- Performance: Q2 adjusted Return on Sales (RoS) reached 10.2% at

Mercedes-Benz Cars and 17.5% at Mercedes-Benz Vans; Mercedes-Benz

Mobility adjusted Return on Equity (RoE) at 8.4%. Q2 Group-EBIT

reached €4.0 billion, 5% above Q1 2024.

- Cash Generation: Mercedes-Benz Group with solid free

cash flow from the industrial business of €1.6 billion.

- Transformation: Battery development capacity strengthened with

new eCampus competence center for battery technologies. Roll out of

Automatic Lane Change capability in Europe.

- Share buyback update: Sustainable cash generation continued,

share buyback volume reached €2.8 billion in Q2. Since the

beginning of the programs in March 2023, the company has bought

back shares equivalent to €5.1 billion as of end June 30,

2024.

- Outlook: Mercedes-Benz Cars adjusted Return on Sales (RoS)

expected in the range of 10% - 11%; Mercedes-Benz Vans adjusted

Return on Sales guidance (RoS) seen at 14% - 15%; Mercedes-Benz

Mobility’s adjusted Return on Equity (RoE) seen in the range of

8.5% - 9.5%. Guidance for Group revenue, Group EBIT and Group free

cash flow from the industrial business remains unchanged.

Mercedes-Benz Group AG (ticker symbol: MBG) achieved solid

second-quarter results with Group Earnings Before Interest and

Taxes (EBIT) of €4.0 billion (Q2 2023: €5.0 billion) supported by

operational efficiency and a focus on healthy sales of cars and

vans in a challenging environment. The adjusted Return on Sales

(RoS) at Mercedes-Benz Cars reached 10.2% (Q2 2023: 13.5%) and

17.5% (Q2 2023: 15.5%) at Mercedes-Benz Vans. Group revenue reached

€36.7 billion (Q2 2023: €38.2 billion) in the quarter.

“Thanks to our desirable passenger cars and

vans, Mercedes-Benz achieved double-digit margins in a challenging

environment. Going forward, we continue to invest in cutting-edge

products while fostering our financial resilience. Sales and the

model mix are expected to improve in the second half of the year,

supported by further market launches of new models particularly in

the Top-End segment.” Ola Kaellenius, Chief Executive Officer of

Mercedes-Benz Group AG

Mercedes-Benz Group

Q2 2024

Q2 2023

Change 24/23

Q1-Q2 2024

Q1-Q2 2023

Change 24/23

Revenue*

36,743

38,241

-3.9%

72,616

75,757

-4.1%

Earnings before Interest and Taxes

(EBIT)*

4,037

4,988

-19.1%

7,900

10,492

-24.7%

Net profit/loss*

3,062

3,641

-15.9%

6,087

7,652

-20.5%

Free Cash Flow (industrial

business)*

1,629

3,363

-51.6%

3,862

5,527

-30.1%

Earnings per share (EPS) in EUR

2.95

3.34

-11.7%

5.81

7.03

-17.4%

*in millions of €

Investments, free cash flow, net liquidity

The free cash flow from the industrial business in the second

quarter reached €1.6 billion (Q2 2023: €3.4 billion) due to the

solid cash conversion rate at cars and vans. This was influenced by

lower Earnings Before Interest and Taxes (EBIT) and headwinds in

working capital development due to higher inventory levels ahead of

the expected higher H2 sales. The net liquidity from the industrial

business reached €28.0 billion (end of 2023: €31.7 billion) due to

the dividend payment of €5.5 billion and cash outs for share

buybacks of approximately €2.8 billion in the second quarter. Since

the beginning of the buyback programs in March 2023, the company

has bought back shares for €5.1 billion as of end June 30, 2024.

The Group’s investments in property, plant and equipment in the

second quarter totaled €0.9 billion (Q2 2023: €0.8 billion).

Research and development expenditure fell to €2.3 billion (Q2 2023:

€2.4 billion).

Divisional results

Adjusted Earnings Before Interest and Taxes (EBIT) at

Mercedes-Benz Cars reached €2.8 billion (Q2 2023: €3.8 billion) on

lower sales volumes but resulted in an adjusted Return on Sales

(RoS) of 10.2%, up from 9.0% in the first quarter, (Q2 2023: 13.5%)

due to a focus on sales quality in a challenging environment and

due to favorable material costs. Mercedes-Benz Cars unit sales

reached 496,712 units in the second quarter, a plus of 7% compared

to the first quarter due to improved product availability in China

and the United States. Top-End Q2 sales increased by 6% compared to

Q1, but remain below year-earlier levels, mainly due to model

changeovers and a subdued market environment in Asia. The

availability of Top-End models continues to improve with the

all-new electric G-Class1 launched. Sales of the AMG CLE53, AMG E53

and AMG GLC43 models started in the second quarter. Furthermore,

the Mercedes-Benz S-Class remains the undisputed market leader in

its segment in all major markets. Sales in the Core segment rose by

8% in Q2 compared to previous quarter mainly driven by the E-Class

and GLC, the latter of which has retained its status as the

top-selling model.

Mercedes-Benz Cars

Q2 2024

Q2 2023

Change 24/23

Q1-Q2 2024

Q1-Q2 2023

Change 24/23

Sales in units

496,712

515,746

-3.7%

959,690

1,019,229

-5.8%

- thereof xEV

89,963

95,910

-6.2%

180,140

187,608

-4.0%

- thereof BEV

45,843

61,211

-25.1%

93,364

112,850

-17.3%

Share of xEV in unit sales in %

18.1

18.6

-

18.8

18.4

-

Revenue*

27,170

28,244

-3.8%

52,883

56,056

-5.7%

Earnings before Interest and Taxes

(EBIT)*

2,756

3,852

-28.5%

5,212

8,000

-34.9%

Earnings before Interest and Taxes

(EBIT) adjusted*

2,763

3,812

-27.5%

5,086

7,925

-35.8%

Return on Sales (RoS) in %

10.1

13.6

-3.5%pts

9.9

14.3

-4.4%pts

Return on Sales (RoS) adjusted in

%

10.2

13.5

-3.3%pts

9.6

14.1

-4.5%pts

Cash Flow Before Interest and Taxes

(CFBIT)*

2,156

3,769

-42.8%

4,453

6,750

-34.0%

Cash Flow Before Interest and Taxes

(CFBIT) adjusted*

2,192

3,842

-42.9%

4,533

6,862

-33.9%

Cash Conversion Rate adjusted

0.8

1.0

-

0.9

0.9

-

*in millions of €

The adjusted Return on Sales (RoS) for Mercedes-Benz Vans rose

to 17.5% (Q2 2023: 15.5%). The lower unit sales were outweighed by

healthy net pricing, and a favorable structure, as well as

favorable material costs and positive foreign exchange effects.

Adjusted Earnings Before Interest and Taxes (EBIT) increased by 5%

to €834 million (Q2 2023: €792 million). Mercedes-Benz Vans global

sales reached 103,435 units in the second quarter maintaining sales

at the same level as in the first quarter (-2% compared to Q1).

Thus, the division achieved a strong first half-year in 2024, with

Q2 influenced by model changes both in the private and commercial

segment of midsize and large vans and a phased ramp up of the

eSprinter.

Mercedes-Benz Vans

Q2 2024

Q2 2023

Change 24/23

Q1-Q2 2024

Q1-Q2 2023

Change 24/23

Sales in units

103,435

119,505

-13.4%

208,860

218,390

-4.4%

- thereof BEV

5,209

5,054

+3.1%

8,189

8,624

-5.0%

Share of BEV in unit sales in %

5.0

4.2

-

3.9

3.9

-

Revenue*

4,774

5,123

-6.8%

9,667

9,738

-0.7%

Earnings before Interest and Taxes

(EBIT)*

830

806

+3.0%

1,763

1,568

+12.4%

Earnings before Interest and Taxes

(EBIT) adjusted*

834

792

+5.3%

1,634

1,511

+8.1%

Return on Sales (RoS) in %

17.4

15.7

+1.7%pts

18.2

16.1

+2.1%pts

Return on Sales (RoS) adjusted in

%

17.5

15.5

+2.0%pts

16.9

15.5

+1.4%pts

Cash Flow Before Interest and Taxes

(CFBIT)*

591

777

-23.9%

1,234

1,187

+4.0%

Cash Flow Before Interest and Taxes

(CFBIT) adjusted*

624

819

-23.8%

1,312

1,269

+3.4%

Cash Conversion Rate adjusted

0.7

1.0

-

0.8

0.8

-

*in millions of €

The portfolio of Mercedes-Benz Mobility shows an increasing

share of xEV vehicles (battery electric vehicles and plug-in hybrid

vehicles) in the second quarter of 2024. As a result, more than

every second electric vehicle is now leased or financed by

Mercedes-Benz Mobility. Overall, the total portfolio amounted to

€135.7 billion at the end of June 2024 and is thus at the same

level as year-end 2023 (FY 2023: €135.0 billion). At €14.1 billion,

the new business of Mercedes-Benz Mobility is below prior-year

level (Q2 2023: €15.4 billion). The adjusted Earnings Before

Interest and Taxes (EBIT) decreased to €271 million mainly driven

by a lower interest margin and higher cost of credit risk (Q2 2023:

€448 million). As a result, the adjusted Return on Equity (RoE)

decreased to 8.4% (Q2 2023: 12.8%).

Mercedes-Benz Mobility

Q2 2024

Q2 2023

Change 24/23

Q1-Q2 2024

Q1-Q2 2023

Change 24/23

Revenue*

6,347

6,506

-2.4%

13,202

13,145

+0.4%

New business*

14,094

15,415

-8.6%

28,844

30,116

-4.2%

Contract volume (June, 30)*

135,747

131,375

+3.3%

135,747

135,027**

+0.5%

Earnings before Interest and Taxes

(EBIT)*

271

172

+57.6%

550

711

-22.6%

Earnings before Interest and Taxes

(EBIT) adjusted*

271

448

-39.5%

550

987

-44.3%

Return on Equity (RoE) in %

8.4

4.9

+3.5%pts

8.5

10.2

-1.7%pts

Return on Equity (RoE) adjusted in

%

8.4

12.8

-4.4%pts

8.5

14.2

-5.7%pts

*in millions of € ** Year-end figure

2023

Transformation

Battery development capacity was strengthened with a new

competence center for the development of cells and batteries, the

so-called eCampus designed to develop innovative chemical

compositions and optimized production processes for

high-performance cells with “Mercedes-Benz DNA”. Furthermore,

Mercedes-Benz made progress with rolling out its Automatic Lane

Change function2 in Europe. Mercedes-Benz Auto Finance Ltd.

(MBAFC), part of the Mercedes-Benz Mobility division, successfully

issued its first Green Auto Loan Asset-Backed-Security (ABS) in

July 2024 in the Chinese Interbank Bond Market. It is

Mercedes-Benz’s first Green ABS worldwide and Mercedes-Benz is the

first foreign automotive company to issue a Green

Asset-Backed-Security in China.

Outlook

The economic situation and automotive markets continue to be

characterized by a degree of uncertainty. In addition to unexpected

macroeconomic developments, uncertainties for the global economy

and the business development of Mercedes-Benz Group may arise from

geopolitical events and trade policy.

The company sees unit sales of Mercedes-Benz Cars at the

prior-year level, with overall sales expected to rise in the second

half of 2024, driven by the full availability of all new E-Class

and GLC models and an increase in Top-End Vehicle sales.

In Europe, Mercedes-Benz sees the overall sentiment

improving.

In China Mercedes-Benz has a cautious view on the macroeconomic

sentiment and fierce competition in the Entry segment and to a

certain extent in the Core segment. In China the company seeks to

successfully defend its leading position in the Top-End Vehicle

segment in a softer market environment.

In the United States, solid momentum is seen for sales and

demand. A positive year-over-year development is expected for the

second half of 2024 driven by sales of the GLC.

The xEV share is expected to be between 19% - 20%. Sales of

plug-in hybrids are expected to increase in the second half, driven

by SUVs and the full availability of the E-Class.

The adjusted Return on Sales (RoS) guidance is seen in the

narrower range of 10% - 11% (previously 10%-12%). Mercedes-Benz

expects an increase in sales volumes and an improved model mix in

the second half of the year. Mercedes-Benz also seeks to hold and

defend pricing at current levels. The company sees some

normalization of the used vehicle business which overall remains on

a healthy level. Investments in property plant & equipment,

research & development expenditure, and the adjusted Cash

Conversion Rate (CCR) are seen unchanged at 0.8 to 1.0.

Mercedes-Benz Vans raises its adjusted Return on Sales (RoS)

guidance to 14%-15% (previously 12% - 14%) given continued healthy

net pricing and favorable structure supported by comprehensive cost

reductions. The Vans division is currently in a sweet spot with

regards to product lifecycle. The company expects a healthy return

on sales in H2 but influenced by increasing costs for the new

VAN.EA platform. Considering current macro developments and

uncertainties with regard to H2, the company remains prudent and

takes a cautious view. Market demand is expected to soften in the

private and commercial van segments in H2. As the EV markets ease,

the xEV share is now seen at 5% - 7%. The full year guidance on

sales, research & development expenditure, investments in

property plant & equipment as well as the adjusted CCR remain

unchanged.

Due to the demanding market environment and interest rates which

are remaining higher for longer, Mercedes-Benz Mobility now expects

the adjusted Return on Equity (RoE) for the division in the range

of 8.5% - 9.5% for the full year (previously 10%-12%). Coming from

an adjusted Return on Equity (RoE) of 8.5% in H1 the company

expects a flat portfolio margin in H2. Improving cost of credit

risk will be partially outweighed by further increasing ramp up

costs for charging infrastructure and a challenging market

environment especially in China. Mercedes-Benz Mobility will

continue to work on efficiencies.

The Mercedes-Benz Group confirms its group guidance. Group

revenue is expected to remain at the prior- year level with

Mercedes-Benz Cars, Mercedes-Benz Vans and Mercedes-Benz Mobility

revenue forecasts unchanged. Group EBIT is expected to be slightly

below the prior-year level, resulting out of the divisional

guidance, with the guidance raise at Vans balancing out

Mercedes-Benz Mobility. Group free cash flow from the industrial

business is seen slightly below the very strong levels from

2023.

Link to press information “Sales figures Q2 2024”:

media.mercedes-benz.com/sales

Link to capital market presentation Q2 2024:

group.mercedes-benz.com/q2-2024/en

[1] Mercedes-Benz G 580 with EQ Technology | energy consumption

combined: 30.3-27.7 kWh/100 km | CO₂ emissions combined: 0 g/km |

CO₂ class: A. The specified values were determined in accordance

with the WLTP (Worldwide harmonized Light vehicles Test Procedure)

measurement method. The ranges given refer to ECE markets. The

energy consumption and CO₂ emissions of a car depend not only on

the efficient utilization of the fuel or energy source by the car,

but also on the driving style and other non-technical factors.

[2] MBUX Navigation is a prerequisite. The driving assistance

and safety systems from Mercedes-Benz are merely aids, and do not

relieve the driver of responsibility. The driver must observe the

information in the Owner's Manual and the system limitations

described therein.

Further information on Mercedes-Benz Group AG is available at:

group-media.mercedes-benz.com and

group.mercedes-benz.com

Forward-looking statements:

This document contains forward-looking statements that reflect

our current views about future events. The words “anticipate”,

“assume”, “believe”, “estimate”, “expect”, “intend”, “may”, “can”,

“could”, “plan”, “project”, “should” and similar expressions are

used to identify forward-looking statements. These statements are

subject to many risks and uncertainties, including an adverse

development of global economic conditions, in particular a negative

change in market conditions in our most important markets; a

deterioration of our refinancing possibilities on the credit and

financial markets; events of force majeure including natural

disasters, pandemics, acts of terrorism, political unrest, armed

conflicts, industrial accidents and their effects on our sales,

purchasing, production or financial services activities; changes in

currency exchange rates, customs and foreign trade provisions;

changes in laws, regulations and government policies (or changes in

their interpretation), particularly those relating to vehicle

emissions, fuel economy and safety or to ESG reporting

(environmental, social or governance topics); price increases for

fuel, raw materials or energy; disruption of production due to

shortages of materials or energy, labor strikes or supplier

insolvencies; a shift in consumer preferences towards smaller,

lower-margin vehicles; a limited demand for all-electric vehicles;

a possible lack of acceptance of our products or services which

limits our ability to achieve prices and adequately utilize our

production capacities; a decline in resale prices of used vehicles;

the effective implementation of cost-reduction and

efficiency-optimization measures; the business outlook for

companies in which we hold a significant equity interest; the

successful implementation of strategic cooperations and joint

ventures; the resolution of pending governmental investigations or

of investigations requested by governments and the outcome of

pending or threatened future legal proceedings; and other risks and

uncertainties, some of which are described under the heading “Risk

and Opportunity Report” in the current Annual Report or in this

Interim Report. If any of these risks and uncertainties

materializes or if the assumptions underlying any of our

forward-looking statements prove to be incorrect, the actual

results may be materially different from those we express or imply

by such statements. We do not intend or assume any obligation to

update these forward-looking statements since they are based solely

on the circumstances at the date of publication.

Mercedes-Benz Group at a glance

Mercedes-Benz Group AG is one of the world's most successful

automotive companies. With Mercedes-Benz AG, the Group is one of

the leading global suppliers of high-end passenger cars and premium

vans. Mercedes-Benz Mobility AG offers a product range from

financing, leasing, vehicle subscription, rental and fleet

management to insurance, innovative mobility services, digital

payment solutions as well as products and services around charging.

The company founders, Gottlieb Daimler and Carl Benz, made history

by inventing the automobile in 1886. As a pioneer of automotive

engineering, Mercedes-Benz sees shaping the future of mobility in a

safe and sustainable way as both a motivation and obligation. The

company's focus therefore remains on innovative and green

technologies as well as on safe and superior vehicles that both

captivate and inspire. Mercedes-Benz continues to invest

systematically in the development of efficient powertrains and sets

the course for an all-electric future. Mercedes-Benz is

consistently implementing its strategy to transform itself toward a

fully electric and software-driven future. The company's efforts

are also focused on the intelligent connectivity of its vehicles,

autonomous driving and new mobility concepts as Mercedes-Benz

regards it as its aspiration and obligation to live up to its

responsibility to society and the environment. Mercedes-Benz sells

its vehicles and services in nearly every country of the world and

has production facilities in Europe, North and Latin America, Asia

and Africa. In addition to Mercedes-Benz, the world's most valuable

luxury automotive brand (source: Interbrand study, 22 Nov. 2023),

Mercedes-AMG, Mercedes-Maybach and Mercedes me as well as the

brands of Mercedes-Benz Mobility: Mercedes-Benz Bank, Mercedes-Benz

Financial Services and Athlon. The company is listed on the

Frankfurt and Stuttgart stock exchanges (ticker symbol MBG). In

2023, the Group had a workforce of around 166,000 and sold around

2.5 million vehicles. Group revenues amounted to €153.2 billion and

Group EBIT to €19.7 billion.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240725681612/en/

Andrea Berg, phone +1 917 667 2391,

andrea.a.berg@mercedes-benz.com Willem Spelten, +49 151 58624395,

willem.spelten@mercedes-benz.com Edward Taylor, +49 176 30941776,

edward.taylor@mercedes-benz.com Benjamin Kraft, +49 176 30957277,

benjamin.b.kraft@mercedes-benz.com

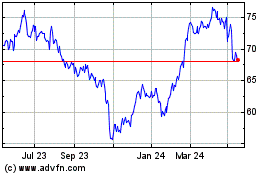

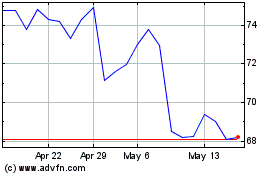

MercedesBenz (TG:MBG)

Historical Stock Chart

From Feb 2025 to Mar 2025

MercedesBenz (TG:MBG)

Historical Stock Chart

From Mar 2024 to Mar 2025