Creates Long-Term Alignment Between Two

Leading Investment Managers

Provides Accretive Financing Capacity to

Support Growth of Redwood’s Market-Leading Operating

Platforms

Redwood Trust, Inc. (NYSE: RWT; “Redwood” or the

“Company”), a leader in expanding access to housing for homebuyers

and renters, and Canada Pension Plan Investment Board (“CPP

Investments”), through subsidiaries of CPPIB Credit Investments

Inc., today announced a $750 million strategic capital

partnership.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240319990631/en/

The partnership consists of a newly formed $500 million Asset

Joint Venture and a $250 million corporate secured financing

facility that CPP Investments is providing to Redwood.

The Joint Venture will initially invest across the broad suite

of Redwood’s residential investor bridge and term loans, targeting

more than $4 billion in total acquisitions. Redwood and its

subsidiaries will administer the assets on behalf of the Joint

Venture. Together, CPP Investments and Redwood will contribute up

to $500 million of equity to the Joint Venture, with an anticipated

split of 80% from CPP Investments and 20% from Redwood. Redwood

will earn ongoing fees to oversee the administration of the Joint

Venture and is entitled to earn additional performance fees upon

realization of specified return hurdles.

The secured corporate financing will have total capacity of up

to $250 million and carry a two-year term, with a one-year

extension option. The facility is structured with revolving

capacity to support the continued growth and scale of Redwood’s

mortgage banking platforms.

To further promote long-term strategic alignment, CPP

Investments will also receive warrants to acquire Redwood common

stock in an initial amount of approximately $15 million with the

option to acquire up to an additional $36 million if certain joint

venture deployment targets are achieved1. The warrants are struck

at a 25% premium to the trailing 30-day average stock price and

have anti-dilution mechanics including a mandatory conversion

feature.

“We are thrilled to announce this strategic partnership with CPP

Investments, whose experienced team sees the power of Redwood’s

franchise and the financial assets we procure,” said Christopher

Abate, Chief Executive Officer of Redwood. “Last year, we unveiled

a key initiative to evolve our investment approach, deploying

capital side-by-side with strategic investing partners and driving

organic scale within our operating platforms. Today’s announcement

is a critical step forward in that evolution, one which we believe

supports the unprecedented growth opportunities in front of us to

scale our mortgage banking businesses and generates attractive

earnings streams for our shareholders.”

“This investment partnership with Redwood provides an attractive

opportunity to deploy capital at scale into residential mortgage

assets alongside a well-established leader in the U.S. mortgage

credit sector with a 30-year proven track record,” said David

Colla, Managing Director, Head of Capital Solutions, CPP

Investments. “We have confidence in Redwood’s long-term growth

strategy and the strength of their origination franchise. This

transaction expresses our positive thesis on U.S. housing and other

asset-backed credit opportunities.”

For additional information on this announcement, please see the

Current Report on Form 8-K filed by Redwood with the SEC

concurrently with the publication of this press release.

_________________________ 1 Represents the aggregate exercise

price of the warrants.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995, including statements related to the

opportunity to scale Redwood’s mortgage banking business and

generate attractive earnings streams, as well as statements related

to total equity commitment to the joint venture, the targeted

amount of total loan acquisition volume by the joint venture, and

Redwood’s opportunity to earn administrative fees and performance

fees upon realization of specified return hurdles in connection

with the joint venture. Forward-looking statements involve numerous

risks and uncertainties. Redwood's actual results may differ from

Redwood's beliefs, expectations, estimates, and projections and,

consequently, you should not rely on these forward-looking

statements as predictions of future events. Forward-looking

statements are not historical in nature and can be identified by

words such as “anticipate,” “estimate,” “will,” “should,” “expect,”

“believe,” “intend,” “seek,” “plan” and similar expressions or

their negative forms, or by references to strategy, plans, or

intentions. These forward-looking statements are subject to risks

and uncertainties, including, among other things, those described

in our Annual Report on Form 10-K for the year ended December 31,

2023 under the caption “Risk Factors”. Other risks, uncertainties,

and factors that could cause actual results to differ materially

from those projected may be described from time to time in reports

we file with the Securities and Exchange Commission, including

reports on Forms 10-Q and 8-K. We undertake no obligation to update

or revise any forward-looking statements, whether as a result of

new information, future events, or otherwise.

About Redwood

Redwood Trust, Inc. (NYSE: RWT) is a specialty finance company

focused on several distinct areas of housing credit. Our operating

platforms occupy a unique position in the housing finance value

chain, providing liquidity to growing segments of the U.S. housing

market not well served by government programs. We deliver

customized housing credit investments to a diverse mix of

investors, through our best-in-class securitization platforms;

whole-loan distribution activities; and our publicly traded shares.

Our aggregation, origination and investment activities have evolved

to incorporate a diverse mix of residential, business purpose and

multifamily assets. Our goal is to provide attractive returns to

shareholders through a stable and growing stream of earnings and

dividends, capital appreciation, and a commitment to technological

innovation that facilitates risk-minded scale. We operate our

business in three segments: Residential Mortgage Banking, Business

Purpose Mortgage Banking and Investment Portfolio. Additionally,

through RWT Horizons™, our venture investing initiative, we invest

in early-stage companies strategically aligned with our business

across the lending, real estate, and financial technology sectors

to drive innovations across our residential and business-purpose

lending platforms. Since going public in 1994, we have managed our

business through several cycles, built a track record of

innovation, and established a best-in-class reputation for service

and a common-sense approach to credit investing. Redwood Trust is

internally managed and structured as a real estate investment trust

("REIT") for tax purposes. For more information about Redwood,

please visit our website at www.redwoodtrust.com or connect with us

on LinkedIn.

About CPP Investments

Canada Pension Plan Investment Board (CPP Investments™) is a

professional investment management organization that manages the

Fund in the best interest of the more than 22 million contributors

and beneficiaries of the Canada Pension Plan. In order to build

diversified portfolios of assets, investments are made around the

world in public equities, private equities, real estate,

infrastructure and fixed income. Headquartered in Toronto, with

offices in Hong Kong, London, Luxembourg, Mumbai, New York City,

San Francisco, São Paulo and Sydney, CPP Investments is governed

and managed independently of the Canada Pension Plan and at arm’s

length from governments. At December 31, 2023, the Fund totalled

C$590.8 billion (US$448.1 billion). For more information, please

visit www.cppinvestments.com or follow us on LinkedIn, Instagram or

on X @CPPInvestments.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240319990631/en/

Redwood Kaitlyn Mauritz Managing

Director, Head of Investor Relations Phone: 866-269-4976 Email:

investorrelations@redwoodtrust.com

CPP Investments Asher Levine

Managing Director, Public Affairs & Communications Phone:

929-208-7939 Email: alevine@cppib.com

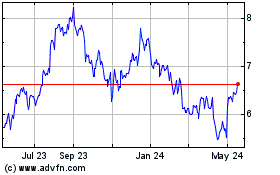

Redwood (NYSE:RWT)

Historical Stock Chart

From Dec 2024 to Jan 2025

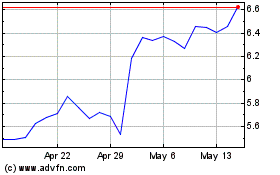

Redwood (NYSE:RWT)

Historical Stock Chart

From Jan 2024 to Jan 2025