UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2023

Commission

File Number: 001-37922

ZTO Express (Cayman) Inc.

Building One, No. 1685 Huazhi Road

Qingpu District

Shanghai, 201708

People's Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

Exhibit Index

Exhibit 99.1 – Next Day Disclosure Return dated December 1, 2023

Exhibit 99.2 – Announcement – Connected Transaction Provision of Financial Assistance

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

ZTO Express (Cayman) Inc. |

| |

|

|

|

| |

By |

: |

/s/ Huiping Yan |

| |

Name |

: |

Huiping Yan |

| |

Title |

: |

Chief Financial Officer |

Date: December 1, 2023

Exhibit 99.1

| FF304

Page 1 of 5 v 1.2.5

Next Day Disclosure Return

(Equity issuer - changes in issued share capital and/or share buybacks)

Instrument: Equity issuer Status: New Submission

Name of Issuer: ZTO Express (Cayman) Inc. (A company controlled through weighted voting rights and incorporated in the Cayman Islands with limited liability)

Date Submitted: 01 December 2023

Section I must be completed by a listed issuer where there has been a change in its issued share capital which is discloseable pursuant to rule 13.25A of the Main Board Rules (the “Main Board

Listing Rules”) / rule 17.27A of the GEM Rules (the “GEM Listing Rules”) Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the “Exchange”)

Section I

1. Class of shares WVR ordinary shares Type of shares Other type (specify in description) Listed on SEHK (Note 11) Yes

Stock code (if listed) 02057 Description Class A Ordinary Shares

Issues of shares

(Notes 6 and 7) No. of shares

Issued shares as a %

of existing number of

issued shares before

relevant share issue

(Notes 4, 6 and 7)

Issue price per share

(Notes 1 and 7)

Closing market price per

share of the immediately

preceding business day

(Note 5)

% discount(-)/

premium of issue

price to market price

(Note 7)

Opening balance as at (Note 2) 29 November 2023 609,009,010

1). Repurchase of shares (or other securities) but not

cancelled

Repurchase of 658,495 American depository shares

(representing 658,495 class A ordinary shares) on

November 22, 2023 U.S. time

Date of changes 22 November 2023

658,495 % %

2). Repurchase of shares (or other securities) but not

cancelled

Repurchase of 160,524 American depository shares

(representing 160,524 class A ordinary shares) on

November 24, 2023 U.S. time

Date of changes 24 November 2023

160,524 % %

3). Repurchase of shares (or other securities) but not

cancelled

Repurchase of 579,998 American depository shares

579,998 % % |

| FF304

Page 2 of 5 v 1.2.5

(representing 579,998 class A ordinary shares) on

November 27, 2023 U.S. time

Date of changes 27 November 2023

4). Repurchase of shares (or other securities) but not

cancelled

Repurchase of 338,369 American depository shares

(representing 338,369 class A ordinary shares) on

November 28, 2023 U.S. time

Date of changes 28 November 2023

338,369 % %

5). Repurchase of shares (or other securities) but not

cancelled

Repurchase of 503,119 American depository shares

(representing 503,119 class A ordinary shares) on

November 29, 2023 U.S. time

Date of changes 29 November 2023

503,119 % %

6). Repurchase of shares (or other securities) but not

cancelled

Repurchase of 1,842 American depository shares

(representing 1,842 class A ordinary shares) on

November 30, 2023 U.S. time

Date of changes 30 November 2023

1,842 % %

Closing balance as at (Note 8) 30 November 2023 609,009,010 |

| FF304

Page 3 of 5 v 1.2.5

We hereby confirm to the best knowledge, information and belief that, in relation to each issue of securities as set out in Section I, it has been duly authorised by the board of directors of the

listed issuer and, insofar as applicable:

(Note 9)

(i) all money due to the listed issuer in respect of the issue of securities has been received by it;

(ii) all pre-conditions for the listing imposed by the Main Board Listing Rules / GEM Listing Rules under "Qualifications of listing" have been fulfilled;

(iii) all (if any) conditions contained in the formal letter granting listing of and permission to deal in the securities have been fulfilled;

(iv) all the securities of each class are in all respects identical (Note 10);

(v) all documents required by the Companies (Winding Up and Miscellaneous Provisions) Ordinance to be filed with the Registrar of Companies have been duly filed and that compliance

has been made with other legal requirements;

(vi) all the definitive documents of title have been delivered/are ready to be delivered/are being prepared and will be delivered in accordance with the terms of issue;

(vii) completion has taken place of the purchase by the issuer of all property shown in the listing document to have purchased or agreed to be purchased by it and the purchase

consideration for all such property has been duly satisfied; and

(viii) the trust deed/deed poll relating to the debenture, loan stock, notes or bonds has been completed and executed, and particulars thereof, if so required by law, have been filed with the

Registrar of Companies.

Notes to Section I:

1. Where shares have been issued at more than one issue price per share, a weighted average issue price per share should be given.

2. Please insert the closing balance date of the last Next Day Disclosure Return published pursuant to Main Board Rule 13.25A / GEM Rule 17.27A or Monthly Return pursuant to Main

Board Rule 13.25B / GEM Rule 17.27B, whichever is the later.

3. Please set out all changes in issued share capital requiring disclosure pursuant to Main Board Rule 13.25A / GEM Rule 17.27A together with the relevant dates of issue. Each category

will need to be disclosed individually with sufficient information to enable the user to identify the relevant category in the listed issuer's Monthly Return. For example, multiple issues of

shares as a result of multiple exercises of share options under the same share option scheme or of multiple conversions under the same convertible note must be aggregated and

disclosed as one category. However, if the issues resulted from exercises of share options under 2 share option schemes or conversions of 2 convertible notes, these must be disclosed

as 2 separate categories.

4. The percentage change in the number of issued shares of listed issuer is to be calculated by reference to the listed issuer's total number of shares in issue (excluding for such purpose

any shares repurchased or redeemed but not yet cancelled) as it was immediately before the earliest relevant event which has not been disclosed in a Monthly Return or Next Day

Disclosure Return.

5. Where trading in the shares of the listed issuer has been suspended, “closing market price per share of the immediately preceding business day” should be construed as “closing market

price per share of the business day on which the shares were last traded”.

6. In the context of a repurchase of shares:

■ “issues of shares” should be construed as “repurchases of shares”; and |

| FF304

Page 4 of 5 v 1.2.5

■ “issued shares as a % of existing number of shares before relevant share issue” should be construed as “repurchased shares as a % of existing number of shares before

relevant share repurchase”.

7. In the context of a redemption of shares:

■ “issues of shares” should be construed as “redemptions of shares”;

■ “issued shares as a % of existing number of shares before relevant share issue” should be construed as “redeemed shares as a % of existing number of shares before relevant

share redemption”; and

■ “issue price per share” should be construed as “redemption price per share”.

8. The closing balance date is the date of the last relevant event being disclosed.

9. Items (i) to (viii) are suggested forms of confirmation which may be amended to meet individual cases.

10. “Identical” means in this context:

■ the securities are of the same nominal value with the same amount called up or paid up;

■ they are entitled to dividend/interest at the same rate and for the same period, so that at the next ensuing distribution, the dividend/interest payable per unit will amount to

exactly the same sum (gross and net); and

■ they carry the same rights as to unrestricted transfer, attendance and voting at meetings and rank pari passu in all other respects.

11. SEHK refers to Stock Exchange of Hong Kong. |

| FF304

Page 5 of 5 v 1.2.5

Section II must also be completed by a listed issuer where it has made a repurchase of shares which is discloseable under Main Board Rule 10.06(4)(a) / GEM Rule 13.13(1).

The issuer has Purchase report or additional information for issuer whose primary listing is on the Exchange

Section II

1. Class of shares WVR ordinary shares Type of shares Other type (specify in description) Listed on SEHK (Note) Yes

Stock code (if listed) 02057 Description Class A Ordinary Shares

A. Purchase report

Trading date Number of securities

purchased

Method of purchase

(Note)

Price per share or highest price

paid $ Lowest price paid $ Total paid $

1). 30 November 2023 1,842 On another stock exchange

New York Stock Exchange

USD 22.3 USD 22.09 USD 40,893.32

Total number of securities

purchased 1,842 Total paid $ USD 40,893.32

B. Additional information for issuer whose primary listing is on the Exchange

1). Number of such securities purchased on the Exchange in the year to date (since ordinary resolution) (a) 4,250,876

2). % of number of shares in issue at time ordinary resolution passed acquired on the Exchange since date of resolution

( (a) x 100 )/ Number of shares in issue

0.52 %

We hereby confirm that the repurchases set out in A above which were made on the Exchange were made in accordance with the Main Board Listing Rules / GEM Listing Rules and that there

have been no material changes to the particulars contained in the Explanatory Statement dated May 10, 2023 which has been filed with the Exchange. We also confirm that any purchases set

out in A above which were made on another stock exchange were made in accordance with the domestic rules applying to purchases made on that other exchange.

Remarks: The "Exchange" mentioned in B above includes both The Stock Exchange of Hong Kong Limited and the New York Stock Exchange. The total number of issued and

outstanding shares on the date of the ordinary resolution referred to in B above was 817,117,539 (comprising 611,017,539 Class A ordinary shares and 206,100,000

Class B ordinary shares).

Note to Section II: Please state whether on the Exchange, on another stock exchange (stating the name of the exchange), by private arrangement or by general offer.

Submitted by: Songfei LI

(Name)

Title: Joint Company Secretary

(Director, Secretary or other Duly Authorised Officer) |

Exhibit 99.2

Hong

Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement,

make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising

from or in reliance upon the whole or any part of the contents of this announcement.

Under

our weighted voting rights structure, our share capital comprises Class A ordinary shares and Class B ordinary shares. Each

Class A ordinary share entitles the holder to exercise one vote, and each Class B ordinary share entitles the holder to exercise

10 votes, respectively, on all matters that require a shareholder’s vote. Shareholders and prospective investors should be aware

of the potential risks of investing in a company with a weighted voting rights structure. Our American depositary shares, each representing

one of our Class A ordinary shares, are listed on the New York Stock Exchange in the United States under the symbol ZTO.

ZTO Express (Cayman)

Inc.

中通快遞(開曼)有限公司

(A

company controlled through weighted voting rights and incorporated in the Cayman Islands with limited liability)

(Stock Code:

2057)

CONNECTED

TRANSACTION

PROVISION

OF FINANCIAL ASSISTANCE

THE

LOAN EXTENSION AGREEMENT

On

December 1, 2023, the Lender, an indirect wholly-owned subsidiary of the Company, entered into the Loan Extension Agreement with

Zhongkuai Future City and Mr. Jilei WANG, pursuant to which the Lender agreed to continue to provide Zhongkuai Future City with

the Loan in the principal amount of RMB500,000,000 for a term of 36 months, with Mr. Jilei WANG as guarantor.

HONG

KONG LISTING RULES IMPLICATIONS

As

Zhongkuai Future City is held as to approximately 57% by Mr. Meisong LAI (an executive Director and controlling shareholder of the

Company) as of the date of this announcement, Zhongkuai Future City is an associate of Mr. Meisong LAI and thus a connected person

of the Company. Mr. Jilei WANG, an executive Director, is also a connected person of the Company. Therefore, the entering into of

the Loan Extension Agreement and the transactions contemplated thereunder constitutes a connected transaction of the Company under Chapter

14A of the Hong Kong Listing Rules in the form of financial assistance.

As

the highest applicable percentage ratio calculated pursuant to the Hong Kong Listing Rules in respect of the Loan Extension Agreement

and the transactions contemplated thereunder is more than 0.1% but less than 5%, the Loan Extension Agreement and the transactions contemplated

thereunder are subject to the reporting and announcement requirements but exempt from the independent Shareholders’ approval requirement

under Chapter 14A of the Hong Kong Listing Rules.

BACKGROUND

In December 2020,

the Lender, an indirect wholly-owned subsidiary of the Company, Zhongkuai Future City and Mr. Jilei WANG entered into the Original

Loan Agreement, pursuant to which the Lender provided the Original Loan in the amount of RMB500,000,000 to Zhongkuai Future City for

a term of 36 months with Mr. Jilei WANG as guarantor. As the Original Loan Agreement was entered into before the Primary Conversion,

the entering into of such agreement and transactions contemplated thereunder was not subject to the requirements under Chapter 14 and

Chapter 14A of the Hong Kong Listing Rules at the time of the agreement.

After arm’s

length negotiation, on December 1, 2023, the Lender, Zhongkuai Future City and Mr. Jilei WANG entered into the Loan Extension

Agreement, pursuant to which the Lender agreed to continue to provide Zhongkuai Future City with the Loan in the principal amount of

RMB500,000,000 for a term of 36 months, with Mr. Jilei WANG as guarantor.

PRINCIPAL TERMS OF THE LOAN EXTENSION

AGREEMENT

The principal terms of the Loan Extension

Agreement are set out below:

| Date | : |

December 1, 2023 |

| | |

|

| Parties | : |

(1) the

Lender (as the lender); |

| | |

(2) Zhongkuai

Future City (as the borrower); and |

| | |

(3) Mr. Jilei

WANG (as the guarantor). |

| | |

|

| Principal Amount | : |

RMB500,000,000 |

| | |

|

| Term | : |

A fixed term

of 36 months, from December 4, 2023 to December 3, 2026 |

| | |

|

| Interest Rate | : |

The interest rate on the Loan is

5% per annum, which shall accrue from December 4, 2023. The interest amount shall

be paid together with the repayment of the principal amount on the maturity date of the Loan

(i.e., December 3, 2026). |

| | |

|

| Early repayment term | : |

The principal amount of the Loan,

together with all interest accrued, shall be repayable in full on the maturity date

of the Loan. Zhongkuai Future City may repay the Loan early with prior notice to the Lender. |

| Guarantee: |

: | Mr. Jilei WANG agreed to

provide joint and several liability guarantee in favor of the Lender in respect of the

obligations of Zhongkuai Future City under the Loan Extension Agreement for a term of two years

from the due date of the Loan under the Loan Extension Agreement. |

| |

| |

| Default |

: | If Zhongkuai

Future City is in breach of the Loan Extension Agreement, the Lender is entitled to declare

that all outstanding amount under the Loan Extension Agreement becomes due immediately, to

request Zhongkuai Future City to pay all principal and interest due under the Loan Extension

Agreement and to claim damages. |

The Group will

finance the Loan with the Group’s internal resources.

INFORMATION

ON RELEVANT PARTIES

The Group

The Company was

incorporated under the laws of Cayman Islands on April 8, 2015. The securities of the Company are dual-primary listed on the NYSE

and the Hong Kong Stock Exchange. The Group is principally engaged in express delivery services in the PRC through a nationwide network

partner model.

The Lender is an

indirect wholly-owned subsidiary of the Company established under the laws of the PRC and principally engaged in the business of providing

technical support and consulting services.

Zhongkuai Future

City

Zhongkuai Future

City is a company established under the laws of the PRC and is principally engaged in real estate development and operation. As at the

date of this announcement, Zhongkuai Future City is held as to (i) approximately 57% by Mr. Meisong LAI, an executive Director

and controlling shareholder of the Company, (ii) approximately 16% by Mr. Jianfa LAI, a substantial shareholder of ZTO Express

Co. Ltd. (a consolidated affiliated entity of the Company), (iii) approximately 12% by Mr. Jilei WANG, an executive Director

of the Company, (iv) approximately 10% by Mr. Jianchang LAI, a brother-in-law of Mr. Meisong LAI, and (v) approximately

5% by Mr. Zengqun ZHANG, a third party independent of the Company and its connected persons.

The Guarantor

Mr. Jilei

WANG is an executive Director and is interested in approximately 6.93% of the Class A ordinary shares in issue as of the date of

this announcement.

REASONS FOR

AND BENEFITS OF THE LOAN EXTENSION AGREEMENT

The terms of the

Loan Extension Agreement, including the interest rate applicable, were negotiated and arrived at after arm’s length negotiations

among the parties, having taken into account the prevailing market interest rates in the PRC and practices. The Loan Extension Agreement

was entered into by the Lender having regard to (i) the good financial position and the existing cash surplus of the Group; (ii) the

interest income per annum to be generated by the transactions contemplated under the Loan Extension Agreement being more favorable than

that offered by commercial banks in the PRC for fixed deposit for similar terms; (iii) the low credit risk of the Loan considering

that Zhongkuai Future City is controlled by Mr. Meisong LAI, who is an executive Director and controlling shareholder of the Company

and is interested in approximately 0.82% of the Class A ordinary shares and 100% of the Class B ordinary shares in issue (collectively

representing approximately 77.34% of voting rights in the Shares) as of the date of this announcement, and (iv) the joint and several

liability guarantee provided by Mr. Jilei WANG, who is an executive Director and is interested in approximately 6.93% of the Class A

ordinary shares in issue as of the date of this announcement.

In view of the

above, the Directors (including the independent non-executive Directors) consider that the terms of the Loan Extension Agreement have

been made on normal commercial terms, are fair and reasonable and in the interests of the Company and its shareholders as a whole. Although

the provision of the Loan is not conducted in the ordinary and usual course of business of the Group, the Directors (including the independent

non-executive Directors) are of the view that the provision of financial assistance to Zhongkuai Future City under the Loan Extension

Agreement will enhance the Group’s utilization of surplus cash and generate a stable income for the Group.

HONG KONG LISTING

RULES IMPLICATIONS

As Zhongkuai Future

City is held as to approximately 57% by Mr. Meisong LAI (an executive Director and controlling shareholder of the Company) as of

the date of this announcement, Zhongkuai Future City is an associate of Mr. Meisong LAI and thus a connected person of the Company.

Mr. Jilei WANG, an executive Director, is also a connected person of the Company. Therefore, the entering into of the Loan Extension

Agreement and the transactions contemplated thereunder constitutes a connected transaction of the Company under Chapter 14A of the Hong

Kong Listing Rules in the form of financial assistance.

As the highest

applicable percentage ratio calculated pursuant to the Hong Kong Listing Rules in respect of the Loan Extension Agreement and the

transactions contemplated thereunder is more than 0.1% but less than 5%, the Loan Extension Agreement and the transactions contemplated

thereunder are subject to the reporting and announcement requirements but exempt from the independent Shareholders’ approval requirement

under Chapter 14A of the Hong Kong Listing Rules.

Each of Mr. Meisong

LAI (as the controlling shareholder of Zhongkuai Future City) and Mr. Jilei WANG (as equity holder of Zhongkuai Future City and

the guarantor under the Loan Extension Agreement), is or may be perceived to have a material interest in the Loan Extension Agreement,

and as a result has abstained from voting on the resolutions of the Board approving the Loan Extension Agreement. Other than the aforesaid

Directors, no other Directors have a material interest in the Loan Extension Agreement or are required to abstain from voting on the

resolutions of the Board approving the transactions under the Loan Extension Agreement.

DEFINITIONS

In

this announcement, unless the context otherwise requires, the following terms shall have the following meanings:

| “associate(s)” |

has the meaning ascribed to it under

the Hong Kong Listing Rules |

| |

|

| “Board” |

the board of Directors |

| |

|

| “Class A ordinary

shares” |

Class A ordinary shares of the share capital of

the Company with a par value of US$0.0001 each, giving a holder of a Class A ordinary share one vote per share on any

resolution tabled at the Company’s general meeting |

| |

|

| “Class B ordinary

shares” |

Class B ordinary shares of the share capital of

the Company with a par value of US$0.0001 each, conferring weighted voting rights in the Company such that a holder of a Class B

ordinary share is entitled to 10 votes per share on any resolution tabled at the Company’s general meeting |

| |

|

| “Company” |

ZTO Express (Cayman) Inc., a company incorporated in

the Cayman Islands on April 8, 2015 as an exempted company and, where the context requires, its subsidiaries and consolidated

affiliated entities from time to time |

| |

|

| “connected person(s)” |

has the meaning ascribed to it under the Hong Kong

Listing Rules |

| |

|

| “controlling shareholder” |

has the meaning ascribed to it under the Hong Kong

Listing Rules |

| |

|

| “Director(s)” |

the director(s) of the Company |

| |

|

| “Group” |

the Company, subsidiaries and consolidated affiliated

entities from time to time |

| |

|

| “Hong Kong Listing

Rules” |

the Rules Governing the Listing of Securities

on the Hong Kong Stock Exchange, as amended or supplemented from time to time |

| |

|

| “Hong Kong Stock

Exchange” |

The Stock Exchange of Hong Kong Limited |

| |

|

| “Lender” |

上海中通吉網絡技術有限公司(Shanghai

Zhongtongji Network Technology Co., Ltd.), an indirect wholly-owned subsidiary of the Company |

| |

|

| “Loan” |

the loan in the principal amount of RMB500,000,000

provided by the Lender to Zhongkuai Future City under the Loan Extension Agreement |

| |

|

| “Loan Extension Agreement”

|

the loan extension agreement dated December 1,

2023 entered into among the Lender as the lender, Zhongkuai Future City as the borrower and Mr. Jilei WANG as the guarantor |

| “NYSE” |

New York Stock Exchange |

| |

|

| “Original Loan” |

the loan made by the Lender to Zhongkuai Future City

in the principal amount of RMB500,000,000 pursuant to the terms of the Original Loan Agreement |

| |

|

| “Original Loan Agreement” |

the loan agreement entered into on December 3,

2020 among the Lender as the lender, Zhongkuai Future City as the borrower and Mr. Jilei WANG as the guarantor in respect

of the Original Loan |

| |

|

| “PRC” |

the People’s Republic of China |

| |

|

| “Primary Conversion” |

the Company’s voluntary conversion of its secondary

listing status in Hong Kong to dual primary listing on the Hong Kong Stock Exchange, which took effect on May 1, 2023 |

| |

|

| “RMB” |

Renminbi, the lawful currency of China |

| |

|

| “Share(s)” |

the Class A ordinary shares and Class B ordinary

shares in the share capital of the Company, as the context so requires |

| |

|

| “Shareholder(s)” |

the holder(s) of the Share(s), where the context

requires, ADSs |

| |

|

| “subsidiary(ies)” |

has the meaning ascribed to it under the Hong Kong

Listing Rules |

| |

|

| “substantial shareholder” |

has the meaning ascribed to it under the Hong Kong

Listing Rules |

| |

|

| “US$” |

United States dollars, the lawful currency of the United

States of America |

| |

|

| “Zhongkuai Future City” |

中快(桐廬)未來城產業發展有限公司(Zhongkuai

(Tonglu) Future City Industrial Development Co., Ltd.), a company established under the laws of the PRC |

The

English names of the PRC entities referred to in this announcement are translations from their Chinese names and are for identification

purposes only.

|

By order of the Board

ZTO Express (Cayman) Inc.

Meisong

LAI

Chairman |

Hong Kong, December 1, 2023

As

at the date of this announcement, the board of directors of the Company comprises Mr. Meisong

LAI as the chairman and executive director, Mr. Jilei WANG and Mr. Hongqun

HU as executive directors, Mr. Xing LIU and Mr. Xudong

CHEN as non-executive directors, Mr. Frank Zhen WEI, Mr. Qin

Charles HUANG, Mr. Herman YU, Mr. Tsun-Ming

(Daniel) KAO and Ms. Fang XIE as independent non-executive directors.

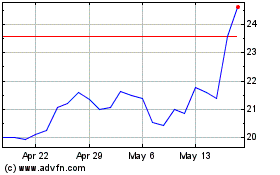

ZTO Express Cayman (NYSE:ZTO)

Historical Stock Chart

From Apr 2024 to May 2024

ZTO Express Cayman (NYSE:ZTO)

Historical Stock Chart

From May 2023 to May 2024