false

0001494582

0001494582

2024-05-13

2024-05-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 17, 2024 (May 13, 2024)

|

BOSTON OMAHA CORPORATION

|

|

(Exact name of registrant as specified in its Charter)

|

| |

|

Delaware

|

001-38113

|

27-0788438

|

|

(State or other jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification Number)

|

| |

| |

|

1601 Dodge Street, Suite 3300

Omaha, Nebraska 68102

(Address and telephone number of principal executive offices, including zip code)

|

|

(857) 256-0079

(Registrant's telephone number, including area code)

|

|

Not Applicable

(Former name or address, if changed since last report)

|

Securities registered under Section 12(b) of the Exchange Act:

|

Title of Class

|

Trading Symbol

|

Name of Exchange on Which Registered

|

|

Class A common stock,

$0.001 par value per share

|

BOC

|

The New York Stock Exchange

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of Registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

ITEM 1.01

|

ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

|

Services Agreement

As part of the previously announced wind down of Boston Omaha Asset Management, LLC (“BOAM”), a subsidiary of Boston Omaha Corporation (“Boston Omaha”), BOAM and Brendan J. Keating entered into a Services Agreement for Mr. Keating to provide management services associated with the wind down of BOAM. These services will be provided through a limited liability company owned by Mr. Keating named Local Asset Management LLC (“Local”). As a result, the employment agreement between Mr. Keating and BOAM previously in effect has been terminated and replaced with the Services Agreement between BOAM and Local. The Services Agreement provides for consulting fees which will be reduced over time as assets managed by BOAM are sold. The termination of Mr. Keating's employment agreement is expected to result in significant cost-savings to BOAM over this time period. In addition, BOAM and Mr. Keating entered into a customary Separation Agreement and Release. The foregoing description of each of the Services Agreement and the Separation Agreement and Release are not complete and are qualified in their entirety by reference to the complete text of each of the Services Agreement and the Separation Agreement and Release, copies of which are attached to this Form 8-K as Exhibits 10.1 and 10.2, respectively and are incorporated herein by reference.

Mr. Keating will continue to serve as a member of the Board of Directors of Boston Omaha.

As previously announced, BOAM is now a wholly-owned subsidiary of Boston Omaha and each of Messrs. Peterson, Keating and Rozek, the former holders of Class C units of BOAM, are no longer members of BOAM or have any rights to any distributions from BOAM.

Consummation of Rozek Separation Agreement

As previously announced on May 10, 2024, on May 9, 2024, the Company entered into a Separation Agreement with each of Alex. Rozek, former Co-CEO and Co-Chairman of the Board of Directors of Boston Omaha and Boulderado Partners LLC. The Separation Agreement allowed Mr. Rozek seven days to revoke his acceptance of the Separation Agreement. Mr. Rozek elected not to revoke his acceptance of the Separation Agreement and the Separation Agreement remains in full force and effect.

|

ITEM 9.01

|

FINANCIAL STATEMENTS AND EXHIBITS

|

|

(d)

|

Exhibits. The Exhibit Index set forth below is incorporated herein by reference.

|

EXHIBIT INDEX

|

Exhibit Number

|

Exhibit Title

|

| |

|

|

10.1

|

|

|

10.2

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

BOSTON OMAHA CORPORATION

(Registrant)

|

|

| |

|

|

|

| |

|

|

|

| |

By:

|

/s/ Joshua P. Weisenburger

|

|

| |

|

Joshua P. Weisenburger,

|

|

| |

|

Chief Financial Officer

|

|

Date: May 17, 2024

EXHIBIT 10.1

SERVICES AGREEMENT

This Services Agreement (the “Agreement”), by and between Boston Omaha Asset Management, LLC (“Company”) and Local Asset Management LLC, a Nevada limited liability company (“Manager”) (each a “Party” and collectively the “Parties”), is entered into and effective as of May 13, 2024 (the “Effective Date”).

WHEREAS, Company, through separate single purpose subsidiaries (the “Owners”), holds ownership or profits interests in those certain real estate assets held under those real estate funds as more particularly set forth on Exhibit A attached hereto (collectively the “Assets,” and individually, a “Asset”);

WHEREAS, Company desires to engage Manager to provide certain real estate management services with respect to the Assets; and

WHEREAS, Company and Manager desire to express the terms and conditions of Manager’s engagement in this Agreement.

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

1. Position and Services.

A. Position. As of the Effective Date, Company shall engage Manager as a co-manger the Assets.

B. Services.Manager agrees to provide on a non-exclusive basis certain real estate management services for the Term (as defined below) in accordance with the terms and provisions of this Agreement. Manager will devote such time as reasonably required in order to perform the services, and will have control of the means and methods used to provide the services. Manager shall use its commercially reasonable efforts to promote the success of the Assets and shall cooperate with Company in the advancement of the best interests of the Assets.

2. Term. The term of this Agreement (the “Term”) shall commence on the Effective Date and continue until the sale and related single purpose entity is wound down (referred to as the “Sale”) for all of the Assets, whether through a single transaction or through multiple, separate transactions, unless terminated earlier in accordance with the terms hereof. Company may terminate this Agreement prior to expiration of the Term: (i) for Cause (defined below) upon prior written notice to Manager, or (ii) upon the Sale of all of the Assets, whether through a single transaction or through multiple, separate transactions, this Agreement shall automatically terminate as of the date of the Sale of the last Asset.

“Cause” shall be defined as (a) a material breach of this Agreement, and Manager’s failure to cure such breach within thirty (30) days following written notice from Company to Manager; or (b) Manager’s gross negligence, fraud, willful misconduct or violation of law.

3. Compensation and Reimbursements.

A. Guaranteed Payments. During the Term, Company shall pay Manager a fee equal to $45,833.33 per month (equal to $550,000 annually), beginning on May 1, 2024 (the “Guaranteed Fee”); provided, however that the Guaranteed Fee shall decrease on a quarterly basis following the occurrence of either: (i) real estate Asset(s) being sold and the underlying members of Company receiving their pro rata distribution of the sales proceeds from the sale of such Asset(s) prior to the end of the then applicable quarter, or (ii) the current manager of Company is replaced with Manager herein through the governing documents of Company (each a “Reduction Event”). As of the Effective Date, the total gross Asset value of Company is $89,895,238 (the “Initial Gross Asset Value”). Following each calendar year quarter, if a Reduction Event has occurred in the preceding quarter, the Guaranteed Fee shall be reduced by the percentage amount equal to product of one (1) minus the product of the (a) gross asset value of the Assets (the numerator), divided by the (b) Initial Gross Asset Value (the denominator). By way of illustration, if one (1) real estate Asset is sold, and that sale reduces the Initial Gross Asset Value from $89,895,238 to $71,916,190, then the Guaranteed Fee shall be reduced by 20% and shall be equal to $440,000 annually. The reduced Guaranteed Fee shall be applied in the calendar quarter immediately following the quarter in which the Reduction Event occurred. The Guaranteed Fee will be paid within thirty (30) days of each calendar month in which the Guaranteed Fee is earned, until the Guaranteed Fee is reduced to zero following the sale of all Assets of Company and pro rata distribution of the sale proceeds to the underlying members of Company, and replacement of the current manager of Company with Manager, as applicable.

B. Business Expenses. During the Term, Company shall reimburse Manager for all customary Expenses (as defined below) incurred by representatives of Manager while performing the Services. All reimbursements owed to Manager will be paid within thirty (30) days after receipt by Company of an expense report accompanied by substantiating receipts or invoices.

“Expenses” shall be defined as the reasonable cost of all (a) transportation (including travel on commercial flights within the continental United States for any flight, lodging, and other usual and customary expense while traveling away from the applicable Manager representative’s residence on behalf of Company; (b) reimburse the portion of certain independent contractor fees or employee salaries allocated towards the Services provided through the Manager for the Company, which shall be reconciled between Company and Manager on the twentieth (20th) day of the calendar month immediately following the calendar month in which the services were performed; and (c) other usual and customary expenses incurred in connection with Manager’s performing the Services under this Agreement, but excluding any general overhead or similar costs and expenses, including rent, and personal property and equipment expenses.

4. Ownership of Work Product. All right, title and interest in and to any corporate data relating to Company’s business operations and Owners, including, without limitation, all data and information relating to corporate legal document and contract terms, internal memos, emails, and communications, governance protocols, board meetings minutes, corporate level financial information and regulatory compliance information and other related corporate organizational proprietary information (collectively referred to “Corporate Information”), shall be the property of Company. Upon expiration or termination of the Term, copies of any Corporate Information of whatever nature or kind, including materials incorporating proprietary information of Company, shall be the personal property and proprietary work product of Company. Notwithstanding any of the foregoing to the contrary, Manager shall at all times maintain ownership as to (i) Manager’s principals and affiliates image, likeness, and other characteristics in Manager’s principal’s services, marketing and informational materials, and (ii) data relating to the real estate asset management operations including, but not limited to real property portfolio information, leasing terms and metrics, tenant relations, financial statements and performance, value add strategies, real estate acquisition and disposition information, rate and pricing terms, occupancy rates, capital improvement plans, management protocols, prior asset performance and analytics, investors and lender participants and other related real estate asset management and operations data (collectively referred to “Asset Management Information”).

5. No Exclusivity. This Agreement is nonexclusive, and Manager may contract with other entities to perform services related to or within the Terms of this Agreement. Nothing in this Agreement shall prevent or limit the Manager’s from directly or indirectly (i) soliciting any investor or prospective investors of the Company for the purpose of offering providing any services related to or within the Term of this Agreement; (ii) soliciting to employ or employing any employee of the Company, Boston Omaha Asset Management, LLC or BOAM RIA, LLC; or (iii) pursuing any business opportunity that involves the management of assets for compensation and/or is the type and character of the business activities of the Company.

6. Performance. Manager makes no promises or representations whatsoever as to the performance returns Company and Owners can expect at any time under this Agreement. Manager may engage the services of third parties that may perform the same or similar services as those provided by Manager under this Agreement. No guarantee or representation is made that any investments and Asset will be successful, and investment results may vary substantially over time. The past results of Manager and its principals and affiliates in managing commercial real estate assets are not necessarily indicative of their future performance, and Manager cannot guarantee future results, levels of activity, performance or achievements.

7. Independent Contractor Status. Manager’s status under this Agreement shall be that of an independent contractor, and not that of an employee of Company or otherwise. Company is interested only in the results to be achieved, and the conduct and control of Manager’s work will lie solely with Manager; provided, however, all Services are to be performed in a timely and professional manner consistent with industry standards, and in accordance with the terms and conditions of this Agreement. Manager acknowledges that Company’s fringe benefit plans (if any) are limited solely to Company’s employees, and that Manager shall not participate in any of Company’s fringe benefit plans. Manager is solely responsible for all tax returns and payments required to be filed with or made to any federal, state, or local tax authority with respect to Manager’s performance of the Services and receipt of compensation under this Agreement; Company will report amounts paid to Contractor by filing the necessary Forms 1099 with the Internal Revenue Service, as required by law; and Company will not withhold or make payments for Social Security, make unemployment insurance or disability insurance contributions, or obtain workers’ compensation insurance on Manager’s behalf.

8. Confidentiality. During the Term, except as permitted herein, Company and Manager shall not disclose the provisions of this Agreement to any third party unless otherwise agreed to in writing by the other party. Notwithstanding the forgoing, this confidentiality covenant shall not limit disclosure: (i) of information which is or becomes a matter of public record or is contained in other sources readily available to the public; (ii) of information which was in the possession of the other or its representatives prior to the Effective Date and was not known to such party to be subject to a confidentiality agreement; (iii) of information which is independently developed by Manager or its representatives; (iv) to the agents, consultants, advisors, and attorneys retained by Manager in connection with the Services under this Agreement; (v) to Company’s advisors, representatives, and attorneys; (v) to Company’s and Manager’s affiliates, investors, partners, lenders or potential lenders; or (vi) of Asset Management Information. The confidentiality covenant shall also not limit disclosure by a party that may be required by law, court order or rules of any securities exchange.

9. Indemnification. In performing the Services, Manager is acting solely in an advisory capacity to Company, and, unless caused by the gross negligence or willful misconduct of Manager, or any act by Manager constituting Cause, Manager shall not be liable, directly or indirectly, for any event or occurrence at or in connection with the Assets or for any debt or liability whatsoever incurred in connection with the Assets. Company shall indemnify and hold harmless Manager and its respective directors, shareholders, partners, lenders, members, managers, contractors, agents, affiliates, and employees from and against any and all liability, loss, claims, damages, costs and expenses (“Liabilities”) arising out of or incurred in connection with the ownership, management or operation of the Assets (including, without limitation, any Liability related to any environmental or hazardous materials condition or occurrence).

10. Dispute Resolution.

A. Arbitration. Any dispute, controversy or claim (except an action for a temporary restraining order, preliminary injunction or similar equitable relief) asserted by any party hereto against another party arising out of or relating to this Agreement or any document or agreement executed pursuant to this Agreement or the breach thereof, shall be settled by arbitration if so, requested by any party pursuant to Section 8(B). The arbitration shall be conducted by one arbitrator, who shall be appointed pursuant to the Commercial Arbitration Rules of the American Arbitration Association (“AAA”). The arbitration shall be held in Las Vegas, Nevada, and shall be conducted in accordance with the Commercial Arbitration Rules of the AAA, except that the rules set forth in this Section 8 shall govern such arbitration to the extent that they conflict with the rules of the AAA.

B. Notice; Procedures. Upon written notice by a party to the other parties of a request for arbitration hereunder, the parties shall use their best efforts to cause the arbitration to be conducted in an expeditious manner with such arbitration to be completed within sixty (60) days after selection of the arbitrator. In the arbitration, Nevada law shall govern, except to the extent those laws conflict with the Commercial Arbitration Rules of the AAA and the provisions of this Section 8. The arbitrator shall permit and set deadlines for reasonable discovery at the request of either party. All other procedural matters shall be within the discretion of the arbitrator. In the event a party fails to comply with the procedures in any arbitration in any manner as determined by the arbitrator, the arbitrator shall fix a reasonable period of time for compliance and, if a party fails to comply within such period, a remedy deemed just by the arbitrator, including, without limitation, an award of default, may be imposed. The prevailing party in any such arbitration shall be awarded costs, including, without limitation, attorneys’ fees, by the arbitrator.

C. Binding Nature. The determination of the arbitrator shall be final and binding on the parties. Judgment upon the award rendered by the arbitrator may be entered in any court having jurisdiction thereof.

11. Severability. The provisions of this Agreement are severable. If any provision is determined to be invalid, illegal, or unenforceable, in whole or in part, the remaining provisions and any partially enforceable provisions shall remain in full force and effect.

12. Waiver. The Company’s failure to enforce any provision of this Agreement shall not act as a waiver of that or any other provision. The Company’s waiver of any breach of this Agreement shall not act as a waiver of any other breach.

13. Attorneys’ Fees. In the event of litigation relating to this Agreement, the Company shall, if it is the prevailing party, be entitled to recover attorneys’ fees and costs of litigation in addition to all other remedies available at law or in equity.

14. Entire Agreement. This Agreement constitutes the entire agreement between the Parties concerning the subject matter of this Agreement. This Agreement supersedes any prior communications, agreements or understandings, whether oral or written, between the Parties relating to the subject matter of this Agreement. Other than terms of this Agreement, no other representation, promise or agreement has been made with Manager to cause Manager to sign this Agreement.

15. Successors and Assigns. This Agreement shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns; provided, however, Manager may assign this Agreement or its rights or obligations hereunder to an entity that is an affiliate of Manager without the prior written approval of Company.

16. No Strict Construction. If there is a dispute about the language of this Agreement, the fact that one Party drafted the Agreement shall not be used in its interpretation.

17. Notice. Whenever any notice is required, it shall be given in writing addressed as follows:

To Company: Boston Omaha Asset Management, LLC

1601 Dodge Street, Suite 3300

Omaha, NE 68102

Attn: Adam Peterson

To Manager: Local Asset Management LLC

3900 S Hualapai Way Ste 200

Las Vegas, NV 89147

Notice shall be deemed given and effective on the earlier of: (i) the date on which it is actually received; (ii) the next business day after it is deposited with UPS, FedEx, or a similar overnight courier service for next business day delivery; or (iii) three (3) days after its deposit in the U.S. Mail addressed as above and sent first class mail, certified, return receipt requested. Either Party may change the address to which notices shall be delivered or mailed by notifying the other party of such change in accordance with this Section.

18. Governing Law/Consent to Jurisdiction and Venue. The laws of the State of Nevada shall govern this Agreement. If Nevada’s conflict of law rules would apply another state’s laws, the Parties agree that Nevada law shall still govern. If any action or proceeding is brought concerning this Agreement, it shall be brought in, and the sole and exclusive venue of any such action shall be, a court of competent jurisdiction sitting in Las Vegas, Nevada, or, if in a federal court, in the District of Nevada, Clark County.

19. Execution. This Agreement may be executed in one or more counterparts, including, but not limited to, facsimiles and scanned images. Each counterpart shall for all purposes be deemed to be an original, and each counterpart shall constitute this Agreement.

20. Consultation with Attorney. The parties acknowledge and understand that Stibor Group, LLC, a Nevada limited liability company, dba “Davis Stibor”, has acted as legal counsel to the Manager, Company and in connection with the preparation of this Agreement. Further, Stibor Group, LLC, a Nevada limited liability company, has acted as legal counsel to the Company and its Owners in connection with the Assets. The parties are hereby advised to consult with their own attorney and/or accountant regarding all legal concerning this Agreement and has done so to the extent it considers necessary. The parties acknowledges and understands that the interests of each party is different with respect to this Agreement from the interests of each other party, and each party waives any conflict of interest that may exist with respect to the preparation of this Agreement.

[Signature Page Follows]

IN WITNESS WHEREOF, the parties have executed this Agreement to be effective as of the Effective Date.

COMPANY

Boston Omaha Asset Management, LLC

By: /s Adam K. Peterson

Adam K. Peterson, Manager

MANAGER

Local Asset Management LLC

a Nevada limited liability company

By: Brendan Keating, LLC

a Nevada limited liability company

Its: Manager

By: /s/ Brendan J. Keating

Brendan J. Keating, Manager

EXHIBIT A

LIST OF REAL ESTATE FUNDS

| |

1.

|

24th Street Fund I, LLC

|

| |

2.

|

24th Street Fund II, LLC

|

| |

3.

|

Boston Omaha Build for Rent LP

|

| |

5.

|

BORE Fourth Street, LLC

|

EXHIBIT 10.2

SEPARATION AGREEMENT AND RELEASE

This Separation Agreement and Release (this “Separation Agreement”) is entered into effective as of May 13, 2024 (the “Effective Date”) by and among Brendan Keating, individually (“Keating”), and Boston Omaha Asset Management, LLC, a Delaware limited liability company (the “Company”). Keating and the Company are collectively referred to herein as the “Parties” and individually as a “Party.”

WHEREAS, Company and Keating are parties to that certain Services Agreement dated January 6, 2023 (the “Services Agreement”);

WHEREAS, Keating was employed by the Company as its Co-Managing Partner;

WHEREAS, Keating’s engagement and employment with the Company terminated effective on April 30, 2024 (“Termination Date”); and

WHEREAS, the Parties wish to confirm the terms and conditions of Keating’s separation from the Company.

NOW, THEREFORE, in consideration of One Hundred Dollars ($100) and the foregoing and following waivers, representations, covenants and agreements, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties, intending to be legally bound hereby, agree as follows:

The recitals (together with the defined terms contained therein) are intended to be substantive provisions of this Separation Agreement and are incorporated by this reference into this Separation Agreement as a substantive part of this Separation Agreement.

The Parties acknowledge and agree that Company and Keating have mutually and voluntarily terminated the Services Agreement and Keating’s employment effective as of the Termination Date.

|

Section 3.

|

Post Termination Waivers

|

(a) The Company and Keating hereby agree that the non-solicitation of customers, non-solicitation of prospective customers, non-recruitment of employees and the business opportunity rights restrictive covenants set forth in Section 4(D)(ii) to 4(D)(v) of the Service Agreement shall not survive termination of the Services Agreement and that such restrictive covenants shall be deemed terminated and of no further force and effect as of the Termination Date.

(b) The Company and Keating hereby agree that Keating shall be free to utilize the Company’s data relating to the real estate asset management operations that relate to Keating in connection with his provision of future real estate and asset management services, regardless if such information was prepared by Keating during the term of the Services Agreement, including, but not limited to real property portfolio information, leasing terms and metrics, tenant relations, financial statements and performance, value add strategies, real estate acquisition and disposition information, rate and pricing terms, occupancy rates, capital improvement plans, management protocols, prior asset performance and analytics, investors and lender participants and other related real estate asset management and operations data (collectively referred to “Asset Management Information”) and such Asset Management Information shall not be deemed trade secrets or confidential information of the Company. The Company and Keating hereby agree that the trade secrets or confidential information restrictive covenant set forth in Section 4(D)(i) of the Service Agreement shall not apply to the Asset Management Information; provided, however, except as otherwise set forth in this Agreement or consented to by Company, Keating shall continue to treat Company corporate data as confidential, which shall include corporate legal document and contract terms, internal memos, emails, and communications, governance protocols, board meetings minutes, corporate level financial information and regulatory compliance information and other related corporate organizational proprietary information (collectively referred to “Corporate Information”). Keating shall not disclose or share such Corporate Information with others outside of the Company and shall remain bound by the post-engagement obligations set forth in Section 4(D)(i) of the Services Agreement in connection with such Corporate Information. Additionally, Keating shall maintain continued access to all email addresses and database systems utilized under the Services Agreement.

(c) The Company and Keating hereby agree that all restrictive covenants set forth in Section 4(D)(ii) to 4(D)(v) of the Service Agreement shall not survive termination of the Services Agreement, and Company terminates and waives any and all restrictions set forth in the Services Agreement in connection with the “Restriction Period” as defined therein, including Company termination and waiver of the non-solicitation of customers, non-solicitation of prospective customers, non-recruitment of employees and the business opportunity rights set forth therein. The restrictive covenant of non-solicitation of customers, non-solicitation of prospective customers, non-recruitment of employees and the business opportunity rights are hereby void and of no further force and effect.

(d) Keating is free, without limitation, to solicit any customer or prospective customer of the Company for the purpose of offering investment interests, selling or providing real estate asset management services, acting as a manager (or the equivalent), or otherwise earning customary asset management fees and compensation as a manager (or the equivalent), of an asset manager that may or be deemed to compete with any existing business of (i) the Company, or (ii) any currently existing or future, direct or indirect, subsidiary of the Company; and to recruit, engage or hire any employee of the Company for any purpose including providing real estate asset management services.

(e) Keating is not restricted by or subject to any obligation or right to first provide the Company an opportunity to any business, including any business that involves the management of assets for compensation, and Keating is free, without limitation, to pursue future investment from customers, prospective customers, and investors of the Company for the purposes of selling or providing real estate asset management services, acting as a manager (or the equivalent), or otherwise earning customary asset management fees and compensation as a manager (or the equivalent), of an asset manager that may or be deemed to compete with any existing business of (i) the Company or (ii) any currently existing or future, direct or indirect, subsidiary of the Company.

(f) Any and all data relating to the real estate asset management operations of the Company including Keating’s “track record” shall not be deemed a “Trade Secret” of the Company as relates to Keating, and Keating shall be free, without limitation, to utilize such data and information in connection with any and all future real estate and asset management services, regardless if such information was prepared by Keating during the term of the Services Agreement. Additionally, Keating shall maintain continued access to all email addresses and database systems utilized under the Services Agreement.

To the extent necessary, the Services Agreement shall be deemed amended and modified in accordance with the terms set forth above and any conflict they may exist between the terms of the Services Agreement and this Separation Agreement, then this Separation Agreement shall control.

|

Section 4.

|

Release and Waiver.

|

As of the Effective Date, the Parties agree to release and waive claims against each other as provided for below.

(a) In consideration of the representations, waivers, covenants, and promises contained herein, Keating hereby irrevocably and absolutely releases and forever discharges the Company and its parent entities, subsidiaries, employees, assigns, agents, insurers, affiliates, officers, members, managers, owners, successors, predecessors, attorneys, representatives and others acting by or through them, from any and all past, present, or future claims, damages (including attorney fees), demands, actions or causes of action of any kind or nature, whether known or unknown, whether under contract or tort, that Keating, his heirs, executors, administrators, and assigns, has, or may have, whether known or unknown, present or contingent, up to and including the Effective Date of this Separation Agreement (collectively the “Claims”), Claims arising out of Keating’s employment with Company, any Claim arising from any agreement, policy or plan of Company, including, but not limited to, the Services Agreement, and any Claim under any federal, state or local statutory or common laws, including, but not limited to, Title VII of the Civil Rights Act, the Americans with Disabilities Act, the Fair Labor Standards Act, the Family and Medical Leave Act, the National Labor Relations Act, the Employee Retirement Income Security Act, the Age Discrimination in Employment Act, the Older Workers Benefit Protection Act, and the Nevada Fair Employment Practices Act, all as amended. The Parties acknowledge and agree that this release does not apply to a claim to enforce this Separation Agreement. This release also does not extend to claims based solely on conduct that occurs after the Effective Date.

(b) In consideration of the representations, waivers, covenants, and promises contained herein, the Company, on its behalf, as well as on behalf of their parent entities, subsidiaries, employees, assigns, agents, insurers, affiliates, officers, members, managers, owners, successors, predecessors, attorneys, representatives and others acting by or through them, hereby irrevocably and absolutely release and forever discharge Keating, his spouse, assigns, and others acting by or through him, from any and all past, present, or future claims, demands, obligations, actions, causes of action, or administrative or other proceedings of whatever kind or nature, whether in law, statute, or equity and whether known or unknown, present or contingent, for damages, costs, losses, expenses, compensation, and legal fees which the Company has held or now holds, whether known or unknown, arising directly or indirectly out of or involving the Services Agreement between Keating and the Company, with the sole exception of a claim to enforce this Separation Agreement. This release does not extend to claims based solely on conduct that occurs after the Effective Date.

The Parties represent and warrant that they fully understand that the facts presently known to them may later be found to be different, and expressly accept and assume the risk that the facts may be found to be different. The release and waiver contained herein shall be effective in all respects and shall not be subject to termination or rescission because of any such difference in facts. Thus, for the purpose of implementing a full and complete release and discharge, the Parties expressly acknowledge that this Separation Agreement is intended to include in its effect without limitation, all claims which they do not know or suspect to exist at the time of execution hereof, and that this Separation Agreement contemplates the extinguishment of any such claim or claims and does specifically waive any claim or demand including any such claim or demand, which has been omitted from this Separation Agreement either through oversight or error intentionally or unintentionally or through mutual mistake.

|

Section 5.

|

Indemnification

|

The Company hereby covenants and agrees that Company shall indemnify and hold Keating harmless from and against any and all claims, demands, losses, liabilities, damages and expenses (including, without limitation, reasonable attorneys’ fees and other costs of defense), whatsoever kind or nature, presently known or unknown, actual or contingent, asserted or unasserted, foreseeable or unforeseeable, caused by or arising out of (i) operation of the Company from and after the Termination Date, (ii) any third party that has or may have now or in the future against the Company or Keating with regard to Keating’s involvement in the Company, and (iii) winding down the affairs of the Company and future dissolution of the Company. The Company agrees that this Separation Agreement does not limit, restrict, or preclude any coverage or protection of Keating under any directors and officers insurance maintained by the Company.

|

Section 6.

|

No Waiver of Breaches of Agreement.

|

The failure of any Party to insist upon strict compliance by the other Party with any of the covenants or restrictions contained in this Separation Agreement shall not be construed as a waiver, nor shall any course of action deprive any Party of the right to require strict compliance with this Separation Agreement.

Each party agrees that neither this Separation Agreement nor any obligations under this Separation Agreement constitute an admission by any party of any violation of any federal, state or local laws, rules or regulations or of any liability under contract or tort theories. The Company and Keating each specifically disclaim any wrongdoing whatsoever against the other party.

|

Section 8.

|

Representations.

|

The Company and Keating each represent and warrant that each of them has the sole right and exclusive authority to execute this Separation Agreement, and that neither of them has sold, assigned, transferred, conveyed, or otherwise previously disposed of any claim or demand released pursuant to Section 4 of this Separation Agreement.

|

Section 9.

|

Complete Agreement and Modifications.

|

This Separation Agreement constitutes the entire agreement among the Parties with regard to the respective subject matter and, except as otherwise stated herein, shall supersede any and all prior and contemporaneous representations, contracts or agreements of any nature. The Services Agreement is incorporated herein by reference. Any modification of any provision of this Separation Agreement shall not be valid unless in writing and executed by the Parties. The Parties further agree that each is signing this Separation Agreement voluntarily and without coercion, intimidation or threat of retaliation and after consultation with independent legal counsel.

|

Section 10.

|

Knowing Waiver.

|

Each of the Parties represents that it or he has read this Separation Agreement, and understands each of the terms of this Separation Agreement. Each of the Parties further understands that it or he has entered into and executed this Separation Agreement voluntarily and willingly. Further, the Parties acknowledge and understand that Stibor Group, LLC, a Nevada limited liability company, dba “Davis Stibor”, has acted as legal counsel to the Company and Keating in connection with certain real estate asset management services. The Parties are hereby advised to consult with their own attorney regarding all legal matters concerning this Separation Agreement and has done so to the extent it considers necessary. The Parties acknowledges and understands that the interests of each Party is different with respect to this Separation Agreement from the interests of each other Party, and each Party waives any conflict of interest that may exist with respect to the preparation of this Separation Agreement.

|

Section 11.

|

Review Period.

|

Keating is hereby advised to consult with an attorney prior to signing this Separation Agreement. Keating acknowledges that he has been represented in connection with this Separation Agreement. Keating confirms and acknowledges that he has read and understands this Separation Agreement and that he has signed this Separation Agreement freely and voluntarily with the intent to fully release the Company from any and all Claims. Keating further acknowledges that he has been given up to twenty-one (21) days to consider signing this Separation Agreement (the “Review Period”). Keating further acknowledges and agrees that by signing this Separation Agreement prior to the expiration of the Review Period, Keating knowingly and voluntarily waives the Review Period and surrenders whatever rights or claims he may have to challenge the Separation Agreement because the Review Period did not expire before he signed the Separation Agreement.

|

Section 12.

|

Right of Revocation.

|

Keating acknowledges and understands that he may revoke this Separation Agreement for a period of up to seven (7) days after he executes it (not counting the day it is signed). To revoke this Separation Agreement, Keating must give written notice to the Company stating that he wishes to revoke this Separation Agreement, by providing notice by hand-delivery or mail to the Company, 1601 Dodge Street, Suite 3300, Omaha, NE 68102, Attn: Adam Peterson. This Separation Agreement shall become effective and enforceable on the eighth (8th) day following his return of an executed copy of this Separation Agreement to the Company, assuming it has not been revoked, or upon execution by both parties, whichever is later (the “Effective Date”).

|

Section 13.

|

Severability.

|

If any provision of this Separation Agreement shall be held invalid, illegal or unenforceable, the validity, legality and enforceability of the remaining provisions of this Separation Agreement shall not be impaired thereby.

|

Section 14.

|

Successors and Assigns.

|

The benefits and obligations under this Separation Agreement shall be binding upon and shall inure to and may be enforced by the Parties and their respective successors and permitted assign, personal or legal representatives, executors, administrators, successors, heirs, devisees and legatees.

|

Section 15.

|

Counterparts.

|

This Separation Agreement may be executed via facsimile or other electronic signature in separate counterparts, each of which is deemed to be an original and all of which taken together constitute one and the same Separation Agreement.

|

Section 16.

|

Applicable Law and Jurisdiction

|

This Separation Agreement shall be governed by and construed in accordance with the laws of the State of Nevada, without giving effect to the principles of conflicts of law thereof. Each of the Parties agrees that all actions, suits or proceedings arising out of or based upon this Separation Agreement, or the subject matter hereof shall be brought and maintained exclusively in the state or federal courts located in Clark County, Nevada. Each of the Parties by execution hereof (a) hereby irrevocably submits to the jurisdiction of the state and federal courts located in the Clark County, Nevada, for the purpose of any action arising out of or based upon this Separation Agreement or the subject matter hereof and (b) hereby waives to the extent not prohibited by applicable law, and agrees not to assert, by way of motion, as a defense or otherwise, in any such action, any claim that it is not subject personally to the jurisdiction of the above-named court, that it is immune from extraterritorial injunctive relief, that its property is exempt or immune from attachment or execution, that any such action may not be brought or maintained in the above-named court, should be dismissed on the grounds of forum non conveniens, should be transferred to any court other than the above-named court, should be stayed by virtue of the pendency of any other action in any court other than the above-named court, or that this Separation Agreement or the subject matter hereof may not be enforced in or by the above-named court. Each of the Parties hereby consents to service of process in any such action in any manner permitted by the laws of the State of Nevada. The provisions of this Section shall not restrict the ability of any Party to enforce in any court any judgment obtained in the state or federal courts located in the State of Nevada, Clark County.

|

Section 17.

|

Further Assurances.

|

Each Party will execute and deliver any further instruments or documents, and take all further action, reasonably requested by the other party to carry out the transactions contemplated by this Separation Agreement.

All notices, reports, records, or other communications which are required or permitted to be given to the Parties under this Agreement shall be sufficient in all respects if given in writing and delivered in person, by facsimile or other electronic transmission or by overnight courier, to the receiving Party at the address listed on the signature page to this Agreement, or to such other address as such Party may have given to the other by notice pursuant to Section 17 of the Services Agreement. Notice shall be deemed given on the date of delivery, in the case of personal delivery or facsimile or other electronic transmission, or on the delivery or refusal date, in the case of overnight courier.

[Signature Page Follows]

WHEREFORE, the Parties voluntarily enter into this Separation Agreement by affixing their signatures on the date set forth below to be effective as of the Effective Date.

COMPANY:

Boston Omaha Asset Management, LLC

a Delaware limited liability company

By: /s/ Adam K. Peterson

Adam K. Peterson, Manager

KEATING:

/s/ Brendan J. Keating

Brendan J. Keating, individually

v3.24.1.1.u2

Document And Entity Information

|

May 13, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

BOSTON OMAHA CORPORATION

|

| Document, Type |

8-K

|

| Document, Period End Date |

May 13, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-38113

|

| Entity, Tax Identification Number |

27-0788438

|

| Entity, Address, Address Line One |

1601 Dodge Street

|

| Entity, Address, Address Line Two |

Suite 3300

|

| Entity, Address, City or Town |

Omaha

|

| Entity, Address, State or Province |

NE

|

| Entity, Address, Postal Zip Code |

68102

|

| City Area Code |

857

|

| Local Phone Number |

256-0079

|

| Title of 12(b) Security |

Class A common stock

|

| Trading Symbol |

BOC

|

| Security Exchange Name |

NYSE

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001494582

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

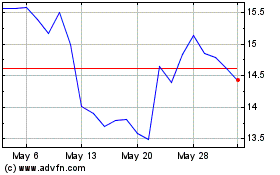

Boston Omaha (NYSE:BOC)

Historical Stock Chart

From May 2024 to Jun 2024

Boston Omaha (NYSE:BOC)

Historical Stock Chart

From Jun 2023 to Jun 2024