Company achieves profitability on higher

volumes, margin growth and productivity

Completes Vision 2025 and launches

new strategic plan - Project North Star

Highlights:

- Revenue of $315 million, up 18% compared to the prior year.

Adjusted revenue of $329 million, up 26% compared to the prior

year.

- Company announces Ridgeland Mortgage joint venture with Smith

Douglas Homes, expanding loanDepot’s network of partnerships with

top homebuilders.

- Pull-through weighted gain on sale margin of 329 basis points,

the highest margin since the beginning of the market downturn.

- Net income of $3 million and adjusted net income of $7 million,

compared with prior year net loss and adjusted net loss of $34

million and $29 million, respectively, reflect the positive impact

of higher revenue and cost productivity.

- Adjusted EBITDA of $64 million compared with $15 million in the

prior year.

- Strong liquidity profile with cash balance of $483

million.

loanDepot, Inc. (NYSE: LDI), (together with its subsidiaries,

“loanDepot” or the “Company”), a leading provider of products and

services that power the homeownership journey, today announced

results for the third quarter ended September 30, 2024.

“Through the successful implementation of our Vision 2025

strategic program, loanDepot returned to profitability in the third

quarter on modest improvements in market volumes, which resulted in

higher revenue,” said President and Chief Executive Officer Frank

Martell. “We are also realizing the benefits of our ongoing cost

management and productivity programs, which helped to fund

strategic investments in our platforms, solutions and people. These

investments should help position the company for success in 2025

and beyond.

“Vision 2025, launched in July of 2022, was a critical factor in

our successful navigation of unprecedented and challenging market

conditions over the past three years. The launch of Project North

Star builds on the strategic pillars of Vision 2025, including our

focus on durable revenue growth, positive operating leverage,

productivity and investments in platforms and solutions that

support our customer’s homeownership journey,” added Martell.

“We are pleased that the successful completion of the strategic

objectives of Vision 2025 has delivered the company’s first

profitable quarter since the beginning of the market downturn in

the first quarter of 2022,” said David Hayes, Chief Financial

Officer. “The third quarter served as validation of our strategy as

we saw a modest improvement in the mortgage market, coupled with

the company’s positive operating leverage fueled our return to

profitability. As we look toward 2025, we anticipate continued

market challenges, but we believe that the implementation of

Project North Star will allow us to capture the benefit of higher

market volumes while we continue to capitalize on our ongoing

investments in operational efficiency to achieve sustainable

profitability in a wide variety of operating environments.”

Third Quarter Highlights:

Financial Summary

Three Months Ended

Nine Months Ended

($ in thousands except per share data)

(Unaudited)

Sep 30, 2024

Jun 30, 2024

Sep 30, 2023

Sep 30, 2024

Sep 30, 2023

Rate lock volume

$

9,792,423

$

8,298,270

$

8,295,935

$

24,893,023

$

25,738,036

Pull-through weighted lock volume(1)

6,748,057

5,782,309

5,685,209

17,262,202

17,067,876

Loan origination volume

6,659,329

6,090,634

6,083,143

17,308,314

17,301,023

Gain on sale margin(2)

3.33

%

3.06

%

2.74

%

3.11

%

2.66

%

Pull-through weighted gain on sale

margin(3)

3.29

%

3.22

%

2.93

%

3.12

%

2.69

%

Financial Results

Total revenue

$

314,598

$

265,390

$

265,661

$

802,772

$

745,395

Total expense

311,003

342,547

305,128

961,497

949,760

Net income (loss)

2,672

(65,853

)

(34,262

)

(134,685

)

(175,743

)

Diluted earnings (loss) per share

$

0.01

$

(0.18

)

$

(0.09

)

$

(0.36

)

$

(0.48

)

Non-GAAP Financial Measures(4)

Adjusted total revenue

$

329,499

$

278,007

$

261,116

$

838,318

$

755,852

Adjusted net income (loss)

7,077

(15,890

)

(29,211

)

(48,309

)

(124,417

)

Adjusted EBITDA

63,742

34,575

15,253

98,820

(8,399

)

(1)

Pull-through weighted rate lock volume is

the principal balance of loans subject to interest rate lock

commitments, net of a pull-through factor for the loan funding

probability.

(2)

Gain on sale margin represents the total

of (i) gain on origination and sale of loans, net, and (ii)

origination income, net, divided by loan origination volume during

period.

(3)

Pull-through weighted gain on sale margin

represents the total of (i) gain on origination and sale of loans,

net, and (ii) origination income, net, divided by the pull-through

weighted rate lock volume.

(4)

See “Non-GAAP Financial Measures” for a

discussion of Non-GAAP Financial Measures and a reconciliation of

these metrics to their closest GAAP measure.

Year-over-Year Operational Highlights

- Non-volume related expenses decreased $11.4 million from the

third quarter of 2023, primarily due to lower general and

administrative expenses, offset somewhat by higher headcount

related salary expenses and marketing costs.

- Accrued a net benefit of $18.9 million primarily associated

with expected insurance proceeds related to the settlement of

class-action litigation related to the first quarter Cybersecurity

Incident.

- Incurred restructuring and impairment charges totaling $1.9

million, a decrease of $0.4 million from the third quarter of

2023.

- Pull-through weighted lock volume of $6.7 billion for the third

quarter of 2024, an increase of $1.1 billion or 19% from the third

quarter of 2023.

- Loan origination volume for the third quarter of 2024 was $6.7

billion, an increase of $0.6 billion or 9% from the third quarter

of 2023.

- Purchase volume totaled 66% of total loans originated during

the third quarter, down slightly from 71% during the third quarter

of 2023.

- Our preliminary organic refinance consumer direct recapture

rate1 increased to 71% from the third quarter 2023’s recapture rate

of 69%.

- Net income for the third quarter of 2024 of $2.7 million as

compared to net loss of $34.3 million in the third quarter of 2023.

Net income increased primarily due to higher revenue from increased

volume and pull-through weighted gain on sale margin.

- Adjusted net income for the third quarter of 2024 was $7.1

million as compared to adjusted net loss of $29.2 million for the

third quarter of 2023.

Outlook for the fourth quarter of 2024

- Origination volume of between $6 billion and $8 billion.

- Pull-through weighted rate lock volume of between $5.5 billion

and $7.5 billion.

- Pull-through weighted gain on sale margin of between 285 basis

points and 305 basis points.

Servicing

Three Months Ended

Nine Months Ended

Servicing Revenue Data:

($ in thousands)

(Unaudited)

Sep 30, 2024

Jun 30, 2024

Sep 30, 2023

Sep 30, 2024

Sep 30, 2023

Due to collection/realization of cash

flows

$

(41,498

)

$

(42,285

)

$

(38,502

)

$

(119,783

)

$

(114,777

)

Due to changes in valuation inputs or

assumptions

(52,557

)

15,623

68,651

(8,690

)

73,422

Realized gain (loss) on sale of servicing

rights

32

(3,057

)

5,247

(2,980

)

12,411

Net gain (loss) from derivatives hedging

servicing rights

37,624

(25,183

)

(69,353

)

(23,876

)

(96,290

)

Change in fair value of servicing rights,

net of hedging gains and losses

(14,901

)

(12,617

)

4,545

(35,546

)

(10,457

)

Other realized losses on sales of

servicing rights (1)

(164

)

(5,885

)

(1,731

)

(7,290

)

(1,734

)

Changes in fair value of servicing rights,

net

$

(56,563

)

$

(60,787

)

$

(35,688

)

$

(162,619

)

$

(126,968

)

Servicing fee income (2)

$

124,133

$

125,082

$

120,911

$

373,273

$

360,329

(1)

Includes the (provision) recovery for sold

MSRs and broker fees.

(2)

Servicing fee income for the three and

nine months ended September 30, 2023, has been adjusted to

incorporate earnings credits, which were previously classified as

part of net interest income.

_________________________________

1 We define organic refinance consumer direct recapture rate as the

total unpaid principal balance (“UPB”) of loans in our servicing

portfolio that are paid in full for purposes of refinancing the

loan on the same property, with the Company acting as lender on

both the existing and new loan, divided by the UPB of all loans in

our servicing portfolio that paid in full for the purpose of

refinancing the loan on the same property. The recapture rate is

finalized following the publication date of this release when

external data becomes available.

Three Months Ended

Nine Months Ended

Servicing Rights, at Fair

Value:

($ in thousands)

(Unaudited)

Sep 30, 2024

Jun 30, 2024

Sep 30, 2023

Sep 30, 2024

Sep 30, 2023

Balance at beginning of period

$

1,566,463

$

1,970,164

$

1,998,762

$

1,985,718

$

2,025,136

Additions

62,039

66,115

80,068

176,529

215,229

Sales proceeds

(8,466

)

(439,199

)

(73,972

)

(503,777

)

(171,167

)

Changes in fair value:

Due to changes in valuation inputs or

assumptions

(52,557

)

15,623

68,651

(8,690

)

73,422

Due to collection/realization of cash

flows

(41,498

)

(42,285

)

(38,502

)

(119,783

)

(114,777

)

Realized gains (losses) on sales of

servicing rights

32

(3,955

)

3,647

(3,984

)

10,811

Total changes in fair value

(94,023

)

(30,617

)

33,796

(132,457

)

(30,544

)

Balance at end of period (1)

$

1,526,013

$

1,566,463

$

2,038,654

$

1,526,013

$

2,038,654

(1)

Balances are net of $16.7 million, $16.7

million, and $14.7 million of servicing rights liability as of

September 30, 2024, June 30, 2024, and September 30, 2023,

respectively.

% Change

Servicing Portfolio Data:

($ in thousands)

(Unaudited)

Sep 30, 2024

Jun 30, 2024

Sep 30, 2023

Sep-24

vs

Jun-24

Sep-24 vs

Sep-23

Servicing portfolio (unpaid principal

balance)

$

114,915,206

$

114,278,549

$

143,959,705

0.6

%

(20.2

)%

Total servicing portfolio (units)

409,344

403,302

490,191

1.5

(16.5

)

60+ days delinquent ($)

$

1,654,955

$

1,457,098

$

1,235,443

13.6

34.0

60+ days delinquent (%)

1.4

%

1.3

%

0.9

%

Servicing rights, net to UPB

1.3

%

1.4

%

1.4

%

Balance Sheet Highlights

% Change

($ in thousands)

(Unaudited)

Sep 30, 2024

Jun 30, 2024

Sep 30, 2023

Sep-24 vs

Jun-24

Sep-24 vs

Sep-23

Cash and cash equivalents

$

483,048

$

533,153

$

717,196

(9.4

)%

(32.6

)%

Loans held for sale, at fair value

2,790,284

2,377,987

2,070,748

17.3

34.7

Loans held for investment, at fair

value

122,066

120,287

—

1.5

NM

Servicing rights, at fair value

1,542,720

1,583,128

2,053,359

(2.6

)

(24.9

)

Total assets

6,417,627

5,942,777

6,078,529

8.0

5.6

Warehouse and other lines of credit

2,565,713

2,213,128

1,897,859

15.9

35.2

Total liabilities

5,825,578

5,363,839

5,309,594

8.6

9.7

Total equity

592,049

578,938

768,935

2.3

(23.0

)

An increase in loans held for sale at September 30, 2024,

resulted in a corresponding increase in the balance on our

warehouse lines of credit. Total funding capacity with our lending

partners was $3.1 billion at September 30, 2024, and $3.9 billion

at September 30, 2023. Available borrowing capacity was $0.5

billion at September 30, 2024.

Consolidated Statements of

Operations

($ in thousands except per share data)

Three Months Ended

Nine Months Ended

Sep 30, 2024

Jun 30, 2024

Sep 30, 2023

Sep 30, 2024

Sep 30, 2023

(Unaudited)

(Unaudited)

REVENUES:

Interest income

$

38,673

$

35,052

$

37,253

$

104,650

$

98,271

Interest expense

(39,488

)

(35,683

)

(36,770

)

(106,837

)

(96,459

)

Net interest (expense) income

(815

)

(631

)

483

(2,187

)

1,812

Gain on origination and sale of loans,

net

198,027

166,920

148,849

481,007

411,336

Origination income, net

23,675

19,494

17,740

56,775

48,088

Servicing fee income

124,133

125,082

120,911

373,273

360,329

Change in fair value of servicing rights,

net

(56,563

)

(60,787

)

(35,688

)

(162,619

)

(126,968

)

Other income

26,141

15,312

13,366

56,523

50,798

Total net revenues

314,598

265,390

265,661

802,772

745,395

EXPENSES:

Personnel expense

161,330

141,036

141,432

436,683

440,258

Marketing and advertising expense

36,282

31,175

33,894

95,811

104,520

Direct origination expense

23,120

21,550

15,749

62,841

50,352

General and administrative expense

22,984

73,160

46,522

153,889

157,473

Occupancy expense

4,800

5,204

5,903

15,113

18,083

Depreciation and amortization

8,931

8,955

10,592

27,329

31,339

Servicing expense

8,427

8,467

8,532

25,155

19,116

Other interest expense

45,129

53,000

42,504

144,676

128,619

Total expenses

311,003

342,547

305,128

961,497

949,760

Income (loss) before income taxes

3,595

(77,157

)

(39,467

)

(158,725

)

(204,365

)

Income tax expense (benefit)

923

(11,304

)

(5,205

)

(24,040

)

(28,622

)

Net income (loss)

2,672

(65,853

)

(34,262

)

(134,685

)

(175,743

)

Net income (loss) attributable to

noncontrolling interests

1,303

(33,642

)

(17,663

)

(69,588

)

(92,793

)

Net income (loss) attributable to

loanDepot, Inc.

$

1,369

$

(32,211

)

$

(16,599

)

$

(65,097

)

$

(82,950

)

Basic income (loss) per share

$

0.01

$

(0.18

)

$

(0.09

)

$

(0.36

)

$

(0.48

)

Diluted income (loss) per share

$

0.01

$

(0.18

)

$

(0.09

)

$

(0.36

)

$

(0.48

)

Weighted average shares outstanding

Basic

185,385,271

182,324,046

175,962,804

183,041,489.00

173,568,986.00

Diluted

332,532,984

182,324,046

175,962,804

183,041,489.00

173,568,986.00

Consolidated Balance Sheets

($ in thousands)

Sep 30, 2024

Jun 30, 2024

Dec 31, 2023

(Unaudited)

ASSETS

Cash and cash equivalents

$

483,048

$

533,153

$

660,707

Restricted cash

95,593

98,057

85,149

Loans held for sale, at fair value

2,790,284

2,377,987

2,132,880

Loans held for investment, at fair

value

122,066

120,287

—

Derivative assets, at fair value

68,647

59,779

93,574

Servicing rights, at fair value

1,542,720

1,583,128

1,999,763

Trading securities, at fair value

92,324

89,477

92,901

Property and equipment, net

62,974

64,631

70,809

Operating lease right-of-use asset

23,020

24,549

29,433

Loans eligible for repurchase

860,300

740,238

711,371

Investments in joint ventures

17,899

17,905

20,363

Other assets

258,752

233,586

254,098

Total assets

$

6,417,627

$

5,942,777

$

6,151,048

LIABILITIES AND EQUITY

LIABILITIES:

Warehouse and other lines of credit

$

2,565,713

$

2,213,128

$

1,947,057

Accounts payable and accrued expenses

381,543

375,319

379,971

Derivative liabilities, at fair value

22,143

17,856

84,962

Liability for loans eligible for

repurchase

860,300

740,238

711,371

Operating lease liability

38,538

41,896

49,192

Debt obligations, net

1,957,341

1,975,402

2,274,011

Total liabilities

5,825,578

5,363,839

5,446,564

EQUITY:

Total equity

592,049

578,938

704,484

Total liabilities and equity

$

6,417,627

$

5,942,777

$

6,151,048

Loan Origination and Sales Data

($ in thousands)

(Unaudited)

Three Months Ended

Nine Months Ended

Sep 30, 2024

Jun 30, 2024

Sep 30, 2023

Sep 30, 2024

Sep 30, 2023

Loan origination volume by

type:

Conventional conforming

$

3,254,702

$

3,232,905

$

3,158,107

$

8,991,282

$

9,375,605

FHA/VA/USDA

2,564,827

2,271,104

2,354,630

6,489,956

6,371,168

Jumbo

300,086

229,379

126,408

646,787

405,551

Other

539,714

357,246

443,998

1,180,289

1,148,699

Total

$

6,659,329

$

6,090,634

$

6,083,143

$

17,308,314

$

17,301,023

Loan origination volume by

purpose:

Purchase

$

4,378,575

$

4,383,145

$

4,337,476

$

12,057,993

$

12,403,166

Refinance - cash out

1,954,071

1,562,827

1,660,578

4,660,580

4,599,564

Refinance - rate/term

326,683

144,662

85,089

589,741

298,293

Total

$

6,659,329

$

6,090,634

$

6,083,143

$

17,308,314

$

17,301,023

Loans sold:

Servicing retained

$

3,818,375

$

4,011,399

$

4,175,126

$

10,816,315

$

11,396,678

Servicing released

2,487,589

1,893,515

2,092,762

5,833,916

6,345,660

Total

$

6,305,964

$

5,904,914

$

6,267,888

$

16,650,231

$

17,742,338

Third Quarter Earnings Call

Management will host a conference call and live webcast today at

5:00 p.m. ET on loanDepot’s Investor Relations website,

investors.loandepot.com, to discuss the Company’s earnings

results.

The conference call can also be accessed by dialing (800)

715-9871, Conference ID: 9881136. Please call five minutes in

advance to ensure that you are connected prior to the call. A

webcast can also be accessed at

https://events.q4inc.com/attendee/479196723.

A replay of the webcast will be made available on the Investor

Relations website following the conclusion of the event.

For more information about loanDepot, please visit the company’s

Investor Relations website: investors.loandepot.com.

Non-GAAP Financial Measures

To provide investors with information in addition to our results

as determined by GAAP, we disclose certain non-GAAP measures to

assist investors in evaluating our financial results. We believe

these non-GAAP measures provide useful information to investors

regarding our results of operations because each measure assists

both investors and management in analyzing and benchmarking the

performance and value of our business. They facilitate

company-to-company operating performance comparisons by backing out

potential differences caused by variations in hedging strategies,

changes in valuations, capital structures (affecting interest

expense on non-funding debt), taxation, the age and book

depreciation of facilities (affecting relative depreciation

expense), and other cost or benefit items which may vary for

different companies for reasons unrelated to operating performance.

These non-GAAP measures include our Adjusted Total Revenue,

Adjusted Net Income (Loss), Adjusted Diluted Earnings (Loss) Per

Share (if dilutive), and Adjusted EBITDA (LBITDA). We exclude from

these non-GAAP financial measures the change in fair value of MSRs,

gains (losses) from the sale of MSRs and related hedging gains and

losses that represent realized and unrealized adjustments resulting

from changes in valuation, mostly due to changes in market interest

rates, and are not indicative of the Company’s operating

performance or results of operation. Beginning in the second

quarter of 2024, we began to include the gains (losses) from the

sale of MSRs in valuation changes in servicing rights, net of

hedging gains and losses to appropriately capture all valuation

changes in MSRs up to and including the sales date. Prior periods

have been revised to conform with this new presentation. We also

exclude stock-based compensation expense, which is a non-cash

expense, expenses directly related to the Cybersecurity Incident,

net of expected insurance recoveries, including costs to

investigate and remediate the Cybersecurity Incident, the costs of

customer notifications and identity protection, professional fees,

including legal expenses, litigation settlement costs, and

commission guarantees, gains or losses on extinguishment of debt

and disposal of fixed assets, non-cash goodwill impairment, and

other impairment charges to intangible assets and operating lease

right-of-use assets, as well as certain costs associated with our

restructuring efforts, as management does not consider these costs

to be indicative of our performance or results of operations.

Adjusted EBITDA (LBITDA) includes interest expense on funding

facilities, which are recorded as a component of “net interest

income (expense),” as these expenses are a direct operating expense

driven by loan origination volume. By contrast, interest expense on

our non-funding debt is a function of our capital structure and is

therefore excluded from Adjusted EBITDA (LBITDA). Adjustments for

income taxes are made to reflect historical results of operations

on the basis that it was taxed as a corporation under the Internal

Revenue Code, and therefore subject to U.S. federal, state and

local income taxes. Adjustments to Diluted Weighted Average Shares

Outstanding assumes the pro forma conversion of weighted average

Class C shares to Class A common stock. These non-GAAP measures

have limitations as analytical tools and should not be considered

in isolation or as a substitute for revenue, net income, or any

other operating performance measure calculated in accordance with

GAAP, and may not be comparable to a similarly titled measure

reported by other companies. Some of these limitations are:

- they do not reflect every cash expenditure, future requirements

for capital expenditures or contractual commitments;

- Adjusted EBITDA (LBITDA) does not reflect the significant

interest expense or the cash requirements necessary to service

interest or principal payment on our debt;

- although depreciation and amortization are non-cash charges,

the assets being depreciated and amortized will often have to be

replaced or require improvements in the future, and Adjusted Total

Revenue, Adjusted Net Income (Loss), and Adjusted EBITDA (LBITDA)

do not reflect any cash requirement for such replacements or

improvements; and

- they are not adjusted for all non-cash income or expense items

that are reflected in our statements of cash flows.

Because of these limitations, Adjusted Total Revenue, Adjusted

Net Income (Loss), Adjusted Diluted Earnings (Loss) Per Share, and

Adjusted EBITDA (LBITDA) are not intended as alternatives to total

revenue, net income (loss), net income (loss) attributable to the

Company, or Diluted Earnings (Loss) Per Share or as an indicator of

our operating performance and should not be considered as measures

of discretionary cash available to us to invest in the growth of

our business or as measures of cash that will be available to us to

meet our obligations. We compensate for these limitations by using

Adjusted Total Revenue, Adjusted Net Income (Loss), Adjusted

Diluted Earnings (Loss) Per Share, and Adjusted EBITDA (LBITDA)

along with other comparative tools, together with U.S. GAAP

measurements, to assist in the evaluation of operating performance.

See below for a reconciliation of these non-GAAP measures to their

most comparable U.S. GAAP measures.

Reconciliation of Total Revenue to

Adjusted Total Revenue

($ in thousands)

(Unaudited)

Three Months Ended

Nine Months Ended

Sep 30, 2024

Jun 30, 2024

Sep 30, 2023

Sep 30, 2024

Sep 30, 2023

Total net revenue

$

314,598

$

265,390

$

265,661

$

802,772

$

745,395

Valuation changes in servicing rights, net

of hedging gains and losses(1)

14,901

12,617

(4,545

)

35,546

10,457

Adjusted total revenue

$

329,499

$

278,007

$

261,116

$

838,318

$

755,852

(1)

Represents the change in the fair value of

servicing rights due to changes in valuation inputs or assumptions,

net of gains or losses from derivatives hedging servicing rights.

Beginning in the second quarter of 2024, we began to include the

gains (losses) from the sale of MSRs in valuation changes in

servicing rights, net of hedging gains and losses to appropriately

capture all valuation changes in MSRs up to and including the sales

date. Prior periods have been revised to conform with this new

presentation.

Reconciliation of Net Income (Loss) to

Adjusted Net Income (Loss)

($ in thousands)

(Unaudited)

Three Months Ended

Nine Months Ended

Sep 30, 2024

Jun 30, 2024

Sep 30, 2023

Sep 30, 2024

Sep 30, 2023

Net income (loss) attributable to

loanDepot, Inc.

$

1,369

$

(32,211

)

$

(16,599

)

$

(65,097

)

$

(82,950

)

Net income (loss) from the pro forma

conversion of Class C common shares to Class A common stock (1)

1,303

(33,642

)

(17,663

)

(69,588

)

(92,793

)

Net income (loss)

2,672

(65,853

)

(34,262

)

(134,685

)

(175,743

)

Adjustments to the (provision) benefit for

income taxes(2)

(326

)

8,838

4,845

17,982

25,054

Tax-effected net income (loss)

2,346

(57,015

)

(29,417

)

(116,703

)

(150,689

)

Valuation changes in servicing rights, net

of hedging gains and losses(3)

14,901

12,617

(4,545

)

35,546

10,457

Stock-based compensation expense

8,200

5,898

3,940

18,952

15,619

Restructuring charges(4)

1,853

3,127

2,007

7,105

8,357

Cybersecurity incident(5)

(18,880

)

26,942

—

22,760

—

Loss (gain) on extinguishment of debt

—

5,680

(1,651

)

5,680

(1,690

)

Loss (gain) on disposal of fixed

assets

3

—

93

(25

)

1,105

Other impairment(6)

10

1,193

129

1,202

470

Tax effect of adjustments(7)

(1,356

)

(14,332

)

233

(22,826

)

(8,046

)

Adjusted net income (loss)

$

7,077

$

(15,890

)

$

(29,211

)

$

(48,309

)

$

(124,417

)

(1)

Reflects net income (loss) to Class A

common stock and Class D common stock from the pro forma exchange

of Class C common stock.

(2)

loanDepot, Inc. is subject to federal,

state and local income taxes. Adjustments to the (provision)

benefit for income taxes reflect the income tax rates below, and

the pro forma assumption that loanDepot, Inc. owns 100% of LD

Holdings.

Three Months Ended

Nine Months Ended

Sep 30, 2024

Jun 30, 2024

Sep 30, 2023

Sep 30, 2024

Sep 30, 2023

Statutory U.S. federal income tax rate

21.00 %

21.00 %

21.00 %

21.00 %

21.00 %

State and local income taxes (net of

federal benefit)

4.01 %

5.27 %

6.43 %

4.84 %

6.00 %

Effective income tax rate

25.01 %

26.27 %

27.43 %

25.84 %

27.00 %

(3)

Represents the change in the fair value of

servicing rights due to changes in valuation inputs or assumptions,

net of gains or losses from derivatives hedging servicing rights,

and gains (losses) from the sale of MSRs. Beginning in the second

quarter of 2024, we began to include the gains (losses) from the

sale of MSRs in valuation changes in servicing rights, net of

hedging gains and losses to appropriately capture all valuation

changes in MSRs up to and including the sales date. Prior periods

have been revised to conform with this new presentation.

(4)

Reflects employee severance expense and

professional services associated with restructuring efforts

subsequent to the announcement of Vision 2025 in July 2022.

(5)

Represents expenses directly related to

the Cybersecurity Incident, net of expected insurance recoveries,

including costs to investigate and remediate the Cybersecurity

Incident, the costs of customer notifications and identity

protection, professional fees including legal expenses, litigation

settlement costs, and commission guarantees. During the three

months ended September 30, 2024, the Company recorded a $20.0

million receivable for reimbursement from its insurers. During the

nine months ended September 30, 2024, the Company recorded $35.0

million for an insurance reimbursement and receivable, and an

accrual of $25.0 million in connection with class action litigation

related to the Cybersecurity Incident.

(6)

Represents lease impairment on corporate

and retail locations.

(7)

Amounts represent the income tax effect

using the aforementioned effective income tax rates, excluding

certain discrete tax items.

Reconciliation of Adjusted Diluted Weighted Average Shares

Outstanding to Diluted Weighted Average Shares Outstanding

($ in thousands except per share data)

(Unaudited)

Three Months Ended

Nine Months Ended

Sep 30, 2024

Jun 30, 2024

Sep 30, 2023

Sep 30, 2024

Sep 30, 2023

Net income (loss) attributable to

loanDepot, Inc.

$

1,369

$

(32,211

)

$

(16,599

)

$

(65,097

)

$

(82,950

)

Adjusted net income (loss)

7,077

(15,890

)

(29,211

)

(48,309

)

(124,417

)

Share Data:

Diluted weighted average shares of Class A

and Class D common stock outstanding

332,532,984

182,324,046

175,962,804

183,041,489

173,568,986

Assumed pro forma conversion of weighted

average Class C shares to Class A common stock (1)

—

142,907,533

147,171,089

142,333,213

148,741,661

Adjusted diluted weighted average shares

outstanding

332,532,984

325,231,579

323,133,893

325,374,702

322,310,647

(1)

Reflects the assumed pro forma exchange

and conversion of anti-dilutive Class C common shares.

Reconciliation of Net Income (Loss) to

Adjusted EBITDA (LBITDA)

($ in thousands)

(Unaudited)

Three Months Ended

Nine Months Ended

Sep 30, 2024

Jun 30, 2024

Sep 30, 2023

Sep 30, 2024

Sep 30, 2023

Net income (loss)

$

2,672

$

(65,853

)

$

(34,262

)

$

(134,685

)

$

(175,743

)

Interest expense - non-funding debt

(1)

45,129

53,000

42,504

144,676

128,619

Income tax expense (benefit)

923

(11,304

)

(5,205

)

(24,040

)

(28,622

)

Depreciation and amortization

8,931

8,955

10,592

27,329

31,339

Valuation changes in servicing rights, net

of

hedging gains and losses(2)

14,901

12,617

(4,545

)

35,546

10,457

Stock-based compensation expense

8,200

5,898

3,940

18,952

15,619

Restructuring charges(3)

1,853

3,127

2,007

7,105

8,357

Cybersecurity incident(4)

(18,880

)

26,942

—

22,760

—

Loss (gain) on disposal of fixed

assets

3

—

93

(25

)

1,105

Other impairment(5)

10

1,193

129

1,202

470

Adjusted EBITDA (LBITDA)

$

63,742

$

34,575

$

15,253

$

98,820

$

(8,399

)

(1)

Represents other interest expense, which

includes gain or loss on extinguishment of debt and amortization of

debt issuance costs and debt discount, in the Company’s

consolidated statements of operations.

(2)

Represents the change in the fair value of

servicing rights due to changes in valuation inputs or assumptions,

net of gains or losses from derivatives hedging servicing rights,

and gains (losses) from the sale of MSRs. Beginning in the second

quarter of 2024, we began to include the gains (losses) from the

sale of MSRs in valuation changes in servicing rights, net of

hedging gains and losses to appropriately capture all valuation

changes in MSRs up to and including the sales date. Prior periods

have been revised to conform with this new presentation.

(3)

Reflects employee severance expense and

professional services associated with restructuring efforts

subsequent to the announcement of Vision 2025 in July 2022.

(4)

Represents expenses, directly related to

the Cybersecurity Incident, net of expected insurance recoveries,

that occurred in the first quarter of 2024, including costs to

investigate and remediate the Cybersecurity Incident, the costs of

customer notifications and identity protection, professional fees

including legal expenses, litigation settlement costs, and

commission guarantees. During the three months ended September 30,

2024, the Company recorded a $20.0 million receivable for

reimbursement from its insurers. During the nine months ended

September 30, 2024, the Company recorded $35.0 million for an

insurance reimbursement and receivable, and an accrual of $25.0

million in connection with class action litigation related to the

Cybersecurity Incident.

(5)

Represents lease impairment on corporate

and retail locations.

Forward-Looking Statements

This press release may contain "forward-looking statements,"

which reflect loanDepot's current views with respect to, among

other things, our business strategies, including Project North

Star, our progress toward run-rate profitability, ongoing cost

management and productivity programs, our HELOC product, financial

condition and liquidity, competitive position, industry and

regulatory environment, potential growth opportunities, the effects

of competition, the impact of the Cybersecurity Incident,

operations and financial performance. These forward-looking

statements can be identified by the fact that they do not relate

strictly to historical or current facts and may contain the words

“outlook,” “potential,” “believe,” “anticipate,” “expect,”

“intend,” “plan,” “predict,” “estimate,” “project,” “will be,”

“will continue,” “will likely result,” or other similar words and

phrases or future or conditional verbs such as “will,” “may,”

“might,” “should,” “would,” or “could” and the negatives of those

terms. These forward-looking statements are based on current

available operating, financial, economic and other information, and

are not guarantees of future performance and are subject to risks,

uncertainties and assumptions that are difficult to predict,

including but not limited to, the following: our ability to achieve

the expected benefits of Project North Star and the success of

other business initiatives; our ability to achieve run-rate

profitability; our loan production volume; our ability to maintain

an operating platform and management system sufficient to conduct

our business; our ability to maintain warehouse lines of credit and

other sources of capital and liquidity; impacts of cybersecurity

incidents, cyberattacks, information or security breaches and

technology disruptions or failures, of ours or of our third party

vendors; the outcome of legal proceedings to which we are a party;

our ability to reach a definitive settlement agreement related to

the Cybersecurity Incident; adverse changes in macroeconomic and

U.S residential real estate and mortgage market conditions,

including changes in interest rates; changing federal, state and

local laws, as well as changing regulatory enforcement policies and

priorities; and other risks detailed in the "Risk Factors" section

of loanDepot, Inc.'s Annual Report on Form 10-K for the year ended

December 31, 2023, and Quarterly Reports on Form 10-Q as well as

any subsequent filings with the Securities and Exchange Commission.

Therefore, current plans, anticipated actions, and financial

results, as well as the anticipated development of the industry,

may differ materially from what is expressed or forecasted in any

forward-looking statement. loanDepot does not undertake any

obligation to publicly update or revise any forward-looking

statement to reflect future events or circumstances, except as

required by applicable law.

About loanDepot

loanDepot (NYSE: LDI) is a leading provider of lending solutions

that make the American dream of homeownership more accessible and

achievable for all, especially the increasingly diverse communities

of first-time homebuyers, through a broad suite of lending and real

estate services that simplify one of life's most complex

transactions. Since its launch in 2010, the company has been

recognized as an innovator, using its industry-leading technology

to deliver a superior customer experience. Our digital-first

approach makes it easier, faster and less stressful to purchase or

refinance a home. Today, as one of the largest non-bank lenders in

the country, loanDepot and its mellohome operating unit offer an

integrated platform of lending, loan servicing, real estate and

home services that support customers along their entire

homeownership journey. Headquartered in Southern California and

with hundreds of local market offices nationwide, loanDepot’s

passionate team is dedicated to making a positive difference in the

lives of their customers every day.

LDI-IR

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241105434727/en/

Investor Relations Contact: Gerhard Erdelji Senior Vice

President, Investor Relations (949) 822-4074

gerdelji@loandepot.com

Media Contact: Rebecca Anderson Senior Vice President,

Communications & Public Relations (949) 822-4024

rebeccaanderson@loandepot.com

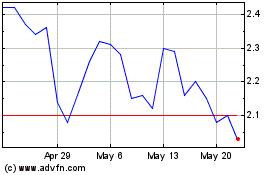

loanDepot (NYSE:LDI)

Historical Stock Chart

From Nov 2024 to Dec 2024

loanDepot (NYSE:LDI)

Historical Stock Chart

From Dec 2023 to Dec 2024