FALSE000159480500015948052025-02-112025-02-110001594805dei:OtherAddressMember2025-02-112025-02-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________

FORM 8-K

________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 11, 2025

________________________________________________

Shopify Inc.

(Exact name of registrant as specified in its charter)

________________________________________________

| | | | | | | | | | | | | | |

| Canada | 001-37400 | 98-0486686 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | |

| 151 O'Connor Street, Ground Floor | | 148 Lafayette Street |

| Ottawa, | Ontario | | New York, | New York |

| Canada | K2P 2L8 | | USA | 10012 |

| (Address of Principal Executive Offices) (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (613) 241-2828 x 1045

________________________________________________

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading | | Name of each exchange on which registered |

| Class A Subordinate Voting Shares | | SHOP | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On February 11, 2025, Shopify Inc. (the "Company") issued a press release announcing its financial results for the quarter and full year ended December 31, 2024. A copy of the press release is furnished as Exhibit 99.1 to this report.

The information furnished with this Item 2.02, including Exhibit 99.1, shall not be deemed "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| SHOPIFY INC. |

| | |

| Date: February 11, 2025 | | |

| By: | /s/ Michael L. Johnson |

| | Name: Michael L. Johnson |

| | Title: Corporate Secretary |

Shopify Merchant Success Powers Q4 Outperformance Across Both Top and Bottom-Line

Q4 Revenue Growth Accelerates to 31% and Free Cash Flow Margin Expands to 22%;

Full Year Revenue Up 26% and Free Cash Flow Margin Increases to 18%

Internet, Everywhere - February 11, 2025 - Shopify Inc. (NYSE, TSX: SHOP), a leading commerce technology company announced today financial results for the quarter and year ended December 31, 2024.

“2024 was a stand-out year for Shopify. We seized every opportunity to fuel our growth and it showed in the results quarter after quarter,” said Harley Finkelstein, President of Shopify. “Heading into 2025, we are committed to making entrepreneurship more common and further establishing Shopify as the go-to commerce platform for businesses of all sizes. With our proven track record, the agility of our platform, and our relentless focus on merchant success, we like our odds in this evolving technology landscape, and are excited about the opportunities it brings for Shopify and our merchants.”

Jeff Hoffmeister, Chief Financial Officer of Shopify, said, “We are thrilled with our strong performance in Q4, wrapping up an outstanding 2024. Q4 marks our seventh consecutive quarter of 25% or greater revenue growth when excluding logistics. Moreover, we grew free cash flow margin sequentially each quarter of 2024, reaching 22% for Q4. GMV growth accelerated each quarter this year, achieving a 24% year-over-year increase in 2024, marking our highest GMV growth in three years. These consistent results are a testament to our strategic initiatives and operational discipline, positioning us well for continued success and growth in the future.”

Selected Business Performance Information(1)

(In US $ millions, except percentages)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended

December 31, | | | Years ended

December 31, |

| 2024 | | 2023 | | | 2024 | | 2023 |

| GMV | 94,460 | | 75,125 | | | 292,275 | | 235,910 |

| | | | | | | | |

| MRR | 178 | | 144 | | | 178 | | 144 |

| | | | | | | | |

| Revenue | 2,812 | | 2,144 | | | 8,880 | | 7,060 |

| | | | | | | | |

| Gross profit | 1,352 | | 1,062 | | | 4,472 | | 3,515 |

| | | | | | | | |

| Operating income (loss) | 465 | | 289 | | | 1,075 | | (1,418) |

| | | | | | | | |

| Free cash flow | 611 | | 446 | | | 1,597 | | 905 |

| | | | | | | | |

| | | | | | | | |

| YoY revenue growth rate | 31 | % | | 24 | % | | | 26 | % | | 26 | % |

| | | | | | | | |

| Free cash flow margin | 22 | % | | 21 | % | | | 18 | % | | 13 | % |

(1)See notes below for definitions of GMV, MRR and additional information on free cash flow and free cash flow margin, which are non-GAAP financial measures and are reconciled to the comparable GAAP measure in the non-GAAP reconciliation at the end of this press release.

2024 Highlights(1)

| | | | | | | | | | | | | | |

| Rapid growth at scale | | Improving profitability |

| | |

| $1Tn | Milestone crossed in cumulative GMV | | $1.1Bn | Operating income in 2024 |

| | |

2.4X | More GMV than 2020 | | 12X | More operating income than 2020 |

| | |

3X | More revenue than 2020 | | $1.6Bn | Free cash flow generated in 2024 |

| | |

| 7 | Consecutive quarters of 25% or greater revenue growth, excluding logistics | | 9 | Consecutive quarters of positive free cash flow |

| | |

| +26% | Annual revenue growth that persists with scale (2024: 26%, 2023: 26%, 2022: 21%) | | +500bps | Free cash flow margin expansion |

| | |

Multiple growth drivers

gaining momentum | | Gold standard for trusted commerce |

| | |

| +33% | International revenue growth(2) | | 875M+ | Unique online shoppers purchasing from Shopify merchants in 2024 |

| | |

| +33% | Offline revenue growth(3) | | 200M+ | Hundreds of millions of Shop Pay users |

| | |

| >140% | B2B GMV growth(4) | | >12% | US ecommerce market share(5) |

| | |

| +50% | Shop Pay GMV growth | | |

| |

| +32% | Gross Payments Volume growth | |

(1)All comparisons are to 2023, unless otherwise stated.

(2)International revenue represents total revenue for all regions outside North America, which are defined as the Europe, Middle East and Africa region, Asia-Pacific region, and Latin America region.

(3)Offline revenue includes revenue from Shopify Payments for offline, POS Pro and Retail plan subscriptions and POS Hardware.

(4)Represents a very small portion of GMV today, given it is a newer product offering for merchants only on Plus.

(5)The US ecommerce market is based on a combination of US Census Bureau data (Quarterly Retail E-Commerce Sales, not adjusted) and internal estimates. Shopify market share represents sales by Shopify merchants based on Shopify’s 2024 US GMV (excluding merchant sales made through POS).

2025 Outlook

The outlook that follows supersedes all prior financial outlook statements made by Shopify, constitutes forward-looking information within the meaning of applicable securities laws, and is based on a number of assumptions and subject to a number of risks. Actual results could vary materially as a result of numerous factors, including certain risk factors, many of which are beyond Shopify’s control. Please see "Forward-looking Statements" below for more information.

We expect the strong merchant momentum from Q4 to carry over into Q1, recognizing that Q1 is consistently our lowest GMV quarter seasonally. With that backdrop, for the first-quarter of 2025 we expect:

•Revenue to grow at a mid-twenties percentage rate on a year-over-year basis;

•Gross profit dollars to grow at a low-twenties percentage rate on a year-over-year basis;

•Operating expense as a percentage of revenue to be 41% to 42%;

•Stock-based compensation to be $120 million; and

•Free cash flow margin to be in the mid-teens.

Quarterly Conference Call

Shopify’s management team will hold a conference call to discuss our fourth-quarter results today, February 11, 2025, at 8:30 a.m. ET. The conference call will be webcast on the investor relations section of Shopify’s website at www.shopifyinvestors.com/news-and-events. An archived replay of the webcast will be available following the conclusion of the call.

Shopify’s Annual Report on Form 10-K for the year ended December 31, 2024, including the Audited Consolidated Financial Statements and accompanying notes, Management's Discussion and Analysis, will be available on Shopify’s website at www.shopify.com and will be filed on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov. Shareholders may, upon request, receive a hard copy of the complete audited financial statements free of charge.

About Shopify

Shopify is the leading global commerce company that provides essential internet infrastructure for commerce, offering trusted tools to start, scale, market, and run a retail business of any size. Shopify makes commerce better for everyone with a platform and services that are engineered for speed, customization, reliability, and security, while delivering a better shopping experience for consumers online, in store, and everywhere in between. Shopify powers millions of businesses in more than 175 countries and is trusted by brands such as BarkBox, Vuori, BevMo, Carrier, JB Hi-Fi, Meta, ButcherBox, SKIMS, Supreme, and many more.

For more information visit www.shopify.com

| | | | | | | | |

| CONTACT INVESTORS: | | CONTACT MEDIA: |

| Carrie Gillard | | Alex Lyons |

| Director, Investor Relations | | Senior Lead, External Communications |

| IR@shopify.com | | press@shopify.com |

Shopify Inc. Condensed Consolidated Statement of Operations

(In US $ millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended

December 31, | | | Years ended

December 31, |

| 2024 | | 2023 | | | 2024 | | 2023 |

| Revenues | | | | | | | | |

| Subscription solutions | 666 | | 525 | | | 2,350 | | 1,837 |

| Merchant solutions | 2,146 | | 1,619 | | | 6,530 | | 5,223 |

| 2,812 | | 2,144 | | | 8,880 | | 7,060 |

| | | | | | | | |

| Cost of revenues | | | | | | | | |

| Subscription solutions | 134 | | 97 | | | 434 | | 354 |

| Merchant solutions | 1,326 | | 985 | | | 3,974 | | 3,191 |

| 1,460 | | 1,082 | | | 4,408 | | 3,545 |

| Gross profit | 1,352 | | 1,062 | | | 4,472 | | 3,515 |

| | | | | | | | |

| Operating expenses | | | | | | | | |

| Sales and marketing | 348 | | 317 | | | 1,393 | | 1,220 |

| Research and development | 351 | | 311 | | | 1,367 | | 1,730 |

| General and administrative | 112 | | 100 | | | 410 | | 491 |

| Transaction and loan losses | 76 | | 45 | | | 227 | | 152 |

| Impairment on sales of Shopify's logistics businesses | — | | — | | | — | | 1,340 |

| Total operating expenses | 887 | | 773 | | | 3,397 | | 4,933 |

| | | | | | | | |

| Operating income (loss) | 465 | | 289 | | | 1,075 | | (1,418) |

Net other income, including taxes(1) | 828 | | 368 | | | 944 | | 1,550 |

| | | | | | | | |

| Net income | 1,293 | | 657 | | | 2,019 | | 132 |

less: equity investments, mark to market, net of taxes | 835 | | 320 | | | 782 | | 1,361 |

| | | | | | | | |

Net income (loss) excluding the impact of equity investments(2) | 458 | | 337 | | | 1,237 | | (1,229) |

(1)Net other income, including taxes includes interest income, gains and losses on equity and other investments, foreign exchange gains and losses and our provision for income taxes.

(2)Net income excluding the impact of equity investments is a non-GAAP financial measure which is reconciled below in the non-GAAP reconciliation at the end of this press release. The impact of any gains or losses of our equity investments in third parties are not relevant to the fundamentals of our business. Valuations of third parties in public and private markets are outside of our control, and therefore, fluctuations in those valuations have little analytical or predictive value regarding our ability to drive operational results.

A full Consolidated Statements of Operations and Comprehensive Income (Loss) are available in the Annual Report on Form 10-K filed concurrently with this press release with Canadian and US regulators and available at www.sedarplus.ca and www.sec.gov.

Shopify Inc. Condensed Consolidated Balance Sheets

(In US $ millions)

| | | | | | | | | | | |

| | | |

| December 31, 2024 | | December 31, 2023 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | 1,498 | | | 1,413 | |

| Marketable securities | 3,981 | | | 3,595 | |

| Trade and other receivables, net | 342 | | | 282 | |

| Loans and merchant cash advances, net | 1,224 | | | 816 | |

| Other current assets | 209 | | | 169 | |

| 7,254 | | | 6,275 | |

| Long-term assets | | | |

| Property and equipment, net | 47 | | | 49 | |

| Operating lease right-of-use assets, net | 93 | | | 98 | |

| Intangible assets, net | 22 | | | 29 | |

| Deferred tax assets | 37 | | | 44 | |

| Other long-term assets | 21 | | | — | |

| Long-term investments | 709 | | | 115 | |

Equity and other investments ($3,930 and $2,977, carried at fair value) | 4,647 | | | 3,482 | |

| Equity method investment | 642 | | | 780 | |

| Goodwill | 452 | | | 427 | |

| 6,670 | | | 5,024 | |

| Total assets | 13,924 | | | 11,299 | |

| Liabilities and shareholders’ equity | | | |

| Current liabilities | | | |

| Accounts payable and accrued liabilities | 737 | | | 579 | |

| Deferred revenue | 283 | | | 302 | |

| Operating lease liabilities | 18 | | | 17 | |

| Convertible senior notes | 918 | | | — | |

| 1,956 | | | 898 | |

| Long-term liabilities | | | |

| Deferred revenue | 147 | | | 196 | |

| Operating lease liabilities | 190 | | | 217 | |

| Convertible senior notes | — | | | 916 | |

| Deferred tax liabilities | 73 | | | 6 | |

| 410 | | | 1,335 | |

Commitments and contingencies | | | |

| Shareholders’ equity | | | |

| Common stock | 9,634 | | | 9,201 | |

| Additional paid-in capital | 305 | | | 251 | |

| Accumulated other comprehensive (loss) income | (10) | | | 4 | |

| Accumulated surplus (deficit) | 1,629 | | | (390) | |

| Total shareholders’ equity | 11,558 | | | 9,066 | |

| Total liabilities and shareholders’ equity | 13,924 | | | 11,299 | |

| | | |

| | | |

| | | |

Shopify Inc. Condensed Consolidated Statements of Cash Flows

(In US $ millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended

December 31, | | | Years ended

December 31, |

| 2024 | | 2023 | | | 2024 | | 2023 |

| Cash flows from operating activities | | | | | | | | |

| Net income for the period | 1,293 | | 657 | | | 2,019 | | 132 |

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: | | | | | | | | |

| Amortization and depreciation | 8 | | 10 | | | 36 | | 70 |

| | | | | | | | |

| Stock-based compensation | 109 | | 98 | | | 430 | | 615 |

| | | | | | | | |

| Provision for transaction and loan losses | 52 | | 29 | | | 148 | | 80 |

| Deferred income tax expense (recovery) | 72 | | (3) | | | 78 | | (1) |

| Revenue related to non-cash consideration | (19) | | (35) | | | (94) | | (158) |

| Impairment on sales of Shopify's logistics businesses | — | | — | | | — | | 1,340 |

| Impairment of right-of-use assets and leasehold improvements | — | | — | | | — | | 38 |

| Net (gain) loss on equity and other investments | (929) | | (368) | | | (992) | | (1,419) |

| Net loss on equity method investment | 22 | | 48 | | | 138 | | 58 |

| Unrealized foreign exchange loss (gain) | 34 | | (12) | | | 19 | | (6) |

| Changes in operating assets and liabilities | (27) | | 24 | | | (166) | | 195 |

| Net cash provided by operating activities | 615 | | 448 | | | 1,616 | | 944 |

| Cash flows from investing activities | | | | | | | | |

| Purchases of property and equipment | (4) | | (2) | | | (19) | | (39) |

| Purchases of marketable securities | (2,339) | | (1,683) | | | (8,396) | | (5,841) |

| Maturities of marketable securities | 1,810 | | 1,612 | | | 7,457 | | 5,590 |

| Purchases and originations of loans | (877) | | (527) | | | (3,006) | | (1,861) |

| Repayments and sales of loans | 775 | | 514 | | | 2,542 | | 1,338 |

| Purchases of equity and other investments | (26) | | (260) | | | (137) | | (364) |

| Acquisition of businesses, net of cash acquired | — | | — | | | (30) | | (31) |

| Other | — | | — | | | 3 | | (36) |

| Net cash used in investing activities | (661) | | (346) | | | (1,586) | | (1,244) |

| Cash flows from financing activities | | | | | | | | |

| Proceeds from the exercise of stock options | 49 | | 17 | | | 61 | | 60 |

| Net cash provided by financing activities | 49 | | 17 | | | 61 | | 60 |

| Effect of foreign exchange on cash and cash equivalents | (12) | | 7 | | | (6) | | 4 |

| Net (decrease) increase in cash, cash equivalents and restricted cash | (9) | | 126 | | | 85 | | (236) |

| Cash, cash equivalents and restricted cash – Beginning of period | 1,507 | | 1,287 | | | 1,413 | | 1,649 |

| Cash, cash equivalents and restricted cash – End of Period | 1,498 | | 1,413 | | | 1,498 | | 1,413 |

| | | | | | | | |

Reconciliation of Non-GAAP Financial Measures

Free Cash Flow Reconciliation

(In US $ millions, except percentages)

The following table illustrates how free cash flow is calculated in this press release:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended

December 31, | | | Years ended

December 31, |

| 2024 | | 2023 | | | 2024 | | 2023 |

| Net cash provided by (used in) operating activities | 615 | | | 448 | | | | 1,616 | | | 944 | |

less: capital expenditures(1) | (4) | | | (2) | | | | (19) | | | (39) | |

| Free cash flow | 611 | | | 446 | | | | 1,597 | | | 905 | |

| Revenue | 2,812 | | | 2,144 | | | | 8,880 | | | 7,060 | |

| Free cash flow margin | 22 | % | | 21 | % | | | 18 | % | | 13 | % |

(1)Capital expenditures is equivalent to the amount included in “Purchases of property and equipment” on our consolidated statements of cash flows for the reported period.

Net Income (Loss) Excluding the Impact of Equity Investments Reconciliation

(In US $ millions)

The following table illustrates how Net Income (Loss) Excluding the Impact of Equity Investments is calculated in this press release:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended

December 31, | | | Years ended

December 31, |

| 2024 | | 2023 | | | 2024 | | 2023 |

| Net income | 1,293 | | 657 | | | 2,019 | | 132 |

less: equity investments, mark to market, net of taxes | 835 | | 320 | | | 782 | | 1,361 |

Net income (loss) excluding the impact of equity investments(1) | 458 | | 337 | | | 1,237 | | (1,229) |

(1)Net income excluding the impact of equity investments is a non-GAAP financial measure. The impact of any gains or losses of our equity investments in third parties are not relevant to the fundamentals of our business. Valuations of third parties in public and private markets are outside of our control, and therefore fluctuations in those valuations have little analytical or predictive value regarding our ability to drive operational results.

Financial Performance Constant Currency Analysis

(In US $ millions, except percentages)

The following table converts our GMV, revenues, gross profit and operating income using the comparative period's monthly average exchange rates. The table below setting out the effect of foreign exchange rates on GMV and our consolidated statements of operations disclosure is a supplement to our consolidated financial statements, which are prepared and presented in accordance with US GAAP. We have provided the below disclosure as we believe it presents a clear comparison of our period to period operating results by removing the impact of fluctuations in foreign exchange rates and to assist investors in understanding our financial and operating performance.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, |

| GMV | | Revenue | | Subscription solutions revenue | | Merchant solutions revenue | | Gross profit | | Operating income |

| 2023 as reported (GAAP, excl. GMV) | 75,125 | | 2,144 | | 525 | | 1,619 | | 1,062 | | 289 |

| 2024 as reported (GAAP, excl. GMV) | 94,460 | | 2,812 | | 666 | | 2,146 | | 1,352 | | 465 |

| Percentage change YoY (GAAP, excl. GMV) | 26% | | 31% | | 27% | | 33% | | 27% | | 61% |

| Constant currency impact | (422) | | (3) | | 0 | | (3) | | (1) | | 7 |

| Percentage change YoY (GAAP, excl. GMV) constant currency | 26% | | 31% | | 27% | | 33% | | 27% | | 58% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Years ended December 31, |

| GMV | | Revenue | | Subscription solutions revenue | | Merchant solutions revenue | | Gross profit | | Operating income |

| 2023 as reported (GAAP, excl. GMV) | 235,910 | | 7,060 | | 1,837 | | 5,223 | | 3,515 | | (1,418) |

| 2024 as reported (GAAP, excl. GMV) | 292,275 | | 8,880 | | 2,350 | | 6,530 | | 4,472 | | 1,075 |

| Percentage change YoY (GAAP, excl. GMV) | 24% | | 26% | | 28% | | 25% | | 27% | | * |

| Constant currency impact | (1,043) | | (5) | | (1) | | (4) | | 0 | | (22) |

| Percentage change YoY (GAAP, excl. GMV) constant currency | 24% | | 26% | | 28% | | 25% | | 27% | | * |

* Not a meaningful comparison

Forward-looking Statements

This press release contains forward-looking statements and forward-looking information (collectively, “forward-looking statements”), including statements related to Shopify’s financial outlook, including expected revenue and expenses for the next fiscal quarter. These statements can be identified by words such as “expect” and are based on Shopify's current projections and expectations about future events and financial results. Known and unknown risks may cause actual results to differ materially from those described in the forward-looking statements. These risks include, but are not limited to, the Company’s ability to maintain expected growth and manage expenses, the impact of changes in economic conditions and consumer spending in key markets such as the United States and Europe and globally, the impact of measures that affect international trade, including tariffs, our reliance on third party cloud providers to deliver services, a cyberattack or security breach, and serious errors or defects in software or hardware. Other factors and risks that may cause actual results to differ materially from those set out in the forward-looking statements are set out in Shopify's Annual Report on Form 10-K and other filings made with US and Canadian securities regulators, available at www.sedarplus.ca and www.sec.gov. Undue reliance should not be placed on the forward-looking statements in this press release, which are based on information available to management on the date hereof and represent management’s beliefs regarding future events, projection and financial trends, which, by their nature, are inherently uncertain. The forward-looking statements are provided to give additional information about management’s expectations and beliefs and may not be appropriate for other purposes. Shopify undertakes no duty to publicly update or revise any forward-looking statements, except as may be required by law.

Notes: (1)Gross Merchandise Volume, or GMV, represents the total dollar value of orders facilitated through the Shopify platform including certain apps and channels for which a revenue-sharing arrangement is in place in the period, net of refunds, and inclusive of shipping and handling, duty and value-added taxes.

Monthly Recurring Revenue, or MRR, is calculated by multiplying the number of merchants by the average monthly subscription plan fee in effect on the last day of that period and is used by management as a directional indicator of subscription solutions revenue going forward assuming merchants maintain their subscription plan the following month. In the three months ended March 31, 2024, the Company revised the inclusion of paid trials in the calculation of MRR.

Free cash flow and free cash flow margin are non-GAAP financial measures which are reconciled in the non-GAAP reconciliation at the end of this press release. Shopify believes free cash flow and free cash flow margin provide useful information to help investors and others understand our operating results and the performance of our business in the same manner as management. Shopify does not reconcile forward-looking non-GAAP free cash flow margin as certain financial information, the probable significance of which cannot be determined, is not available and cannot be reasonably estimated. Free cash flow is a non-GAAP financial measure calculated as cash flow from operations less capital expenditures.

v3.25.0.1

Cover

|

Feb. 11, 2025 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 11, 2025

|

| Entity Registrant Name |

Shopify Inc.

|

| Entity Incorporation, State or Country Code |

Z4

|

| Entity File Number |

001-37400

|

| Entity Tax Identification Number |

98-0486686

|

| Entity Address, Address Line One |

151 O'Connor Street, Ground Floor

|

| Entity Address, City or Town |

Ottawa,

|

| Entity Address, State or Province |

ON

|

| Entity Address, Country |

CA

|

| Entity Address, Postal Zip Code |

K2P 2L8

|

| City Area Code |

613

|

| Local Phone Number |

241-2828 x 1045

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Subordinate Voting Shares

|

| Trading Symbol |

SHOP

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001594805

|

| Other Address |

|

| Document Information [Line Items] |

|

| Entity Address, Address Line One |

148 Lafayette Street

|

| Entity Address, City or Town |

New York,

|

| Entity Address, State or Province |

NY

|

| Entity Address, Country |

US

|

| Entity Address, Postal Zip Code |

10012

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_EntityAddressesAddressTypeAxis=dei_OtherAddressMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

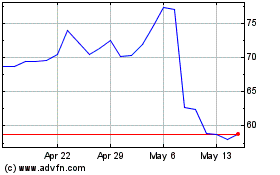

Shopify (NYSE:SHOP)

Historical Stock Chart

From Jan 2025 to Feb 2025

Shopify (NYSE:SHOP)

Historical Stock Chart

From Feb 2024 to Feb 2025