Rio Tinto (LSE:RIO) (ASX:RIO):

- Resilient financials with underlying EBITDA of $23.3 billion,

despite 11% lower iron ore price*.

- Higher net cash generated from operating activities of $15.6

billion, driven by portfolio mix and effective working capital

management.

- Profit after tax attributable to owners of Rio Tinto (referred

to as "net earnings" throughout this release) of $11.6

billion.

- Full year ordinary dividend of $6.5 billion, a 60% payout:

nine-year track record at top end of payout range

* On a Free on Board (FOB) basis.

Year ended 31 December

2024

2023

Change

Net cash generated from operating

activities (US$ millions)

15,599

15,160

3%

Purchases of property, plant and equipment

and intangible assets (US$ millions)

9,621

7,086

36%

Free cash flow¹ (US$ millions)

5,553

7,657

(27)%

Consolidated sales revenue (US$

millions)

53,658

54,041

(1)%

Underlying EBITDA¹ (US$ millions)

23,314

23,892

(2)%

Profit after tax attributable to owners of

Rio Tinto (net earnings) (US$ millions)

11,552

10,058

15%

Underlying earnings per share (EPS)¹ (US

cents)

669.5

725.0

(8)%

Ordinary dividend per share (US cents)

402.0

435.0

(8)%

Underlying return on capital employed

(ROCE)¹

18%

20%

At 31 Dec 2024

At 31 Dec 2023

Net debt¹ (US$ millions)

5,491

4,231

30%

1 This financial performance indicator is

a non-IFRS (as defined below) measure which is reconciled to

directly comparable IFRS financial measures (non-IFRS measures). It

is used internally by management to assess the performance of the

business and is therefore considered relevant to readers of this

document. It is presented here to give more clarity around the

underlying business performance of the Group’s operations. For more

information on our use of non-IFRS financial measures in this

report, see the section entitled “Alternative performance measures”

(APMs) and the detailed reconciliations on pages 37 to 46. Our

financial results are prepared in accordance with IFRS — see page

32 for further information.

Rio Tinto Chief Executive Jakob Stausholm said: "We continue to

build on our momentum with another set of strong operational and

financial results. With underlying EBITDA of $23.3 billion and

operating cash flow of $15.6 billion, we are increasing our

investments to underpin our plans for a decade of profitable

growth. We are reporting underlying earnings of $10.9 billion,

after taxes and government royalties of $8.2 billion, and a healthy

return on capital employed of 18%.

"Our strong balance sheet enables us to pay a $6.5 billion

ordinary dividend, maintaining our practice of a 60% payout, the

ninth consecutive year at the top end of our payout range, as we

continue to invest with discipline.

"We are excited as we head into 2025, with all the building

blocks for an incredibly successful, diversified and growing

business in place including the expected closing of the Arcadium

acquisition in March. We will remain disciplined in the short,

medium and long term, while paying attractive returns to

shareholders."

Safety is our top priority. Tragically, there were 5

fatalities in our business in 2024. On 23 January 2024, a plane

crashed shortly after takeoff near Fort Smith, Northwest

Territories, Canada, resulting in the loss of 4 Diavik team members

and 2 airline crew. On 26 October 2024, an employee of one of our

contractors was injured at the SimFer Port Project in Morebaya,

part of the Simandou project in Guinea, and subsequently passed

away from his injuries.

Our team is committed to learning how we continuously improve

safety. This remains imperative throughout 2025 and underpins

our ability to deliver on our four objectives.

Prioritising the health of our people, our ore body knowledge

and the health of our assets, we have improved our operational

performance and delivered strong financial results. We have

maintained our financial strength, which allows us to invest for

the future to deliver profitable growth, while also continuing to

pay attractive returns.

Continued successful delivery in 2024: accelerating growth in

2025 and beyond

As part of our focus on Best Operator, we aim to safely and

sustainably realise the full value of our assets, through our Safe

Production System (SPS). Our operational performance is improving:

in 2024, we delivered over 1% production growth and a 3% increase

in sales volumes, both on a copper equivalent basis (based on

long-term consensus pricing), and by the end of the year we had

commenced deployment of SPS at 31 (~80%) of our sites. Just one

outcome of the program is the achievement of a 5 million tonne

production uplift for Pilbara Iron Ore in 2024 for the second

consecutive year.

In line with our Excel in Development objective, we are growing

and diversifying our portfolio, as we build a pipeline for the

future:

- at the Oyu Tolgoi copper-gold mine in Mongolia, we

commissioned ventilation Shafts 3 and 4 and are commissioning the

conveyor to surface, as the mine ramps up to 500 thousand

tonnes1 of copper per year from 2028 to 2036.

- at the Simandou iron ore project in Guinea, the SimFer mine2 is

on track to deliver first production at the mine gate in 2025,

ramping up over 30 months to an annualised capacity of 60 million

tonnes per year3 (27 million tonnes per year Rio Tinto share).

- in the Pilbara, we advanced 5 replacement iron ore projects,

including Western Range where first ore is on plan for the first

half of 2025.

- we announced a definitive agreement to acquire Arcadium Lithium

plc in an all-cash transaction for $6.7 billion, establishing

ourselves as a global leader in energy transition commodities. The

transaction is expected to close in March 2025.

- we approved $2.5 billion to expand the Rincon project in

Argentina, our first commercial scale lithium operation, to an

annual capacity of 60,000 tonnes of battery grade lithium

carbonate.

Aligned with striving for impeccable ESG credentials, the

low-carbon transition continues to be at the heart of our strategy.

In 2024, our Scope 1 and 2 emissions, on an equity basis,

were 30.7Mt CO2e (33.9Mt4 adjusted emissions in 2023),

14% below our 2018 baseline of 35.7Mt CO2e4.

In 2024, we reduced our emissions by 3.2Mt CO2e,

primarily through new renewable energy contracts. We also made

commitments to projects that are expected to deliver abatement of

around 3.6Mt per year in 2030, mostly through renewable

electricity and biofuels. Significant progress on the repowering of

our Gladstone assets was made when we announced two major renewable

Power Purchase Agreements in early 2024, one for solar and one for

wind.

We are also supporting our customers and suppliers in

reducing emissions from our value chain, particularly those

from steelmaking. We continued to advance the development of

BioIron™, an innovative ironmaking process. When combined with the

use of renewable energy and fast-growing biomass, this has the

potential to reduce CO2 emissions by up to 95% compared with the

current blast furnace method. We are investing $143 million to

build a research and development facility in Western Australia,

scheduled for commissioning in 2026, with a pilot plant 10 times

larger than its predecessor.

For further detail, please refer to the climate section of our

2024 Annual Report released today.

In 2024, we strengthened our social performance capacity

to become a better operator and partner. Together with Voconiq, a

third-party engagement science research company, we launched our

global Community Perception Monitoring program, Local Voices. The

program will help us to engage more effectively and better

understand communities’ perceptions, leading to improved

data-driven decisions.

In 2024, we completed one of the final recommendations of the

Everyday Respect report; publishing an independent progress

review conducted by Elizabeth Broderick & Co. Change is

happening: one of the findings indicates people are more empowered

to speak up and Everyday Respect is now widely considered a normal

conversation within the company, which is a critical step for

culture change.

Developing our talent and diversity, we increased gender

diversity to 25.2% (from 24.3% in 2023). The increases were

distributed across all levels of the organisation with female

senior leaders increasing to 32% (from 30.1% in 2023).

Footnotes

- The 500 thousand tonne per year copper production target

(stated as recoverable metal) for the Oyu Tolgoi underground and

open pit mines for the years 2028 to 2036 was previously reported

in a release to the Australian Securities Exchange (ASX) dated 11

July 2023 “Investor site visit to Oyu Tolgoi copper mine,

Mongolia”. All material assumptions underpinning that production

target continue to apply and have not materially changed.

- SimFer Jersey Limited is a joint venture between the Rio Tinto

Group (53%) and Chalco Iron Ore Holdings Ltd (CIOH) (47%), a

Chinalco-led joint venture of leading Chinese SOEs (Chinalco (75%),

Baowu (20%), China Rail Construction Corporation (2.5%) and China

Harbour Engineering Company (2.5%)). SimFer S.A. is the holder of

the mining concession covering Simandou Blocks 3 & 4, and is

owned by the Guinean State (15%) and SimFer Jersey Limited (85%).

SimFer Infraco Guinée S.A. will deliver SimFer’s scope of the

co-developed rail and port infrastructure, and is co-owned by

SimFer Jersey (85%) and the Guinean State (15%). SimFer Jersey will

ultimately own 42.5% of Compagnie du Transguinéen, which will own

and operate the co-developed infrastructure during operations.

- The estimated annualised capacity of approximately 60 million

dry tonnes per annum iron ore for the Simandou life of mine

schedule was previously reported in a release to the ASX dated 6

December 2023 titled “Investor Seminar 2023”. Rio Tinto confirms

that all material assumptions underpinning that production target

and those production profiles continue to apply and have not

materially changed.

- We have adjusted our 2018 baseline and 2023 emissions to

exclude emissions reductions achieved by divesting assets and allow

increases associated with acquisitions. In 2023, we restated prior

year emissions numbers and our 2018 baseline following an update to

our GHG reporting methodology. Further detail on these changes in

reporting is available in our Scope 1, 2 and 3 Emissions

Calculation Methodology.

The 2024 full year results release is available here

This announcement is authorised for release to the market by Rio

Tinto’s Group Company Secretary.

LEI: 213800YOEO5OQ72G2R82

Classification: 3.1 Additional regulated information required to

be disclosed under the laws of a Member State

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250219937612/en/

Please direct all enquiries to

media.enquiries@riotinto.com

Media Relations, United Kingdom David

Outhwaite M +44 7787 597 493

Media Relations, Australia Matt Chambers

M +61 433 525 739 Michelle Lee M +61 458 609

322 Rachel Pupazzoni M +61 438 875 469

Media Relations, Canada Malika Cherry

M +1 418 592 7293 Vanessa Damha M +1 514 715

2152

Media Relations, US Jesse Riseborough

M +1 202 394 9480

Investor Relations, United Kingdom Rachel

Arellano M: +44 7584 609 644 David Ovington M +44

7920 010 978 Laura Brooks M +44 7826 942 797

Weiwei Hu M +44 7825 907 230

Investor Relations, Australia Tom Gallop

M +61 439 353 948 Amar Jambaa M +61 472 865

948

Rio Tinto plc 6 St James’s Square London SW1Y 4AD United

Kingdom T +44 20 7781 2000 Registered in England No.

719885

Rio Tinto Limited Level 43, 120 Collins Street Melbourne

3000 Australia T +61 3 9283 3333 Registered in Australia ABN

96 004 458 404

riotinto.com

Category: General

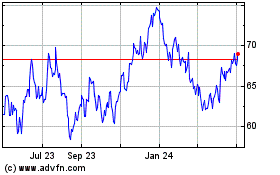

Rio Tinto (NYSE:RIO)

Historical Stock Chart

From Jan 2025 to Feb 2025

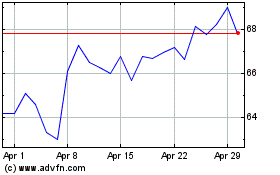

Rio Tinto (NYSE:RIO)

Historical Stock Chart

From Feb 2024 to Feb 2025