SiriusPoint Announces Pricing of Secondary Offering of 4,106,631 Common Shares by Entities Associated with Daniel S. Loeb and Repurchase of 500,000 Shares by SiriusPoint

26 February 2025 - 12:52PM

SiriusPoint Ltd. (“SiriusPoint” or the “Company”) (NYSE: SPNT)

today announced the pricing of its previously announced registered

secondary offering by entities associated with Daniel S. Loeb

(colllectively, the “Loeb Entities”) of an aggregate of 4,106,631

common shares at a price to the public of $14.00 per share. The

offering is expected to close on February 27, 2025, subject to the

satisfaction of customary closing conditions.

SiriusPoint has agreed to repurchase an aggregate of 500,000 of

the common shares being offered in the offering at the public

offering price. SiriusPoint will cancel the 500,000 common

shares it repurchases in the offering.

Immediately following the completion of the offering and our

previously announced repurchase of all of the common shares and

warrants currently held by CM Bermuda, it is expected that the Loeb

Entities will own approximately 9.54% of SiriusPoint’s issued and

outstanding common shares.

Under the terms of the transaction, the remaining shares owned

by the Loeb Entities will be subject to a 90 day lock-up agreement

with the sole bookrunning manager.

Jefferies is acting as the sole bookrunning manager for the

offering.

The offering is being made only by means of an effective

registration statement and a prospectus. The Company has previously

filed with the U.S. Securities and Exchange Commission (the “SEC”)

a registration statement (including a prospectus) on Form S-3 (File

No. 333-283827), dated December 16, 2024, and a prospectus

supplement for the offering to which this communication relates.

Before you invest, you should read the prospectus in that

registration statement, the accompanying prospectus supplement, and

other documents the Company has filed with the SEC for more

complete information about the Company and this offering. When

available, copies of the prospectus supplement and the accompanying

prospectus relating to the offering may be obtained from: Jefferies

LLC, Attention: Equity Syndicate Prospectus Department, 520 Madison

Avenue, New York, NY 10022, by telephone at (877) 821-7388, or by

email at prospectus_department@jefferies.com. Electronic copies of

the prospectus supplement and accompanying prospectus will also be

available on the website of the SEC at http://www.sec.gov. This

press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

ContactsInvestor RelationsLiam

Blackledge, SiriusPointLiam.Blackledge@siriuspt.com+ 44 203 772

3082MediaSarah Hills,

Rein4ceSarah.Hills@rein4ce.co.uk+ 44 7718 882011

About SiriusPoint

SiriusPoint is a global underwriter of insurance and reinsurance

providing solutions to clients and brokers around the world.

Bermuda-headquartered with offices in New York, London, Stockholm

and other locations, we are listed on the New York Stock Exchange

(SPNT). We have licenses to write Property & Casualty and

Accident & Health insurance and reinsurance globally. Our

offering and distribution capabilities are strengthened by a

portfolio of strategic partnerships with Managing General Agents

and Program Administrators within our Insurance & Services

segment. With over $2.6 billion total capital, SiriusPoint’s

operating companies have a financial strength rating of A-

(Excellent) from AM Best, S&P and Fitch, and A3 from

Moody’s.

FORWARD-LOOKING STATEMENTS

We make statements in this press release that are

forward-looking statements within the meaning of

the U.S. federal securities laws. We intend these

forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements in

the U.S. federal securities laws. These statements

involve risks and uncertainties that could cause actual results to

differ materially from those contained in the forward-looking

statements. These risks and uncertainties include, but are not

limited to, the impact of general economic conditions and

conditions affecting the insurance and reinsurance industry; the

adequacy of our reserves; fluctuation in the results of operations;

pandemic or other catastrophic event; uncertainty of

success in investing

in early-stage companies, such as the risk of

loss of an initial investment, highly variable returns on

investments, delay in receiving return on investment and

difficulty in liquidating the investment; our ability to

assess underwriting risk, trends in rates for property and casualty

insurance and reinsurance, competition, investment market and

investment income fluctuations; trends in insured and paid losses;

regulatory and legal uncertainties; and other risk factors

described in SiriusPoint’s Annual Report on Form 10-K for the

period ended December 31, 2024.

Except as required by applicable law or regulation, we disclaim

any obligation to publicly update or revise any forward-looking

statement to reflect changes in underlying assumptions or factors,

or new information, data or methods, future events, or other

circumstances after the date of this press release.

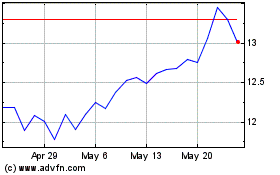

SiriusPoint (NYSE:SPNT)

Historical Stock Chart

From Mar 2025 to Apr 2025

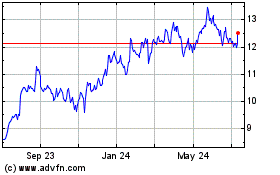

SiriusPoint (NYSE:SPNT)

Historical Stock Chart

From Apr 2024 to Apr 2025