false000168024700016802472024-12-102024-12-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): December 10, 2024

ProPetro Holding Corp.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

|

| | | | | | |

| Delaware | | 001-38035 | | 26-3685382 |

(State or Other Jurisdiction

of Incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

303 W. Wall St, Suite 102, Midland, Texas 79701

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: (432) 688-0012

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | PUMP | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 7.01 Regulation FD Disclosure.

On December 10, 2024, ProPetro Holding Corp. (the “Company”) issued a press release announcing its ProPWRSM power generation business. A copy of the press release is furnished as Exhibit 99.1 hereto.

The information furnished with this report, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 8.01 Other Events.

In connection with the announcement of its ProPWRSM mobile power generation business, ProPetro Energy Solutions, LLC (“PES”), an indirect wholly-owned subsidiary of the Company, placed a purchase order for the manufacture of approximately 110 megawatts of mobile natural gas-fueled power generation equipment. The aggregate cost of such equipment is approximately $122 million and will be funded through a combination of cash and debt financing. The cash investment of up to approximately $20 million is expected to be made in early-2025 with the remaining cost of the investment expected to be financed as progress payments become due and deliveries ultimately occur commencing in mid-2025. PES expects to deploy the units following delivery commencing in mid-2025 through early 2026. The purchase order and terms and conditions of sale also contain customary representations, warranties and agreements of the parties, indemnification obligations, and other customary terms and conditions.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit

Number | | Description of Exhibit |

| | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File. The cover page XBRL tags are embedded within the inline XBRL document (contained in Exhibit 101) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: December 10, 2024

| | |

| PROPETRO HOLDING CORP. |

| |

| /s/ David S. Schorlemer |

David S. Schorlemer

Chief Financial Officer |

ProPetro Announces ProPWRSM Power Generation Business

MIDLAND, Texas, December 10, 2024, (Business Wire) – ProPetro Holding Corp. (“ProPetro” or the “Company”) (NYSE: PUMP) today announced a new subsidiary, ProPetro Energy Solutions, LLC, that will do business as ProPWRSM (pronounced as “Pro – power”) and its initial order of over 110 megawatts of mobile natural gas-fueled power generation equipment for use across multiple oilfield and industrial applications.

Sam Sledge, CEO of ProPetro, stated, "We are thrilled to announce our first organic service line startup in over a decade, a testament to our willingness to innovate and draw on our entrepreneurial roots. ProPWRSM is aimed squarely at the growing power demand across the Permian Basin for both oil and gas and developing infrastructure opportunities within the market, and to create more certainty of power generation capacity for our high-performance FORCE® electric-powered hydraulic fracturing fleets. We have assembled a first-class team led by industry veterans Travis Simmering, President of ProPWRSM, and Dave Bosco, Vice President of Technical Services, who are managing our operations and commercial efforts. By leveraging ProPetro’s established platform and extensive customer base, they are well-positioned to drive our success. As always, we will be focused on premium service quality and reliability paired with commercial creativity and innovation that all our stakeholders have come to expect from ProPetro.”

Travis Simmering, President of ProPWRSM, commented, "We are excited to provide a differentiated power generation experience in the Permian Basin. The forecasted load growth for electricity is significant and these assets will enable ProPetro to access growth markets, inclusive of supporting ProPetro’s industry-leading and expanding FORCE® electric-powered hydraulic fracturing services which are currently utilizing approximately 140 megawatts of mobile power generation capacity and growing. Our focus is initially on oilfield power applications, but we fully intend to build a platform that will be highly competitive in serving non-oil and gas applications such as general industrial projects and data centers that we believe are likely to gravitate towards the Permian Basin. The combination of these mobile power generation assets along with ProPetro’s established reputation as a leading service provider positions ProPWRSM to capitalize on growing market demand in the basin. With this initial order of over 110 megawatts of mobile power generation assets, we are poised to execute on our strategy of becoming the premier mobile power services provider in the Permian Basin.”

This growth capital investment of approximately $122 million will be funded through a combination of cash and external financing resources with equipment deliveries anticipated to take place between June 2025 and March 2026. The cash investment will

consist of up to approximately $20 million in early 2025 with the remaining cost of the investment expected to be financed as progress payments become due and deliveries ultimately occur commencing mid-2025. The Company anticipates deploying these initial assets promptly following their delivery commencing mid-2025 and early into 2026 under contracts, some of which are currently being proposed or negotiated. The Company aims to build a diverse portfolio of mobile power generation and related equipment, expanding well beyond the initial 110 megawatts.

About ProPetro

ProPetro Holding Corp. is a Midland, Texas-based provider of premium integrated completion services to leading upstream oil and gas companies engaged in the exploration and production of North American unconventional oil and natural gas resources. We help bring reliable energy to the world. For more information visit www.propetroservices.com.

Forward-Looking Statements

Except for historical information contained herein, the statements and information in this news release are forward-looking statements that are made pursuant to the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. Statements that are predictive in nature, that depend upon or refer to future events or conditions or that include the words “may,” “could,” “plan,” “project,” “budget,” “predict,” “pursue,” “target,” “seek,” “objective,” “believe,” “expect,” “anticipate,” “intend,” “estimate,” “will,” “should,” "designed" and other expressions that are predictions of, or indicate, future events and trends or that do not relate to historical matters generally identify forward‑looking statements. Our forward‑looking statements include, among other matters, statements about the anticipated commercial success of ProPWRSM, including our ability to successfully commence operations, the demand for its services and anticipated benefits of the new business line, our business strategy, projected financial results and future financial performance. A forward‑looking statement may include a statement of the assumptions or bases underlying the forward‑looking statement. We believe that we have chosen these assumptions or bases in good faith and that they are reasonable.

Although forward‑looking statements reflect our good faith beliefs at the time they are made, forward-looking statements are subject to a number of risks and uncertainties that may cause actual events and results to differ materially from the forward-looking statements. Such risks and uncertainties include the volatility of oil prices, changes in the supply of and demand for mobile power generation, the risks associated with the establishment of a new service line, including delays, lack of customer acceptance and cost overruns, the global macroeconomic uncertainty related to the conflict in the Israel-Gaza region and continued hostilities in the Middle East, including rising tensions with Iran, and the Russia-Ukraine war, general economic conditions, including the impact of continued inflation, central bank policy actions, other factors described in the Company's Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, particularly the “Risk Factors” sections of such filings, and other filings with the Securities and Exchange Commission (the “SEC”). In addition, the Company may be subject to currently unforeseen risks that may have a materially adverse impact on it. Accordingly, no assurances can be given that the actual events and results will not be materially different than the anticipated results described in the forward-looking statements. Readers are cautioned not to place undue reliance on such forward-looking statements and are urged to carefully review and consider the various disclosures made in the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other filings made with the SEC from time to time that disclose risks and uncertainties that may affect the Company’s business. The forward-looking statements in this news release are made as of the date of this news release.

ProPetro does not undertake, and expressly disclaims, any duty to publicly update these statements, whether as a result of new information, new developments or otherwise, except to the extent that disclosure is required by law.

Investor Contacts:

David Schorlemer

Chief Financial Officer

david.schorlemer@propetroservices.com

432-227-0864

Matt Augustine

Director, Corporate Development and Investor Relations

matt.augustine@propetroservices.com

432-219-7620

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

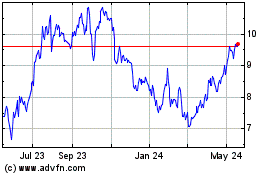

ProPetro (NYSE:PUMP)

Historical Stock Chart

From Dec 2024 to Jan 2025

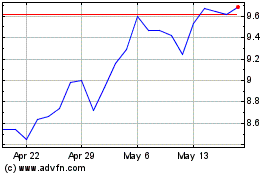

ProPetro (NYSE:PUMP)

Historical Stock Chart

From Jan 2024 to Jan 2025