Filed by Andretti Acquisition Corp. and Zapata Computing,

Inc.

Pursuant to Rule 425 under the Securities Act of 1933

and deemed filed

pursuant to Rule 14a-12 under the Securities Exchange

Act of 1934

Subject Company: Andretti Acquisition Corp.

Commission File No. 001-41218

Date: February 1, 2024

Full Transcript of IPO Edge Fireside Chat with Christopher

Savoie, CEO Zapata AI, and Bill Sandbrook, CEO Andretti Acquisition

John Jannarone (JJ), IPO Edge: Hello, I'm John

Jannarone, editor in chief of IPO Edge. Very happy to be back today with a company I think you are all going to find super interesting.

This is Zapata AI, which is going public through a merger with Andretti Acquisition Corp., which trades on the New York Stock Exchange

on WNNR. That merger is expected to close in just a few weeks here. Now this company is fastening. They deploy AI everywhere, from race

tracks to trading floors. We're going to hear all about that from the CEO of Zapata AI, along with the Co-CEO of Andretti Acquisition

Corp. Before we get started, folks, I just want to remind everyone to ask questions. The two gentlemen will be happy to answer them later

on in the show. The simplest way to do that is right there in the Zoom terminal. Just pop those questions in and we'll address those later

on. Lastly, if you'd like to watch a replay, the easiest way to find it is on ipoedge.com. I'm sorry ipo-edge.com, or just look up the

WNNR ticker on your Bloomberg Terminal or on Yahoo! Finance and you'll find it there as well. Before we kick off the introduction of the

guests, let's play a little clip to give you an overview of the business. For those of you who are not familiar, this is Zapata AI.

[Video plays]

JJ: Alright. With that, I'm going to pass the

baton to Jarrett Banks, who's going to introduce our guest. Jarrett.

Jarrett Banks (JB), IPO Edge: Thanks, John, and

welcome, gentlemen. Bill, you're the CEO of Andretti Acquisition. Let's start with you. We cover a lot of SPACs here at IPO Edge. You've

had a very successful tenure as the CEO of U.S. Concrete where you drove M&A strategy and ultimately sold to Vulcan Materials a couple

of years ago. How did you end up with Andretti and focused on AI?

Bill Sandbrook (BS), Andretti Acquisition Corp.:

It's a very interesting story and it goes back all the way to 1970. I grew up right next-door neighbors to the Andrettis, so I've known

Michael, Mario and his entire family for 54 years. Michael went off to a racing career. I went into the military and then subsequently,

a business career. But we stayed very close through all those years. We’ve vacationed together. Actually, U.S. Concrete sponsored

Michael's son, Marco Andretti, for three years in the IndyCar Series. I'm co-owner with Michael in the Extreme E series, so I've been

around racing my entire life, my entire career, and Michael came to me and said, ‘Bill, you know, you've been a successful CEO.

You know public markets. I have a fantastic brand and I have a penchant for mobility technology. Let's get together with this new SPAC

vehicle – at that time – and let's see if we can put your skill set and my skill set together and see if we can find an appropriate

company to take public that that transcends not only racing, but would have a big total addressable market and preferably on the technology

side of mobility but that that can spread its wings and find many, many other applications.’ So Michael and I went off and did that

in 2021. We ended up vetting over 90 companies and originally Zapata and Christopher were part of the team that was helping them in their

race diagnostics that you saw in the video. And at the end of that long search myself, Michael and my team said, ‘You know what?

This this has some legs. I think Zapata really should be the target that we really go after.’ And from there, we negotiated a deal

and we are here, you know, on the cusp of actually bringing this company public.

JB: Alright, fantastic. Let's bring Christopher

Savoie, the CEO of Zapata AI, into the conversation. Christopher, can you describe your business and what differentiates the Zapata AI

from other AI focused companies? Now we saw there in the video the sports angle, but there's actually a whole lot more to it, isn't there?

Christopher Savoie (CS), Zapata AI: There's

a lot more and a lot of it gets into rocket science-y type of stuff, so I'll try to keep it recognizable for all audiences, but we spun

out of Harvard in 2017, with some

really cool math. Really cutting-edge math that can

be applied to AI and a bunch of other areas. We really are working on some of the hardest math problems in the world. We came out of the

lab that was doing quantum chemistry and quantum physics, and we're applying what we've learned on taking on that kind of complicated

math in those kind of academic areas to industrial areas where it really makes a difference and creates business value. And one of those

areas very early on that we thought that this could have a real impact to apply this linear algebra that we have, this really cutting-edge

math, was in generative AI. Now this was in 2017 when we just got started, and at the time, there was no open AI. There were no chat bots

using large language models or any of that kind of type, but we knew that this math could be applicable there. And we also knew that the

generative AI technology could be useful for things other than just creating some marketing lines and poems and take pictures of cats.

That's not really a great business model. But you can use the generative AI technology to do other things. As you've seen a little bit

in the clip there with the racing, we can use it to do some very serious things like analytics where, you know, it's at speeds of 240

miles an hour and, you know, massive data amounts and these kinds of things that we have to deal with in industrial types of solutions,

and racing is just one area as you alluded to. We've applied it to other areas as well. So, you know, this this from the very beginning

was a differentiator in that we were going to apply this physics-based math – this really high-end math – to real industrial

problems using generative AI as the mechanism to solve these problems.

JB: Alright, great. Let let's talk a little bit

more in depth about what industrial problems Zapata AI is solving for companies.

CS: Sure. I mean we can start with the racing

example because it's kind of cool. What are we actually doing there? Well, on these cars there are a lot of sensors. There's a lot of

data going. The whole game of racing nowadays is about the data really. You need to know when are your tires going to degrade? What is

your engine doing? What are these things doing? There are hundreds of sensors on those cars to help you figure that out. That's where

you see all these computers over time expand their … they're measuring everything. Fuel levels this, that and the other thing.

It all, it really is more than in baseball or any other sport, about the analytics to win nowadays in modern racing. But there are certain

physical properties that we don't have a sensor for that we really care about. For example, the slip angle of the tires. What's the slip

angle of the tires? Well, when you're going around the track, you want to know how those where the friction is on those tires because

you need to know how those tires are going to degrade so you know when to pit the car. And if you get that wrong, if you pit too fast,

you pit too late, you lose. So, this is a multimillion-dollar decision every weekend, right? And for that, you really need to know not

just where the tire of the direction the tires are going, but where they're actually sliding on the track, the slip angle. And you'd say,

’Well, maybe it's the direction of the tires, you have a sensor for that, right?’ Yeah. Well, but the problem is when you

go 240 miles an hour and qualifying at the Indy 500 and you turn left, the car wants to go right because it's centrifugal force. So that's

not the slip angle. The slip angle is the product of all these vectors to really know where that thing’s sliding. So, you don't

have a sensor for that. You don't have a SpaceX accelerometer on the outside of the wheels of a racing car that has open wheels because

if you hit the wall or you touch another car, that's a very expensive day at the track and it wouldn't be great for aerodynamics either.

So, you don't have an accelerometer, you don't have a sensor to actually detect that angle. GPS is too slow at 240 miles an hour and video

is not accurate enough. So, what do you do? Well, we have 20 years of historical data of going around that track, lots of data from all

the other sensors, and we have some lab data, some limited data that tells us how that correlates to the slip angle. So, what we can do

is if you can deep fake a picture of a cat like we use in DALL-E or you can deep fake some poetry on ChatGPT, we can use the same underlying

technology – this generative AI technology – to deep fake what that sensor should be or would be based on all of the other

data. So, we're able to actually deep fake the way around the track. Like I said in the video there, we're less than 1% error. We’re

like dead on what that actual slip angle would be. Now we can feed that into our models of the tire degradation and these kind of things

in this time series and then update it real time, update our models real time, and be able to predict when we need to pit that car ideally

for the race strategy to win. So, that sounds great for racing. That's really … what does that have to do with any other industrial

problems? Well, that's time series data and we have massive amounts of time series data, really fast at 240 miles an hour. To qualify

for the Indy 500 last year, you had to be up to #20, between #20 and #21, after 8 miles at 240 miles an hour. It was a tie down to one-ten-thousandth

of a second to give you an idea of the kind of criticality in the speed that we're dealing with. So, yeah, there's no margin for error

at all. And that actually is a harder problem than applying to the same time series data

in trading or with a bank. And we announced recently

that we're working with Sumitomo Mitsui (SMTB) Trust Bank to apply the exact same math that we use to determine how to win a race to determine

how to do a trading strategy and to deep fake different scenarios. Basically, you know, you can deep fake a cat, you can deep fake a steering

trace or a or a slip angle. You can also deep fake what would happen if the Fed kept its rates stable and the Japanese Fed lowered its

rates. So, yeah, we can actually dep fake these scenarios with pretty good accuracy and have that inform our decisions in these industrial

problems. We can also use it for optimization. We've worked with BMW on optimizing their factories for getting the most production out

of a limited workforce and in certain parts and other kinds of constraints that they have. So, we can apply this kind of generative capability

not just to pictures and words, but to really important things for humanity, for healthcare, for, you know, building new bridges, designing

new means of having logistics work in a more decarbonized manner, all these kind of things.

JB: It's absolutely mind-blowing technology. I just

hope we don't put Mr. Yen out of a job there. But could you give us the sense of the market opportunity for generative AI?

CS: It's massive. I mean, we've talked about

the TAM and, you know, whichever number you want to believe, the Gartner numbers, the McKinsey numbers, they're all huge and, you know,

we're talking, you know, billions, trillions of dollars because this will really affect how we do everything creatively in the economy.

And when we think of creativity, we think of the arts. We think about music and we've seen how, you know, generative AI can create new

music and these kind of things. But creativity is in everything that we do. In science, developing a new drug. We can actually, we've

shown that we can use these enhanced quantum inspired AI models to get better drug molecules then you would with a normal AI model. So,

developing new drugs, developing new medicines, developing … and the market for these kind of things is massive and the kind of

business change that this is going to cause is massive. Now we're not going to replace humans, but what we'll be able to do is give the

engineer instead of – like we're doing with the race engineer – look, here are three different new strategies that you may

not have thought of that we've generated for you. And here are three new bridge designs that you haven't thought of. Three new building

designs that may be more efficient on energy consumption, for example. So, it's really a massive TAM that's really almost hard to quantify

because it's going to affect every area of human endeavor in my estimation.

JB: Great. I want to bring Bill back in if we could.

Bill, what stood out to you so much about Zapata AI?

BS: Well, first mover. A proven business model.

A relationship with the Andrettis. So, the Andrettis understand and work with this team. A first notch management team and top, top, engineers

and scientists. And, as Christopher said, a huge TAM that's untapped and we’re at the cutting edge and we're first movers. So, all

the above made this a very, very compelling company to partner with.

JB: I'm so glad you mentioned that first mover advantage.

Christopher, what is the advantage there in your mind of being, you know, a pureplay AI first mover?

CS: Well, yeah, I think we're, you know, in

the marketplace as a stock will be, to my knowledge, one of the first pureplay generative AI companies out there as a public entity. Now

there are other companies that are kind of our competitors, our peers in this space. Microsoft, you know, AWS, others are participating

in this. Google. But if you're investing in Microsoft, you're investing in everything that Microsoft does, including, you know, OpenAI

type of things, but also Office 365 and all the other legacy stuff. So, as a pureplay, we think that that's kind of unique and special.

It gives us an opportunity to participate in the public capital markets, which, you know, these are our competitors, the Microsoft's the

world and these kind of folks. So, it allows us the same kind of competitiveness and the advantages of being a public company. When you're

dealing with the procurement department of a government or a large Fortune 100 company, it's just a lot easier when you're a public company.

Your financials are transparent and it makes it smoother to conduct business in that manner. Public companies trust other public companies

is really part of the issue. And also in acquiring talent and maintaining our talent, being a public company is really an advantage over

private companies in the same space.

JB: There's certainly a war for talents in this

industry right now, too, isn't there?

CS: There absolutely is. The kind of people

who can do, create the technologies that are behind this, there really is some rocket science, some really tough math that you have to

do to make these statistics work well. And that kind of talent doesn't grow on trees. And we really haven't yet as an educational system

created, you know, generative AI courses for college or graduate school yet. You're doing something else in machine learning or computer

science and you happen upon this kind of an area. So, the people who really know how to do this – the top flight, A players –

are a rare commodity out there right now.

JB: Right. Now, tell us a little bit about the business

model and your growth strategy.

CS: The business model is very much like other

AI companies here in this space. So you know, we're kind of building off of the shoulders of giants here in what we're doing. You've seen

other folks like Palantir and C3 AI and others who are focused on, you know, high end analytics and this kind of thing. We’re specifically

focused on kind of the generative aspects of this and that’s really our differentiation plus the quantum math that we can put behind

it. But the business model itself is very similar. I mean we engage our customers, we have a platform of software that helps us train

– Orquestra® – which helps us train these models and then deliver these models in an enterprise environment. And then

on top of that, we offer the ability to develop new algorithms for these specific vertical applications like, you know, in racing, in

the OEM area of mobility, in banking and other areas. So, those services and those things all get bundled in a rapidly recognizable model

that we have that's very similar to the way those other businesses conduct their business. So, you know, for our customers, some of them

are already Palantir customers or C3 AI customers as well, and so for them, this is no mystery. They know how this business model works,

and so for them, it's nothing they haven't seen before as far as procurement goes.

JB: Alright, great. And in your mind, why does it

make sense to go public now?

CS: Well, I think I alluded to really the access

to the public capital markets, the exposure that this gives you, the credibility that this gives you when you're dealing with our customers.

You know, this is not a consumer play. We're dealing with, you know, large industrials globally. And when you're dealing with a large

Japanese bank, it helps if you are on a path to be public and you’re a public company ultimately for building that trust, because,

you know, as a public company, you're subject to scrutiny and transparency, which in the case of the procurement side of this, they know

when you're going to want to, they're going to want you for their vendors to be around for a while. They're going to want for you there

to be transparency in your financials and all of this stuff for their own due diligence. So, on the procurement side of this and on our

side of sales, it's a lot easier. It reduces friction. And also, for talent acquisition and retention that's a key thing for us and the

ability to offer, you know, liquid restricted stock units (RSUs) instead of options that could maybe be worth something someday, but might

not. With a startup, that's a big difference in in trying to retain rarefied talent.

JB: Let's talk a little bit more about that deal

with Sumitomo Mitsui Trust Bank. Can you explain how that came about and how generative AI can help in banking?

CS: Yeah. Well, as I said, we, we actually talked

to them. They saw a seminar that I gave in Japan and another one I gave in Boston, and they were interested in the time series data stuff

that we were doing with Andretti. And they had a highly technical person there who said, ‘Wait, that's the same math I'm trying

to deal with my problems trying to create trading and investment strategies for the regional banks that are their clients.’ And

so, they said, ‘Well, you know, if this is time series data that you can do, this is something that's highly applicable to the kind

of scenarioizing and the things that we're doing in banking and finance. And so, that was the birth of the discussion that led to, you

know, this engagement that we've announced with the bank to basically apply the same math that we're using in the Andretti racing situation,

ironically, with a little bit slower database with the banks. You know trading is fast, but it's not as fast as a car going 240 miles

an hour. So, for us this is kind of a slower pace to a problem in a way and a little bit easier, ironically.

JB: It it's absolutely fascinating. I want to bring

my colleague, John, back into the mix here who's going to ask some follow up questions, take questions from the audience. Take it away,

John.

JJ: Thanks a lot, Jarrett. Yeah, we've got a couple

… why don't I start with a couple of audience questions. Then we got some more material to go through. On these financial services

customers, is Sumitomo Mitsui, is that unusual or there be more? I mean, I think I noticed on your website that you worked with BBVA as

well. So, is there a lot of scope for more and, you know, the broad, you know, Wall Street financial world?

CS: Absolutely. We think that this is an area

of expansion for us. Financials are, you know, this is one that we've announced and now going public, we can only talk about the things

that are public, but obviously this is an area that we think if it's good for one bank, it's good for lots of other banks and lots of

other areas as well. I mean this is not just limited to application to banking per se or trading per se, but other things like annuities,

for example. When you're trying to figure out how to sell an annuity, you have to figure out how someone's going to invest and divest

that annuity over a few years to create the right product. And you need to understand that behavior. You need to be predictive of that

behavior. And the kind of predictivity of how a car's going to go or around the racetrack, or how a trading thing is going to go, is very

applicable to other financial areas such as insurance.

JJ: Great. And at risk of getting two in the weeds

here, Christopher, looking at that BVVA case study on your website, it looks like you're helping them do something, a Monte Carlo simulation,

which is done in credit pricing, has been for a very long time, but you're helping them do it better or more efficiently, right? So, it's

not entirely new, it's just kind of a better approach. Is that fair?

CS: Yeah. I guess you can say that we have newer

– it's not so new – but better math to apply to this that we've taken out of the quantum physics and quantum chemistry space

which deals with some of the hardest problems that are known to man mathematically. And we're applying that to in this in some sense simpler

things like trading and, you know, credit adjustment and this kind of thing.

JJ: Great. And one more audience question will slip

in here. Someone's asking if you can just tell us at all a at high level how your sales contracts look. Is there an upfront payment? And

then is there a recurring service payment and are they long term? Can you tell us anything about that without getting too detailed?

CS: Yeah. I mean some of the contracts are available

in our disclosures in the S4, so I encourage people to go look through them, read through them. It's pretty transparent. You know, these

are usually multiyear, multimillion dollar engagements that we recognize ratably over month to month that includes the software and includes

the services of creating some of these algorithms and the IP that we've created over all these years in those licenses and services deals.

So basically, you end up with a, you know, multiyear deal, multimillion dollars and that's structured as a month-to-month ratably recognized

revenue stream on our side.

JJ: Great. Alright, I'm going to take another even

though I don't normally go in this order. Let's keep the audience asking questions happy here. Here's one for Bill. Joseph’s asking,

you know, and we discussed this yesterday in our little practice called gentleman. You know, Bill has done dozens and dozens of M&A

deals. Can you tell us about how you're gonna help Zapata AI and Christopher's team out with that, you know, incredible experience you

have over the last few decades.?

BS: Sure. Well, some of the Christopher's growth

strategy, obviously, is organic, but some is going to be acquisitive as well in this space and my experience, and my CFO’s experience,

Matt Brown, who's actually going to be on the Zapata board, have done over 150 acquisitions. From vetting to seeing what's real, what's

not real, valuation, vetting management teams. Christopher's team will have to vet the technology, but the actual, you know, nuts and

bolts of deal making, we're very experienced with and Matt’s going to be on Christopher's board and helping out there as well. And

plus, myself will still be involved with racing and the Andrettis and Zapata is going to be involved with racing, so we'll be shoulder

to shoulder in formal settings and informal settings going forward for many, many years.

JJ: Great. Here's another question. How important

is the quantum computing facet to your overall business model and growth story? I believe I noticed that you announced a partnership with

IonQ, so there's some stuff cooking there. Christopher, can you tell us how important that is and how much investors should focus on it?

CS: Sure. As I said, our math is based on quantum

math, if you want to call it that. You know, the technical people will get really angry at me for saying something like that. It's oversimplified.

But our math is linear algebra that comes out of the quantum physics, quantum chemistry background, and quantum computers eventually we'll

be able to do that even faster than the GPUs that are state-of-the-art today. So, our math works on GPUs today, doing the same linear

algebra types of tasks in a faster way then some of the other methods like neural networks that are out there for OEM's, so we get some

advantage and some acceleration today on GPU's over other methodologies. Eventually though, these quantum computers are going to be able

to do that math exponentially fast in certain areas. And when that hardware does show up, we have already shown … we've actually

did the first experiment with IonQ on doing generative modeling on the actual quantum computer that was published actually was part of

their deSPAC back a couple of years ago. That was our software running that first experiment where we've done generative AI, much like

we're doing for all these other industrial customers on an actual quantum computer. Now, when those computers are more accurate and able

to handle larger volumes of data and tasks, the math, that's going to accelerate this even further. And if you looked at, you know, Satya's

[Nadella, CEO of Microsoft] recent talk, the last 30 minutes were about how quantum and AI are kind of converging and we believe that

this is a further accelerator in the future. Once those computers are capable enough, that's going to create an acceleration and our software

will be pretty much needed and ready to be forward compatible to that technology when it goes. But the advantage for us is that we can

use some of the same methods that we're using on GPU's today. Not as fast, but faster than the current methods.

JJ: Makes sense. I want to talk about something

which is illustrated quite well in your investor presentation. There's a slide that shows your patents and where you stack up against

some of these gigantic names. Can you without – we don't need to show it right now, I encourage people to go check it out, it's

easy to find – but Christopher, can you tell us about that? You know, I'm talking about Microsoft, the really big guys, and you're

not too far away in terms of the number of patents you secured, right?

CS: Right. This is about applying the kind of

quantum math to this area. So, we're not the only one saying, ‘OK, you can use this quantum physics, quantum chemistry type of math,

quantum inspired algorithms’ if you want to call them that. Quantum algorithms apply to machine learning and AI and this European

patent office list, their 2023 study, showed that we were kind of in, I think we were #5 on that list if I'm not mistaken, up there, kind

of in a tie, 21 or 20 and I think we were 19 with patents with companies like Accenture and Microsoft. And below us, with about half,

about 10 or 11 patents, where companies like Meta and Google and some other giants and there's not a startup to be found. There's not

an AI, you know, West Coast VC backed company on that list because we have this very new technology and we've been doing it for years.

And that's why we have that; we've built up this pretty formidable IP portfolio in the area. And so, I guess we're, you know, for a smaller

company, we're really punching above our weight.

JJ: Great. Now, Christopher, we talked about talent

before and obviously this talent is very, very much in demand these days. But tell us about your growth strategy in terms of your team.

Do you expect to hire more engineers or other folks? And by the way, how many employees do you have right now?

CS: Yeah, we're about 65, I think maybe approaching

70. We are growing. Especially with going public, we're going to have to add not just engineers, but even in the back office on the G&A

side of things to be publicly compliant. But most of the growth will be in our engineering staff for product engineering, for the science

that we're doing the math and for delivery to our clients. So yeah, that staff will have to grow globally. And this I think points to,

you know, what is the strategy for doing that? Obviously, we will continue to hire organically. We've done so and we've been able to retain

some of the best talent in the world globally in this space, but we're not limited to that. And, you know, one of the motivations in being

a public company is that, you know, you have public equity. And I think Bill alluded to this is that there will be some inorganic

growth opportunities that will arise and that's important

for us. And that's one of the motivations again for being public is that you can actually do M&A not just with cash, but with public

equity and that's very helpful for us because, you know, we won't be able to grow fast enough with the talent acquisition just organically.

So, definitely strategic well thought out acquisitions will be a part of what we do.

JJ: Well, that leads me to another question. Can

you tell me how you describe the company's culture? And this must be something that would come up, you know, if you're doing an M&A

deal, you've got to make sure that you're going to, you know, mesh well with your new partners. How do you describe the culture at the

company?

CS: Well, we have a very open and transparent

culture. I think, you know, integrity is a big part of what we're about. And I mean that the personal integrity but also scientific integrity,

not over hyping things. Trying to under hype I think is part of our culture being a bit, maybe understated in our work. And I think that's

really helpful in our business and because our customers are huge industrial companies that are, you know, sometimes risk averse. If you're

a pharmaceutical company, you're talking about, you know, if you make the wrong medicine, people die. So, you know, if you make the wrong

decision on the racetrack, that can be really disastrous. So, for these kinds of industrial important activities, having a culture of

transparency, integrity and trying to get things right really is important and is really part of the culture. But there's also …

we're named after a Mexican revolutionary. We do want to push the edge. We do want to be revolutionary in our thought process and really

try to change things and really change the world in a positive direction. And that revolutionary spirit is also part of who we are and

it's literally written into our name.

JJ: Now this business model strikes me as unique,

but who should I look at in terms of competition out there? I mean, there are these big names that we know that are on that slide, but

are there also smaller companies doing what you're doing? And at the same time, are you a couple of years ahead of them because you guys

started relatively early?

CS: Yeah, I think, it's a complex and constantly emerging

… every week we see new news in this space about generative AI, you know, thanks to OpenAI and Sam Altman and all the news that

that's been getting and the traction that's been getting. There's a lot of excitement in this space and there's a lot of new activity,

new investment happening into newer companies with ideas in the space. So, I think in our industrial end of the spectrum as opposed to

consumer applications, you know our real competition are the incumbents, you know, the Oracles of the world, the Microsofts of the world,

the people who are already in with those customers deep in doing analytics. But, you know, as we've seen with the intellectual property

space, we're kind of punching above our weight in in that category and we go toe to toe. We have gone toe to toe against those folks and

won accounts in the past. So, and you can see from our customers, the kind of customers that we're interacting with we're showing wins.

You know, if you can win a large Japanese bank customer, you're doing pretty well. So, and part of this comes from having a very new technology

stack. We're not made of the same technology that large language models and ChatGPT are made on. That's made on an older, you know, transformer

model based on neural networks that's 10 years old. We have this new quantum math, these tensor networks, these different networks that

they're more efficient at doing the same kinds of tasks in our arsenal as well. So, we have some technology advantages over that, but

there will be competition that will emerge. There's a lot of VC money going into generative AI startups particularly, you know, in the

Bay Area and elsewhere and we'll see. I think those companies will be competitive. They're also able to hire some pretty good talent and

we'll see, you know, they probably don't have, to your point, you know, four or five years already under their belts working on this stuff

with the industrial customers. So, from that perspective, I think our biggest competition will come from the incumbents, the Microsofts

of the world and folks like.

JJ: Interesting stuff. Now I want to talk a bit

more about some folks who are not present with us. You've got a really, really impressive slate of advisors and directors. You have Bill

here, of course. Mario and Michael Andretti. Can we talk a bit about some of the other folks who are gonna be there to help steer the

ship and advise you in in the first couple of years after going public?

CS: Our board is pretty fantastic. Our lead

independent director is Clark Golestani, who is the former CIO and President of Innovation at Merck, the pharmaceutical company. We have

Jeff Huber, who had products

at like Gmail and sold GRAIL to Illumina for quite

a few billion dollars as well. So, these are operators on our board who've operated and have been on boards of public companies, have

been an executives at public companies, and really know how to steer the ship. Matt is joining us from Andretti has been a public company

CFO. So, we have a lot of that public facing public company growth experience on the board. So, this isn’t a bunch of newbies. You

know, I wouldn't suggest that, you know, the latest start up that’s just been given their first round of VC funding go public as

their first step here. You know, this is a very different thing where we have people who've actually done this before. This is my second

IPO in my career, so by no means is this for the faint of heart, but for this company and for the markets that we serve, it really is

probably the best choice. And we do have, as you alluded to, you know, a really esteemed board who who've been there, done that and have

the scar tissue to help guide us through all of this.

JJ: Great. Now something I want to ask you guys,

you know, there are a lot of companies and brand new sectors. In fact, we've hosted many of them on our program. Outer space for instance,

there's a whole new industry there. Is that the kind of place where your technology could be applied, Christopher?

CS: Absolutely. I mean, we're currently working

as a defense contractor through the DARPA program on two different programs and defense and aerospace are one of the key areas. So, you

can see obviously the connection with racing. It’s pretty similar kind of background. You don't always have connectivity to the

cloud, it's too fast for the cloud in some ways. So, you have to have this edge capability for your AI and independence from Houston in

a sense. That kind of environment and you know, speeds that are, you know, in the case of cars it's, you know, 240 miles an hour, but

you may be dealing with hypersonic missiles in defense and aerospace. So, these kinds of high-speed data applications are really where

we’ve cut our teeth and where we think that there will be serious applications going forward and a very large business there to

be had.

JJ: Great. I wanna ask an investing question here

and let Bill weigh in on this but perhaps Christopher as well. How should I look at valuation here? You know, the companies that are on

that page that we keep referring to are much, much bigger than you guys and yet, you know, you're doing … you're kind of up there

in terms of where your patents are and what you're executing on. So, Bill, how should investors look at, you know, the valuation of, you

know, of an enterprise value of, you, know under $300 million. So how do I frame that or benchmark it?

BS: Yeah. Well, we took a very conservative

approach to valuation in conjunction with the negotiation with Christopher and his team and his advisors. And, you know, of our

theories is with the SPAC market, it's, you know, a lot of the failed SPACs were because, simply because of a miscalculation or over exuberance

in valuation. So, as Christopher said, the DNA of his company, it's conservative, it's transparent, it's honest. So, we took a very conservative

approach to the valuation and we're going to let Christopher's results in the future, you know, drive that valuation forward.

JJ: Great. You know, one other quick question about

the SPAC structure, Bill, if I can ask, you know, and as you were just alluding to, I believe. You know, a lot of SPAC transactions after

the big boom in 2021, face very heavy redemptions. How do you guys, have you guys addressed that, or given that consideration?

BS: Yeah. We had a first round of redemptions

in July when we extended the time frame to consummate a deal. And, at that time, in July, we had an extremely positive result on the amount

of money remaining in trust, which gives us, you know, it gives us encouragement of how this is going to end up here in the next couple

of weeks because we've already went through one round.

JJ: Yeah, makes a lot of sense. Christopher, another

question for you. People are very curious about some of the other applications within the sports world. Could Zapata AI be used for things

like, you know, the Moneyball approach to choosing the right players and that sort of thing?

CS: One hundred percent. I have to be careful about

forward-looking things and as, you know, but yeah, absolutely. That is spot on and, you know, that there are other sporting applications

to what we're doing,

obviously. You know, we saw how, you know, the shift

was eventually made illegal in baseball because it worked. So, you know, statistics really and the math matters and we have some of the

best, most powerful statistics in our arsenal to throw at that. So, yeah, we're definitely interested in the space and you can see us

in the future expanding beyond just racing.

JJ: Great. Someone's got a follow up question here

on the M&A strategy. One of you mentioned there are companies appearing it seems like every day within this, this broader sphere.

But does that mean there's a menu of attractive targets necessarily? Do you need to be pretty careful because it almost feels like a bit

of a gold rush?

CS: Definitely. We would be careful. We're conservative

by our nature because we have to deliver to, you know, as I said, we're a defense contractor. You know, you don't just go throw anything

at the U.S. Department of Defense. And, you know, we need to, you know, believe in technology, team and also P&L responsibility, right?

You need to have a profitable business. So, a lot of the startups are probably trying to figure out what's out there, figure out where

the market is and that kind of thing. And that probably would be a less applicable kind of target, you know, for us, you know. What we're

looking for are people that have deep expertise in an area like finance, where we're interested or, you know, perhaps the sporting analytics

or whatever that vertical is that we're going after. Pharmaceuticals for example, where there's domain expertise that's really what we

would be looking at from our perspective. And also, you know, a path to profitability because at the end of the day, you're going to be

judged as a public company on your EPS, right, and that's really what we're aiming for long term is to be able to expand that and get,

you know, logo wins in those categories and that this can help accelerate that, but that means that these have to be a little bit more

mature businesses, more like what we are in order to make a really good integration happen then.

JJ: That makes sense. You know, on that point about

a path to profitability, what strikes me is how remarkably versatile this technology is going from, you know, a trading floor to outer

space, to the racetrack. Does that mean that … does good operating leverage come with that? Or do you have to reinvest when you're

going to a different sector? How does how does that look?

CS: Well, fortunately for us, you know, we've

got a platform that allows us to train these models. You know, we've done everything from racing, to banking to defense and these kind

of things. So, you can look, it's pretty, pretty broad. The underlying math for us is the same. It doesn't look that way like what does

racing have to do banking? But from a mathematical perspective, what we're doing with the generative AI technology behind it is the same.

The models are pretty similar mathematically, but, you know, it does … the devil is in the details with the domain expertise that

you have to put on that. You know, we leverage the domain expertise of our customers and doing that. You know, when we went in with Andretti,

you know, you know, some of us have a car background. I was a Nissan person for a while, but not everyone on the team did. We had to embed

ourselves, literally embed every weekend in the races with the team there and learn from the domain experts about how to apply our math

there. So that that piece, you do need to, you know, have domain expertise and there's a learning curve there in each of these areas.

But once you've learned that area, it's easier to apply those libraries of software that you create and then the IP and all that to expand

in that particular vertical.

JJ: Great. Now a question on another category. We

here at IPO Edge have interviewed many, many, many companies in the electric vehicle space, LiDAR, autonomous driving. Is there a role

for your technology there? I'm thinking particularly with autonomous driving or LiDAR, the sensor work you're doing with these cars going

240 miles an hour might work with regular cars.

CS: Oh, absolutely. And that's one of the …that's

why you see so many technology companies associated with racing. If you just look at the logos on F1 cars, you know, Cognizant and Microsoft

and all these companies, there's some affiliation there because this is the space where you do the hardest data problems in sports. So,

that association isn't by coincidence. And a lot of the technologies that we find in our daily passenger vehicles have come from racing.

I mean the rearview mirror, that invention actually happened at the Indy 500. So, you know the, you know, we wouldn't have the rearview

mirror but for racing. And other things, you know, different seat belt technologies, different sensor technologies, anti-lock breaking,

all these kinds of things have developed from the racing world. So, absolutely the things that we're learning about

tire degradation are important for other vehicles,

passenger vehicles and for large equipment as well. You know, a tire degrades in a mine, it tips over, that's a deadly accident. So, these

things are really important for industrial vehicles, for freight carrying vehicles, for all kinds of vehicles and passenger vehicles as

well. So yeah, absolutely, what we're learning on the track is going to be applied to the OEM world.

JJ: Great. Now I think you touched on this a little

bit earlier, but with some of these very, very well-known partners, Andretti, BMW, Sumitomo, does that allow you to get new business without

having to spend a lot of money on marketing? Do you just get natural introductions or people hear about you because of that stuff?

CS: Yeah, a lot of this actually has been inbounds

and we meet a lot of these partners actually through the Andretti relationship at the track. Many people don’t know this, but, you

know, judging by the logos, you can understand, on F1 that there's a huge affinity with technology buyers to racing. And it's because

it's really the most exciting data sport out there. So, for geeks, it's really an attractive place. So, we do meet a lot of people organically

who are interested in the analytics that we're doing behind the scenes at Andretti at the track every weekend. And so, we've had a lot

of inbound traction. We also have our own active business development and building, but a lot of this has been word of mouth because of

where we are. And, you know, people can look at the public records of those patents and see, you know, who are the players out there.

So, we kind of developed a, I think, a bit of an enviable reputation out there with our technology capabilities.

JJ: Great, now this technology is very powerful,

but are you able to take steps to ensure it never gets in the hands of bad actors or bad countries out there, particularly with the, you

know, the defense contracts you have?

CS: Yeah, I mean, I happen to be also a licensed

attorney and I sit on, I'm currently the chair of the Quantum Economic Development consortia (QEDC) Law, Technical Advisory Committee,

and we're very concerned about bad actors, state actors, trying to, particularly in AI and quantum technologies, you know, steal our stuff

because there could be a nation state geopolitical political advantage for actors who are able to use this in nefarious ways, ways that

are against our interests. So yeah, we're very much attuned to that. We partner with the government and others to make sure that we and

others are safe to the extent that we can and, you know, this kind of risk management is a big deal for us and for our customers who are

deploying this technology. And I think it should be more and more thought about because we really need to kind of get ahead of that, you

know, I think people can be a little bit laissez faire and relaxed about, ‘Oh well it's just AI, it's just chat bots, it's just

this,’ but this technology can be misused. Just like any technology can, right? They're have been misuses of it. And I think it's

really important for us as a society to start to get around, ‘OK, what does this future look like and what protections do we need

to put in place, security wise and otherwise, to protect ourselves from the misuse of this technology?’

JJ: Now, Christopher, the company is very diversified

across industries already. As we keep discussing but also geographies. We've touched on Japan, Spain, the U.S. Are there any particular

parts of the world where there's most opportunity? I mean, it sounds like there's probably plenty here domestically, but you're already

in far-flung places around the world too.

CS: Well, I think that the major economies in

the Western world are really where our market is. The U.S., Europe and Japan are, you know, leaders in in trying to acquire this kind

of technology right now. And, so and, you know, everything in this technology is global by its nature, and when you're dealing with the

Fortune Global 100, they're global companies, so we have no choice but to be a global company from the onset.

JJ: Great. Now something makes a lot of headlines,

Christopher, is, you know, the possibility of sentinent AI. I don't think that's something you guys are working on, but what do you tell

people? And perhaps if you're at a cocktail party and someone says, ‘Hey, you're an AI expert, is that real? Is there gonna be a

computer that can feel emotions at some point here?’

CS: Maybe in the future. I don't know if that

will be a goal … and I think a lot of the hype that's been around this has been that, ‘OK, you know, maybe ChatGPT is some

kind of general intelligence,’ which it's not, you know. It’s statistical machine that's, you know, does some pretty surprising

human like things with statistics because our brains also work in a kind of statistical way so maybe that's no surprise. So yeah, I think

that there's this idea, ‘OK, that we're going to have this be all omniscient thing that just solves every problem.’ And that's

really not how it's going to work. I don't think. At least for solving the kinds of problems we want to solve. We don't as humans have

like the omniscient person who does every job. You know, your electrician does the electricity job. Your engineer does the engineering

job. Your nurse does the nursing job. And I think that that's more like what we'll see with these AI models. They will become more specific

attuned to certain tasks, but they're going to be built to do tasks for the most part, and this idea that they're going to come to some

kind of a general intelligence, I think maybe in the future that could happen. I think we're a long way away from how or anything like

that really, really happening.

JJ: Great. And a simpler question here. Can you

just remind everyone when the deal is expected to close? I think in a few weeks, at which point soon after the ticker will change and

they'll be Zapata AI.

CS: Bill, do you want to take that one?

BS: Yeah, we're expecting this in next couple

of weeks. We're on a solid path for that. And at that point, the ticker will change from WNNR to Zapata ticker symbol.

JJ: OK, great. Alright, gentlemen, we're just about

out of questions here. I want to thank everyone for tuning in here. But before we do wind up obviously just a couple weeks away before

this deal happens, but I'd like to give both of you a chance to tell me what are you excited about for the rest of the year? Bill, how

about you go first?

BS: Well, I'm excited to get this deal completed.

We've been working on it for a long time. We’ve spent … it was interesting when you said the applicability of the technology

to LiDAR, into EV's, into autonomous. We looked at all of those technologies. We looked at all the companies in there and a lot of them

have had some trouble. But with Christopher’s company in Zapata, he gets to solve each of those companies problems. So instead of

picking a winner in LiDAR or picking a winner in autonomous, we picked somebody who can help all of that technology advance and way beyond

just the scope of mobility. So, we're really excited about getting this deal done and sending Christopher and his team on the way to grow

and do good things for the country.

JJ: Alright. And Christopher, how about you?

CS: Yeah. No, I'm excited about this opportunity

to really bring our story to a wider audience, to a wider investing audience as well. And really excited about the work that we're going

to do over the coming year. You know, we're going to be back on the race track in March as the Indy series kicks off again. And we're

going to be applying these, these models live on the timing stand there. And we're going to be working on the banking applications with

and Sumitomo and some of the other things. And I'm really interested in all the new areas that we're constantly discovering where this

generative AI has surprising applicability. And, so I think, you know, the future is really bright and exciting for how generative AI

is going to be applied in various markets. And so, it's, you know, looking pretty interesting for the next few years here.

JJ: Alright, great. We're gonna leave it there.

That's been Christopher Savoie, who's the CEO and Co-Founder of Zapata AI, along with Bill Sandbrook, who is the Co-CEO of Andretti Acquisition

Corp. Folks, please check out the replay of this. The easiest place to find it is on ipo-edge.com. Or just look up WNNR. That's the SPAC

stock ticker on your Bloomberg Terminal or Yahoo Finance. You’ll find it there in a couple hours. Thanks everyone for tuning in.

FORWARD LOOKING STATEMENTS

Certain statements included in this

communication, and certain oral statements made from time to time by representatives of Andretti or Zapata Holdings, Inc.

(“Zapata”), that are not historical facts are forward-looking statements for purposes of the safe harbor provisions

under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by

words such as “believe,” “may,” “will,” “continue,” “intend,” “expect,”

“should,” “would,” “plan,” “predict,” “potential,” “seem”

“seek” “future” “outlook,” and similar expressions that predict or indicate future events or

trends or that are not statements of historical matters.

These forward-looking statements include, but are

not limited to, statements regarding projections of market opportunity. These statements are based on various assumptions, whether

or not identified in this Current Report, and on the current expectations of the management of Zapata and Andretti, as the case may

be, and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and

are not intended to serve as, and must not be relied on by an investor as, a guarantee, an assurance, a prediction or a definitive

statement of fact or probability. Actual events and circumstances are beyond the control of Zapata and Andretti. These

forward-looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business,

market, financial, political and legal conditions, the inability of Zapata or Andretti to successfully or timely consummate the

proposed business combination of Zapata and a wholly owned subsidiary of Andretti (the “Business Combination”), the

occurrence of any event, change or other circumstances that could give rise to the termination of negotiations and any subsequent

definitive agreements with respect to the Business Combination; the outcome of any legal proceedings that may be instituted against

Andretti, Zapata, the Surviving Company or others following the announcement of the Business Combination and any definitive

agreements with respect thereto; the inability to complete the Business Combination due to the failure to obtain approval of the

shareholders of Andretti, the ability to meet stock exchange listing standards following the consummation of the Business

Combination; the risk that the Business Combination disrupts current plans and operations of Zapata as a result of the announcement

and consummation of the Business Combination, failure to realize the anticipated benefits of the Business Combination, risks related

to the performance of Zapata’s business and the timing of expected business or revenue milestones, and the effects of

competition on Zapata’s business. If any of these risks materialize or our assumptions prove incorrect, actual results could

differ materially from the results implied by these forward-looking statements. In addition, forward-looking statements reflect

Zapata’s expectations, plans or forecasts of future events and views as of the date of this Current Report. Zapata anticipates

that subsequent events and developments will cause Zapata’s assessments to change. Neither Andretti nor Zapata undertakes or

accepts any obligation to release publicly any updates or revisions to any forward-looking statements to reflect any change in its

expectations or any change in events, conditions or circumstances on which any such statement is based. These forward-looking

statements should not be relied upon as representing Andretti’s or Zapata’s assessments of any date subsequent to the

date of this Current Report. Accordingly, undue reliance should not be placed upon the forward-looking statements.

IMPORTANT ADDITIONAL INFORMATION AND WHERE TO FIND

IT

In connection with the contemplated transaction, Andretti

filed a Registration Statement, which includes a proxy statement/prospectus, with the SEC. Additionally, Andretti will file other relevant

materials with the SEC in connection with the transaction. A definitive proxy statement/final prospectus will also be sent to the shareholders

of Andretti, seeking any required shareholder approval. This Current Report is not a substitute for the Registration Statement, the definitive

proxy statement/final prospectus, or any other document that Andretti will send to its shareholders. Before making any voting or investment

decision, investors and security holders of Andretti are urged to carefully read the entire Registration Statement and proxy statement/prospectus

and any other relevant documents filed with the SEC as well as any amendments or supplements to these documents, because they contain

important information about the transaction. Shareholders also can obtain copies of such documents, without charge, at the SEC’s

website at www.sec.gov. In addition, the documents filed by Andretti may be obtained free of charge from Andretti at andrettiacquisition.com.

Alternatively, these documents can be obtained free of charge from Andretti upon written request to Andretti Acquisition Corp., 7615 Zionsville

Road, Indianapolis, Indiana 46268, or by calling (317) 872-2700. The information contained on, or that may be accessed through, the websites

referenced in this Current Report is not incorporated by reference into, and is not a part of, this communication.

PARTICIPANTS IN THE SOLICITATION

Andretti, Andretti’s

sponsors, Zapata and certain of their respective directors and executive officers may be deemed to be participants in the solicitation

of proxies from the shareholders of Andretti, in connection with the Business Combination. Information regarding Andretti’s directors

and executive officers is contained in Andretti’s Annual Report on Form 10-K for the year ended December 31, 2022, which is filed

with the SEC. Additional information regarding the interests of those participants, the directors and executive officers of Zapata and

other persons who may be deemed participants in the transaction may be obtained by reading the Registration Statement and the proxy statement/prospectus

and other relevant documents filed with the SEC. Free copies of these documents may be obtained as described above.

NO OFFER OR SOLICITATION

This Current

Report is for informational purposes only and shall not constitute a proxy statement or solicitation of a proxy, consent, or authorization

with respect to any securities or in respect of the Business Combination. This Current Report shall also not constitute an offer to sell

or a solicitation of an offer to buy any securities, nor shall there be any sale, issuance, or transfer of securities in any state or

jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities

laws of any such state or jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements

of Section 10 of the Securities Act or an exemption therefrom.

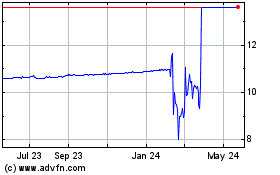

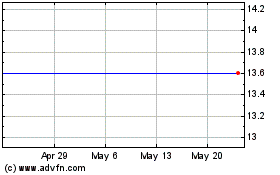

Andretti Acquisition (NYSE:WNNR)

Historical Stock Chart

From Apr 2024 to May 2024

Andretti Acquisition (NYSE:WNNR)

Historical Stock Chart

From May 2023 to May 2024