requirements of the

Securities Act and applicable state securities laws.

This press release shall not constitute an offer to sell or a

solicitation of an offer to buy, nor shall there be any sale of,

these notes in any jurisdiction in which such an offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such

jurisdiction.

About XP

XP is a leading, technology-driven platform and a trusted

provider of low-fee financial products and services in Brazil. XP’s

mission is to disintermediate the legacy models of traditional

financial institutions by:

- Educating new classes of investors;

- Democratizing access to a wider range of financial

services;

- Developing new financial products and technology applications

to empower clients; and

- Providing high-quality customer service and client experience

in the industry in Brazil.

XP provides customers with two principal types of offerings, (i)

financial advisory services for retail clients in Brazil,

high-net-worth clients, international clients and corporate and

institutional clients, and (ii) an open financial product platform

providing access to over 800 investment products including equity

and fixed income securities, mutual and hedge funds, structured

products, life insurance, pension plans, real-estate investment

funds (REITs) and others from XP, its partners and competitors.

Forward Looking Statements

This press release contains "forward-looking statements" within

the meaning of the "safe harbor" provisions of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements are made as of the date they were first issued and were

based on current expectations, estimates, forecasts and projections

as well as the beliefs and assumptions of management. Words such as

"expect," "anticipate," "should," "believe," "hope," “aim,”

"target," "project," "goals," "estimate," "potential," "predict,"

"may," "will," "might," "could," "intend," variations of these

terms or the negative of these terms and similar expressions are

intended to identify these statements. Forward-looking statements

are subject to a number of risks and uncertainties, many of which

involve factors or circumstances that are beyond XP Inc’s control.

XP, Inc’s actual results could differ materially from those stated

or implied in forward-looking statements due to several factors,

including but not limited to: competition, change in clients,

regulatory measures, a change the external forces among other

factors.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240628453793/en/

Investor Contact: ir@xpi.com.br IR Website:

investors.xpinc.com

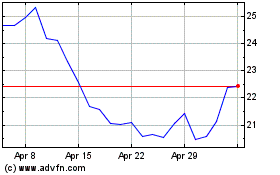

XP (NASDAQ:XP)

Historical Stock Chart

From Nov 2024 to Dec 2024

XP (NASDAQ:XP)

Historical Stock Chart

From Dec 2023 to Dec 2024