Fitch Ratings Revises Outlook on SiriusPoint to Positive Based on Significant Underwriting Performance Improvement

06 March 2025 - 8:36AM

Fitch Ratings (Fitch) has today announced that it has affirmed the

ratings of SiriusPoint Ltd. (“SiriusPoint” or the “Company”),

including its Long-Term Issuer Default Rating at ‘BBB’, its senior

debt rating at ‘BBB-‘ and its Insurer Financial Strength (IFS)

rating at ‘A-‘ (Strong) of SiriusPoint’s subsidiaries. It has also

revised the Company’s Outlook to Positive from Stable.

Fitch said: “The Positive Outlook reflects

significant underwriting performance improvement in 2024 and 2023

as a result of repositioning the (re)insurance portfolio and

exiting non-core lines in order to improve profitability and reduce

overall volatility.”

Key drivers of the ratings include the completed

transaction for the full repurchase of all outstanding shares and

warrants from CM Bermuda Limited, as well as solid underwriting

results in both 2024 and 2023. Fitch said it “anticipates the

favourable underwriting results to continue while the company

expects to grow its business, particularly in primary

insurance.”

Fitch also recognizes SiriusPoint’s strong

financial performance of $184m for net income 2024, while citing

its “strong operating income from underwriting profits, increased

investment income and a gain of $96m on the deconsolidation of an

MGA.”

SiriusPoint CEO, Scott Egan said: “Fitch Ratings'

decision to improve SiriusPoint’s Outlook to Positive follows nine

consecutive quarters of strong operating performance. The outlook

revision validates the measurable progress we have made in

repositioning our business, building out a successful underwriting

platform, and growing a track record of performance, while also

strengthening and simplifying our capital structure. This

decision is a reflection of the contribution and hard work of our

global team. We look forward to continuing our momentum towards

additional favourable outcomes for the Company and its

stakeholders."

Click here for full details in the Fitch press

release.

ContactsInvestor

RelationsLiam Blackledge,

SiriusPointLiam.Blackledge@siriuspt.com+ 44 203 772 3082

MediaStephen Breen,

Rein4ceStephen.breen@rein4ce.co.uk+ 44 7843 076556

About SiriusPoint

SiriusPoint is a global underwriter of insurance

and reinsurance providing solutions to clients and brokers around

the world. Bermuda-headquartered with offices in New York, London,

Stockholm and other locations, we are listed on the New York Stock

Exchange (SPNT). We have licenses to write Property & Casualty

and Accident & Health insurance and reinsurance globally. Our

offering and distribution capabilities are strengthened by a

portfolio of strategic partnerships with Managing General Agents

and Program Administrators within our Insurance & Services

segment. With over $2.6 billion total capital, SiriusPoint’s

operating companies have a financial strength rating of A-

(Excellent) from AM Best, S&P and Fitch, and A3 from

Moody’s.

FORWARD-LOOKING STATEMENTS

We make statements in this press release that are

forward-looking statements within the meaning of

the U.S. federal securities laws. We intend these

forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements in

the U.S. federal securities laws. These statements

involve risks and uncertainties that could cause actual results to

differ materially from those contained in the forward-looking

statements. These risks and uncertainties include, but are not

limited to, the impact of general economic conditions and

conditions affecting the insurance and reinsurance industry; the

adequacy of our reserves; fluctuation in the results of operations;

pandemic or other catastrophic event; uncertainty of

success in investing

in early-stage companies, such as the risk of

loss of an initial investment, highly variable returns on

investments, delay in receiving return on investment and

difficulty in liquidating the investment; our ability to

assess underwriting risk, trends in rates for property and casualty

insurance and reinsurance, competition, investment market and

investment income fluctuations; trends in insured and paid losses;

regulatory and legal uncertainties; and other risk factors

described in SiriusPoint’s Annual Report on Form 10-K for the

period ended December 31, 2024.

Except as required by applicable law or regulation,

we disclaim any obligation to publicly update or revise any

forward-looking statement to reflect changes in underlying

assumptions or factors, or new information, data or methods, future

events, or other circumstances after the date of this press

release.

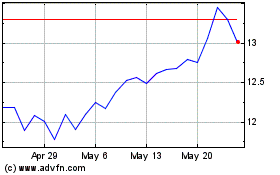

SiriusPoint (NYSE:SPNT)

Historical Stock Chart

From Mar 2025 to Apr 2025

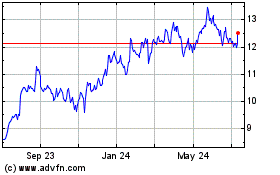

SiriusPoint (NYSE:SPNT)

Historical Stock Chart

From Apr 2024 to Apr 2025