- Cash generation: Solid cash generation with a €9.2

billion free cash flow from the industrial business in 2024.

- Performance: Comprehensive performance enhancement plan

(Next Level Performance) seeks to return Mercedes-Benz Cars to a

double-digit adjusted Return on Sales (RoS) margin.

- Outlook 2025: Group revenue expected slightly below

prior-year level, Group EBIT and free cash flow from the industrial

business expected significantly below prior-year level.

- Shareholder returns: Capital allocation framework in

place. Dividend of €4.30 per share proposed and new share buyback

program for a maximum of up to €5 billion in up to 24 months

decided, subject to Annual General Meeting approval to buy back up

to 10% of share capital.

Mercedes-Benz Group AG (ticker symbol: MBG) delivered solid

financial results for 2024 and unveiled a multi-year product and

performance enhancement plan to strengthen the company’s

resilience.

“Mercedes-Benz Group delivered solid results in

a very challenging environment thanks to a range of outstanding

products and strict cost discipline. To ensure the company’s future

competitiveness in an increasingly uncertain world, we are taking

steps to make the company leaner, faster and stronger, while

readying an intense product launch campaign for multiple new

vehicles starting with the all new CLA.” Ola Kaellenius, Chief

Executive Officer of Mercedes-Benz Group AG

Mercedes-Benz's product launch program starts in 2025 with the

CLA, followed by a major upgrade of the S-Class in 2026, an

all-electric GLC and C-Class, as well as a string of BEV and

electrified high-tech ICE launches at Mercedes-AMG. Overall, sales

are expected to gain traction after dozens of new or refreshed

models reach the markets until 2027.To strengthen its

competitiveness and resilience, Mercedes-Benz has launched a

comprehensive performance enhancement program – known as Next Level

Performance. Through a set of initiatives, Mercedes-Benz Group aims

to further leverage growth potential through its direct sales

channel, elevate the customer service experience to a new level and

to boost revenue quality. In addition, the company will take steps

to make its global production footprint more efficient and more

flexible. The company plans to cut production costs by 10% until

2027. Material costs will be tackled in close collaboration with

suppliers and fixed-cost reductions will continue through to 2027,

building on significant progress achieved over the past four

years.

Technology and design

Going forward a coherent design language will be used across the

entire portfolio. BEV and electrified high-tech ICE models will

exploit their respective strengths, without sacrificing space,

elegance, convenience or efficiency. Thanks to intelligent

modularisation, Mercedes-Benz will offer a unified tech stack in

infotainment and Advanced Driver Assistance Systems (ADAS), a

consistent customer experience as well as best-in-class roominess

and perfect proportions while keeping a tight grip on costs and

manufacturing flexibility, allowing Mercedes-Benz to tailor

products to specific markets like China.

2024 results

Group earnings before interest and taxes (EBIT) reached €13.6

billion (2023: €19.7 billion). Group revenues came in at €145.6

billion (2023: €152.4 billion). The free cash flow from the

industrial business reached €9.2 billion (2023: €11.3 billion)

mainly due to a very high cash conversion rate at Cars and Vans.

The net liquidity of the industrial business reached €31.4 billion

(end of 2023: €31.1 billion) remaining on a similar level as the

prior year, demonstrating strong cash generation at work, despite

more than €10 billion cashout for dividend payments and share

buybacks in 2024.

Mercedes-Benz Group

FY 2024

FY 2023

Change 24/23

Revenue*

145,594

152,390

-4.5%

Earnings before interest and taxes

(EBIT)*

13,599

19,660

-30.8%

Net profit/loss*

10,409

14,531

-28.4%

Free cash flow industrial business

(FCF)*

9,152

11,316

-19.1%

Earnings per share (EPS) in EUR

10.19

13.46

-24.3%

* in millions of €

Divisional results

The adjusted EBIT at Mercedes-Benz Cars fell to €8.7

billion (2023: €14.3 billion) on lower volumes, particularly in

China, negative net pricing and an unfavourable model mix. The

adjusted RoS in 2024 was 8.1% (2023: 12.6%). Research and

Development costs remained on a high level due to investments for

future platforms and technologies, particularly for MB.OS, while

investments in PP&E remained at the previous year’s level.

Mercedes-Benz Cars

FY 2024

FY 2023

Change 24/23

Unit Sales

1,983,403

2,044,051

-3.0%

- thereof xEV

367,610

401,943

-8.5%

- thereof BEV

185,059

240,668

-23.1%

Share of xEV in unit sales in %

18.5

19.7

-

Revenue*

107,761

112,756

-4.4%

Earnings before interest and taxes

(EBIT)*

8,460

14,224

-40.5%

Adjusted earnings before interest and

taxes (EBIT)*

8,677

14,252

-39.1%

Adjusted return on sales (RoS) in %

8.1

12.6

-4.5%pts

Cash flow before interest and taxes

(CFBIT)*

8,963

12,336

-27.3%

Adjusted cash conversion rate (CCR)

1.0

0.9

-

* in millions of €

Adjusted EBIT at Mercedes-Benz Vans reached €2.8 billion

(2023: €3.1 billion) and the adjusted RoS remained almost at the

previous year’s level, at 14.6% (2023: 15.1%). A healthy mix

supported by improved product substance partially offset lower

overall sales. Furthermore, in the challenging environment, the

comprehensive cost initiative further supported profitability.

Research and Development costs remained on a high level due to

investments into the new, further flexibilized van architecture

with two variants: Van Electric Architecture (VAN.EA) for BEV

models and Van Combustion Architecture (VAN.CA) for ICE models.

Mercedes-Benz Vans

FY 2024

FY 2023

Change 24/23

Unit Sales

405,610

447,790

-9.4%

- thereof BEV

19,516

22,666

-13.9%

Share of BEV in unit sales in %

4.8

5.1

-

Revenue*

19,320

20,288

-4.8%

Earnings before interest and taxes

(EBIT)*

2,932

3,138

-6.6%

Adjusted earnings before interest and

taxes (EBIT) *

2,825

3,063

-7.8%

Adjusted return on sales (RoS) in %

14.6

15.1

-0.5%pts

Cash flow before interest and taxes

(CFBIT)*

2,705

2,817

-4.0%

Adjusted cash conversion rate (CCR)

1.0

1.0

-

* in millions of €

Mercedes-Benz Mobility remains a strong partner for

Mercedes-Benz Cars and Vans. In 2024, Mercedes-Benz Mobility´s

total portfolio amounted to €138.1 billion (2023: €135.0 billion)

while new business declined to €59.5 billion (2023: €62.0 billion).

The adjusted EBIT came in at €1.1 billion (2023: €1.7 billion) and

was impacted mainly due to a reduced interest margin resulting from

interest rate developments and increased competition in the

financial services sector, especially in China. As a result, the

adjusted return on equity (RoE) declined to 8.7% (2023: 12.3%).

Mercedes-Benz Mobility

FY 2024

FY 2023

Change 24/23

Revenue*

25,083

25,571

-1.9%

New business*

59,486

62,014

-4.1%

Contract volume (December, 31)*

138,095

135,027

+2.3%

Earnings before interest and taxes

(EBIT)*

1,134

1,302

-12.9%

Adjusted earnings before interest and

taxes (EBIT) *

1,134

1,695

-33.1%

Adjusted return on equity (RoE) in %

8.7

12.3

-3.6%pts

* in millions of €

Dividend

At the Annual General Meeting on May 7, 2025, the Board of

Management and the Supervisory Board will propose a dividend of

€4.30 per share (2023: €5.30).

Share buyback policy

Mercedes-Benz has decided to buy back own shares worth up to a

maximum €5 billion (not including incidental costs) on the stock

exchange over a period of up to 24 months, subject to the renewal

of the authorization by the Annual General Meeting in May 2025 to

buy back own shares up to a maximum of 10% of the share capital.

This buyback is based on and in line with the existing buyback

policy, that any future free cash flow from the industrial

business, (as available post potential small-scale M&A)

generated beyond the approximately 40% dividend payout ratio of

Group Net Income, shall be used to fund share buybacks with the

purpose of redeeming shares.

Outlook

The Mercedes-Benz Group expects Group revenue in 2025 to

be slightly below the prior-year level. In a market environment

that remains challenging, Group EBIT is expected to be

significantly below the previous year's level resulting out of

divisional guidances. Group free cash flow from the industrial

business is seen significantly below the strong level of 2024, due

to lower EBIT at Mercedes-Benz Cars and Mercedes-Benz Vans and

lower CCR at Mercedes-Benz Vans.

Outlook

FY 2024 Actuals

FY 2025 Guidance

Unit Sales

Mercedes-Benz Cars

1,983k units

Slightly below

Mercedes-Benz Vans

406k units

Slightly below

xEV Share

Mercedes-Benz Cars (xEV)

19%

20 to 22%

Mercedes-Benz Vans (xEV)

5%

8 to 10%

Adjusted* return on sales (RoS)

Mercedes-Benz Cars

8.1%

6 to 8%

Mercedes-Benz Vans

14.6%

10 to 12%

Mercedes-Benz Mobility (RoE)

8.7%

8 to 9%

Adjusted cash conversion rate (CCR)

Mercedes-Benz Cars

1.0

0.9 to 1.1

Mercedes-Benz Vans

1.0

0.5 to 0.7

Investment in pp&e

Mercedes-Benz Cars

€3.4 billion

Significantly above

Mercedes-Benz Vans

€0.6 billion

Significantly above

R&D expenditure

Mercedes-Benz Cars

€8.7 billion

At prior-year level

Mercedes-Benz Vans

€1.0 billion

Significantly above

* The adjustments include material

adjustments if they lead to significant effects in a reporting

period. These material adjustments relate in particular to legal

proceedings and related measures, restructuring measures and

M&A transactions.

Link to press release “Sales figures 2024”:

media.mercedes-benz.com/sales

Link to capital market presentation on full year 2024:

https://group.mercedes-benz.com/results-2024/

Pictures of the event will be available here:

group-media.mercedes-benz.com

Further information about Mercedes-Benz Group is available at:

media.mercedes-benz.com and group.mercedes-benz.com

The figures in this document are preliminary and have neither

been approved yet by the Supervisory Board nor audited by the

external auditor.

Forward-looking statements

This document contains forward-looking statements that reflect

our current views about future events. The words “anticipate”,

“assume”, “believe”, “estimate”, “expect”, “intend”, “may”, “can”,

“could”, “plan”, “project”, “should” and similar expressions are

used to identify forward-looking statements. These statements are

subject to many risks and uncertainties, including an adverse

development of global economic conditions, in particular a negative

change in market conditions in our most important markets; a

deterioration of our refinancing possibilities on the credit and

financial markets; events of force majeure including natural

disasters, pandemics, acts of terrorism, political unrest, armed

conflicts, industrial accidents and their effects on our sales,

purchasing, production or financial services activities; changes in

currency exchange rates, customs and foreign trade provisions;

changes in laws, regulations and government policies (or changes in

their interpretation), particularly those relating to vehicle

emissions, fuel economy and safety or to ESG reporting

(environmental, social or governance topics); price increases for

fuel, raw materials or energy; disruption of production due to

shortages of materials or energy, labour strikes or supplier

insolvencies; a shift in consumer preferences towards smaller,

lower-margin vehicles; a limited demand for all-electric vehicles;

a possible lack of acceptance of our products or services which

limits our ability to achieve prices and adequately utilize our

production capacities; a decline in resale prices of used vehicles;

the effective implementation of cost-reduction and

efficiency-optimization measures; the business outlook for

companies in which we hold a significant equity interest; the

successful implementation of strategic cooperations and joint

ventures; the resolution of pending governmental investigations or

of investigations requested by governments and the outcome of

pending or threatened future legal proceedings; and other risks and

uncertainties, some of which are described under the heading “Risk

and Opportunity Report” in the current Annual Report or in the

current Interim Report. If any of these risks and uncertainties

materialises or if the assumptions underlying any of our forward-

looking statements prove to be incorrect, the actual results may be

materially different from those we express or imply by such

statements. We do not intend or assume any obligation to update

these forward-looking statements since they are based solely on the

circumstances at the date of publication.

Mercedes-Benz Group at a glance

Mercedes-Benz Group AG is one of the world’s most successful

automotive companies. With Mercedes-Benz AG, the Group is one of

the leading global suppliers of high-end passenger cars and premium

vans. Mercedes-Benz Mobility AG specialises in financial and

mobility services. The products range from financing, leasing,

vehicle subscription, rental and fleet management to insurance,

innovative mobility services, digital payment solutions as well as

products and services around charging. The company founders,

Gottlieb Daimler and Carl Benz, made history by inventing the

automobile in 1886. As a pioneer of automotive engineering,

Mercedes-Benz sees shaping the future of mobility in a safe and

sustainable way as both a motivation and obligation. The company’s

focus therefore remains on innovative and green technologies as

well as on safe and superior vehicles that both captivate and

inspire. Mercedes-Benz continues to invest systematically in the

development of efficient powertrains and sets the course for an

all-electric future. Mercedes-Benz is consistently implementing its

strategy to transform itself toward a fully electric and

software-driven future. The company’s efforts are also focused on

the intelligent connectivity of its vehicles, autonomous driving

and new mobility concepts as Mercedes-Benz regards it as its

aspiration and obligation to live up to its responsibility to

society and the environment. Mercedes-Benz sells its vehicles and

services in nearly every country of the world and has production

facilities in Europe, North and Latin America, Asia and Africa. In

addition to Mercedes-Benz, the world’s most valuable luxury

automotive brand (source: Interbrand study, 10. Oct. 2024),

Mercedes-AMG, Mercedes-Maybach as well as the brands of

Mercedes-Benz Mobility: Mercedes-Benz Bank, Mercedes-Benz Financial

Services and Athlon. The company is listed on the Frankfurt and

Stuttgart stock exchanges (ticker symbol MBG). In 2024, the Group

had a workforce of around 175,000 and sold around 2.4 million

vehicles. Group revenues amounted to €145.8 billion and Group EBIT

to €13.7 billion.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250219508899/en/

Willem Spelten, +49 151 5862 4395,

willem.spelten@mercedes-benz.com Edward Taylor, +49 176 3094 1776,

edward.taylor@mercedes-benz.com Benjamin Kraft, +49 176 3095 7277,

benjamin.b.kraft@mercedes-benz.com Andrea Berg, +1 917 667 2391,

andrea.a.berg@mercedes-benz.com

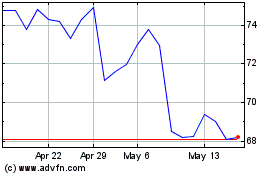

MercedesBenz (TG:MBG)

Historical Stock Chart

From Jan 2025 to Feb 2025

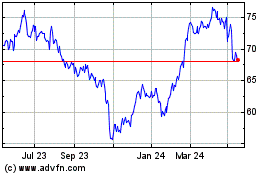

MercedesBenz (TG:MBG)

Historical Stock Chart

From Feb 2024 to Feb 2025