null

Exhibit

99.1

|

3Q24 Earnings Release

November 19th,

2024

|

XP Inc. Reports Third Quarter 2024

Results

São Paulo, Brazil, November

19, 2024 – XP Inc. (NASDAQ: XP) (“XP” or the “Company”), a leading tech-enabled platform and a trusted pioneer

in providing low-fee financial products and services in Brazil, reported today its financial results for the third quarter of 2024.

Summary

| Operating Metrics (unaudited) |

3Q24 |

3Q23 |

YoY |

2Q24 |

QoQ |

| Total Client Assets (in R$ bn) |

1,213 |

1,080 |

12% |

1,167 |

4% |

| Total Net Inflow (in R$ bn) |

31 |

48 |

-36% |

32 |

-3% |

| Annualized Retail Take Rate |

1.33% |

1.34% |

-1 bps |

1.29% |

4 bps |

| Active Clients (in '000s) |

4,659 |

4,413 |

6% |

4,626 |

1% |

| Headcount (EoP) |

7,241 |

6,699 |

8% |

6,834 |

6% |

| Total Advisors (in '000s) |

18.4 |

16.9 |

9% |

18.3 |

1% |

| Retail DATs (in mn) |

2.3 |

2.1 |

6% |

2.4 |

-6% |

| Retirement Plans Client Assets (in R$ bn) |

78 |

68 |

15% |

75 |

5% |

| Cards TPV (in R$ bn) |

12.0 |

10.7 |

12% |

11.5 |

4% |

| Credit Portfolio (in R$ bn) |

20.1 |

19.9 |

1% |

19.3 |

4% |

| Gross Written Premiums (in R$ mn) |

362 |

248 |

46% |

307 |

18% |

| |

|

|

|

|

|

| Financial Metrics (in R$ mn) |

3Q24 |

3Q23 |

YoY |

2Q24 |

QoQ |

| Gross revenue |

4,536 |

4,364 |

4% |

4,503 |

1% |

| Retail |

3,494 |

3,179 |

10% |

3,294 |

6% |

| Institutional |

340 |

386 |

-12% |

346 |

-2% |

| Corporate & Issuer Services |

552 |

519 |

6% |

629 |

-12% |

| Other |

150 |

281 |

-46% |

233 |

-36% |

| Net Revenue |

4,319 |

4,132 |

5% |

4,219 |

2% |

| Gross Profit |

2,940 |

2,896 |

2% |

2,940 |

0% |

| Gross Margin |

68.1% |

70.1% |

-199 bps |

69.7% |

-160 bps |

| EBT |

1,212 |

1,157 |

5% |

1,384 |

-12% |

| EBT Margin |

28.1% |

28.0% |

6 bps |

32.8% |

-472 bps |

| Net Income |

1,187 |

1,087 |

9% |

1,118 |

6% |

| Net Margin |

27.5% |

26.3% |

118 bps |

26.5% |

98 bps |

| Basic EPS (in R$) |

2.21 |

1.99 |

11% |

2.05 |

8% |

| Diluted EPS (in R$) |

2.18 |

1.96 |

11% |

2.03 |

8% |

| ROAE¹ |

23.0% |

22.6% |

38 bps |

22.1% |

83 bps |

| ROTE2 |

28.4% |

25.8% |

258 bps |

27.2% |

114 bps |

1 – Annualized

Return on Average Equity.

2 – Annualized Return on Average

Tangible Equity. Tangible Equity excludes Intangibles and Goodwill

Operating KPIs

Client Assets and Net Inflow (in R$ billion)

Client Assets totaled R$1.2 trillion in

3Q24, up 12% YoY and 4% QoQ. Year-over-year growth was driven by R$96 billion net inflows and R$37 billion of market appreciation.

In 3Q24, Net Inflow was R$31 billion, and Retail

Net Inflow was R$25 billion, 6% higher QoQ, and 124% higher YoY, excluding the effects from inorganic Net Inflow

from Modal’s Acquisition.

Active Clients (in ‘000s)

Active clients grew 6% YoY and 1% QoQ, totaling

4.7 million in 3Q24.

Total Advisors (in ‘000s)

Total Advisors connected to XP, includes (1) IFAs,

(2) XP employees who offer advisory services, (3) Registered Investment Advisors, consultants and wealth managers, among others. As of

3Q24, we had 18.4 thousand Total Advisors, an increase of 9% YoY.

Retail Daily Average Trades (in million)

Retail DATs totaled 2.3 million in 3Q24,

up 6% YoY and down 6% QoQ.

NPS

Our NPS, a widely known survey methodology used

to measure customer satisfaction, was 72 in 3Q24. Maintaining a high NPS score remains a priority for XP since our business model

is built around client experience. The NPS calculation as of a given date reflects the average scores in the prior six months.

Retirement

Plans Client Assets (in R$ billion)

As per public data published by Susep, XPV&P’s

individual’s market share (PGBL and VGBL) was stable at 4.9%. Total Client Assets were R$78 billion in 2Q24, up 15% YoY.

Assets from XPV&P, our proprietary insurer, grew 20% YoY, reaching R$64 billion.

Cards TPV (in R$ billion)

In 3Q24, Total TPV was R$12.0 billion, a

12% growth YoY, and 4% increase QoQ.

Active Cards (in ‘000s)

Total Active Cards were 1.3 million in 3Q24,

a growth of 25% YoY and 3% QoQ, being 1.0 million Credit Cards and 0.3 million Active Debit Cards.

Credit Portfolio (in R$ billion)

Total Credit Portfolio reached R$20 billion

as of 3Q24, expanding 1% YoY and 4% QoQ. Currently, this Credit Portfolio is 85% collateralized with Investments.

3

- From 3Q22 onwards, the credit portfolio is disclosed gross (versus previously net) of loan loss provisions, also retroactively, not

including Intercompany transactions and Credit Card related loans and receivables

Gross Written Premiums (in R$ million)

Gross written premiums (GWP) refer to the total

amount of premium income that XPs has written or sold during a particular reporting period before deductions for provisions, reinsurance

and other expenses. This figure represents the total premiums that customers have agreed to pay for life insurance policies issued by

the company, or sold by the company and issued by third-party insurers, including both new policies and renewals. It is a crucial metric

for assessing the total business volume of an insurance company or insurance broker within that period.

In the 3Q24, Gross Written Premiums grew 46%

YoY and 18% QoQ.

Discussion of Financial Results

Total Gross Revenue

Gross Revenue was R$4.5 billion in 3Q24,

up 1% QoQ and up 4% YoY, primarily driven by growth both in our Retail and Corporate & Issuer Services revenue year-over-year.

Retail Revenue

| (in R$ mn) |

3Q24 |

3Q23 |

YoY |

2Q24 |

QoQ |

| Retail Revenue |

3,494 |

3,179 |

10% |

3,294 |

6% |

| Equities |

1,059 |

1,131 |

-6% |

1,115 |

-5% |

| Fixed Income |

938 |

718 |

31% |

820 |

14% |

| Funds Platform |

354 |

323 |

9% |

357 |

-1% |

| Retirement Plans |

100 |

98 |

3% |

97 |

3% |

| Cards |

302 |

259 |

17% |

313 |

-4% |

| Credit |

75 |

49 |

51% |

54 |

38% |

| Insurance |

55 |

36 |

55% |

51 |

8% |

| Other Retail |

611 |

565 |

8% |

485 |

26% |

| Annualized Retail Take Rate |

1.33% |

1.34% |

-1 bps |

1.29% |

4 bps |

Retail revenue was R$3,494 million in 3Q24,

6% higher QoQ and 10% YoY. Sequential Retail revenue was driven by a stronger performance in Fixed Income revenue, which increased 14%

QoQ. YoY growth was also led by Fixed Income, with a 31% revenue growth YoY, and Cards, with a 17% growth.

Take Rate

Annualized Retail Take Rate was 1.33% in 3Q24,

up 4 bps QoQ, and stable YoY.

Institutional Revenue

Institutional revenue was R$340 million in 3Q24,

down 2% QoQ and 12% YoY.

Corporate & Issuer Services Revenue

Corporate & Issuer Services revenue totaled

R$552 million in 3Q24, down 12% QoQ and up 6% YoY, reinforcing our strategy to diversify our revenue stream through our Wholesale Bank,

also demonstrating XP is well positioned to continue benefiting from DCM activity in Brazil.

Other Revenue

Other revenue was R$150 million in 3Q24, down 36%

QoQ and 46% YoY.

Costs of Goods Sold and Gross Margin

Gross Margin was 68.1% in 3Q24 versus 70.1% in

3Q23 and 69.7% in 2Q24. Sequential decrease in Gross Margin was mainly related to revenue mix between products and channels in the quarter.

SG&A Expenses4

| (in R$ mn) |

3Q24 |

3Q23 |

YoY |

2Q24 |

QoQ |

| Total SG&A |

(1,515) |

(1,547) |

-2% |

(1,420) |

7% |

| People |

(984) |

(1,048) |

-6% |

(978) |

1% |

| Salary and Taxes |

(444) |

(396) |

12% |

(399) |

11% |

| Bonuses |

(405) |

(486) |

-17% |

(446) |

-9% |

| Share Based Compensation |

(135) |

(166) |

-18% |

(133) |

2% |

| Non-people |

(530) |

(499) |

6% |

(442) |

20% |

| LTM Compensation Ratio5 |

24.0% |

25.7% |

-173 bps |

24.6% |

-66 bps |

| LTM Efficiency Ratio6 |

35.5% |

37.3% |

-179 bps |

36.1% |

-60 bps |

| Headcount (EoP) |

7,241 |

6,699 |

8% |

6,834 |

6% |

SG&A4 expenses totaled R$1.5

billion in 3Q24, 7% higher QoQ, mainly driven by Expert event expenses, that happened during 3Q24, and 2% lower YoY,

reinforcing our commitment with cost discipline.

Our last twelve months (LTM) compensation

ratio5in 3Q24 was 24.0%, an improvement from 25.7% in 3Q23 and from the 24.6% in 2Q24. Also, our LTM efficiency

ratio6 reached 35.5% in 3Q24, the lowest level since our IPO, reinforcing once again our focus on cost discipline

and efficient expenses management.

4

- Total SG&A and non-people SG&A exclude revenue from incentives from Tesouro Direto, B3.

5

- Compensation ratio is calculated as People SG&A (Salary and Taxes, Bonuses and Share Based Compensation) divided by Net Revenue.

6

- Efficiency ratio is calculated as SG&A ex-revenue from incentives from Tesouro Direto, B3, and others divided by Net Revenue.

Earnings Before Taxes

EBT was R$1,212 million in 3Q24, down 12%

QoQ and up 5% YoY. EBT Margin was 28.1%, similar to our LTM EBT Margin, which was also 28.1%. Our EBT Margin was 472 bps

lower QoQ and 6 bps higher YoY.

Net Income and EPS

In 3Q24, Net Income was R$1.2 billion, a

record number, up 6% QoQ and up 9% YoY. Basic EPS was R$2.21, up 8% QoQ and up 11% YoY. Fully diluted EPS was R$2.18 for the quarter,

11% higher QoQ and 8% higher YoY.

ROTE7 and ROAE8

We now present Return on Tangible Equity, which

excludes Intangibles and Goodwill. We believe this metric allows a more meaningful comparison with our peers.

In 3Q24, ROTE7 was 28.4%, up

114 bps QoQ and up 258 bps YoY. Our ROAE8 in 3Q24 was 23.0%, up 83 bps QoQ and up 38 bps YoY.

Capital Management9

We are enhancing our financial disclosures to include

key capital management ratios, such as the BIS ratio and Risk-Weighted Assets (RWA). These metrics will replace the former Adjusted

Gross Financial Assets and Net Asset Value (NAV) metrics, which are no longer insightful in reflecting our current business activities.

In 3Q24, BIS ratio was 21.5%, up 96 bps

QoQ and 145 bps lower YoY. While our total RWA was R$94.7 billion, with a 3% increase QoQ and 30% increase YoY.

Aiming to optimize our capital structure and continue

delivering value to our shareholders, we are pleased to announce a dividend payment of R$2 billion, scheduled for December 18,

2024. In addition, our Board of Directors has approved a new share repurchase program totaling R$1 billion.

7

– Annualized Return on Tangible Common Equity, calculated as Annualized Net Income over Tangible Common Equity, which excludes

Intangibles and Goodwill, net of deferred taxes.

8 – Annualized

Return on Average Equity.

9 – Managerial

BIS ratio is calculated using the same methodology as the BIS ratio for our Prudential Conglomerate. However, it is based on the

total assets and equity of the entire group.

Other Information

Webcast and Conference Call Information

The

Company will host a webcast to discuss its fourth quarter financial results on Tuesday, November 19th, 2024, at 5:00 pm ET

(7:00 pm BRT). To participate in the earnings webcast please subscribe at 3Q24 Earnings Web Meeting.

The replay will be available on XP’s investor relations website at https://investors.xpinc.com/

Investor Relations Contact

ir@xpi.com.br

Important Disclosure

In reviewing the information contained in this

release, you are agreeing to abide by the terms of this disclaimer. This information is being made available to each recipient solely

for its information and is subject to amendment. This release is prepared by XP Inc. (the “Company,” “we” or “our”),

is solely for informational purposes. This release does not constitute a prospectus and does not constitute an offer to sell or the solicitation

of an offer to buy any securities. In addition, this document and any materials distributed in connection with this release are not directed

to, or intended for distribution to or use by, any person or entity that is a citizen or resident or located in any locality, state, country

or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would

require any registration or licensing within such jurisdiction.

This release was prepared by the Company. Neither

the Company nor any of its affiliates, officers, employees or agents, make any representation or warranty, express or implied, in relation

to the fairness, reasonableness, adequacy, accuracy or completeness of the information, statements or opinions, whichever their source,

contained in this release or any oral information provided in connection herewith, or any data it generates and accept no responsibility,

obligation or liability (whether direct or indirect, in contract, tort or otherwise) in relation to any of such information. The information

and opinions contained in this release are provided as at the date of this release, are subject to change without notice and do not purport

to contain all information that may be required to evaluate the Company. The information in this release is in draft form and has not

been independently verified. The Company and its affiliates, officers, employees and agents expressly disclaim any and all liability which

may be based on this release and any errors therein or omissions therefrom. Neither the Company nor any of its affiliates, officers, employees

or agents makes any representation or warranty, express or implied, as to the achievement or reasonableness of future projections, management

targets, estimates, prospects or returns, if any.

The information contained in this release does

not purport to be comprehensive and has not been subject to any independent audit or review. Certain of the financial information as of

and for the periods ended of December 31, 2021 and December 31, 2020, 2019, 2018 and 2017 has been derived from audited financial statements

and all other financial information has been derived from unaudited interim financial statements. A significant portion of the information

contained in this release is based on estimates or expectations of the Company, and there can be no assurance that these estimates or

expectations are or will prove to be accurate. The Company’s internal estimates have not been verified by an external expert, and

the Company cannot guarantee that a third party using different methods to assemble, analyze or compute market information and data would

obtain or generate the same results.

Statements in the release, including those regarding

the possible or assumed future or other performance of the Company or its industry or other trend projections, constitute forward-looking

statements. These statements are generally identified by the use of words such as “anticipate,” “believe,” “could,”

“expect,” “should,” “plan,” “intend,” “estimate” and “potential,”

among others. By their nature, forward-looking statements are necessarily subject to a high degree of uncertainty and involve known and

unknown risks, uncertainties, assumptions and other factors because they relate to events and depend on circumstances that will occur

in the future whether or not outside the control of the Company. Such factors may cause actual results, performance or developments to

differ materially from those expressed or implied by such forward-looking statements and there can be no assurance that such forward-looking

statements will prove to be correct. These risks and uncertainties include factors relating to: (1) general economic, financial, political,

demographic and business conditions in Brazil, as well as any other countries we may serve in the future and their impact on our business;

(2) fluctuations in interest, inflation and exchange rates in Brazil and any other countries we may serve in the future; (3) competition

in the financial services industry; (4) our ability to implement our business strategy; (5) our ability to adapt to the rapid pace of

technological changes in the financial services industry; (6) the reliability, performance, functionality and quality of our products

and services and the investment performance of investment funds managed by third parties or by our asset managers; (7) the availability

of government authorizations on terms and conditions and within periods acceptable to us; (8) our ability to continue attracting and retaining

new appropriately-skilled employees; (9) our capitalization and level of indebtedness; (10) the interests of our controlling shareholders;

(11) changes in government regulations applicable to the financial services industry in Brazil and

elsewhere; (12) our ability to compete and conduct

our business in the future; (13) the success of operating initiatives, including advertising and promotional efforts and new product,

service and concept development by us and our competitors; (14) changes in consumer demands regarding financial products, customer experience

related to investments and technological advances, and our ability to innovate to respond to such changes; (15) changes in labor, distribution

and other operating costs; (16) our compliance with, and changes to, government laws, regulations and tax matters that currently apply

to us; (17) other factors that may affect our financial condition, liquidity and results of operations. Accordingly, you should not place

undue reliance on forward-looking statements. The forward-looking statements included herein speak only as at the date of this release

and the Company does not undertake any obligation to update these forward-looking statements. Past performance does not guarantee or predict

future performance. Moreover, the Company and its affiliates, officers, employees and agents do not undertake any obligation to review,

update or confirm expectations or estimates or to release any revisions to any forward-looking statements to reflect events that occur

or circumstances that arise in relation to the content of the release. You are cautioned not to unduly rely on such forward-looking statements

when evaluating the information presented and we do not intend to update any of these forward-looking statements.

Market data and industry information used throughout

this release are based on management’s knowledge of the industry and the good faith estimates of management. The Company also relied,

to the extent available, upon management’s review of industry surveys and publications and other publicly available information

prepared by a number of third-party sources. All of the market data and industry information used in this release involves a number of

assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Although the Company believes that these

sources are reliable, there can be no assurance as to the accuracy or completeness of this information, and the Company has not independently

verified this information.

The contents hereof should not be construed as

investment, legal, tax or other advice and you should consult your own advisers as to legal, business, tax and other related matters concerning

an investment in the Company. The Company is not acting on your behalf and does not regard you as a customer or a client. It will not

be responsible to you for providing protections afforded to clients or for advising you on the relevant transaction.

This release includes our Float, Adjusted Gross

Financial Assets, Net Asset Value, and Adjustments to Reported Net Income, which are non-GAAP financial information. We believe that such

information is meaningful and useful in understanding the activities and business metrics of the Company’s operations. We also believe

that these non-GAAP financial measures reflect an additional way of viewing aspects of the Company’s business that, when viewed

with our International Financial Reporting Standards (“IFRS”) results, as issued by the International Accounting Standards

Board, provide a more complete understanding of factors and trends affecting the Company’s business. Further, investors regularly

rely on non-GAAP financial measures to assess operating performance and such measures may highlight trends in the Company’s business

that may not otherwise be apparent when relying on financial measures calculated in accordance with IFRS. We also believe that certain

non-GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of public

companies in the Company’s industry, many of which present these measures when reporting their results. The non-GAAP financial information

is presented for informational purposes and to enhance understanding of the IFRS financial statements. The non-GAAP measures should be

considered in addition to results prepared in accordance with IFRS, but not as a substitute for, or superior to, IFRS results. As other

companies may determine or calculate this non-GAAP financial information differently, the usefulness of these measures for comparative

purposes is limited. A reconciliation of such non-GAAP financial measures to the nearest GAAP measure is included in this release.

For purposes of this release:

“Active Clients” means the total number

of retail clients served through our XP Investimentos, Rico, Clear, XP Investments and XP Private (Europe) brands, with Client Assets

above R$100.00 or that have transacted at least once in the last thirty days. For purposes of calculating this metric, if a client holds

an account in more than one of the aforementioned entities, such client will be counted as one “active client” for each such

account. For example, if a client holds an account in each of XP Investimentos and Rico, such client will count as two “active clients”

for purposes of this metric.

“Client Assets” means the market value

of all client assets invested through XP’s platform and that is related to reported Retail Revenue, including equities, fixed income

securities, mutual funds (including those managed by XP Gestão de Recursos Ltda., XP Advisory Gestão de Recursos Ltda. and

XP Vista Asset Management Ltda., as well as by third-party asset managers), pension funds (including those from XP Vida e Previdência

S.A., as well as by third-party insurance companies), exchange traded funds, COEs (Structured Notes), REITs, and uninvested cash balances

(Float Balances), among others. Although Client Assets includes custody from Corporate Clients that generate Retail Revenue, it does not

include custody from institutional clients (asset managers, pension funds and insurance companies).

Rounding

We have made rounding adjustments to some of the

figures included in this release. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of

the figures that preceded them.

Unaudited Managerial Income Statement (in R$

mn)

| Managerial Income Statement |

3Q24 |

3Q23 |

YoY |

2Q24 |

QoQ |

| Total Gross Revenue |

4,536 |

4,364 |

4% |

4,503 |

1% |

| Retail |

3,494 |

3,179 |

10% |

3,294 |

6% |

| Equities |

1,059 |

1,131 |

-6% |

1,115 |

-5% |

| Fixed Income |

938 |

718 |

31% |

820 |

14% |

| Funds Platform |

354 |

323 |

9% |

357 |

-1% |

| Retirement Plans |

100 |

98 |

3% |

97 |

3% |

| Cards |

302 |

259 |

17% |

313 |

-4% |

| Credit |

75 |

49 |

51% |

54 |

38% |

| Insurance |

55 |

36 |

55% |

51 |

8% |

| Other |

611 |

565 |

8% |

485 |

26% |

| Institutional |

340 |

386 |

-12% |

346 |

-2% |

| Corporate & Issuer Services |

552 |

519 |

6% |

629 |

-12% |

| Other |

150 |

281 |

-46% |

233 |

-36% |

| Net Revenue |

4,319 |

4,132 |

5% |

4,219 |

2% |

| COGS |

(1,378) |

(1,236) |

11% |

(1,279) |

8% |

| Gross Profit |

2,940 |

2,896 |

2% |

2,940 |

0% |

| Gross Margin |

68.1% |

70.1% |

-199 bps |

69.7% |

-160 bps |

| SG&A |

(1,454) |

(1,541) |

-6% |

(1,328) |

10% |

| People |

(984) |

(1,048) |

-6% |

(978) |

1% |

| Non-People |

(470) |

(493) |

-5% |

(350) |

34% |

| D&A |

(72) |

(71) |

1% |

(66) |

9% |

| Interest expense on debt |

(198) |

(135) |

47% |

(204) |

-3% |

| Share of profit in joint ventures and associates |

(3) |

9 |

-135% |

41 |

-103% |

| EBT |

1,212 |

1,157 |

5% |

1,384 |

-12% |

| EBT Margin |

28.1% |

28.0% |

6 bps |

32.8% |

-472 bps |

| Tax Expense (Accounting) |

(26) |

(71) |

-63% |

(266) |

-90% |

| Tax expense (Tax Withholding in Funds)10 |

(154) |

(169) |

-9% |

(107) |

44% |

| Effective tax rate (Normalized) |

(13.2%) |

(18.1%) |

489 bps |

(25.0%) |

1183 bps |

| Net Income |

1,187 |

1,087 |

9% |

1,118 |

6% |

| Net Margin |

27.5% |

26.3% |

118 bps |

26.5% |

98 bps |

10

- Tax adjustments are related to tax withholding expenses that are recognized net in gross revenue.

Accounting Income Statement (in R$ mn)

| Accounting Income Statement |

3Q24 |

3Q23 |

YoY |

2Q24 |

QoQ |

| Net revenue from services rendered |

1,940 |

1,822 |

6% |

1,949 |

0% |

| Brokerage commission |

576 |

525 |

10% |

541 |

6% |

| Securities placement |

570 |

637 |

-11% |

686 |

-17% |

| Management fees |

446 |

414 |

8% |

443 |

1% |

| Insurance brokerage fee |

61 |

43 |

40% |

52 |

17% |

| Commission Fees |

211 |

206 |

2% |

260 |

-19% |

| Other services |

241 |

169 |

42% |

148 |

63% |

| Sales Tax and contributions on Services |

(163) |

(173) |

-6% |

(181) |

-10% |

| Net income from financial instruments at amortized cost |

(861) |

142 |

-708% |

(244) |

252% |

| Net income from financial instruments at fair value through profit or loss |

3,239 |

2,168 |

49% |

2,515 |

29% |

| Total revenue and income |

4,319 |

4,132 |

5% |

4,219 |

2% |

| Operating costs |

(1,332) |

(1,122) |

19% |

(1,236) |

8% |

| Selling expenses |

(43) |

(50) |

-15% |

(33) |

29% |

| Administrative expenses |

(1,565) |

(1,544) |

1% |

(1,456) |

7% |

| Other operating revenues (expenses), net |

81 |

(18) |

-545% |

95 |

-15% |

| Expected credit losses |

(47) |

(115) |

-59% |

(43) |

9% |

| Interest expense on debt |

(198) |

(135) |

47% |

(204) |

-3% |

| Share of profit or (loss) in joint ventures and associates |

(3) |

9 |

-135% |

41 |

-108% |

| Income before income tax |

1,212 |

1,157 |

5% |

1,384 |

-12% |

| Income tax expense |

(26) |

(71) |

-63% |

(266) |

n.a. |

| Net income for the period |

1,187 |

1,087 |

9% |

1,118 |

6% |

Balance Sheet (in R$ mn)

| Assets |

|

|

|

3Q24 |

2Q24 |

| Cash |

|

|

|

4,626 |

5,604 |

| Financial assets |

|

|

|

291,996 |

272,686 |

| Fair value through profit or loss |

|

|

|

167,489 |

170,035 |

| Securities |

|

|

|

133,717 |

134,481 |

| Derivative financial instruments |

|

|

|

33,773 |

35,554 |

| Fair value through other comprehensive income |

|

|

|

50,552 |

38,386 |

| Securities |

|

|

|

50,552 |

38,386 |

| Evaluated at amortized cost |

|

|

|

73,955 |

64,266 |

| Securities |

|

|

|

3,152 |

3,613 |

| Securities purchased under agreements to resell |

|

|

|

26,153 |

21,773 |

| Securities trading and intermediation |

|

|

|

2,934 |

4,440 |

| Accounts receivable |

|

|

|

958 |

675 |

| Loan Operations |

|

|

|

27,512 |

26,321 |

| Other financial assets |

|

|

|

13,246 |

7,445 |

| Other assets |

|

|

|

10,743 |

10,138 |

| Recoverable taxes |

|

|

|

523 |

392 |

| Rights-of-use assets |

|

|

|

347 |

390 |

| Prepaid expenses |

|

|

|

4,479 |

4,432 |

| Other |

|

|

|

5,394 |

4,923 |

| Deferred tax assets |

|

|

|

2,572 |

2,597 |

| Investments in associates and joint ventures |

|

|

|

3,417 |

3,129 |

| Property and equipment |

|

|

|

435 |

416 |

| Goodwill & Intangible assets |

|

|

|

2,596 |

2,570 |

| Total Assets |

|

|

|

316,385 |

297,141 |

| Liabilities |

|

|

|

3Q24 |

2Q24 |

| Financial liabilities |

|

|

|

228,003 |

213,285 |

| Fair value through profit or loss |

|

|

|

51,216 |

49,597 |

| Securities |

|

|

|

18,602 |

14,683 |

| Derivative financial instruments |

|

|

|

32,614 |

34,913 |

| Evaluated at amortized cost |

|

|

|

176,787 |

163,688 |

| Securities sold under repurchase agreements |

|

|

|

51,135 |

53,890 |

| Securities trading and intermediation |

|

|

|

20,040 |

19,034 |

| Financing instruments payable |

|

|

|

90,589 |

72,397 |

| Accounts payables |

|

|

|

791 |

623 |

| Borrowings |

|

|

|

- |

2,528 |

| Other financial liabilities |

|

|

|

14,231 |

15,216 |

| Other liabilities |

|

|

|

66,781 |

63,693 |

| Social and statutory obligations |

|

|

|

751 |

1,111 |

| Taxes and social security obligations |

|

|

|

508 |

627 |

| Retirement plans liabilities |

|

|

|

64,126 |

60,981 |

| Provisions and contingent liabilities |

|

|

|

135 |

129 |

| Other |

|

|

|

1,262 |

845 |

| Deferred tax liabilities |

|

|

|

243 |

201 |

| Total Liabilities |

|

|

|

295,028 |

277,179 |

| Equity attributable to owners of the Parent company |

|

|

|

21,353 |

19,958 |

| Issued capital |

|

|

|

0 |

0 |

| Capital reserve |

|

|

|

18,401 |

19,402 |

| Other comprehensive income |

|

|

|

(265) |

(226) |

| Treasury |

|

|

|

(117) |

(1,366) |

| Retained earnings |

|

|

|

3,333 |

2,147 |

| Non-controlling interest |

|

|

|

5 |

4 |

| Total equity |

|

|

|

21,358 |

19,962 |

| Total liabilities and equity |

|

|

|

316,385 |

297,141 |

Exhibit 99.2

3Q24 Earnings Presentation

2 Important Disclosure IN REVIEWING THE INFORMATION CONTAINED IN THIS PRESENTATION, YOU ARE AGREEING TO ABIDE BY THE TERMS OF THIS DISCLAIMER . THIS INFORMATION IS BEING MADE AVAILABLE TO EACH RECIPIENT SOLELY FOR ITS INFORMATION AND IS SUBJECT TO AMENDMENT . This presentation is prepared by XP Inc . (the “Company,” “we” or “our”), is solely for informational purposes . This presentation does not constitute a prospectus and does not constitute an offer to sell or the solicitation of an offer to buy any securities . In addition, this document and any materials distributed in connection with this presentation are not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would require any registration or licensing within such jurisdiction . This presentation was prepared by the Company . Neither the Company nor any of its affiliates, officers, employees or agents, make any representation or warranty, express or implied, in relation to the fairness, reasonableness, adequacy, accuracy or completeness of the information, statements or opinions, whichever their source, contained in this presentation or any oral information provided in connection herewith, or any data it generates and accept no responsibility, obligation or liability (whether direct or indirect, in contract, tort or otherwise) in relation to any of such information . The information and opinions contained in this presentation are provided as at the date of this presentation, are subject to change without notice and do not purport to contain all information that may be required to evaluate the Company . The information in this presentation is in draft form and has not been independently verified . The Company and its affiliates, officers, employees and agents expressly disclaim any and all liability which may be based on this presentation and any errors therein or omissions therefrom . Neither the Company nor any of its affiliates, officers, employees or agents makes any representation or warranty, express or implied, as to the achievement or reasonableness of future projections, management targets, estimates, prospects or returns, if any . The information contained in this presentation does not purport to be comprehensive and has not been subject to any independent audit or review . Certain of the financial information as of and for the periods ended December 31 , 2019 , 2018 and 2017 has been derived from audited financial statements and all other financial information has been derived from unaudited interim financial statements . A significant portion of the information contained in this presentation is based on estimates or expectations of the Company, and there can be no assurance that these estimates or expectations are or will prove to be accurate . The Company’s internal estimates have not been verified by an external expert, and the Company cannot guarantee that a third party using different methods to assemble, analyze or compute market information and data would obtain or generate the same results . Statements in the presentation, including those regarding the possible or assumed future or other performance of the Company or its industry or other trend projections, constitute forward - looking statements . These statements are generally identified by the use of words such as “anticipate,” “believe,” “could,” “expect,” “should,” “plan,” “intend,” “estimate” and “potential,” among others . By their nature, forward - looking statements are necessarily subject to a high degree of uncertainty and involve known and unknown risks, uncertainties, assumptions and other factors because they relate to events and depend on circumstances that will occur in the future whether or not outside the control of the Company . Such factors may cause actual results, performance or developments to differ materially from those expressed or implied by such forward - looking statements and there can be no assurance that such forward - looking statements will prove to be correct . These risks and uncertainties include factors relating to : ( 1 ) general economic, financial, political, demographic and business conditions in Brazil, as well as any other countries we may serve in the future and their impact on our business ; ( 2 ) fluctuations in interest, inflation and exchange rates in Brazil and any other countries we may serve in the future ; ( 3 ) competition in the financial services industry ; ( 4 ) our ability to implement our business strategy ; ( 5 ) our ability to adapt to the rapid pace of technological changes in the financial services industry ; ( 6 ) the reliability, performance, functionality and quality of our products and services and the investment performance of investment funds managed by third parties or by our asset managers ; ( 7 ) the availability of government authorizations on terms and conditions and within periods acceptable to us ; ( 8 ) our ability to continue attracting and retaining new appropriately - skilled employees ; ( 9 ) our capitalization and level of indebtedness ; ( 10 ) the interests of our controlling shareholders ; ( 11 ) changes in government regulations applicable to the financial services industry in Brazil and elsewhere ; ( 12 ) our ability to compete and conduct our business in the future ; ( 13 ) the success of operating initiatives, including advertising and promotional efforts and new product, service and concept development by us and our competitors ; ( 14 ) changes in consumer demands regarding financial products, customer experience related to investments and technological advances, and our ability to innovate to respond to such changes ; ( 15 ) changes in labor, distribution and other operating costs ; ( 16 ) our compliance with, and changes to, government laws, regulations and tax matters that currently apply to us ; ( 17 ) the negative impacts of the COVID - 19 pandemic on global, regional and national economies and the related market volatility and protracted economic downturn ; and ( 18 ) other factors that may affect our financial condition, liquidity and results of operations . Accordingly, you should not place undue reliance on forward - looking statements . The forward - looking statements included herein speak only as at the date of this presentation and the Company does not undertake any obligation to update these forward - looking statements . Past performance does not guarantee or predict future performance . Moreover, the Company and its affiliates, officers, employees and agents do not undertake any obligation to review, update or confirm expectations or estimates or to release any revisions to any forward - looking statements to reflect events that occur or circumstances that arise in relation to the content of the presentation . You are cautioned not to unduly rely on such forward - looking statements when evaluating the information presented and we do not intend to update any of these forward - looking statements . Market data and industry information used throughout this presentation are based on management’s knowledge of the industry and the good faith estimates of management . The Company also relied, to the extent available, upon management’s review of industry surveys and publications and other publicly available information prepared by a number of third party sources . All of the market data and industry information used in this presentation involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates . Although the Company believes that these sources are reliable, there can be no assurance as to the accuracy or completeness of this information, and the Company has not independently verified this information . The contents hereof should not be construed as investment, legal, tax or other advice and you should consult your own advisers as to legal, business, tax and other related matters concerning an investment in the Company . The Company is not acting on your behalf and does not regard you as a customer or a client . It will not be responsible to you for providing protections afforded to clients or for advising you on the relevant transaction . This presentation also includes certain non - GAAP financial information . We believe that such information is meaningful and useful in understanding the activities and business metrics of the Company’s operations . We also believe that these non - GAAP financial measures reflect an additional way of viewing aspects of the Company’s business that, when viewed with our International Financial Reporting Standards (“IFRS”) results, as issued by the International Accounting Standards Board, provide a more complete understanding of factors and trends affecting the Company’s business . Further, investors regularly rely on non - GAAP financial measures to assess operating performance and such measures may highlight trends in the Company’s business that may not otherwise be apparent when relying on financial measures calculated in accordance with IFRS . We also believe that certain non - GAAP financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of public companies in the Company’s industry, many of which present these measures when reporting their results . The non - GAAP financial information is presented for informational purposes and to enhance understanding of the IFRS financial statements . The non - GAAP measures should be considered in addition to results prepared in accordance with IFRS, but not as a substitute for, or superior to, IFRS results . As other companies may determine or calculate this non - GAAP financial information differently, the usefulness of these measures for comparative purposes is limited . A reconciliation of such non - GAAP financial measures to the nearest GAAP measure is included in this presentation . For purposes of this presentation : “Active Clients” means the total number of retail clients served through our XP Investimentos, Rico, Clear, XP Investments and XP Private (Europe) brands, with Client Assets above R $ 100 . 00 or that have transacted at least once in the last thirty days . For purposes of calculating this metric, if a client holds an account in more than one of the aforementioned entities, such client will be counted as one “active client” for each such account . For example, if a client holds an account in each of XP Investimentos and Rico, such client will count as two “active clients” for purposes of this metric . “Client Assets” means the market value of all client assets invested through XP’s platform, including equities, fixed income securities, mutual funds (including those managed by XP Gestão de Recursos Ltda . , XP Advisory Gestão Recursos Ltda . and XP Vista Asset Management Ltda . , as well as by third - party asset managers), pension funds (including those from XP Vida e Previdência S . A . , as well as by third - party insurance companies), exchange traded funds, COEs (Structured Notes), REITs, and uninvested cash balances (Floating Balances), among others .

Index 3Q24 Financials and Main KPIs 02 Final Remarks 03 01 Key Highlights Q&A 04 Appendix 05

01. Key Highlights

5 Highlights Notes: 1 – Annualized Return on Average Tangible Equity. Tangible Equity excludes Intangibles and Goodwill; 2 – Managerial BIS Ratio, c alculated in accordance with Central Brank methodology Our Clear Strategy Delivering Consistent Growth and Record Results 2.11 3.71 6.26 6.25 7.16 7.93 2019 2020 2021 2022 2023 3Q24 LTM Diluted EPS R$ R$ 1.2 trillion Client’s assets ( +12% YoY) Core Investment KPIs 1 8 .4 k Total Advisors ( +9% YoY) 4.7 million Active Clients ( + 6 % YoY) 28.4 % ROTE 1 (+ 258bps YoY) 21.5 % BIS Ratio 2 11.0 % Diluted EPS Growth YoY Balance Sheet and Profitability R$ 13.3 billion Gross Revenue ( +17% YoY) R$ 3.7 billion EBT ( +25% YoY) R$ 3.3 billion Net Income ( +17% YoY) Income Statement 9M24 R$ 4.5 billion Gross Revenue ( +4% YoY) R$ 1. 2 billion EBT ( +5% YoY) R$ 1.2 billion Net Income ( +9% YoY) 3Q24 +32% CAGR 3Q24

6 14.8 17.6 3Q23 LTM @ ID 3Q24 LTM 2026 Guidance 26.8 Strategy Tracker 22.8 20% CAGR 12% CAGR 20% CAGR Gross Revenue R$ Billion Retail Investments Leadership in Core Business Our main goal is to achieve leadership in the investment market, our core business. To do this, we need to maintain and expand our differentials and continue to grow in all customer segments . Retail Cross - Sell Grow with Our Clients’ Needs Starting from our clients’ needs, we will expand our offer to serve their complete financial needs , aiming to break the link of investors with the incumbent banks once and for all. Corporate & SMB Premier Service with Unique Value We want to fully explore the synergy of a Wholesale Bank offer with the investment universe, deepening our relationship with the main economic groups in Brazil.' Quality Financial planning at scale, a new competitive advantage that enhances both the engagement and experience of our investor clients. 30% - 34% EBT Margin 28% 26%

7 Strategy Tracker Retail Investments Leadership in Core Business Our main goal is to achieve leadership in the investment market, our core business. To do this, we need to maintain and expand our differentials and continue to grow in all customer segments . Retail Cross - Sell Grow with Our Clients’ Needs Starting from our clients’ needs, we will expand our offer to serve their complete financial needs , aiming to break the link of investors with the incumbent banks once and for all. Corporate & SMB Premier Service with Unique Value We want to fully explore the synergy of a Wholesale Bank offer with the investment universe, deepening our relationship with the main economic groups in Brazil.' Quality Financial planning at scale, a new competitive advantage that enhances both the engagement and experience of our investor cli ent s.

8 14 24 25 8 6 3Q23 2Q24 3Q24 32 31 +124% Retail Corporate Retail Investments – Consistent Net New Money Notes: 1 – Excluding Inorganic Net New Money from Modal’s acquisition in 3Q23. Net New Money (1) R$ Million Retail Strategy – Keeping Our Moats Expanding and Protecting our Core Business Multi - Channel Distribution and Expansion Through Internal Advisors and RIAs 2 Product Platform Best Investment Options – from Fixed - Income to Alternative Investments 1 Segmentation with Accurate Value Proposition Competitive Pricing, Services and Product Range to each client segment 3 Value - Added Services Through Large - Scale Financial Planning 4 Ability To Grow In Our Core Business Strategy Execution Setting us Apart from Peers

9 Strategy Tracker Retail Investments Leadership in Core Business Our main goal is to achieve leadership in the investment market, our core business. To do this, we need to maintain and expand our differentials and continue to grow in all customer segments . Retail Cross - Sell Grow with Our Clients’ Needs Starting from our clients’ needs, we will expand our offer to serve their complete financial needs , aiming to break the link of investors with the incumbent banks once and for all. Corporate & SMB Premier Service with Unique Value We want to fully explore the synergy of a Wholesale Bank offer with the investment universe, deepening our relationship with the main economic groups in Brazil.' Quality Financial planning at scale, a new competitive advantage that enhances both the engagement and experience of our investor cli ent s.

10 Retail Cross - Sell Notes: 1 - Active Credit Cards vs. Total Active Clients, 2 – Company Estimates for Peers and Market Average, 3 – Penetration base d on Active Clients from XP and Rico only, 4 - Excluding Credit Cards, 5 - Includes FX, Digital Account, Global Investments, Consortium and Other Insurance Penetration (2)(3) Cards TPV (in R$bn ) Main KPI Example: Revenue Per Client Improves with Cross - Sell Across Different Client Segments (base 100) 200 138 100 Average 228 158 100 Less than 50k 144 116 100 50k - 300k 130 111 100 300k - 3mm 115 106 100 3mm - 10mm 3+ 2+ 1+ Number of Products 10.7 11.5 12.0 3Q23 2Q24 3Q24 +12% 3Q24 Peers Avg. 29% 50% 248 307 362 3Q23 2Q24 3Q24 +46% 3Q24 Market Avg. 2% 17% 68 75 78 3Q23 2Q24 3Q24 +15% 3Q24 Market Leader 5% 28% 49 54 75 0 2 4 0 50 100 1.1% 3Q23 1.1% 2Q24 1.6% 3Q24 +51% Other New Products Revenue (5) (in R$mm ) 104 140 201 3Q23 2Q24 3Q24 +92% Life Insurance Gross Written Premium (in R$mm ) Retirement Plans Assets (in R$bn ) Credit – NII (4) (in R$mm ) ▪ FX ▪ Digital Account ▪ Global Investments ▪ Consortium Client Segment (R$) Market Share Penetration (1)(2) % Expected Credit Losses +100% +38% NIM < 1 % ECL

11 Quality Financial planning at scale, a new competitive advantage that enhances both the engagement and experience of our investor cli ent s. Strategy Tracker Retail Investments Leadership in Core Business Our main goal is to achieve leadership in the investment market, our core business. To do this, we need to maintain and expand our differentials and continue to grow in all customer segments . Retail Cross - Sell Grow with Our Clients’ Needs Starting from our clients’ needs, we will expand our offer to serve their complete financial needs , aiming to break the link of investors with the incumbent banks once and for all. Corporate & SMB Premier Service with Unique Value We want to fully explore the synergy of a Wholesale Bank offer with the investment universe, deepening our relationship with the main economic groups in Brazil.

12 Wholesale 2,687 3,651 3Q23 LTM 3Q24 LTM Institutional, Corporate and Issuer Services Gross Revenue R$ Million +36% YoY Investment Banking DCM Volume 1 (in R$bn ) Main KPI 10.8 13.6 8.6 3Q23 2Q24 3Q24 - 20% 3Q24 YTD Market Leader 14% 25% 149 179 177 3Q23 2Q24 3Q24 +19% 3Q24 Market Leader 8% 18% 13 26 23 3Q23 2Q24 3Q24 +79% Institutional – Equities Traded Volume 2 (in R$bn ) Corporate Securities (in R$bn ) OTC Derivatives Ranking 2 FX Ranking 3 2 nd 1 st 15 th 41 st 2020 3Q24 10 th 2022 4 th 3Q24 Market Share Ranked 1 st in CRA and FII Ranked 2 nd in DCM YTD Market Share ▪ Interest Rate Swaps #1 3Q24 Market Leader 8% 15% 3Q24 Market Leader 1% 13% Market Share Market Share 1 st Corporate Credit Broker in CETIP Note 1 - Source: Anbima, Distribuição de RF & Híbridos , 2 – Source: B3, 3 – Source: Central Bank

02. 3Q24 Financials

14 73% 9% 12% 6% 3Q23 73% 8% 14% 5% 2Q24 77% 7% 12% 3% 3Q24 100% 100% 100% Gross Revenue Retail Gaining Traction… …Representing 77% of Total Revenues Gross Revenue Breakdown % Gross Revenue Breakdown R$ Million Retail Institutional Corporate & Issuer Services Other 3,179 3,294 3,494 386 346 340 519 629 552 281 233 3Q23 2Q24 150 3Q24 4,364 4,503 4,536

15 Another Quarter with Fixed Income as the Main Highlight Retail Revenue Breakdown % Retail Revenue R$ Million 36% 23% 10% 14% 18% 3Q23 34% 25% 11% 16% 15% 2Q24 30% 27% 10% 15% 17% 3Q24 100% 100% 100% Retail Revenue 3,179 3,294 3,494 2,300 2,400 2,500 2,600 2,700 2,800 2,900 3,000 3,100 3,200 3,300 3,400 3,500 3Q23 2Q24 3Q24 +10% Equities Fixed Income Funds Platform New Verticals Other 10% Growth YoY Driven by Strong Fixed Income Activity

16 Solid DCM and Corporate Activity During the Quarter Corporate & Issuer Services Revenue Note 1: Corporate Securities considered in our Total Loan Portfolio. Corporate & Issuer Services Breakdown R$ Million 197 245 229 322 384 323 3Q23 2Q24 3Q24 519 629 552 +6% Corporate Issuer Services Fostering New Investment Options Corporate Issuer Underwriting & Warehousing Retail Distribution Market Making & Liquidity Provider Corporate Securities 1 R$ Billion 13 26 23 3Q23 2Q24 3Q24 +79%

17 Efficiency and Compensation Ratios 1 LTM % Sales, General & Administrative Expenses (SG&A)¹ and Ratios Notes: 1 – Calculated as SG&A ex - revenue from incentives from Tesouro Direto , B3, and others divided by Net Revenue. 2 – Calculated as People SG&A (Salary and Taxes, Bonuses and Share Based Compensation) divided by Net Revenue;. 1,048 978 984 499 442 530 3Q23 2Q24 3Q24 1,547 1,420 1,515 - 2% People Non - people SG&A¹ R$ Million 29.8% 25.2% 24.0% 41.7% 38.3% 36.5% 35.5% 3Q22 4Q22 1Q23 26.8% 2Q23 3Q23 4Q23 1Q24 2Q24 3Q24 Strict Expenses Control Another Record for Efficiency Ratio Efficiency Ratio Compensation Ratio

18 1,157 1,384 1,212 -20 -10 0 10 20 30 40 50 60 70 600 700 800 900 1,000 1,100 1,200 1,300 1,400 28.0% 3Q23 32.8% 2Q24 28.1% 3Q24 +5% EBT R$ million Solid EBT Results with Different Revenue Mix Earning Before Taxes (EBT) EBT Margin 2,941 3,685 20 22 24 26 28 30 32 34 36 38 40 42 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 27.2% 9M23 29.3% 9M24 +25%

19 1,087 1,118 1,187 18 20 22 24 26 28 30 32 34 600 700 800 900 1,000 1,100 1,200 26.3% 3Q23 26.5% 2Q24 27.5% 3Q24 +9% Net Income R$ million Another Quarter with Record - Setting Results , with +118bps Net Margin YoY Net Income Net Margin 2,859 3,334 20 22 24 26 28 30 32 500 1,000 1,500 2,000 2,500 3,000 3,500 26.4% 9M23 26.5% 9M24 +17%

20 RWA / Total Assets 30% 31% 30% 21.7% 18.7% 19.6% 1.2% 0.9% 0.9% 0.9% 0.9% 3Q23 2Q24 3Q24 22.9% 20.5% 21.5% Credit RWA aligned with our Business Model, with a R$22mm VaR (2) Risk - Weighted Assets and VaR Capital Management Notes: 1 – Managerial BIS Ratio, calculated in accordance with Central Brank methodology, 2 – Average Daily VaR,1 day, 95% BIS Ratio (1) 43% 59% 45% 19% 18% 28% 38% 23% 26% 3Q23 2Q24 3Q24 Reducing excess capital through a more efficient capital management Common Equity Tier 1 Additional Tier 1 Tier 2 Credit RWA Market RWA Operational RWA 18.3% Assuming R$2bn Dividend Distribution And R$1bn Share Buyback VaR 2 (% of Total Equity) 12 bps 16 bps 10 bps

21 Consistent Capital Distribution to Shareholders Payout Ratio (1)(2) 1,815 3,542 2,000 916 2,249 2022 2023 2024E 4,458 4,249 Capital Management In Three Years + R$10.5bn In Dividends and Share Repurchases (1) Dividends Paid Share Repurchases Dividends Paid and Share Repurchases (1) R$ Million 2022 2023 2024E 51% 114% >90% Notes: 1 – Assumption of approximately R$2bn dividend distribution and R$1bn Share Buyback execution in December 2024. 2 - Payou t ratio calculated based on 9M24 Annualized Net Income (1)

22 Annualized ROTE¹ and ROAE² % Notes: 1 – Annualized Return on Average Tangible Equity. Tangible Equity excludes Intangibles and Goodwill; 2 – Annualized Retur n on Average Equity; 3 – Net Income Attributable to Owners of Parent Company. 25.8% 27.2% 28.4% 22.6% 22.1% 23.0% 3Q23 2Q24 3Q24 ROTE ROAE EPS and Return on Tangible Equity 1,086 1,117 1,186 1.96 2.03 2.18 0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 1.6 1.8 2.0 2.2 0 200 400 600 800 1,000 1,200 1,400 1,600 3Q23 2Q24 3Q24 Net Income (R$mm) Diluted EPS (R$) EPS ROTE of 28.4%, driven by 9% YoY growth in Net Income and a R$1.2 billion buyback in the first half 3

03. Final Remarks

24 Solid Quarter x Guidance on Track 1 2 x Retail NNM Consistency Net New Money 3 x Financial Planning at Scale as a New Edge Moats Final Remarks 4 x Strong Capital Distribution and EPS Increase Capital Return

04. Q&A

26 Total Loan Portfolio¹ Note: 1 – Gross of Expected Credit Losses. Total Unsecured Secured R$ billion 20.1 3.1 17.0 Loans 7.8 2.6 5.2 Credit Card 22.8 17.4 5.4 Corporate Securities 50.7 23.0 27.7 Credit Portfolio Main Activities • Investment Banking • Fixed Income Distribution • Corporate Credit

27 Adjusted Assets [A - B - C] [C] Float [B] Retirement Plans [A] Assets 232,233 20,040 64,126 316,400 Total 69,591 - 64,126 133,717 Securities - Fair Value through P&L 26,153 - - 26,153 Securities - Repos 33,445 17,107 - 50,552 Securities - Fair Value through OCI - 2,934 - 2,934 Securities - Trading & Intermediation 36,925 - - 36,925 Other Financial Instruments 66,120 - - 66,120 Other Assets Adjusted Assets [A - B - C] [C] Float [B] Retirement Plans [A] Liabilities + Equity 232,233 20,040 64,126 316,400 Total 51,135 - - 51,135 Securities - Repos 35,936 - - 35,936 Other Finan. Liab. - - 64,126 64,126 Retirement Plans - 20,040 - 20,040 Securities - Trading & Intermediation 145,163 - - 145,163 Other Liabilities & Equity Non - GAAP Financial Information Adjusted Assets (from the factors listed below) reflects our business more realistically [B] Retirement Plans ▪ AUM from XP Vida & Previdência is accounted in both assets and liabilities [C] Float ▪ Uninvested cash from clients allocated in sovereign bonds Key factors inflating our balance sheet Simplified Balance Sheet (in R $ mn )

3Q24 Earnings Presentation Investor Relations ir@xpi.com.br https://investors.xpinc.com/

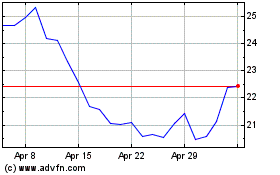

XP (NASDAQ:XP)

Historical Stock Chart

From Nov 2024 to Dec 2024

XP (NASDAQ:XP)

Historical Stock Chart

From Dec 2023 to Dec 2024