- Way forward: Mercedes-Benz readies its biggest ever

product and tech launch campaign with dozens of new or refreshed

models until 2027.

- Design language: Mercedes-Benz to introduce a coherent,

status-oriented design language across the entire portfolio.

- Intelligent modularization and cutting-edge tech:

Mercedes-Benz Operating System (MB.OS) lays foundation for all

domains, especially infotainment and automated driving

functionalities. Electric drive units and batteries designed to be

modular and highly scalable.

- Performance: Comprehensive performance enhancement plan

(Next Level Performance) aims to raise the competitiveness and

resilience of Mercedes-Benz.

Mercedes-Benz Group AG (ticker symbol: MBG) delivered solid

financial results for 2024 and unveiled its biggest ever product

and tech launch program as well as performance enhancement measures

designed to deliver exceptional value to customers and

shareholders.

“As the custodians of this iconic brand we

ensure that Mercedes-Benz continues leveraging its full potential.

We're launching the company’s biggest ever product and tech

campaign and a comprehensive performance enhancement program.”

Ola Kaellenius, Chief Executive Officer of

Mercedes-Benz Group AG.

Building the most desirable cars

A Mercedes-Benz is a Mercedes-Benz – no matter how it’s powered.

This means: Every Mercedes is extraordinary. Its status derives

from exceptional design, advanced technology, superb refinement and

craftsmanship, a sublime ride and drivetrain, world class safety

systems and outstanding digital solutions – be it a

battery-electric vehicle (BEV), a hybrid, or a car with an

electrified high-tech combustion engine (ICE). Mercedes-Benz will

apply a coherent, status-oriented design across the entire

portfolio and customers will primarily decide on a model – and then

choose their preferred drive type. The all new CLA, which will be

offered as both a BEV and an ICE variant, takes a big step in this

direction. And there is more to come.

The concept offers drivetrain flexibility in the form of a pure

electric car with benchmark range, consumption and charging

performance; in addition to a highly efficient ICE variant using

small transverse high-tech electrified engines.

Even though the designs will be almost identical, in the Core

and Top-End Vehicles (TEV) segments, the rear-wheel-drive cars will

be based on separate, uncompromised BEV/ICE concepts. Cutting-edge

BEV and ICE models can exploit their respective strengths, without

sacrificing space, elegance, convenience, or efficiency. Thanks to

intelligent modularization, Mercedes can offer best-in-class

roominess and perfect proportions while keeping a tight grip on

costs and manufacturing flexibility.

By focusing on the most promising segments, Mercedes-Benz

retains the ambition to defend margins as the BEV share increases.

Mercedes-Benz plans to expand and protect the share of Top-End

Vehicles (TEV) and aims to leverage the potential of its luxury

brands such as G-Class, as the undisputed icon of adventurous

luxury; Maybach as the epitome of sophisticated luxury and

Mercedes-AMG as the performance luxury brand. The legendary G-Class

family will be expanded with a new smaller version. Mercedes-AMG

plans to outgrow the performance market, thanks to a heavily

refreshed model lineup from 2026 onwards and a strategic evolution

of its portfolio, which will include a next-generation, high-tech

electrified V8 and dedicated high-performance electric models based

on AMG.EA.

Biggest ever product launch campaign

Beginning with the all-new CLA this year, Mercedes-Benz will

start the most intense product launch program in its history,

including the major upgrade of the S-Class in 2026 as well as a

string of launches at Mercedes-AMG. Overall, Mercedes-Benz plans

for dozens of new or refreshed models to reach markets until

2027.

The CLA will be offered with an electric drivetrain or a 48-volt

electrified high-tech four-cylinder engine, paired to an

electrified eight-speed dual-clutch transmission. The electric

variant sets new standards in its class in terms of range,

consumption and charging power, thanks to know-how transferred from

the VISION EQXX technology program. The product substance in this

class will be elevated, while at the same time, the portfolio

complexity of its family will be reduced from seven to four

variants.

By launching all-new electric GLC and C-Class models,

Mercedes-Benz will close a gap in its electric core segment. An

all-new fully electric E-Class will round out the picture.

The pace of BEV adoption will continue to be determined by

market conditions, infrastructure and customer needs. Boosted by

new BEV model introductions, the Mercedes-Benz Group AG is

targeting an xEV share of more than 30% in 2027.

“We will excite our customers with a full

rollout of uncompromising cars. They will be an intelligent part of

their life. All of them come with a fully integrated tech stack and

leverage the latest developments in AI. They will be packed with

advanced technologies like the latest ADAS systems and innovative

tech features like a new steer-by-wire system. It all starts very

soon with our new CLA, our first software-defined vehicle powered

by our very own in-house operating system MB.OS. It will be

followed by our new electric GLC, which is a turning point in our

mid-size segment. This is the all-electric SUV our customers have

been waiting for.”

Markus Schaefer, Member of the Board of

Management of Mercedes-Benz Group AG. Chief Technology Officer,

Development & Procurement

Intelligent scalable modules

With the launch of the CLA, all new Mercedes vehicles will run

on the proprietary AI-enhanced Mercedes-Benz Operating System

(MB.OS), a chip-to-cloud software operating system which covers

infotainment, automated driving, comfort as well as driving &

charging. By having full control of all sensors and actuators,

Mercedes-Benz will be able to deliver a superior product

experience. MB.OS is scalable to fit every segment and can be

tailored to each region. For example, with navigation,

Mercedes-Benz will use Google in western markets, AMAP for China

and TMAP in Korea.

The BEV drivetrain portfolio will make use of highly modular

electric drive units and batteries which are scalable for all

segments, including cost-effective Lithium-Iron-Phosphate (LFP) and

advanced Nickel-Manganese-Cobalt (NMC) batteries, as well as

high-performance round cells.

For the batteries used in the CLA, the cost per kilowatt hour

has been cut by about 30% compared to its predecessor generation.

Further improvements in energy density and cost efficiency are

being worked on, in addition to advances in cell chemistry.

Lithium-Manganese-Oxide (LMO)/NMC blends will lower costs while

increasing energy density to NMC levels.

The newly developed, flexible Electric Drive Unit 2.0 (EDU 2.0)

will offer two and four-wheel options across all segments.

To also ensure a comprehensive portfolio of electrified

high-tech combustion-engine vehicles, Mercedes-Benz already has a

full range of future-proof EU-7 ready engines and transmissions

ranging from four to eight cylinders. In selected markets,

12-cylinder engines will continue to be offered.

Lead in tech

Mercedes-Benz continues to push boundaries with cutting-edge

technology, including a new steer-by-wire system and a fully

integrated tech stack, which includes a water-cooled supercomputer.

With the all-new CLA, Mercedes-Benz will introduce not just MB.OS,

but also the MBUX Virtual Assistant, which incorporates multi-agent

AI functionalities. Using the latest Large Language Models (LLM)

and incorporating conversational as well as behavioral AI, it makes

the user experience more proactive and human like. It can even

answer follow-up questions in a natural way for up to an hour,

thanks to memory.

MB.OS also supports next level automated driving, including

Level 2++ point-to-point navigation which handles complex urban

traffic. This feature will be available in China and the US with

the all-new CLA, and Europe will follow as soon as legislation

permits. Speeds for SAE Level 3 conditionally automated driving are

increasing, and the goal is to get a 130 km/h system on the road by

the end of the decade. Mercedes-Benz became the first international

car maker to gain approval for testing SAE Level 4 highly-automated

driving in Beijing on designated urban roads and highways.

Winning in China

The S-Class remains the undisputed market leader in its segment,

and Mercedes-Benz continues to lead the segments for vehicles

priced 1 million RMB and above. China is already home to

Mercedes-Benz's biggest and strongest research and development

network outside of Germany. Local facilities in Beijing and

Shanghai allow Mercedes-Benz to take full advantage of the local

ecosystem and supplier landscape. This enables Mercedes-Benz to

combine upholding its high internal standards while innovating at

“China speed.” Mercedes-Benz is already setting standards in

navigation with lane-level navigation and 3D maps.

Utilizing the China R&D network will allow Mercedes-Benz to

elevate the intelligence of its products while at the same time

greatly lowering complexity and cost. Products made for the Chinese

market will be locally developed and loaded with China-specific

apps and content, including dedicated infotainment and automated

driving features. As part of the announced product launch campaign

there will be seven models dedicated to China across all segments

and drivetrains.

Despite a challenging year 2024, the Mercedes-Benz China Joint

Venture operations achieved a strong return on sales. Mercedes-Benz

plans to optimize the BBAC joint venture together with its partner.

A 10% reduction in material costs is targeted through deeper

localization of parts in the China supply chain. Variable

production costs and fixed costs are set to be reduced as well.

Potential adjustments to the dealer network and production

footprint are also being evaluated.

R&D costs

Mercedes-Benz is prioritizing global R&D resources with a

laser focus on the customer. The company will continue investing in

the Mercedes-Benz Tech Stack to defend and expand its position in

software and hardware. The vertical integration of MB.OS will allow

for a continuous, iterative approach to product development with an

increased emphasis on software. The use of digital tools also

allows Mercedes-Benz to achieve greater levels of efficiency in its

use of hardware and test fleets.

Investments are expected to reach their peak in 2025 due to the

massive product launch plan and will ease from 2026 onwards. The

majority of investments for the CLA family of vehicles, the

electric GLC and C-Class as well as AMG.EA models will be completed

by 2027, with products on the road. Investments into combustion

engine technology will remain limited, thanks to a reduction in

powertrain complexity and the use of intelligent modularization

between BEV and electrified high-tech ICE products. The highly

efficient four-cylinder engine for the all-new CLA was developed

and designed by Mercedes-Benz and is being industrialized with a

partner in China.

Next Level Performance:

Production: Mercedes-Benz Group is adapting its cost base with a

raft of measures. The company plans to cut production costs by 10%

until 2027 after using the past years to adjust its nominal

production capacity. This, among other factors, resulted in an exit

from plants in Hambach (France), Iracemapolis (Brazil) as well as

CKD plants in Russia and Indonesia. A powertrain plant in Poland is

being transformed into a future production site for Vans and the

sale of a Van plant in Argentina is another step towards adapting

the company’s global production footprint. Global production

capacity for passenger cars is planned to be reduced from 2.5

million in 2024 to between 2 - 2.2 million units by 2027, while

retaining the flexibility to readjust, as the product launch

campaign gains traction. There are no plans to shut down plants in

Germany. Production capacity at each German plant is being balanced

at an average 300,000 units. A core segment model will be added to

the production lineup in Kecskemet (Hungary), where capacity is

being added to take advantage of factor costs which are roughly 70%

lower than in Germany.

Mercedes-Benz will make greater use of digitalization and AI,

adopting a ‘digital first’ approach. Thanks to digital twins,

Mercedes-Benz can plan potential moves of models between plants,

including ramp up times, and retooling of the plans without having

to significantly interrupt real world production.

Local for local: By 2027 the share of local-for-local production

is planned to be increased from 60% to 70%. An additional Core

segment model could be allocated to the United States and a

long-wheelbase version of the GLE will be localized in China by

mid-2026.

Material Costs: Suppliers are engaged in a dialogue with

Mercedes-Benz procurement and engineering teams to reduce material

costs by challenging specifications and the design of components to

identify where cost can be reduced through standardization and

technical refinement. One result is earlier and deeper integration

of key suppliers in the development process. Material costs will be

tackled in close collaboration with suppliers. The BEAT26 program

aims to jointly achieve long-term and sustainable changes to cost

structures in procurement for both Mercedes-Benz and its

partners.

Fixed Costs: Mercedes-Benz achieved a 19% reduction in fixed

costs between 2019 and 2024, net of inflation. An additional

reduction of more than 10% is being targeted over the next three

years. To achieve this, the company is constructively discussing

measures with its works council. Moreover, opportunities are being

evaluated to determine how Mercedes-Benz sales and financial

services organizations can work more closely together, to cater to

customers across the different touchpoints more efficiently. In

addition to selling its own retail business in Germany to

experienced dealer groups, the company plans to further reduce

management positions and increase the use of digitalization and

generative AI to streamline processes.

“To ensure that the company can weather an even

more dynamic geopolitical environment as well as challenging

markets, efficiency measures are being intensified across the

board. Paired with strong product substance and our product launch

plan, Mercedes-Benz is well positioned to recalibrate its operating

point and to return to double-digit margins in the near

future.”

Harald Wilhelm, Chief Financial Officer of

Mercedes-Benz Group AG

Link to capital market presentation:

https://group.mercedes-benz.com/results-2024/ Pictures of the event

will be available here: group-media.mercedes-benz.com

Further information about Mercedes-Benz Group is available at:

media.mercedes-benz.com and group.mercedes-benz.com

The figures in this document are preliminary and have neither

been approved yet by the Supervisory Board nor audited by the

external auditor.

Further information about Mercedes-Benz Group is

available at: media.mercedes-benz.com and

group.mercedes-benz.com

Forward-looking statements

This document contains forward-looking statements that reflect

our current views about future events. The words “anticipate”,

“assume”, “believe”, “estimate”, “expect”, “intend”, “may”, “can”,

“could”, “plan”, “project”, “should” and similar expressions are

used to identify forward-looking statements. These statements are

subject to many risks and uncertainties, including an adverse

development of global economic conditions, in particular a negative

change in market conditions in our most important markets; a

deterioration of our refinancing possibilities on the credit and

financial markets; events of force majeure including natural

disasters, pandemics, acts of terrorism, political unrest, armed

conflicts, industrial accidents and their effects on our sales,

purchasing, production or financial services activities; changes in

currency exchange rates, customs and foreign trade provisions;

changes in laws, regulations and government policies (or changes in

their interpretation), particularly those relating to vehicle

emissions, fuel economy and safety or to ESG reporting

(environmental, social or governance topics); price increases for

fuel, raw materials or energy; disruption of production due to

shortages of materials or energy, labour strikes or supplier

insolvencies; a shift in consumer preferences towards smaller,

lower-margin vehicles; a limited demand for all-electric vehicles;

a possible lack of acceptance of our products or services which

limits our ability to achieve prices and adequately utilize our

production capacities; a decline in resale prices of used vehicles;

the effective implementation of cost-reduction and

efficiency-optimization measures; the business outlook for

companies in which we hold a significant equity interest; the

successful implementation of strategic cooperations and joint

ventures; the resolution of pending governmental investigations or

of investigations requested by governments and the outcome of

pending or threatened future legal proceedings; and other risks and

uncertainties, some of which are described under the heading “Risk

and Opportunity Report” in the current Annual Report or in the

current Interim Report. If any of these risks and uncertainties

materialises or if the assumptions underlying any of our forward-

looking statements prove to be incorrect, the actual results may be

materially different from those we express or imply by such

statements. We do not intend or assume any obligation to update

these forward-looking statements since they are based solely on the

circumstances at the date of publication.

Mercedes-Benz Group at a glance

Mercedes-Benz Group AG is one of the world’s most successful

automotive companies. With Mercedes-Benz AG, the Group is one of

the leading global suppliers of high-end passenger cars and premium

vans. Mercedes-Benz Mobility AG specialises in financial and

mobility services. The products range from financing, leasing,

vehicle subscription, rental and fleet management to insurance,

innovative mobility services, digital payment solutions as well as

products and services around charging. The company founders,

Gottlieb Daimler and Carl Benz, made history by inventing the

automobile in 1886. As a pioneer of automotive engineering,

Mercedes-Benz sees shaping the future of mobility in a safe and

sustainable way as both a motivation and obligation. The company’s

focus therefore remains on innovative and green technologies as

well as on safe and superior vehicles that both captivate and

inspire.

Mercedes-Benz continues to invest systematically in the

development of efficient powertrains and sets the course for an

all-electric future. Mercedes-Benz is consistently implementing its

strategy to transform itself toward a fully electric and

software-driven future. The company’s efforts are also focused on

the intelligent connectivity of its vehicles, autonomous driving

and new mobility concepts as Mercedes-Benz regards it as its

aspiration and obligation to live up to its responsibility to

society and the environment. Mercedes-Benz sells its vehicles and

services in nearly every country of the world and has production

facilities in Europe, North and Latin America, Asia and Africa. In

addition to Mercedes-Benz, the world’s most valuable luxury

automotive brand (source: Interbrand study, 10. Oct. 2024),

Mercedes-AMG, Mercedes-Maybach as well as the brands of

Mercedes-Benz Mobility: Mercedes-Benz Bank, Mercedes-Benz Financial

Services and Athlon. The company is listed on the Frankfurt and

Stuttgart stock exchanges (ticker symbol MBG). In 2024, the Group

had a workforce of around 175,000 and sold around 2.4 million

vehicles. Group revenues amounted to €145.8 billion and Group EBIT

to €13.7 billion.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250219817693/en/

Willem Spelten, +49 151 5862 4395,

willem.spelten@mercedes-benz.com Edward Taylor, +49 176 3094 1776,

edward.taylor@mercedes-benz.com Tobias Mueller, +49 160 862 0035,

tobias.mueller@mercedes-benz.com Andrea Berg, +1 917 667 2391,

andrea.a.berg@mercedes-benz.com

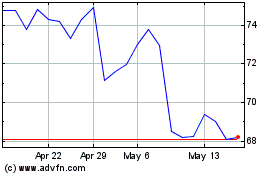

MercedesBenz (TG:MBG)

Historical Stock Chart

From Jan 2025 to Feb 2025

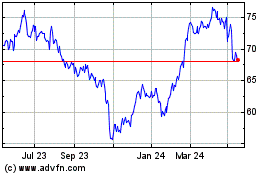

MercedesBenz (TG:MBG)

Historical Stock Chart

From Feb 2024 to Feb 2025